Relying on a standard business insurance policy to protect a jewelry store is like using a screen door to stop a burglar. It might look like a barrier, but it’s full of holes that leave you dangerously exposed. For any jeweler, these gaps aren't just minor oversights—they're critical vulnerabilities that can put you out of business overnight.

That's where specialized jewelry insurance companies come in, offering policies built from the ground up to address the very specific risks of our trade.

Why Standard Insurance Fails the Jewelry Business

Picture this: you walk into your store one morning and a high-value tray from a display case is simply gone. There’s no sign of a break-in, no shattered glass, no alarm triggered. A standard business policy would likely chalk this up to an inventory counting error or deny the claim outright, leaving you to absorb a massive loss.

This is the harsh reality for anyone trying to protect a jewelry business with generic insurance. A standard commercial policy is designed for general risks—a customer slipping on a wet floor or a fire in the back room. It was never meant to handle the unique, high-stakes threats that are just another Tuesday in the jewelry world.

The Perilous Gaps in Generic Coverage

A typical business owner's policy (BOP) is riddled with exclusions that are disastrous for a jeweler. These policies consistently fail to cover situations that are, unfortunately, all too common in this industry.

Here are the key areas where standard insurance for a jewelry store just doesn’t cut it:

- Mysterious Disappearance: This covers inventory that vanishes without any explanation or clear evidence of theft. It’s a scenario completely shut out of most standard plans but a very real risk for jewelers.

- Off-Premises Risks: What happens when a piece leaves your store? Generic policies usually wash their hands of it, offering no protection for items with a traveling salesperson, at a trade show, or in transit to a client.

- Employee Dishonesty: While some policies have a sliver of crime coverage, it’s often laughably insufficient for the kind of high-value items an employee could pocket.

- Customers' Property: A standard plan probably won't cover a customer's heirloom that gets damaged or goes missing while in your care for a repair. That’s a liability nightmare waiting to happen.

This is precisely why Jewelers Block insurance exists. It’s not just another policy add-on; it's a purpose-built shield designed by expert jewelry insurance companies to wrap your entire operation in one seamless layer of protection—from the loose stones in your vault to the finished pieces in your window.

An Industry-Specific Solution

Jewelers are catching on. The global jewelry insurance market was valued at around $351.8 billion in 2023 and is expected to hit $578.5 billion by 2033. This isn't just a random trend; it shows a growing understanding that unique risks demand a specialized defense. When theft and mysterious disappearance affect up to 15% of small jewelry businesses every year, you can't afford to be unprepared. You can learn more about the jewelry insurance market growth and what’s driving it.

Working with a specialized agency like First Class Insurance to secure the right coverage isn't just another business expense. It's a fundamental investment in your survival, giving you the peace of mind to focus on what you do best without worrying that a single incident could become a catastrophic financial blow.

Understanding Jewelers Block: Your All-In-One Shield

Think of standard commercial insurance as a flimsy umbrella—it might help in a light drizzle, but it’s completely useless in a hurricane. For a jeweler, the daily risks you face are much closer to a storm than a shower. This is where Jewelers Block insurance comes in, acting less like an umbrella and more like a purpose-built fortress for your entire operation.

Unlike a generic policy that makes you patch together different coverages, insurance for a jewelry business under a Jewelers Block plan is a true "all-risk" solution. That means it’s built from the ground up to protect you against nearly every peril imaginable, unless a risk is specifically excluded. It creates a single, seamless shield around your most valuable assets.

What Does the All-In-One Shield Actually Cover?

The real power of specialized jewelry store insurance is its sheer breadth. It’s designed to protect your inventory—the absolute lifeblood of your business—no matter where it is or what form it takes. This level of protection is something a generic policy could never come close to offering.

Just think about the journey of a single diamond. It arrives as a loose stone, gets set into a ring, sits in your showcase, travels to a trade show, and is finally shipped to a customer. A Jewelers Block policy is designed to cover that diamond at every single point in that lifecycle.

A well-structured plan from a specialist like the First Class Insurance Jewelers Block Agency will typically safeguard:

- Stock and Inventory: This covers everything from loose gems and precious metals to finished pieces in your showcase and the raw materials for custom work.

- Property of Others: It protects customer items left with you for repair, appraisal, or on consignment. This is absolutely critical for maintaining client trust and your reputation.

- Goods in Transit: Your coverage follows your inventory when it’s shipped to customers, sent to suppliers, or transported between your locations via approved carriers.

- Off-Premises Coverage: The policy extends protection to items at trade shows, with your traveling salespeople, or even out on memo to trusted clients.

A Jewelers Block policy is the industry standard for a reason. It consolidates multiple, complex risks into a single, cohesive framework, ensuring there are no dangerous gaps where a significant loss could wipe you out.

Why It Fills the Gaps Left by Standard Policies

Let’s walk through a real-world scenario to see the difference. Imagine a fire damages your store. A standard business owner's policy might cover the building and general fixtures, but it will have severe limitations on high-value inventory like jewelry, often capping payouts at a meager $1,000 to $1,500.

With insurance for a jewelry store, the conversation is entirely different. The policy is built around the actual, appraised value of your inventory. If your stock is worth $1 million, your policy is structured to protect that $1 million. This fundamental difference is what separates a minor headache from a business-ending catastrophe.

Here’s how it directly addresses the failures of generic insurance:

- Theft and Burglary: It provides robust coverage for losses from break-ins, armed robbery, and smash-and-grabs—the primary threats every jeweler faces.

- Accidental Damage: A piece dropped by an employee or a stone damaged during the setting process is typically covered.

- Fire and Natural Disasters: Your inventory is protected against perils like fire, floods, and earthquakes, based on your policy's specific terms.

Ultimately, this specialized coverage goes far beyond simple premises protection. It understands that a jewelry business is fluid, with assets constantly on the move. When you decide to get a quote for Jewelers Block, you're not just buying a policy; you're investing in a security system that adapts to the unique rhythm and risks of your trade. It is the only way to truly secure your livelihood.

Crucial Coverage Areas Beyond The Basics

While a standard Jewelers Block policy lays a strong foundation, the most effective insurance for a jewelry business is one that’s built for the way you actually operate. Real security isn’t found in the base policy; it’s in the details—the specific coverages that protect you from the risks most jewelers overlook until it’s too late.

Think of it like building a custom vault. The thick steel door is your basic policy, but what about motion sensors, heat detectors, and off-site monitoring? The best jewelry insurance companies act like your security consultant, helping you identify every potential vulnerability and layering your protection so there are zero blind spots.

Shielding Against The Unexplained: Mysterious Disappearance

One of the most essential—and most misunderstood—coverages is for mysterious disappearance. This isn't your typical smash-and-grab theft. It’s for those head-scratching moments when a piece of inventory is simply gone without a trace or explanation.

Maybe a ring was accidentally swept into the trash during cleanup, or an employee misplaced a tray of earrings. A standard policy would likely deny the claim, leaving you to absorb a loss that's as frustrating as it is costly. This single coverage can be the difference between a minor hiccup and a major financial blow to your jewelry store insurance.

Mysterious disappearance coverage is a hallmark of a specialized Jewelers Block policy. It acknowledges a unique and significant risk in the high-value, small-item world of jewelry, protecting your business from losses that defy simple explanation.

Securing Your Inventory On The Move

Your inventory is almost never sitting still. It’s constantly moving between suppliers, appraisers, trade shows, and clients. Every single one of those trips is a high-risk moment, and this is exactly where a standard insurance for a jewelry store often falls apart. A rock-solid policy needs to cover your assets no matter where they are.

These protections are non-negotiable for a modern jewelry business:

- Goods in Transit: This covers your pieces while being shipped via approved carriers like FedEx or UPS. The policy will have strict rules for packaging and declared values, but following them means you're protected if a package is lost, damaged, or stolen.

- Traveling Salespeople: When your sales team hits the road with a line of valuable pieces, this coverage extends your policy’s protection to their inventory, whether it's locked in a hotel safe or being shown to a client.

- Trade Show Coverage: Shows are a massive opportunity, but they’re also a huge security risk. This extension makes sure your inventory is covered from the moment you start setting up to the moment you pack up and leave.

Jewelers Block vs Standard Business Insurance

It's easy to see why a generic business policy just doesn't cut it. The risks are completely different. This table breaks down a few common scenarios and shows how a specialized Jewelers Block policy responds compared to a standard one.

| Risk Scenario | Coverage Under Jewelers Block | Coverage Under Standard Business Policy |

|---|---|---|

| Mysterious Disappearance | A $20,000 watch vanishes from a display case overnight with no sign of forced entry. Covered. | Unexplained losses are almost always excluded. Not Covered. |

| Goods in Transit | A parcel containing $50,000 in diamonds is "lost" by the shipping carrier. Covered. | Typically has very low limits for goods in transit, often just $5,000 or less. Partial or No Coverage. |

| Off-Premises Theft | A salesperson's sample case is stolen from their locked car while at a client meeting. Covered. | Property is usually only covered at the specified business address. Not Covered. |

As you can see, the difference is night and day. A standard policy leaves you dangerously exposed in situations that are a daily reality for a jeweler.

By working with a knowledgeable agent, you can build a policy that truly reflects the risks you face. Digging into these details is a crucial part of the process when you get a quote for Jewelers Block. For a sense of the kind of irreplaceable items that demand this level of protection, take a look at this stunning image of a diamond ring on a black background. These coverages are what turn a good policy into a great one.

What Underwriters Look for When Quoting Your Policy

When you ask for a quote on insurance for a jewelry business, the process goes a lot deeper than just plugging your inventory value into a calculator. Behind the scenes, underwriters act like risk detectives, digging into every corner of your operation. Their entire goal is to answer one fundamental question: how likely are you to file a claim?

Think of an underwriter as the insurance company's security consultant. They don't just see a $500,000 inventory; they see 500,000 individual risks that need to be buttoned up. How well you’ve protected those assets directly shapes the coverage and the premium you’re offered. It’s the reason one jeweler gets a great rate while another, with a similar inventory value, ends up paying far more.

The Anatomy of a Risk Assessment

Underwriters from the best jewelry insurance companies look at your business through a very specific lens. They’re focused on the layers of protection you've built around your assets, analyzing both your physical fortifications and your day-to-day procedures. A strong application is one that shows you're proactive about security in every single area.

Here’s what they scrutinize the most:

- Physical Security: This is, without a doubt, the most heavily weighted factor. Underwriters want the specifics on your safes (especially the TRTL rating), your alarm systems (Is it monitored? Is there a cellular backup?), your surveillance cameras (What’s the coverage? How long do you keep recordings?), and any physical barriers like bollards or security gates.

- Inventory Management: How do you keep track of your stock? Underwriters love seeing a solid, digital inventory system that gives a crystal-clear, up-to-the-minute record of every single piece. Regular audits and airtight protocols for handling both new and sold items are non-negotiable.

- Employee Protocols: Your team can either be your greatest strength or your biggest liability. Underwriters need to know your procedures for opening and closing, how you show high-value items to customers, and whether you run background checks on new hires.

Your Security Measures and Their Impact on Premiums

Every security measure you put in place sends a clear signal to an underwriter: you are a lower-risk client. For U.S.-based jewelry businesses, theft is the elephant in the room, accounting for a staggering 40% of all claims. This makes physical and procedural security the absolute top priority for any insurer.

Independent stores, which hold a 35% retail market share, are often seen as prime targets, making robust protections even more critical. After assessing these risks, insurers set premiums that typically average 1-2% of your total insured value each year. But by demonstrating advanced security and meticulous inventory management, you can bring that number down significantly. You can discover more about jewelry insurance market trends to see how these factors play out on a larger scale.

By understanding what underwriters prioritize, you can transform your role from a passive quote-seeker to an active partner in securing favorable terms. Proactively strengthening your security posture is the single most effective way to lower your premiums.

The details matter immensely. A store with a high-rated vault, a 24/7 monitored alarm, and clear protocols for handling memo goods will always get a better rate than one with a basic safe and a looser operation. Showing that you take risk management seriously can save you thousands of dollars a year. Underwriters aren't just insuring your beautiful products, like these exquisite high-end watches, they are insuring your commitment to protecting them.

How to Get an Accurate Jewelers Block Insurance Quote

Getting the right insurance for a jewelry business isn’t like buying an off-the-rack policy. It’s a custom-tailoring process where every single detail matters. If you hand an underwriter a vague or incomplete application, you’re essentially asking a master tailor to craft a perfect suit based on a blurry photo. It just won’t work.

The first and most important step is to find an agent who actually specializes in this world. You need someone who lives and breathes the jewelry industry, not a generalist who dabbles in it. They know what underwriters are looking for and how to frame your business in a way that gets you the right coverage without overpaying.

Prepare Your Documentation Thoroughly

Before you even think about getting a quote for Jewelers Block, you need to get your house in order. Underwriters operate on facts and figures, and a meticulously prepared application tells them you’re a serious, low-risk partner.

The absolute foundation of your application is a detailed inventory. Your first move should be creating a detailed jewelry collection inventory that leaves no stone unturned. This isn't just about a total value; it’s a complete breakdown including:

- Detailed Valuations: Professional appraisals for your high-value pieces and precise cost data for all other stock.

- Inventory Categorization: A clear separation between finished jewelry, loose stones, raw metals, and any customer property you're holding.

- Off-Site Inventory: A specific list of any items out on memo, with your traveling sales team, or stored at other locations.

Think of it this way: a well-organized inventory and a clear security profile are your two greatest assets in this process. They prove your professionalism and proactive risk management—exactly what the best jewelry insurance companies want to see.

Communicate Your Security and Operational Risks

Once your inventory is dialed in, you need to paint a crystal-clear picture of your security setup. Just saying you have an alarm system isn't enough. Underwriters need the specifics to give you credit for the protections you’ve invested in.

Get ready to provide details on:

- Safes and Vaults: The specific UL or TRTL rating, its size, and where it’s located.

- Alarm Systems: Who is the provider? Is there a cellular backup? What kind of sensors are installed (motion, glass break, etc.)?

- Surveillance: How many cameras do you have, what’s their resolution, and how long is the footage saved?

- Protocols: What are your exact procedures for opening and closing, showing high-value pieces, and managing your inventory day-to-day?

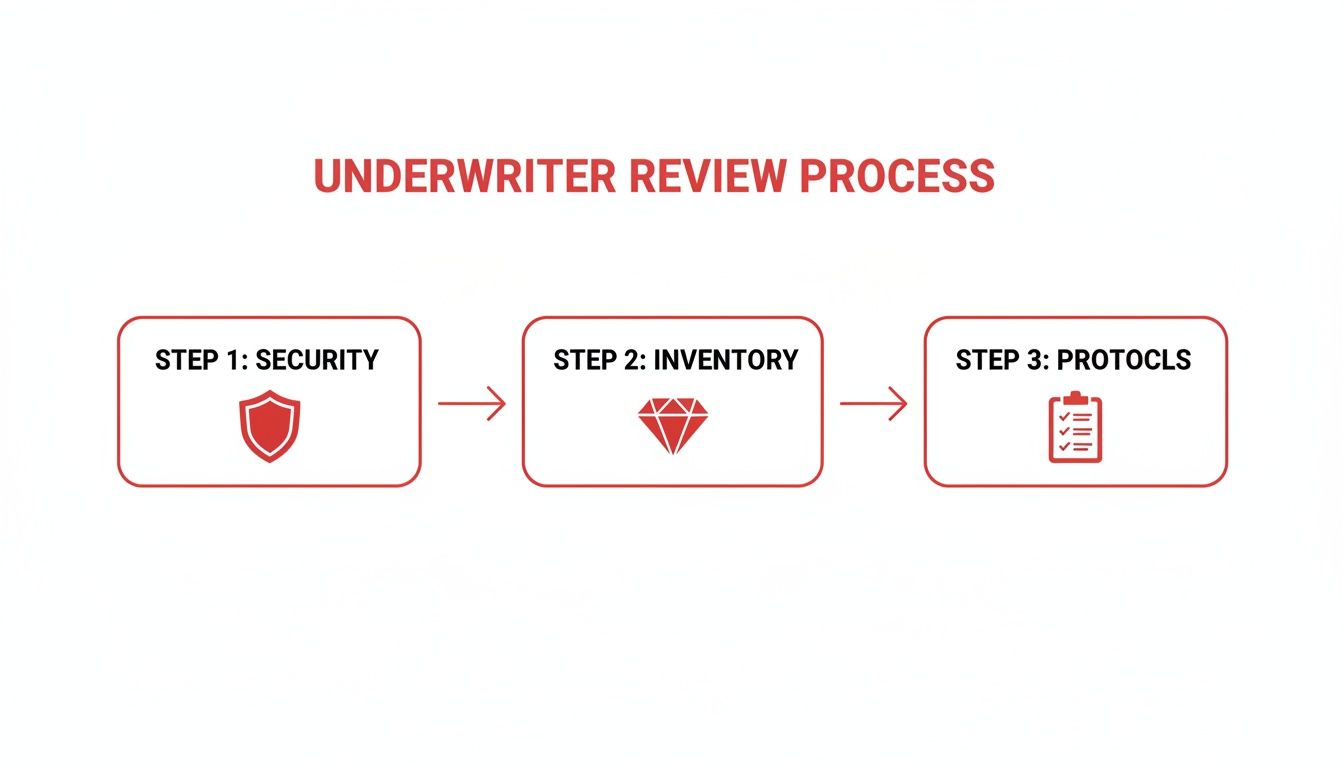

The infographic below shows exactly what an underwriter looks at when they're reviewing a jeweler's application.

As you can see, a solid security posture, accurate inventory valuation, and clear operational protocols are the three pillars of a successful review.

Being upfront about your unique operational risks is just as critical. Do you specialize in one-of-a-kind bespoke pieces? Do you attend a dozen international trade shows a year? These details help an underwriter build a policy that actually fits your business. Without proper documentation, for example, valuation issues on unique pieces can delay a claim by 20-30%.

By laying all your cards on the table, you make the whole process smoother and ensure your jewelry store insurance doesn't have any dangerous gaps when you need it most.

Choosing the Right Insurance Partner for Your Business

Picking an insurance provider is as crucial as sourcing your gemstones. It’s not just about chasing the lowest premium; it's about finding a partner who genuinely understands the unique rhythm of the jewelry business. The right one is a true asset, offering guidance and support that goes far beyond a simple policy document.

The wrong choice, on the other hand, can be a complete disaster. An agent who asks only surface-level questions or tries to push a generic, one-size-fits-all policy is a massive red flag. Vague exclusions or a clear lack of industry knowledge can leave you dangerously exposed when a crisis hits, turning a manageable problem into a financial catastrophe.

Green Flags: Identifying an Expert Partner

A top-tier agency or broker who specializes in insurance for a jewelry business will show several clear, positive signs. Think of these as the "green flags" that signal you’re dealing with a real expert who can protect your livelihood. You want a partner who is proactive, not just reactive.

Here’s what to look for:

-

Deep Industry Expertise: They speak your language. They know the difference between memo and consignment and understand the specific risks that come with trade shows and traveling sales teams.

-

Strong Underwriter Relationships: A well-connected agency has access to the best markets, like Lloyd's of London, which means they can secure the best terms and coverage for your unique needs.

-

Proactive Risk Management Advice: They don’t just sell you a policy and disappear. They offer practical advice on improving your security, tightening up inventory protocols, and ultimately lowering your risk profile.

Red Flags to Watch Out For

Just as important is knowing what to avoid. Some jewelry insurance companies or generalist agents might try to squeeze your specialized business into a generic commercial box. It helps to understand the broader insurance industry landscape so you can spot these mismatches from a mile away.

Be wary of any potential partner who seems more interested in a quick sale than in understanding the intricate details of your operation. A superficial approach during the quoting process often leads to superficial coverage when it matters most.

The jewelry market is projected to hit $450 billion by 2030, and fine jewelry is expected to make up 68% of that. This incredible growth brings with it increased risk. In fact, theft and mysterious disappearance can account for a combined 55-65% of losses for some jewelers.

A top-tier insurance partner lives and breathes this reality. They offer customized Jewelers Block policies, quick quote turnarounds, and even coverage for other high-value assets.

Your insurance partner should be a trusted advisor, not just a vendor. By recognizing these green and red flags, you can look beyond the price tag and choose a reliable ally who will actually be there to protect you when you need it most.

Frequently Asked Questions About Jewelers Insurance

Running a jewelry business means you've got questions, and when it comes to insurance, the details really matter. Whether you’re an established retailer or a designer just starting out, getting straight answers is the first step to protecting your life's work. Let’s clear up some of the most common questions we hear from jewelers.

What Is the Average Cost of Jewelers Block Insurance?

There’s really no simple answer here, because Jewelers Block insurance is priced specifically for your business. Think of it less like a flat-rate product and more like a custom-tailored suit. As a general rule of thumb, you can expect to pay somewhere between 0.5% and 2% of your total inventory's value each year.

What pushes that number up or down? It all comes down to risk. An underwriter will look at everything from your total inventory value and your shop's location to your claims history. Most importantly, they’ll scrutinize your physical security—things like high-quality safes and modern alarm systems. A jeweler who has invested heavily in top-tier security will always get a better rate from jewelry insurance companies.

Does Jewelers Block Insurance Cover Items During Shipment?

Yes, and this is one of the most critical parts of any solid jewelry store insurance policy. Coverage for your goods while they're in transit is a core feature, but it's not unconditional. To make sure you’re actually protected, you have to follow the rules of your policy to the letter.

Your policy will have very specific requirements, like:

- Approved Shipping Carriers: You’ll be required to use specific services, like Brinks, FedEx, or UPS, often at a particular service level.

- Packaging Standards: Insurers will have strict rules for how pieces must be packaged to prevent theft or damage in transit.

- Declared Value Limits: There will always be a cap on the maximum value you can insure in a single shipment.

Skipping any of these steps is a huge gamble. If a package goes missing and you didn't follow the carrier or packaging rules, you could find your claim denied.

Are My Customers' Items Covered During Repairs?

Absolutely. This is a non-negotiable part of any legitimate insurance for a jewelry store, often called "care, custody, and control" coverage. It’s designed to protect items that belong to other people while they are temporarily in your hands.

This means if a customer's engagement ring is damaged or a family heirloom is stolen from your safe while you're repairing or appraising it, your policy is there to cover the loss. This coverage is as much about protecting your reputation as it is about protecting your clients' valuables.

How Is Mysterious Disappearance Different From Theft?

This is a fantastic question, and the answer gets to the heart of why specialized jeweler’s insurance is so essential. Theft is straightforward—there’s clear evidence a crime happened. Think of a broken display case, a forced entry caught on camera, or a smash-and-grab.

Mysterious disappearance, on the other hand, is when an item is just… gone. There’s no sign of forced entry, no broken lock, and no evidence of what happened to it. It simply vanished. A standard business policy won't touch a claim like that, but for an industry built on small, high-value items, this unique coverage is a must-have.

Ready to secure your business with a policy built for your unique risks? The team at First Class Insurance has over 30 years of experience protecting jewelers nationwide. Let us help you build the right coverage at a competitive price. Get a quote for Jewelers Block today by visiting https://firstclassins.com.