It’s a common—and often devastating—misconception to think your standard homeowners insurance policy has your jewelry covered. The hard truth is that a typical policy offers very limited protection, often capping theft payouts at a mere $1,500 to $2,500 for your entire collection.

After a loss, that small number can leave a huge financial hole.

Why Your Homeowners Policy Leaves Your Jewelry at Risk

Picture this: you come home to find your bedroom ransacked, the jewelry box holding your $10,000 engagement ring and a family heirloom necklace now empty. The shock is bad enough, but what happens next can feel like a second betrayal. You file a claim, confident in your coverage, only to learn your policy will only pay out a tiny fraction of their actual value.

This scenario plays out all the time because homeowners insurance is built to protect the general contents of your home—your couch, your TV, your clothes—not high-value, specialized assets like jewelry.

The Problem of Sub-Limits

Deep within the policy documents, you’ll find sub-limits. These are specific, lower coverage caps for certain categories of items that are easy targets for theft. For jewelry, this limit is often just $1,500.

And that isn't a per-item limit. It’s the total amount your insurer will pay for all stolen jewelry, no matter how many pieces were taken or what they were worth.

So, if a burglar makes off with your $10,000 ring, a $5,000 watch, and a pair of $2,000 earrings, your policy might only reimburse you for $1,500 of that $17,000 loss.

A standard homeowners policy treats your priceless jewelry like any other household item, applying low internal limits that fail to cover its true value. This gap creates a perfect storm for major financial loss.

Deductibles and Peril Exclusions

On top of those painfully low limits, you still have to pay your standard policy deductible. If your deductible is $1,000 and your jewelry sub-limit is $1,500, the absolute most you could get from a theft claim is just $500. For smaller losses, it might not even be worth filing a claim.

This shows you just how little protection a basic policy offers for something as precious as a stunning diamond ring.

It gets worse. Standard policies usually operate on a “named-peril” basis. This means they only cover losses from specific events listed in the policy, like fire and theft. What about the much more common ways jewelry is lost?

- Accidental Loss: Misplacing your ring at the beach.

- Mysterious Disappearance: Realizing a diamond has fallen out of its setting.

- Damage: Chipping a gemstone or breaking the clasp on a bracelet.

These everyday risks are almost always excluded from a basic homeowners policy. This toxic combination of low limits, high deductibles, and narrow coverage leaves your most treasured possessions dangerously exposed. The rest of this guide will show you how to close these gaps for good.

Decoding the Fine Print of Your Standard Policy

To really see why your standard policy isn't enough, you have to dig past the main declarations page and get into the nitty-gritty. Hidden deep in the policy language are specific rules that slash or completely wipe out coverage for your most precious items. It’s these little details in the fine print that blindside so many homeowners after a loss.

Think of your homeowners insurance like a giant umbrella designed to cover your house and everything in it. But when it comes to small, high-value things like jewelry, that umbrella shrinks to the size of a cocktail parasol. Let's break down the three big limitations that create this serious gap in your homeowners insurance jewelry protection.

The Low Ceiling of Coverage Caps

The first and most brutal limitation is the sub-limit for jewelry theft. Most standard policies cap the payout for stolen jewelry at a shockingly low figure, usually somewhere between $1,500 and $2,500.

It's critical to understand that this isn't a per-item limit. It's the absolute most your policy will pay for your entire collection if it's stolen in one go. If a burglar takes your $7,000 engagement ring and a $3,000 watch, you'll still only get the policy's sub-limit, leaving you to absorb a massive financial hit on your own.

When Your Deductible Makes a Claim Pointless

Next up is your deductible. Your standard policy deductible—often $1,000 or more—applies to any claim you make, including one for your jewelry.

Let's do the quick math. If your jewelry sub-limit is $1,500 and your deductible is $1,000, the maximum check you could ever get from a theft claim is just $500. For many people, filing a claim for that amount just isn't worth the risk of a future premium hike.

A standard homeowners policy essentially forces you to self-insure the majority of your jewelry's value through a combination of low internal limits and high deductibles that erode your potential payout.

Homeowners are catching on to this reality, and it's driving major changes in the market. The global jewelry insurance market was valued at around USD 4.5 to 4.9 billion in 2023-2024 and is forecast to grow to between USD 7.13 billion and USD 9.65 billion by 2031-2033. This growth signals a clear trend: people are moving away from standard policies that just don't offer real protection. You can find more details on this industry shift and other jewelry insurance market insights on cognitivemarketresearch.com.

The Peril of "Named-Peril" Coverage

Finally, standard policies are almost always "named-peril" contracts. This means they only cover losses from specific events, or "perils," spelled out in the policy—things like fire, lightning, and theft.

But what about the most common ways jewelry actually disappears?

- Mysterious Disappearance: You glance down and the diamond from your ring is just… gone.

- Accidental Loss: The clasp on your bracelet breaks, and it slips off your wrist while you're running errands.

- Unexplained Damage: You take off your watch and find a deep scratch across the crystal, with no idea how it happened.

These all-too-common scenarios are almost never covered. Your policy won't pay a dime for these real-world accidents. This is exactly where specialized jewelry coverage, which works on an "all-risk" basis (covering any loss not specifically excluded), becomes an absolute necessity.

Taken together, these three things—low caps, high deductibles, and narrow perils—leave your most valuable pieces dangerously exposed.

To see the difference in black and white, it helps to put the two types of coverage side-by-side. A standard homeowners policy offers a thin layer of protection, while a specialized rider or floater policy is built from the ground up to safeguard your valuables.

Standard Homeowners Policy vs. Specialized Jewelry Insurance

| Coverage Feature | Standard Homeowners Insurance | Specialized Jewelry Insurance (Rider/Floater) |

|---|---|---|

| Coverage Limit | Low sub-limit (typically $1,500 – $2,500 total) | Covers the full appraised value of each piece |

| Deductible | Standard policy deductible applies (often $1,000+) | Low or no deductible (often $0) |

| Covered Causes of Loss | Named Perils only (theft, fire, etc.) | All-Risk (covers almost everything, including loss) |

| Mysterious Disappearance | Not covered | Covered |

| Accidental Loss/Damage | Not covered | Covered |

| Claim Impact | Can raise your entire homeowners premium | Claim is separate; won't affect home policy rates |

| Valuation | Pays actual cash value (depreciated) or replacement cost | Pays agreed value (the appraised amount) |

The takeaway here is pretty clear. While your homeowners policy is great for your house, it was never designed to properly protect something as unique and valuable as your jewelry.

Scheduling Your Jewelry for Better Protection

After seeing the serious limitations of a standard policy, it’s easy to feel a bit discouraged. But there's good news. You can close those dangerous coverage gaps with a simple and surprisingly affordable solution: scheduling your jewelry.

Think of it like this: your standard homeowners policy is a general admission ticket to a concert. It gets you in the door, but you're stuck in the nosebleed seats. Scheduling an item is like upgrading to a VIP backstage pass—it singles out that specific piece of jewelry for special treatment and far better protection.

This upgrade is officially called a personal articles floater or an insurance rider. It’s basically an add-on to your existing homeowners or renters policy that lists—or "schedules"—your high-value items for their full, documented worth.

How Scheduling Works

The whole process is pretty straightforward. Instead of lumping your valuable pieces in with everything else under a tiny sub-limit, scheduling isolates each one and insures it individually. This is how you make sure your homeowners insurance jewelry coverage actually matches the value of what you own.

To get it done, your insurer will ask for a couple of key things:

- A Professional Appraisal: You’ll need a recent, detailed appraisal from a certified gemologist. This document is the official proof of your item's replacement value, which becomes the amount it's insured for.

- Adding the Rider: Your insurance agent will take that appraisal and use it to add the rider to your policy. The rider will have a specific description of the item and its insured value listed right on it.

- Paying the Premium: You might be surprised at how affordable this is. The cost is typically calculated as 1% to 2% of the item's total value per year. For example, a $10,000 engagement ring might only cost $100 to $200 annually to insure the right way.

Once an item is scheduled, it's covered by a whole new set of rules—rules that are much, much better than what your standard policy offers. We're talking about three game-changing benefits.

The Three Pillars of Scheduled Protection

Adding a rider completely changes how your jewelry is covered. It goes from being a forgotten detail in a broad policy to a specifically protected asset.

Scheduling an item of jewelry lifts it out of the restrictive world of your standard policy and places it under a protective bubble of superior coverage, defending it against a much wider range of real-world risks.

This superior protection is built on three key advantages:

- Coverage for Full Value: That measly $1,500 sub-limit is no longer a factor. If your $12,000 watch is stolen, you’re covered for the full $12,000, not just a tiny fraction of its worth. You can see more examples of high-value timepieces we cover in our gallery of insured luxury watches.

- "All-Risk" Protection: Standard policies only cover "named perils" (like fire or theft). A rider, on the other hand, usually provides "all-risk" coverage. This means your jewelry is protected from just about anything—accidental loss, damage, mysterious disappearance—unless the policy specifically excludes it. Dropped your ring down the drain? You’re covered.

- No Deductible: This is a big one. Most jewelry riders come with a $0 deductible. If you have to file a claim for a lost or damaged piece, you won't have to pay a dime out of pocket before your coverage kicks in. You get the full replacement value, period.

When a Standalone Jewelry Policy Is the Smartest Move

While adding a jewelry rider to your homeowners policy is a great first step, there’s a point where it just isn’t enough. For serious collectors, owners of truly irreplaceable pieces, or anyone with significant assets to protect, a standalone jewelry policy is the only way to go. This type of policy is often called a Personal Articles Floater, and it offers the highest level of security you can get.

Think of it this way: a rider on your home insurance is like upgrading to business class. It’s a definite improvement over coach. But a standalone policy? That’s like chartering a private jet. It's a completely separate contract built from the ground up just for your valuables, offering coverage and flexibility a standard homeowners add-on could never match.

This move makes sense if your collection is getting extensive. It simplifies everything by putting all your pieces under one specialized contract. It’s also the right call for irreplaceable, custom-designed items, since these policies usually offer much more flexible options if you need to make a claim.

Shielding Your Primary Homeowners Policy

Here’s one of the biggest, and often overlooked, advantages of a standalone policy: it protects your main homeowners insurance from claims.

When your jewelry is scheduled on your home policy, any claim—even for a single lost earring—goes on that policy's record. A few of those, and you could be looking at a non-renewal or a huge spike in premiums for your entire home.

A standalone policy completely isolates your jewelry risk. If you file a claim for a stolen watch, it has zero impact on the rates or eligibility of your homeowners insurance. For high-net-worth individuals, this separation is non-negotiable for keeping a clean insurance record and predictable premiums.

By separating your jewelry coverage, you create a financial firewall. A jewelry claim won't trigger a rate hike on your home insurance, preserving your favorable rates and claims history where it matters most.

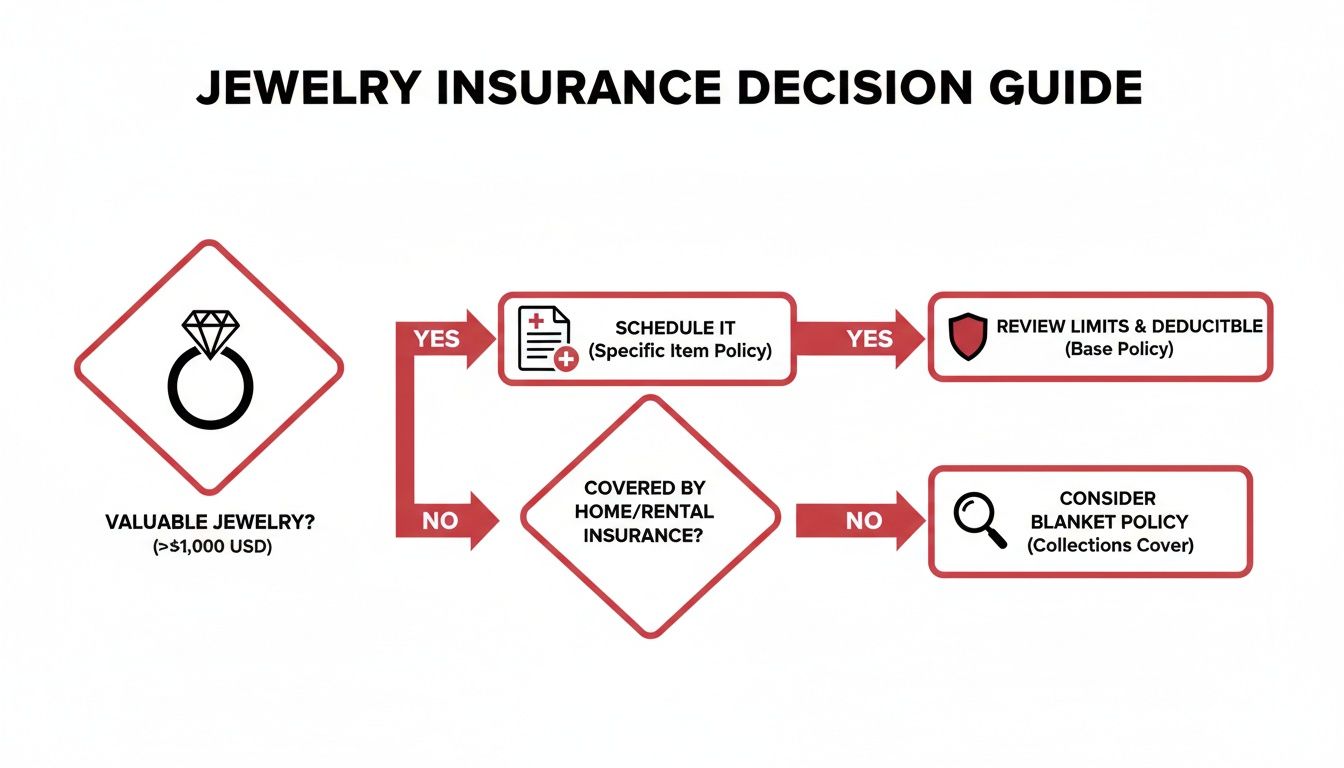

This decision tree gives you a visual guide for when it's time to schedule your jewelry or move up to a more specialized policy.

The takeaway is simple: as the value of your jewelry climbs, the need for dedicated, scheduled coverage becomes undeniable if you want to avoid a massive financial loss.

Unmatched Coverage and Flexibility

Standalone policies are written by insurers who live and breathe high-value assets. That expertise shows in the policy terms, which are far superior to what you’ll find anywhere else.

Here are a few of the key benefits you get with a dedicated policy:

- Worldwide Coverage: Your pieces are protected anywhere on the planet, no questions asked. This is an absolute must for frequent travelers.

- Flexible Replacement: Many policies give you the choice of a cash payout for the full appraised value. This lets you replace the item with something you choose or not replace it at all.

- Expert Claims Handling: You'll work with adjusters who are often gemologists or jewelry experts. They get the nuances of valuation and repair, which makes for a smooth, fair process.

This is a completely different world from filing a standard property claim.

When Your Passion Becomes a Business

Finally, if your collection starts to blur the line between a personal passion and a business, you've outgrown personal insurance altogether. If you occasionally sell pieces, exhibit your collection, or run any kind of jewelry business, a personal policy won't cover you. Period.

In that situation, you need Jewelers Block insurance. This is a commercial policy designed for the unique risks of the jewelry trade, covering everything from inventory in your store to items in transit. If you're a professional, getting the right insurance for a jewelry store is the only way to protect your livelihood.

We can help you Get a Quote for Jewelers Block through our dedicated agency. This specialized coverage is the ultimate safety net for any commercial operation.

Protecting Your Business with Jewelers Block Insurance

Personal jewelry insurance is great for protecting a private collection. But the moment you turn that passion into a business—whether you’re a retailer, wholesaler, or designer—you’re playing in a completely different ballpark. Your standard homeowners insurance jewelry rider, or even a standalone personal policy, simply wasn't built to handle the risks of a commercial operation. This leaves a massive and dangerous gap in your financial protection.

That’s where a specialized commercial policy becomes non-negotiable. For anyone needing a jewelry store insurance plan, the industry’s gold standard is Jewelers Block insurance. This isn't just a beefed-up personal policy; it's a completely different kind of protection, designed from the ground up for the unique and complicated world of the jewelry trade.

Think of it like this: a personal policy is the solid deadbolt on your home's front door, perfect for what's inside. A Jewelers Block policy is the entire security system for a bank vault—it protects your inventory, your customers' property, and all your assets in motion, all under one powerful contract.

What Is Jewelers Block Insurance

A Jewelers Block policy is an all-in-one insurance solution that wraps your entire business in a blanket of broad coverage. Unlike personal policies that focus on a few specific items, this commercial coverage protects your whole inventory—whether it’s locked in the safe overnight, sitting in a display case, or on its way to a trade show.

It pulls multiple types of protection into a single, seamless package. This is absolutely critical because a jewelry business faces far more diverse threats than an individual collector. You aren't just worried about a home burglary; you're dealing with public access to your store, shipping incredibly valuable goods, and holding a customer's family heirloom for repair.

Jewelers Block insurance is the definitive commercial safeguard for the jewelry industry. It moves beyond personal coverage to protect the full scope of business operations, from inventory on-premises to goods in transit and customer property in your care.

For any professional in this business, getting the right insurance for jewelry business isn't just a smart move. It's a fundamental requirement for staying in business long-term.

Core Protections for Your Jewelry Business

The real power of a Jewelers Block policy is just how comprehensive it is. It’s your shield against the most common and devastating threats that can sink a jewelry business overnight. Whether you’re a small artisan or a major retailer, this plan is essential, and a specialized agency is the best place to Get a Quote for Jewelers Block.

Here are the key protections you'll typically find:

- On-Premises Inventory: This covers your entire stock—jewelry, loose stones, precious metals—against theft, fire, and other damage while it's at your business location. It’s your first and best defense against a catastrophic loss from a break-in or disaster.

- Property in Transit: Shipping to a customer? Receiving from a supplier? Traveling to a show? This has you covered. Your merchandise is at its most vulnerable when it's on the move, making this protection absolutely vital.

- Trade Show and Exhibition Coverage: Your inventory is still protected while being displayed at trade shows, exhibitions, and other off-site events.

- Bailee Coverage (Customer Property): This is one of the most critical parts of the policy. It protects you if a customer's item is lost, damaged, or stolen while in your care for repair, appraisal, or on consignment. This coverage is essential for maintaining your customers' trust and your reputation.

By bundling these different coverages, a Jewelers Block policy makes sure your business is secure from nearly every angle, so you can run your operations with confidence. When searching for the right policy, it pays to work with a First Class Insurance Jewelers Block Agency that truly gets the market and partners with esteemed underwriters, like those associated with the historic market represented by the

.

Essential Steps to Document and Safeguard Your Valuables

While having the right insurance policy is your ultimate financial safety net, the best claim is always the one you never have to file. Think of proactive protection and meticulous documentation as your first lines of defense. They're the practical steps you take to prevent a loss in the first place and to make any potential claim go smoothly.

These habits are critical for individual collectors, but they're non-negotiable for any business with insurance for a jewelry store. Your insurance policy is the final wall of your fortress, but solid records and smart habits are the guards on patrol.

Create an Airtight Record of Your Assets

When it comes to proving a loss, a detailed and current inventory is everything. Without it, you're walking into a claim with your hands tied. It’s nearly impossible to prove what you owned—or what it was worth.

- Get Regular Appraisals: An appraisal is the official document that assigns a concrete value to your jewelry. You need a certified gemologist to perform a detailed appraisal every two to three years. Why so often? Because the values of precious metals and gemstones are constantly fluctuating.

- Keep a Visual Inventory: High-quality photos of each piece are invaluable. Make sure to shoot them from multiple angles and get close-ups of any unique markings or features. Store these images somewhere safe, like a secure cloud drive.

- Secure All Documents: Keep your original sales receipts, any certificates of authenticity (like a GIA report), and your appraisal documents together. A fireproof home safe or a digital vault is the perfect place for them.

Practical Tips for Safeguarding Your Valuables

Beyond just paperwork, a few simple habits can drastically reduce your risk of theft or loss. For a business handling high-value inventory, these aren't just suggestions—they are fundamental security protocols.

Proactive risk management isn’t just about buying a safe. It's about creating a culture of security through smart daily habits, from being discreet online to securing items in transit.

Here are a few smart, actionable steps you can start with:

- Use Secure Storage: A home safe is a great start for personal items. For a jewelry business, professional-grade safes and strict vault procedures are usually a requirement for your jewelry store insurance policy.

- Be Discreet on Social Media: It’s tempting to show off a beautiful new piece, but avoid posting pictures of valuable jewelry, especially if the post is geotagged to your home or you're traveling. It’s like putting out an advertisement for thieves.

- Understand Travel Risks: Never, ever pack valuable jewelry in your checked luggage. That’s a recipe for disaster. Keep it on your person or in a secure carry-on bag at all times.

This kind of diligence is becoming more and more common. North America leads the global jewelry insurance market, with the United States alone making up 26% of the worldwide share. This is largely driven by a strong culture of insuring valuable assets, which makes proper documentation and education more important than ever.

And remember, good habits go beyond just securing your policy. Knowing the best ways to store your jewelry helps keep it safe and in pristine condition. These simple protective measures work hand-in-hand with your insurance coverage to give you complete peace of mind.

Frequently Asked Questions About Jewelry Insurance

When you start digging into the details of jewelry insurance, a lot of questions tend to pop up. We get it. To cut through the confusion, we’ve put together some straight answers to the questions we hear all the time. Think of this as a quick refresher to help you lock in what you've learned and feel confident about protecting your valuables.

How Much Does It Cost to Insure Jewelry?

Protecting your jewelry properly is surprisingly affordable. The general rule of thumb is that you’ll pay about 1% to 2% of its total appraised value per year.

So, for a $10,000 engagement ring, you’re looking at a premium of around $100 to $200 a year for a specialized rider. Of course, that final number can shift based on things like where you live (theft rates vary by zip code) and whether you have a safe, but that small annual cost buys you peace of mind that your basic homeowners policy just can't deliver.

What Is the Difference Between Replacement Cost and Actual Cash Value?

Getting this right is absolutely critical. "Actual Cash Value" (ACV) sounds straightforward, but it means your insurer will pay you what the item was worth at the time it was lost—after factoring in depreciation. For jewelry, which often holds or increases in value, this is almost never the right choice.

"Replacement Cost" (RC) is the industry standard for any good jewelry policy or rider. It gives you the full amount needed to repair the piece or replace it with a new one of similar kind and quality, with no deduction for depreciation. You should always insist on a policy that provides replacement cost coverage. It ensures you can actually replace what you lost.

The choice between Actual Cash Value and Replacement Cost can mean the difference between getting a fraction of your jewelry's worth and being made whole after a loss. Always insist on Replacement Cost coverage for your valuables.

What Should I Do Immediately After My Jewelry Is Lost or Stolen?

Acting fast and taking the right steps can make a huge difference in how smoothly your claim goes.

- File a Police Report: If you even suspect theft, this is your first call. Your insurance company will need that police report number to even start your claim.

- Contact Your Insurer: Get in touch with your agent or insurance company as soon as you can to get the ball rolling.

- Gather Your Documents: Pull together all your paperwork. This means the appraisal, good photos of the piece, and any original receipts or diamond certificates you have.

From there, an adjuster will walk you through the process, verify the loss, and get things moving to repair or replace your jewelry according to your policy.

How Often Should I Get My Jewelry Reappraised?

This is a big one. You should have your valuable jewelry reappraised every two to three years.

The market for precious metals and gemstones is always moving. An appraisal from five years ago might leave you seriously underinsured today. Keeping your appraisal current makes sure your coverage limit actually matches what it would cost to replace the item now, protecting you from a nasty out-of-pocket surprise if you have to file a claim.

Whether you need personal coverage for a growing collection or comprehensive Jewelers Block insurance for your business, having the right protection is essential. The experts at First Class Insurance can help you secure the right policy for your specific needs. Get a quote for your jewelry insurance today.