For any jeweler, a certified jewelry appraisal is so much more than a piece of paper with a price on it. Think of it as the official financial blueprint for a high-value asset. It establishes undeniable proof of value, which is absolutely non-negotiable for securing the right insurance, closing high-stakes sales, and managing your inventory with real precision.

The True Value of a Certified Jewelry Appraisal

It’s a common—and costly—misconception in the jewelry business to think a sales receipt or an informal estimate carries the same weight as a certified appraisal. That’s a critical error. A receipt only proves what was paid at one point in the past, and a casual guess has none of the detailed analysis needed to hold up under scrutiny.

Here’s a better way to think about it: a certified jewelry appraisal is like the deed to a house. A deed legally proves ownership and defines a property’s boundaries and worth. In the same way, an appraisal provides an official, defensible valuation of a piece of jewelry at a specific moment in time. This formal document is the absolute bedrock of your financial protection.

The Foundation of Jewelers Block Insurance

For any jewelry store, getting adequate Jewelers Block insurance is flat-out impossible without accurate appraisals. At First Class Insurance, we see a precise, professional appraisal as the single most important tool for managing risk. It’s the first and most critical step in protecting your business from the devastating fallout of theft, damage, or loss.

Without that documented proof of value, an insurer is just guessing. They have no reliable way to set your coverage limits or process a claim fairly. An appraisal cuts through all the ambiguity, making sure your insurance for a jewelry business reflects the true replacement cost of your inventory. This is why it's a non-negotiable part of any solid insurance plan. Just look at how a clear image, like this stunning diamond ring on a black background, can complement the granular details found in an appraisal document.

A certified appraisal transforms an asset from an item with perceived value into an asset with proven, insurable worth. It is your primary defense in a claim scenario, ensuring you are made whole after a loss.

A Growing Industry Standard

This push for certified documentation isn't just an insurance thing; it’s a growing global standard. The jewelry appraisal market was valued at around USD 3.3 billion and is on track to hit USD 5.0 billion by 2030. That growth says it all—certified appraisals are becoming more crucial than ever for insurance, high-value sales, and estate planning. You can dig into the numbers yourself in this global jewelry appraisal market trends report on ResearchAndMarkets.com.

This trend points to a fundamental reality for modern jewelers: professional documentation isn’t an optional expense. It’s a core piece of a smart business strategy. When you invest in regular, certified jewelry appraisals, you’re not just getting a piece of paper—you’re protecting your inventory, strengthening your insurance coverage, and building a more resilient business.

Understanding Different Types of Jewelry Appraisals

Not all jewelry appraisals are created equal. Far from it. Handing over the wrong type of appraisal for your insurance is a surprisingly common and costly mistake, one that can leave your jewelry business dangerously exposed.

Think of it this way: appraisals are like different kinds of maps. One map shows you the scenic route for a private sale, another gives you the emergency exit route in a liquidation, and a third—the most important one for us—details the full cost to rebuild your entire inventory piece by piece after a disaster. For a jeweler, knowing which map to follow is everything.

Insurance Replacement Value: The Gold Standard for Protection

The single most critical appraisal for any jeweler is the Insurance Replacement Value appraisal. This is the only number that matters when it comes to your Jewelers Block insurance policy. It’s not a theoretical value; it’s a practical one that answers a simple question: what would it cost, right now, to replace this exact item with a brand-new one of the same kind and quality in the current retail market?

This isn't what you paid for the piece wholesale. It’s not a sale price. It’s the full, realistic retail cost, factoring in materials, craftsmanship, and market markups. This is precisely why First Class Insurance requires this type of certified appraisal. It’s the only figure that guarantees your policy can truly make you whole after a theft, fire, or other disaster, letting you restock without taking a massive financial hit.

Fair Market Value: A Completely Different Ballgame

Next up is the Fair Market Value (FMV) appraisal. This one serves an entirely different purpose and operates under a different set of rules. FMV is the price a willing buyer would reasonably pay a willing seller when neither is in a rush and both know all the relevant facts about the piece.

You'll typically see FMV appraisals used in situations like:

- Estate Settlements: Valuing assets for inheritance and tax purposes.

- Divorce Proceedings: Ensuring a fair division of marital property.

- Charitable Donations: Substantiating the value of a donation for a tax write-off.

- Private Sales: Acting as a neutral guide for a transaction between two individuals.

Because it reflects a negotiated price rather than an immediate replacement cost, FMV is almost always lower than the Insurance Replacement Value. If you try to insure your inventory using an FMV appraisal, you’re setting yourself up for a major coverage gap.

Liquidation Value: When You Need Cash, Fast

Finally, there’s the Liquidation Value appraisal. This valuation represents the absolute bottom-dollar price, used when you have to sell inventory immediately under pressure. Think of a "going out of business" sale or a bankruptcy auction where the main goal is to convert assets into cash as quickly as humanly possible.

The value is steeply discounted because speed is the only priority. While a liquidation appraisal has its place in certain legal or financial scenarios, it is completely wrong for insuring a jewelry store. Using this number would leave your business catastrophically underinsured. A quick look at a collection of fine antique jewelry makes it obvious why a rushed, lowball valuation fails to capture the true worth you need to protect.

To make these differences crystal clear, let's break them down side-by-side.

Comparing Key Jewelry Appraisal Types

This table shows exactly how each appraisal functions and where it fits into your business operations.

| Appraisal Type | Primary Purpose | Valuation Basis | Common Use Case |

|---|---|---|---|

| Insurance Replacement | To secure complete insurance protection. | Full retail cost to replace the item new today. | The only type for your Jewelers Block insurance policy. |

| Fair Market Value (FMV) | For legal, tax, or private sale transactions. | What a knowledgeable buyer and seller agree upon. | Estate planning, divorce settlements, or private sales. |

| Liquidation Value | To turn inventory into cash immediately. | A heavily discounted price for a forced, urgent sale. | Bankruptcy proceedings or business closure. |

The takeaway here is simple but crucial.

Always tell your appraiser exactly what you need the valuation for. When you say, "I need an appraisal for insurance," you're making it clear that you require the Insurance Replacement Value. That’s the only figure that builds a solid foundation for your Jewelers Block policy with First Class Insurance.

How Appraisals Strengthen Your Jewelers Block Insurance

For a jeweler, a certified appraisal isn't just a piece of paper—it's the bedrock of your Jewelers Block insurance policy. Without that critical proof of value, your insurer is essentially flying blind. At First Class Insurance, we view these documents as the essential blueprint for building accurate, reliable coverage for every single piece in your inventory, from the masterpieces in the vault to the items glittering in your showcase.

Think of it like building a house. You wouldn't pour the foundation without a detailed architectural plan, would you? It’s the same logic here. An insurer simply can't construct a sound jewelry store insurance policy without a detailed inventory appraisal. These documents give underwriters a clear, precise map to assess risk and set coverage limits that truly reflect the replacement cost of what you own.

The Make-or-Break Role in a Claim Scenario

Let’s walk through a real-world nightmare scenario to see why this is so critical. Imagine a smash-and-grab robbery at your store. Thieves get away with a handful of your best diamond engagement rings and a whole tray of custom earrings. The shock is devastating. But what happens next hinges almost entirely on the quality of your paperwork.

Here’s how that plays out in two very different ways:

- Jeweler A (With Current Appraisals): This jeweler has up-to-date, certified jewelry appraisals for every stolen piece. The documents are meticulous, with detailed descriptions, sharp photos, and current replacement values. When they file the claim, the process is clean and simple. The insurer has undeniable proof of what was lost and what it costs to replace it. The claim is paid quickly and fully, letting the business restock and get back on its feet with minimal disruption.

- Jeweler B (With Outdated or No Appraisals): This jeweler was relying on old invoices and some informal notes. When they file the claim, it's an immediate headache. The insurer has no way to verify the quality of the diamonds or the true value of the custom work. Without solid proof, the settlement turns into a drawn-out, painful negotiation. The result? A payout that’s a fraction of the actual replacement cost, leaving the business to cover the rest out-of-pocket and threatening its very survival.

The difference is night and day. Jeweler A invested in being prepared. Jeweler B is now facing a second disaster, this one caused by poor documentation. An investment in professional appraisals is a direct investment in your business’s future.

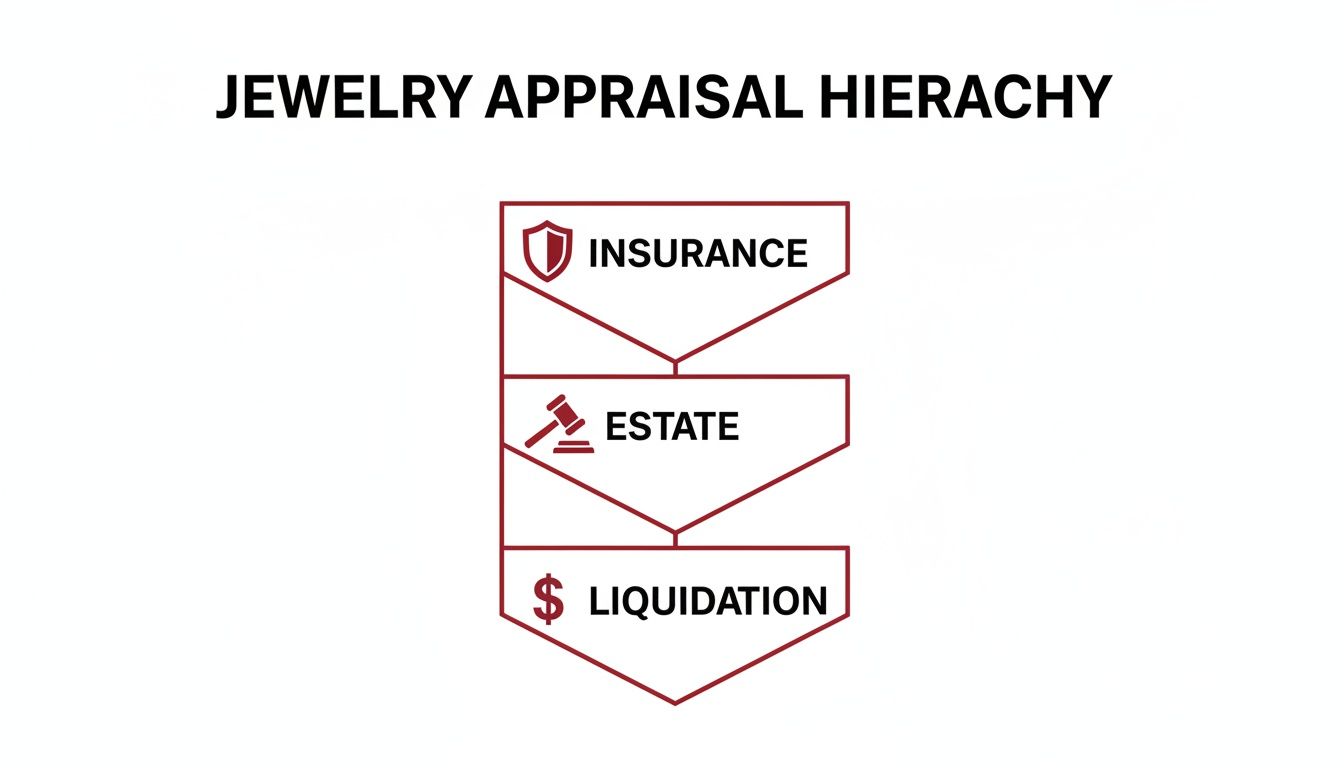

The diagram below shows the different types of appraisals, highlighting why an insurance valuation sits at the very top when it comes to protecting your business.

While estate and liquidation appraisals have their place, only a proper insurance appraisal is designed to make you whole again after a loss.

Avoiding the Underinsurance Trap

The consequences of weak documentation aren't just theoretical. The industry numbers paint a bleak picture: inadequate or missing appraisals result in insurance payouts that are, on average, 40-50% below actual replacement costs after a theft or loss.

This is a huge problem for thousands of U.S. jewelry stores every year, where 70% of claims come from showcase thefts or in-transit losses—exactly the situations where certified appraisals make all the difference. You can dig into these trends and learn how to avoid the staggering 25% denial rate for undocumented items by checking out the latest jewelry appraisal market research from ArchiveMarketResearch.com.

In the world of insurance for a jewelry business, an un-appraised item is an unprotected item. Your policy is only as strong as the documentation that backs it up.

Ultimately, certified appraisals provide the hard proof you need to turn a potential catastrophe into a manageable business event. They eliminate guesswork, speed up the claims process, and ensure your insurance for a jewelry store does its job when you need it most.

At First Class Insurance Jewelers Block Agency, we work with our clients to make sure their coverage is built on this solid foundation of verified value. Don’t wait for a loss to find the holes in your protection. Get a Quote for Jewelers Block today, and let us help you align your policy with the true value of your inventory.

Choosing a Qualified Jewelry Appraiser

Let's be clear: the credibility of your certified jewelry appraisal rests entirely on the expert who signs off on it. An appraisal from an unqualified source isn't worth the paper it's printed on and will be flatly rejected by any reputable provider of Jewelers Block insurance.

Choosing the right professional isn’t just about getting an accurate number. It’s about making sure your documentation holds up under pressure when you need it the most.

Think of it this way: for a complex heart issue, you’d see a cardiologist, not a general practitioner. The same logic applies here. For valuing high-end jewelry, you need an appraiser with specific, verifiable credentials in gemology and valuation science. Their proven expertise is what gives the appraisal its authority, turning it into a powerful tool for securing your insurance for a jewelry business.

Identifying Professional Credentials and Affiliations

The very first thing you should look for when vetting an appraiser is their certifications from leading industry organizations. These groups enforce rigorous standards for education, ethics, and hands-on experience. An appraiser affiliated with them has already proven their professional competence.

Keep an eye out for these key organizations:

- Gemological Institute of America (GIA): While famous for its grading labs, a Graduate Gemologist (GG) diploma from GIA is considered the absolute gold standard for gem identification and quality analysis. This is a non-negotiable, foundational credential for any serious appraiser.

- American Society of Appraisers (ASA): This is a multi-disciplinary organization, but their "Gems and Jewelry" designation is critical. An Accredited Senior Appraiser (ASA) has passed grueling exams on valuation theory and ethics, proving they are experts in the science of valuation itself.

- National Association of Jewelry Appraisers (NAJA): As the largest group exclusively dedicated to jewelry appraising, their Certified Master Appraiser (CMA) designation is the peak of the profession. It signifies years of experience and a portfolio of exemplary work.

These letters aren't just for show; they're proof of a deep commitment to the craft. An appraiser with these qualifications is far more likely to produce a report that a carrier like First Class Insurance Jewelers Block Agency will accept without a second thought.

Vetting Your Potential Appraiser

Once you find a candidate with the right credentials on paper, it's time to ask some direct questions. A true professional will welcome your diligence and have ready, clear answers.

Here’s a quick checklist to guide that conversation:

- What are your credentials? Ask them to be specific about their certifications (GIA, ASA, NAJA) and how long they've been appraising.

- What is your experience with this type of jewelry? An expert in modern diamonds might not be the best fit for your collection of antique Georgian pieces. Make sure their specialty aligns with your inventory.

- Can you describe your valuation process? They should be able to walk you through how they examine items, grade stones, and research market data to land on a final value.

- Is your lab equipment up to date? Professional appraisal requires specialized tools like microscopes, refractometers, and spectrometers. Don't be afraid to ask.

- Will the appraisal be done on-site? For obvious security reasons, you should insist on an appraiser who can perform the evaluation in your store, without ever taking your inventory off-premises.

The goal is to find a partner whose work is so thorough and defensible that it makes the underwriting process for your jewelry store insurance completely seamless. The right appraiser strengthens your entire risk management strategy.

Choosing your appraiser carefully ensures the reports you pay for provide real protection and are accepted without hesitation. It's a proactive step that helps you secure the best coverage when you Get a Quote for Jewelers Block and gives you the confidence that your assets are properly valued and protected.

What Happens During a Professional Appraisal

A professional certified jewelry appraisal isn't just a quick peek through a loupe. It's a deep-dive, almost forensic, examination that turns a piece of jewelry into a fully documented asset. Understanding what really goes on behind the scenes shows you why this process is so critical for getting solid Jewelers Block insurance.

From the moment you hand over a piece, it’s treated like evidence at a crime scene. The appraiser isn’t just slapping a price tag on it; they're meticulously building a complete profile that can hold up under the intense scrutiny of an underwriter or claims adjuster. That rigor is what gives the final report its power.

The Initial Examination and Documentation

First things first: the piece gets a thorough cleaning. You’d be surprised how much dust, lotion, and everyday grime can hide important details or throw off a gemological test.

Once it's sparkling, the appraiser gets to work weighing and measuring everything with extreme precision—we're talking dimensions recorded down to the hundredth of a millimeter. Next up are the precious metals. They'll run tests to confirm the metal's exact purity (14K, 18K, platinum, etc.) and hunt for any maker's marks or hallmarks. These details are the bedrock of the item's value and a non-negotiable part of any valuation for insurance for a jewelry store.

Grading Gemstones with Scientific Precision

With the metalwork documented, all eyes turn to the gemstones. This is where a certified gemologist’s training really shines. Every major stone is systematically graded against the universal standards of the 4Cs.

- Carat: The stone is weighed on an incredibly sensitive scale to lock in its exact carat weight.

- Color: For diamonds, this means grading it on the D-to-Z scale against a set of master stones. For colored gems, it's about evaluating the specific hue, tone, and saturation.

- Clarity: Using a high-powered microscope, the appraiser maps out every internal inclusion and external blemish.

- Cut: Here, they analyze the stone’s proportions, symmetry, and polish to see how well it plays with light.

This is a painstaking process. The appraiser documents every single detail, making sure the stone’s quality is backed by objective, scientific data. You absolutely need this level of detail to secure comprehensive insurance for a jewelry business.

Research and Final Valuation

An appraisal value doesn't just come out of thin air. After the physical exam is done, the appraiser hits the books and databases. They dig into current commodity prices for gold and platinum, scour sales records for similar pieces, and consider factors like brand prestige and the quality of craftsmanship.

The final value is a synthesis of physical analysis and current market realities. A proper certified jewelry appraisal provides a defensible replacement value that an insurer like First Class Insurance Jewelers Block Agency can confidently use to underwrite your policy.

The whole process wraps up in a detailed report. This isn't some flimsy one-page certificate. It’s a comprehensive, multi-page document laying out everything the appraiser found, complete with high-resolution photos, a full narrative description, the complete grading analysis, the appraiser’s credentials, and a clear statement of value. This airtight documentation is what ensures your most valuable assets are properly protected with jewelry store insurance.

Protect Your Business with the Right Insurance Partner

It’s easy to look at a certified jewelry appraisal as just another piece of paperwork, another business expense to check off the list. That’s a huge mistake. Think of it less as a cost and more as a direct investment in the stability of your business. Without accurate, up-to-date appraisals, your Jewelers Block insurance policy is built on a foundation of pure guesswork.

That formal proof of value is everything. When you don't have it, any insurance for a jewelry store becomes a gamble. At First Class Insurance, we're not just selling policies; we're your partners in protection. Our job is to help you draw a clear, undeniable line between your inventory’s true replacement value and the coverage you pay for, leaving zero room for dangerous gaps.

From Paperwork to Partnership

When you have the right insurance relationship, the appraisal process stops being a chore and becomes a core part of your business strategy. An insurer who actually gets the jewelry industry can take your certified appraisals and build a policy that fits your operation like a glove. This kind of partnership ensures that every single piece, whether it's sitting in a showcase or locked in the vault, is valued and protected correctly.

This isn't just about having insurance for a jewelry business—it's about having a robust financial shield that’s ready to perform when a crisis hits. You want a seamless connection between your documented assets and your coverage. That's the standard upheld by the most trusted underwriters in the world, like those in the Lloyd's of London marketplace, where verified value is everything.

A strong insurance partner uses your certified jewelry appraisals to build a fortress of protection around your assets, ensuring that in the event of a loss, you are made whole, not left negotiating.

Beyond just getting the policy right, it pays to understand expert strategies to maximize your insurance claim payout. Your appraisal is the critical first step, but knowing how to use it effectively if you ever have to file a claim is just as important for protecting your financial future.

Secure Your Assets and Your Peace of Mind

At the end of the day, a certified jewelry appraisal gives you more than just a number on a page—it gives you certainty. It’s the confidence of knowing that your life’s work is properly safeguarded against the unexpected. Here at First Class Insurance Jewelers Block Agency, we’ve dedicated our expertise to turning that certainty into an ironclad reality for your business.

Don’t leave your future to chance. Let us help you build the protection your business deserves, founded on the proven value of your inventory. It's time to take the single most important step in securing your assets and your peace of mind. Get a Quote for Jewelers Block today and see how a dedicated partnership can make all the difference.

Your Questions About Jewelry Appraisals, Answered

We get a lot of questions about certified jewelry appraisals. Let's cut through the noise and give you the straight answers you need to protect your business.

How Often Should I Re-Appraise My Inventory?

For your Jewelers Block insurance to really work when you need it, we recommend getting your high-value items and key inventory pieces re-appraised every two to three years.

Think about it—the markets for gold, platinum, and diamonds are always moving. An appraisal from five years ago might leave your insurance for a jewelry store dangerously out of date, meaning it wouldn't cover the full replacement cost if you had to file a claim today.

What's the Difference Between a Lab Report and an Appraisal?

This is a big one. A lab report, like one from GIA, is a purely scientific document. It’s like a blueprint for a gemstone, meticulously grading its cut, color, clarity, and carat weight. It gives you the "what," but it never assigns a dollar value.

An appraisal, on the other hand, is a financial document. It takes that scientific data from the lab report, combines it with current market analysis, and determines what an item is worth for a specific purpose, like getting proper jewelry store insurance.

A lab report tells you what you have. An appraisal tells you what it's worth for insurance purposes. Both are essential for complete protection.

Can I Use a Sales Receipt for My Insurance Policy?

In a word, no. A sales receipt is just a snapshot of a past transaction. It only proves what someone paid for an item at a specific point in time, not what it would cost to replace it in today's market.

Insurers like First Class Insurance Jewelers Block Agency need a formal, certified appraisal to correctly underwrite your policy. This is the only way to make sure a claim is settled based on current market values, not a historical price tag. A key part of this process involves the verification of signatures for fraud prevention, which confirms the appraisal is authentic and can stand up to scrutiny.

At First Class Insurance, we believe your coverage should be built on the solid foundation of accurate, verified value. Don't leave your most important assets under-protected. Get a quote for your insurance needs at First Class Insurance and get the peace of mind you deserve.