Getting your jewelry insured is more than just a box to check—it’s a critical process that starts with a professional appraisal, moves to choosing the right policy, and requires you to document everything meticulously. For a jewelry business, this is about protecting your entire inventory from the very real risk of theft. For a collector or individual, it's about securing those irreplaceable personal pieces.

Why Insuring Your Jewelry Is a Critical Investment

Picture this: you've built a thriving jewelry store, only to get a call in the middle of the night about a smash-and-grab that just wiped out half your inventory. This isn’t a far-fetched nightmare; it's a harsh reality for jewelers across the country.

Theft losses for U.S. jewelers have been averaging over $100 million annually in recent years. That number alone should tell you that robust insurance isn't just another business expense—it's the bedrock of your financial security.

The gap in coverage is alarmingly wide. While about 67% of engagement rings get insured, a staggering 34% of other fine jewelry pieces are left completely unprotected. That’s a massive exposure to potential loss, whether you're a business owner protecting your livelihood or a collector safeguarding precious heirlooms.

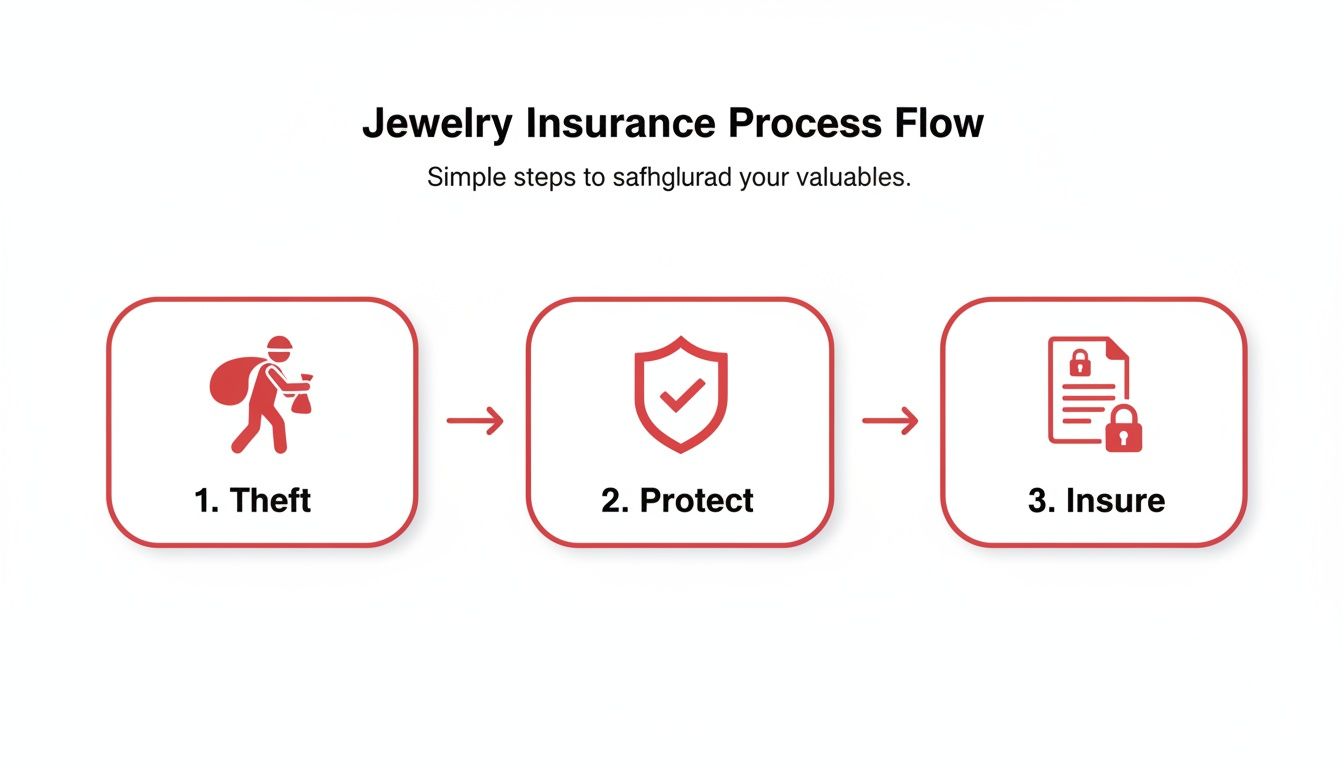

This cycle is constant: the risk of theft is always there. The only things that stand in its way are proactive protection and the right insurance policy.

The Two Paths to Protection

When it comes to insuring jewelry, you’re looking at two very different routes. The path you choose will define how well your financial safety net holds up when you need it.

-

For Businesses: The only real answer is Jewelers Block insurance. This isn't your average commercial policy; it's tailor-made for the unique risks of the jewelry trade. It’s designed to cover everything from the inventory in your safe and customer pieces in for repair to goods you’re shipping or displaying at a trade show.

-

For Individuals: If you have a high-value personal collection, a dedicated personal jewelry policy is essential. It goes far beyond what a standard homeowner's policy rider can offer, often covering tricky situations like "mysterious disappearance"—when a piece simply vanishes without a clear explanation.

Understanding which path is yours is the first step. You can see how an insurer views high-value items, like this diamond ring on a black background, and why specialized coverage is so crucial.

Finding an Expert Guide

You wouldn't ask a general family doctor to perform heart surgery, and the same logic applies here. A general insurance agent simply doesn't have the deep knowledge required for this industry. They don't understand the nuances of inventory valuation, secure transit protocols, or the specific safe ratings underwriters demand.

This is where a specialist broker makes all the difference.

By partnering with an expert who lives and breathes the jewelry trade, you get an advocate. They know how to build a policy that fits your specific operations, leaving no dangerous gaps in your coverage.

A specialist can help you gather the right documentation and frame your risk profile in a way that gets you the best possible terms from underwriters. When you’re ready to take that step, the next move is to Get a Quote for Jewelers Block from a provider who truly speaks your language.

Choosing Your Coverage: Jewelers Block vs. Personal Policies

Not all jewelry insurance is created equal. In fact, choosing the wrong policy can be just as risky as having no coverage at all. The entire world of jewelry insurance splits into two distinct paths: one for businesses and one for individuals.

Understanding which path is yours is the single most important step in protecting what you've got. For anyone in the trade—retailers, designers, wholesalers—a specialized commercial policy is the only real option. For individuals, a dedicated personal policy offers a level of protection that a standard homeowner's insurance add-on simply can't match.

Let's dig into what sets these two worlds apart.

The Commercial Shield: Jewelers Block Insurance

Jewelers Block insurance is the gold standard for a reason. It's a highly specialized, all-in-one policy built from the ground up to handle the unique, high-stakes risks of a jewelry business. Think of it as a comprehensive shield that follows your inventory everywhere—from the vault, to the workbench, to a trade show across the country.

A generic business owner's policy just doesn't have the DNA to cover an insurance for a jewelry store. It completely misses the mark on how a jewelry business actually operates with its high-value, portable inventory.

A solid Jewelers Block policy wraps its arms around your entire operation.

- Inventory Coverage: This protects your entire stock—loose diamonds, finished pieces, raw metals, you name it—from theft, fire, and other perils.

- Customer Property: This is critical. It covers items left in your "care, custody, and control," like a watch in for repair or a ring being resized. It's a massive trust-builder.

- Goods in Transit: Your assets are covered while on the move, whether you’re shipping to a client or receiving from a supplier.

- Off-Premises Protection: Coverage follows you to the high-risk environments of trade shows, exhibitions, and out with your traveling sales team.

Bottom line: a Jewelers Block policy is the operational backbone for any serious jewelry enterprise.

The Personal Fortress: Standalone Jewelry Policies

For individuals, the story is completely different. Too many people fall into the trap of thinking their homeowner's or renter's policy is enough. It isn't. Not even close. Most of these policies have heartbreakingly low limits for jewelry theft, typically capping the payout at $1,500 to $2,500 for your entire collection.

This is where a standalone personal jewelry policy comes in. It "schedules" each item, insuring it for its full appraised value and offering far broader protection.

A dedicated policy is superior in every way. It usually provides "all-risk" coverage, which includes protection against things a homeowner's policy won't touch, like mysterious disappearance. That's insurance-speak for "it just vanished." If your earring is suddenly gone and you have no idea how or where, a standalone policy is designed to cover that exact scenario.

Another major perk? Filing a claim on your separate jewelry policy won't jack up the premiums on your main homeowner's insurance.

To bring this all into focus, a quick comparison table can help clarify the key differences.

Jewelers Block vs Personal Jewelry Insurance At a Glance

| Feature | Jewelers Block Insurance (For Businesses) | Personal Jewelry Insurance (For Individuals) |

|---|---|---|

| Who It's For | Retailers, wholesalers, designers, appraisers, and manufacturers. | Individuals and collectors protecting their personal jewelry. |

| Primary Coverage | Business inventory, raw materials, goods in transit, and customer property. | Specific, individual items ("scheduled") like engagement rings and watches. |

| Biggest Risks Covered | Robbery, burglary, shoplifting, shipping losses, and employee dishonesty. | Theft, damage, accidental loss, and mysterious disappearance. |

| Value Basis | Based on the cost or wholesale value of inventory. | Based on the full retail replacement value from an appraisal. |

| Location Coverage | Covers items at the business premises, in vaults, at trade shows, and in transit. | Covers the item anywhere in the world. |

As you can see, these policies are built for entirely different purposes. One protects business assets and operations, while the other safeguards personal sentiment and value.

Real-World Scenarios: Clarifying the Divide

Let's make this even clearer with a couple of real-life examples.

Scenario 1: The Diamond Wholesaler

A New York wholesaler ships a package of diamonds worth $250,000 to a retailer in California. The courier loses the package. Without the robust transit coverage from a Jewelers Block insurance policy, this is a business-ending catastrophe. With it, the wholesaler files a claim and recovers their loss.

Scenario 2: The Traveling Heirloom

Someone is on vacation in Italy, wearing their $35,000 antique engagement ring. At some point during the trip, they look down and the ring is gone. They can't say if it was stolen or slipped off. A standard homeowner's policy would likely deny the claim or pay out just $1,500. But with a standalone personal policy that covers mysterious disappearance, they can file a claim for the full appraised value.

These stories show why context is everything. The nature of your risk—whether you’re running a business or protecting a personal treasure—determines the kind of policy you absolutely need.

For businesses, the comprehensive coverage of a Jewelers Block policy is non-negotiable. If that’s you, the next step is to connect with a specialist who understands the trade and can Get a Quote for Jewelers Block. An expert from a First Class Insurance Jewelers Block Agency will know exactly how to assess your risks and build a policy that lets you operate with confidence.

The Secret to Accurate Coverage: Professional Valuations

The entire foundation of a solid jewelry insurance policy—whether for your business or a personal collection—rests on one thing: an accurate, professional valuation.

Getting this wrong is a critical mistake. If you under-insure your assets, any claim you file won't cover the true replacement cost. That leaves you paying the difference right out of your own pocket.

It’s a common misconception that an old sales receipt is good enough for insurance. While it’s a helpful piece of the puzzle, a receipt from years ago doesn’t reflect today’s market, and it certainly lacks the detailed gemological info an underwriter needs. That’s why a formal appraisal from a certified gemologist is non-negotiable.

What a Comprehensive Appraisal Includes

A legitimate appraisal is far more than just a number on a piece of paper. It’s a detailed, scientific report that substantiates an item’s value, and it's the core document you’ll submit to your insurance carrier.

A proper valuation should always include:

- Detailed Gemstone Information: For diamonds, this means a full breakdown of the 4 Cs—Cut, Color, Clarity, and Carat weight. For other gems, it will note the type, size, quality, and whether they're natural or synthetic.

- Precious Metal Details: The report has to specify the type of metal (like platinum or 18k yellow gold), its weight, and any identifying marks or stamps.

- High-Resolution Photographs: Clear photos from multiple angles are essential. They serve as visual proof of the item's existence and condition at that moment in time.

- Current Replacement Value: This is the key figure for insurance. It estimates what it would cost to replace the item with a new, similar piece in today's market—not its resale or cash value.

Understanding the specific properties of your jewelry, such as how to test gold purity, is essential because it directly impacts its overall worth and the accuracy of your valuation.

Keeping Your Valuations Current

An appraisal isn't a one-and-done task. The values of precious metals and gemstones are constantly shifting due to market demand, supply chain issues, and economic trends. A valuation from five years ago might be dangerously outdated today.

For individuals and collectors, the industry best practice is to have your high-value pieces re-appraised every two to three years. This ensures your coverage keeps pace with market changes, protecting you from being underinsured.

For a business running on a Jewelers Block insurance policy, the approach is different. Instead of appraising every single item, jewelers typically rely on a perpetual inventory system. This system tracks the cost value of all stock, giving the insurer an ongoing, accurate total of the assets on hand.

However, key high-value or unique pieces—especially consigned items—should still have individual appraisals on file. A detailed inventory is also critical for recovering from a loss, as a collection of beautiful antique jewelry pieces like this would each require meticulous documentation.

Why Documentation Is Your Best Friend

Think of your appraisal documents and inventory records as your pre-approved claim evidence. Having this paperwork organized and ready before you even start the insurance process makes everything smoother.

When an underwriter sees professional, up-to-date valuations, it signals that you're a responsible, organized client. This not only streamlines the application but also ensures the policy you get is based on a true reflection of your assets.

And if you ever do have to file a claim, this documentation becomes undisputed proof of what was lost. It dramatically simplifies and speeds up the reimbursement process. Without it, you’re left scrambling to prove value after the fact—a difficult and often disappointing exercise.

How to Lower Your Premiums with Smart Security

Insurance underwriters are, at their core, professional risk assessors. The better you manage your risk, the better your premiums and coverage terms will be. When you invest in serious security, you’re not just stopping thieves—you’re showing insurers that you're a responsible partner worth taking a chance on.

This proactive approach has a direct impact on your bottom line. By putting a smart mix of physical and procedural security in place, you can dramatically lower your risk profile and, in turn, your insurance costs.

Fortifying Your Physical Defenses

Your physical security is what stands between your inventory and a smash-and-grab or after-hours burglary. Insurers look for specific, industry-standard protections when underwriting insurance for a jewelry store.

A multi-layered system is the only way to go. It creates overlapping barriers that make criminals think twice and give law enforcement precious time to respond.

Here are the key physical security investments underwriters want to see:

- UL-Rated Safes and Vaults: This is non-negotiable. An underwriter will require specific UL ratings (like a TRTL-30×6) based on the value of inventory you keep overnight. A higher-rated safe is one of the most direct ways to earn better premium credits.

- Multi-Layered Alarm Systems: Your alarm needs to protect every possible point of entry. That means contacts on all doors and windows, backed by motion sensors, glass-break detectors, and strategically placed hold-up alarms. Central station monitoring is an absolute must.

- Secure Display Cases: All of your showcases need laminated, shatter-resistant glass and high-quality locks. This is your primary defense against a quick smash-and-grab attempt while you're open for business.

These aren't just good ideas—they are fundamental requirements for securing a top-tier Jewelers Block insurance policy.

Implementing Strong Procedural Security

While alarms and safes guard against outside threats, your internal procedures are your best defense against employee theft and simple human error. These protocols dictate how your team handles high-value inventory, and you can bet insurers will be scrutinizing them.

One of the industry's biggest headaches is "mysterious disappearance"—a frustrating term for losses that have no clear evidence of theft. These claims are a nightmare for jewelers, making up as much as 40% of losses globally and costing more than $250 million annually in the U.S. alone. Taking proactive steps and getting expert risk guidance can slash premiums by 15-20% by building better safeguards.

Strong internal controls are your best weapon against these ambiguous and costly losses. By demonstrating procedural discipline, you show underwriters that your operation is managed with precision and care.

Key Protocols to Implement

To build a tough security posture from the inside out, nail down these critical procedures:

- Dual-Control Protocols: No single employee should ever open or close the store or access the main vault alone. Requiring two authorized people for these key moments drastically reduces the opportunity for internal theft.

- Thorough Employee Screening: Don't skip the comprehensive background checks for new hires. This means verifying criminal history and calling references to filter out high-risk individuals before they get near your inventory.

- Strict Inventory Management: Keep a detailed, real-time inventory log. Conducting regular cycle counts and full physical inventories helps you spot discrepancies fast, deterring theft and pinpointing losses before they spiral out of control.

These procedures create a culture of accountability that underwriters absolutely value. Beyond high-tech security, even simple passive measures—like following sound tips for properly storing gold jewelry—demonstrate your commitment to preserving your assets. Every step you take makes your insurance for a jewelry business more affordable.

Ultimately, your security posture is a direct investment in your insurability. When you’re ready to prove you're serious about risk management, the next step is to get a quote for Jewelers Block from an agency that gets it. A firm like First Class Insurance Jewelers Block Agency doesn't just sell you a policy; we provide expert risk management guidance to help you strengthen your defenses and lock in the best possible insurance terms.

Finding the Right Partner for Your Policy

Let's be blunt: insuring high-value jewelry isn't like buying car insurance online. This is a specialized world where the stakes are astronomical, and a bad policy can be just as financially devastating as no policy at all. This is exactly why partnering with a specialist broker isn't just a good idea—it's a necessity.

You wouldn’t ask your family doctor to perform brain surgery. So why would you trust a general insurance agent—who spends their day quoting home and auto policies—with the unique, high-risk world of your jewelry business? They simply don’t speak the language.

The Specialist Broker Advantage

A true specialist, like the team at First Class Insurance Jewelers Block Agency, is more than just a salesperson. They're your guide, your advocate, and your translator in a market that can be incredibly complex. They understand the difference between a TL-15 and a TRTL-30×6 safe, the specific security protocols underwriters demand, and the nuances of insuring inventory that’s constantly in motion.

This kind of deep industry knowledge is where the real value lies. A specialist knows which underwriters are comfortable with a small custom design studio versus a large-scale diamond wholesaler. They have access to exclusive markets and esteemed syndicates, like those represented by this renowned insurance market logo, that are completely off-limits to mainstream agents.

But their role goes far beyond just getting you a policy. They become a trusted advisor.

- They help you package your business to look its absolute best to underwriters.

- They offer practical risk management advice to toughen up your security.

- Most critically, when a claim happens, they're the ones in your corner, fighting to make sure you get a fair and fast settlement.

This transforms insurance from a painful annual expense into a strategic alliance. Your broker becomes a core part of your business's defense system, laser-focused on protecting what you've built.

Preparing to Get an Accurate Quote

To get the best possible quote, you need to show up prepared. Underwriters are trying to get a complete, accurate picture of the risk they're being asked to cover. Having all your documentation ready not only makes the process faster but also signals that you run a professional, well-managed operation.

Your specialist broker will walk you through the specifics, but you’ll want to have the following information on hand to Get a Quote for Jewelers Block insurance.

Key Documentation and Information:

- Detailed Inventory Listing: A full breakdown of your stock by category (loose diamonds, finished gold, watches, etc.) and its total cost value.

- Professional Appraisals: Current, detailed appraisals for any single high-value items, especially anything you hold on consignment.

- Security System Details: The specs of your alarm system—provider, central station monitoring (this is non-negotiable), and a list of all protective devices.

- Safe and Vault Specifications: The make, model, and UL rating (e.g., TL-30, TRTL-30×6) for every safe and vault where inventory is kept overnight.

- Business Operations Overview: A clear snapshot of how you operate—retail, wholesale, manufacturing—along with annual sales figures and your protocols for shipping and receiving merchandise.

Providing this level of detail gives your broker the ammunition they need to accurately represent your risk profile, which is the key to unlocking the best possible terms.

The Difference in Practice

Let’s look at a real-world example. A jewelry store owner needs to renew their insurance for a jewelry store. Their general agent presents a quote with a sky-high premium and a brutal warranty requiring two employees on-premises at all times—a near-impossible feat for a small family business.

Frustrated, the owner calls a specialist from First Class Insurance. The broker immediately spots that the store’s new UL-rated vault wasn't properly credited on the original application. By providing the underwriter with the correct vault specs and emphasizing the owner's meticulous security procedures, the specialist secures a new policy with a 15% lower premium and a far more realistic on-site staff warranty.

That is the tangible, dollars-and-cents difference an expert makes. They know what questions to ask and how to build a case for your unique insurance for jewelry business needs. They aren't just paper-pushers; they're strategists. Choosing the right partner isn't just one step in the process—it is the process.

What to Do When You Need to File a Claim

Even with the world's best security system and a rock-solid insurance policy, a loss can still happen. It’s a gut-wrenching moment. But in the critical hours that follow, a calm, methodical approach will be your best friend. What you do right away can make a huge difference in how smoothly your claim is handled.

Your first two phone calls are non-negotiable and need to happen immediately.

First, call the police. You need to report the theft or loss and get an official police report filed. Second, call your specialist insurance broker. Don't wait until the next morning—call them as soon as you can. Your broker is your advocate, and they'll start guiding you through the process from that very first conversation.

Putting Your Claim Documentation Together

After you've made those initial calls, your focus needs to shift to gathering the documents that will support your claim. This is the moment where all that diligent record-keeping really pays off. A well-organized, complete submission not only speeds things up but also shows the insurer the clear validity of your loss.

You’ll want to pull together a file with the following:

- The Official Police Report: This is the cornerstone document that formally establishes the incident.

- Proof of Ownership: Think original sales receipts, vendor invoices, or any other records of purchase.

- Proof of Value: This is where your up-to-date professional appraisals become indispensable. They give the insurer the detailed descriptions and replacement values they need to see.

- Photographs of the Items: Clear pictures of the lost pieces are powerful visual evidence.

- A Detailed Inventory List: If you're a business, this means a complete printout of all missing stock from your perpetual inventory system.

Having this packet ready to go eliminates so much of the potential back-and-forth with the adjuster. It transforms a chaotic, stressful event into a manageable, step-by-step process.

Understanding the Key Players

As your claim moves forward, you’ll be working with two main people: the insurance adjuster and your broker. It’s important to understand their roles.

The insurance adjuster works for the insurance company. Their job is to investigate the claim, verify all the details of the loss, and determine the final settlement amount based on the terms of your policy.

Your broker, on the other hand, works for you. They are your representative in this process. They'll communicate with the adjuster on your behalf, help clarify any questions that come up, and make sure everything stays on track. This partnership is invaluable—your broker’s expertise helps demystify the entire process and ensures your interests are protected from start to finish.

Answering Your Top Jewelry Insurance Questions

When you're trying to figure out jewelry insurance, a lot of questions pop up, especially when you're trying to separate your business needs from your personal collection. Getting the right answers is the only way to avoid nasty surprises and coverage gaps if you ever have to file a claim. Let's clear up some of the most common points of confusion.

How Often Should I Get My Jewelry Re-Appraised?

This is a big one. For both your personal pieces and your business inventory, you should get a professional re-appraisal every two to three years. It’s easy to let this slide, but the market for gold, platinum, and gemstones can change dramatically in a short time.

If you’re still relying on an appraisal from five years ago, you're almost certainly underinsured. That means a claim payout won't be enough to cover the actual replacement cost at today's prices.

Does My Jewelers Block Policy Cover My Personal Jewelry?

In almost all cases, no. A Jewelers Block insurance policy is a highly specialized commercial product. It’s built from the ground up to protect your business assets—the inventory you sell, the raw materials you use, and the customer pieces you're repairing.

Your own personal jewelry, even if you keep it at your store, needs its own personal jewelry policy. The policy for insurance for a jewelry store is designed for commercial operations, not for your family heirlooms.

Don't make this mistake. Your jewelry store insurance is there to protect the assets that keep your business running. Trying to cover personal items under that policy is a fast track to a denied claim and a major financial headache.

What Exactly Is "Mysterious Disappearance"?

Mysterious disappearance is one of those insurance terms that sounds vague but is incredibly important. It refers to a loss where you simply can't explain what happened. The item is just gone, with no signs of a break-in or clear evidence of theft.

This is a classic exclusion in a lot of standard property policies. For jewelers and collectors, it's a huge risk. That’s why making sure this specific coverage is included in your insurance for jewelry business or your personal policy is absolutely critical for protecting you against those frustrating, unexplainable losses.

Protecting what you've built starts with getting the right advice. The experts at First Class Insurance live and breathe the unique risks of the jewelry world and can build a policy that actually works for you. Get a Quote for Jewelers Block today and get the peace of mind you deserve.