When something goes wrong—and eventually, it will—a disaster recovery plan is the documented strategy that gets your business back on its feet. Think of it less as a dusty binder on a shelf and more as a survival toolkit. It lays out the exact procedures for everything from a smash-and-grab to a crippling cyberattack, ensuring you can protect your assets, your data, and the reputation you've worked so hard to build.

Honestly, this plan is the most critical investment you can make in your business’s future.

Why Your Jewelry Business Is Uniquely at Risk

Let’s be direct. Most small businesses don’t survive a major disaster, whether it's a tornado or a simple burst pipe. But for a jeweler, the stakes are exponentially higher. Your entire business is built on high-value, highly portable inventory, making you a prime target for threats that go far beyond fires and floods.

This isn't just about boarding up the windows for a hurricane. It’s about having a real plan for theft, internal fraud, and digital attacks that can wipe you out in minutes. Without a plan, you're not just risking a few bad days—you're risking everything.

The Sobering Statistics for Small Businesses

The numbers paint a pretty grim picture. According to FEMA, a staggering 40% of businesses never reopen after a major disaster. Even worse, the Small Business Administration (SBA) estimates that figure could climb as high as 90%. When your inventory consists of high-value assets, those odds are terrifying. You can get more insights on the challenges small businesses face from the Milken Institute.

These aren't just abstract statistics; they represent real people, shattered dreams, and permanently shuttered storefronts.

Beyond Generic Checklists: A Jeweler-Specific Approach

A generic disaster recovery template you download online simply won't cut it. Your business is built on precious metals and even more precious client trust, and your plan needs to reflect that.

You need to answer very specific questions:

- Inventory Security: What is the protocol for securing every single piece in your showcases and vault during a sudden evacuation order? Who does what, and in what order?

- Data Protection: What happens if your point-of-sale system—holding years of customer history, appraisals, and sales data—is hit by ransomware?

- Reputation Management: How will you communicate with clients whose treasured family heirlooms are in your care for repair when your shop is suddenly inaccessible?

This guide is designed to move past the vague fears and give you concrete, actionable steps. It’s a practical toolkit designed to protect your inventory, your client data, and your hard-earned reputation. Think of it as a different kind of insurance for your jewelry business—one that protects your very ability to operate.

A well-crafted Disaster Recovery Plan (DRP) isn't an expense; it's the operational blueprint that ensures your business can continue. It protects your legacy when the unexpected happens by transforming panic into procedure.

Ultimately, this plan becomes your framework for resilience. It ensures that when an emergency strikes, you and your team have a clear, documented path forward. That preparation is what separates a temporary setback from a permanent closure.

Pinpointing Your Greatest Vulnerabilities

Before you can build a solid plan, you have to know exactly what you’re up against. A generic, one-size-fits-all approach just won’t cut it when your entire business is built on high-value, highly portable assets. This means doing a real, boots-on-the-ground risk assessment tailored specifically to the threats a jeweler faces every single day.

You need to think beyond the obvious stuff like fires and floods. What are the scenarios that actually keep you up at night? A smash-and-grab in the middle of the afternoon? A ransomware attack that locks up your entire client database and POS system? Or that sinking feeling when a high-value piece on consignment just… disappears? These are the real-world threats we need to plan for.

The goal here is to walk through every inch of your operation—your showroom, your workshop, your back office—with a brutally honest eye. We’re looking for the weak spots in your physical security, your digital defenses, and even your day-to-day habits. This isn’t about being paranoid; it's about building a sharp, focused plan that works.

Evaluating Your Physical Security Weaknesses

Your store is your fortress, and it’s time for an inspection. The best way to do this is to think like a thief. Examine every door, window, display case, and storage area as if you were trying to get in. It's amazing what you'll notice when you shift your perspective from owner to adversary.

This is where professional expertise can be a game-changer. Bringing in professional commercial locksmith services can make a world of difference. They can spot vulnerabilities you might miss, assessing everything from your primary door locks and window reinforcements to the integrity of your safes and vaults.

Here are a few key areas to zero in on during your walkthrough:

- Showroom Displays: Are your most valuable pieces properly secured? How fast can you get everything into the safe if you need to?

- Safes and Vaults: When was the last time a professional serviced your safe? More importantly, does it meet the specific requirements laid out in your Jewelers Block insurance policy?

- Access Control: Who has keys? Who has the alarm codes? What’s your protocol for when an employee leaves—do you change the locks or codes immediately?

- Surveillance Systems: Are your cameras actually recording in high-def, and are they covering the critical spots? Where is that footage stored? If a thief takes the DVR, you've got nothing.

Fixing a weak lock or an unmonitored back door today is infinitely cheaper and easier than dealing with the aftermath of a break-in tomorrow.

Uncovering Digital and Operational Risks

In this business, your digital assets are just as critical as your physical inventory. A breach of your Point-of-Sale (POS) system or e-commerce site can be absolutely catastrophic, grinding your business to a halt and shattering the trust you've built with your clients.

Let's be blunt about the numbers. Recent studies show that the average cost of IT downtime is a staggering $5,600 per minute. That works out to over $336,000 an hour. For a small jeweler, an outage lasting just a few hours could be a company-ending event. No sales, no access to inventory, no way to contact customers—you're completely dead in the water.

But risk isn't just about technology; it's baked into your daily routines. Do you have a strict, documented process for handling loose stones and high-value pieces, or does it change depending on who's working? How do you verify the identity of someone picking up a five-figure repair? These operational details are the bedrock of your security, especially when it comes to irreplaceable items like your collection of antique jewelry.

A proper risk assessment isn't a one-time task. It's an ongoing process of questioning your assumptions and continuously looking for potential points of failure before they find you.

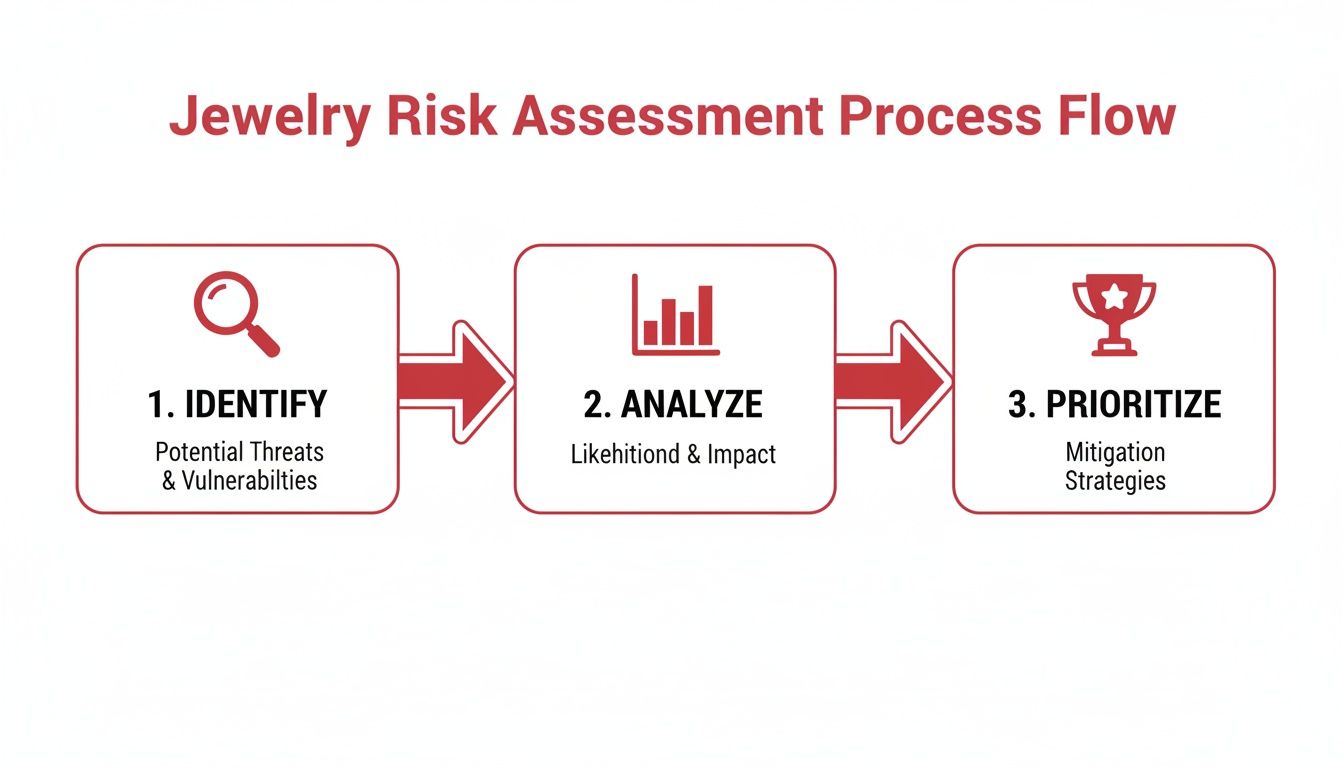

Creating a Prioritized Action Plan

Once you have a list of vulnerabilities, it's easy to feel overwhelmed. The key is to turn that long list into a clear, manageable action plan. A simple risk matrix is the perfect tool for this, helping you organize and prioritize each risk based on its potential impact and the likelihood of it actually happening.

Here’s a simple way to map out the threats you’ve identified. This matrix will help you see what needs your attention right now versus what can be addressed down the line.

Jewelry Business Risk Assessment Matrix

Use this matrix to identify, categorize, and prioritize potential disasters and their specific impact on your inventory, data, and operations.

| Risk Category (e.g., Physical Theft, Cyberattack, Natural Disaster) | Specific Threat Example (e.g., Smash-and-Grab, Ransomware, Hurricane) | Impact on Inventory | Impact on Operations/Sales | Likelihood (Low/Medium/High) | Priority Level |

|---|---|---|---|---|---|

| Physical Theft | Smash-and-Grab | High (Direct Loss) | High (Forced Closure, Fear) | Medium | CRITICAL |

| Cyberattack | Ransomware on POS | Low (No Direct Loss) | High (Sales Halt) | Medium | HIGH |

| Natural Disaster | Hurricane/Flood | High (Damage/Loss) | High (Forced Closure) | Low | MEDIUM |

| Internal Fraud | Employee Theft | Medium (Slow Loss) | Low (Covert) | Low | MEDIUM |

| Utility Failure | Extended Power Outage | Low | High (Sales Halt) | Medium | HIGH |

By visually laying out the threats this way, you can focus your time and money where they will have the greatest effect. A "CRITICAL" priority item, like reinforcing your front windows to prevent a smash-and-grab, obviously needs to be handled immediately. This structured approach transforms the huge task of securing your business into a series of small, achievable steps.

Building Your Core Recovery Strategies

Once you’ve pinpointed your biggest threats, it’s time to build the actual strategies that form the backbone of your disaster recovery plan. This is where the theory gets real. We’re talking about the practical, documented procedures your team will fall back on when the pressure is on and every second matters.

These strategies aren't just abstract ideas; they're your operational playbooks for protecting your most valuable assets. Let's dig into the three core pillars of recovery for any jewelry business: your inventory, your data, and your communications.

The process is simple but critical: you have to systematically identify, analyze, and prioritize what could go wrong before you can build strategies that will actually work.

Protecting Your Precious Inventory

For a jeweler, inventory is everything. A fire, flood, or smash-and-grab doesn't just disrupt business—it can wipe out your entire net worth in minutes. Your recovery plan needs to have explicit, step-by-step instructions for securing these assets at a moment's notice.

Imagine getting a sudden evacuation order for a wildfire or hurricane. Who clears the display cases? What's the exact sequence for locking down the main vault? Documenting this process eliminates the deadly guesswork that happens in high-stress situations.

Beyond your main vault, you absolutely need to consider these crucial inventory protection measures:

- Off-Site Storage: Have a secure, secondary location like a bank safe deposit box ready for your highest-value pieces or critical client consignments. This is a non-negotiable step to distribute your risk.

- Photo-Documented Inventory: Keep a detailed, constantly updated visual catalog of your stock. High-resolution photos of every piece, including hallmarks and unique identifiers, are pure gold when it comes to an insurance claim.

- Emergency Grab-and-Go Kits: Prepare a kit with vault keys, alarm codes, essential tools for moving heavy items, and laminated copies of your security protocols. Keep it somewhere accessible.

A well-documented inventory plan isn't just for recovery. It’s a vital tool for filing a successful claim on your jewelry store insurance. When you have to prove what you lost, that documentation is your most powerful asset.

Safeguarding Your Critical Business Data

While your physical inventory is the most obvious asset, your data is the invisible engine that keeps your business running. Sales records, client lists, custom design files, and appraisal histories are simply irreplaceable. Losing this data can be just as financially devastating as losing a tray of diamonds.

A solid data backup strategy is not optional. The "3-2-1 rule" is the industry-standard framework for a reason: keep three copies of your data, on two different types of media, with one copy stored completely off-site.

This means you can't just rely on a single external hard drive sitting next to your computer.

A fire or flood that takes your primary computer will almost certainly take your on-site backup with it. True data resilience demands a mix of local and cloud solutions to protect you from any disaster you can think of.

Here’s how to structure your data protection strategy:

- Automated Cloud Backups: Use a reputable service to automatically back up critical files every single day. This must include your POS system data, accounting files (like QuickBooks), and your customer database (CRM).

- Local Physical Backups: Don't abandon physical backups. Supplement your cloud system with a local backup to an external hard drive or a network-attached storage (NAS) device. This gives you a lightning-fast way to recover from a simple hardware failure.

- Encrypted Off-Site Copy: Make sure your cloud backup is encrypted. For an extra layer of security, you could even keep a secondary encrypted physical drive at a secure off-site location, updated weekly or monthly.

This multi-layered approach ensures no single event can wipe out your business's operational history. It’s a fundamental part of any modern insurance for a jewelry business policy, protecting the information you need to rebuild customer relationships and get back to making sales.

Establishing an Emergency Communications Plan

When disaster strikes, chaos and confusion become your worst enemies. A clear, pre-defined emergency communications plan ensures you can quickly connect with the people who matter most: your employees, your key suppliers, and your customers.

Your plan should have ready-to-go templates and designated communication channels to prevent panic and let you control the narrative. Trying to figure out what to say and how to say it in the middle of a crisis is a recipe for failure.

Key Communication Components

| Audience | Primary Channel | Key Message Template |

|---|---|---|

| Employees | Group Text / App (e.g., Slack) | "URGENT: Store is closed due to [EVENT]. All staff are safe. Await instructions at [TIME] via [CHANNEL]." |

| Suppliers | Email / Direct Call | "This is an update regarding [YOUR STORE]. We've experienced [EVENT]. We will contact you about outstanding orders by [DATE]." |

| Clients | Social Media / Website | "Our store is temporarily closed due to an emergency. We are working to assess the situation and will provide updates here." |

For clients with pieces in for repair, you need a more direct and personal touch. Your plan should outline how to contact them individually to provide reassurance and a timeline for when they can expect more information. This kind of proactive communication is absolutely essential for maintaining the trust that is the bedrock of any successful jewelry business.

Integrating Jewelers Block Insurance Into Your Plan

A solid disaster recovery plan is what gets your business doors back open, but it’s your insurance that makes you financially whole again. For a jeweler, trying to get by with a standard business owner's policy is a dangerous gamble. It’s simply not built for the unique, high-stakes world you operate in.

This is where specialized Jewelers Block insurance becomes the absolute financial pillar of your recovery.

Think of it this way: your disaster recovery plan for a small business is the operational playbook that tells you how to handle and document a catastrophe. Your insurance policy is what actually provides the cash to replace that stolen inventory and rebuild. The two are inseparable partners in your survival.

Why Standard Insurance Falls Short for Jewelers

A generic policy might cover a fire or a burst pipe, sure. But it will almost certainly have massive, glaring gaps when it comes to the real-world threats that actually keep jewelers up at night.

Standard policies almost never cover scenarios like:

- Mysterious Disappearance: A high-value diamond is there in the morning but gone by closing, with absolutely no sign of theft.

- Theft from a Showcase: A slick thief distracts your staff and palms a piece right in the middle of business hours.

- Goods in Transit: Loss or damage to jewelry being shipped to a client or moved between your stores.

- Employee Dishonesty: Coverage for the painful losses that come from internal theft.

These specific risks are precisely what a dedicated insurance for a jewelry store is designed to cover. It’s built from the ground up to protect your unique assets, no matter where they are.

Aligning Your DRP with Your Insurance Policy

Your disaster plan and your insurance policy have to speak the same language. An expert agency, like First Class Insurance Jewelers Block Agency, will help you line up your operational rules with your coverage requirements. For instance, your policy will have specific demands for safe ratings, alarm systems, and how you handle inventory.

Your disaster recovery plan must bake in and enforce these policy requirements. Failing to follow the security protocols laid out in your insurance contract is one of the fastest ways to get a claim denied, leaving you with a devastating, business-ending loss.

This alignment is non-negotiable. It ensures the steps you take in a crisis are the same ones that lead to a fast, successful claim settlement. Reputable underwriters, including those from organizations like Lloyd's of London, expect and demand this level of operational discipline.

The Critical Role of Accurate Valuations

The foundation of any successful insurance claim is rock-solid, up-to-date documentation. This is an area where far too many businesses tragically fall short. A U.S. Chamber of Commerce Foundation survey found a shocking gap: while 94% of businesses think they’d recover from a disaster, a mere 26% actually have a plan. This blind spot is often most obvious in poor paperwork.

Your disaster recovery plan needs a non-negotiable process for keeping a perpetual inventory. For every single high-value piece, you must have:

- High-resolution photos from multiple angles.

- Detailed descriptions, including serial numbers, carat weights, and unique markings.

- Current appraisals or valuation documents.

Store this information securely in two places: a physical, fireproof safe and a cloud-based service. When you have to file a claim, this detailed evidence becomes your best friend. It cuts through disputes over value, speeds up the entire process, and helps you get a quote for Jewelers Block coverage that actually reflects your true risk—ensuring you’re never left underinsured when it matters most.

Putting Your Recovery Plan to the Test

Creating a disaster recovery plan is a huge first step, but a plan sitting in a binder is just paper. Its true value only comes to light when you know—with absolute certainty—that it works in the real world. This is where you bring that plan to life, building the muscle memory your team needs to act decisively when a crisis hits.

A plan that hasn't been tested is, frankly, a plan that's likely to fail. You don't want to discover a critical flaw, like an old phone number for your alarm company or a corrupted backup drive, in the middle of a real emergency. Testing is how you turn a theoretical document into a reliable, battle-ready tool.

Running Realistic Drills and Tabletop Exercises

The single best way to validate your plan is through tabletop exercises. Think of these as structured walkthroughs. You get your team together and talk through a specific disaster scenario, step-by-step, without the pressure of an actual event. It's a low-stress way to find gaps, clarify roles, and make sure everyone knows exactly what to do.

Let's imagine a scenario: a sudden city-wide power outage during peak business hours.

- Who is responsible for manually securing the showcases and the vault?

- What's the protocol for a customer who's mid-transaction?

- How do you switch to your backup payment processor on a mobile device?

Just walking through these questions as a team will immediately expose weak points. You might realize the person with the only vault key left an hour ago, or that your backup internet hotspot has a dead battery. These are the simple, devastating problems that drills are designed to uncover before they can cause real damage.

A disaster recovery plan is a hypothesis. A tabletop exercise is the experiment that proves it. Running these drills transforms your plan from a list of 'shoulds' into a set of practiced, reliable actions.

Annual Reviews and Continuous Improvement

Your business isn't static, so your recovery plan can't be either. It absolutely has to be a living document, updated regularly to reflect changes in your staff, technology, and operations. An annual review is the bare minimum.

Set a dedicated time each year to go through the entire plan. But you should also treat certain business changes as triggers for an immediate review, such as:

- New Key Employees: Make sure any new manager or keyholder is fully trained on their role in an emergency.

- Technology Upgrades: A new POS system, alarm panel, or security camera setup means your recovery procedures need an immediate update.

- Changes to Your Insurance Policy: If you update your Jewelers Block insurance, check that your recovery protocols still meet the policy’s requirements for things like security and inventory reporting.

- Physical Renovations: A change to your store's layout could completely alter evacuation routes or security protocols.

To make sure your plan actually works, you have to emphasize the importance of regular backup and continuity drills, validating every single step. This constant cycle of testing and refining is what turns a disaster recovery plan for a small business into a truly resilient shield.

Ensuring Critical Documents Are Always Accessible

In the middle of a crisis, the last thing you want is to be hunting for a piece of paper. Your plan is useless if you can't get to it when your store is flooded or the power is out. That's why having both physical and digital copies of your essential documents is non-negotiable.

Your "go-bag" of crucial information has to include:

- Updated Contact Lists: Every employee, key supplier, your insurance agent, and local emergency services.

- Inventory Records: Your most recent, detailed inventory list, complete with photos and valuations.

- Insurance Documents: A full copy of your insurance for jewelry business policy, especially the declaration page and the contact info for the claims department.

The best practice is a two-pronged approach. Keep hard copies in a fireproof, waterproof safe you can grab on your way out the door. At the same time, store encrypted digital copies in a secure cloud service. This redundancy ensures that whether you're dealing with a fire, a server crash, or a city-wide evacuation, your roadmap to recovery is always within reach.

Common Questions About Jewelry Business Recovery

When we start talking about a disaster recovery plan for a small business, a lot of the same questions come up. As a jeweler, your concerns are a unique mix of high-value inventory and the deep trust you've built with clients. Let’s clear up some of the most common queries we hear.

Do I Really Need a Formal Plan?

Absolutely. The truth is, the smaller your jewelry business, the more a single event can knock you out for good. A smash-and-grab, a fire, or even a week-long power outage can be an existential threat to an independent jeweler who doesn't have the deep pockets of a major chain.

A "formal" plan doesn't have to be some hundred-page binder that gathers dust. Think of it as your survival toolkit—a clear, organized document with key contacts, inventory records, Jewelers Block insurance details, and simple procedures to follow when things go sideways. It’s this preparation that gets a small business back on its feet while others are forced to close their doors for good.

How Often Should I Update My Inventory for Insurance?

In a business where high-value, portable assets are always moving, your inventory is never static. The gold standard is a perpetual inventory system that you update with every single sale and new piece. This keeps your day-to-day operations tight and your records accurate.

For insurance and recovery purposes, though, you have to be even more diligent.

- At a minimum, do a full physical inventory twice a year and square it with your digital records.

- Get into the habit of photographing and documenting any new high-value pieces the moment they arrive.

- Keep your agent at a provider like First Class Insurance Jewelers Block Agency in the loop with these updated valuations. This is how you guarantee your insurance for a jewelry store policy actually covers what you have and you don't get stuck underinsured after a loss.

What Is the Most Important First Step?

The single most critical first step is a practical risk assessment. You can't protect your business if you don't know what you're protecting it from. It’s the foundation for your entire disaster recovery plan for a small business.

Seriously, take a few hours. Walk through your store and think about the real, credible threats you face. Go beyond the obvious like fires and floods—what about a smash-and-grab robbery? A ransomware attack that locks up your customer database? Even something like internal theft.

Once you’ve identified your top five vulnerabilities, everything else falls into place. Your data backup strategy, the specific riders on your insurance for jewelry business coverage—it all becomes clearer and more targeted. This one step turns a huge, intimidating task into a manageable plan of action.

Isn't Business Interruption Coverage Enough?

Business interruption coverage, a key part of your Jewelers Block insurance policy, is a lifesaver, but it's only one piece of the puzzle. It’s designed to replace lost income while your shop is closed, but it doesn't tell you how to get the doors open again.

Here’s the difference: your insurance policy is what pays the bills, but your disaster recovery plan is the roadmap that gets the business running again. The plan is what tells you who to call, how to recover your client data, how to manage customer communications, and how to get your suppliers back on board. One provides the money for the recovery; the other makes the recovery actually happen.

A solid disaster recovery plan, working hand-in-hand with specialized insurance, is the best defense for your jewelry business. At First Class Insurance, we offer the expert guidance and tailored coverage you need to protect your assets and secure your legacy. Get a Quote for Jewelers Block and start building a more resilient future today.