Here’s a startling truth that trips up too many jewelers: the insurance your carrier has is not designed to protect you.

Jewelers block insurance is a comprehensive policy that protects your inventory, but what about when you ship? When you hand a package to a carrier, they are covered by their own cargo liability insurance. This is a policy a shipping company—like FedEx, UPS, or an armored car service—carries to protect themselves from financial ruin if something happens to the goods they’re transporting. It’s their safety net, not yours. This is a critical distinction, and misunderstanding it can be an incredibly expensive mistake for any jewelry business.

Why Your Carrier's Insurance Isn't Your Safety Net

When you hand a high-value parcel to a carrier, it’s easy to assume it's automatically insured for its full value. That assumption is a huge financial gamble. The reality is, the carrier's cargo liability insurance is there to shield their own business from lawsuits and catastrophic claims, not to make you whole for your lost inventory.

Think of it like this: A landlord's insurance covers their apartment building—the structure itself and their liability. It does nothing to protect your personal belongings inside. For that, you need your own renter's insurance. It’s the exact same principle here. Your jewelry business needs its own first-party coverage, like a Jewelers Block insurance policy, to properly protect your goods in transit.

What Carrier Liability Actually Covers

At its core, cargo liability insurance is a third-party policy. Its job is to defend the transportation company against claims that they were legally responsible for damaging or losing the cargo. While this coverage is often required by law, the protection it offers you as the shipper is razor-thin.

Here’s what you’re up against:

- Bare-Bones Payouts: Standard liability limits are shockingly low. We’re talking as little as $100 per package or a nominal amount per pound, no matter if the contents are worth $50,000.

- The Burden of Proof: To get a single dollar, you have to legally prove the carrier was negligent. This is often a grueling, expensive, and time-consuming fight you may not even win.

- A Long List of Exclusions: Carriers aren't liable for losses from things they can't control, like "Acts of God" (hurricanes, floods) or mistakes made by the shipper, such as improper packaging.

Relying on a carrier's liability coverage is like betting your entire business on their flawless performance, while also agreeing to their restrictive terms if things go south. It’s a gamble no jeweler can afford.

The table below breaks down the essential differences.

Cargo Liability vs. First-Party Coverage at a Glance

This quick comparison shows why your own policy is non-negotiable.

| Coverage Aspect | Carrier's Cargo Liability Insurance | Jewelers Block or Shipper's Interest |

|---|---|---|

| Who It Protects | The carrier (shipping company) | You (the jeweler/shipper) |

| Coverage Basis | Legal liability (you must prove carrier fault) | All-risk (covers your property directly) |

| Typical Payout | Extremely limited (e.g., $100/package) | Full insured value of the goods |

| Claim Process | Complex, often requires legal action against the carrier | Straightforward, filed directly with your insurer |

| Main Purpose | To protect the carrier's business from lawsuits | To make you whole after a loss |

As you can see, the two policies serve completely different functions.

It's All in the Fine Print

The legal relationship between you and the carrier is cemented in the shipping documents. To truly grasp this, it’s worth understanding the crucial role of a Bill of Lading in defining shipping liabilities. This contract spells out the carrier's duties and, more importantly, their limits of liability.

At the end of the day, the lesson is simple: cargo liability insurance is the carrier's shield. Real peace of mind only comes from having your own dedicated jewelry store insurance that covers your assets from door to door, no fault-finding required.

Comparing Your Key Insurance Options

Trying to figure out shipping insurance can feel like sorting through a pile of puzzle pieces that all look the same. When your valuable inventory is on the road, you’ll run into three main types of coverage: the carrier’s cargo liability insurance, a separate Shipper's Interest policy, and your own Jewelers Block insurance. Getting the difference isn’t just a detail—it’s the one thing that can separate a minor headache from a financial disaster.

The biggest split to understand is between first-party and third-party coverage. The carrier's cargo liability policy is third-party insurance. It’s there to protect them from a lawsuit you might bring against them. On the flip side, Shipper's Interest and Jewelers Block are first-party insurance—they protect your property and pay you directly when something goes wrong, no matter whose fault it was.

This distinction changes everything. If you're relying on the carrier's policy, you’re forced to prove they were negligent. That’s a long, expensive, and often losing battle. With first-party coverage, you just file a claim with your own insurer. It's a clean and simple process designed to get you back on your feet.

Differentiating Your First-Party Choices

Even when you’re looking at first-party policies, you’ve got options. A Shipper's Interest policy (sometimes called a first-party cargo policy) is a one-off solution. You buy it for a specific shipment or a set of shipments to cover your goods only while they're in transit.

Your Jewelers Block policy, however, is a different beast entirely. It’s the comprehensive, all-in-one protection built specifically for the jewelry trade. It doesn’t just cover your pieces in transit; it protects your entire inventory, whether it’s in your showcase, at a trade show, or out on memo with a salesperson.

For any serious jewelry business, a well-written Jewelers Block policy is the gold standard. A hallmark of this specialized insurance is that it nearly always includes solid coverage for your goods in transit, which makes buying a separate Shipper's Interest policy redundant.

When you bundle your transit risk with your on-premises risk, you’re creating a seamless shield. There are no dangerous gaps in coverage, and you’re managing just one policy that protects your assets wherever they are.

A Tale of Two Claims: The Reality of a Lost Shipment

Let's walk through a jeweler's nightmare scenario to see why this really matters. A $50,000 diamond bracelet you shipped to a client just disappears from a carrier’s sorting facility. Poof. Gone.

Scenario 1: You Rely on the Carrier’s Cargo Liability Insurance

You start by filing a claim with the shipping company. In response, they’ll almost certainly point you to the fine print in your agreement. Thanks to a federal law called the Carmack Amendment, they can legally limit their liability to a laughably small amount—often just $100.

If you want more, you're looking at a legal fight to prove their negligence. You’ll need to gather evidence and documentation while their legal team works to deny everything. Months later, after a long and frustrating battle, you might get back a tiny fraction of the bracelet's value. Or you might get nothing at all.

Scenario 2: You Have a Jewelers Block Policy

Instead of gearing up for a fight, you make a single phone call to your insurance agent at a firm like First Class Insurance Jewelers Block Agency. You explain what happened and send over your proof of value and loss. Your insurer takes it from there.

Because it’s first-party coverage, proving negligence isn't your problem. The fact that the piece is gone is all it takes to trigger the policy. Within a few weeks, you have a check for the full insured value of the bracelet. You can replace the inventory and keep your business running without taking a devastating financial hit. Your insurance company might go after the carrier for reimbursement—a process called subrogation—but that’s their fight, not yours.

The contrast couldn't be clearer. The carrier’s liability insurance is a flimsy shield you have to fight to use. Your own policy is a safety net that catches you automatically.

Decoding Policy Limits and Exclusions

Trying to make sense of a carrier's cargo liability insurance policy can feel like you’re being handed a rulebook for a game you can’t win. The language is dense, the terms are confusing, and every clause is written to protect the carrier—not you. Understanding these details is the first step to seeing just how vulnerable your jewelry business is without its own first-party coverage.

The biggest shock for most jewelers is the policy limit. A standard carrier’s liability is often capped at a laughable figure, like $100 per package or a small amount per kilogram. That $100 limit is the same whether the box holds a few silver charms or a six-figure diamond ring. Betting your business on that is a catastrophic risk you can't afford to take.

This is where the idea of "declared value" fools a lot of people. When you pay a carrier extra to declare a higher value, you are not buying insurance. You’re only raising the ceiling on what you could potentially recover, and that's only if you can prove their direct negligence—an uphill legal battle that is rarely won.

Understanding Common Exclusions

On top of the dangerously low limits, a carrier's cargo liability policy is full of trapdoors called exclusions. These are all the situations where they can legally deny your claim and walk away without paying a dime. These aren't obscure, once-in-a-lifetime events; they're standard practice.

Here are a few key exclusions every jeweler needs to know:

- Acts of God: Carriers won’t cover losses from natural disasters. If a flood, earthquake, or hurricane hits a sorting facility and your shipment is destroyed, you have zero recourse through their policy.

- Improper Packaging: If a carrier decides your packaging wasn't good enough to protect the jewelry, they can deny the claim. The burden of proof is on you to show your methods were secure, which is a tough, subjective argument to win.

- Acts of the Shipper: Any mistake you make—like a labeling error or incorrect paperwork—that contributes to the loss can get your claim thrown out.

- Inherent Vice: This legal term refers to an item's natural tendency to degrade. While it’s less of a concern for jewelry, it’s a standard exclusion that shows just how narrow the policy’s focus really is.

A carrier’s policy is built on a foundation of limitations and denials. Their primary goal is to limit their financial exposure, which is why a claim approval is the exception, not the rule. Proving negligence is a high bar that many shippers fail to clear.

Endorsements That Matter to Jewelers

For jewelers, standard carrier agreements are a non-starter. This is why high-security carriers and specialized insurance policies offer specific add-ons, or endorsements, to cover the unique risks of our trade. While these are more common in a true Jewelers Block insurance policy, knowing about them helps you see what's missing from a standard shipping arrangement. For a deeper dive into protecting one-of-a-kind pieces, check out our insights on insuring valuable antique and period jewelry.

When you’re looking at a carrier’s services or your own insurance, these are the additions that really count:

- Mysterious Disappearance: This is absolutely vital. It gives you coverage if a sealed package arrives at its destination but the jewelry inside is gone. Standard liability policies almost never cover this scenario.

- Named Carrier Endorsements: Your own insurance policy might have a "warranty" that requires you to ship only with approved high-security carriers like Brinks or Malca-Amit. Use an unapproved shipper, even once, and you could void your coverage for that shipment.

- All-Risk Transit Coverage: This is the gold standard, typically found in a first-party policy like Jewelers Block. It covers your goods against loss from any cause unless it's specifically excluded, completely flipping the script in your favor.

At the end of the day, digging into the limits and exclusions of cargo liability insurance leads to one simple conclusion: it provides a false sense of security. Real protection for a jewelry business only comes from a dedicated, first-party insurance policy designed to cover your assets' full value, no matter what happens on the way.

How High-Value Jewelry Shipments Are Underwritten

To get the best possible terms on your Jewelers Block insurance, you need to learn to see your business through an underwriter’s eyes. Underwriters are professional risk assessors. Their entire job is to analyze every single detail of your shipping process and predict the chances of something going wrong.

The good news is that their process isn't some big secret. It’s a logical evaluation of how well you protect your pieces when they're at their most vulnerable—in transit. They’re looking for hard evidence of disciplined procedures and tight internal controls that cut down the risk of theft, damage, or simply disappearing. Every choice you make, from the type of box you use to the carrier you hire, has a direct impact on your premiums.

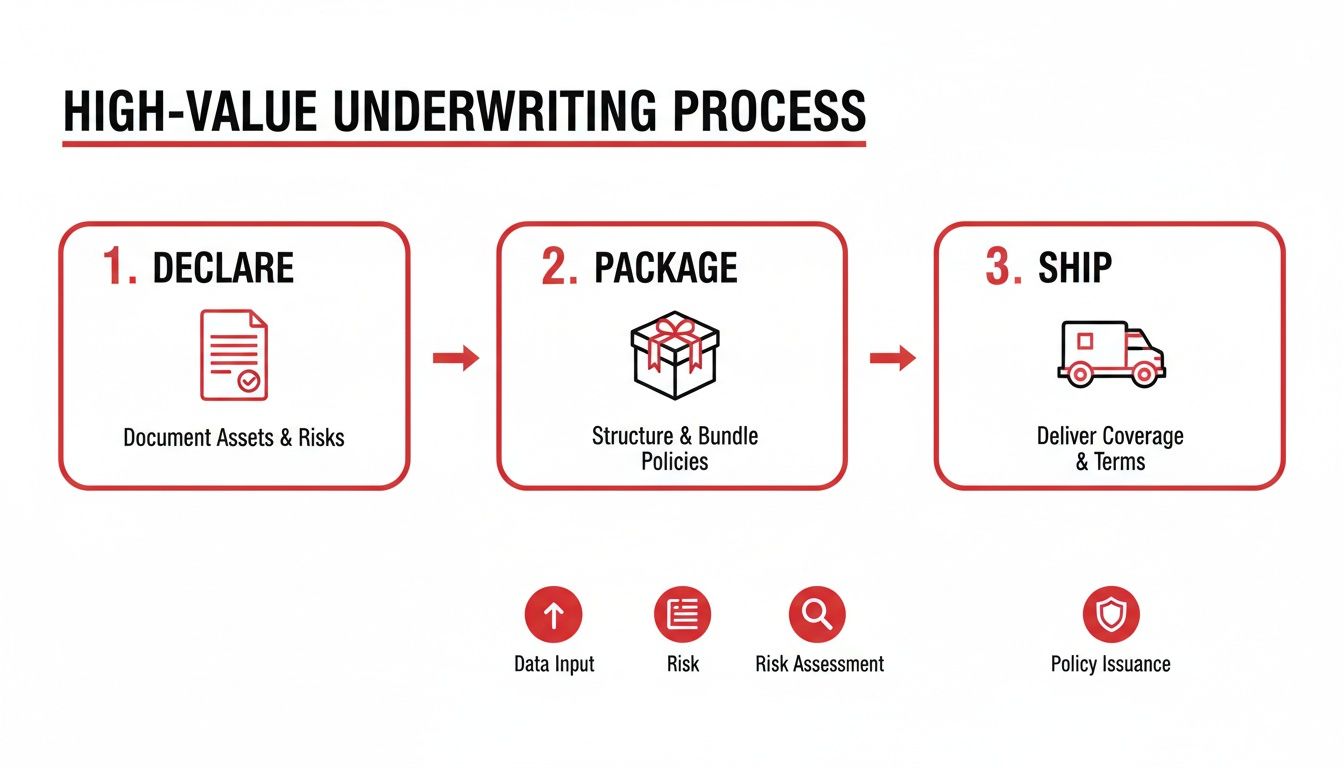

The Underwriter's Checklist

When an underwriter gets your application, they’re essentially running through a mental checklist. They dig deep into four key areas: your declarations, your packaging methods, your choice of carrier, and the routes your shipments take. A weak link in any one of these chains can throw up a major red flag, leading to higher premiums, restrictive conditions, or even an outright denial of coverage.

Your job is to show them you’re serious about managing risk at every single step. This proves you're a responsible partner in protecting the assets they're being asked to insure.

- Detailed Declarations: Let's be clear: honesty and accuracy are non-negotiable here. You must declare the exact nature and full value of the jewelry in every shipment. Trying to understate the value to save a few bucks on the premium is a huge mistake that can void your coverage completely if you ever need to file a claim.

- Secure Packaging Standards: Underwriters have expectations, and they’re based on industry best practices. Double-boxing is the absolute minimum standard. This means putting a small, unmarked box inside a larger, plain shipping box. The inner box must be sealed tight, and the outer box should give zero clues about the valuable contents inside.

- Carrier Choice: From an underwriting perspective, the difference between a standard courier and an armored carrier like Malca-Amit or Brinks is night and day. For your most valuable shipments, using one of these high-security services might not be a suggestion—it could be a mandatory condition, or "warranty," in your policy.

- Transit Route Assessment: The entire journey is put under the microscope. If your shipments pass through regions known for high rates of cargo theft or political instability, the risk profile goes up. Underwriters will even scrutinize specific airports or sorting facilities that have a reputation for security problems.

Proactive Risk Management and Its Rewards

At the end of the day, the underwriting process is designed to reward businesses that take risk management seriously. Strong internal controls and meticulous record-keeping are your best friends here. Many jewelers find that specialized systems can make this much easier—you can learn more by reading about choosing jewelry inventory management software.

An underwriter’s job is to price risk. When you can prove that your shipping procedures are secure, documented, and consistent, you are actively lowering your risk profile. This translates directly into better insurance terms and more favorable premiums.

This proactive mindset is becoming even more crucial. The global cargo transportation insurance market is expected to hit $76,557.77 million by 2032, growing at a rate of 4.3% each year. This growth highlights just how complex and vulnerable modern supply chains are, making solid underwriting and reliable coverage essential for staying in business.

By understanding what underwriters at firms like Lloyd's of London are looking for, you can get your own practices in line with their requirements. This positions your jewelry business not as a risky liability, but as a well-managed operation that deserves excellent coverage.

Real-World Claims Scenarios Jewelers Face

The theory behind cargo liability insurance is one thing, but seeing how it plays out in the real world is something else entirely. The gap between what a carrier’s basic protection covers and what your own first-party policy provides becomes painfully clear when a high-value shipment vanishes.

Let's walk through a few nightmare scenarios that jewelers unfortunately face, showing two very different outcomes for each one.

These stories underscore why a proper Jewelers Block insurance policy is so critical, especially as supply chains become more vulnerable. Recent data shows cargo theft incidents have surged by 27%, with the average loss skyrocketing to over $202,000. With risks like these, relying on a carrier’s built-in limited liability is a dangerous gamble. You can discover how market conditions impact risk strategies on risk-strategies.com to learn more.

Scenario One: The Armed Robbery

A custom engagement ring worth $75,000 is on its way to a client. Halfway through the journey, the carrier's armored truck is hit in a sophisticated armed robbery, and everything inside is stolen.

-

Claiming Against Cargo Liability: You file a claim with the carrier. Their legal team comes back saying that while the event was unfortunate, their liability is contractually capped at a tiny fraction of the ring’s value—maybe a few thousand dollars, tops. To get anything more, you'd have to launch a long, expensive legal battle to prove they were negligent in their security, which is nearly impossible for a shipper to do. The financial hit is almost entirely yours.

-

Claiming with a Jewelers Block Policy: You call your insurance agent at First Class Insurance Jewelers Block Agency. You send over the shipping documents and proof of the ring’s value. Your policy’s transit coverage kicks in, and because it’s a first-party, all-risk policy, the cause of the loss is covered. Within a few weeks, you have a check for the ring’s full insured value. You can now remake the piece for your client, protecting both your finances and your reputation.

Scenario Two: The Mysterious Disappearance

A box containing $120,000 in loose diamonds arrives at its destination. The outer shipping container is sealed and looks untouched, but when the recipient opens it, the inner box holding the diamonds is just… gone.

-

Claiming Against Cargo Liability: This is the classic "mysterious disappearance." Carrier liability policies almost always exclude this. Since there’s no sign of forced entry or theft, they’ll argue they did their job by delivering a sealed package. Your claim is denied flat out, leaving you with a complete loss.

-

Claiming with a Jewelers Block Policy: Thankfully, your policy includes a "Mysterious Disappearance" endorsement. You file the claim, providing the documentation for what was shipped. Your insurer investigates, but the burden of proving the carrier messed up isn't on you. The claim is approved, and you're made whole for the full value of the lost diamonds. What could have been a business-ending disaster becomes a manageable problem. You can explore our resources to see how to best protect unique pieces, like this stunning diamond ring on a black background.

This is why following a strict underwriting process is so important—it helps prevent these kinds of losses from happening in the first place.

The process is simple: proper declaration, secure packaging, and using trusted shipping methods are the bedrock of reliable insurance coverage.

Scenario Three: The Sorting Facility Fire

A shipment of assorted gold jewelry valued at $200,000 is sitting in a carrier's sorting hub, waiting for the next leg of its trip. Overnight, a massive fire breaks out, destroying the facility and everything in it.

-

Claiming Against Cargo Liability: You file your claim, only to have it denied. The carrier points to the "Act of God" clause in their contract. It’s a standard exclusion that lets them off the hook for damages from natural disasters or other uncontrollable events, like a catastrophic fire. You’re left with nothing.

-

Claiming with a Jewelers Block Policy: Your policy is built for exactly these situations. An "Act of God" isn't an exclusion. You file your claim, and your insurer processes it quickly, covering the full wholesale value of your lost inventory. Your business is safe. This is precisely why a strong, first-party Jewelers Block insurance policy is one of the most important assets you can have.

Making Shipping Coverage Part of Your Jewelers Block Policy

Thinking of shipping insurance as a separate line item from your main business policy is one of the most common—and expensive—mistakes a jeweler can make. The smartest way to protect your inventory is to see your Jewelers Block insurance as a seamless shield, one that covers your pieces from the moment they leave your vault to the second they’re in your customer’s hands. When you integrate them, you close the dangerous gaps where one policy ends and another might begin.

Your Jewelers Block policy shouldn't just be for on-site theft; it needs to be your first line of defense for every piece you ship. The first step is to stop treating your policy documents like fine print and start using them as your operational playbook. You need to know your "transit" or "shipping" limits as well as you know your best clients.

Get to Know Your Policy's Transit Warranties

Buried inside your Jewelers Block policy is a section on transit coverage that contains a set of non-negotiable rules called warranties. These aren't suggestions. They're mandatory conditions you absolutely have to follow to keep your coverage intact. If you breach a warranty, even by accident, your insurer has every right to deny an otherwise perfectly valid claim.

Your review should zero in on a few critical areas:

- Maximum Value Per Shipment: Your policy will clearly state the highest dollar value you can send in a single package. If you ship a $75,000 ring when your limit is $50,000, you could find yourself with no coverage at all for that shipment.

- Approved Carriers: Insurers almost always require you to use specific, high-security carriers like Brinks or Malca-Amit for items over a certain value. Using a standard courier for a high-value piece just to save a few bucks is a classic warranty violation that could void your coverage.

- Packaging Requirements: Many policies are incredibly specific about how you pack. They often mandate things like double-boxing and using tamper-evident tape to cut down on theft risk.

- Geographic Limitations: Make sure you know where you're covered to ship. Your policy might have restrictions on sending items to certain high-risk countries or regions.

Knowing When You Need a Standalone Policy

For most jewelry businesses, a well-written Jewelers Block policy offers all the transit protection you’ll ever need. But there are times when a separate, standalone cargo liability insurance policy or a special endorsement becomes necessary.

This usually happens when your shipping needs just outgrow what your current policy allows. For example, if you’re transporting an entire collection to an exhibition that’s worth far more than your standard per-shipment limit, you’ll have to arrange for extra coverage. The key is to have an open conversation with your insurance broker at a trusted agency like First Class Insurance Jewelers Block Agency before you ship, not after a package goes missing.

Here’s the bottom line: your shipping practices and your insurance policy have to be in perfect sync. Your daily operations should be a direct reflection of what your policy requires, turning compliance into a simple, everyday habit.

Right now, the marine cargo insurance market is seeing some softening rates. Certain transit policies in the U.S. are even seeing reductions of -5% to -10% for clients with a solid loss history. While that's good news, underwriters are still being extremely strict with high-exposure cargo. You can get more details on these market trends on specialty.ajg.com. This makes it even more important to show them you have rock-solid shipping protocols in place.

A simple checklist can help guide your review and make sure the conversation with your broker is productive, ensuring your jewelry store insurance is ironclad.

Common Questions About Insuring Jewelry in Transit

When it comes to shipping high-value jewelry, the world of insurance can feel a bit confusing. Let's clear up some of the most common questions jewelers have.

Does Paying for Shipping Automatically Insure My Package?

Absolutely not. This is a huge misconception that can cost you dearly. The basic fee you pay a carrier like FedEx or UPS only covers their absolute minimum liability, which is often just $100.

Even when you declare a higher value and pay extra, you aren't actually buying insurance. All you're doing is increasing the carrier's potential liability if you can prove they were negligent—a legal battle that's often tough and expensive to win. Your own Jewelers Block insurance policy is what provides real, first-party protection without having to prove fault.

What Is the Carmack Amendment?

The Carmack Amendment is a federal law that puts carriers on the hook for goods they lose or damage during interstate transport. But here's the catch: it also gives them the legal right to limit that liability in their contracts.

That's exactly why their standard coverage is so low. To get more than that tiny limit, you have to jump through legal hoops to prove carrier negligence. It’s a process designed to protect them, not you. This is why having your own dedicated insurance for a jewelry store is the only smart move.

What Does the Shipping Limit on My Jewelers Block Policy Mean?

This is your safety net. Having a dedicated shipping or transit limit on your Jewelers Block policy means your own insurance has your back up to that amount. You aren't left hoping the carrier will pay up.

The crucial part is to know and follow your policy's shipping warranties to the letter. These are the rules of the road—things like using specific carriers, following strict packaging protocols, or staying under certain value limits for a single package. Understanding just how little cargo liability insurance actually covers makes it clear why a solid Jewelers Block policy is the cornerstone of protecting your insurance for jewelry business.

Your inventory is too valuable to leave to chance. At First Class Insurance Jewelers Block Agency, we build insurance solutions designed for the unique risks of the jewelry trade. Protect your assets from your vault to their final destination with a policy that understands your business.