When it comes to insuring an engagement ring, the first question everyone asks is, "What's this going to cost me?" The good news is, it's probably far less than you think.

A solid rule of thumb is to budget between 1% to 2% of the ring's appraised value for your annual premium. That’s it. For a tiny fraction of what the ring is worth, you get total peace of mind.

Breaking Down The Annual Cost Of Ring Insurance

Think of ring insurance as a practical financial safeguard, not just an emotional one. While the 1-2% rule is a great starting point, seeing the actual dollars and cents makes the value crystal clear.

Let's say your ring was appraised at $8,000. Based on that rule, you'd be looking at an annual premium somewhere between $80 and $160. It's a small, predictable expense that protects you from the gut-wrenching cost of replacing a lost, stolen, or badly damaged ring entirely on your own dime.

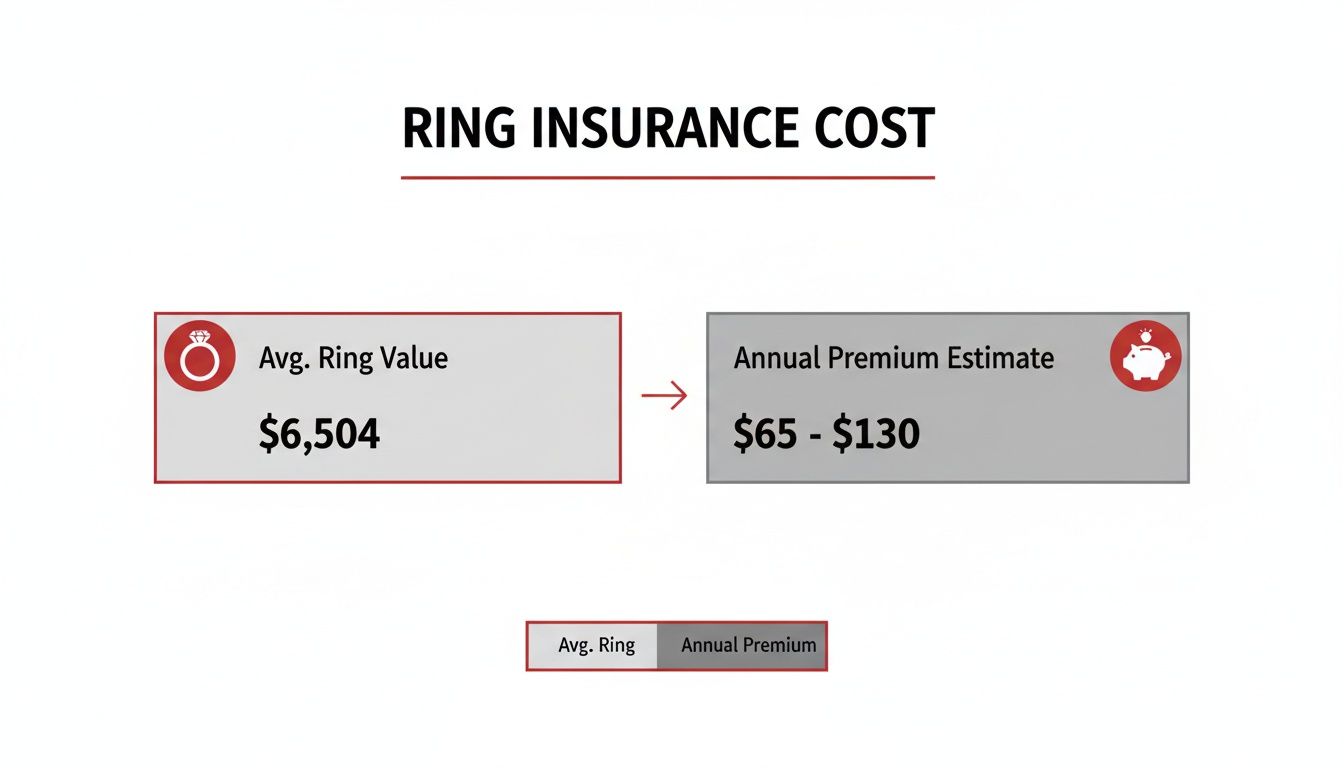

This infographic breaks it down for a ring right around the national average value.

As you can see, insuring one of your most precious assets is a completely manageable expense. It makes true peace of mind accessible to everyone.

Estimated Annual Insurance Cost By Ring Value

To give you a clearer picture, this table breaks down the typical annual and monthly premiums for engagement rings at different price points, using that standard 1-2% calculation.

| Ring Appraised Value | Estimated Annual Premium (1-2%) | Estimated Monthly Premium |

|---|---|---|

| $5,000 | $50 – $100 | $4 – $8 |

| $8,000 | $80 – $160 | $7 – $13 |

| $12,000 | $120 – $240 | $10 – $20 |

| $15,000 | $150 – $300 | $12 – $25 |

| $20,000 | $200 – $400 | $17 – $33 |

Keep in mind, these are just estimates. The final cost depends on several factors, including where you live and the specific coverage you choose, but this gives you a reliable ballpark figure to start with.

Real-World Cost Scenarios

Let's look at the hard data. In 2025, the average cost of an engagement ring in the U.S. settled at $6,504. Applying our 1-2% rule, insuring that ring would cost between $65 and $130 per year.

Some specialty insurers can even offer lower rates. A provider like BriteCo, for instance, might quote a premium in the 0.5% to 1.5% range. For that same $6,504 ring, your annual cost could drop to as little as $32.50 to $97.50.

The takeaway is simple: insuring your ring is a fractional investment. For a tiny percentage of its value, you get a comprehensive safety net against the unexpected.

Think about it this way—for less than the cost of a few nice dinners out, you can wear your ring every single day without that nagging "what if?" worry. This kind of dedicated policy covers situations that a standard homeowners or renters policy just won't, giving you a proper shield for a cherished https://jewelersblockins.com/wp-content/uploads/2025/11/diamond-ring-on-black-background-first-class-insurance-scaled-1-768×512.jpg and all that it represents.

If you want to go deeper on what drives these numbers, you can explore a comprehensive guide to engagement ring insurance costs. It's a smart annual investment that ensures a symbol of your love is protected for a lifetime.

Key Factors That Determine Your Premium

So why does engagement ring insurance cost so much from one person to the next, even when the rings have a similar price tag? That 1-2% rule of thumb is a great place to start, but it's just that—a starting point. Insurers dig a lot deeper to figure out your final premium.

Think about it like car insurance. The price of your car is a big deal, but your premium also depends on your driving record and where you park it overnight. The same logic applies here. The ring’s value is the main driver, but a few other key factors can really move the needle.

The Ring’s Appraised Value

This one’s the heavyweight. A higher appraised value means the insurer is on the hook for more if something happens, which leads directly to a higher premium. It’s simple math: a ring valued at $15,000 will cost more to protect than one valued at $5,000.

An official appraisal from a certified gemologist isn't optional; it's the foundation your entire policy is built on. This document breaks down not just the total value, but all the little details about the stone and setting—which brings us to our next point.

Even the type of stone can shift the price. For instance, insuring a moissanite or lab-grown diamond is often cheaper than insuring a natural diamond of the same size, purely because its replacement cost is lower.

Your Geographic Location

Where you live really matters. Insurers use location data to figure out risk, so if you live in an area with higher rates of theft, you can expect your premium to be a bit higher. This is one of the most common reasons two people with identical rings get totally different quotes.

This has become even more important as the market grows. The global engagement ring insurance market was valued at $500 million in 2025 and is on track to hit $1.1 billion by 2033. Premiums in big cities often reflect higher risks, a trend you can see in this Engagement Ring Insurance Market Report.

Simply put, your zip code is a direct input in the risk calculation. An insurer views a ring kept in a bustling city differently than one in a quiet suburban town.

Your Personal Claims History

Just like with your car insurance, your past claims can come into play. If you have a history of filing claims for lost or stolen items, an insurer might see you as a higher risk.

On the flip side, a clean record shows you're a responsible owner, which can earn you a better rate. A previous claim might add a small loading to your premium, often around 10%.

The Ring’s Characteristics

Beyond the main stone, the ring's specific design details can influence the cost.

- Setting Style: A complicated setting with lots of tiny pavé or halo diamonds is tougher—and more expensive—to repair or replace than a simple solitaire. That intricacy can bump up the premium.

- Type of Metal: The metal itself, whether it's platinum or 14k gold, directly impacts the replacement value listed on your appraisal.

- Unique Features: Heirloom pieces or custom-designed rings often need a specialized appraisal and coverage. Protecting these stunning antique jewelry designs is critical because of their one-of-a-kind value.

By looking at all these pieces together, insurers can create a premium that accurately reflects what it takes to protect your specific ring, moving well beyond a simple percentage.

Specialized Jewelry Insurance Vs Homeowners Policies

Thinking your standard homeowners or renters insurance has you covered for an engagement ring is one of the biggest—and most expensive—mistakes people make. It seems to make sense, right? It’s a personal belonging. But the reality is that those policies are built to protect your house and the stuff inside it, not high-value, easy-to-lose items like a diamond ring.

This simple misunderstanding can turn into a painful financial lesson if you ever have to make a claim. Standard policies almost always have shockingly low coverage limits for valuables, often capping the payout at just $1,500. When your ring is worth thousands more, you’re left with a massive gap, forced to cover the rest out of your own pocket.

The Limitations of Homeowners Policies

It’s not just about the low payout caps. Homeowners policies are packed with other limitations that make them a terrible fit for protecting an engagement ring. For starters, they almost always come with a high deductible, meaning you could be on the hook for the first $500 or $1,000 of any claim before your insurance pays a dime.

Worse yet are the coverage gaps. Most basic policies only cover specific, named events like a fire or a burglary at your home. This leaves you completely exposed to the most common ways a ring actually disappears.

- Accidental Loss: Drop your ring down the kitchen sink or leave it in a public restroom? A homeowners policy will almost certainly tell you that’s not their problem.

- Mysterious Disappearance: Can't find your ring but you can't prove it was stolen? That’s often called "mysterious disappearance," a classic exclusion in most standard policies.

- Damage: If you chip a stone or bend the prongs while going about your day, you’re on your own. Daily wear and tear is rarely, if ever, covered.

- Worldwide Coverage: Your policy’s protection usually ends at your front door, offering little to no help if something happens while you're on vacation or just out running errands.

The Superior Protection of Specialized Policies

This is exactly where a standalone jewelry policy proves its worth. It’s not just an add-on; it’s a dedicated shield built from the ground up to handle the unique risks that come with wearing and traveling with fine jewelry. A specialized policy gives you what the industry calls ‘all-risk’ or ‘open perils’ coverage.

Think of it this way: instead of a short list of things that are covered, an all-risk policy covers your ring against everything except for a few specific exclusions (like intentionally damaging it yourself). This means you’re protected from theft, damage, accidental loss, and even mysterious disappearance—anywhere in the world.

These policies are also designed for a much smoother claims process. Many offer a $0 deductible option, which means you pay nothing out of pocket for a repair or replacement. And unlike filing a claim on your homeowners policy (which can jack up your rates for years), a claim on a standalone jewelry policy won't impact your other insurance premiums.

To put it simply, one is a generalist, and the other is a specialist. Here’s a quick breakdown of how they stack up.

Standalone Jewelry Insurance Vs. Homeowners Policy Rider

| Feature | Specialized Jewelry Insurance | Homeowners/Renters Policy |

|---|---|---|

| Coverage Type | 'All-Risk' (covers everything except specific exclusions) | 'Named Perils' (only covers events listed in the policy) |

| Common Scenarios | Covers accidental loss, mysterious disappearance, damage, and theft | Typically only covers theft from the home and fire |

| Coverage Limits | Covers the full appraised value of the ring | Very low limits, often capped at $1,500 |

| Deductible | $0 deductible options are widely available | Subject to the policy's standard deductible (often $500+) |

| Geographic Scope | Worldwide protection, no matter where you are | Coverage is usually limited to your primary residence |

| Claims Impact | A claim does not affect your homeowners premium | A claim can raise your homeowners premium for years |

| Replacement | You can often work with your original jeweler for an exact match | Insurer chooses a replacement, often from a network partner |

As you can see, the difference in protection is night and day. A homeowners policy offers a false sense of security, while a specialized policy delivers real peace of mind.

A Real-World Example of Why It Matters

Let’s play out a scenario. You’re on your honeymoon in Italy, and after a swim in the ocean, you look down at your hand and your ring is gone. Total panic. If you’re relying on homeowners insurance, you’ll make a frantic call only to be told that loss outside the home isn't covered, or that the $1,500 limit is the best they can do—after you pay your deductible.

Now, imagine that same moment but with a specialized jewelry policy. You make one call. Your insurer gets to work, often coordinating directly with your jeweler back home to create an identical replacement that’s waiting for you when you return. The heartbreak is still there, but the financial disaster is completely gone. That’s the difference.

Understanding Commercial Insurance For A Jewelry Business

While insuring a single engagement ring is a personal choice, the math completely changes when you're in the business of selling them. A jewelry business faces risks on a totally different scale, and that calls for a specialized shield far tougher than any individual policy. This is where the whole concept of insurance for a jewelry store becomes absolutely essential.

Protecting an entire inventory—from loose stones to finished pieces—demands a commercial solution. The industry standard for this kind of protection is known as Jewelers Block insurance. This isn't just another policy; it's a comprehensive safety net built from the ground up for the unique vulnerabilities of the jewelry trade.

What Is Jewelers Block Insurance

Unlike a personal policy covering one item, Jewelers Block insurance is an all-in-one policy designed to protect a store's entire stock. It covers inventory whether it’s sitting in a showcase, locked in a vault overnight, or even while it's being transported to a trade show or another location.

This type of insurance for a jewelry business wraps multiple coverages into a single, straightforward policy. It’s specifically built to handle the perils jewelers face every day, offering a level of protection that your standard business insurance just can't touch.

Key Coverage Areas For A Jewelry Store

A solid Jewelers Block policy goes way beyond simple theft protection. It provides a multi-layered defense for nearly every part of a jeweler's operation. When you partner with a specialist like a First Class Insurance Jewelers Block Agency, you ensure your coverage is meticulously matched to your business model.

Core protections almost always include:

- Inventory Coverage: This protects your entire stock of jewelry, gemstones, and precious metals against theft, damage, and loss.

- Transit and Shipping: This covers your goods while they're on the move, whether shipped via armored car or sent through carriers like FedEx or UPS.

- Travel Coverage: Get protection for inventory when you or your salespeople are on the road meeting clients or attending industry events.

- Customers' Property: This covers jewelry customers leave in your care for repair, appraisal, or consignment.

- Showcase Protection: Covers losses from the nightmare scenario of a smash-and-grab theft during business hours.

Jewelers Block insurance is the operational backbone for any jewelry business. It transforms a collection of high-value, high-risk assets into a secured, insurable inventory, allowing owners to focus on their craft and customers instead of constant worry.

Why Standard Business Insurance Falls Short

Trying to protect a jewelry store with a standard Business Owner's Policy (BOP) is like trying to stop a flood with a paper towel. It just won't work. These general policies have laughably low sub-limits for valuable items like jewelry and often exclude common risks like mysterious disappearance or off-premises theft. The very nature of the jewelry business, with its high-value and portable assets, demands a specialized approach.

This is why it's so critical to work with underwriters who actually get the industry, like those associated with markets such as Lloyd's of London. These organizations have centuries of experience underwriting unique and complex risks, which is exactly what a jewelry business is.

How To Get A Quote For Jewelers Block

Getting the right jewelry store insurance starts with a detailed application process. An insurer who specializes in this field will need to get a deep understanding of your business operations to give you an accurate quote. The whole point is to build a policy that perfectly mirrors your specific risk exposure.

To get a quote for Jewelers Block, you'll need to have information ready on:

- Inventory Values: The total value of your stock, broken down by category (e.g., watches, diamonds, gold).

- Security Measures: All the details about your safes, alarm systems, surveillance cameras, and physical security protocols.

- Business Operations: Information on your business hours, number of employees, and whether you travel with inventory.

- Claims History: A record of any previous losses or insurance claims.

An experienced agency will walk you through this from start to finish, making sure every factor is considered to build a policy that gives you complete protection without a dollar of wasted cost. This dedicated approach is the only real way to secure the assets and future of a jewelry business.

How To Get An Accurate Quote And Secure Coverage

Ready to get that ring protected? The good news is that securing the right insurance isn't nearly as complicated as it sounds. It just comes down to doing a few key things in the right order to make sure your quote is spot-on and your coverage is solid.

It all boils down to one thing first: a professional appraisal. This isn’t just a nice-to-have; it’s the bedrock of your entire policy. Without it, an insurer is just guessing at your ring’s value, and that’s not a risk you want to take.

Start With A Professional Appraisal

Before any insurer can tell you your engagement ring insurance cost, they have to know exactly what they’re protecting. An appraisal is a hyper-detailed report from a certified gemologist that breaks down every last feature of your ring—the four Cs of the diamond, the metal type, the setting's craftsmanship, you name it.

This document does two critical jobs:

- It Establishes Value: It gives you an official, expert-verified replacement value. No guesswork.

- It Creates a Blueprint: If the worst happens, this report is the exact recipe needed to create an identical replacement.

Think of the appraisal as your ring’s official biography. It’s the single most important document you’ll need, and most insurers will want one that's been updated in the last couple of years to keep up with market prices.

Gather Your Essential Documents

Once you have your appraisal, you’re almost there. The next step is just pulling together a few other key pieces of paperwork. Having everything ready to go will make the whole process a breeze.

You’ll want to have these on hand:

- The original sales receipt for proof of purchase.

- Your diamond’s GIA certificate or grading report, if it came with one.

- A few clear, well-lit photos of the ring from different angles.

To keep everything straight and make any potential claims down the road easier, check out this practical guide to home inventory for insurance. Staying organized from the start is a game-changer.

When you hand over this complete package, you're not just asking for a quote—you're giving the insurer everything they need to give you a precise one, fast. The more detail you provide, the better the policy will reflect your ring's true value.

Compare Offers And Read The Fine Print

After you submit your documents, you'll get a personalized quote. Now, it’s tempting to just look at the annual premium and pick the lowest number, but that's a mistake. You have to dig a little deeper and see what you're actually getting for that price.

Ask the important questions. Does it cover "mysterious disappearance" (a.k.a. you have no idea where it went)? What’s the deductible? Can you go back to your original jeweler for a replacement? Getting answers to these questions is the difference between having just any policy and having the right one.

While premiums typically run between 1% to 2% of your ring's value, the coverage itself can be worlds apart. For a $5,000 ring, you might pay just $50 to $100 a year, but what that money buys is what really counts. Even so, about 40% of ring owners skip getting a specialized policy, leaving them exposed to the major gaps in standard homeowners insurance. This last step of careful review ensures you’re buying real peace of mind, not just a price tag.

Still Have Questions About Ring Insurance?

Even after digging into the details, it's natural to have a few more questions pop up. Let's tackle some of the most common ones we hear, giving you the clear, direct answers you need to move forward with total confidence.

Can I Insure A Lab-Grown Diamond Or Moissanite Ring?

Absolutely. You can and absolutely should insure rings with alternative stones like lab-grown diamonds and moissanite. The process is exactly the same as insuring a natural diamond ring, starting with a professional appraisal to nail down its true replacement value.

Because these stones are usually more affordable than their mined counterparts, the engagement ring insurance cost is often much lower. For example, insuring a $3,000 lab-grown diamond ring might only set you back between $30 and $60 a year. That’s a tiny price to pay for complete peace of mind.

What Happens If I Lose My Ring Abroad?

This is where a specialized jewelry insurance policy really proves its worth. Unlike a standard homeowners policy, which often confines coverage to your property lines, a dedicated jewelry policy gives you worldwide protection.

If you lose your ring while traveling, your coverage is right there with you. You'd simply file a claim, and your insurer works to get you a repair or replacement, often coordinating directly with your original jeweler—no matter where you are in the world.

Is It Better To Use A Specialist Or My Homeowners Policy?

While adding a rider to your homeowners policy is an option, it's rarely the best one. These policies are notorious for high deductibles, low coverage limits (sometimes capped as low as $1,500), and a long list of exclusions that leave you exposed to common mishaps like accidental loss.

A specialized policy is built for this one job. It offers 'all-risk' coverage that includes mysterious disappearance and often comes with a $0 deductible option. Plus, making a claim on a standalone policy won't jack up your homeowners premium, which is a huge financial advantage.

What Is Jewelers Block Insurance?

Think of it this way: while personal jewelry insurance protects your ring, Jewelers Block insurance is the commercial-grade version for a jewelry business. It’s the essential insurance for a jewelry store, covering an entire inventory against threats like theft, damage, and loss while items are in transit.

It's a policy that bundles multiple protections into one, making it the industry standard insurance for a jewelry business. Getting the right coverage usually means working with a First Class Insurance Jewelers Block Agency to evaluate your store’s specific risks and get a quote for Jewelers Block that truly fits how you operate.

Ready to secure your assets with an expert on your side? Whether you need personal jewelry protection or comprehensive insurance for your jewelry store, First Class Insurance delivers solutions built for you. Get a quote for Jewelers Block and personal coverage today.