When you're dealing with fine art, you're not just protecting an object—you're safeguarding a unique, often irreplaceable, piece of cultural and financial history. Fine art insurance is the specialized coverage built to do just that. It protects valuable works from the real-world risks they face, like theft, accidental damage, or mishaps during shipping—risks that your standard insurance policy simply wasn't designed to handle.

This kind of protection is absolutely essential for anyone responsible for high-value art, whether you're a private collector, a gallery owner, or even a jeweler displaying artwork in your showroom.

Why Your Collection Needs Specialized Protection

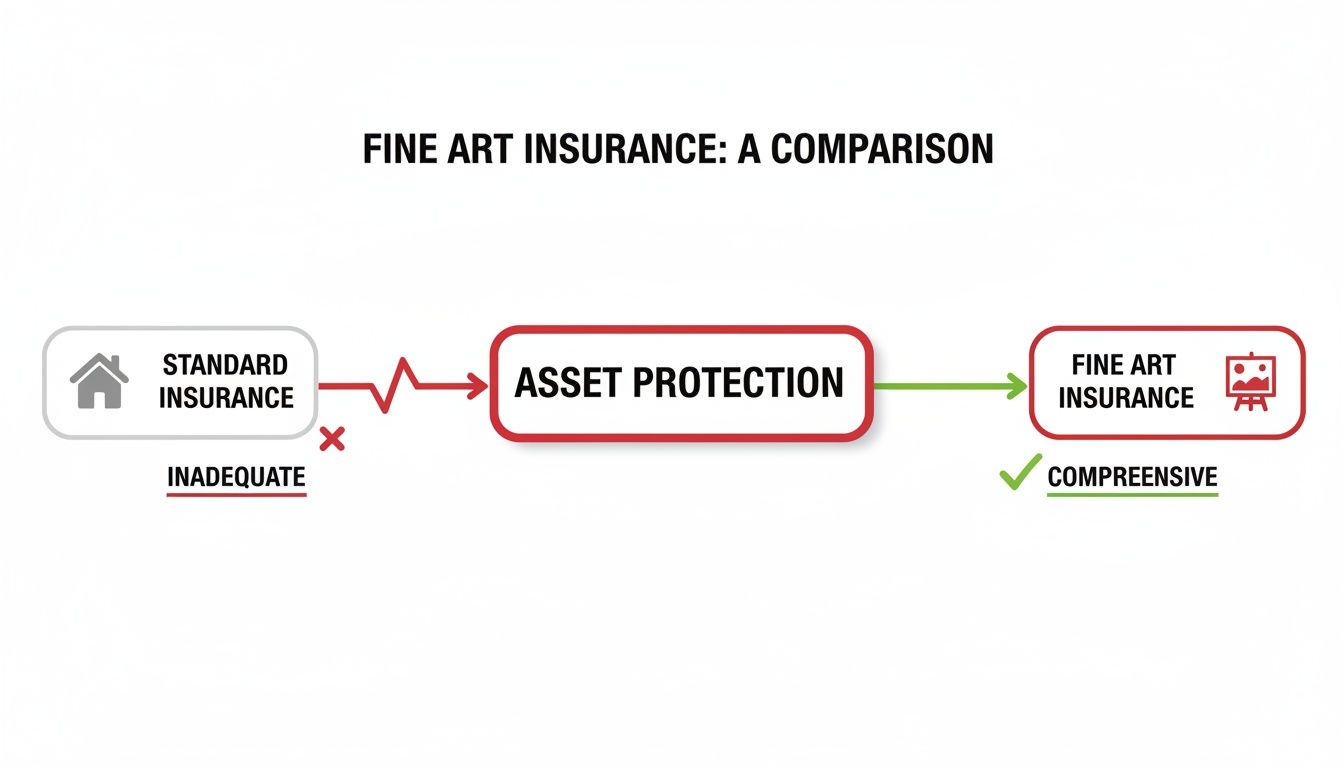

Relying on a standard homeowners or commercial policy to protect fine art is like using a generic wrench to fix a delicate Swiss watch. It’s the wrong tool for the job. That off-the-rack policy might provide some basic coverage, but it's guaranteed to have serious gaps when it comes to high-value, one-of-a-kind assets.

For starters, these policies slap shockingly low limits on valuables. It's not uncommon to see a cap of just $2,500, which might not even cover the frame on a significant piece, let alone the artwork itself.

Worse yet, standard insurance almost always pays out based on "actual cash value." This model factors in depreciation, which is the exact opposite of how fine art typically behaves. Art appreciates. A payout based on a depreciated value would leave you with a fraction of your collection's true market worth after a loss.

The Shortcomings of Standard Insurance

A standard policy creates a false sense of security that can be financially devastating when you actually need to file a claim. They just don't account for the specific vulnerabilities of art.

Here are their biggest weaknesses:

- Inadequate Valuation: They don't use the "agreed value" model, which is the gold standard for art insurance. This means you and the insurer agree on a piece's value upfront, and that's the amount you're paid if it's a total loss. No arguments, no depreciation.

- Restrictive Coverage: Most policies only cover a list of "named perils" like fire or theft. What about accidental breakage while cleaning? Or damage during an installation? Those common risks are often completely excluded.

- Limited Transit Protection: What happens when you ship a piece to a gallery, lend it to a museum, or move it between your homes? Standard policies offer little to no real protection for art in transit.

These gaps all point to one critical truth: when you're protecting significant assets, you need a purpose-built solution. That’s where specialized fine art insurance steps in.

Integrating Protection for Diverse Assets

For businesses that handle a mix of high-value items—like a jewelry store that also displays fine art—a cohesive insurance strategy is non-negotiable. Your commercial policy might cover your jewelry inventory, but it will almost certainly ignore the unique risks facing the paintings and sculptures on your walls.

This is exactly where an expert broker like First Class Insurance proves its worth. We specialize in seeing the whole picture and creating policies that bridge those dangerous gaps.

For example, we can seamlessly integrate a fine art policy with a robust Jewelers Block insurance plan. This unified approach ensures that every single asset, from a diamond ring in the vault to a canvas in the showroom, is protected under one comprehensive strategy. You eliminate coverage holes and simplify risk management for your entire operation.

At First Class Insurance, we build these reliable solutions by partnering with trusted global underwriters, including those in esteemed markets like Lloyd's of London. If you're looking to secure every facet of your business, it's a smart move to get a quote for Jewelers Block insurance and see how a truly comprehensive plan can work for you.

How To Read And Understand Your Fine Art Policy

Let’s be honest, an insurance policy can feel like a dense legal document, deliberately packed with jargon. But once you know what to look for, you can cut through the noise and confirm you actually have the protection you're paying for.

For fine art, the single most important term to find in your policy is agreed value.

Why "Agreed Value" Is Non-Negotiable

Insuring art is nothing like insuring your car. If your sedan gets totaled, the insurance company can look up its market price and cut you a check. It’s straightforward. But what happens if a one-of-a-kind sculpture is destroyed? There's no Kelly Blue Book for that; its value is unique and can fluctuate wildly.

This is precisely where agreed value coverage steps in. Before the policy even begins, you and the insurer agree on a specific value for each piece, typically based on a professional appraisal. If a total loss ever happens, that pre-approved number is exactly what you get paid. No arguments, no last-minute haggling over market conditions or depreciation.

It's the gold standard for protecting irreplaceable assets.

This chart breaks down just how different a specialized fine art policy is from the standard insurance most people have.

As you can see, standard policies are full of gaps, while a dedicated fine art policy acts as a complete safety net for your collection.

To see just how crucial this is, let's compare how different valuation methods play out after a total loss. Imagine a unique sculpture, appraised and insured for $100,000, is destroyed in a fire.

Agreed Value vs Other Insurance Valuations

| Valuation Method | How It Works | Payout for a $100,000 Sculpture | Ideal For |

|---|---|---|---|

| Agreed Value | Value is determined and agreed upon before the policy starts. | $100,000 (The full, pre-agreed amount) | Fine art, antiques, and one-of-a-kind collectibles. |

| Actual Cash Value (ACV) | Pays the replacement cost minus depreciation. | Potentially much less than $100,000. The insurer could argue for depreciation, leaving a huge gap. | Mass-produced items like cars, electronics, and furniture. |

| Replacement Cost | Pays the cost to replace the item with a similar new one. | Impossible. You can't replace a unique sculpture, so this method is useless for fine art. | Standard home contents like appliances or roofing. |

The takeaway is clear: for any asset where the value is subjective and unique, agreed value is the only method that truly protects your investment.

Unpacking Your Policy’s Structure

Fine art coverage generally comes in two flavors. Knowing which one you have tells you a lot about the quality of your protection.

- Standalone Collection Policy: This is a dedicated, separate policy built from the ground up just for your art collection. It offers the most robust and customized coverage, making it the right choice for serious collectors, galleries, and any insurance for a jewelry business that holds significant pieces.

- Scheduled Floater or Rider: This is an add-on to an existing homeowners or renters policy. While it’s certainly better than nothing, a floater is often more restrictive and simply can't offer the same depth of protection you get from a standalone policy.

For any collection that holds real value, a standalone policy is always the superior choice. It's designed to cover the unique risks art faces—from being in transit to hanging in an exhibition—providing a level of security a simple rider can't hope to match.

The Truth About "All-Risk" Coverage

You'll often see fine art policies advertised as "all-risk" or "all-peril." The name sounds fantastic, suggesting that absolutely everything is covered, no matter what. But that’s a bit misleading.

A better way to think of it is as an "open perils" policy. This means that everything is covered except for what is specifically excluded.

This is a critical distinction. The real power comes from reading and understanding the exclusions list. While an all-risk policy protects against the big things like theft, fire, and accidental damage, there are a few situations that are almost always left out.

Be on the lookout for these common exclusions:

- Inherent Vice: This is damage caused by the artwork destroying itself. For instance, if an artist used a type of paint that is known to crack and flake over time, that natural degradation isn't covered.

- Wear and Tear: Gradual damage that happens from normal aging or handling is typically excluded.

- Pest Damage: Destruction caused by insects, mice, or other vermin is a standard exclusion, which highlights why proper storage and pest management are so important.

- War and Government Action: Losses that result from acts of war or if an item is seized or confiscated by a government authority are not covered.

Knowing your exclusions isn't about finding flaws in your policy; it's about empowerment. It shows you exactly where you need to step up your own risk management to protect against the things insurance won't. For a business like a jewelry store, this clarity is essential for protecting every asset, whether it's covered under a Jewelers Block insurance plan or a fine art policy.

To make sure every piece in your care is fully protected, you can get a quote for Jewelers Block from a specialized agency like First Class Insurance Jewelers Block Agency.

The Importance of Professional Art Appraisals

An accurate valuation is the bedrock of any solid fine art insurance policy. While you might have a gut feeling about what your collection is worth, insurers need a formal, defensible number to write your coverage. This is where a professional art appraisal stops being a suggestion and becomes a non-negotiable step in securing real protection.

Think of an appraisal as the blueprint for your insurance policy. Without one, the insurer is just guessing at the value they need to cover, which almost always creates a nightmare when you have to file a claim. An old or informal valuation is a recipe for being dangerously underinsured.

The Pitfall of Underinsurance

Underinsurance is one of the most common—and costly—mistakes we see in the art world. Market data shows it’s a constant problem, especially for private collectors and smaller businesses like jewelry retailers that might display art.

One global analysis found that 54% of growth constraints in the fine art insurance market were due to underinsurance and another 46% to inconsistent valuation standards. It's a huge issue, and it all boils down to collections being insured for far less than their actual market value.

This happens for a simple reason: the art market doesn't sit still. A piece you bought for $10,000 five years ago might be worth $50,000 today because the artist’s profile has exploded, new auction records have been set, or collector tastes have shifted. If your policy is still pegged to that original purchase price, you’ve got a $40,000 gap in your coverage.

In a total loss, your policy would only pay out the old, lower value. You’d be left on the hook for the rest. This is why getting regular appraisals is a core part of responsible collection management, not just a one-and-done task.

What Makes an Appraiser Qualified

Not all appraisals are created equal. For an insurer to take a valuation seriously, it has to come from a qualified, certified professional. You can't just ask a gallery owner for a verbal estimate; you need a formal report prepared by someone with legitimate credentials.

Look for appraisers who are members of major professional organizations. These groups enforce strict ethical codes and require their members to pass tough exams and keep up with ongoing education.

The two most respected certifications in the United States are:

- ASA (American Society of Appraisers): An ASA designation means the appraiser has proven expertise in a specific area, like fine art, and follows the Uniform Standards of Professional Appraisal Practice (USPAP).

- ISA (International Society of Appraisers): Similarly, an ISA-certified appraiser has gone through extensive training and testing, ensuring they can produce a detailed, well-supported valuation report.

When you hire a certified appraiser, you’re not just getting a price tag. You're getting a detailed document that establishes an artwork's identity, provenance, condition, and fair market value, giving your insurer everything needed to write an accurate policy.

Creating a Reappraisal Schedule

Because art values can swing so quickly, keeping your appraisals up to date is absolutely vital. A valuation from ten years ago is practically useless for today’s insurance needs. The best way to stay protected is to set up a regular schedule for reappraisals, ensuring your fine art insurance coverage keeps up with the market.

For most collections, getting a reappraisal every three to five years is a smart move. It strikes a good balance, catching major market shifts without becoming a huge administrative headache.

However, some events should trigger an immediate call to your appraiser, no matter where you are in your cycle:

- An artist's death: The passing of an artist often causes a sudden and dramatic spike in the value of their work.

- A major museum exhibition: If an artist gets a big retrospective at a well-known museum, public interest and market demand can go through the roof.

- Record-breaking auction results: When a similar piece by an artist smashes auction estimates, it can reset the value for all their other works.

Regularly updating your valuations ensures your insurance—whether for a private collection or a jewelry store's inventory—remains accurate, protecting the true value of your assets. For items like these valuable antiques, frequent valuation is key. This proactive approach turns your insurance policy from a static piece of paper into a living shield that grows and adapts right alongside your collection.

Insuring Artwork in Transit or on Loan

An artwork is never more vulnerable than when it's on the move. Whether you're shipping a piece from a private home to a gallery, loaning it to a museum, or sending it from your jewelry store to a client, the risk of damage or loss skyrockets the moment it comes off the wall.

This is exactly why specialized fine art insurance policies include what’s known in the industry as nail-to-nail coverage. The name says it all. Think of it as an invisible, protective bubble that forms around your artwork the instant it's taken down from its original spot (the first "nail") and doesn't pop until it's securely hung in its new home (the final "nail").

This isn’t just basic shipping insurance. True nail-to-nail coverage is comprehensive, protecting the piece through every stage of its journey—from professional packing and crating to shipping, temporary storage, and the entire exhibition period at the destination.

Due Diligence Before Loaning Artwork

For collectors and jewelers, loaning a piece is an exercise in trust—but that trust needs to be backed up by verification. Before an item ever leaves your care, you have to be absolutely sure that the borrower has the right protections in place. Essentially, you're extending your own risk management standards to their facility.

Your pre-loan checklist needs to cover a few non-negotiables:

- Verify the Borrower’s Insurance: Don't just take their word for it. Always get a certificate of insurance from the borrower and review it carefully. You're looking to confirm they have adequate nail-to-nail coverage and that the policy limits are high enough to cover the full agreed value of your piece.

- Review Facility Reports: A facility report is the venue's report card. It details everything from their security systems and environmental controls to their staffing protocols. Scrutinize it to make sure their climate control, fire suppression, and security measures are up to professional standards.

- Confirm Handling Protocols: Who, specifically, is going to be touching your art? Ask who will be responsible for handling, packing, and installing the piece. Make sure they are experienced, professional art handlers who know how to work with objects like yours.

Skipping this homework can create massive coverage gaps. If something goes wrong while your artwork is in someone else's care, you could be left completely exposed.

Best Practices for Secure Transit

Even with the best policy in the world, the goal is always to prevent a loss in the first place. That means being proactive about how your art is packed and shipped. This is where partnering with true professionals becomes a non-negotiable part of your risk management strategy.

When you're trying to protect a collection, it’s vital to see why specialized coverage is so different from a standard policy, which almost always comes up short. For more on this, check out this guide on understanding specialized insurance for items in transit.

To give your artwork the best chance of arriving safely, you need to insist on the following:

- Use Experienced Art Handlers: Never, ever trust valuable art to a standard moving company. Professional art handlers are trained specifically to manage fragile, high-value, and often irreplaceable objects. They have the right equipment and the right expertise.

- Invest in Custom Crating: For any piece that’s high-value or particularly delicate, a custom-built crate is a must. These aren't just wooden boxes; they are engineered to absorb shock, buffer against temperature changes, and protect against moisture during transit.

- Document Everything: Before the piece is even touched, create a detailed condition report with high-resolution photos. This document is your baseline, and it will be invaluable for preventing disputes or supporting a claim if any damage occurs.

For a jewelry store owner shipping a one-of-a-kind creation, these steps are just as critical as having a solid Jewelers Block insurance policy. Proper documentation and expert handling, like what’s shown in this detailed image of a professional at work (https://jewelersblockins.com/wp-content/uploads/2025/11/AdobeStock_529523591_Editorial_Use_Only-scaled-1-1536×1024.jpeg), are fundamental. By managing every detail of the transit process, you can ensure your assets are protected, no matter where they're headed.

Lowering Your Premiums with Smart Risk Management

When an insurer puts together a premium for your fine art insurance, they’re really just doing one thing: calculating risk. They look at a handful of key factors to figure out how likely it is they’ll have to pay a claim on your collection. If you understand what they’re looking for, you can start taking steps to actively lower your costs.

No surprise here, the biggest factor is the total agreed value of your collection. A higher value means more on the line for the insurer, which naturally leads to a higher premium. But that’s just the starting point.

Where your collection lives is another huge piece of the puzzle. Insurers look at location-specific risks, like the odds of a hurricane, wildfire, or flood, as well as local crime rates. A collection in a high-risk area is simply going to cost more to insure than one in a quieter, more stable environment.

Proactive Steps to Reduce Insurance Costs

The good news is, you’re not just along for the ride. By putting smart risk management strategies in place, you can show insurers you’re a lower-risk client—and that can lead to some serious discounts. This is the point where you stop just buying insurance and start actively protecting your assets.

These principles hold true whether you’re a private collector, a gallery owner, or a business owner looking for the right insurance for a jewelry store that also features valuable art. Good protection is good protection.

A great place to start is by beefing up your physical security. Insurers love to see properties with robust, professional-grade protective systems.

Here are the systems that make the biggest difference:

- Central Station Burglar and Fire Alarms: These are basically non-negotiable for any serious collection. A system that’s monitored 24/7 by a central station is in a different league than a simple local alarm that just makes noise.

- Fire Suppression Systems: While old-school sprinklers can cause as much damage as the fire, modern gas-based systems like FM-200 can put out a fire without harming your art.

- Professional-Grade Vaults or Safes: For smaller, high-value pieces, storing them in a properly rated safe or vault when they’re not on display drastically cuts the risk of theft.

Best Practices for Collection Care

Beyond the high-tech hardware, the way you manage your collection day-to-day sends a powerful message to your insurer. Proving you're a responsible steward of your art can directly impact your rates. For any insurance for jewelry business or gallery, these protocols are essential for protecting your entire inventory.

A well-documented collection is a well-protected one. Creating and maintaining a detailed inventory is one of the most effective risk management tools you have. This needs to be more than just a quick list.

A photographic inventory is your best friend in both risk management and the claims process. For each piece, you should have high-resolution images from multiple angles, including close-ups of any signatures, markings, or existing condition issues.

Proper environmental controls are also critical, both for the long-term health of your art and for lowering your premiums. Insurers know that wild swings in temperature and humidity can cause irreversible damage over time—a risk they call "inherent vice."

Follow these environmental and handling best practices:

- Climate Control: Keep the environment stable with consistent temperature and humidity. Storing art in basements, attics, or damp areas is asking for trouble.

- UV Light Protection: Keep art out of direct sunlight. Using UV-filtering glass or film on windows can prevent fading and long-term damage.

- Professional Installation: Always hire experienced art handlers to install your pieces. You’d be surprised how many claims come from improper hanging.

- Secure Storage: When art isn't on display, it should be in custom crates or specialized storage racks—never just leaned against a wall where it can be easily knocked over.

By adopting these strategies, risk management becomes a powerful tool for both preserving your collection and controlling your insurance costs. This is exactly why First Class Insurance Jewelers Block Agency advises clients on these proactive measures. When you’re ready to get serious about protecting your assets, it’s wise to get a quote for Jewelers Block.

Navigating the Claims Process with Confidence

When something goes wrong, a clear head and an immediate plan are your best friends. Even with the best risk management in the world, accidents happen, and you need to be ready. Filing an insurance claim for fine art isn't something to stumble through; it requires a methodical approach to get a fair and timely resolution.

The moment you discover damage or theft, your focus has to shift to documentation and communication. Those first few hours are absolutely critical, and the steps you take right away can make or break your claim.

Immediate Actions After a Loss

First things first: make sure the area is safe and secure to prevent any further damage. After that, your only job is to document everything exactly as you found it.

Here’s a quick guide on what to do:

- Don't Touch a Thing: Fight the urge to clean up or move items around, especially after a break-in or major damage. The police and your insurer need to see the scene undisturbed.

- Become a Photographer: Pull out your phone and take extensive photos and videos. Capture the damage up close, the surrounding area, and any potential entry points if there was a theft.

- Call the Authorities: If a piece has been stolen, your first call should be to the police to file a report. Your insurance company will need a copy of this report to even start the claims process.

- Contact Your Insurance Specialist: Get on the phone with your broker, like us at First Class Insurance Jewelers Block Agency, as soon as possible. They will walk you through your policy's specific requirements and get the ball rolling on your claim.

The Roles of Adjusters and Conservators

Once your claim is filed, a couple of key professionals will step in. The claims adjuster is sent by the insurance company to investigate what happened, look over your documentation, and figure out the extent of the damage your policy covers.

If a piece is damaged, you'll also likely work with a professional art conservator. Their job is to assess whether the artwork can be restored and to provide an estimate for that work. More importantly, they help determine if the damage resulted in a "loss in value"—a critical part of any serious fine art claim.

Even if a piece is restored to perfection, the simple fact that it was damaged can permanently lower its market value. A true fine art insurance policy is designed to compensate you for this depreciation, something a standard homeowners policy would never even consider.

This is precisely why specialized art insurance has become so essential. As art values have climbed, the market has grown right alongside them. Global estimates place the fine art insurance market at around USD 3.24–3.4 billion, and forecasts predict it could hit USD 4.9–5.8 billion by 2034.

Expert Guidance Is Key to a Smooth Resolution

Getting through a claim successfully all comes down to preparation and expert guidance. If you already have a detailed inventory, professional appraisals, and clear documentation, you’ve done most of the hard work already. It's also incredibly important for collectors to understand your rights during insurance claims.

Having a specialist broker in your corner is the final piece of the puzzle. An expert provides the support you need to build a protection strategy that covers all your high-value assets. Whether it’s Jewelers Block insurance for a retail inventory or a dedicated policy for a private collection, the right partner is your best guarantee for a swift, fair resolution when it matters most.

Got Questions About Fine Art Insurance? We've Got Answers.

Here are some quick, straightforward answers to the questions we hear most often from collectors, jewelers, and gallery owners. It's the practical stuff you need to know to make sure your most valuable pieces are properly protected.

Key Coverage Questions

Is My Homeowners Insurance Good Enough for My Art?

Honestly? Almost never. Your standard homeowners policy might cover a piece or two, but it’s usually capped at a very low limit—think $2,500—and only for specific risks like fire or theft. More importantly, it won't pay out based on "agreed value," which is critical for unique assets.

If you have any kind of serious art or jewelry collection, a specialized fine art insurance policy is the only way to go. It's designed to cover the true market value of your pieces, protecting you from a real financial hit.

What Does "Inherent Vice" Actually Mean?

Think of "inherent vice" as a problem that comes from within the artwork itself. It's damage caused by the natural breakdown of the materials the artist chose. For example, if a specific type of paint is known to crack over time because of its chemical makeup, that's inherent vice.

Insurers see this as a standard exclusion because their policies are designed to cover unexpected, external events—not the inevitable aging process of an object due to how it was made.

Specialized and Modern Coverage

How Do You Insure Digital Art and NFTs?

This is a new frontier, and insuring digital assets like NFTs is a highly specialized field. The focus here shifts from physical damage to digital risks. Coverage is built around things like the theft of your private keys from a hacked computer or a compromised online wallet.

Because the risks are so different from traditional art, you need a broker who gets it. They'll partner with underwriters who offer specific policies for cyber and digital asset protection.

This is one area where having a forward-thinking broker is non-negotiable. You need someone who understands both priceless paintings and blockchain assets to create a policy that truly covers your whole collection.

Can I Combine My Fine Art and Jewelers Block Policies?

Yes, and for many businesses, it’s the smartest way to do it. If you’re a jeweler who displays fine art or a gallery that also sells high-end watches, a blended policy is ideal.

A specialized broker can build a single, comprehensive policy that combines Jewelers Block insurance for your inventory with a fine art floater for your displayed pieces. This is the perfect insurance for a jewelry store with diverse assets. It closes any potential gaps in your coverage and gives you one cohesive strategy for managing all your risk.

Protecting every single high-value asset in your business isn't just a good idea—it's essential. First Class Insurance specializes in building these integrated solutions. Get a Quote for Jewelers Block and see how our expertise can safeguard your entire inventory.