Imagine you're shipping your most valuable pieces to a private client or heading to a major trade show. The moment that inventory leaves your storefront, your standard property insurance likely stops working, creating a massive—and terrifying—risk gap. This is precisely where inland marine insurance steps in, acting like a protective bubble that travels with your assets wherever they go.

Why Your Assets Need Protection Beyond the Storefront

As a jeweler, your inventory is everything. Unlike your display cases and computers, which are covered by standard property insurance, your diamonds, watches, and finished pieces are constantly on the move. They travel between suppliers, appraisers, shows, and clients, exposing them to a whole different level of risk.

This is the fundamental problem that a standard insurance policy just can't solve. Those policies are built for static property at a single address. The second a high-value item leaves that address, it’s often completely uninsured, leaving you dangerously exposed to theft, damage, or just plain disappearing.

Where Does a Name Like "Inland Marine" Come From?

The term "inland marine" is admittedly confusing. It has absolutely nothing to do with boats or water. It’s an old industry term meant to distinguish the transportation of goods over land from "ocean marine" insurance, which covers property shipped over the sea.

Inland marine insurance was created for one specific reason: to cover property that is mobile, in transit, or temporarily in someone else's care. For a jeweler, that describes a normal Tuesday.

This coverage evolved to fill a critical hole in the market. Its roots go back to early 20th-century policies designed to protect a merchant’s stock as it moved by rail or truck, plugging the gaps left by traditional fire and ocean marine policies.

A Modern-Day Must-Have for Any Jewelry Business

Today, a solid inland marine policy is the backbone of any real protection plan for a jeweler. It’s a specialized type of property coverage that sticks to your assets, providing a seamless shield of protection no matter where they are.

This includes inventory that is:

- Shipped via carriers like FedEx, UPS, or armored transport.

- With a traveling salesperson on the road.

- On display at a trade show or exhibition.

- Temporarily with a setter or repair shop.

- Out on memo with another retailer.

This specialized insurance is built for the dynamic, high-stakes nature of the insurance for a jewelry business. Understanding its role is the first step to truly protecting your most valuable assets, like the ones you can see in our image gallery, and securing your company’s future. At the First Class Insurance Jewelers Block Agency, our specialists build these exact types of protective programs.

Understanding Jewelers Block: The Ultimate Protection Policy

For anyone in the jewelry business, the most critical form of inland marine insurance you’ll encounter is a Jewelers Block policy. Think of it less as a single policy and more as a master key that unlocks layers of protection, all bundled into one seamless plan.

It’s the gold standard for a reason. This specialized coverage is built from the ground up to handle the unique, high-stakes risks that jewelers face every single day. It goes far beyond the limits of standard business policies to create a comprehensive shield around your most valuable assets.

More Than Just Inventory Coverage

A common mistake is thinking a Jewelers Block insurance policy only covers the finished pieces in your display case. The reality is that its protection is far broader, designed to guard your assets throughout their entire journey within your business.

This all-in-one approach means your coverage extends to:

- Your primary stock: This covers your finished jewelry, loose stones, precious metals, and watches held for sale.

- Items in progress: It protects pieces being worked on at the bench, from raw materials to nearly completed creations.

- Customer property: The policy safeguards jewelry, watches, and other items left in your care, custody, or control for repair, appraisal, or consignment. This is a huge one.

- Goods on memo or consignment: This includes inventory you've sent to other retailers or received from suppliers.

Essentially, it creates a protective net around nearly every valuable asset that’s part of your business, which is why it’s the absolute cornerstone of proper jewelry store insurance.

A Shield Against a Wide Array of Perils

The true power of a Jewelers Block policy is its "all-risk" foundation. Instead of listing only what is covered, these policies cover losses from every possible peril except for those specifically named in the exclusions. This structure provides exceptionally broad protection.

A solid policy will protect your assets whether they are on your premises, locked in a vault, being shipped, or out with a salesperson on the road. For example, having robust insurance for courier services is crucial for protecting items in transit, and this is a key component often built directly into a well-designed block policy.

The most common scenarios covered include:

- Theft: This includes burglary (forced entry), robbery (theft using force or threats), and even grab-and-run shoplifting.

- Fire and Natural Disasters: Provides coverage against damage from fires, floods, earthquakes, and other specified natural events.

- Damage: It covers accidental damage to your inventory, whether it happens in your store or during transport.

- Mysterious Disappearance: This is a game-changer. It covers unexplained losses where there’s no clear evidence of theft—like an item being present for the morning inventory count but gone by closing time.

This broad protection is why a Jewelers Block policy isn't just an option—it's a necessity for anyone serious about complete insurance for a jewelry store. It addresses the real-world situations that standard policies simply ignore.

Jewelers Block vs Standard Business Property Insurance

It's easy to assume your standard business owner's policy (BOP) has your inventory covered. For a jeweler, that's a dangerous assumption. This table breaks down why a specialized Jewelers Block policy is in a league of its own.

| Coverage Feature | Jewelers Block (Inland Marine) | Standard Business Property Insurance |

|---|---|---|

| Basic Premise | "All-Risk" (covers everything unless excluded) | "Named Peril" (only covers specifically listed risks) |

| Inventory in Transit | Yes, covered while shipped, with salespeople, etc. | No, coverage typically ends at the property line. |

| Customer Property | Yes, covers items left for repair, appraisal, or sale. | No, requires a separate, often limited, Bailee policy. |

| Mysterious Disappearance | Yes, a key feature for unexplained losses. | No, requires evidence of a covered peril like theft. |

| Off-Premises Coverage | Yes, covers inventory at trade shows or on memo. | No, limited to the insured business address. |

| Coverage Limits | High limits tailored to the value of jewelry stock. | Very low sub-limits for theft of valuable items. |

The takeaway is simple: standard property insurance is designed for desks, computers, and general merchandise—not for a dynamic, high-value inventory like jewelry.

At First Class Insurance, we specialize in structuring these policies to match the specific operational risks of each client. Whether you're a retail storefront, a wholesaler, or a private designer, the goal is to leave no gaps in your asset protection. By working with a specialist, you ensure your policy is built for your business, not just a generic template.

Essential Inland Marine Coverages for Jewelers

Think of a Jewelers Block policy as the foundation of your business's protection. It's solid, essential, and covers everything within your four walls. But the minute your inventory leaves the building, you step into a world of completely different risks. That’s where specialized inland marine coverages come in.

These policies aren't just add-ons; they're precision tools designed to follow your assets wherever they go. A truly comprehensive insurance plan anticipates every single scenario—from a simple FedEx shipment to a major trade show—and makes sure there are no gaps.

Protecting Goods in Transit

One of the most nerve-wracking moments for any jeweler is when a valuable piece is in transit. Whether you're sending a custom engagement ring to a client or receiving a parcel of loose diamonds from a cutter, that item is completely out of your control. This is exactly what Transit Coverage is for.

This policy protects your goods from the second they leave your possession until they are safely signed for at their destination. It’s designed to cover the real-world risks of shipping:

- Theft: Protection if a package is stolen, a truck is hijacked, or an item mysteriously disappears from a carrier’s hub.

- Damage: Covers you if a parcel is crushed, dropped, or otherwise mangled during its journey.

- Loss: Safeguards against a shipment that simply vanishes without a trace.

Relying on the carrier’s declared value is a rookie mistake. Their liability is often pennies on the dollar, leaving you to foot the bill for a catastrophic loss.

Safeguarding Inventory on the Road

Your sales team is your lifeblood, but their travel also represents a massive, mobile risk. A Salespersons Floater is an inland marine policy that travels right along with them, protecting the "line" of jewelry they carry.

Picture this: your top salesperson has their car broken into at a hotel overnight, and their entire sample case is stolen. A standard policy won't touch this. The Salespersons Floater is the specific coverage built to respond to this exact, devastating scenario.

This is non-negotiable coverage for any jeweler who conducts off-site appointments, trunk shows, or client visits. It protects the merchandise whether it’s in their vehicle, at a hotel, or on a display pad in a client's office. The growing complexity of supply chains is a key reason the inland marine insurance market is projected to grow at a 6% CAGR through 2030. As more high-value goods move across North America and Europe, the need for this specialized protection only intensifies, a trend explored further in the inland marine insurance market's growth report on cognitivemarketresearch.com.

Coverage for Exhibitions and Trade Shows

Trade shows are a fantastic opportunity for sales and networking, but they are also a high-stakes concentration of risk. You have an incredible amount of inventory in a temporary, crowded, and often chaotic environment. Exhibition and Trade Show Coverage is built for this very situation.

This policy protects your stock for the entire event lifecycle, including:

- While it's being set up at your booth and taken down afterward.

- During the show itself, covering risks like grab-and-run theft or damage.

- In transit to the convention center and on the return trip.

While a Jewelers Block policy might offer some limited coverage for shows, it often comes with strict sub-limits or conditions. A dedicated exhibition policy ensures your limits are high enough for the concentrated value you're displaying. At First Class Insurance, our experts know how to blend these coverages perfectly. We’re here to help you get a quote for Jewelers Block that truly fits the way you do business.

Navigating the Underwriting and Claims Process

Getting the right inland marine insurance policy is a huge first step, but what happens next is just as important. You need to understand how insurers think during the underwriting process and what to do when you actually have to file a claim.

Knowing how these two sides of the coin work makes you a better partner to your insurer. It can even lead to better rates and a much smoother resolution if something goes wrong. Let's pull back the curtain on these two critical phases of your Jewelers Block insurance.

The Art and Science of Underwriting

When you apply for insurance for a jewelry store, underwriters essentially become risk detectives. Their whole job is to dig into the details of your business and figure out how likely you are to file a claim down the road. This isn't just a numbers game; it's about building a complete, 360-degree view of your operation.

They meticulously review a handful of key factors to build your risk profile. Think of it like a full-blown security audit—every strength you have can lower your perceived risk, and every weakness can raise it.

Here’s what’s under their microscope:

- Inventory Value and Composition: Underwriters look at the total value of your stock, from loose diamonds to finished watches. Naturally, a higher value means a higher potential risk.

- Physical Security Systems: This is a big one. They'll want to know everything about your safes (TL-15 or TL-30 ratings), your alarm systems (including cellular backups), and your high-def surveillance cameras.

- Operational Protocols: Strong, consistent procedures matter. This means things like strict opening and closing checklists, dual-control policies for accessing high-value items, and secure travel protocols for your sales team.

- Claims History: Your track record is one of the best predictors of future risk. A clean history shows you're on top of your risk management, which can lead to much better terms.

Once you understand what they're looking for, you can proactively strengthen your security and fine-tune your procedures. You're not just buying insurance; you're presenting your business as a responsible, low-risk partner.

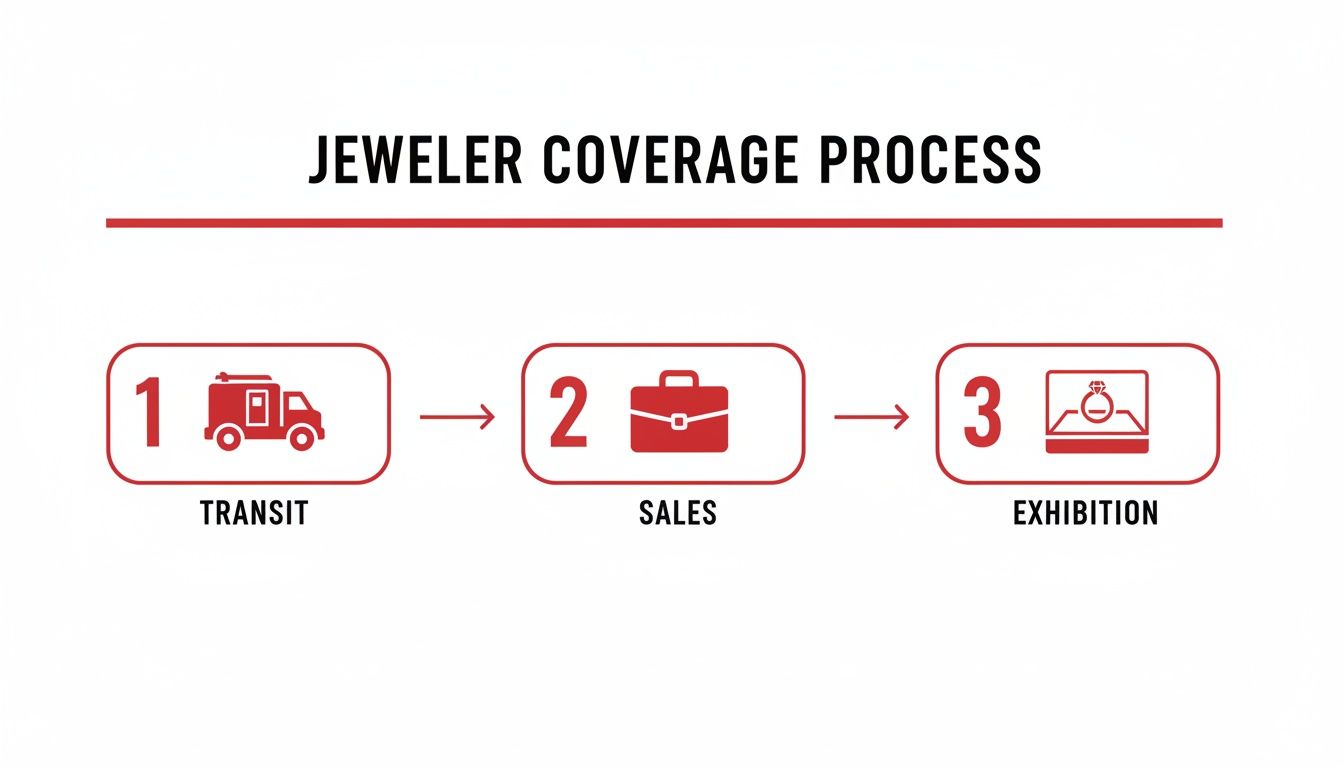

This visual shows exactly how a solid policy protects your assets at every stage—from the moment they're in transit to the final sale.

It highlights that real protection isn't just about what happens inside your store, but also covers the critical—and often vulnerable—moments when your inventory is on the move.

A Step-by-Step Guide to the Claims Process

Let's be honest, nobody wants to file a claim. But being prepared can make an incredibly stressful situation far more manageable. When a loss happens—whether it's a theft, damage, or a mysterious disappearance—a clear, methodical approach is your best bet for a prompt and fair resolution.

The moments right after a loss are critical. What you do can seriously impact the outcome of your claim, so knowing the right steps is vital to protecting your business.

If you find yourself in this situation, here’s how to navigate the process:

- Prioritize Safety and Secure the Scene: First things first, make sure you and your staff are safe. Then, secure the premises to prevent any further loss, but be careful not to disturb the scene until the police have done their work.

- Contact Law Enforcement Immediately: For any kind of theft, file a police report right away. This official report is a non-negotiable document for your insurance claim.

- Notify Your Insurance Agent: Call your agent at the First Class Insurance Jewelers Block Agency as soon as you possibly can. We’re your primary advocate and will walk you through the specific steps your policy requires.

- Document Everything Thoroughly: Start gathering all your paperwork. This means detailed inventory records for the missing or damaged items, recent appraisals, sales receipts, and any surveillance footage you have. The more proof you provide, the smoother the process will be.

- Cooperate with the Claims Adjuster: Your insurer will assign a claims adjuster to investigate the loss. Be ready to answer their questions and give them all the documentation you've collected. Working with them openly and honestly is the fastest way to a fair settlement.

Getting through a claim successfully is all about being prepared, organized, and proactive. When you partner with a specialist who lives and breathes insurance for a jewelry business, you have an expert in your corner every step of the way. You can learn more about the trusted underwriters we work with, such as Lloyd's of London, in our partners section.

How Practical Risk Management Lowers Your Premiums

Your inland marine insurance premium isn't some arbitrary number. It’s a direct reflection of how much risk an underwriter sees in your business. By taking charge of those risks, you don't just protect your inventory—you get to actively drive down your insurance costs.

Think of it as a partnership with your insurer. When you can prove you’re serious about security, you give them the confidence they need to offer you better terms and lower premiums. This commitment is one of the most powerful financial levers you can pull for your insurance for a jewelry store.

Bolstering Your Physical Security

The most obvious sign of a well-protected business is its physical defense system. This is the first thing underwriters look at. A smart investment here can pay for itself through savings on your Jewelers Block insurance policy.

These are the non-negotiables:

- High-Grade Safes: A UL-rated TL-30 safe isn't just a suggestion; it's the industry standard. This rating means it can resist a professional tool-based attack for at least 30 minutes, which is often more than enough to send a burglar running.

- Modern Alarm Systems: Your alarm needs layers—motion sensors, door contacts, and glass-break detectors. The most critical feature? A cellular backup. If the phone lines get cut, your system still calls for help.

- HD Surveillance: Crystal-clear HD cameras covering every entry point, display case, and back room are your best friend after an incident. They provide undeniable evidence and act as a massive deterrent.

Strengthening Your Procedural Security

What your team does day-in and day-out is just as important as the locks on your doors. Solid, consistently followed procedures show underwriters that you’re minimizing opportunities for theft, both from the outside and within.

Start by getting these operational rules locked down:

- Meticulous Inventory Management: You need a perpetual, itemized inventory that's updated daily. This isn't just for spotting a missing piece quickly; it's absolutely essential for filing an accurate and fast claim.

- Strict Opening and Closing Protocols: Create a checklist for opening and closing that is followed without exception. This means checking every lock, arming the alarm, and securing all high-value pieces in the safe overnight. Every single time.

- Regular Staff Training: Your team is your first line of defense. Run regular training drills on security awareness, how to spot suspicious behavior, and exactly what to do during a robbery.

A crucial element in managing risk—and lowering premiums—is ensuring the authenticity of your high-value inventory. Consulting an expert authentication guide to identify genuine items is a key step in this process.

Securing Assets During Travel and Transit

Your inventory is never more vulnerable than when it's on the move. Whether it’s with a traveling salesperson or in the hands of a shipping carrier, having a rock-solid plan for transit security is a must.

Drill these best practices into your team:

- Never, ever leave merchandise unattended in a vehicle—not even for a minute.

- Avoid predictable patterns. Vary travel routes and schedules.

- Use discreet, unmarked cases that don't scream "valuable jewelry inside."

- Always maintain a detailed list of every single item being carried off-site.

By putting these risk management strategies into action, you stop being a passive insurance buyer and start actively shaping your costs. When you're ready to show insurers your commitment to security, contact the First Class Insurance Jewelers Block Agency. We can help you get a quote for Jewelers Block that actually rewards your hard work.

Finding The Right Partner For Custom Protection

Picking the right insurance partner is just as important as picking the right policy. A general business insurance agent might get the basics, but they simply don't live and breathe the high-stakes, nuanced world of a professional jeweler. This is where partnering with a true specialist becomes a powerful strategic move for your business.

A specialist in Jewelers Block insurance isn't interested in one-size-fits-all coverage. Their first step is a deep dive into how your business actually works. Are you a retail shop with tons of foot traffic? A wholesaler moving inventory constantly? Or a private jeweler meeting clients one-on-one? Each one carries a completely different risk profile.

The Real Value Of An Industry Expert

A true specialist knows that no two jewelry businesses are the same. The kind of protection a retailer needs for a huge public-facing display is fundamentally different from the insurance for a jewelry business that operates mostly through secure shipping and private sales. Getting that distinction right is the key to building a real shield around your assets.

An experienced agency like First Class Insurance Jewelers Block Agency doesn't just sell you a policy and walk away. We act more like a risk management consultant, working with you to understand your day-to-day operations and spot potential weak points before they turn into expensive claims.

Choosing a specialist means you're not just buying a product; you're gaining an advocate. They use their deep industry knowledge and strong underwriter relationships to build a program that is both airtight and cost-effective.

Building A Truly Custom Insurance Program

This is where a specialist really proves their worth. They have established relationships with the top-tier underwriters—the companies that actually take on the risk—and can negotiate the best possible terms for you. They know which carriers are best for specific risks, whether it's high-value transit, international trade show exhibitions, or unique custom design work.

This all leads to an insurance program that covers your business from every conceivable angle, including:

- Tailored Coverage Limits: Making sure your policy limits accurately reflect the true, fluctuating value of your inventory, especially during your busiest seasons.

- Cost-Effective Premiums: By presenting your business as a well-managed risk to the underwriters, a specialist can often secure much better pricing.

- Responsive Service: From a simple process to get a quote for Jewelers Block to having an expert you can actually call to walk you through a claim, great service is everything.

At the end of the day, the right partner provides more than just a piece of paper. They offer peace of mind, because you know you have a dedicated advocate who understands your world inside and out. To see how a specialized agency makes a difference, check out our insights on industry events like the upcoming International Gem & Jewelry Show on jewelersblockins.com.

Common Questions About Jewelers Insurance

Diving into the world of Jewelers Block insurance can feel complicated. As a very specific type of inland marine insurance, it doesn't play by the same rules as your standard business policy. Let's clear up some of the most common questions we hear from jewelers.

Is My Standard Business Property Insurance Enough for My Jewelry Inventory?

Almost certainly not. Think of your standard business property policy as being designed to protect things that stay put—your display cases, your computers, the safe itself. It has painfully low limits for valuable items like jewelry and offers almost zero protection the second your inventory walks out the door.

A Jewelers Block insurance policy is built for property on the move. It’s designed to cover your inventory whether it’s sitting in your store, being shipped to a client, on display at a trade show, or in a salesperson’s briefcase on the road.

What Is Mysterious Disappearance and Why Is It Important?

Mysterious disappearance is exactly what it sounds like: coverage for when an item is simply gone, and you have no idea how. You log a diamond ring in your morning count, but by closing time, it has vanished. There’s no sign of a break-in, no camera footage of a theft—it's just gone.

Standard insurance policies will almost always deny that claim. But for a jeweler, whose entire business is built on small, high-value items, this coverage is an absolute lifeline. It's the safety net for those strange, unexplainable losses that, unfortunately, are a real-world risk in this business.

How Should I Value My Inventory for My Insurance Policy?

This is critical: you have to get your valuation right to get paid correctly after a loss. Your best bet is to run a perpetual, itemized inventory system that gets updated daily. No exceptions.

For your jewelry store insurance, your valuations should always be based on your actual cost to create or acquire the piece—that includes materials and labor—not the retail price tag. For custom jobs or very high-value items, you absolutely need to keep recent, independent appraisals on file. Always go over your total inventory value with your insurance agent to make sure your policy limits are high enough, especially before you head into a busy season.

What Are the First Steps After Discovering a Theft or Loss?

First, and most importantly, make sure you and your staff are safe. Your very next call is to the police to file an official report. That report is a non-negotiable requirement for any insurer.

As soon as that's done, call your insurance agent. Secure the building to prevent any more losses, but be very careful not to contaminate the crime scene before the police have had a chance to investigate. From there, start pulling together your documents: inventory records for the missing pieces, any surveillance footage you have, and anything else that can help build the claim.

Ready to secure your peace of mind with protection designed for your unique risks? The team at First Class Insurance is here to help you build a policy that fits your business perfectly. Get a quote for Jewelers Block coverage by visiting us at https://firstclassins.com.