A single catastrophic lawsuit can shatter a jewelry business faster than a dropped diamond. When a major claim blows past the limits of your standard policies, Jewelers Block insurance with an umbrella or excess liability component is the critical layer of protection that kicks in, acting as a financial backstop to safeguard your business from ruin.

Why Jewelers Need Protection Beyond Standard Policies

Your standard policies—like General Liability or even a specialized Jewelers Block policy—are the foundation of your protection. They’re built to handle the everyday risks you face. But let’s be honest, the jewelry business isn’t an everyday business. You deal with exceptionally high values and unique exposures that can lead to lawsuits big enough to wipe you out.

Imagine a client slipping in your showroom and filing a multi-million dollar lawsuit. What if a major theft is traced back to alleged employee negligence? Or a security failure during a private event leads to a massive loss? In scenarios like these, a standard $1 million liability limit can be eaten up in the blink of an eye, leaving your business on the hook for the rest.

High Stakes of the Jewelry Trade

The risks tied to running a jewelry store or wholesale operation are immense. A solid insurance plan for a jewelry store has to account for much more than just the sparkle in the cases.

Think about these potential exposures:

- High-Value Inventory: A single showcase can hold millions in merchandise, making you a magnet for sophisticated criminals. A major heist could easily spiral into complex liability claims.

- Client Interactions: You’re not just selling jewelry; you’re handling irreplaceable family heirlooms and crafting custom pieces for high-profile clients. One accident could trigger a lawsuit that far exceeds the item's actual cost.

- Transit Security: Every time high-value goods are on the move, you’re exposed. A loss or theft during transit can lead to liability that goes beyond the price of the pieces to include serious reputational damage.

This extra layer of liability protection isn't a "nice-to-have." In today's world, it's a core component of survival for any insurance for jewelry business.

The Growing Need for Enhanced Coverage

As the world gets more litigious, the demand for this extra protection is climbing. The global umbrella insurance market, already valued at $3.034 billion, is expected to skyrocket to $5.05 billion by 2035.

This isn't just an abstract number. It reflects the real-world increase in massive claims hitting businesses just like yours. In a single recent year, insurers wrote over 1.2 million new commercial umbrella policies—a staggering 16% jump from the year before.

Umbrella and excess liability insurance is the ultimate safeguard for your jewelry business. It's the only thing standing between a catastrophic claim and the assets you’ve worked a lifetime to build.

Primary vs. Umbrella and Excess Liability At a Glance

It helps to see exactly how these policies stack up. Your primary policies are your first line of defense, but umbrella and excess coverage is what you’ll rely on when things get serious.

| Coverage Type | What It Covers | Typical Limit Example | Where It Falls Short |

|---|---|---|---|

| Primary Liability (e.g., General Liability) | Bodily injury, property damage, and personal injury claims that happen on your premises or due to your operations. | $1 million per occurrence / $2 million aggregate | Can be quickly exhausted by a single, severe lawsuit (e.g., a major injury or multi-party claim). |

| Jewelers Block (Primary Property & Liability) | Theft, damage, or loss of your inventory, plus some liability specific to your trade. | $1 million liability limit | Primarily focused on your inventory; its liability limits are subject to the same risks as a standard GL policy. |

| Umbrella/Excess Liability | Extends the limits of your underlying primary policies (GL, auto, etc.) once they've been maxed out. | $5 million to $25 million or more | Does not kick in until your primary policy limits are completely used up. Does not cover claims your primary policy excludes. |

As you can see, each policy plays a distinct role. While your primary insurance handles the expected, your umbrella policy is there for the unexpected catastrophe.

Distinguishing Between Umbrella and Excess Liability Insurance

People in the insurance world often toss around the terms umbrella and excess liability insurance like they're the same thing. They’re not. Knowing the difference is a game-changer for any jeweler looking to build a truly bulletproof safety net as part of their Jewelers Block insurance.

Think of your core policies—like General Liability and Commercial Auto—as your first line of defense. Both umbrella and excess policies sit on top of them to give you more protection, but they go about it in completely different ways.

It really boils down to one simple concept: depth versus breadth. An excess liability policy gives you deeper coverage, while an umbrella policy gives you broader coverage. Let's unpack what that actually means for your store.

Excess Liability Insurance: Deeper Coverage

An excess liability policy is the more straightforward of the two. It’s what we call a "following form" policy because it does just that—it follows the exact terms, conditions, and exclusions of the specific primary policy it sits on top of.

Imagine your General Liability policy has a $1 million limit. An excess policy can add another $5 million directly on top of it, giving you a total of $6 million in coverage for the exact same types of claims your GL policy covers. Nothing more, nothing less.

- Its Purpose: To beef up the dollar limit of a single, specific policy.

- Its Function: It only wakes up and starts paying after your primary policy's limit is totally wiped out.

- Its Limitation: It will not cover a single thing that your primary policy excludes. If a claim isn’t covered by your General Liability, your excess policy won't touch it either.

This makes excess liability a fantastic tool for adding vertical protection against a known, high-level risk. If your biggest nightmare is a catastrophic slip-and-fall lawsuit, stacking an excess policy on your General Liability provides a powerful, focused defense.

Umbrella Liability Insurance: Broader Coverage

An umbrella policy is a much more powerful and flexible beast. While it also boosts your policy limits, it does it in a much broader way. Instead of just sitting over one policy, a single umbrella can extend its protection over several of your underlying policies at once.

This usually includes:

- Commercial General Liability

- Commercial Auto Liability

- Employers' Liability (which is typically part of your Workers' Comp)

But here's the real magic: an umbrella policy can "drop down" to cover claims that aren't included in your underlying policies at all. We're talking about things like libel, slander, or false arrest—risks your General Liability policy probably ignores.

A true umbrella policy doesn't just give you higher limits; it actively fills the dangerous gaps in your foundational coverage. It protects you from the bizarre, unforeseen risks your standard policies exclude, making it a cornerstone of risk management for any public-facing business.

For these "drop-down" coverages, the umbrella policy has its own deductible, called a Self-Insured Retention (SIR). Once you pay the SIR (say, $10,000), the umbrella policy kicks in to handle the rest, even if your primary policy offered zero coverage to begin with.

A Practical Comparison for a Jewelry Store

Let’s put this into a real-world scenario. A furious customer starts a vicious online campaign, falsely accusing your store of selling fake diamonds. The reputational damage is massive, your sales plummet, and you’re hit with a defamation lawsuit.

- With an Excess Liability Policy: Your General Liability policy almost certainly excludes defamation. Since the excess policy just follows the GL's lead, it excludes it, too. You’re on your own, paying for lawyers and any damages out of your own pocket.

- With an Umbrella Liability Policy: Defamation is a classic "personal injury" claim often covered by a good umbrella policy. After you meet your Self-Insured Retention, your umbrella policy would step in to cover the costly legal defense and any settlement, saving your business from a potentially fatal financial blow.

This is the fundamental difference in action. An excess policy gives you more of the same protection. An umbrella policy gives you more protection against a wider range of potential disasters. For a business as complex as a jewelry store, the broad protection of an umbrella/excess liability insurance plan is almost always the smarter, more strategic choice.

How Coverage Layers with Your Jewelers Block Policy

Your Jewelers Block policy is the heart of your insurance portfolio, the specialized coverage built to protect your most crucial assets—your inventory. But as comprehensive as it is for your stock, its built-in liability protection has its limits.

This is exactly where umbrella/excess liability insurance comes in. It doesn't replace your primary policies; it reinforces them, creating a financial backstop for your entire operation. Think of it as stacking layers of armor—the next layer only kicks in when the one below it has been pierced.

This critical extra coverage sits on top of the liability portions of your other policies, providing a unified shield over your:

- Jewelers Block Policy: For liability claims tied directly to your core operations.

- Commercial General Liability: To cover things like a slip-and-fall in your showroom.

- Commercial Auto Policy: Protecting you from accidents involving company vehicles.

Without this top layer, a single, devastating lawsuit could punch right through your foundational coverage, leaving your business assets completely exposed.

A Real-World Scenario: Employee Negligence and a Major Theft

Let's walk through a realistic, high-stakes claim to see how these layers actually work together.

Imagine a sophisticated theft at your store leads to a $3.5 million loss, wiping out a huge chunk of your inventory and several high-value customer pieces left for repair. The investigation reveals an employee, breaking strict security rules, forgot to activate a secondary alarm. The client whose jewelry was stolen sues your business for gross negligence and the court awards them $2.5 million in damages.

Here’s how your layered insurance plan would respond.

Tracing the Claims Process Step by Step

The claim triggers a cascade of policy responses, with each layer doing its job until the full bill is paid.

Jewelers Block Policy Responds First: Your Jewelers Block policy has a liability limit—let's say it's $1 million. This is your first line of defense. The policy pays out this full $1 million toward the $2.5 million judgment.

The Coverage Gap: After your main policy is exhausted, you’re still on the hook for a $1.5 million shortfall. For a business without the right protection, this is a catastrophic, potentially bankrupting figure that would have to be paid out-of-pocket.

Umbrella Policy Kicks In: This is where your foresight pays off. Your $5 million umbrella policy activates to cover the rest. It seamlessly pays the outstanding $1.5 million, satisfying the court’s judgment in full.

In this scenario, the umbrella policy absorbed a financial blow that would have otherwise crippled or destroyed the business. It protected your cash, your remaining inventory, and the personal assets tied to your company. You can learn more about protecting valuable assets like antique jewelry with the right insurance in our other guides.

The primary function of an umbrella policy is to provide peace of mind. It ensures that one catastrophic event doesn't erase decades of hard work, allowing your business to survive, recover, and continue serving its community.

This layering strategy is the key to true financial resilience. It lets you manage everyday risks with cost-effective primary policies while preparing for the worst-case scenarios with a robust umbrella policy. For any jeweler, this isn't just good planning—it's essential for protecting your legacy.

Navigating the Hard Market and Rising Insurance Costs

If you’ve tried to get an insurance quote for your jewelry business lately, you’ve probably noticed two things: insurers are more cautious, and the premiums are going up. This isn’t just you; it’s a market-wide shift called a hard market, and understanding it is the first step to protecting your business without breaking the bank.

What's driving this? A massive spike in multi-million dollar lawsuits and what the industry calls "nuclear verdicts"—jury awards so high they send shockwaves through the entire system. This has made insurers incredibly nervous. They're paying out more in claims than ever before, forcing them to raise rates and be much pickier about who and what they cover.

For a jeweler, this means getting the high-limit protection you need is more challenging and expensive than it was just a few years ago.

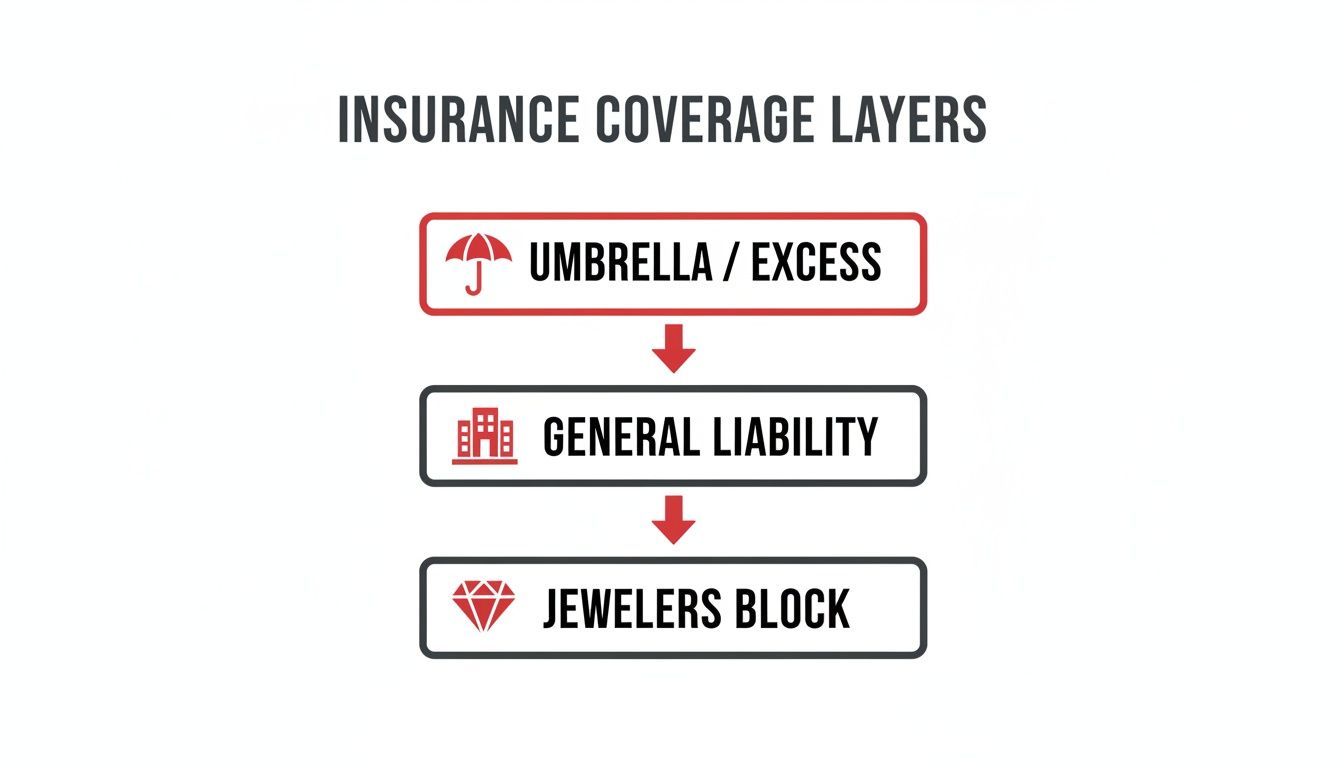

The diagram below shows how different insurance policies stack on top of each other, with umbrella and excess liability acting as the final, crucial safety net.

This visual makes it clear how each policy builds on the one below it. Your umbrella policy only kicks in after the limits on your primary policies, like your Jewelers Block, have been completely used up.

What a Hard Market Means for Your Quote

In a hard market, the game completely changes. Insurers that used to eagerly offer $100 million in coverage are now backing away, often refusing to offer a layer of more than $5 million or $10 million. To make matters worse, the price for that much smaller slice of coverage has often doubled or even tripled.

This forces business owners to piece together their coverage by stacking multiple smaller policies from different carriers—a complicated and expensive headache.

The numbers are staggering. In one recent quarter alone, 89 catastrophic cases hit the market, the most since the Great Recession. This is why we're seeing massive rate hikes across the board. An excess liability tower that once gave you $100 million for $400,000 might now cost you triple that price for just $25 million of protection.

In a market this tough, chasing the lowest price is a losing strategy. The real value is in finding a specialist who knows how to navigate this volatile environment and can build the best possible protection with reliable carriers.

Partnering with an Expert Broker

This is where working with a knowledgeable partner like First Class Insurance Jewelers Block Agency makes all the difference. We live and breathe the jewelry industry and have built strong relationships with underwriters who actually understand your unique risks. We know who is still offering fair terms and how to structure your coverage to get the protection you need without getting taken for a ride.

Understanding the fine print is critical, especially when the market is working against you. Getting familiar with the Top Insurance Claim Denial Reasons can also help you avoid common pitfalls that could jeopardize your business's future. By understanding these market forces, you can set realistic expectations and make smarter decisions, ensuring your legacy is protected no matter what.

Choosing the Right Coverage for Your Jewelry Business

Picking the right amount of protection isn’t just pulling a number out of thin air. It’s a calculated move based on a hard look at your specific risks. Getting the right amount of umbrella/excess liability insurance means honestly assessing everything from your total assets down to how you run your business day-to-day.

After all, a small, appointment-only design studio just doesn't face the same threats as a bustling retail store in a high-end shopping mall.

This kind of practical evaluation takes the guesswork out of the equation. It empowers you to have a much smarter conversation with your insurance agent, ensuring the policy you get is a perfect fit—one that truly protects your life's work.

Key Factors in Determining Your Coverage Limits

To figure out the right number, you need to think like a plaintiff’s attorney. If the worst happened and you were sued, what assets would they come after?

Start by looking at these critical areas:

- Total Business and Personal Assets: In a massive lawsuit, everything you own could be on the line. Add up the value of your business assets (inventory, equipment, property) and your major personal assets (your home, investments, savings). Your liability limit needs to be high enough to act as a shield, protecting them from being seized to pay a judgment.

- Showroom Foot Traffic: The more people walking through your door, the higher your odds of a slip-and-fall or other accident. A high-traffic store absolutely needs a higher limit than a private jeweler who sees clients by appointment only.

- Inventory and High-Value Items: Your Jewelers Block insurance is there to cover the physical loss of your stock. But a catastrophic event, especially one involving customer-owned pieces, can easily lead to massive liability claims. The more value you handle, the bigger your potential exposure.

- Employee-Related Risks: Do your employees drive company cars? Handle off-site deliveries? Travel to trade shows? Every single thing they do on behalf of your business creates a potential liability that your insurance must be ready to cover.

The Urgency of Securing Adequate Limits

The need for higher limits is getting more urgent as the insurance market gets tighter. The global umbrella market is expected to balloon to $187.78 billion by 2030. In this new reality, costs for umbrella/excess liability insurance have shot up, with rates spiking anywhere from 20-300% in some sectors.

Insurers are getting nervous, slashing their available limits from $10-25 million down to just $2-3 million per layer. Recent policy renewals saw an average hike of 9.26%, which should tell every jeweler one thing: lock in strong coverage now before it gets even more expensive.

Choosing your coverage limit is one of the most important financial decisions you will make for your business. It is the firewall that protects your legacy from being consumed by a single catastrophic event.

When you're looking at different carriers and what they offer, checking out programs like the Penn National Umbrella can give you a better sense of what's available. An informed decision is always your best defense.

Jeweler's Risk Assessment Checklist

This simple checklist is designed to help you get a clearer picture of your jewelry store insurance needs. Think of it as a self-assessment to help you and your insurance professional zero in on the right level of coverage for your unique business.

| Risk Factor | Low Risk (Consider $1-2M) | Medium Risk (Consider $2-5M) | High Risk (Consider $5M+) |

|---|---|---|---|

| Annual Revenue | Under $1M | $1M – $5M | Over $5M |

| Inventory Value | Under $500k | $500k – $2.5M | Over $2.5M |

| Foot Traffic | Appointment-only, very low traffic | Moderate retail traffic | High-volume retail, mall location |

| Employee Count | 1-3 employees | 4-10 employees | 10+ employees with delivery drivers |

| Business Operations | Single location, no off-site work | Multiple locations, occasional trade shows | Nationwide operations, frequent travel |

Think of this table as a starting point for a deeper conversation. Ultimately, picking the right coverage amount is a strategic decision. As specialists in insurance for jewelry business owners, we at First Class Insurance Jewelers Block Agency thrive on navigating these complex choices. We'll help you analyze your real-world risks and build a protection plan that makes perfect sense for your bottom line.

Partner With a Specialist to Secure Your Legacy

In the high-stakes world of the jewelry business, your standard policies are just the starting point. A single catastrophic liability claim can easily blow past the limits of even the most robust primary coverage, threatening everything you've worked so hard to build.

That’s where umbrella/excess liability insurance comes in. Think of it as your business's ultimate financial shield. It’s the critical difference between weathering a severe storm and losing your business entirely. This is the coverage that kicks in precisely when your foundational policies—like general liability or your Jewelers Block—are completely tapped out, paying for the massive costs that remain.

Why Specialization Matters in Jewelry Store Insurance

Choosing the right insurance partner is just as critical as choosing the right policy. The unique risks that come with insurance for jewelry business owners demand an agent who truly gets the nuances of high-value inventory, sophisticated security threats, and even delicate client interactions. A generalist simply doesn't have the deep industry insight to structure your protection the right way.

With over 30 years of dedicated experience, we at First Class Insurance excel at building customized protection plans. We know exactly how to layer a comprehensive Jewelers Block insurance policy with the right amount of umbrella or excess liability coverage to make sure there are no dangerous gaps. Our expertise, which includes strong partnerships with industry leaders like those at

Protecting your legacy isn't just about insuring inventory; it's about creating a financial fortress that can withstand a true worst-case scenario. A specialized agent is the architect of that fortress.

Our nationwide reach ensures that no matter where your business is located, you get expert guidance and access to top-tier insurance products. Don't wait for a disaster to discover you're underinsured. Protect your hard-earned assets and secure your future by partnering with a specialist who knows your world inside and out. Get a Quote for Jewelers Block and umbrella coverage today to safeguard your legacy.

Frequently Asked Questions

When you get into the weeds of umbrella and excess liability insurance, a few key questions always pop up. Let's tackle the most common ones we hear from jewelers so you can make decisions with confidence.

How Much Does Umbrella Insurance Cost for a Jewelry Store?

There's no single price tag on an umbrella policy. The cost for your jewelry store insurance plan is built around your specific risk profile, so it can vary quite a bit from one business to the next.

What drives the price? Insurers look at things like your annual revenue, the value of your inventory, where your store is located, and your claims history. A small, appointment-only boutique might pay a few thousand a year, but a high-traffic store with millions in inventory is a different ballgame and will see higher premiums. A good broker knows how to shop the market and find the most competitive rate for your operation.

Is My Personal Umbrella Policy Enough to Cover My Business?

This is a huge point of confusion, and the answer is almost always a hard no. A personal umbrella policy is built to shield your personal assets—your house, your car, your savings—from lawsuits that come from your personal life.

It is specifically designed to exclude business-related risks. To properly protect your insurance for a jewelry business, you need a dedicated commercial umbrella or excess liability policy. This policy is written to sit directly on top of your commercial policies, like your Jewelers Block and general liability.

Relying on a personal umbrella for business protection is a dangerous and costly mistake. The policy simply will not respond to a commercial claim, leaving your business assets completely exposed.

What Is a Self-Insured Retention?

Think of a Self-Insured Retention (SIR) as a kind of deductible you have to pay out-of-pocket before the insurance company steps in. You'll usually see this with liability policies, especially umbrella coverage.

An SIR comes into play when your umbrella policy "drops down" to cover a claim that your primary policy doesn't cover at all. For example, say your umbrella policy covers defamation, but your general liability policy doesn't. If you're hit with a defamation lawsuit, you would have to pay the SIR amount first—say, $10,000—before your umbrella insurer takes over and handles the rest.

At First Class Insurance, we specialize in crafting the precise layers of protection your jewelry business needs to thrive securely.

Get a Quote for Jewelers Block