Excess liability insurance is a second line of defense that only comes into play after your primary policy, like a Jewelers Block policy, is completely tapped out from a major claim. Think of it as a critical financial backstop for your jewelry business, standing between a catastrophic lawsuit and your company’s future.

Your Financial Safety Net Beyond Standard Limits

Picture your main insurance policy as a high-security vault. It's built to handle the most common risks your business faces, like theft or a minor customer injury. That vault is tough, but it has a limit. What happens when a disaster is so big it blasts right through the vault's door?

This is exactly where excess liability insurance steps in. It’s like a fortified bunker built underneath your vault. Once a massive lawsuit or claim blows through your primary policy's limit, this secondary coverage kicks in to handle the rest. It's a layer of security designed specifically for those rare but financially devastating events.

Why Standard Policies Are Not Enough

Your standard Jewelers Block insurance or general liability policies are the foundation of your protection, but they have hard caps. A serious slip-and-fall in your showroom that leads to a multi-million-dollar lawsuit can easily blow past a standard $1 million limit. Without more coverage, your business is on the hook for every dollar beyond that.

This is what makes excess liability a vital tool for smart decision making under uncertainty. It closes the dangerous gap between what your primary policy covers and the true cost of a catastrophe.

For a jeweler, where trust and reputation are everything, a single massive, uncovered lawsuit does more than just drain your bank account—it can shatter your brand. Excess liability protects both your balance sheet and your good name.

At the end of the day, this isn't just an add-on; it's a strategic necessity. It ensures that one terrible event doesn’t wipe out years of hard work, protecting your assets, your team, and your legacy.

How Excess Liability Insurance Actually Works

The best way to get your head around excess liability insurance is to think of it as a stacked defense system. Your primary policy, like your Jewelers Block coverage, is your first line of defense. It’s built to handle the expected claims and absorb the initial financial hit, but only up to its limit.

When a truly catastrophic event blows past that primary limit, your excess liability policy kicks in. It picks up right where the first policy stops, covering the damages that would otherwise come straight out of your pocket. This handoff point has a name: the attachment point.

Understanding Attachment Points and Following Form

The attachment point is just the dollar amount where your primary coverage ends and the excess coverage begins. For example, if your Jewelers Block policy has a $1 million limit, the attachment point for your excess policy is $1,000,001. It’s a clean handoff designed to make sure there are no gaps in your financial armor.

Most of the time, excess liability policies are written to "follow form." This is a critical detail. It means the excess policy simply adopts the same terms, conditions, and exclusions as your primary policy. It’s not there to add new types of coverage—it’s there to add more dollars on top of the protection you already have.

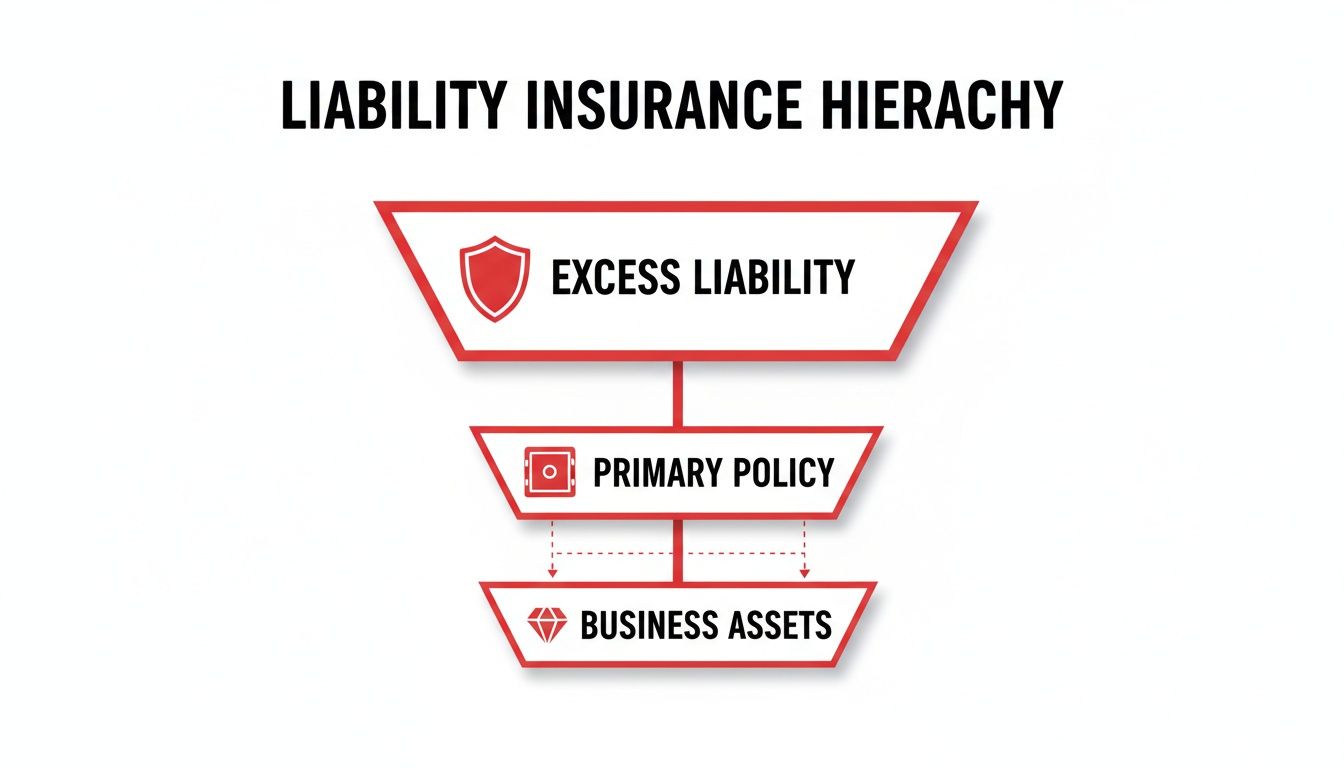

This diagram shows you exactly how these layers of protection are stacked to shield your business assets.

As you can see, the excess liability layer sits directly on top of your primary policy, providing that crucial extra buffer between a massive claim and your company’s financial foundation.

How the Layers Stack Up

This layered approach is a smart, standard strategy in commercial insurance. It gives businesses a predictable and structured way to handle worst-case scenarios. Let’s say a jewelry store has a $1,000,000 general liability policy and adds a $2,000,000 excess layer on top. Just like that, they have $3,000,000 in total coverage. If a lawsuit results in a $2.5 million judgment, the primary policy pays its full $1 million, and the excess insurer steps in to cover the remaining $1.5 million. This structure is explored further in resources like cpajournal.com.

An excess liability policy isn't a substitute for your primary insurance; it's a powerful reinforcement. It works on the assumption that your foundational coverage is already solid and builds on it, giving you the financial depth to survive a major disaster.

At the end of the day, this strategy allows a jeweler to secure multi-million-dollar protection without the sky-high premiums of a single, massive primary policy. By stacking policies, you create a far more efficient and robust defense that’s customized for the high-stakes risks you face.

Choosing Between Excess Liability and Umbrella Insurance

When you start looking for ways to boost your coverage beyond your primary policy limits, you’ll run into two key terms: excess liability and umbrella insurance. It’s easy to think they’re the same thing—many people use the terms interchangeably—but they have critical differences. For a jeweler, picking the wrong one could leave a massive, unexpected gap in your financial protection.

The biggest difference boils down to one simple thing: the scope of the coverage. Excess liability insurance is designed to be a clean, straightforward extension of a policy you already have.

Excess Liability: The 'Follow Form' Principle

An excess liability policy is what we in the industry call a “follow form” policy. That’s a fancy way of saying it mirrors the exact terms, conditions, and exclusions of your underlying policy, like your Jewelers Block or general liability insurance. Its only job is to add a higher dollar limit on top of that existing coverage.

Think of it like adding an extra fuel tank to your car. You’re not changing the engine or what the car is capable of doing; you’re just giving it the ability to go a lot farther. If your primary policy doesn’t cover a certain kind of claim, your excess liability policy won’t cover it either. Simple as that.

Umbrella Policies: Broadening the Coverage

An umbrella policy is a different beast. While it also gives you higher liability limits, its main feature is that it can actually be broader than your underlying policies. This means it can "drop down" and kick in to cover certain claims your primary policies specifically exclude.

For instance, your standard general liability policy might not cover claims related to libel or slander. A good umbrella policy, however, often does. This makes it more like upgrading your car’s engine and adding that extra fuel tank—you get more power and more range.

An excess policy just raises the ceiling on your existing protection. An umbrella policy can raise the ceiling and, in some cases, expand the whole room by covering risks your primary policy won’t touch.

To help you see the differences side-by-side, here’s a quick breakdown:

Excess Liability vs. Umbrella Insurance Key Differences

| Feature | Excess Liability Insurance | Umbrella Insurance |

|---|---|---|

| Primary Function | Increases the financial limits of a specific underlying policy. | Increases liability limits and can also cover claims excluded by underlying policies. |

| Coverage Scope | "Follow Form"—it strictly mirrors the terms of the primary policy. | Can be broader than the primary policy, filling in coverage gaps. |

| How It Works | Stacks vertically on top of one existing policy (e.g., General Liability). | Spreads horizontally over multiple policies (e.g., General Liability, Auto Liability) and adds height. |

| Complexity | Simpler. Its only job is to add more money to an existing structure. | More complex. It can act as primary insurance for claims not covered by other policies. |

Choosing between the two really comes down to your specific needs. For most jewelry stores just looking to increase protection against a catastrophic liability claim, a follow-form excess policy is often the most direct and effective solution.

It cleanly stacks on top of your existing jewelry store insurance, creating a taller, stronger financial shield without overcomplicating things. A quick chat with a specialized broker, like the team at First Class Insurance Jewelers Block Agency, can help you figure out exactly which structure best protects your business.

Why Jewelers Face Catastrophic-Level Risks

The world of fine jewelry is built on exceptionally high stakes. Unlike just about any other retail business, a single incident at your store can unleash liability claims that skyrocket into the millions, making a standard insurance policy feel paper-thin in an instant.

This is where the idea of excess liability coverage stops being an abstract concept and becomes a very real, very concrete necessity. Your Jewelers Block insurance is the foundation, but its limits can be wiped out in the blink of an eye. The unique environment of a jewelry store creates a perfect storm for risks that go far beyond a simple smash-and-grab.

Scenarios That Dwarf Standard Limits

Picture this: you're hosting an exclusive evening event to unveil a new collection. The showroom is buzzing with high-net-worth clients, champagne is flowing, and the energy is electric. Suddenly, a temporary display holding heavy pieces collapses, triggering a chain reaction that injures several guests and shatters priceless heirlooms they were wearing.

The lawsuits that follow could easily climb into the multi-million-dollar range, blowing past a typical $1 million general liability limit.

Other high-risk scenarios are just as plausible:

- Severe Premises Liability: A client slips on a freshly polished marble floor and suffers a permanent, life-altering injury. The resulting medical bills, lost income claims, and pain and suffering damages could easily lead to a judgment of $3 million or more.

- Third-Party Property Damage: A fire starts in your workshop while you're repairing a client's heirloom watch. The blaze spreads next door to a high-end art gallery, destroying millions in inventory. Your business would be on the hook for all of it.

- High-Value Consignment Loss: A collector entrusts you with a rare, multi-million-dollar diamond for a custom setting. It gets stolen from your safe in a sophisticated heist. Your standard policy might only cover a fraction of its staggering value, leaving you personally responsible for the rest.

These aren't Hollywood plots; they are real-world possibilities that keep experienced jewelers awake at night. While the average slip-and-fall claim can top $50,000, a truly severe case can multiply that figure exponentially.

A Story of Financial Survival

Let’s walk through what a catastrophic claim looks like in the real world. A long-time customer brings in an antique necklace appraised at $2.5 million for cleaning and a minor repair. A junior employee mishandles the piece, causing irreparable damage. The devastated client sues your store for the full replacement value.

Your primary Jewelers Block policy has a liability limit of $1 million. The policy pays out its full limit, but you're still staring at a $1.5 million bill.

Without excess liability coverage, that $1.5 million shortfall comes directly out of your business assets. You'd be forced to liquidate inventory, sell property, and potentially face bankruptcy. The business you spent decades building could be wiped out by one terrible mistake.

Now, imagine the same scenario, but you have a $5 million excess liability policy in place. Once your primary policy pays its $1 million, the excess policy kicks in to cover the remaining $1.5 million of the judgment. It's the critical backstop that turns a business-ending disaster into a manageable crisis. It protects not just your assets, but your entire legacy.

You can learn more about securing high-value items by viewing beautifully protected pieces like this stunning diamond ring on a black background.

Understanding the Costs and Calculating Your Limits

Let's talk about the bottom line: how much does this protection cost, and how much do you actually need? Figuring out the right amount of excess liability insurance is all about balancing the premium against the kind of catastrophic risk that could close your doors for good.

While the peace of mind is priceless, the premiums are a real business expense. Underwriters at a specialty firm like First Class Insurance Jewelers Block Agency don’t just pull numbers from a spreadsheet. They dig deep into your specific operations to price a policy that accurately reflects your risk.

Key Factors That Drive Your Premium

When it comes to insurance for a jewelry business, underwriters look at a few critical things to understand your risk profile. The more risk they see, the higher your premium will be.

Here’s what they’re zeroing in on:

- Your Desired Coverage Limit: This is the most straightforward factor. A $10 million policy is going to cost more than a $2 million one simply because the insurer is on the hook for a much larger potential payout.

- Your Claims History: A track record of frequent or large liability claims sends up a red flag. On the other hand, a clean history shows you run a tight ship, which can work in your favor to lower costs.

- Business Revenue and Size: It's a simple numbers game. More revenue and more foot traffic usually mean more exposure to potential liability, which gets factored into the premium.

- Physical Security and Operations: This is where you have some control. Strong security protocols, a well-maintained storefront, and rigorous employee training can significantly lower your perceived risk—and your premium along with it.

What Jewelers Can Expect to Pay

Premiums can really swing depending on the factors above. A small, low-risk business might pay somewhere between $500–$2,000 a year for a $1 million layer of coverage.

A medium-sized jewelry store needing $1–$5 million in protection could see premiums in the $2,000–$10,000 range. For high-end firms or those with significant risk exposures looking for $10+ million in coverage, costs could easily run $10,000–$50,000 or more annually. You can get a better sense of how underwriters view these factors from insights on LibertyInsurance.com. The goal is to find that sweet spot for your specific operation.

Think of your excess liability premium not as just another bill, but as a strategic investment in the long-term survival of your business. It’s the price you pay for resilience when a worst-case scenario hits.

Per-Occurrence vs. Aggregate Limits

Finally, you need to get clear on how your policy limits are structured. Every policy has two numbers that matter most:

- Per-Occurrence Limit: This is the absolute maximum the policy will pay for any single claim or incident.

- Aggregate Limit: This is the total amount the policy will pay out over the entire policy term (usually one year), no matter how many separate claims you file.

For a jeweler, making sure both of these limits are high enough is non-negotiable. When you layer your policies correctly, you're building a financial fortress that protects every facet of your business, including your irreplaceable collection of antique jewelry.

Securing the Right Coverage for Your Jewelry Business

Navigating the world of insurance for a jewelry business can feel like a maze, but getting the right protection really boils down to one thing: working with a specialist. You need a partner, not just a policy provider.

An expert broker, like First Class Insurance Jewelers Block Agency, lives and breathes the unique, high-stakes risks that standard insurers just don’t get. They're your advocate, making sure your coverage is built for the world you actually operate in, not some generic business template.

A good broker ensures your excess liability policy fits seamlessly over your primary Jewelers Block insurance, like a second skin. This is critical for preventing the kind of dangerous gaps that can leave you financially exposed after a major claim. They'll also walk you through the underwriting process, helping you frame your business in the best possible light to lock in better terms and pricing.

Questions for Your Insurance Broker

Before you sign anything, you need to ask the right questions. Think of this less as a purchase and more as a crucial part of your risk management strategy.

Here’s what to ask:

- Does this excess policy truly "follow form" with my current Jewelers Block coverage?

- Are there any surprising exclusions in this excess policy I need to be aware of?

- In a worst-case scenario, how do the per-occurrence and aggregate limits actually work together?

- What documents should I get ready now to make the underwriting process go smoothly?

Your broker should have clear, confident answers. Their expertise is your single greatest asset in building a financial fortress around your business, backed by trusted underwriters like those seen in this Lloyd's of London logo.

At the end of the day, the right partnership makes all the difference. It's time to start the conversation and properly safeguard the legacy you've worked so hard to build. Get a Quote for Jewelers Block and talk through your specific excess liability needs with an expert who truly knows your industry inside and out.

Answering Your Top Questions

Getting into the specifics of excess liability insurance always brings up a few key questions, especially for a jeweler handling high-value assets. Let's clear up some of the most common ones.

Can I Get an Excess Liability Policy on Its Own?

In a word, no. Excess liability isn't a standalone policy. Think of it as a booster pack for your existing coverage, like your Jewelers Block insurance or general liability policy.

Its entire job is to kick in after your primary insurance has been completely used up. The primary policy always pays first, and only when its limit is exhausted does the excess policy jump in to cover the rest.

Does This Cover a Mistake I Make as a Jewelry Appraiser?

Probably not. A standard excess liability policy almost always "follows form," meaning it copies the terms of the general liability policy it sits on top of. General liability is designed for things like slip-and-falls or property damage—it specifically excludes professional mistakes, also known as Errors & Omissions (E&O).

An appraisal error that costs a client money is a professional liability issue. To get more coverage for that kind of risk, you'd need a dedicated E&O policy first, and then find an excess policy built to stack on top of that specific professional coverage.

How Much Excess Coverage Does My Jewelry Store Really Need?

There's no one-size-fits-all answer here, as it depends entirely on your store's unique risks. You have to consider the total value of your inventory, your annual sales, where your store is located, and frankly, what helps you sleep at night. Proper insurance for a jewelry store requires a careful assessment.

A great place to start is to picture a true worst-case scenario, like a lawsuit that runs into the millions after a serious customer injury. If you have a lot of foot traffic or work with seven-figure client pieces, you should be looking at higher limits—often in the $5 million to $10 million range, or sometimes even more, to make sure one bad day doesn't sink the business.

Protecting the business you've poured everything into requires a partner who gets it. The experts at First Class Insurance Jewelers Block Agency live and breathe the unique risks of the jewelry world. We can build an insurance program that truly safeguards your assets and your future. Get a Quote for Jewelers Block and get the peace of mind you deserve.