Cargo marine insurance is your financial bodyguard for high-value goods—diamonds, gemstones, finished pieces—once they're in transit internationally. Think of it as a personal security detail for your assets from the second they leave your hands, covering everything from outright theft and accidents to the dreaded "mysterious disappearance."

For any jewelry business with a global footprint, this isn't just a good idea; it's essential.

Why Your Jewelry Business Needs Transit Protection

The moment you hand off a high-value parcel to a carrier, it enters a high-stakes world filled with unique dangers. Your standard insurance for a jewelry business is fantastic for what happens inside your four walls, but that coverage usually stops dead at the door.

This is where cargo marine insurance becomes a critical safety net, wrapping a shield around your goods as they cross the globe.

Imagine sending a collection of rare gems to an overseas buyer. That journey involves multiple handlers, transfers between trucks and planes, and stops in various holding facilities. Every single step is a new opportunity for something to go wrong. Cargo insurance is built from the ground up to address these specific weak points—the ones completely outside your control.

It's More Than Just a Lost Package

The risks to a jewelry shipment are unique and demand a level of protection that a carrier's basic liability policy just can't touch. We're talking about threats like:

- Organized Theft: High-value goods are magnets for sophisticated crime rings that target ports and logistics hubs.

- Mysterious Disappearance: Sometimes a package just… vanishes. No signs of forced entry, no clear explanation. It's a scenario many basic policies won't even cover.

- Physical Damage: Mishandling, turbulence, or even something as simple as a temperature shift can damage delicate pieces, instantly tanking their value.

- Global Events: Geopolitical instability, strikes, or riots in a transit country can put your shipment in jeopardy without a moment's notice.

A robust insurance policy is the financial backstop that allows you to operate globally with confidence. It transforms a potentially catastrophic loss into a manageable business event, ensuring your capital isn't tied up in a lost or damaged shipment.

The sheer scale of international shipping highlights why this is so critical. In 2024, worldwide cargo marine insurance premiums hit USD22.64 billion, with cargo coverage accounting for a massive 57.9% of the total marine market. It’s a testament to how vital this protection is for global trade.

Of course, while insurance provides the financial security, physical protection is just as important. Following proper packaging and prep guidelines for secure transit is your first line of defense against physical risks, helping to ensure your jewelry arrives in perfect condition.

At First Class Insurance Jewelers Block Agency, we help jewelers weave this specialized coverage into a comprehensive Jewelers Block insurance policy, giving you the peace of mind you need to ship your incredible pieces anywhere in the world.

Comparing Your Insurance Options

Trying to sort out insurance for your jewelry business can feel like learning a whole new language. You’ve got all these different policies, and figuring out which one protects what—and when—is absolutely critical.

To make it simple, let's break down the three main types of coverage every jeweler needs to understand: Cargo Marine, Inland Marine, and the all-important Jewelers Block policy.

Think of them as different travel documents for your high-value inventory. Each one serves a very specific purpose, and mixing them up can leave you with dangerous gaps in your protection.

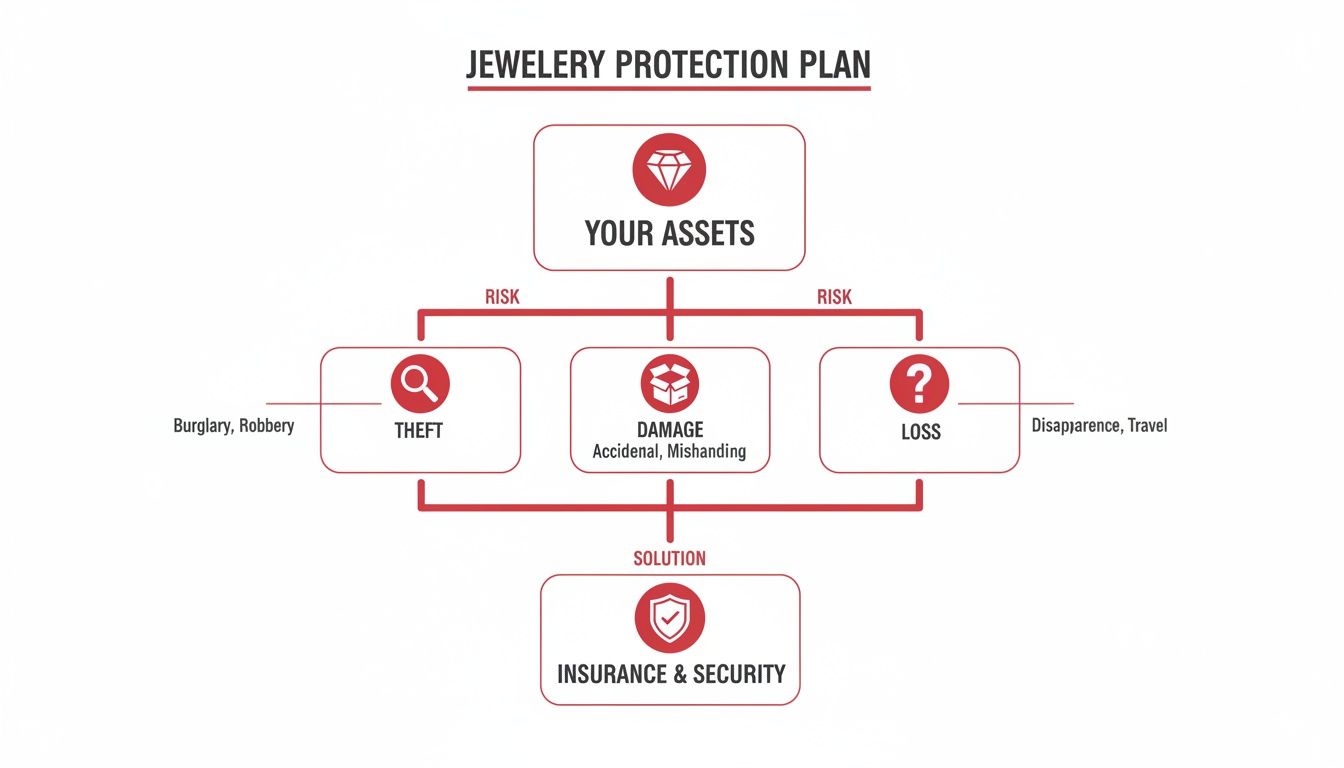

This flowchart maps out the biggest risks you face—theft, damage, and loss—and shows how a smart insurance strategy creates a shield around your assets.

The key thing to remember is that you're not just buying one policy; you're building an overlapping defense against every possible threat.

To help clarify the roles of each policy, here’s a quick comparison.

Comparing Insurance Policies for Jewelers

| Insurance Type | Primary Coverage | Best For | Key Feature |

|---|---|---|---|

| Cargo Marine | Goods in transit between countries (sea or air) | Jewelers who import/export internationally | Protects against the unique perils of global shipping |

| Inland Marine | Goods in transit within a country (ground or air) | Domestic shipments to partners, clients, or trade shows | Covers property once it's off your premises but still in the country |

| Jewelers Block | Comprehensive coverage for inventory | All professional jewelers | An all-in-one policy covering inventory on-premises, in transit (domestic & international), and elsewhere |

Each policy has its place, but as you can see, they are designed for very different scenarios. Now let’s dig into the specifics of each one.

Cargo Marine Insurance: Your International Passport

Cargo marine insurance is your passport for global transit. Plain and simple. It’s designed to protect your goods the second they cross a national border, whether they're on a container ship or in the cargo hold of a plane.

If you’re importing diamonds from Antwerp or shipping finished pieces to a buyer in Dubai, this is the policy that covers the unique and heightened risks of international logistics. You’re dealing with customs, multiple handlers, and long journeys, all of which crank up the potential for something to go wrong.

Inland Marine Insurance: Your Domestic Driver's License

If cargo marine is the passport, then inland marine insurance is your domestic driver's license. This policy is built to protect your goods while they’re moving within your country's borders.

It kicks in when you’re shipping an engagement ring to a client two states over or sending a collection via armored transport to a trade show in Las Vegas. The name is a bit of a throwback to when goods were moved from ports "inland" on rivers, but today it’s the standard for any domestic transit.

Jewelers Block: The All-Access Pass

Finally, we get to the gold standard for any serious jewelry operation: a Jewelers Block insurance policy. This is your all-access pass—a highly specialized package built from the ground up for the realities of our industry. A proper Jewelers Block policy will often wrap in the protection of both cargo and inland marine transit.

But it does so much more. It also protects your inventory while it's sitting in your safe, on display in your showroom, out for repair, or even being shown by a salesperson off-site. This wall-to-wall approach gets rid of the dangerous seams where one policy stops and another is supposed to start.

The value of this kind of specialized transit coverage can't be overstated. Cargo insurance alone makes up 57.9% of the global marine insurance market, a massive sector expected to hit USD $47 billion by 2034. As e-commerce continues to drive luxury shipments, having an all-in-one policy that provides "all-risks" coverage for things like mysterious disappearance is non-negotiable. You can discover more about these market insights and their impact on global trade.

The real power of a Jewelers Block policy is its seamless, end-to-end protection. You stop juggling different policies for transit and on-site risk and get one cohesive solution from underwriters who actually understand what jewelers are up against.

By working with specialists who partner with respected underwriters like Lloyd's of London, you can get coverage that’s truly built for your business, not just a generic plan with your name on it.

Understanding the Real Risks to Jewelry Shipments

Shipping a high-value piece of jewelry isn’t like mailing a book. It’s an exercise in managing serious, specialized risk. The second a parcel with thousands of dollars in gems or finished pieces leaves your hands, it enters a world of threats most businesses never have to think about.

For a jeweler, the transit phase is often the most vulnerable part of the entire supply chain. It's a journey that exposes your assets to a nasty combination of sophisticated crime and simple logistical failure—either of which can cause a catastrophic financial loss.

This is exactly why relying on a shipping carrier’s basic liability is one of the most dangerous gambles you can make. Their declared value limits are shockingly low and designed to protect them, not you. A true cargo marine insurance component within your Jewelers Block policy is built to counter these exact high-stakes scenarios.

Beyond Simple Loss and Damage

The risks to your shipments go way beyond a dropped box or a traffic accident. Jewelers face a much more menacing set of challenges that demand specialized protection. These aren't just hypothetical what-ifs; they are daily realities in the logistics world.

Some of the most critical threats include:

- Organized Cargo Theft: Your shipments are valuable, portable, and hard to trace, making them prime targets for sophisticated criminal rings. These groups often have inside knowledge of shipping routes and know exactly what they’re looking for.

- Internal Pilferage: Even within supposedly secure sorting facilities, the risk of employee theft is significant. A small, high-value item can easily be pocketed and vanish from a larger shipment.

- Subtle Environmental Damage: It’s not always about theft. Certain gemstones are highly sensitive to extreme temperature shifts or humidity, which can cause cracking or discoloration during transit. A standard policy might not even recognize this as a covered loss.

But the most frustrating risk of all is often the "mysterious disappearance." This is when a package simply vanishes from the supply chain with no sign of theft or forced entry. Without specific coverage for this, you could be left holding the bag.

The global logistics network is massive and complex, creating endless opportunities for things to go wrong. And with global trade constantly growing, those risks are only amplified. The entire marine cargo insurance market, valued at USD 14.12 billion in 2024, is expected to balloon to USD 21.49 billion by 2035, driven by this expansion. U.S. jewelers are part of the market that drives 86.8% of North American marine insurance, meaning more shipments, more complexity, and more potential points of failure. You can learn more about these global shipping market trends and what they mean for high-value goods.

The Inadequacy of Carrier Liability

When you ship an item with a carrier like FedEx or UPS, they offer a basic level of liability, but it's critical to understand what this really is. It is not insurance. It's a predetermined, legally capped amount they'll pay if they're found negligent for the loss or damage.

Here’s why it’s a dangerously weak safety net for a jewelry store:

- Extremely Low Payouts: Carrier liability is often capped at a mere $100 per package. Even if you declare a higher value, their maximums are often far too low to cover the true worth of your items.

- Burden of Proof: To get paid, you often have to prove the carrier was directly at fault. This can be nearly impossible, especially in cases of mysterious disappearance.

- Numerous Exclusions: Carrier liability is full of loopholes and fine print, excluding everything from "acts of God" to delays and damage from improper packaging (even if you packed it perfectly).

Ultimately, a carrier's primary goal is to limit its own financial exposure. Your goal is to protect the full value of your assets. Those two goals are fundamentally opposed. This is why true first-party insurance, like a Jewelers Block policy from First Class Insurance, is the only reliable solution. It’s designed to pay your claim regardless of who was at fault, giving you a direct path to getting your money back.

Decoding Your Insurance Policy

An insurance policy isn't just a stack of paper; it's a promise. But for a jeweler, that promise is only as solid as your understanding of the fine print. The language inside your cargo marine insurance or Jewelers Block policy can be the one thing that separates a smooth claim from a business-crippling loss.

Think of your policy as the rulebook for a high-stakes game. If you don't know the rules, you can't possibly win. Getting familiar with the key terms now means there are no gut-wrenching surprises when you need that coverage the most.

All Risks Versus Named Perils

One of the first, and most critical, distinctions you'll run into is whether a policy is "All Risks" or "Named Perils." This single difference completely changes what you're protected against.

- All Risks Policy: This is the gold standard for any jewelry business. It offers the widest possible protection, covering you against every type of loss or damage unless it’s specifically listed as an exclusion. The best part? The burden is on the insurance company to prove your loss was caused by something they excluded.

- Named Perils Policy: This is a much tighter, more restrictive policy. It only pays out for losses caused by the specific risks—or "perils"—written into the document, like fire, theft, or flood. If your loss is caused by something not on that list, you're out of luck.

For a jeweler dealing with high-value, portable assets, an "All Risks" policy is the only sensible choice. It's built to handle the unique and often strange threats that come with the territory, like the dreaded "mysterious disappearance."

For a high-value shipment, an 'All Risks' policy is your default security setting, providing comprehensive protection unless a specific threat is turned off. A 'Named Perils' policy is like starting with no security and having to manually turn on protection for every single potential threat you can think of.

Key Terms That Impact Your Bottom Line

Digging deeper, you’ll find specific clauses that have a direct impact on your wallet. Two of the most important are your deductible and the ancient maritime concept of "General Average."

A deductible is simply the amount of money you have to pay out-of-pocket on a claim before the insurance company steps in. Let's say you have a $5,000 deductible and suffer a covered loss of $50,000. You'd pay the first $5,000, and your insurer would handle the remaining $45,000. It's vital to choose a deductible that you can actually afford to pay on a bad day.

General Average is a maritime principle that’s been around for centuries, and it can be a nasty shock if you aren't prepared for it. Here’s the scenario: if the ship carrying your goods has to make a huge sacrifice to save the entire vessel—like throwing cargo overboard during a massive storm—that loss is shared proportionally by everyone with a financial stake in the voyage. Without the right cargo insurance, you could be on the hook to help pay for someone else’s lost cargo just to get your own goods released from the port.

Common Cargo Insurance Clauses Explained

Getting a handle on the language in your policy is half the battle. This table breaks down a few of the key clauses you're likely to see and what they actually mean for your jewelry business.

| Clause / Term | What It Means for a Jeweler | Coverage Impact |

|---|---|---|

| Delay Clause | Excludes coverage for losses caused solely by a delay in transit, like spoilage. | Critical to understand, as a delay can indirectly cause damage that may not be covered. |

| Mysterious Disappearance | Covers a loss where inventory vanishes without evidence of theft. | A vital endorsement for any jewelry store insurance policy, as it's a common risk. |

| Trade Show Endorsement | Extends coverage to your inventory while it's at a trade show or exhibition. | Essential for jewelers who travel, as it closes a potential gap in off-premises protection. |

| Packing Warranty | A requirement that your goods are packed professionally and securely for transit. | Failing to meet this standard could give an insurer grounds to deny a damage claim. |

Understanding these moving parts is what turns a generic policy into real, effective protection. At a specialized agency like First Class Insurance, we build your Jewelers Block policy by tackling these points from day one. We help you ask the right questions to make sure there are no dangerous gaps between your coverage and the real-world risks you face every day.

Navigating the Claims Process and Preventing Loss

The best cargo marine insurance policy is the one you never have to use. But let’s be realistic—when a shipment gets lost, damaged, or stolen, your response in those first few hours is everything. It can be the difference between a manageable financial recovery and a devastating loss.

Think of it as having an emergency plan for your inventory on the move. You wouldn't operate your store without a security protocol for a break-in, right? The same logic applies here. When things go wrong and stress is high, you won't be scrambling; you'll be executing a clear, pre-planned strategy to protect your assets.

Immediate Steps After a Loss

When you realize a shipment has been compromised, the clock starts ticking. Your top priorities are to stop any further damage and get the incident officially on the record.

- Notify Your Insurer Immediately: This should be one of your very first calls. Prompt notification isn't just a good idea; it's almost always a requirement of your policy. Getting them involved early lets them guide you and kickstarts their investigation. A delay here could put your entire claim at risk.

- Contact the Carrier: Get in touch with the shipping company (FedEx, Brinks, etc.) and formally notify them of the loss or damage in writing. This creates an official paper trail that’s crucial for both your insurance claim and any action you might take against the carrier.

- Preserve All Evidence: Whatever you do, don't throw away damaged goods or packaging. If you suspect theft, secure what's left of the shipment. Take tons of photos and videos from every angle, documenting the condition of the box and its contents the moment you received them.

Essential Documentation for a Smooth Claim

To process your claim quickly, your insurer is going to need a complete paper trail. Having these documents ready to go from the start will cut down on delays and prove the legitimacy of your loss.

You'll typically need to pull together:

- Commercial Invoice: Proof of the value of the goods in the shipment.

- Bill of Lading or Air Waybill: This is your contract with the carrier, detailing the shipment's journey and contents.

- Packing List: An itemized list of exactly what should have been in the box.

- Photos of Damage: Crisp, clear images showing any and all damage to the items and their packaging.

- Proof of Loss Statement: A formal document your insurer provides for you to fill out, detailing the specifics of your claim.

A well-documented claim is a strong claim. The more evidence you provide to back up your loss, the faster your insurer can work to make you whole. It takes the guesswork out of the equation and just smooths out the entire validation process.

Shifting Focus to Proactive Loss Prevention

Knowing how to file a claim is one thing, but preventing the loss in the first place is the real goal. Your insurer should be more than just a check in the mail; they should be a partner in risk management. Being proactive doesn't just protect your irreplaceable inventory—it can also lead to lower insurance premiums down the road.

It’s all about hardening the target. By making your shipments more secure and less attractive to thieves, you actively shrink your risk profile. Your insurance is the financial safety net, but smart physical security is your first line of defense. You can and should explore various effective theft protection strategies to round out your approach.

Here are a few practical strategies every jeweler should be using:

- Use Tamper-Evident Packaging: Spend the money on quality, tamper-evident bags, seals, and tape. It makes it glaringly obvious if a package has been opened and can deter a thief looking for an easy target.

- Leverage GPS Tracking: For your really high-value shipments, slipping a discreet GPS tracker inside the box gives you real-time location data. This is an absolute game-changer for recovery efforts if a package vanishes.

- Vet Your Shipping Partners: Don't just go with the cheapest carrier. Work with companies that have a solid, proven reputation for handling high-value goods with care and security. You can also gain valuable industry insights by joining organizations like the Southern Jewelry Travelers Association.

- Avoid Descriptive Labeling: Never, ever label the outside of a package in a way that screams "jewelry inside!" Use a nondescript company name or acronym for the sender. Be boring.

- Split High-Value Shipments: If you have an exceptionally valuable order, consider breaking it into smaller, separate shipments. This spreads your risk so that if one package is lost, it doesn't wipe out the entire order.

Why a Specialist Jeweler's Insurance Is Essential

Let’s be blunt: relying on a generic insurance policy to protect your jewelry business is like using a cardboard box as a vault. A standard cargo marine insurance policy might be fine for shipping widgets, but it's completely blind to the realities of your world—the extreme value, easy portability, and unique threats that follow every piece you handle.

That gap is exactly where a dedicated Jewelers Block insurance policy proves its weight in gold. This isn’t just another plan; it’s a security strategy built from the ground up for the jewelry trade. It’s designed to provide seamless, wall-to-wall protection, integrating robust international transit coverage with security for your inventory at every other point—in the safe, on display, and even at trade shows.

The Advantage of Expert Guidance

Working with an insurance specialist who lives and breathes the jewelry industry isn't a luxury; it's a necessity. A general provider sees a package; an expert sees the nuance.

- Policies That Actually Fit: Instead of forcing your business into a one-size-fits-all box, a specialist like First Class Insurance builds a policy around your specific operations, from your shipping methods to your security protocols.

- Real-World Risk Management: You get practical, actionable advice on loss prevention that’s directly relevant to protecting high-value jewelry, not generic business assets.

- Smarter Claims Support: When a loss happens, you’re not starting from square one. You’re working with a team that already understands the value of your assets and the documentation required, which makes a world of difference during a stressful time.

A general insurance policy might see a lost package. A specialist sees a lost GIA-certified diamond and understands the immediate financial and reputational crisis it creates for your business. That difference in perspective is everything.

The right insurance for a jewelry store isn't a piece of paper; it's a true partnership. It ensures that from the moment a gem leaves a supplier to the second a finished piece is sold, your business is shielded from every angle.

Your life's work is far too valuable to leave to chance. It deserves coverage as exceptional as the pieces you create. Get a Quote for Jewelers Block and get the peace of mind that comes from knowing you're properly protected.

Frequently Asked Questions

When you're dealing with cargo marine insurance, the devil is always in the details. For jewelers, knowing the fine print isn't just a good idea—it's the only thing standing between you and a catastrophic loss while your pieces are in transit.

Let's cut through the noise and get straight to the questions we hear most often.

Does My Jewelers Block Policy Already Cover International Shipments?

More often than not, the answer is yes. A solid Jewelers Block insurance policy is built to be a comprehensive, "all-risk" solution for your business. That usually includes worldwide transit coverage, wrapping your inventory in a seamless shield of protection whether it's crossing a state line or an ocean.

But—and this is a big but—never assume. Policies can vary dramatically. You absolutely must read your specific policy documents or, even better, have a frank conversation with your insurance agent. Confirm your geographical limits, your in-transit coverage amounts, and any specific requirements to make sure there are no dangerous gaps when you ship high-value items internationally.

What Is the Difference Between Carrier Liability and Cargo Insurance?

This is probably the single most critical distinction you can make. Carrier liability is the bare-minimum legal responsibility a shipping company has for your goods. It is not insurance.

That liability is usually capped at a laughably low amount, like $50 per package or a few dollars per kilogram. It won't come anywhere close to covering your actual loss. Worse, to collect even that small amount, you often have to prove the carrier was negligent—a difficult and time-consuming process.

On the other hand, cargo marine insurance (or the transit coverage in your Jewelers Block) is your policy. It's first-party coverage you buy to protect the full invoice value of your goods. It’s designed to pay for a covered loss regardless of who was at fault, covering you for risks like theft, accidental damage, or even mysterious disappearance.

Think of it this way: Carrier liability is designed to protect the shipping company's bottom line. Your cargo insurance is designed to protect yours.

How Is My Insurance Premium Calculated?

Your insurance premium is a direct reflection of your specific risk profile. Underwriters look at several key factors to figure out what it will cost to cover your insurance for a jewelry store or wholesale operation. They're essentially trying to understand the odds and potential cost of a claim.

The biggest drivers of your rate include:

- Value and Type of Goods: The total value of your inventory and the types of pieces you ship are the primary considerations.

- Shipping Routes and Methods: Where you ship, how often, and which carriers you trust all matter. Some routes are just plain riskier than others.

- Claims History: Your track record of past losses is one of the strongest predictors of future risk.

- Security Measures: The proactive steps you take can make a real difference. Using armored transport, GPS tracking, and tamper-evident packaging shows underwriters you're serious about security, which can positively impact your rates.

Working with an insurance specialist who lives and breathes the jewelry industry is key. They know how to present your business to underwriters in the best possible light, which often leads to better terms and pricing.

Your business is built on assets that are small, priceless, and irreplaceable. Protecting them takes more than a generic, off-the-shelf policy—it requires deep expertise and specialized coverage. At First Class Insurance, we build policies that cover the real-world risks of the jewelry trade. To secure the protection your life's work deserves, get a quote for a Jewelers Block policy today.