Getting proper insurance for your jewelry isn't as simple as adding a line item to your existing policy. It demands specialized coverage that understands the real value and unique risks you're facing.

For business owners, that usually means a Jewelers Block insurance policy. For private collectors, it’s a dedicated personal policy or a specific rider. The bottom line is this: your standard homeowner's or business insurance almost certainly leaves you dangerously exposed.

Why Your Standard Insurance Is Not Enough

So many jewelers and collectors fall into the same trap—they assume their standard insurance has them covered for high-value pieces. It’s an easy mistake to make, but it can lead to financial ruin when something goes wrong.

A typical homeowner's policy, for example, usually caps jewelry theft coverage at a shockingly low $1,500 to $2,500. That might not even cover the cost of a single engagement ring, let alone a curated collection of antique pieces.

It’s the same story on the business side. A standard Business Owner's Policy (BOP) just isn't built for the specific dangers of the jewelry world. It’s great for a slip-and-fall accident or a broken window, but it completely misses the mark on the nuanced risks that come with holding small, valuable, and highly portable assets.

Unique Risks Facing the Jewelry Industry

The world of fine jewelry is a magnet for risks that general insurance policies simply don't understand. Whether you run a storefront or keep a private collection, you’re up against threats that go way beyond simple theft.

Think about these all-too-common scenarios:

- Smash-and-Grab Robberies: A crew smashes through a display case and is gone in under 60 seconds, taking tens of thousands of dollars in inventory with them.

- Mysterious Disappearance: A diamond bracelet was there during the morning count but has vanished by closing time, with no sign of forced entry or a clear culprit.

- Damage in Transit: A GIA-certified stone gets chipped while being shipped to a client, or worse, on its way back from a trusted setter.

- Employee Dishonesty: You discover a long-term, trusted employee has been pocketing small items for years, adding up to a massive loss.

These situations are precisely why specialized insurance for a jewelry store isn’t just a good idea—it's essential for survival. The gold standard for this level of protection is Jewelers Block insurance.

A Jewelers Block policy is an all-in-one insurance solution built from the ground up for the jewelry industry. It covers everything from your inventory and raw materials to customer property left for repair and pieces you're showing at trade shows or shipping to a client. It’s a blanket of security that standard policies just can't offer.

The Problem with Underinsurance

It's easy for jewelers and high-net-worth collectors to underestimate the financial risk of being underinsured, but the numbers tell a sobering story.

While 67% of engagement ring buyers get their pieces insured, that number drops to just 34% for other fine jewelry purchases, leaving billions of dollars in assets vulnerable. For a business, that gap is a huge liability. Smash-and-grab robberies are a constant threat, spiking by 30% in major U.S. cities between 2022 and 2024. You can find more market analysis at Data Insights Market.

For Collectors, The Limits Are Clear

If you’re a private collector, leaning on your homeowner's policy is a massive gamble. It's not just about the low payout limits; it’s about what those policies won't cover. A lost stone that falls out of a ring or damage that happens while you're traveling often isn't covered at all.

This is where a dedicated personal jewelry policy, sometimes called a "floater," becomes non-negotiable. Unlike a standard homeowner's policy, these are designed to provide "all-risk" coverage for your specific pieces at their full appraised value. It ensures that whether an heirloom is lost, stolen, or damaged, you can be made financially whole again.

Frankly, understanding these limitations is the first real step in learning how to insure jewellery the right way.

Before diving deeper, let's quickly break down who needs what. Different owners face different risks, and their insurance needs to match.

Jewellery Insurance Needs At a Glance

| Owner Profile | Primary Risks | Recommended Policy Type |

|---|---|---|

| Retail Jeweler | Smash-and-grab, employee theft, mysterious disappearance, transit loss | Jewelers Block Insurance |

| Private Collector | Theft from home, loss during travel, accidental damage, mysterious loss | Personal Jewelry Policy or Floater |

| Wholesaler/Designer | Shipping & transit risks, employee theft, damage at trade shows | Jewelers Block Insurance with transit focus |

| Online-Only Retailer | Shipping loss/damage, cyber theft, returns fraud | Jewelers Block + Cyber Liability Insurance |

| Pawnbroker | Robbery, damage to customer property (pledged items), employee dishonesty | Jewelers Block or specialized Pawnbroker's Policy |

As you can see, a one-size-fits-all approach just doesn't work. The right policy is built around your specific daily operations and the unique threats you face.

Choosing the Right Jewellery Insurance Policy

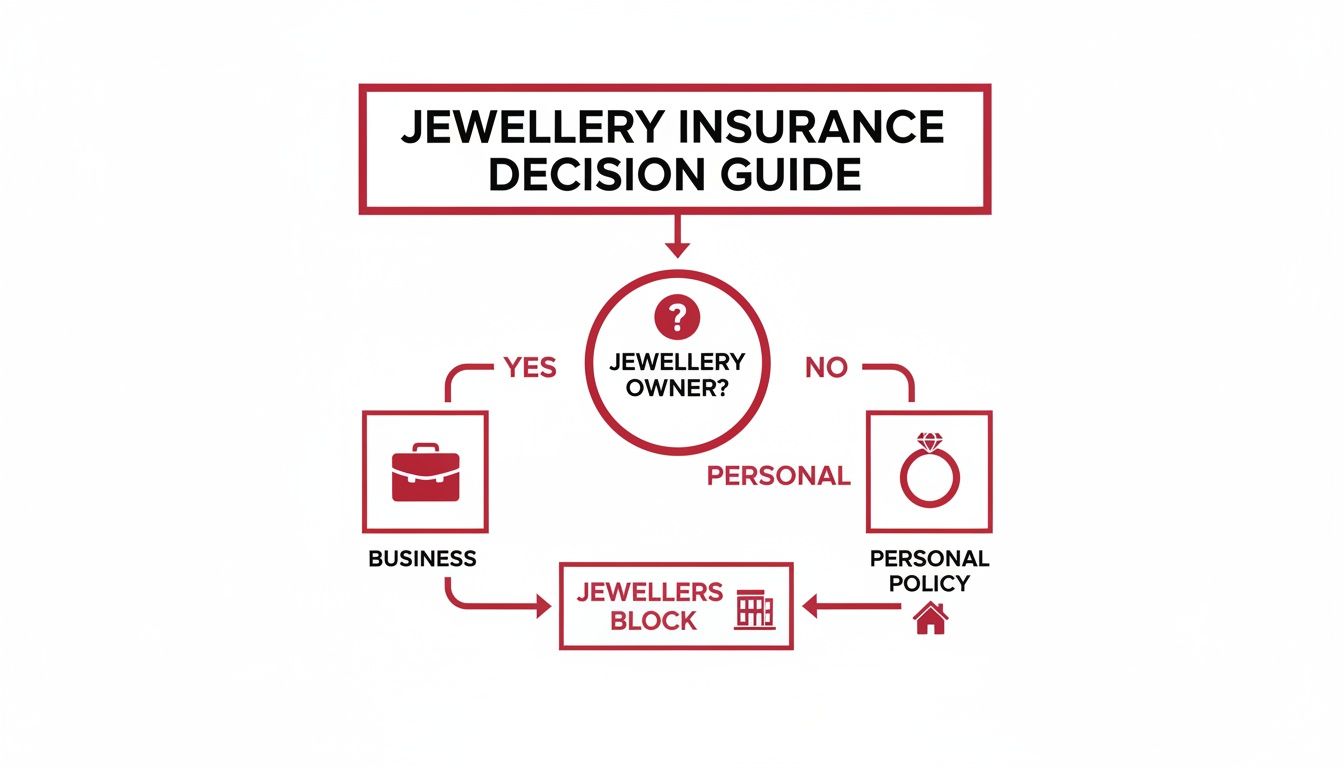

Picking the right insurance policy isn’t just a formality—it's a critical business decision that can make or break you. There are a few different paths you can take, and knowing the core differences is what separates adequate coverage from a policy full of holes. The choice really boils down to one simple question: are you protecting a business or a personal collection?

This simple flowchart lays out the first and most important fork in the road.

As you can see, the path splits right away. Businesses need specialized commercial policies, while individuals need personal coverage. It's that straightforward.

The Gold Standard for Businesses: Jewelers Block Insurance

If you run a jewelry business of any kind—from a retail shop to a wholesale operation—a Jewelers Block insurance policy is the non-negotiable industry standard. And for good reason. It’s a specialized, all-in-one package built to handle the unique, high-stakes risks jewelers face every single day.

Think of it as a comprehensive shield for your entire operation. A standard business policy just won't cut it. A Jewelers Block policy is designed to cover your assets wherever they are, including:

- Inventory on Premises: Your entire stock of finished jewelry, loose gems, and raw materials is protected against theft, fire, and other disasters.

- Customer Property: You’re covered for any items customers leave with you for repair, appraisal, or consignment. This is crucial for protecting your reputation.

- Goods in Transit: This covers your pieces against loss or damage while being shipped to a customer or received from a supplier.

- Off-Premises Coverage: Your inventory stays protected when you’re on the road at trade shows, with travelling salespeople, or out on memo.

For wholesalers, that transit coverage is absolutely vital. Shipping high-value goods is one of the most vulnerable moments in the entire supply chain. A solid Jewelers Block policy ensures those assets are protected from door to door. A specialty agency, like a First Class Insurance Jewelers Block Agency, can help you Get a Quote for Jewelers Block that is specifically designed for these complex transit risks.

A Practical Example: An Artisan Jeweler's Safety Net

Let’s imagine an artisan jeweler who designs custom engagement rings from a small workshop. She sells online and sets up a booth at local art fairs on the weekends. Her risks are everywhere: a thief could break into her workshop and steal gold and diamonds, a courier could lose a package, or a finished ring could get damaged at a market.

A generic business owner's policy would leave her exposed to most of these scenarios. By securing a Jewelers Block policy, she protects her raw materials, her works-in-progress, and her finished inventory. When she pairs this with a general liability policy to cover things like a customer slipping in her workshop, she’s built a complete safety net. That’s how you get proper insurance for jewelry business.

Options for Personal Collectors

For private collectors and individuals, the insurance landscape looks a bit different. You’ve generally got two main options for how to insure jewellery. The right one for you will depend on the value of your collection and how much protection you need.

-

Adding a "Rider" or "Floater" to Your Homeowner's Policy: This is the most common route for insuring one or two valuable pieces, like an engagement ring. A rider is an add-on that lists a specific item for its full appraised value, which gets you around the very low default limits in a standard homeowner's policy. It's convenient, but it can have limitations, especially when it comes to "mysterious disappearance."

-

Securing a Standalone Personal Jewelry Policy: If you have a larger collection or a few extremely high-value pieces, a standalone policy offers far better protection. These policies are broader and usually provide worldwide, all-risk coverage. The claims process is often smoother, and making a claim on this policy won't jack up the rates on your homeowner's insurance.

When you're weighing these two personal options, read the fine print. The devil is in the details, like deductibles, coverage for mysterious loss, and how often you need to get items reappraised. For any significant collection, a standalone policy almost always provides more peace of mind.

At the end of the day, whether you need robust jewelry store insurance or a simple rider for an heirloom, the goal is identical. It's all about matching the policy's strengths to your specific risks. That way, if the worst happens, you’re financially prepared to recover and rebuild.

The Importance of Appraisals and Documentation

An insurance policy is just a promise on paper. Its real strength comes from the paperwork you have to back it up. Without accurate, up-to-date documentation, even the best policy can leave you short-changed and frustrated when it’s time to file a claim.

This is why getting your documents in order before you even start shopping for coverage is so critical. Think of your appraisals and inventory lists as the foundation of your protection. They are the undeniable proof of what you own and, more importantly, what it would cost to replace it in today's market.

For a jewelry business, a meticulous, constantly updated inventory system is non-negotiable. For a private collector, professional appraisals are your absolute best friend.

Finding a Certified Appraiser and What to Expect

Let's be clear: not all appraisals are created equal. To make sure your valuation actually holds weight with an insurer, you need a report from a qualified, credentialed professional. I always tell my clients to look for appraisers with certifications from respected organizations like the Gemological Institute of America (GIA). A Graduate Gemologist (GG) designation is a solid sign you’re dealing with an expert.

A proper appraisal is so much more than a price tag. The comprehensive report that insurers need is a detailed blueprint of your piece. It breaks down all the factors that give your jewelry its value, like understanding different diamond cuts, clarity, and carat weight.

A legitimate appraisal report should always include:

- Detailed Descriptions: Covers everything from the style and setting to unique marks or engravings.

- Stone Grades: Precise measurements and grades for the 4Cs (cut, color, clarity, and carat) for every significant stone.

- Metal Types: Specifies the type and weight of precious metals, like 18k gold or platinum.

- High-Quality Photographs: Clear, detailed photos taken from multiple angles are a must.

- Current Replacement Value: This is the number that matters. It’s not what you paid; it’s the real-world cost to buy a new, comparable item today.

Why Accurate Valuations Prevent Underinsurance

Having a recent, professional appraisal is the single best way to avoid being underinsured. The market for precious metals and gemstones is always moving. An appraisal from five years ago might value a ring at $10,000, but if market prices have jumped, its true replacement cost today could easily be $15,000.

Without that updated valuation, you’d be on the hook for that $5,000 difference yourself after a loss.

Solid documentation also makes the claims process a hundred times smoother. With a detailed report already on file, there’s no room for debate about the quality or value of the stolen or damaged item. It simplifies everything and helps your insurer process your claim much faster. If you want to see how detailed imagery helps, check out our guide on photographing diamond rings for documentation purposes.

An outdated appraisal is one of the most common and costly mistakes both collectors and businesses make. We recommend getting high-value pieces reappraised every two to three years to ensure your coverage keeps pace with market values.

The Essential Checklist for a Jewelers Block Quote

For jewelry store insurance, the paperwork requirements get even more serious. When you’re ready to Get a Quote for Jewelers Block, an underwriter will need a complete picture of your business operations to gauge your risk.

Get ready to pull together the following:

- A Complete Inventory List: A detailed, itemized list of your entire stock with current wholesale values.

- Security System Specifications: All the details on your alarms, surveillance cameras, and safes (including their UL ratings, like TL-30).

- Business Financials: Recent financial statements or tax returns to show that your business is stable.

- Operational History: Information on how long you’ve been in business and any prior loss history.

Providing this information upfront helps an insurer accurately assess your risk and build a policy that truly protects your insurance for jewelry business needs. It also shows you’re a responsible operator, which can go a long way in securing a better premium.

How to Get a Quote and Select an Insurer

You’ve done the hard work of documenting everything and getting solid appraisals. Now comes the moment of truth: finding the right insurance partner. Getting a quote is so much more than just a price check. It’s about finding a provider who genuinely understands the high-stakes world you operate in and can build a policy that actually works when you need it.

This is where you’ll immediately see the difference between a generalist and a true specialist. A standard insurance agent might look at your store and see "retail," completely missing the unique risks—mysterious disappearance, losses during transit, or the specific safe ratings that underwriters demand.

The Advantage of a Specialty Agency

For anyone who needs Jewelry store insurance, going with a specialty firm like a First Class Insurance Jewelers Block Agency isn't just a good idea; it's a strategic necessity. These people live and breathe the jewelry industry. They have long-standing relationships with the specific underwriters who handle high-value risks, which often translates to better coverage and more competitive rates for you.

A specialist gets your business. They know a UL-rated TL-15 safe from a TL-30 and can advise you on security upgrades that will both protect your inventory and lower your premiums. They become your advocate, translating your operational reality into the language underwriters understand.

When you Get a Quote for Jewelers Block, a specialist broker knows how to frame your risk profile in the best possible light. That expertise can be the difference between landing an affordable, comprehensive policy and being turned down flat.

What You Need to Provide for a Quote

To get a truly accurate quote, you have to paint a clear, detailed picture of your risk. This is what insurers use to calculate your premium and tailor the policy to your operation. That documentation you’ve already gathered? It's time to put it to use.

For a Jewelers Block insurance policy, an underwriter will want to see:

- A detailed inventory list showing current wholesale values.

- Your security system specifications, including alarm monitoring contracts and safe ratings.

- Annual sales figures and other key business financial statements.

- Operational details, like your opening/closing procedures and how you handle shipments.

- Your loss history from the last three to five years.

The process is a bit simpler for a personal jewelry policy. You’ll typically just need to provide the full appraisal report for each piece you’re looking to cover.

Evaluating Insurers Beyond the Price Tag

The cheapest quote is almost never the best one, especially when you're looking for insurance for jewelry business. A rock-bottom premium could be hiding massive coverage gaps or come from a carrier notorious for denying claims. You have to evaluate potential insurers on a much deeper level to make sure you’re choosing a partner, not just a vendor. Some providers, like those tied to the historic market of

, bring centuries of experience in navigating these exact kinds of specialized risks.

Comparing your options involves looking at the fine print and the company's track record. This table breaks down what you should really be looking for.

Comparing Jewellery Insurance Providers

| Evaluation Criteria | What to Look For in a Provider | Why It Matters |

|---|---|---|

| Claims Handling Reputation | Positive online reviews, industry testimonials, and a history of fair and timely payouts. | When a loss happens, you need a partner who will help you recover quickly, not fight you over every last detail. |

| Industry Expertise | A deep understanding of the jewelry trade, including specific risks like transit and trade shows. | A specialist understands your daily operations and can offer policy features that a generalist wouldn't even think of. |

| Policy Exclusions | Clear, reasonable exclusions. Watch out for vague language or major coverage gaps. | Hidden exclusions, like a lack of coverage for mysterious disappearance, can make a policy worthless right when you need it. |

| Customer Service | Responsive, knowledgeable agents who can answer your questions and provide risk management advice. | Your agent should be an advisor who helps you prevent losses, not just someone who sells you a policy and disappears. |

| Financial Strength | A high rating from agencies like A.M. Best (an A- or better is a good benchmark). | You need total confidence that your insurer has the financial stability to pay out a major claim without any issues. |

Before you put ink on any contract, make sure you've armed yourself with the right questions. Digging into the details now can save you a world of headaches and financial pain later. Don't be shy—ensure you’re getting the right insurance for a jewelry store.

Using Risk Management to Lower Your Premiums

The best insurance policy you can have is the one you never have to use. Smart, proactive risk management doesn’t just prevent the nightmare scenario of a major loss; it can also put real money back in your pocket through lower premiums.

When you apply for jewelry store insurance, the underwriter is essentially placing a bet on your ability to protect your assets. The more you do to secure your inventory and business, the less risky that bet becomes. Insurers love to see a strong commitment to security, and they'll often reward that diligence with better rates.

Essential Security Measures for Your Jewelry Business

When an underwriter looks at your application for Jewelers Block insurance, they’re looking for layers of protection. This isn’t about just checking a few boxes. It’s about building a fortress around your inventory that makes criminals think twice and shows your insurer you’re serious about loss prevention.

Here are the key security upgrades that really move the needle with insurers:

- UL-Rated Safes and Vaults: Your safe is the last line of defense, and its rating matters—a lot. Underwriters will specifically ask for its Underwriters Laboratories (UL) rating. A TL-30 safe, which can withstand tool attacks for at least 30 minutes, is often the bare minimum for holding any significant value overnight.

- Multi-Layered Alarm Systems: A simple door sensor just won’t cut it. You need a comprehensive system with motion detectors, glass-break sensors, and a cellular backup in case the phone lines are cut. Central station monitoring is absolutely non-negotiable.

- High-Definition Surveillance: Today’s 4K camera systems with off-site cloud storage are a game-changer. They act as a powerful deterrent and provide crystal-clear footage for investigators if the worst happens.

- Strict Inventory Protocols: Meticulous opening and closing procedures, where you account for high-value pieces every single day, can shut down opportunities for internal theft and quickly flag a "mysterious disappearance."

Beyond the hardware, your human protocols are just as important. Insurers will want to see that you conduct thorough background checks on all employees—a crucial step in preventing internal theft, which sadly accounts for a huge portion of industry losses.

A Real-World Premium Reduction

Think about a mid-sized retailer I know who was staring down a steep renewal on their insurance for jewelry business. Their security was okay, but it was getting dated. After a chat with their broker at a First Class Insurance Jewelers Block Agency, they decided to invest. They upgraded their vault to a higher UL rating and installed a new 4K camera system.

By presenting these upgrades to their underwriter, they weren't just asking for a better rate; they were proving they had lowered their risk profile. The result? They locked in a 15% reduction on their annual premium. Those savings will pay for the new security system in just a few years. When you Get a Quote for Jewelers Block, showing off these proactive measures is your single best negotiation tool.

Practical Tips for Private Collectors

You might not need a commercial-grade vault in your living room, but the core principles of risk management are the same for personal collections. Insurers always look favorably on collectors who take smart, sensible steps to protect their pieces.

A few simple but effective measures can make a big difference:

- Use a Safe Deposit Box: For items you don’t wear often, a bank’s vault is one of the most secure places on earth. Just be sure to tell your insurer which pieces are stored off-site.

- Invest in a Quality Home Safe: A professionally installed, bolted-down home safe offers fantastic protection against the average smash-and-grab burglary.

- Be Discreet on Social Media: This one is huge. Avoid broadcasting your high-value pieces online, especially when you’re traveling. Thieves actively monitor social media for easy targets.

Ultimately, risk management is a partnership between you and your insurer. By taking demonstrable steps to secure your assets, you're not just protecting your property—you're proving that you are a lower-risk client worthy of a better premium.

Navigating the Claims Process After a Loss

That gut-wrenching moment you realize a piece of jewelry is gone—whether lost, damaged, or stolen—is something no one wants to experience. The initial shock can be paralyzing, but what you do in those first few hours is absolutely critical. It sets the entire tone for a successful insurance claim.

If you’ve experienced a theft or robbery at your store, your first priority is always safety. Once everyone is secure, your very next call should be to the police to file an official report. Don't think of this as just a formality; that police report is one of the foundational documents your insurer will demand.

At the same time, you need to get your insurance agent on the phone immediately. Most policies have strict deadlines for reporting a loss, and waiting too long can put your entire claim at risk. An agent from a specialty firm, like a First Class Insurance Jewelers Block Agency, will know exactly what your policy requires and can start guiding you through the next steps.

Documenting the Loss Thoroughly

With the initial notifications out of the way, it’s time to shift into documentation mode. This is where all your diligent record-keeping really proves its worth. Your job is to build a comprehensive file that leaves no room for doubt or questions.

Start pulling together every piece of paper connected to the missing or damaged items:

- Police Report: Get a copy of the official report with the case number.

- Original Appraisals: Find the most recent, detailed appraisal you have on file.

- Proof of Ownership: This can be anything from original receipts and GIA reports to detailed photographs.

- Inventory Records: If you're a jewelry business, your inventory logs showing the item in stock just before the incident are non-negotiable.

Grab your phone and take clear photos or videos of any physical evidence. That could be a broken display case, a pried-open safe, or the damaged piece of jewelry itself. Every photo helps build a more convincing case.

A well-documented claim is a fast-moving claim. The more organized and thorough your initial submission is, the fewer questions an adjuster will have, which can significantly speed up the approval and payment process.

Working with the Claims Adjuster

Once your claim is filed, the insurance company will assign a claims adjuster to your case. This is the person responsible for investigating the loss, verifying every detail, and ultimately determining how much you’ll be paid based on your policy. Their job is to be meticulous, so your best strategy is open, honest, and prompt communication.

Give them everything they ask for without delay. They'll review your paperwork, inspect any damage, and might need to interview you or your employees. It’s all a standard part of their due diligence for any insurance for a jewelry store or personal policy. For a deeper dive into this part of the process, checking out a comprehensive overview of insurance claims can give you a better idea of what to expect.

The adjuster will rely on your appraisal and other documents to calculate the settlement, whether it's based on replacement cost or actual cash value. This is where having a recent, professional appraisal on hand makes a world of difference—it makes the valuation process straightforward and far less contentious.

A claim is the ultimate test of your insurance policy, and having the right partner in your corner is everything. At First Class Insurance, we provide expert guidance from the moment you Get a Quote for Jewelers Block to the final resolution of a claim, ensuring you have the support you need when it matters most. Learn more about our specialized approach at https://firstclassins.com.