Picture this: you're shipping a one-of-a-kind, million-dollar diamond necklace across the ocean. You wouldn't just pop it in a box and hope for the best, would you? Of course not.

Think of marine freight insurance as that piece’s personal security detail. It’s the specialized protection that guards your diamonds, gemstones, and finished jewelry as they travel by sea, air, or even over land.

Why Your Jewelry Needs Its Own Security Detail on the Move

For jewelers, risk doesn’t end at the showroom door. The moment a high-value piece leaves your hands, it enters a world of uncertainty—mishandling, theft, accidental damage, you name it. Your standard business policy, or even a great Jewelers Block insurance policy, likely has gaps when it comes to covering these specific in-transit risks.

That’s where marine freight insurance steps in. It’s built to fill the holes other policies leave behind, making sure your assets are covered from your door to their final destination. This isn't generic coverage; it’s designed specifically for the unique vulnerabilities of shipping small, high-value goods.

The Modern Realities of Shipping Jewelry

Today's global supply chain is a complicated web. A single shipment might go from a truck to a plane and then onto a ship before it’s done. Every time that package changes hands, a new risk is introduced.

It’s this complexity that has driven the demand for solid protection through the roof.

The global marine freight insurance market is already huge, valued at over USD 37 billion in a recent year, and it’s expected to keep growing. That tells you something important: businesses everywhere understand that the financial hit from a single lost shipment is just too big to ignore.

For a jeweler, losing even one package containing a piece like this stunning diamond ring could be a devastating blow to the business.

More Than a Policy—It’s a Business Lifeline

Good marine freight insurance does more than just repay you for lost goods. It’s about keeping your business running and protecting your hard-earned reputation. A lost shipment means broken promises to clients, strained relationships with partners, and a serious hit to your bottom line.

A key part of this protection is proving you've done your part. Understanding the critical distinction between packaging and shipping supplies isn't just good practice; it’s often a requirement for coverage. Insurers want to see that you’re taking every possible precaution to safeguard your assets.

Ultimately, this insurance gives you the confidence to operate in a global market, knowing you’re protected no matter where your business takes you.

Understanding Your Two Core Policy Options

When you start looking into marine freight insurance for your jewelry, you'll run into two main types of policies: All-Risk and Named Perils. They might sound a bit alike, but the difference in protection is massive. For a jeweler, picking the right one is absolutely critical—it’s the foundation of your financial security when your pieces are out in the world.

Let's break it down with a simple analogy.

Think of an All-Risk policy as a fortress with just a few, clearly marked exits. It’s designed to cover every imaginable risk your shipment could face unless a specific peril—like war or gradual wear-and-tear—is explicitly written out of the policy. This "cover-everything-unless-excluded" approach gives you the most complete protection possible.

On the other hand, a Named Perils policy is more like a security guard with a very specific, short list of threats they’re allowed to stop. This policy only covers losses from the exact events listed in the contract, such as fire, collision, or theft. If your shipment gets damaged by something that isn't on that list, you're out of luck.

All-Risk: The Gold Standard for Jewelers

For anyone in the jewelry business, the choice is almost always crystal clear. The high value and delicate nature of your products demand the kind of comprehensive shield that only an All-Risk policy can offer.

Crucially, it shifts the burden of proof. If a loss happens, the insurance company has to prove an exclusion applies to deny the claim. With a Named Perils policy, the burden is on you to prove the loss was caused by one of the specific events covered. That's a huge difference when you're trying to recover from a loss.

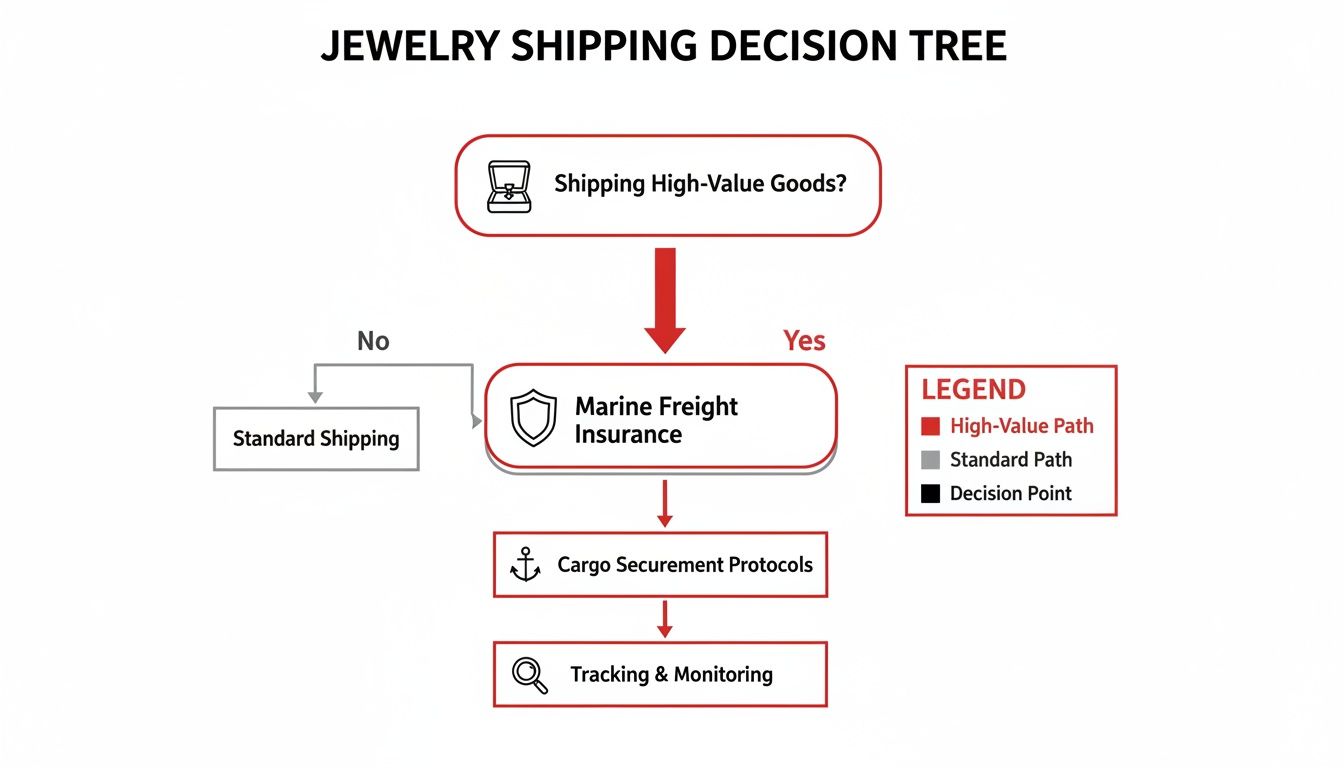

This decision tree shows why specialized insurance is a non-negotiable step when you're moving high-value goods like jewelry.

As you can see, the moment you’re dealing with a high-value shipment, the path leads straight to securing a proper marine freight policy. It’s not an add-on; it's a core part of your logistics plan.

All-Risk vs Named Perils At A Glance

To make the distinction even clearer, let's put the two policy types side-by-side. This table gives you a quick snapshot of what you're really getting with each option.

| Feature | All-Risk Policy | Named Perils Policy |

|---|---|---|

| Coverage Scope | Covers all risks of loss or damage, unless specifically excluded. | Only covers losses from perils specifically listed in the policy. |

| Best For | High-value, delicate, or critical goods like jewelry, electronics, and art. | Low-value, durable goods where risks are well-defined and limited. |

| Burden of Proof | The insurer must prove that an exclusion applies to deny a claim. | The policyholder must prove the loss was caused by a covered peril. |

| Common Scenarios | Covers mysterious disappearance, accidental drops, and most unforeseen events. | Often excludes common issues like mysterious disappearance or accidental damage. |

| Example | A fortress protecting against everything except for a few known exits. | A security guard who only protects against a pre-approved list of threats. |

Ultimately, for a jeweler, the choice is clear. The potential for uncovered losses with a Named Perils policy is just too high to justify the small savings in premium.

Named Perils: Where It Falls Short

While a Named Perils policy might look like a cheaper option, it's a dangerous gamble for jewelers. The list of covered events is finite, but the world of global shipping is filled with an infinite number of things that can go wrong.

Just think about these common scenarios where a Named Perils policy would likely leave you completely exposed:

- Mysterious Disappearance: A package simply vanishes from the tracking system with no clear evidence of theft.

- Accidental Damage: A crate is dropped during loading at the port, shattering the gemstones inside.

- Water Damage: A container seal fails, and moisture seeps in, tarnishing a collection—but it wasn't caused by a named storm.

These situations are almost never on the list for a Named Perils policy, creating enormous gaps in your financial safety net.

In the complex world of shipping, assuming broad coverage from vague terms like "from any cause" can be a costly mistake. Courts often rule that specific exclusions and warranties, like those for shipping delays, can override general coverage grants, leaving businesses with unexpected losses.

This is exactly why you need to understand the fine print and always opt for the clearest, most extensive coverage you can get. The sheer size of the cargo insurance market backs this up. Marine cargo (freight) insurance is the biggest piece of the global marine insurance industry, making up about 56–57% of all premiums. With businesses paying around USD 22.6 billion in a recent year, it’s obvious that financial exposure during shipping is a massive concern. You can explore more about these global shipping statistics and see what they mean for businesses like yours.

How to Properly Value Your High-Value Shipments

For any jeweler, getting the valuation of your shipment right isn’t just a detail—it's the absolute foundation of your marine freight insurance policy. Get it wrong, and a solid policy can become a useless piece of paper at the worst possible moment. Declaring the correct value is what ensures that if a loss happens, your claim gets paid accurately and without a fight.

Think of it like this: you’re setting the payout on a winning lottery ticket before the numbers are even drawn. Set it too low just to save a few bucks on the premium, and you've just forfeited a huge chunk of your winnings. Set it too high, and you're paying for a prize that doesn't exist. The goal here is precision. You want your coverage to perfectly match the real-world value of your goods.

This entire process is about creating an undeniable, pre-approved record of worth, leaving zero room for debate when you're in the middle of a stressful claim.

Agreed Value Versus Actual Cash Value

When it comes to insuring your jewelry in transit, you’ll run into two main valuation methods. Knowing the difference isn't just trivia; it's crucial for protecting your assets.

-

Agreed Value: This is the gold standard for high-value items, especially jewelry. Before the policy is even locked in, you and your insurer agree on the exact value of the items being shipped, usually backed by a fresh appraisal or a detailed invoice. If a total loss occurs, the insurer pays out this pre-determined amount. Period. It completely sidesteps any arguments over depreciation or market swings after the fact.

-

Actual Cash Value (ACV): This method is far less common for fine jewelry, and for good reason—it’s much riskier. ACV calculates an item's worth at the time of the loss, which means depreciation gets factored in. While that might work for a company car, it’s a huge problem for gems and precious metals whose values can fluctuate, creating real uncertainty about your final payout.

For any jewelry business, an Agreed Value policy is almost always the right move. It gives you certainty and protects the full worth of your inventory.

The Dangers of Mis-Declaration

The temptation to under-declare the value of a shipment to shave a little off your insurance premium is a dangerous game. Insurers see this as a breach of your duty of "utmost good faith." If a shipment you declared at $50,000 is actually worth $100,000, your insurer could potentially deny the entire claim based on misrepresentation. That leaves you holding the bag for a total loss.

On the flip side, over-declaring value is just throwing money away. If you insure that same $100,000 shipment for $150,000, you’re paying a higher premium for coverage you can never actually use. In a total loss, the insurer will only pay out the proven, actual value of the items—in this case, $100,000. Accuracy is everything for both protection and cost-efficiency.

Your Essential Documentation Checklist

Getting the valuation right starts and ends with meticulous records. To make sure any marine freight insurance claim gets processed smoothly, you need the right documents on hand, ready to go. Fulfilling your end of the policy bargain begins with organized, accurate paperwork for every single shipment.

A policy is a contract built on transparency. Providing clear, verifiable proof of value from the outset is the most effective way to guarantee a fair and prompt settlement if something goes wrong.

Before your pieces even think about shipping, get the following organized:

- Commercial Invoice: This is your primary document stating the value of the goods. It has to be detailed, accurate, and perfectly match the declared value on your insurance certificate.

- Detailed Packing List: This list itemizes the exact contents of every box, including descriptions, quantities, and individual values. It's absolutely critical for proving what was in a shipment if only a partial loss occurs.

- Bill of Lading or Air Waybill: This is your contract with the carrier. You need to make sure any value declarations on this document align with your insurance policy to avoid any conflicts down the road.

- Current Appraisals: For one-of-a-kind or exceptionally high-value items, a recent appraisal from a certified gemologist is irrefutable proof of worth. This is especially important for custom designs or estate jewelry. For a better sense of this, just look at this collection of high-value watches that would require such documentation.

By preparing this documentation for every shipment, you create an airtight case for your item's value. This turns the claims process into a straightforward validation, not a contentious negotiation.

Key Policy Clauses Every Jeweler Must Understand

Going beyond the basics of All-Risk vs. Named Perils, the real power of your marine freight insurance is found in the details—the specific clauses and endorsements that spell out exactly when and how you're protected. For a jeweler, skipping over this fine print is like leaving a side door to the vault unlocked. It’s a completely avoidable vulnerability.

You don't need to be a lawyer to grasp these concepts, but you do need to understand them. The language in these contracts determines the exact moment your coverage kicks in and what specific scenarios are covered. Knowing this helps you work with a specialist, like First Class Insurance Jewelers Block Agency, to build a policy that closes the gaps that could otherwise be financially devastating.

The All-Important Warehouse to Warehouse Clause

One of the most critical parts of any marine freight policy is the Warehouse to Warehouse clause. Think of it as the policy's work schedule. It clearly states that your coverage begins the moment your jewelry leaves its starting point—your store, a supplier’s workshop, or a warehouse—and stays active until it’s safely delivered to its final destination.

This clause is your guarantee of protection throughout the entire journey, including all the risky handoffs in between. That means it covers the truck ride to the airport, temporary storage at the port, and the final delivery leg. Without it, your policy might only cover the main sea or air transit, leaving your precious cargo uninsured during the most vulnerable loading and unloading phases.

Understanding the General Average Clause

The principle of General Average is an ancient maritime law that can be a huge shock if you're not prepared for it. Picture this: a container ship gets caught in a brutal storm. To save the entire vessel and most of the cargo, the captain decides to jettison several containers to lighten the ship.

Even if your shipment of diamonds arrives untouched, you are legally required to help cover the loss of the cargo that was sacrificed. General Average dictates that every single cargo owner on that voyage must chip in a proportional amount to cover the value of the goods that were intentionally lost for the good of everyone.

A marine freight insurance policy with General Average coverage acts as your shield against this bizarre but very real liability. It ensures your insurer pays your contribution, protecting you from having to foot the bill for another merchant's lost cargo.

Essential Endorsements for Your Jewelry Business

A standard marine policy is a good starting point, but a jewelry business operates with unique risks that demand specific add-ons, known as endorsements. These tailor the policy to fit the real-world situations you face every day. Customizing your policy with the right endorsements is where an experienced agency proves its worth, making sure your insurance for a jewelry business is truly complete.

Here are a few endorsements that are often non-negotiable for jewelers:

- Exhibitions and Trade Shows: This extends your transit coverage to protect your pieces while they are on display at a trade show—a notoriously high-risk environment for theft.

- Traveling Sales Representative Coverage: This covers inventory that is in the hands of your sales team while they are on the road visiting clients.

- Goods on Memo or Consignment: If you send stones or finished jewelry to other retailers on memorandum, this endorsement ensures they remain covered under your policy until they are either sold or safely returned.

The marine freight market is always shifting. For instance, cargo theft incidents recently shot up by about 27% year-over-year, with the average theft hitting over $202,000. That directly impacts how high-value goods are underwritten. You can learn more about these evolving marine market trends to see why this specialized coverage is so crucial. By adding the right endorsements, you build a policy that mirrors the operational realities of your jewelry store insurance needs.

What to Do When a Shipment Is Lost or Damaged

It’s a moment every jeweler dreads: getting the call that a high-value shipment is either missing or has shown up damaged. It's one of the most stressful situations in this business, but how you respond in those first few hours makes all the difference.

Staying calm and being methodical is your best strategy. Knowing exactly what to do can turn a crisis into a manageable process and dramatically improve your chances of getting a prompt and fair settlement. The first moments are critical—you need to act fast to create an official, time-stamped record of what happened.

Your Immediate Action Plan

As soon as you find out there's a problem, the clock starts ticking on the claims process. Any hesitation can complicate things and might even put your coverage at risk. The immediate goal is simple: notify everyone who needs to know, preserve all the evidence, and officially state that you’re filing a claim.

Take these steps right away:

-

Notify Your Insurance Provider Immediately: This is your first and most important call. Contact your agent at First Class Insurance Jewelers Block Agency or your provider directly. They’ll walk you through the specific requirements of your policy and get you the right claim forms.

-

Inform the Carrier in Writing: Send a formal notice of loss or damage to the shipping carrier—whether it's an airline, ocean line, or trucking company. This is a non-negotiable step that officially holds them liable and is required for virtually all marine freight insurance claims.

-

Preserve All Evidence: If a shipment is damaged, don't throw anything away. Keep the packaging, any broken pieces, and the containers. Photograph everything just as it arrived, capturing the damage from every possible angle. This physical evidence is absolutely vital.

Assembling Your Claim Documentation

After making the initial calls, it's time to gather the paperwork to back up your claim. Your insurer needs a complete file to accurately assess the loss and get your payment processed. A well-organized submission is the fastest way to avoid delays and prove your claim is valid.

Think of it as building a case file. Each document is a piece of evidence confirming the shipment's existence, its value, and the details of the loss. With lost or damaged goods, the speed of the claims process is everything. In fact, the industry is increasingly leaning on tech like automated claims processing to make data management more efficient.

An incomplete or poorly documented claim is the number one cause of delays and disputes. If you provide a clear, detailed, and organized file from the get-go, you help move the process from investigation to resolution that much faster.

Here’s an essential checklist of the documents you'll need:

- Original Bill of Lading or Air Waybill: This is your contract with the carrier.

- Commercial Invoice: This proves the value of the items you shipped.

- Detailed Packing List: This shows exactly what was supposed to be in the package.

- Survey Report: An independent inspection report that details the extent of the damage and its likely cause.

- A Detailed Statement of Loss: Your official written account of what happened and the total value you are claiming.

Understanding Key Roles in the Claims Process

During the claims process, you'll work with a couple of key professionals. The first is a surveyor, an independent expert brought in to inspect damaged goods. Their job is to determine the cause and scope of the loss, and their report serves as a critical, impartial piece of evidence.

The other key player is the claims adjuster, who works for the insurance company. They review all the documents, investigate the situation, and determine the final settlement amount based on your policy's terms. The secret to a smooth process is giving them a complete and accurate file.

By following these steps, you can confidently handle the claims journey and ensure your marine freight insurance gives you the protection it was designed for.

Why a Specialist Insurance Partner Is Your Best Asset

When it comes to insuring your jewelry business, grabbing a standard, off-the-shelf policy is one of the biggest gambles you can take. Most general insurance agents simply don’t speak your language. They don't live and breathe the nuances of gemstone valuation or the ironclad security protocols your high-value shipments demand, and that lack of understanding can leave you dangerously exposed.

This is precisely why a specialist partner isn't just a nice-to-have—it's an essential asset for your business.

At First Class Insurance Jewelers Block Agency, we’re not just policy providers; we’re your dedicated risk management consultants. We get that insurance for a jewelry store is an intricate ecosystem, not a one-size-fits-all product. Our goal is to make your protection absolutely seamless.

Bridging Critical Coverage Gaps

Our real expertise shines when we integrate a robust marine freight insurance program directly into your main Jewelers Block insurance policy. This is a critical step that closes the dangerous gaps that often exist between the policy covering your inventory at your store and the one protecting it on the move.

Think about it: a general agent might sell you two separate policies. If a loss happens somewhere in that gray area between your vault and the destination, you can get caught in a nightmare scenario where each insurer points the finger at the other, and neither accepts the claim.

We eliminate that risk entirely by building a single, unified shield that covers your assets from every possible angle.

Choosing a specialist means you have an advocate who speaks the language of both jewelers and underwriters. This ensures your policy is crafted with precision, reflecting the true operational risks of your insurance for jewelry business needs.

This specialized approach is crucial for navigating the complex world of high-value asset protection. It guarantees that whether your pieces are in the vault, on display, or crossing an ocean, they are always secure under a policy built for the realities of the jewelry world, not generic business operations.

Expertise That Translates to Security

Our job goes far beyond just writing the policy. We’re on your team, offering practical advice on secure logistics, from vetting the right carriers to implementing best practices for packaging. And if a claim does arise, we’re right there with you to navigate the process, using our experience to push for a fair and fast resolution.

Protecting your entire jewelry business requires a partner who understands your world from the inside out. We work with trusted underwriters, including those in world-renowned markets like Lloyd's of London, to build programs that deliver real peace of mind.

By tailoring a policy that truly protects your inventory and your reputation, we help you operate with confidence. When you're ready to secure every facet of your operation, you can Get a Quote for Jewelers Block from a team that knows your world.

Your Top Questions Answered

When it comes to marine freight insurance, the details can feel a bit overwhelming. But getting a handle on the key points is absolutely essential for keeping your jewelry business protected. Let's clear up some of the most common questions we hear from jewelers like you.

Does My Jewelers Block Policy Already Cover Shipping?

Not as much as you'd think, and that's a dangerous assumption to make. While most Jewelers Block insurance policies do offer a sliver of transit coverage, it’s often loaded with limitations. You might run into surprisingly low payout limits, tight geographical restrictions, or a very short list of approved carriers that just don't work for your business.

If you're shipping regularly or moving high-value pieces—especially internationally—a separate marine freight policy isn't just a good idea; it's a necessity. It’s the only reliable way to close those dangerous gaps in coverage. A specialist at First Class Insurance Jewelers Block Agency can look at your current policy and tell you exactly where you stand.

What's the Difference Between FOB and CIF Shipping Terms?

These little acronyms are a huge deal because they spell out who's responsible for insuring the shipment.

- FOB (Free On Board): The seller’s responsibility is over as soon as the goods are on the ship. From that point on, the buyer is on the hook for arranging and paying for the marine freight insurance for the main part of the journey.

- CIF (Cost, Insurance, and Freight): The seller handles everything. They are responsible for arranging the insurance all the way to the final destination port.

You absolutely have to know which term applies to your deal. It determines whether you need to secure a policy or if your partner is handling it, preventing a nightmare scenario where a multi-million dollar shipment is accidentally uninsured.

How Does a General Average Claim Affect My Business?

General Average is an ancient maritime law that can deliver a very modern, and very expensive, shock. It comes into play when a voluntary sacrifice is made to save the entire vessel from a shared danger, like a fire or a massive storm. Think of them jettisoning cargo to keep the ship from sinking.

Here’s the kicker: even if your jewelry arrives perfectly safe, you could be legally forced to chip in for the merchant whose cargo was thrown overboard. A proper marine freight policy covers your contribution in a General Average claim, shielding you from these sudden, massive costs that come out of nowhere.

A solid policy is designed to absorb these shared maritime risks. Without one, you could get a huge bill for someone else's bad luck, turning a profitable shipment into a financial disaster.

Are There Specific Packaging Requirements for My Insurance to Be Valid?

Yes, absolutely. Insurers aren't going to cover a loss if your goods weren't packed to handle the normal bumps and bruises of transit. For a jeweler, this means using tough, tamper-evident, and completely unmarked packaging. A double- or even triple-box system is often the standard.

If you use flimsy boxes or, even worse, packaging that hints at the valuable contents inside, an insurer could call it "improper packing." That's all they need to deny a claim for theft or damage.

When you need to be 100% certain your insurance for a jewelry store is rock-solid from your vault to its final destination, you need a specialist. Contact First Class Insurance Jewelers Block Agency today to get a quote for Jewelers Block and make sure your assets are protected every step of the way.