When you're shipping a high-value piece, it's tempting to see that "insured shipping" checkbox and think you're covered. For a jeweler, that's a dangerous mistake. What freight carriers offer isn't true insurance; it's a severely limited form of liability that can leave you with pennies on the dollar after a catastrophic loss. The right insurance for a jewelry store understands that shipments are one of the most vulnerable points in your operation.

Why Standard Shipping "Insurance" Fails Jewelers

Relying on a carrier's declared value coverage is like thinking your landlord's building insurance will replace your belongings after a fire. It won't. The landlord’s policy is there to protect their asset—the building. It does nothing for your furniture, your electronics, or your personal keepsakes.

Carrier liability works the exact same way. It's designed to limit their financial exposure, not to make your business whole.

This "coverage" is often shockingly low, with payouts capped at a set amount per pound. Imagine shipping a small, lightweight package holding $50,000 in diamonds. Under their terms, that package might be valued at less than $100. It’s a massive financial gap that no jeweler can afford to ignore.

The Illusion of Protection

Carrier liability is riddled with loopholes that leave you exposed. If a shipment is lost in a flood or tornado—what they call an "Act of God"—the carrier typically owes you nothing. The same goes if they decide the loss was your fault due to "improper packaging."

To get paid, you have to prove the carrier was negligent. That’s a tough, expensive, and time-consuming fight that you are not guaranteed to win.

In sharp contrast, a real insurance policy, like Jewelers Block insurance, acts as a specialized policy for your inventory while it's on the move. It's built to cover the full value of your goods against a wide range of risks, including the very things carriers exclude.

A dedicated Jewelers Block policy from a specialist like First Class Insurance shifts the burden of proof. Instead of you having to prove the carrier was at fault, you simply have to document that a loss occurred. That one difference is everything when it comes to protecting your assets.

One is a weak promise from a shipping company. The other is a real financial backstop for your most valuable assets.

Carrier Liability vs. Jewelers Block At a Glance

The difference between what a carrier offers and what a real insurance policy provides is night and day. Seeing it laid out side-by-side makes the choice obvious for any jeweler serious about protecting their inventory.

| Feature | Standard Carrier Liability | Jewelers Block Cargo Insurance |

|---|---|---|

| Coverage Basis | Limited to a set amount per pound, often pennies on the dollar. | Based on the actual declared value of your jewelry inventory. |

| Claim Requirement | You must prove the carrier was directly at fault for the loss. | You only need to prove that the loss or damage occurred during transit. |

| Covered Perils | Excludes many common risks like "Acts of God" and shipper error. | Often provides "All-Risk" coverage, protecting against most perils. |

| Payout Speed | Can take many months, often ending in partial payment or total denial. | Claims are typically processed and paid within 30 days. |

Once you understand these gaps, you can see why relying on the carrier is a gamble, while a proper Jewelers Block policy is a sound business strategy.

Understanding Your Core Insurance Options

Trying to understand cargo and freight insurance can feel like decoding a foreign language. But for a jeweler, it really boils down to just a few key ideas. Getting these fundamentals right is the first step to building a truly secure defense for your high-value inventory. The strength of your policy all depends on where your pieces are going and the exact type of protection you choose.

Think of your coverage in two main arenas. First, there's Inland Marine insurance, which covers your goods while they travel over land or by air inside a country. This is what protects your domestic shipments, whether you're using FedEx or an armored truck. Then there's Ocean Marine insurance, built for international freight that crosses the water. Each environment has its own unique set of risks, so your insurance has to be designed to match.

The global cargo insurance market is massive, valued at around USD 75.2 billion in 2025 and expected to grow by 4.5% annually through 2033. That growth is being fueled by a surge in international trade. This is exactly why specialists like us at First Class Insurance stress the need for customized Jewelers Block policies that specifically cover shipments—protecting you from in-transit losses that could wipe out a store's inventory.

The Two Security Systems of Coverage: All-Risk vs. Named Perils

The single most important distinction you'll come across is the difference between "All-Risk" and "Named Perils" coverage. To get a handle on it, imagine you're picking a security system for your store.

A Named Perils policy is like a basic alarm that only goes off for threats you've listed ahead of time—like a broken window or a forced door. If a thief gets in some other way, say through an unsecured vent, that alarm stays silent. In insurance language, this policy only covers losses from specific causes (the "perils") written into the policy, such as:

- Fire or explosion

- A vehicle collision or overturning

- Theft (though often with very restrictive definitions)

A Named Perils policy is a gamble because if the reason for your loss isn't on that specific list, you have no coverage. The burden of proof is on you to show that the loss was caused by one of those listed events.

On the other hand, an All-Risk policy is like a cutting-edge security system with motion detectors, cameras, and round-the-clock monitoring. It’s designed to protect against everything unless a threat is specifically excluded. This is the gold standard for any jewelry business because it flips the burden of proof and covers a far wider range of potential disasters.

With an All-Risk policy, a loss is covered unless the insurance company can prove it was caused by an event explicitly excluded in the policy documents. For jewelers, this is critical because it can cover events like mysterious disappearance, where a stone vanishes without evidence of theft.

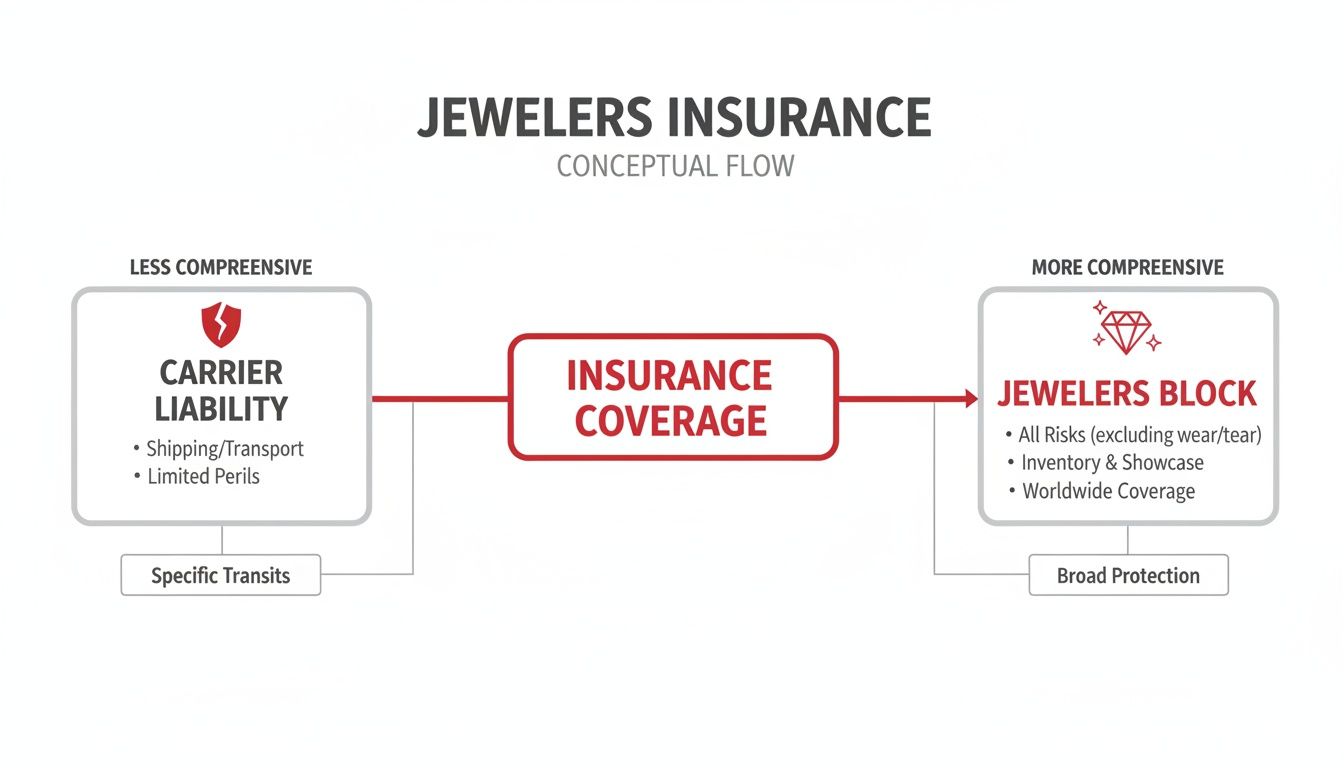

This flow chart perfectly illustrates the weak protection you get from standard carrier liability versus the comprehensive security of a real Jewelers Block policy.

As you can see, a specialized Jewelers Block policy acts as a complete shield for your assets, while carrier liability is a fragmented and unreliable defense at best.

When you ask a Jewelers Block agency for a quote, you are almost always looking for an All-Risk policy. It’s the foundation of real insurance for any jeweler shipping valuable goods. Grasping this core difference lets you ask the right questions and make sure your policy gives you the airtight protection you actually need. You might also be interested to see the top-tier partners we work with, like Lloyd's of London, who underwrite these kinds of complex policies.

Decoding Your Jewelers Block Policy

Knowing you need a Jewelers Block policy is one thing. Knowing how to read it is another. The real protection for your jewelry business isn’t found in the big, bold promises on the first page—it's buried in the details of the fine print. A standard insurance contract can feel intentionally dense, but a few key terms and clauses are all that stand between you and a devastating financial loss.

Getting these details right is what makes your cargo insurance and freight plan actually work. If you don't, you could be paying for a policy with dangerous gaps you only find out about after something goes wrong. This is exactly why you work with a specialist—they translate the jargon into meaningful protection for your jewelry store.

Understanding Your Limits and Deductibles

Every policy revolves around limits and deductibles. They spell out exactly how much the insurer pays versus how much comes out of your own pocket. A deductible is simply the amount you have to pay first before your insurance coverage kicks in. You can often get a lower premium by choosing a higher deductible, but you'll have to be prepared for that bigger initial expense if you ever file a claim.

The real game-changer for shipping, however, are the coverage limits. It's not just one number. These are often broken down into different categories that are absolutely critical to understand.

- Per Shipment Limit: This is the absolute maximum your policy will cover for a single lost or damaged package. Let's say you ship a $75,000 ring, but your per-shipment limit is capped at $50,000. You've just self-insured that remaining $25,000.

- Per Conveyance Limit: This limit sets the maximum payout for all of your goods on a single truck, plane, or ship. Imagine you have three separate $50,000 packages on the same FedEx truck and that truck gets hijacked. Your total loss is $150,000, but if your per conveyance limit is only $100,000, that's the most you'll ever get back.

Think of these limits as the financial guardrails of your policy. It's on you to make sure they're set high enough to cover your most valuable shipping scenarios.

Key Endorsements for the Jewelry Trade

A standard Jewelers Block policy is a solid foundation, but the real power comes from endorsements. These are add-on clauses that stretch your coverage to cover the specific, unique risks of the jewelry trade. Think of them as custom upgrades for how your business actually operates.

For instance, a basic policy might stop protecting your inventory the second it leaves your store. That’s where specialized endorsements become non-negotiable.

Common endorsements you'll want to look for:

- Trade Show Coverage: Protects your inventory while it's on its way to, sitting at, and returning from a trade show.

- Sales Staff Coverage: Insures the jewelry that travels with your salespeople when they're on the road.

- Memorandum Coverage: This is huge. It covers items that aren't technically yours but are in your care—think pieces out on memo to other dealers or on loan from designers.

Without these specific add-ons, you’re looking at some serious uncovered losses. When you’re looking to Get a Quote for Jewelers Block, be sure to walk your broker through every detail of how you do business.

The Mysterious Disappearance Clause

This might be one of the most valuable—and most misunderstood—clauses in any policy: coverage for mysterious disappearance. It’s exactly what it sounds like. It covers a loss where an item simply vanishes without any clear sign or proof of theft. Maybe a stone falls out of its setting during shipping, or a piece gets misplaced during the chaos of a trade show setup.

Sample Policy Language: "This policy covers the mysterious, unexplainable, or unaccountable disappearance of insured property from a secured location or while in transit with an approved carrier."

This is the hallmark of a strong Jewelers Block insurance policy because it doesn't force you to prove a crime happened. For a business built on small, high-value items, that kind of protection is priceless. Make sure any policy you're considering has this language, because it closes a very common and very expensive loophole. Getting a quote from a specialist like First Class Insurance Jewelers Block Agency is the best way to ensure these critical details are baked right in.

Mitigating the Growing Risk of Cargo Theft

Let's be blunt: theft is no longer just a risk for your jewelry business; it's a constant, sophisticated threat. For every shipment that arrives safely, you can bet that organized criminal groups are probing for weak spots in the supply chain. This turns the simple act of moving your high-value goods into a high-stakes challenge.

To protect your inventory, you have to shift your mindset from reactive claims to proactive prevention. Your logistics process needs to become your first and best line of defense.

The financial stakes are staggering. The latest industry data shows cargo theft is skyrocketing, with average losses per incident now exceeding $202,000. That's a dire warning for any jeweler who relies on secure freight.

These aren't random smash-and-grabs. Criminals are evolving, specifically targeting high-value loads like gems, finished pieces, and even bench jewelers' tools while they're on the move. For any U.S.-based jewelry operation, this makes the transit coverage within a Jewelers Block insurance policy absolutely non-negotiable. It’s designed to cover theft, accidents, and even that dreaded "mysterious disappearance" that can plague marine cargo routes.

Secure Packaging: Your First Defense

Your first chance to deter a thief happens long before a package leaves your possession. The goal is simple: make your shipment as anonymous and difficult to breach as possible. You need to think like a thief and strip away any clue that hints at what’s inside.

Effective packaging isn't just a sturdy box; it’s a strategic act of concealment.

- Use Nondescript Boxes: Never, ever use packaging with your jewelry store's name, logo, or anything that screams "jewelry." A plain, generic brown box is always your best bet.

- Double-Box High-Value Items: Put the jewelry inside a small, secure box. Then, place that box inside a larger, plain shipping container with plenty of filler. It adds another barrier of time and effort for any would-be thief.

- Employ Tamper-Evident Seals: Use specialized security tape or seals that clearly show if they've been opened. This is an immediate red flag for the recipient and a strong deterrent for thieves who know they'll be caught.

Vetting Carriers and Planning Routes

Not all carriers are created equal, especially when it comes to handling high-value freight. The major couriers have their protocols, but you need to dig deeper. Ask them about their chain-of-custody procedures, employee background checks, and what security looks like at their sorting hubs.

For your most valuable shipments, using an armored carrier might even be a requirement of your insurance policy. Don't skip this step.

Proactive logistics means never leaving security to chance. It means scrutinizing every single step of the journey, from the carrier you pick to the path that shipment takes. Assuming the default option is secure is one of the costliest mistakes a jeweler can make.

Strategic route planning is another critical layer of security. Always push for direct routes with as few stops or transfers as possible—every handoff is a new opportunity for theft or loss. And try to avoid sending packages that will sit in a warehouse over a weekend or holiday, as those are prime times for heists.

Technology is your friend here. Placing real-time GPS trackers inside your packages gives you an incredible layer of security. You get constant visibility and can react instantly if a shipment goes off course. Smart logistics, paired with robust cargo insurance and freight protection, creates a powerful security shield around your assets.

Many in the industry find that working with trade organizations like the Southern Jewelry Travelers Association (SJTA) offers invaluable resources and best practices for shipping securely.

Your Jewelry Shipment Security Checklist

A disciplined, repeatable process is your best defense against the unpredictable nature of cargo transit. This checklist breaks down the essential actions you should take before, during, and after every high-value shipment to fortify your assets against loss.

| Phase | Action Item | Rationale |

|---|---|---|

| Pre-Shipment | Use Plain Packaging | Avoid logos or branding that identify contents as jewelry. Anonymity is your first line of defense. |

| Pre-Shipment | Double-Box & Seal | Place the primary box inside a larger one and use tamper-evident tape. This creates a physical and psychological barrier. |

| Pre-Shipment | Document & Photograph | Take clear photos of the items and the sealed package. This provides crucial evidence for any potential claim. |

| Pre-Shipment | Verify Carrier Security | Confirm the carrier's protocols for high-value goods, including employee screening and secure sorting facilities. |

| During Transit | Use Real-Time GPS | Place a tracker inside the package to monitor its location independently of the carrier's system. |

| During Transit | Avoid Weekend Layovers | Schedule shipments to avoid having them sit in a warehouse over weekends or holidays, which are high-risk periods. |

| During Transit | Require Signature on Delivery | Ensure the package is handed directly to a specific, authorized individual. Never allow for a "drop-off." |

| Post-Shipment | Inspect on Arrival | Instruct the recipient to inspect the package for any signs of tampering before signing for it. |

| Post-Shipment | Confirm Receipt Immediately | Get direct confirmation from the recipient as soon as the package is securely in their hands. |

By making these steps a standard part of your operating procedure, you move from simply hoping for the best to actively managing and reducing your risk exposure on every single shipment.

Navigating the Claims Process Step By Step

Even with the best planning, things can go wrong. A shipment gets lost, damaged, or stolen. This is the moment your insurance policy goes from being a piece of paper in a file to a critical lifeline for your business.

The claims process can feel daunting, but it doesn't have to be. Think of it as a clear roadmap—a series of manageable steps that turn a stressful event into a structured procedure. What you do in those first few hours can make all the difference.

When a loss happens, time is not on your side. Your first move, without fail, should be to notify your insurance partner, like First Class Insurance, immediately. Getting the ball rolling fast is crucial for preserving evidence and kickstarting the recovery process.

Immediate Actions Following a Loss

Your response in the first few hours is everything. Treat it like a business emergency: secure the scene and document every single detail.

- Notify All Parties: Get on the phone with your insurance agent and the freight carrier right away. If you even suspect theft, file a police report immediately.

- Secure the Scene: If you can, prevent any further damage. This might be as simple as moving a damaged crate to a secure area or cordoning off a space where a theft occurred.

- Document Everything: Pull out your phone and take photos and videos from every conceivable angle. Get shots of the damage, the packaging, and the area around it. This visual evidence is gold.

As you navigate the claims process, you'll run into shipping jargon. Understanding what a shipment exception means, for example, helps you spot red flags when a package is delayed or rerouted. This kind of information is vital when you're piecing together the timeline of a loss for your insurer.

Gathering Your Essential Paperwork

Once you've handled the immediate crisis, it’s time to build your case file. A complete, organized set of documents will make your claim move much faster. The adjuster needs this paperwork to verify what happened and what it's worth.

A well-documented claim is a strong claim. Your ability to provide clear, comprehensive paperwork removes ambiguity and allows the adjuster to process your claim efficiently, leading to a faster resolution.

Here’s the key documentation you'll need to pull together:

- Bill of Lading: This is the official contract you have with the carrier.

- Commercial Invoice: It proves the value of the items that were lost or damaged.

- Packing List: This details exactly what was supposed to be in the shipment.

- Photos and Videos: Your visual proof of the condition of your goods and their packaging.

- Police Report: Absolutely essential for any claim that involves theft.

- Proof of Delivery (if applicable): Shows who signed for the package and, just as importantly, if they noted any damage upon arrival.

The Roles of Surveyors and Adjusters

After you file your claim, your insurance company will assign an adjuster to your case. This person is your main point of contact. Their job is to investigate the claim, figure out the cause of the loss, and determine its value.

For more complicated or high-value claims, the insurer might also bring in an independent surveyor. The surveyor’s job is to inspect the damage firsthand and provide an expert report.

Working with a responsive partner like First Class Insurance means you have an advocate in your corner every step of the way. We help you understand who does what, set realistic expectations for timelines, and make sure your claim is presented professionally. It's about reducing your stress and getting you the best possible outcome. You can see more about how we protect high-value pieces like this stunning diamond ring in our gallery.

How to Get the Right Jewelers Block Coverage

Alright, you understand the risks. Now comes the most important part: protecting your business. Getting the right jewelry store insurance isn't rocket science, but it does require some specific details to get an accurate quote. An insurer needs to see a clear picture of how you operate to build a policy that actually protects your assets.

To get the ball rolling on a quote, you'll need to pull together some key information about your business. This is what underwriters use to size up your unique risks and figure out the right coverage and premium. Have this ready before you talk to an agent.

Preparing for Your Quote

Your agent will need a quick snapshot of your shipping activity. Having these numbers handy makes the whole process smoother and guarantees your quote is based on your real-world needs.

- Annual Shipping Volume: Just a ballpark number—how many packages do you ship out in a year?

- Maximum Value Per Shipment: What's the most value you'd ever put in a single box?

- Typical Transit Routes: Are your shipments mostly domestic, international, or a mix of both?

When you get into the nitty-gritty of commercial insurance applications, you'll see documents like the ACORD 125 form, which is a standard application that captures the core details an underwriter needs.

Why a Specialist Agency Matters

You wouldn't ask your family doctor to perform heart surgery, right? The same logic applies here. Any commercial broker can sell you an insurance policy, but only a specialist truly understands the unique risks that come with the jewelry trade.

This is where an expert like First Class Insurance Jewelers Block Agency makes all the difference. Unlike generalist brokers, we live and breathe this industry. We have direct lines to underwriters who specialize in high-value assets and know the difference between standard freight and a package carrying a six-figure diamond.

Partnering with a specialist isn't just about getting a policy; it's about getting the right policy. We translate your business operations into an insurance contract with no dangerous gaps, ensuring your cargo insurance and freight plan is rock-solid.

At the end of the day, Jewelers Block insurance isn't just another line item on your budget—it's a fundamental investment in your company's survival. It protects your inventory, your reputation, and your peace of mind from the ever-present threat of loss. To protect your assets, Get a Quote for Jewelers Block and make sure your business can handle whatever comes its way.

Frequently Asked Questions

Even after you've got the basics down, a few specific questions always pop up when you're dealing with something as crucial as cargo insurance and freight. Here are some of the most common ones we hear from jewelers, with straight-to-the-point answers to help you lock down your assets.

How Is the Cost of My Cargo Insurance Determined?

Let's get one thing straight: the price you pay for insurance isn't just a number pulled from a hat. It's a calculated risk assessment, especially when it's part of a Jewelers Block insurance policy. Your underwriter is essentially creating a risk profile for every package you send out the door.

A few key things drive that cost:

- Total Shipment Value: Are you shipping a million dollars in goods over a year, or ten million? The higher the total value, the bigger the potential exposure for the insurer.

- Maximum Value Per Shipment: There’s a world of difference between a business whose biggest shipment is $25,000 and one that regularly sends out $250,000 packages.

- Transit Routes: Shipping to a secure domestic address is one thing. Shipping internationally into regions known for theft and logistics problems? That’s a whole different level of risk.

- Security Measures: This is where you can really make a difference. Do you use armored carriers? GPS trackers? Tamper-evident packaging? The more you prove that you take security seriously, the better your rate will be.

Ultimately, showing an underwriter you're a low-risk partner isn't just good practice—it's a smart financial move that directly impacts your premium.

Does My Jewelers Block Policy Cover FedEx or UPS Shipments?

Yes, absolutely. In fact, this is one of the core jobs of a solid Jewelers Block policy. It's designed to step in and cover your shipments with common carriers like FedEx, UPS, and USPS, replacing their incredibly low liability limits with real, value-based coverage.

But—and this is a big but—your policy will come with specific rules you have to follow. In the insurance world, these are called "warranties."

A policy warranty is a promise you make to the insurer. For instance, your policy might state that any package valued over $50,000 must be double-boxed and shipped via Priority Overnight. If you don't follow that rule and the package vanishes, your claim could be denied.

It's absolutely critical to know these shipping rules inside and out. Working with a specialist who understands the jewelry business, like First Class Insurance Jewelers Block Agency, ensures you know exactly what’s expected to keep your coverage locked in, no matter who's carrying the box.

What Is the Difference Between FOB and CIF Shipping Terms?

When you’re moving goods internationally, you’ll run into acronyms like FOB and CIF. These aren't just shipping jargon; they define the exact moment that financial responsibility for your goods shifts from the seller to you, the buyer. Getting this right is crucial for knowing who needs to handle the insurance for a jewelry business shipment.

- FOB (Free On Board): Think of this as the handover point. Once the seller gets the goods loaded onto the ship or plane, their job is done. From that moment on, you—the buyer—are on the hook for the freight costs and, most importantly, the insurance for the rest of the trip.

- CIF (Cost, Insurance, and Freight): With CIF, the seller handles everything. They pay the freight and arrange an insurance policy to cover the goods all the way to your destination port. The catch? The risk still technically transfers to you once the goods are on board, but you're relying on their insurance.

For any jeweler, control is everything. That’s why most prefer FOB terms when buying internationally. It allows you to place the coverage under your own comprehensive Jewelers Block policy, instead of crossing your fingers and hoping the seller’s insurance is good enough.

Getting a handle on the ins and outs of cargo insurance and freight is non-negotiable for protecting the high-value assets that are the lifeblood of your jewelry business. With the right knowledge and a dedicated insurance partner, you can be confident your inventory is secure, whether it's on a truck, a plane, or a ship. To get the expert guidance and tailored coverage your business deserves, contact First Class Insurance today.