Your standard business policy is built for a typical retail store—one selling items with predictable values and risks. Jewelers Block insurance operates on a completely different philosophy. It understands that your inventory of diamonds, watches, and precious metals isn't just stock; it's a collection of high-value, portable, and highly targeted assets.

This fundamental difference is why grabbing an off-the-shelf commercial policy is almost always a mistake for a true jewelry business. You need protection built around the unique, and often fluctuating, value of your inventory and the specific risks your business faces every single day.

Why a Jewelry Business Demands Specialized Insurance

Trying to protect a jewelry store with a standard business owner's policy is like using a basic auto policy to protect a priceless classic car. Sure, both offer "protection," but the standard policy completely misunderstands the nature and real value of the assets it’s supposed to be covering.

A typical business's inventory depreciates or is sold with low, replaceable value. Standard insurance is built entirely around this concept.

In sharp contrast, your jewelry inventory is a high-value asset that is a constant target for theft. A single diamond ring or a luxury watch can be worth more than the entire inventory of a neighboring boutique. Standard insurance models simply aren't designed to handle this reality, creating a massive, and potentially devastating, gap in your financial protection.

The Core Difference: All-Risk Coverage

The single most critical concept that sets Jewelers Block insurance apart is its all-risk nature. It’s a game-changer.

This means the policy covers losses from all perils unless they are specifically excluded in the policy documents. This is the opposite of a "named perils" policy, which only covers the specific risks listed. For a business facing threats as diverse as armed robbery, internal theft, mysterious disappearance, or damage during transit, this comprehensive approach is essential.

In the event of a covered loss, a Jewelers Block policy is designed to cover the actual value of your inventory, providing the financial security needed to restock and continue operations. It protects you against the unique risks inherent to the jewelry business.

This is a world away from the limited coverage provided by standard commercial policies, which often have low sub-limits for theft of high-value items like jewelry. A standard policy might only cover a few thousand dollars in jewelry theft, which could be a tiny fraction of the value of a single lost piece, let alone an entire showcase.

Understanding the Jeweler's Mindset

Specialized insurance carriers get it. They know that owners of jewelry businesses operate under a unique set of pressures. You aren't just a retailer; you are the custodian of significant wealth, responsible for its security at all times. This unique position creates a much higher risk profile.

Providers of insurance for a jewelry store understand the realities of the business:

- High-Value Inventory: Your stock is compact, high-value, and easily transportable, making it a prime target for criminals.

- Complex Operations: You handle shipping, receiving, customer repairs, and off-site appraisals, with valuables constantly in motion and changing hands.

- Specialized Security: Jewelers invest heavily in safes, vaults, alarm systems, and secure showcases. The insurance policy is designed to work in tandem with these measures.

Because of this unique risk profile, specialized carriers can provide vastly superior coverage by understanding your security protocols and operational procedures. They're insuring the business, not just the building.

This is the world we operate in at First Class Insurance. We connect you with underwriters who live and breathe high-value collections, ensuring your policy reflects your inventory's true status as a prized asset, from loose stones to finished masterpieces.

Decoding Your Jewelers Block Policy

Step into the world of specialized Jewelers Block insurance, and you'll find a policy built to protect, not just replace. A standard business policy is often a maze of exclusions for high-value goods. This is different. A Jewelers Block policy is built from the ground up to preserve your business.

Getting a handle on its key components is the only way to make sure your livelihood is properly protected by the right provider of insurance for jewelry business.

At its very heart is comprehensive inventory protection, the cornerstone we talked about earlier. This isn’t just some random feature; it’s the entire foundation of the policy. It covers your stock against a wide range of perils far beyond what a standard policy would ever consider.

Essential Coverage Beyond the Basics

While inventory coverage gets all the attention, a truly solid policy includes several other specialized protections. These are the details that separate a basic policy from one actually designed for a real-world jewelry business. Think of them as custom-fit armor for your store, covering risks that standard insurance flat-out ignores.

It’s no surprise that the market for this kind of protection is critical for jewelers. This isn't just a niche product anymore; it's a clear sign that business owners are waking up to how badly standard insurance fails them. You can learn more about the principles of insuring high-value assets by looking at the collectible car insurance market, where similar concepts of specialized protection apply.

Here are the key coverages you should be looking for:

- Goods in Transit: This protects your jewelry while it's being shipped via carriers like UPS or FedEx, or while you're traveling with it to a trade show or a private client meeting.

- Customers' Property: This is critical. It provides protection for items that customers leave with you for repair, appraisal, or consignment. A loss of a customer's treasured heirloom could be devastating to your reputation and finances.

Flexible Coverage That Fits How You Actually Work

Jewelers Block insurance companies get it—your business isn't confined to the four walls of your store. These policies are designed around the dynamic nature of the jewelry trade, which is a huge part of what makes the coverage so effective.

A key benefit here is worldwide coverage. This ensures your inventory is protected whether it's in your vault, on display at a trade show in Las Vegas, or with a salesperson visiting a client in another country.

This flexibility recognizes that every jewelry business is different. Whether you’re a retail storefront, a private dealer, or a custom designer, the policy can be built to fit your business model, not the other way around.

Specialized Jewelers Block vs. Standard Business Insurance

When you put a specialized Jewelers Block policy next to a standard one, the difference is night and day. The gaps in a standard policy aren't just minor details; they represent massive financial risks for any jewelry business owner.

This table breaks down exactly where those policies diverge.

| Feature | Jewelers Block Insurance | Standard Business Insurance |

|---|---|---|

| Inventory Valuation | Covers Actual Cost/Value: Designed to cover the true value of your precious inventory. | Strict Sub-limits: Often has very low limits (e.g., $2,500) for theft of jewelry, gems, and precious metals. |

| Covered Perils | All-Risk: Covers all risks, including mysterious disappearance and employee dishonesty, unless specifically excluded. | Named Perils: Only covers risks explicitly listed in the policy, often excluding common jewelry-related losses. |

| Off-Premises | Covered: Specific coverage for goods in transit, at trade shows, or with traveling salespeople. | Not Covered: Coverage is typically confined to the business premises only. |

| Customer Property | Covered: Protects items left in your care, custody, and control for repair or appraisal. | Not Covered: A customer's property is generally excluded from coverage. |

| Expertise | Specialized Underwriting: Priced by experts who understand jewelry security (safes, alarms) and business practices. | Generalist Approach: Priced for generic retail risks, failing to account for the unique security needs of a jeweler. |

The takeaway is clear. A standard policy treats your jewelry store like any other shop on the street, leaving you exposed to a huge financial hit. A specialized policy, on the other hand, recognizes it for what it is: a high-risk, high-value business that demands precise, intelligent protection.

Understanding Agreed Value vs. Stated Value

When you step into the world of high-value asset insurance, you'll find it speaks a different language than a standard policy. The two most important terms you need to nail down are Agreed Value and Stated Value. Mixing them up is one of the most expensive mistakes an enthusiast can make, and it can lead to a world of financial pain if you ever face a total loss. This principle is vital whether you are insuring a rare car or seeking the right Jewelers Block insurance.

At first glance, they sound like they could be cousins. In reality, they operate on entirely different planets. One gives you a rock-solid guarantee, while the other hides a nasty surprise right when you need your coverage the most.

The Clear Superiority of Agreed Value

An Agreed Value policy is the gold standard for insuring unique, high-value items, period. It's the only path for a serious collector who wants real protection. The process couldn't be more straightforward: you and the insurance company mutually agree on an item's exact worth before the ink is dry on the policy. That number is then locked in.

If your asset is ever stolen or written off as a total loss, the insurance company simply cuts you a check for that pre-determined amount, minus any deductible. There’s no last-minute haggling. No arguments over a soft market. No talk of depreciation. The value is settled from day one.

Key Takeaway: With an Agreed Value policy, you know the precise dollar amount you will get in a total loss scenario. It’s pure certainty that protects the true value of your investment.

The Hidden Dangers of Stated Value

This is where things get tricky, and where many people get burned. A Stated Value policy sounds great—you get to "state" what you believe your asset is worth. The problem is, that number isn't a promise. It’s really just a ceiling on what the insurer might pay.

In the event of a total loss, the insurance company will pay out the lesser of two numbers: your stated value OR the item's Actual Cash Value (ACV) at the moment of the loss. ACV is the metric standard insurers use, and it always factors in depreciation. That little "lesser of" clause is the whole trap.

Let’s break it down with a quick scenario.

Scenario: The 1967 Mustang

Imagine you have a stunning, nut-and-bolt restored 1967 Ford Mustang. You and your insurance provider agree it has a fair market value of $75,000.

- With an Agreed Value Policy: If that Mustang gets stolen, you get a check for $75,000 (less your deductible). End of story.

- With a Stated Value Policy: You "state" the value at $75,000. After it’s stolen, the insurer’s adjuster calculates its ACV. They decide the market for classic Mustangs has cooled and peg its current value at $60,000. Because they only have to pay the lesser of the two, you get a check for $60,000, leaving you $15,000 out of pocket.

Establishing Your Asset's True Worth

Locking in an accurate Agreed Value isn't about pulling a number out of thin air. It’s a methodical process based on solid evidence. Specialized insurers look at a few key things to land on that magic number.

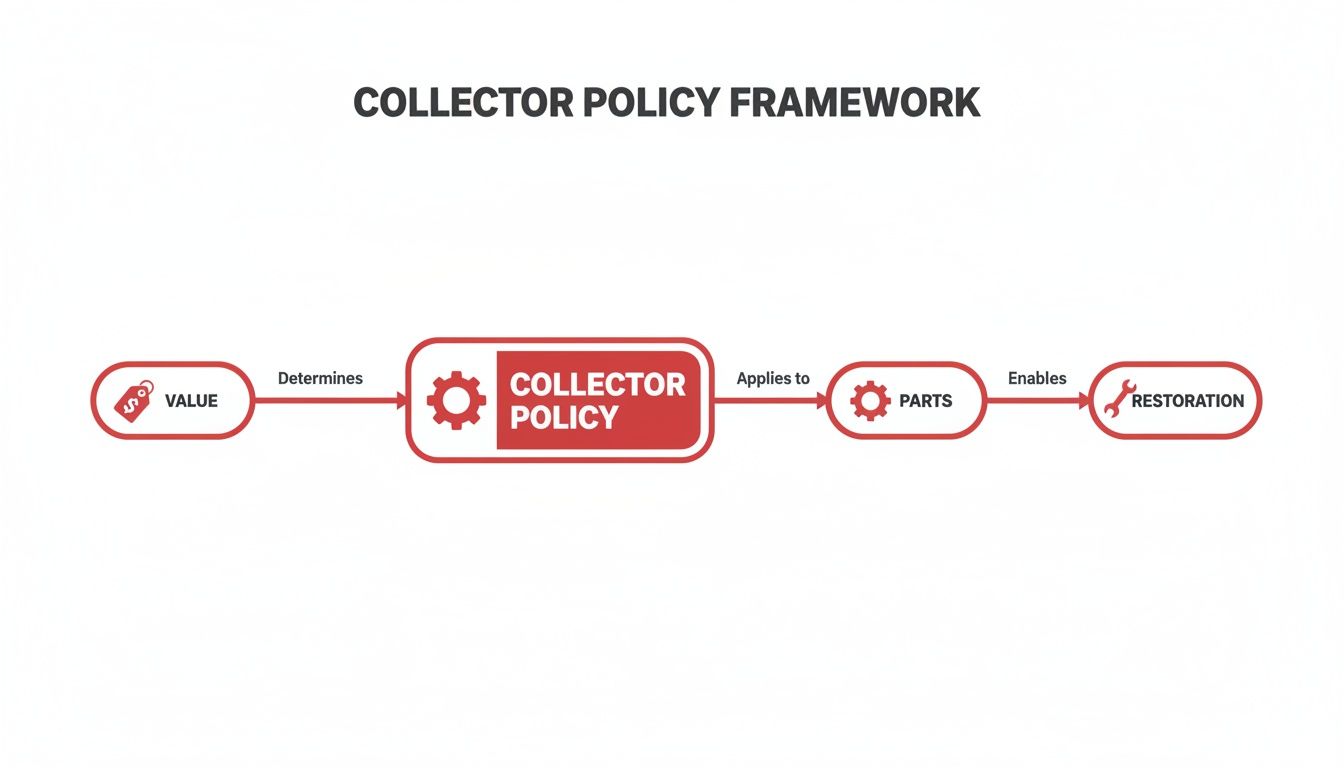

This flowchart shows how the core pieces of a high-value asset policy fit together, with the item's value being the foundation for everything else.

As you can see, the established value sets the terms of the policy, which then has to account for unique components and potential replacement costs.

Here’s what really drives that valuation:

- Professional Appraisals: Nothing beats a detailed appraisal from a certified specialist. It’s an impartial, expert report on your item's condition, originality, and place in the market.

- Market Analysis: Good insurers are always watching the market. They track auction results, private sale data, and trends for specific categories to verify an asset's current value.

- Item Provenance: An asset's backstory is a huge part of its value. A thick binder of documents, a known history, or previous celebrity ownership can add significantly to the bottom line.

- Quality and Condition: When setting an "agreed value," the quality of the item matters. For jewelry, this includes the 4Cs (cut, color, clarity, carat); for a car, it's the quality of the restoration. A comprehensive classic car restoration guide can give you a sense of what goes into a top-tier project that appraisers and underwriters value.

While we're talking about classic cars, the core principle of protecting high-value assets is universal, whether it’s a vintage Ferrari or fine jewelry. You can see how it applies to protecting valuable jewelry, where a similar ironclad valuation is key. In every case, specialized coverage like Jewelers Block insurance is the only way to get true peace of mind and ensure your assets are protected for what they're really worth.

How to Choose the Right Insurance Partner

When you’re looking for **Jewelers Block insurance**, it’s tempting to just compare prices. But this isn’t like buying a commodity. You’re choosing a guardian for your entire livelihood.

Think of it like hiring a master gemologist. You wouldn't just go with the cheapest quote. You'd hunt for proven expertise, a history of incredible work, and a deep understanding of your specific inventory. You need to apply that same level of rigor when vetting an insurance carrier.

The Financial Stability Litmus Test

Before you even glance at policy features, the first thing to check is the company’s financial health. An insurance policy is just a promise, and that promise is only as good as the company's ability to pay when you need them most. A great premium is worthless if the insurer is on shaky financial ground.

The industry gold standard here is a rating from an independent agency like A.M. Best. You’re looking for carriers with an “A” rating (Excellent) or better. This isn't just a minor detail; it’s proof of a strong financial foundation and their ability to meet their obligations to people like you.

Evaluating Expertise and Claims Handling

You find out what an insurance company is really made of when you file a claim. This is where standard, everyday insurers can fail spectacularly.

An adjuster who spends their days dealing with slip-and-falls at grocery stores simply won't understand the nuances of valuing a lost parcel of GIA-certified diamonds. They won't grasp the specialized techniques required to investigate a sophisticated burglary.

This is why a dedicated, in-house claims team with real-world jewelry industry experience is non-negotiable. Their expertise is what ensures a claim is handled fairly and efficiently, preserving your business's financial health and, most importantly, its ability to continue operating.

A critical question for any potential insurer is: "What is your process for handling a mysterious disappearance claim?" An expert team will have a clear, established protocol for investigating these complex situations.

The U.S. market has several major players with deep roots in the jewelry community. For example, a specialist provider understands the specific risks and values at play. That kind of focus doesn't happen by accident; it's earned through specialized service. You can learn more about the principles of high-value asset protection by exploring the collector car market by the numbers, where similar concepts apply.

A Practical Checklist for Vetting Insurers

To cut through the sales pitches and marketing fluff, you need a straightforward checklist. Use these questions to guide your conversations with potential agents and underwriters. The quality and confidence of their answers will tell you everything you need to know about their experience with insurance for a jewelry store.

Critical Questions to Ask Any Agent or Broker:

- Inventory Valuation: "How do you handle fluctuating inventory values, especially with precious metals? How often should I update my stated inventory limits?"

- Security Requirements: "What are your specific requirements for safes, alarms, and surveillance systems? How do upgrades affect my premium?"

- Travel & Transit: "What are the limits and conditions for covering jewelry while I'm traveling or shipping it? Are there any geographical restrictions?"

- Employee Dishonesty: "How does your policy cover losses due to internal theft? What is the claims process for such an event?"

- Mysterious Disappearance: "What documentation is required to file a claim for mysterious disappearance, and how is it investigated?"

Clear, detailed answers are a sign of genuine expertise. If you get vague responses or a sense of uncertainty, consider it a major red flag. It likely means the carrier lacks the specialized knowledge your business demands.

Many of these expert underwriters, including those we partner with at First Class Insurance, have serious financial backing from globally recognized markets. You can learn more by exploring the role of underwriters like Lloyd's of London. Your goal is to find a partner who sees your business not just as a line item on a balance sheet, but as the valuable enterprise it truly is.

Common Red Flags in Jewelers Block Coverage

When it comes to insuring your jewelry business, chasing the lowest premium is one of the biggest—and most costly—mistakes you can make. A cheap policy often creates a dangerous false sense of security, papering over huge coverage gaps that you won't discover until you're trying to file a claim.

To properly vet different providers of Jewelers Block insurance, you have to develop a sharp eye for the details. You need to know the common traps that can leave your prized inventory completely exposed when you need protection the most.

Vague Language and Restrictive Clauses

A good policy is written with absolute clarity. One of the most glaring red flags is language that's fuzzy or open to interpretation, especially around how you secure and transport your inventory. If the rules aren’t spelled out in black and white, you’re handing the insurer the power to deny a claim based on their interpretation of the fine print.

Keep an eye out for these specific issues:

- Unclear Security Warranties: A policy that requires a "functioning alarm" is vague. Look for specific requirements regarding alarm grades, safe ratings (e.g., TL-30), and protocols for opening/closing.

- Ambiguous Travel Exclusions: Your policy needs to say exactly what is required when you travel with merchandise. Are you required to keep it on your person at all times? Is leaving it in a hotel safe covered?

- Restrictive Off-Premises Limits: Some insurers will offer transit coverage but with very low limits that don't reflect the value of what you're actually carrying. Ensure your "out of safe" limit is adequate for your needs.

The Standard Business Policy Trap

This one is a deal-breaker. As we’ve covered, the gap between a real Jewelers Block insurance policy and a standard Business Owner's Policy (BOP) is massive. Any agent trying to sell you a generic BOP with a small "rider" for jewelry is a giant red flag. It’s a marketing gimmick designed to look cheaper upfront, but it functions as a ceiling on your payout, not a guarantee of real protection.

Remember, a standard policy will have a tiny sub-limit for theft of valuable goods like jewelry. This clause almost always works in the insurer's favor, leaving you underinsured precisely when you need the coverage most.

Poor Market Expertise and Claims History

Finally, you have to look at the company’s reputation and experience. An insurer that doesn't live and breathe the jewelry world is a huge risk. They won’t understand how to value your inventory correctly, how to handle a complex claim involving a professional heist, or what a high-quality replacement truly costs.

Before you even think about signing, do your homework. Dig into their claims satisfaction history. Look for reviews and testimonials from other jewelers. A pattern of slow payouts, denied claims on technicalities, or constant disputes is a clear sign to walk away. Trusting an insurer without a proven track record in your industry is a gamble you just can't afford to take.

Integrated Protection for All Your Valuables

For most serious collectors and business owners, the inventory is just the beginning. A passion for fine jewelry often goes hand-in-hand with an appreciation for other fine assets—fine art, rare watches, or classic cars. It turns out, the same logic that makes Jewelers Block insurance non-negotiable for your business also applies to protecting everything else you value.

This is where having a true insurance partner, not just a policy provider, changes the game entirely. Instead of juggling a patchwork of policies from different carriers—one for the business, another for the house, a third for your car collection—an integrated approach brings everything under a single, expert roof. This does more than cut down on paperwork. It builds a seamless fortress of protection, closing the dangerous gaps that often exist between separate, uncoordinated policies.

At First Class Insurance, crafting these comprehensive programs is what we do. With over 30 years of experience, we act as your one expert point of contact, ensuring every single asset receives the same obsessive attention to detail.

A Singular Approach to Diverse Collections

Let's be honest: managing a diverse portfolio of valuable assets is risky if your insurance plan is fragmented. Imagine a fire or a theft. If your standard homeowner's policy has a laughably low limit on jewelry, and your business policy obviously won't touch personal items, you're left facing a devastating, and entirely preventable, financial blow.

An integrated program looks at your collection as a whole, just like you do. We can design a bespoke plan that understands the unique needs of each piece:

- Collector Car Insurance: Whether it's for a single prized vehicle or an entire garage of classics, this offers specialized Agreed Value coverage.

- Fine Art and Antiques: We make sure your art is covered with agreed value protection, accounting for market appreciation over time.

- Yacht and Marine Coverage: Protecting a vessel demands a deep understanding of maritime risks, from navigating open waters to weathering a storm.

The real power here is coherence. By understanding the full picture of what you own, we can work with premier underwriters to build a unified program. Every policy works in concert with the others, leaving no part of your collection dangerously exposed.

Expertise That Spans Your Entire Portfolio

You wouldn't ask a general mechanic to service your vintage Porsche, so why would you trust a generalist agent with your multifaceted collection? Our deep expertise in protecting high-value assets means we speak the language of risk, no matter the category.

Whether we're arranging insurance for a jewelry store or adding a newly acquired sculpture to your personal policy, our client-first focus never wavers. Putting physical security measures in place, like anti-theft devices for cars insurance for your personal vehicle, can also be a smart move to protect your investment and potentially lower your premiums.

The core principles—proper valuation, specialized coverage, and expert handling—are universal. This is true whether we're talking about automotive masterpieces or the intricate details of insurance for a jewelry business. You can see how this applies by looking at this collection of beautiful antique jewelry, which needs the same caliber of careful, expert protection as any classic car.

This global perspective is vital when protecting assets that might travel or have an international market value. First Class Insurance brings this broad view to every client relationship, ensuring your passions are protected, no matter where they are.

Got Questions? We've Got Answers.

When you’re dealing with high-value assets, the right questions always bubble to the surface, whether you're trying to protect a vault full of precious gems or a vintage Porsche 911. The core principles—proper valuation, specialized coverage, and expert handling—are surprisingly similar.

We’ve found that many of our clients who run jewelry businesses also have passions for other fine assets, like collector cars. It's not a huge leap. Because of this, we often get asked about other kinds of specialized protection, like Jewelers Block insurance.

So, What Exactly Is Jewelers Block Insurance?

Think of Jewelers Block as the "agreed value" policy for the jewelry industry. It's a single, comprehensive policy designed to cover a jeweler's entire inventory—whether it’s secured in a vault, sitting in a display case, or even being shipped to a client across the country.

A standard business policy just can't keep up. It doesn't understand the unique risks jewelers face every day, like a mysterious disappearance or accidental damage during a delicate repair job. This is why anyone running an insurance for jewelry business needs this specific coverage.

Who Really Needs Insurance for a Jewelry Store?

Simply put, any business that deals with fine jewelry. This isn't just for big-name retail showrooms; it's essential for wholesalers, independent designers, private appraisers, and even small repair shops. A single major theft or loss event could easily wipe out a business that isn't properly protected.

A well-built insurance for a jewelry store policy will typically cover:

- Your complete inventory at all business locations

- Goods in transit or traveling with your sales team

- Items left in the custody of other businesses (like a setter or polisher)

- Customer property that's in your care for repair, appraisal, or consignment

Just like a collector car expert knows the difference between a numbers-matching engine and a restomod, a Jewelers Block specialist understands the intricate world of jewelry risks. The right policy buys you peace of mind, plain and simple.

Choosing the right insurance partner here is just as critical as it is for your car collection. The team at First Class Insurance Jewelers Block Agency has spent decades building these exact types of programs. We partner with the best underwriters in the business to create coverage that addresses the specific threats you face, ensuring both your inventory and your reputation are secure. It's the only way to get a policy that truly gets your world.

At First Class Insurance, we believe every passion deserves protection built for it, from the diamonds in your display case to the chrome on your classic car. We're here to provide expert guidance and policies built around you. Get a Quote for Jewelers Block or give our team a call today to see how we can protect what matters most to you.