Relying on a generic business policy is a massive gamble for any wholesaler, but when you're dealing in high-value jewelry, it's downright reckless. The right business insurance for wholesalers isn't some off-the-shelf product; it's a specialized shield built for the unique risks you face, from protecting your inventory to covering complex shipping logistics. For anyone in the jewelry business, this isn't just a recommendation—it's non-negotiable.

Why Standard Insurance Falls Short for Wholesalers

Think of a standard Business Owner's Policy (BOP) like a starter home. It's solid, provides general protection, and works perfectly well for a lot of businesses. But a jewelry wholesaler's operation is more like a high-security vault—it demands custom-engineered safeguards that a standard home design just can't provide.

This is where things get serious. Generic policies are riddled with gaps when it comes to the real-world dangers of the jewelry trade. They often put strict, low limits on inventory coverage, exclude goods the second they leave your building, and completely ignore unique risks like mysterious disappearance—where a high-value piece simply vanishes with no evidence of theft.

The Specialized Shield of Jewelers Block

For a jewelry wholesaler, the absolute foundation of your protection is a Jewelers Block insurance policy. This isn't just another line item; it's a comprehensive package policy created by the jewelry industry, for the jewelry industry. It’s designed specifically to close the dangerous loopholes that standard policies leave wide open.

A standard policy might cover a fire in your warehouse but will likely deny a claim for a tray of diamonds that goes missing from a salesperson’s car. A Jewelers Block policy is built to handle both, giving you seamless protection from your vault to your customer’s door.

Moving Beyond Basic Coverage

To truly protect your business, you have to stop thinking of insurance as just another operational expense. For you, it’s a core strategic asset. It's what protects your inventory, your reputation, and your ability to operate with confidence in a very high-stakes world.

This all starts with understanding that a standard policy is the starting line, not the finish. Partnering with a specialist like First Class Insurance ensures you get coverage designed for your reality, not for a generic business down the street.

Understanding Jewelers Block: Your Primary Defense

Trying to protect a jewelry wholesale operation with a standard business policy is like trying to secure a vault with a flimsy bicycle lock. Sure, the lock provides some security, but it's completely outmatched by the value it’s supposed to protect. It simply wasn't built for the job.

This is exactly why Jewelers Block insurance is the absolute bedrock of any serious jewelry business. It’s not just another policy; it's a specialized, all-in-one package designed to shield your high-value inventory as it moves through every single stage of your business. Forget the bicycle lock—this is your custom-built vault, engineered to protect your assets wherever they are.

What Exactly Does Jewelers Block Cover?

A standard property policy is static. It’s designed to protect items that stay put, safely within your four walls. But that's not how the jewelry trade works, is it?

Jewelers Block is built for the dynamic nature of your business. It provides "all-risk" coverage, which is just what it sounds like: it protects against every imaginable peril unless it’s specifically excluded in the policy language.

This seamless protection goes far beyond your main showroom or warehouse. It typically covers:

- Stock on Premises: This is your home base inventory—loose stones, finished pieces, and raw materials held at your primary business location.

- Goods in Transit: Protects your jewelry while it’s being shipped to retailers or other locations. This is a massive gap where standard insurance often fails completely.

- Items on Memo: Covers the inventory you’ve entrusted to retailers, salespeople, or other partners. It’s still your asset, even when it's not in your hands.

- Travel Coverage: Safeguards your inventory while you or your sales reps are on the road, visiting clients, or attending trade shows.

The Critical Case of Mysterious Disappearance

Let’s walk through a real-world scenario that shows exactly why this specialized coverage is so vital.

Imagine your team does a routine inventory count and discovers a tray of diamond rings worth $100,000 is missing. There are no signs of forced entry, no alarms tripped, and no security footage of a theft. The tray is just… gone.

With a standard policy, you'd likely be out of luck. Without clear proof of a break-in, the insurer would almost certainly deny the claim, leaving you to absorb a crippling six-figure loss.

This is what the industry calls "mysterious disappearance," a unique and unnerving risk for any business handling small, high-value items. Jewelers Block insurance is one of the only policies specifically built to cover these unexplained losses, giving you a crucial safety net that standard policies simply ignore.

This one feature alone highlights why Jewelers Block is indispensable. It acknowledges the nuanced, complex risks that are part of the daily reality of the jewelry industry. True insurance for a jewelry business from a specialist gives you the confidence to operate, knowing your most valuable assets are protected from your vault all the way to their final destination.

Building a Complete Safety Net Around Your Business

While your Jewelers Block policy acts as the high-security vault for your inventory, thinking it covers everything is a huge mistake. Your business faces risks that have nothing to do with the jewels themselves, and you need a multi-layered safety net to protect every angle of your operation.

A truly comprehensive business insurance for wholesalers strategy is about more than just one policy. It’s about integrating several key coverages, with each one plugging a specific gap. This ensures a single unexpected event doesn’t unravel the business you’ve worked so hard to build.

Beyond Inventory: The Key Policies You Can't Ignore

Let's break down the essential components that form a complete protective shield. These policies handle the everyday operational risks that every business—especially a high-value wholesaler—has to plan for.

- General Liability Insurance: Imagine a retail partner is visiting your showroom to see a new collection, slips on a wet floor, and gets injured. General Liability is what steps in to cover the medical bills and legal costs that follow, protecting you from third-party claims of bodily injury or property damage.

- Commercial Property Insurance: This policy is for your physical space and everything in it that isn't inventory. We're talking about computers, office furniture, lighting, and your beautiful display cases. If a fire or a nasty storm damages your office, this is the coverage that helps you repair or rebuild.

- Business Interruption Insurance: Let's say that fire forces you to close down for months. How do you pay your team? Or your rent? Business Interruption coverage is designed to replace the income you lose during that downtime, helping you cover payroll and other fixed expenses until you’re back up and running.

This layered approach is non-negotiable. While Jewelers Block is the star player protecting your inventory, think of General Liability and Commercial Property as the essential teammates defending the rest of your business.

Shielding Your Business From Modern Threats

Your safety net also has to account for risks that are less visible but every bit as damaging. In today's world, two policies have become absolutely vital for any jewelry business.

Crime Insurance is what protects you from internal threats, like an employee who has been quietly stealing inventory over a long period. At the same time, Cyber Liability Insurance is your defense against digital threats. If your client database gets hacked, it helps cover the staggering costs of data recovery, notifying customers, and dealing with regulatory fines.

To truly build a complete safety net, you also have to think about physical safeguards that prevent losses before they happen. For example, implementing robust tamper-evident packaging solutions can be a powerful deterrent against theft in transit, which directly strengthens your risk profile in the eyes of an underwriter.

Getting involved with industry organizations can also be a massive help. Groups like the Southern Jewelry Travelers Association provide invaluable resources and risk management guidance that can make all the difference.

What Drives Your Insurance Costs and How to Lower Them

Getting a handle on your insurance premiums is the first step toward controlling them. Think of it like a security assessment for your home—the stronger your defenses are, the less an insurer sees you as a risk. They aren't just looking at the total dollar value of your inventory; they're digging into the specific risks your unique operation faces every single day.

When an underwriter looks at your business, they're meticulously evaluating a handful of key factors to come up with your premium. Things like the total value of your stock, the physical security of your building (we’re talking vault ratings and alarm systems), how you ship your goods, and even where your business is located all paint a picture of your overall risk profile.

Key Factors Influencing Your Premium

The math behind your insurance premium is a mix of tangible assets and the protocols you have in place. Underwriters put a lot of weight on these specific areas:

- Total Inventory Value: This one's the most straightforward. A higher-value inventory naturally represents a bigger potential loss, which means a higher premium. It’s simple math.

- Security Measures: Your best defense is a strong offense. This means having UL-rated vaults and safes, central station alarm systems, high-definition surveillance cameras, and solid access control systems. The more layers, the better.

- Transit Protocols: How your jewelry gets from Point A to Point B is a massive concern for insurers. Using armored carriers for high-value shipments shows you're serious about reducing risk, and it can lower your costs way more than relying on standard shipping methods.

- Claims History: A track record of frequent claims is a red flag for any insurer. It signals higher risk, and that almost always leads to higher premiums.

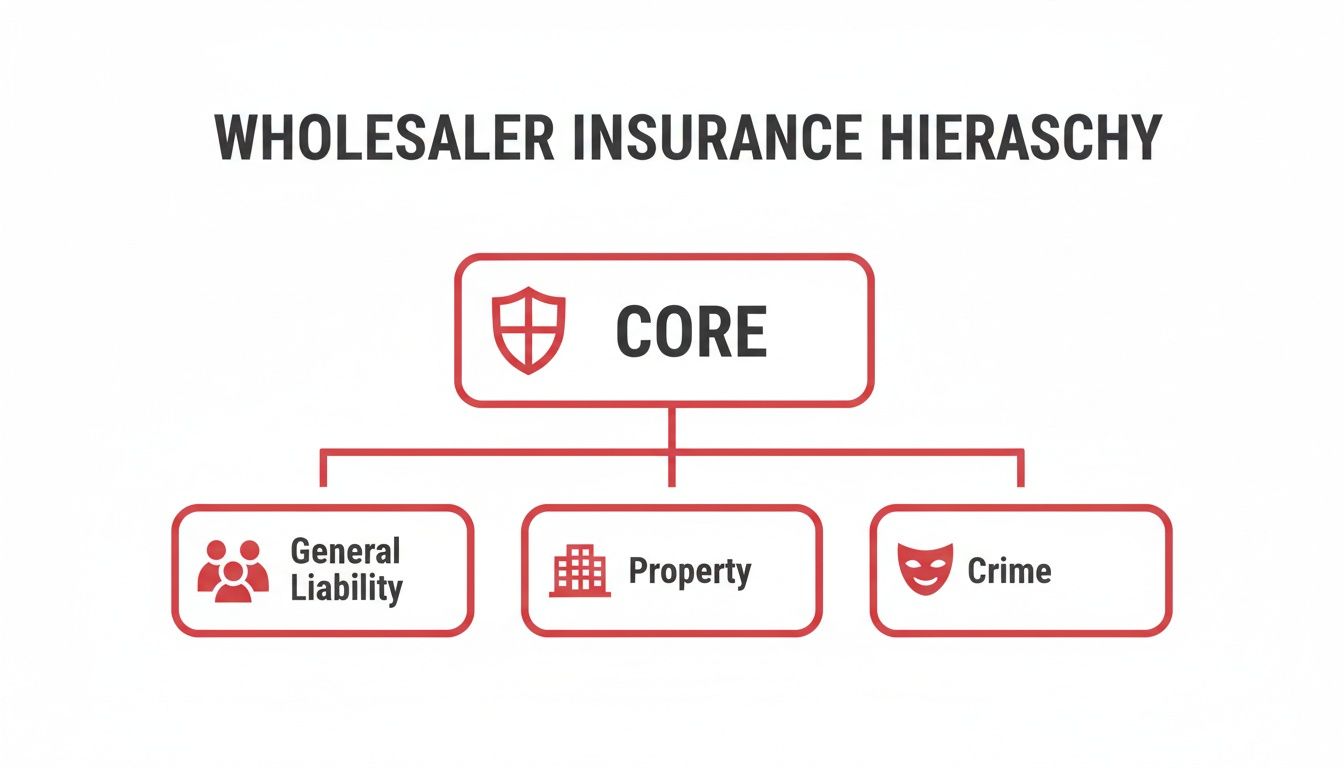

This visual breaks down the core pieces of a solid insurance strategy, which really form the foundation of your business’s protection.

As you can see, even the most specialized coverages are built on those essential pillars: General Liability, Property, and Crime insurance. Get those right first.

Actionable Strategies for Lowering Costs

You have way more control over your insurance costs than you might think. By proactively managing your risks, you can make your business a much more attractive client to underwriters. Simple, smart strategies can lead to some serious long-term savings.

Theft and losses during shipping are two of the biggest threats to jewelry wholesalers. According to the FBI, thousands of cargo thefts are reported in the U.S. every year, and high-value goods like jewelry are always prime targets, adding up to millions in losses. This isn't just a statistic; it's a stark reminder of why you need both specialized coverage and rock-solid risk management.

Taking proactive steps isn't just about saving a few bucks—it's about building a more resilient, secure business from the ground up. A strong risk management plan shows insurers that you’re a responsible partner in protecting your own assets.

Beyond just picking the right policy, strong operational habits can make a huge difference in your risk profile. For example, mastering efficient inventory control doesn't just make your business run smoother; it helps cut down on potential losses, which in turn can lower your premiums.

By conducting regular security audits, constantly training your staff on security protocols, and keeping meticulous records, you're actively lowering your risk and making your business a much better bet for any insurance carrier.

How to Prepare for Your Insurance Quote

Getting the right business insurance for wholesalers shouldn't feel like you're under a microscope. The truth is, walking into the process organized is the fastest way to get a solid, competitive quote. Think of it this way: you're making a professional case for why your business is a smart risk. The clearer and more detailed your story, the better the terms you’ll get.

An underwriter’s entire job is to measure risk. When you hand them a complete, detailed picture of your operation, you eliminate the guesswork. It shows you're a serious, responsible business owner and makes the whole process smoother for everyone involved, ensuring the policy you end up with actually fits your needs.

Your Essential Quote Preparation Checklist

To get the most accurate insurance for a jewelry store or wholesale business, it pays to have your ducks in a row. Pulling together these documents before you even start the conversation will dramatically speed things up.

- Detailed Inventory Lists: This is the absolute foundation of your Jewelers Block policy. You need a complete breakdown of your inventory—what you have, how many, and what it’s all worth at current market value.

- Recent Appraisals: For your high-ticket pieces or significant collections, fresh appraisals from certified gemologists are non-negotiable. Insurers need to see them.

- Security System Specifications: Document everything. I mean everything—the make and model of your alarm system, the specific UL rating of your vault (like a UL TRTL-30×6), details on camera surveillance, and how you control access.

- Shipping and Transit Protocols: How do you move your product? Lay out your procedures clearly. List the carriers you trust, your packaging standards, and whether you use armored transport for high-value shipments.

A comprehensive security overview is your single most powerful tool for influencing a quote. When you can clearly document robust security measures, you directly lower the underwriter's perceived risk. That often translates directly into better premiums.

Partnering with an Expert for Your Quote

Once you have all your information together, the next step is finding a specialist who actually gets the jewelry business. A good agent is more than a go-between; they're your advocate. They know how to present your business in the best possible light because they know what underwriters are looking for.

At First Class Insurance Jewelers Block Agency, we make this simple. You can easily Get a Quote for Jewelers Block by bringing your prepared information to our team. We take our deep industry experience and connect you with the right underwriters, making sure you get a policy that truly protects your business. This kind of partnership is what turns good preparation into real savings and genuine peace of mind.

Choosing the Right Insurance Partner

Picking a policy is only half the battle. The final, most critical piece of the puzzle is choosing the right insurance partner to stand beside you when things go wrong. For a jewelry wholesaler, your agent is just as vital as the policy documents they hand you.

This isn't just another business transaction; it's a strategic partnership. You wouldn't give the keys to your vault to just anyone, and your insurance deserves the same level of trust. The right partner gives you more than a piece of paper—they deliver genuine peace of mind built on years of hands-on industry experience.

What to Look for in a Specialist Agency

Let's be clear: not all agents are created equal. When your entire inventory is on the line, you need a specialist who lives and breathes the jewelry business. An expert partner, like First Class Insurance Jewelers Block Agency, brings specific, tangible advantages to the table that a general insurance agent simply can't.

Your ideal partner should have:

- Deep Industry Expertise: They need to know the difference between memo goods and stock, the critical importance of transit protocols, and the subtle but huge risks like mysterious disappearance. They should speak your language fluently.

- Access to Specialized Underwriters: A specialist has established, trusted relationships with the key underwriters who actually write Jewelers Block insurance. This means you get access to the best terms and coverage options, not just a generic quote. You can learn more about major market makers like Lloyd's of London and their huge role in this specialized world.

- Proactive Risk Management Advice: A great agent doesn’t just sell you a policy. They help you spot potential weak points in your security and operations, offering practical advice that can lower your premiums and, more importantly, stop a loss before it ever happens.

A Partner in Protection Not Just a Policy Provider

Ultimately, the best insurance for a jewelry business comes from an agency that acts like an extension of your own team. They should be there to guide you when you Get a Quote for Jewelers Block and, crucially, be your staunchest advocate if you ever have to file a claim.

Choosing your insurance partner is an investment in your company's resilience. It’s about finding someone who understands what's at stake and is committed to protecting your assets with the same care you do.

With decades of dedicated experience, a specialist provides the confidence that comes from knowing your protection was built by someone who truly gets your world. That’s the real foundation of effective business insurance for wholesalers in the high-stakes jewelry trade.

Frequently Asked Questions

When you're dealing with the kind of high-stakes inventory that jewelry wholesalers handle, it's only natural to have a lot of questions about your insurance. Getting the right answers is the key to protecting your assets properly. Here are some of the most common questions we hear every day.

Is My Homeowners Insurance Enough for My Home-Based Wholesale Business?

This is a common question, and the answer is always a hard no. A standard homeowners policy might cover a few thousand dollars of business property, if you're lucky. That's pocket change compared to the value of a jewelry inventory.

Worse, it does absolutely nothing for the real risks you face, like a shipment vanishing on its way to a retailer or a piece going missing from a memo line. To be truly protected, you need a dedicated Jewelers Block insurance policy. It's built from the ground up to cover the unique risks of the jewelry trade, whether you work from a commercial vault or a secure room in your home.

What Is Mysterious Disappearance Coverage?

Let's be honest, it's one of a jeweler's worst nightmares. You do a spot check on your inventory, and a piece is just… gone. There’s no sign of a break-in, no clear evidence of theft, but you know for a fact it’s missing. That's a mysterious disappearance.

Standard business policies almost never touch this kind of loss. But for a wholesale jeweler managing hundreds of small, high-value items, it's a critical vulnerability. Mysterious disappearance coverage, included in a solid Jewelers Block policy, isn't just a nice-to-have; it's an absolute necessity for real-world peace of mind.

How Do I Ensure My Shipments to Retailers Are Covered?

First, you need to make sure your Jewelers Block insurance policy explicitly includes "goods in transit" coverage. But getting the policy is only step one. The real key is following your insurer's shipping rules to the letter.

These protocols are non-negotiable. They often require using specific carriers like FedEx or UPS for certain values, always double-boxing your packages, and never, ever putting markings on the outside that hint at the valuable contents. If you don't follow these steps precisely, your insurer could have grounds to deny a claim, leaving you with a massive loss.

Ready to secure specialized protection for your wholesale jewelry business? The experts at First Class Insurance are here to help you navigate your options and build a policy that fits your unique needs. Get started with a no-obligation quote today.