So, you're wondering, "how much is engagement ring insurance?" The answer is refreshingly simple. Most of the time, you can expect to pay between 1% and 2% of your ring's appraised value each year.

That means a $10,000 ring would cost you somewhere between $100 and $200 annually to protect. It's a small price for some serious peace of mind.

The True Cost Of Protecting Your Investment

That brilliant new ring on your finger is so much more than a beautiful piece of jewelry—it's a massive financial and emotional investment. The thought of it being lost, stolen, or damaged is gut-wrenching, but ignoring that risk is a far bigger gamble.

Thankfully, buying that peace of mind is surprisingly affordable.

Understanding The 1-2% Rule

The industry standard for figuring out your premium is pretty straightforward. Insurers just take a small percentage of the ring's total appraised value. While you’re thinking about protecting your ring, it’s worth noting how this small cost fits into the bigger picture of the average wedding cost NZ.

This 1-2% rule of thumb makes it incredibly easy to get a ballpark idea of your annual cost. If your ring is appraised at $5,000, you’re looking at an annual premium between $50 and $100. For a more common $10,000 ring, it’s about $100 to $200 a year for full coverage against theft, loss, or damage.

For what often amounts to less than a few fancy coffees a month, you can protect a symbol of your commitment. That small annual fee is nothing compared to the devastating financial hit of replacing an uninsured ring out of pocket.

Estimated Annual Insurance Premiums By Ring Value

To give you a clearer picture, this table provides a quick glance at typical annual insurance costs based on the 1-2% rule for common engagement ring values.

| Appraised Ring Value | Estimated Annual Premium (1%) | Estimated Annual Premium (2%) |

|---|---|---|

| $5,000 | $50 | $100 |

| $8,000 | $80 | $160 |

| $12,000 | $120 | $240 |

| $20,000 | $200 | $400 |

As you can see, the cost to protect your investment is very manageable.

Whether you're an individual with a high-value piece or a local jeweler managing inventory, understanding these numbers is the first step toward smart protection. For businesses or significant personal collections, specialized coverage like Jewelers Block insurance from an expert like First Class Insurance Jewelers Block Agency provides robust protection that standard policies just can't match.

This small investment ensures your most cherished assets are secure. It’s not just a transaction; it's a strategy for keeping your valuables safe. https://jewelersblockins.com/wp-content/uploads/2025/11/diamond-ring-on-black-background-first-class-insurance-scaled-1-1536×1024.jpg

Decoding The Factors That Shape Your Premium

That 1-2% rule of thumb is a great place to start, but it's far from the final word on what you'll actually pay for engagement ring insurance. Think of your premium like a custom recipe—the final cost is a unique blend of several key ingredients, each one influencing the outcome.

Insurers aren't just pulling numbers out of thin air. They're carefully weighing these factors to calculate a price that matches the specific risk they're taking on. Once you understand what those variables are, the whole process makes a lot more sense.

Your Ring’s Appraised Value

This is the big one. The single most important factor driving your premium is the official, appraised value of your ring. A recent, certified appraisal establishes the replacement cost, which becomes the foundation of your entire policy.

It’s simple math: the higher the ring's value, the higher the premium. An insurer's potential payout is just plain bigger. For example, knowing how much a 3 carat ring costs gives you a sense of the stakes. A $25,000 ring will always cost more to insure than a $5,000 one because the financial risk for the insurer is five times larger. This is exactly why a professional appraisal isn't just a suggestion; it's non-negotiable.

The Deductible You Choose

Your deductible is simply the amount you agree to pay out-of-pocket before your insurance kicks in to cover the rest. It’s your share of the risk, and it gives you a direct way to control your premium.

A higher deductible signals to the insurer that you're willing to handle smaller claims yourself, which lowers their risk. In return, they lower your premium.

- $0 Deductible: This is the ultimate convenience—if you file a claim, the insurer covers the entire cost. But that peace of mind comes with a higher annual premium.

- $500 Deductible: You'd pay the first $500 of a claim. By sharing a bit of the risk, you'll see a noticeable drop in your yearly cost.

Choosing a higher deductible is one of the easiest ways to make your policy more affordable, just be sure it's an amount you could comfortably pay if you ever needed to.

Insurers see a $0 deductible as a higher risk because policyholders might be more inclined to file claims for minor damages. By opting for a modest deductible, you can often achieve significant savings on your premium.

Your Geographic Location

Believe it or not, your zip code plays a real role in what you'll pay. Insurers rely on a mountain of data to figure out the risk of theft and loss in different areas.

Living in a major city with higher crime statistics will usually lead to a higher premium than if you live in a quiet, rural town. Your address is a direct input into their risk calculation. While you obviously can't move just to get a better insurance rate, it helps explain why quotes for the exact same ring can vary so much from one city to the next.

This same location-based risk applies to all kinds of fine jewelry, including items like

Choosing Your Coverage: Standalone Policy Vs. Homeowners Rider

When it comes to insuring your engagement ring, you’ll find yourself at a fork in the road with two main options. You can either add it to your existing homeowners or renters insurance as a "rider," or you can get a specialized, standalone jewelry policy.

This isn’t just a minor detail—it's a critical decision. One path offers convenience, but the other provides focused, often superior, protection built specifically for a high-value piece like an engagement ring. Understanding the real-world differences is the key to safeguarding your investment properly.

The Homeowners Rider: An Easy But Risky Option

Adding a rider (sometimes called a "floater" or "endorsement") to your home insurance is the path many people take, mostly out of habit. It seems simple enough, since you’re just calling up the company you already work with. But that convenience can mask some serious risks and coverage gaps.

Here's the problem: standard homeowners policies are built to protect your house, not your jewelry. They often cap jewelry theft at a paltry $1,000 to $2,000. That’s a huge gap when you consider the average ring costs around $5,200. A rider raises this limit, but it doesn't always give you the comprehensive protection you think you're getting.

But the biggest issue is this: filing a claim for your ring through your homeowners policy counts as a claim against your primary property insurance. This can cause your entire home insurance premium to skyrocket at renewal. Worse, it could even lead to your insurer dropping you if you have other recent claims. Suddenly, that lost ring is putting your whole home's coverage in jeopardy.

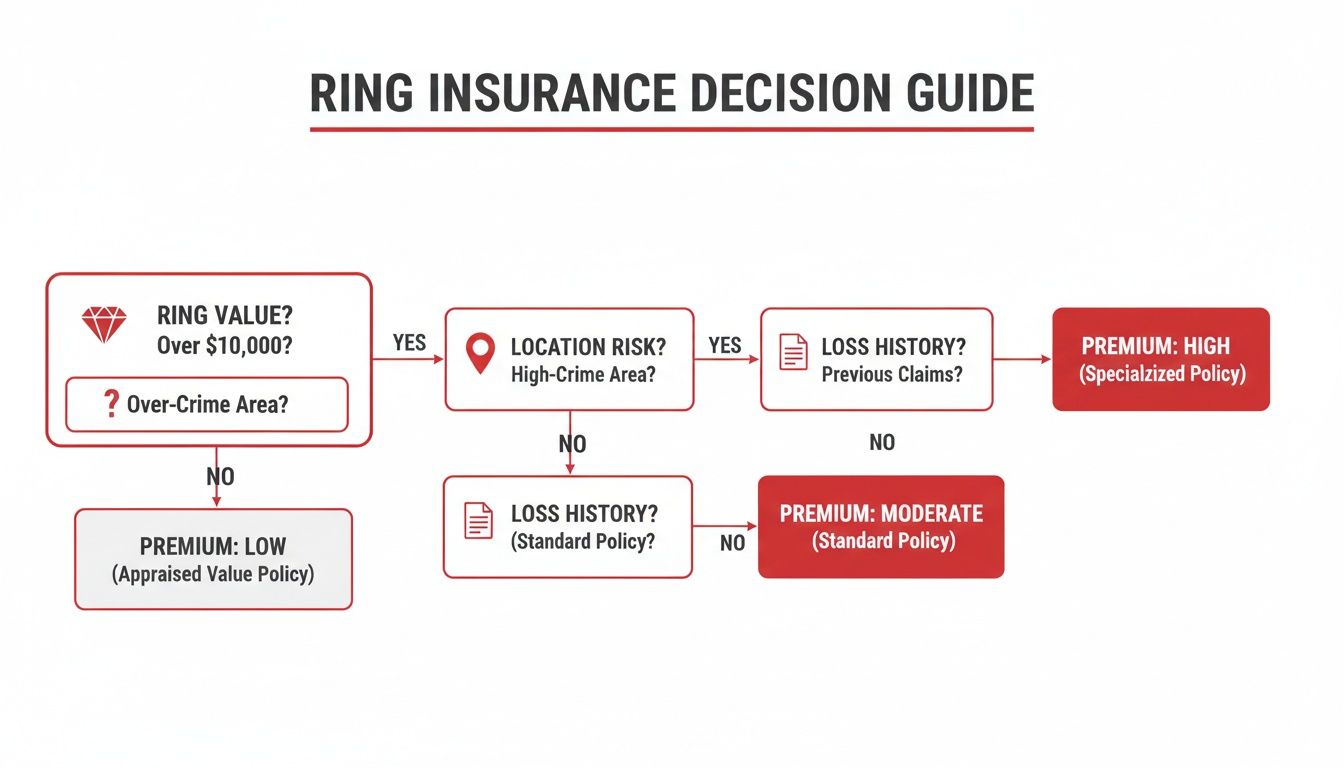

This is where you need to weigh your options carefully. The chart below breaks down how factors like your ring's value and your location's risk profile can point you toward the right decision.

As you can see, higher values and specific risk factors almost always demand more specialized coverage than a simple rider can provide.

The Standalone Policy: Superior Protection

A standalone jewelry policy is different. It’s insurance designed from the ground up with one purpose in mind: protecting your jewelry. These policies are offered by specialty insurers who live and breathe the unique risks that come with valuable, portable items.

This type of insurance typically offers much broader "all-risk" or "open perils" coverage. It protects against scenarios that riders often exclude, like mysterious disappearance—that heart-stopping moment when your ring is just gone, with no clear signs of theft.

Even better, a claim on a standalone policy has zero impact on your homeowners insurance.

By separating your ring’s insurance from your home policy, you insulate your most important asset from premium hikes or cancellation just because of a jewelry-related incident. It’s simply a smarter way to manage your overall risk.

For an entire jewelry store insurance is required, this concept is scaled up with robust Jewelers Block insurance. This is the specialized commercial policy we use at First Class Insurance to protect a store's entire inventory from a huge range of perils. You can see how this dedicated coverage works and understand why separating high-value assets is the professional standard.

So, what are the key differences when you put them head-to-head? This table breaks it down clearly.

Standalone Jewelry Policy Vs. Homeowners Rider

| Feature | Standalone Jewelry Policy | Homeowners Insurance Rider |

|---|---|---|

| Coverage Scope | Typically "all-risk," covering theft, damage, loss, and mysterious disappearance. | Named perils, often with exclusions for mysterious disappearance or specific damages. |

| Claim Impact | A claim does not affect your homeowners insurance premiums or eligibility. | A claim can increase your home insurance premium and may lead to non-renewal. |

| Deductible | Often offers a $0 deductible option. | Usually tied to your home policy's deductible, which can be $1,000 or higher. |

| Coverage Limits | Covers the full appraised value of the ring. | May have coverage sub-limits, even with the rider. |

| Repair & Replacement | Greater flexibility, often allowing you to work with your original jeweler for repairs. | The insurer may require you to use one of their network jewelers, limiting your choice. |

| Best For | Higher-value rings, active lifestyles, and anyone wanting to protect their home policy. | Lower-value rings where the convenience outweighs the potential risks. |

Ultimately, while a rider might feel like the path of least resistance, a standalone policy offers true peace of mind. It’s a dedicated solution for a significant investment, ensuring that a problem with your ring doesn't create a crisis for your home.

Understanding What Your Policy Actually Covers

Knowing how much engagement ring insurance costs is one thing, but understanding what you're actually paying for is the real key. An insurance policy isn't just a piece of paper; it’s a specific promise to protect you from very real, and very specific, disasters. Getting clear on the fine print now saves you a world of heartache later.

Think of your policy as a shield. A good one defends you from the most common threats your ring will ever face. Most specialized jewelry policies are built to handle the "big three" perils that cause the most headaches.

What a Strong Policy Protects Against

A good policy is your safety net for those awful "what if" moments that can happen to anyone, no matter how careful you are. True peace of mind comes from knowing you're covered for these specific situations:

- Accidental Loss: This is for those heart-stopping scenarios where the ring just… vanishes. Imagine it slipping off your finger while swimming in the ocean, or falling out of your pocket during a frantic day of errands. If it’s gone and you honestly can't find it, a solid policy has your back.

- Theft: From a smash-and-grab car break-in to a burglary at home, theft is an unfortunate reality. Worldwide coverage is a critical feature here—it ensures your ring is protected whether it’s stolen from your local gym locker or a hotel room halfway across the globe.

- Damage: Life happens. Rings get hurt. This covers those accidents like smacking your hand on a granite countertop and chipping the diamond, or catching a prong on a sweater so badly it bends and loosens the stone. Damage protection pays to get your ring repaired and restored to its original state.

Perhaps the single most valuable feature in a specialized jewelry policy is coverage for "mysterious disappearance." This is when your ring is simply gone, with no evidence of theft or a clear moment you can point to when it was lost. It’s the ultimate protection for an item that is small, valuable, and always on the move.

Common Exclusions to Be Aware Of

Just as important as knowing what’s covered is understanding what isn’t. No policy on earth covers absolutely everything, and being aware of the typical exclusions helps set realistic expectations from the start.

Most policies will not cover:

- General Wear and Tear: Over years of daily love, the metal on your ring will naturally scuff and develop tiny scratches. This gradual aging process is considered routine maintenance, not insurable damage.

- Manufacturing Defects: If a jeweler set a prong poorly or there's a flaw in the ring's original construction, that responsibility falls under the jeweler's warranty, not your insurance policy.

- Intentional Acts: You can't intentionally damage or "lose" your ring to file a claim. That's called fraud, and it's a universal exclusion in any insurance contract.

By understanding both the protections and the limitations, you get a practical, no-nonsense view of the value you're getting from a quality jewelry insurance policy.

A Simple Step-By-Step Guide To Insuring Your Ring

Getting your ring insured sounds like a headache, but it’s actually a pretty straightforward process when you know the steps. Think of this as your roadmap to getting it done fast so you can get back to wearing your ring without a single worry.

The demand for this kind of protection is exploding. The engagement ring insurance market, valued at $500 million in 2025, is projected to more than double, hitting $1.1 billion by 2033. This surge is fueled by rising diamond values and just how easy it is to get coverage now. You can dive deeper into this expanding market and its trends here.

What does that mean for you? Getting a quote and locking in a policy is simpler and faster than ever before.

Step 1: Get A Professional Appraisal

First things first: you absolutely need a professional appraisal. This isn't just a suggestion; it’s the non-negotiable foundation of your insurance policy. A certified gemologist will create a detailed document outlining your ring’s vital stats—cut, color, clarity, and carat—and assigning it an official replacement value.

Your insurer needs this document as proof of value to write an accurate policy. Without it, you simply can't get coverage.

Step 2: Gather Your Documentation

Once you have the appraisal, pull together a couple of other key documents. You’ll need the original sales receipt and a few clear, high-quality photos of the ring from different angles.

Get digital copies of everything organized in one place:

- The complete appraisal report

- The original purchase receipt

- Sharp, clear photos of the ring

Having these files ready to go will make the whole application process a breeze.

Think of this step like preparing your passport before a trip. Having all your documents in order beforehand eliminates last-minute stress and ensures a seamless journey to getting your policy approved.

Step 3: Get A Quote And Choose Your Policy

Now you’re ready to find the right insurer. You could add a rider to your existing homeowners or renters policy, but a specialized provider like First Class Insurance almost always offers stronger, more focused protection. We can help you secure a standalone policy that won't jeopardize your home insurance premiums if you have to file a claim.

All you have to do is submit your documents to get a quote. The process is surprisingly quick, especially with agencies that provide specialized insurance for a jewelry store and personal collections. We know exactly what we’re looking at and can provide a precise premium based on your appraisal.

Step 4: Review And Finalize Your Coverage

When you get your quote, read through the policy details carefully. Make sure you understand the coverage terms, the deductible (if there is one), and confirm that it explicitly covers theft, damage, and that all-important "mysterious disappearance."

Once you give the green light and pay your first premium, your ring is officially protected. That’s it. You’re covered, and you can finally have complete peace of mind.

Smart Ways To Lower Your Insurance Premium

Once you understand what drives your insurance costs, you gain the power to bring them down. A few smart moves can trim your annual premium without cutting corners on your protection. It really just comes down to making choices that show your insurer you’re a lower-risk client.

One of the most direct ways to control your cost is by adjusting the deductible. A deductible is simply the amount you agree to pay out-of-pocket before the insurance kicks in for a claim. While a $0 deductible sounds great, it always comes with the highest premium.

When you opt for a modest deductible—say, $250 or $500—you’re telling the insurer you're willing to share a tiny piece of the risk. They, in turn, often reward you with a noticeably lower yearly premium. It's a simple trade-off that puts you back in the driver's seat.

Proactive Steps For Premium Reduction

Beyond the deductible, you can take other practical steps to lock in a better rate. Insurers love to see preventative measures that make theft or loss less likely.

- Install a Home Safe: Storing your ring in a securely bolted-down home safe when you aren't wearing it can absolutely earn you a discount. It’s a clear signal to insurers that you take security seriously.

- Use a Bank Vault: For the ultimate peace of mind, keeping your ring in a bank's safe deposit box can lead to even bigger savings. This is especially true for exceptionally high-value pieces.

- Get Regular Reappraisals: The market for diamonds and precious metals is always shifting. A fresh appraisal every two or three years keeps your ring’s insured value accurate. If its market value has dipped, your premium could go down with it, preventing you from overpaying for coverage you don’t need.

Think of this as "stacking" your discounts. By combining a slightly higher deductible with secure storage, each smart decision builds on the last. The result is the most affordable premium possible for the comprehensive protection you deserve.

Common Questions About Ring Insurance

As you get closer to protecting your ring, a few key questions always seem to pop up. Let's walk through them so you can feel completely confident in your decision.

Do I Really Need an Appraisal?

Yes, absolutely. Think of a professional appraisal as the bedrock of your entire policy. It's the official document that proves what your ring is worth and details all its unique characteristics—the cut, the clarity, the metal.

Without it, an insurer has no verifiable way to know the ring's replacement value, which means they simply can't write an accurate policy. It’s non-negotiable.

What Does Filing a Claim Actually Look Like?

Honestly, the process is usually pretty straightforward. It starts with a phone call to your insurance provider to report what happened, whether it was lost, stolen, or damaged.

From there, a claims specialist will walk you through the next steps, like getting a police report if it was stolen. They'll then coordinate the repair or replacement, and in most cases, you can go right back to your original jeweler.

Here's a huge advantage of a specialized jewelry policy: you're dealing with experts. A dedicated jewelry insurance specialist understands the nuances of gemology and craftsmanship, which makes the whole process smoother than working with a general agent who might not know a carat from a carrot.

Is My Ring Covered if I Travel Internationally?

With a dedicated jewelry policy, the answer is almost always yes. These policies are specifically designed for worldwide coverage, which is a massive relief for anyone who travels.

This is a huge step up from a standard homeowners rider, which often comes with frustrating geographic limits or much stricter rules for anything that happens outside the country.

How Often Should I Get My Ring Re-Appraised?

A good rule of thumb is to get your ring reappraised every two to three years. The market for diamonds and precious metals is always shifting, meaning your ring's value can go up or down.

An updated appraisal ensures your coverage keeps pace with its current replacement cost. The last thing you want is to be underinsured if its value has climbed over the years.

Ready to secure your peace of mind? The experts at First Class Insurance can build a policy that protects your most cherished assets. If you're looking for broader insurance for jewelry business needs, we are the specialists. Get a Quote for Jewelers Block today and get a response within 24 hours.