The offer of a free jewelry appraisal often feels like a fantastic deal, but it’s crucial to understand what this document really is—and what it isn't.

While it’s a nice touch to build customer confidence during a sale, these complimentary reports are almost never enough to secure proper insurance coverage. Think of it like this: a free appraisal is the sales receipt, while a formal insurance valuation is the vehicle's title. One confirms a transaction, while the other is a legal document proving value and ownership.

The Hidden Risks of Free Jewelry Appraisals

Let’s be honest, the main purpose of a free appraisal is marketing. It’s a tool meant to make a customer feel great about their purchase by showing a high retail value.

But that marketing focus creates a massive gap when it’s time to protect your business with a solid Jewelers Block insurance policy. An insurer needs far more than a suggested price tag; they need a detailed, unbiased valuation to accurately assess risk and set your coverage limits.

Relying on a simple, complimentary document can leave your jewelry store dangerously underinsured. If a theft, fire, or other disaster strikes, your insurer could easily dispute the value on a marketing-focused appraisal. The result? A claim payout that falls tragically short of your actual replacement costs. This is where the true "cost" of a free appraisal reveals itself—in the thousands of dollars lost because of bad paperwork.

Why Insurance Requires More Detail

Insurance for a jewelry business is built on a foundation of precise, defensible documentation. A proper valuation for insurance isn't just an opinion of value; it's a report that can hold up under scrutiny. It has to include specific, verifiable details that a free appraisal almost always leaves out.

These are the non-negotiables:

- Detailed Gemstone Grading: Exact measurements, carat weights, and grades for color, clarity, and cut.

- Metal Identification: The precise type and purity of the precious metals used.

- Methodology Statement: A clear explanation of how the appraiser arrived at their stated value.

- High-Quality Photographs: Clear images documenting the piece from every important angle.

Without these key elements, the document simply doesn't have the credibility to support a major insurance claim. This is exactly why a formal insurance valuation is the bedrock of real financial protection for your inventory.

A common mistake is assuming any document labeled "appraisal" will satisfy an underwriter. The reality is that insurers scrutinize these reports to ensure the stated value is realistic, defensible, and based on current market data for replacement, not just retail markup.

The Growing Need for Accurate Valuations

This distinction is becoming more critical than ever as jewelry owners increasingly recognize their pieces as serious, protectable assets.

The global jewelry appraisal market, valued at around USD 1.7 billion, is expected to nearly double to USD 3.4 billion by 2033. This explosion is being driven by a greater awareness of risk and tougher insurance requirements, especially in North America, which accounts for over half the global demand. You can read more about the jewelry appraisal market trends here.

This growth sends a clear signal: jewelers need to get documentation that meets these rising standards. It’s the only way to ensure their insurance for a jewelry store is both valid and truly effective when they need it most.

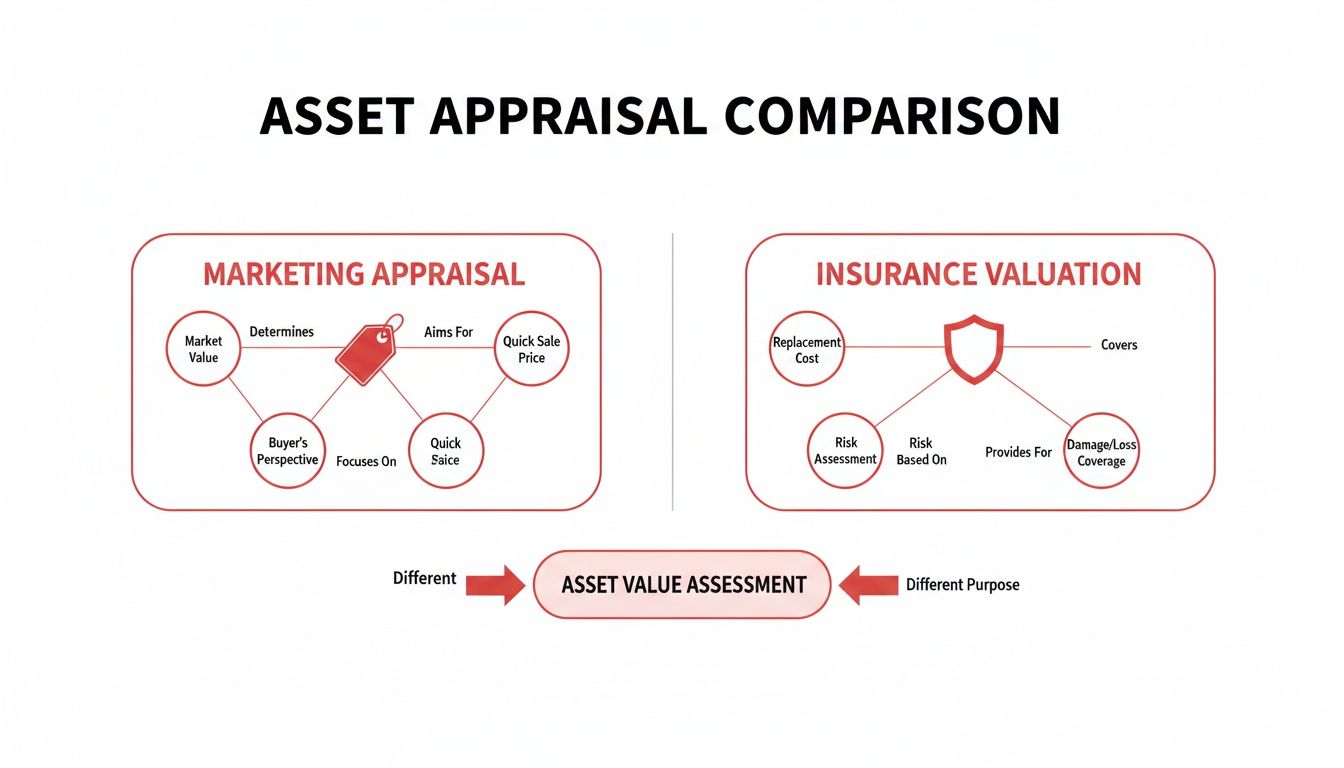

Marketing Appraisal vs. Insurance Valuation

Let's get one thing straight: not all documents called an "appraisal" are created equal. Far from it. Understanding the difference between a marketing appraisal and a formal insurance valuation isn't just semantics—it's absolutely critical for protecting your business.

One is a sales tool. The other is a legal document that forms the bedrock of your insurance for a jewelry business.

Think of that free appraisal you give a customer with a new ring as a "Suggested Retail Price" tag on steroids. Its main job is to make the buyer feel fantastic about their purchase by showing a high retail number. It’s great for customer confidence, but that figure rarely has anything to do with the actual cost to replace that item today.

An insurance valuation is a completely different beast. It’s a detailed, methodical report put together by a certified professional for one reason and one reason only: to establish an accurate, defensible replacement cost. This is the number your Jewelers Block insurance policy is based on, and it's what an underwriter needs to see to pay a claim correctly.

What a Marketing Appraisal Leaves Out

The real difference is in the details—or the glaring lack of them. A complimentary or free jewelry appraisal handed over at the point of sale is almost always light on the technical specs an insurer demands. Its focus is the big, shiny price at the bottom, not the granular data that proves it.

An insurance valuation, on the other hand, is built on a foundation of cold, hard facts. It meticulously documents every single facet of the piece.

A formal insurance valuation is the blueprint for your jewelry. It must have enough specific detail for another jeweler to recreate the exact item from scratch—which is precisely what an insurer needs to calculate a fair replacement cost.

This level of detail is non-negotiable when you’re trying to secure proper insurance for a jewelry store. Without it, you’re basically asking your insurer to take a wild guess at the value of your assets, and that’s a gamble you can’t afford to take.

Marketing Appraisal vs. Insurance Valuation At A Glance

To make the distinction crystal clear, let's break down how these two documents stack up side-by-side. The differences are stark, and they directly impact your ability to be made whole after a loss.

| Feature | Free Marketing Appraisal | Formal Insurance Valuation |

|---|---|---|

| Primary Purpose | Sales tool to validate a purchase price. | To establish a factual, defensible replacement cost for insurance. |

| Value Basis | Often an inflated "suggested retail" figure. | Current market cost of materials and labor to recreate the item. |

| Level of Detail | Minimal; often just basic descriptions. | Extremely detailed; includes all specs needed for recreation. |

| Appraiser Info | May not list credentials. | Always includes appraiser’s qualifications (e.g., G.G. from GIA). |

| Legal Standing | Little to none for an insurance claim. | A legally recognized document for underwriting and claims. |

| Cost | Typically free or included with purchase. | A professional fee based on the complexity of the work. |

As you can see, one is designed to close a sale, while the other is designed to protect an asset. Relying on a marketing appraisal for insurance is like bringing a squirt gun to a fire.

Key Components of an Insurance Valuation

So what, exactly, does a proper insurance valuation include that a marketing appraisal almost always misses? This comprehensive documentation is what gives the report its legal and financial teeth.

- Appraiser Credentials: The report must clearly state the appraiser’s qualifications, like a Graduate Gemologist (G.G.) diploma from the GIA.

- Detailed Item Description: We’re talking precise measurements, metal types and weights, how it was made (e.g., cast, hand-fabricated), and any identifying marks or stamps.

- Complete Gemstone Analysis: For every stone, it must list the "4 Cs" (Carat, Color, Clarity, Cut), plus its shape, measurements, and any known treatments.

- Plotting Diagrams: For significant diamonds, a diagram mapping internal and external characteristics (inclusions and blemishes) is essential for positive identification.

- High-Quality Visuals: Sharp, clear images are non-negotiable. For example, professional jewelry product photos are indispensable for creating a precise visual record for both market assessment and insurance documentation.

- Stated Valuation Purpose: The document has to say, in no uncertain terms, that it is for insurance replacement purposes and define the type of value being used (e.g., Retail Replacement Value).

- Market-Based Justification: The final value must be backed by current, objective market data for materials and labor—not just an arbitrary retail markup.

At the end of the day, a marketing appraisal tells a customer what their new piece could sell for in a perfect retail world. A formal insurance valuation tells your insurer exactly what it would cost to make that piece again today, giving them the factual basis to cover you properly.

What Underwriters Look For in an Appraisal

When you hand over an appraisal for your Jewelers Block insurance, it doesn’t just get filed away. That document lands on the desk of an underwriter—a financial pro whose entire job is to measure risk. They scrutinize every last detail because they need to know exactly what they're insuring. A vague or incomplete report makes that impossible.

Think of an underwriter like an architect who needs a precise blueprint before breaking ground. A napkin sketch, much like a free jewelry appraisal, is useless for building a sturdy structure. They need exact measurements and material specs. In the same way, your appraisal is the blueprint for your insurance policy.

This detailed report becomes the legal and financial backbone for any potential claim. Without it, your inventory's value is just an opinion, not a defensible fact. That's why underwriters are so particular about the paperwork—it's their primary tool for preventing disputes and ensuring a fair, fast payout if you ever suffer a loss.

The Appraiser’s Credentials Matter Most

Before an underwriter even glances at the valuation, they look at who wrote it. The appraiser's credibility is everything. An appraisal from someone without proper certification carries almost no weight in the insurance world.

Underwriters are trained to spot specific professional designations that signal rigorous training and high ethical standards.

- Graduate Gemologist (G.G.) from the GIA: This is the gold standard. It confirms the appraiser has expert-level knowledge in identifying and grading gems.

- Certified Appraiser from a recognized organization: Credentials from groups like the American Society of Appraisers (ASA) or the National Association of Jewelry Appraisers (NAJA) are also highly respected.

These letters tell the underwriter that the valuation rests on established, scientific methods, not just a retailer's gut feeling. It’s the first checkpoint to determine if the document is reliable enough to support an insurance for a jewelry store policy.

Anatomy of an Insurance-Ready Report

Once the appraiser’s authority checks out, the underwriter digs into the report itself. They’re looking for a highly detailed, systematic breakdown of each piece. This isn't about the final dollar amount; it's about the hard evidence that backs it up.

An underwriter's core question is simple: "If this exact item were lost today, what would it cost to recreate or replace it with a new one of like kind and quality?" A strong appraisal answers this question with indisputable facts, leaving no room for ambiguity.

The infographic below shows the difference between a flimsy marketing appraisal and a robust insurance valuation.

As you can see, a real insurance valuation is built on verifiable data. A marketing appraisal is often just focused on a subjective retail price.

A solid report must include:

- A Clear Statement of Purpose: The document has to say it's for "insurance replacement value" to distinguish it from other types, like fair market or liquidation value.

- Detailed Item Descriptions: This means precise measurements, weights (grams for metals, carats for stones), manufacturing methods (like cast vs. hand-fabricated), and any identifying marks.

- Complete Gemological Information: For stones, underwriters need the full 4Cs (Carat, Color, Clarity, Cut), shape, and full disclosure of any treatments.

- High-Resolution Photographs: Clear, focused images from multiple angles are non-negotiable. They create a visual record of the item's condition and unique features.

This level of detail is crucial for any insurance for jewelry business. In fact, a staggering 70% of jewelry insurance claims worldwide run into complications because of bad valuations, with value disputes often reaching 20-30% on poorly appraised items.

Ultimately, a strong appraisal is your best defense. It gives the underwriter the facts they need to build a policy that truly protects your business—a principle that leading insurers have relied on for centuries. You can learn more about the history of market leaders by checking out our information on Lloyd’s of London.

Spotting Red Flags in a Jewelry Appraisal

Just because a document has "appraisal" printed at the top doesn't mean it's worth the paper it's written on. A weak or misleading appraisal creates a false sense of security, which can lead to huge financial losses when you need your Jewelers Block insurance to come through. Learning to spot the warning signs is a critical skill for any jewelry business owner.

Think of it like inspecting a used car. You wouldn't just take a seller's word for it. You’d look under the hood, check the service history, and listen for any strange noises. In the same way, you have to scrutinize an appraisal document to make sure it will actually hold up under the pressure of an insurance claim.

Inflated Values and Vague Language

One of the most common red flags—especially with a free jewelry appraisal—is an inflated valuation. If a number seems too good to be true, it almost certainly is. This is often just a retail price with a massive markup, not a realistic cost to actually replace the item. It’s a great sales tactic to make a customer feel like they got a deal, but it's a disaster for insurance.

Why is this so bad? Because you'll end up paying higher premiums for coverage you can't even use. When a loss happens, the insurer will base their payout on the actual replacement cost, not the puffed-up number on the appraisal. That leaves you covering a serious financial gap all on your own.

Vague language is another massive red flag. An appraisal describing an item as a "nice diamond ring" or a "gold necklace" is practically useless for insurance.

A proper appraisal must contain enough specific detail for a skilled jeweler to recreate the piece exactly without ever having seen it. If the description is too generic to do that, it fails the most fundamental test.

Missing Credentials and Methodology

Just as important as what's in the report is who wrote it. An appraisal from an uncertified individual is a huge problem. Always look for the appraiser's qualifications and professional affiliations, like a Graduate Gemologist (G.G.) diploma from the GIA. If those credentials are missing, the document's credibility is shot.

Equally important is a clear explanation of how the value was determined. A legitimate appraisal will always include a statement of methodology that outlines the market research and calculations used to arrive at the final number.

Here are the specific red flags you need to watch for:

- No Appraiser Credentials: The document doesn't list any formal gemological or appraisal certifications.

- Percentage-Based Fees: Appraisers who charge a percentage of the item's value have a built-in incentive to inflate the price. Reputable pros charge a flat fee or an hourly rate.

- Lack of Clear Photographs: Without high-quality images, positively identifying the item becomes nearly impossible. You can see the level of detail required in professional photos of high-end jewelry.

- Absence of a Stated Purpose: The document must explicitly state it is for "insurance replacement value." Without this, the valuation could be for something else entirely, like estate liquidation, which has a much lower value.

By keeping an eye out for these warning signs, you can better protect your insurance for a jewelry business and ensure your coverage is built on a foundation of fact, not fiction.

Your Checklist for Insurance-Ready Appraisals

It’s time to move from theory to action. While a free jewelry appraisal might be a handy sales tool, it won't hold up when you need it most. To truly protect your assets, you need to build a firewall with documentation that underwriters will actually accept.

This checklist is your guide to getting a robust, insurance-ready valuation—the kind that forms the bedrock of a solid Jewelers Block insurance policy. Following these steps isn't just about paperwork; it's about being a proactive manager of your store's risk and creating your primary defense in a claims situation.

Vetting the Appraiser

The whole process starts and ends with the expert you choose. A valuation is only as credible as the person signing off on it. Before you hand over a single piece, make sure you vet your appraiser with these questions.

- What are your credentials? You’re looking for a Graduate Gemologist (G.G.) diploma from the GIA or certifications from groups like the American Society of Appraisers (ASA). For insurance purposes, these are non-negotiable.

- How do you determine your fees? The right answer is always an hourly rate or a flat fee per item. If they suggest a percentage of the appraised value, it's a massive conflict of interest. Walk away.

- Do you have experience with insurance valuations? Appraising for resale is completely different from appraising for insurance. You need someone who lives and breathes replacement value for an insurance for jewelry business.

- Can you provide a sample report? Ask to see their work. A sample document will immediately tell you if their level of detail meets the high standards your insurer requires.

The Essential Components of the Final Report

Once you’ve found the right professional, the focus turns to the document itself. A truly insurance-ready appraisal is a detailed, multi-page report that leaves zero room for interpretation. Think of it as the legal blueprint for your item—so specific that another expert could recreate the piece from scratch just by reading it.

Your appraisal must be a self-contained, legally defensible document. It needs to tell the complete story of your item, from its creation and materials to its current market value, without needing outside context.

Make sure the final report includes every one of these elements:

- A Clear Statement of Purpose: The document has to say, in no uncertain terms, that it was prepared for "insurance retail replacement value."

- The Appraiser’s Full Credentials and Contact Information: This establishes the report's authority and proves you hired a qualified expert.

- A Detailed Description of the Item: This covers the manufacturing method (cast, hand-fabricated, etc.), metal type, purity stamps, exact measurements, and total weight.

- Complete Gemological Details: For every single gemstone, the report must list the carat weight, measurements, shape, and a full grading for color, clarity, and cut. All known treatments must be disclosed.

- Plotting Diagrams for Significant Diamonds: This is basically a map of the diamond's unique inclusions and blemishes, and it's essential for positive identification.

- High-Resolution Color Photographs: You need clear images from multiple angles to document the item’s condition and unique features. The level of detail shown in this gallery of high-quality antique jewelry photos is exactly what you should expect.

- The Valuation Date: The market is always moving. The effective date of the appraisal is crucial for establishing an accurate value at a specific point in time.

Keeping Your Appraisals Current

Getting a great appraisal is step one. Step two is keeping it relevant. The values of precious metals and gemstones can shift dramatically, and an old valuation can leave you seriously underinsured.

The demand for accurate appraisals is skyrocketing, with the market projected to grow by USD 2.07 billion by 2029. This is driven by a 15-20% yearly jump in luxury jewelry demand and new tech like AI and 3D scanning that can hit 95% valuation accuracy. Insurers love this because properly appraised inventories lead to claims being processed 40% faster—a huge advantage for any jeweler.

Expert Advice:

- High-Value Inventory: For your most significant pieces or one-of-a-kind designer items, get the appraisals updated every two to three years.

- General Stock: For your broader inventory, a review every three to five years is usually enough to keep pace with market changes.

This simple diligence ensures your Jewelry store insurance coverage actually reflects the true cost to replace your assets. Don't wait for a loss to find out your documentation is out of date.

Protecting Your Business with Jewelers Block Insurance

All the meticulous documentation and expert valuations we've discussed lead to a single, critical goal: protecting your life’s work. A detailed, professional appraisal isn't just paperwork. It's the unshakable foundation of a reliable Jewelers Block insurance policy.

Relying on a free jewelry appraisal for this purpose is like building a vault on a foundation of sand—it simply won't hold up when you need it most. Real security for your jewelry store insurance comes from a specialized policy built on precise, defensible facts, not inflated marketing numbers.

The Core Risks Covered by Jewelers Block

This specialized insurance for a jewelry business is designed from the ground up to cover the unique and varied risks you face every single day. It’s the safety net that protects your entire operation, from the moment a piece enters your inventory until it’s safely in a customer’s hands.

A solid policy typically guards against a wide range of perils, including:

- Theft: This covers everything from a smash-and-grab to an overnight burglary or an armed robbery.

- Transit Losses: Your inventory is protected while being shipped to customers, sent to a setter, or transported between your locations.

- Damage to Stock: This includes accidental damage to your jewelry, whether it happens in the display case or in the vault.

- Mysterious Disappearance: This is a crucial coverage that addresses those gut-wrenching inventory losses where theft can't be proven, but a piece is simply gone.

This policy shields the very heart of your business—the valuable assets that generate your revenue and represent your craft.

While Jewelers Block Insurance offers crucial financial protection against losses, physical security measures are equally vital for a jewelry business. To ensure comprehensive safety, consider the common pitfalls to avoid with security guard services to effectively safeguard your assets.

Get a Quote for Your Jewelers Block Policy

Trying to navigate the world of insurance for a jewelry store can feel overwhelming, but it doesn't have to be. At First Class Insurance Jewelers Block Agency, we get the nuances of the jewelry industry because it’s all we do. Our expertise lies in turning your operational risks into a policy that provides real security, not just a false sense of it.

We work directly with you to understand the specifics of your operation—from your inventory levels and security systems to your shipping needs. This lets us build coverage that is both cost-effective and perfectly matched to your business. You won't pay for protection you don’t need, and you won’t have dangerous gaps that leave you exposed.

Your inventory is more than just stock. It's the result of immense skill, investment, and passion. Don't leave its protection to chance or shoddy paperwork.

Contact us today for a comprehensive policy review and a no-obligation quote. Let us show you how the right Jewelers Block insurance can protect everything you’ve worked so hard to build.

Frequently Asked Questions

When it comes to appraisals and your Jewelers Block insurance, a lot of questions can come up. Getting the right answers isn't just a detail—it's fundamental to protecting your inventory and making sure your coverage will actually perform when you need it.

Let's clear up some of the most common things jewelers ask.

How Often Should I Get My Inventory Appraisals Updated?

For your most valuable pieces—think unique designer items or significant gemstones—you should have appraisals updated every two to three years. The market for diamonds, gold, and other materials is always moving, and an old valuation could leave you seriously underinsured after a price spike.

For the rest of your general stock, a fresh look every three to five years is usually enough to keep your coverage in line with current replacement costs.

Can I Just Use a GIA Lab Report Instead of an Appraisal?

No, and this is a critical distinction. A lab report from an institution like the GIA is a scientific blueprint. It grades a loose stone on the 4Cs, but it never assigns a monetary value.

An appraisal is what takes that scientific data, factors in market conditions and craftsmanship, and translates it all into a dollar figure. Your insurer needs both documents to get the full picture.

Think of it this way: the grading report is the "what," and the appraisal is the "how much." One without the other is an incomplete story, and insurance policies are built on complete stories.

What’s the Difference Between Replacement Value and Fair Market Value?

These two terms sound similar, but they're worlds apart and used for completely different reasons.

- Replacement Value: This is the real-world retail cost to replace a lost or stolen item with a new one of similar kind and quality. It’s the number that matters to insurers because it reflects the actual cost to make you whole again after a loss.

- Fair Market Value: This is what a willing buyer would likely pay a willing seller in a normal transaction, like an estate sale. It’s almost always lower than the replacement value and isn't what your insurance policy is based on.

Is a Free "Appraisal" from a Supplier Good Enough for My Insurance?

Almost never. A free jewelry appraisal is typically a sales tool, not a formal valuation. It’s often just an inflated retail price printed on a nice card to make a customer feel good about their purchase.

Insurance companies need a detailed, formal valuation from a certified professional that breaks down exactly how the value was determined. A free document just doesn't have the detail or credibility to stand up to a claims adjuster's review, which can lead to a denied claim or a much smaller payout than you expected.

Protecting your inventory starts with solid documentation and the right insurance partner. At First Class Insurance, we build insurance solutions specifically for the jewelry industry, ensuring your coverage is based on accuracy and a true understanding of your business. Get a Quote for Jewelers Block and get the peace of mind you deserve.