Cargo Insurance protects your high-value pieces in transit. Liability Insurance steps in when a customer slips, falls, or their property gets damaged at your shop. Together, these two policies create a robust safety net for jewelers facing everything from stolen shipments to third-party claims. For jewelry store insurance or insurance for a jewelry business, adding specialized Jewelers Block insurance through First Class Insurance Jewelers Block Agency ensures comprehensive protection across your showroom and supply chain. Get a Quote for Jewelers Block today.

Why Jewelers Need Cargo And Liability Insurance

Whether you run a boutique, an online shop, or a high-end storefront, insurance for a jewelry store is non-negotiable.

Think of cargo insurance as a mobile vault—steel-strong protection on the move.

Liability insurance? That’s your legal shield, standing guard around your store’s doorstep. Together, they cover risks in transit and exposures under your roof.

- Cargo Insurance pays for loss or damage to jewelry during shipment. It kicks in for incidents like theft, accidental breakage, or even mysterious disappearance.

- Liability Insurance handles claims when someone is hurt or their property is damaged on your premises. Lawsuits, medical bills, and settlement costs all fall under its umbrella.

Shipping jewelry brings unique challenges—temperature swings, rough handling, misplaced packages. Inside the showroom, a simple slip-and-fall or a display spill can trigger expensive claims. That’s why both layers matter equally.

Below is a quick side-by-side look at how cargo and liability insurance differ across four main aspects:

Comparison Of Cargo And Liability Insurance

| Aspect | Cargo Insurance | Liability Insurance |

|---|---|---|

| Covered Perils | Theft, damage, mysterious disappearance | Bodily injury, property damage |

| Policy Trigger | Loss or damage during transit | Claim or lawsuit by a third party |

| Covered Parties | Declared shippers and entities | Customers, visitors, third parties |

| Valuation Method | Invoice value, agreed value, declared value | Legal judgments, medical expenses |

This comparison shows why these two policies complement each other—one safeguards your goods, the other protects against lawsuits.

Key Benefits Of Combined Coverage

- Streamlined Claims: One broker handles both transit losses and customer incidents, speeding up resolutions.

- Cost Savings: Bundling these policies often lowers your total premium.

- Regulatory Peace Of Mind: Liability coverage keeps you compliant with venue rules, global regulations, and vendor contracts.

When you’re shipping a high-value ring to a client or hosting an in-store event, this dual protection is priceless.

To see how these coverages work together in a real-world scenario, check out this diamond ring risk example from First Class Insurance: View diamond ring risk scenario.

Armed with these insights, you can choose cargo and liability policies that keep your jewelry business secure at every turn.

Exploring Cargo Insurance Concepts

When a jeweler entrusts a precious heirloom to a courier, cargo insurance becomes your on-the-go safe. It jumps in when customs stalls, transit hiccups, or criminal acts threaten your goods.

There are two core options: All-Risk and Named-Peril. All-risk coverage steps up for almost any loss, while named-peril only responds to the specific dangers you’ve picked—think fire or theft.

- All-Risk Coverage: Protects against virtually all unexpected damage or loss.

- Named-Peril Coverage: Pays out only for the listed threats you select.

- Courier Scenario: Shows how your choice influences claim success after a missed scan or a damaged lockbox.

Institute Cargo Clauses Explained

Behind the scenes of international shipping lie the Institute Cargo Clauses A, B, and C—three levels of protection that let you tailor cover to your needs. Before shipment, agreed-value, invoice-value, or declared-value endorsements lock in your payout limits.

| Clause Type | Coverage Level | Typical Use Case |

|---|---|---|

| A | All Risks | High-value gem cross-border |

| B | Limited Risks | Domestic shipments |

| C | Basic Risks | Low-value mail runs |

Common triggers range from physical damage to outright theft. Even a sapphire disappearing from a conveyor belt can be a “mysterious disappearance” under an all-risk plan.

73% of jewelry theft claims involve transit vulnerabilities that named-peril policies might not cover fully.

Premium Calculations In Shipping

Your premium hinges on declared value, route complexity, and security features. Declare more, pay more—but rest easy knowing full reimbursement.

- Route Complexity: Cross-country runs cost more than local mail.

- Security Measures: Armed courier vs. standard carrier shifts the rate.

- Packaging Standards: Tamper-evident seals and GPS trackers can shave off costs.

In 2025, the global cargo insurance market stands at USD 75,214.5 million, underscoring how vital this coverage is for international trade. For deeper insights, check out the Cargo Insurance Market Report by Cognitive Market Research.

Ecommerce Trends Shaping Cargo Insurance

Online jewelry sales are booming, and that surge brings fresh challenges. International deliveries now face higher logistics fees and tighter carrier rules.

Brokers like First Class Insurance are adjusting models to balance competitive premiums with controlled risk exposure.

Case Study Gem Shipment Example

Imagine a cross-country diamond run from Miami to Seattle with a declared value of $200,000. Thanks to strict chain-of-custody procedures and GPS tracking, the jeweler snagged a 15% premium discount. On the flip side, a simple local mail run valued at $2,000 carried a 0.3% rate.

- Cross-Country Example: 0.5% rate on $200,000 value = $1,000 premium

- Local Mail Example: 0.3% rate on $2,000 value = $6 premium

These scenarios highlight how route and value drive premiums—and why pairing cargo with liability insurance is a smart move.

- Tip: Always review interstate regulations, package with reputable carriers, and confirm declared values with your broker before you ship.

Exploring Liability Insurance Concepts

Liability insurance is your shop’s safety net when things go sideways. Imagine a customer slipping on a slick showroom floor or a display case defect causing injury. Instead of scrambling for funds, you have a policy stepping in to cover medical expenses, legal fees and settlements.

That coverage breaks down into two main buckets:

- General Liability protects you against on-site incidents—think slip-and-fall mishaps and property damage in your store.

- Product Liability acts like a stamp of confidence on every piece you sell, guarding against defects and any harm they might cause.

- Coverage Scope typically includes medical costs, defense counsel fees and court judgments.

“Pinpointing exactly what’s covered prevents nasty surprises when a claim comes in,” says insurance veteran Marisol Cortez.

Policy Limits And Defense Costs

Every liability policy spells out two critical numbers: the per occurrence limit (the max you’ll get per claim) and the aggregate limit (your total ceiling for the policy term).

Legal bills can either sit outside these limits—paid on top—or erode your total available coverage. The fine print in your policy determines which bucket your defense costs fall into.

A customer slips on a glossy showroom floor. The claim trail begins with medical reports, then legal notice arrives. Liability insurance kicks in to handle both defense and settlement up to your policy limits.

Here’s how a typical claim unfolds:

- Incident occurs and you notify your carrier.

- An adjuster reviews photos, medical bills and coverage triggers.

- The carrier appoints defense counsel and negotiates a settlement.

- Claim closes once all legal and medical expenses are settled.

Example Store Event Walk Through

Picture this: a guest trips over a misplaced display box and breaks their wrist. Medical bills come in at $5,000, plus legal expenses.

You have a $100,000 per occurrence limit and a $300,000 aggregate limit. This incident fits comfortably under your policy caps. Even if defense fees run about 20% of the payout, you’re still covered.

- Choose per occurrence limits that exceed likely medical or repair costs.

- Verify whether defense costs eat into or sit outside your coverage limits.

- Keep an eye on aggregate limits so one big claim doesn’t wipe you out.

Pairing Liability With Cargo Protection

Covering in-store accidents is only half the battle. High-value shipments face their own perils: theft, transit damage or “mysterious disappearance.” That’s where cargo insurance comes in.

Endorsements like Jewelers Block insurance extend your protection:

- Vault and in-transit coverage for employee theft

- Valuation methods tied to appraised or invoice values

- Mysterious disappearance safeguards

By combining liability with cargo insurance, you wrap both your showroom and your shipments in a single risk-management strategy.

First Class Insurance Jewelers Block Agency specializes in these tailored solutions. Get a Quote for Jewelers Block today to make sure your store and your shipments are covered from every angle.

Pairing cargo and liability insurance ensures that both your shop floor and your shipments are protected under one roof.

This unified approach minimizes gaps and streamlines claims handling for jewelers juggling store events and transit risks. Visit First Class Insurance to learn more.

Coverage Triggers And Exclusions For Jewelers

Insurance can feel like a safety net—you just have to know where the holes are. For jewelers, those gaps often show up in the fine print under cargo and liability insurance triggers and exclusions.

Whether your gems are en route or under your showcase lights, understanding when coverage kicks in (and when it doesn’t) is the difference between a smooth claim and an unwelcome surprise.

Cargo Insurance Demand And Theft Trends

Global marine cargo premiums climbed to USD 22.64 billion in 2024. At the same time, cargo theft jumped 27% over last year, with losses averaging USD 202,000 per incident. For the full data dive, check the IUMI Stats Report.

Common transit triggers include:

- Courier Theft – Packages tampered with or diverted

- Armed Robbery – Violent seizures during pickup/delivery

- Mysterious Disappearance – Losses without clear evidence

In-store triggers under Jewelers Block or liability policies often cover:

- Shoplifting – Inventory stolen from showcases

- Employee Fraud – Dishonest acts by staff handling valuables

Transit Risk Case Studies

In Denver, a jeweler entrusted a $50,000 diamond necklace to a courier. When the driver sidestepped chain-of-custody protocols, the armed robbery clause kicked in—payout arrived within days.

Down in Miami, a sapphire shipment went missing between customs checkpoints. Rather than dispute carrier liability, the jeweler filed under mysterious disappearance and received full reimbursement.

“Pinpointing your triggers now prevents nasty surprises later,” says Maria Lopez, underwriter at First Class Insurance.

Standard Exclusions

No policy is perfect. Watch out for major carve-outs such as:

- War Risk – Losses due to conflicts or terrorism

- Nuclear Perils – Damage from radiation or contamination

- Wear-And-Tear – Gradual deterioration from regular use

When a glass display aged out of its warranty, a cracked shelf claim was denied under the wear-and-tear exclusion. The solution? An equipment breakdown endorsement to cover aging fixtures.

Coverage Triggers And Exclusions For Jewelers

This table lists common coverage triggers and exclusions specifically relevant to jewelry businesses.

| Coverage Aspect | Trigger | Exclusion |

|---|---|---|

| Courier Theft | Unauthorized package tampering | Natural deterioration |

| Armed Robbery | Violent seizure in transit | Internal employee theft |

| Mysterious Disappearance | Unaccounted loss without proof | Wear-and-tear damage |

| Shoplifting | Theft by customers | Damage during routine cleaning |

| Employee Fraud | Dishonest internal conduct | Third-party property damage |

Use this snapshot to map out coverage gaps before you sign on the dotted line.

Questions To Ask Your Broker

Before you commit, drill into the details:

- Which transit triggers are explicitly covered under my cargo policy?

- Does my declared-value endorsement include mysterious disappearance?

- Can I layer in armed robbery protection at pickup and delivery?

- How does shoplifting coverage differ when bundled with Jewelers Block?

- Are display cases, toolkits, or aging fixtures excluded by default?

Smart endorsements—equipment breakdown, war risk, or nuclear perils—can turn those exclusions into covered scenarios.

Negotiation Best Practices

Insurance isn’t just about price. It’s about precision.

- Request sample policy wording and read it line by line.

- Compare drafts from multiple carriers to spot subtle exclusions.

- Adjust sub-limits and thresholds for your highest-value items.

Match deductibles to your sales volume and risk appetite. A few strategic tweaks can be the difference between approved and denied claims.

Key Takeaway: Clear trigger definitions and filled-in exclusions pave the way for seamless claims.

Finally, schedule an annual review with a specialty broker like First Class Insurance. That way, your coverage evolves with your business—and you’ll never be caught off guard.

Key Policy Endorsements And Add-Ons

Think of standard cargo and liability coverage as the sturdy hull of a ship. Endorsements are the extra bulkheads and watertight doors that protect your most valuable cargo—your jewelry—from every angle.

Four endorsements deserve a jeweler’s close attention: Jewelers Block insurance, In-Transit Coverage, Mysterious Disappearance, and Automatic Reinstatement. Each one plugs a gap that ordinary policies often overlook.

Imagine you’re shipping a high-end necklace and it simply never arrives at the next hub. Without the right endorsement, you could be stuck in months of finger-pointing. With these add-ons, your claim moves from “pending” to “paid” in record time.

Major Endorsements Jewelers Should Consider

-

Jewelers Block insurance

A true all-in-one shield for your inventory, display cases, tools and shipments. It even handles employee dishonesty, vault damage and premises exposures—coverage that goes well beyond basic cargo and liability. -

In-Transit Coverage

Think of this as a bodyguard for your goods on the move. Whether you’re shipping via courier, truck or air, it covers theft, accidental damage and unexpected delays from departure to delivery. -

Mysterious Disappearance

When items vanish without a trace—no visible damage, no paperwork trail—this endorsement steps in. Perfect for handoffs between carriers or bonded storage situations. -

Automatic Reinstatement

After a claim payout, your limits snap right back into place. No gaps. No waiting periods. Ideal for peak seasons when you’re running multiple shipments at once.

In one 2024 example, a jeweler lost a $150,000 opal necklace at a cross-dock facility. Thanks to the Mysterious Disappearance clause, the insurer cut the check within weeks, sidestepping a protracted liability battle.

“Endorsements like Jewelers Block can mean the difference between a quick settlement and a protracted claim fight,” says a First Class Insurance underwriter.

Negotiating Limits And Deductibles

Working with a specialty broker like First Class Insurance lets you tailor sub-limits and deductibles to your cash flow and risk appetite. For example:

- Opt for a $5,000 deductible on in-transit coverage to reduce your premium, if you can absorb minor losses in-house.

- Ask for valuation based on agreed or appraised value instead of the invoice amount.

- Structure per-shipment and aggregate sub-limits that mirror your average consignment size.

Right now, the marine cargo insurance market is seeing rate softening—rates are projected to drop 7.5% to 10% as capacity expands. Learn more about this outlook on Risk Strategies.

Bundling Strategies For Balanced Coverage

Bundling endorsements can unlock savings and simplify your program. Pair Jewelers Block, In-Transit and Mysterious Disappearance under one umbrella and you could see discounts of up to 20%. Then:

- Link valuation endorsements to an annual appraisal to keep premiums in line with market value.

- Review your bundles each year as your sales channels or event schedule shifts.

- Mix higher deductibles on low-risk add-ons to fund richer protection where it matters most.

Discover Lloyd’s of London underwriting insights in our resources by exploring Lloyd’s of London coverage nuances. Smart bundling balances cost and coverage, tailoring endorsements to your unique risk profile.

First Class Insurance walks you through each endorsement choice, building a cargo and liability program that blends robust protection, affordability and peace of mind. Always loop in your broker when new risks emerge.

Claims Process And Risk Management

When a shipment hits a snag or someone gets injured in your store, moving fast can save you serious headaches—and cash. Cargo and liability insurance spell out general steps, but jewelers need a workflow built for high-value pieces.

A clear, phased approach keeps surprises to a minimum. It also prevents delays that can stall your settlement.

Claims Timeline At A Glance

- Notify your insurer within 24 hours of the incident.

- Capture damage details: photos, GPS logs and carrier receipts.

- File a police or carrier investigation report within 14 days.

- Send in valuation certificates from a certified appraiser.

- Respond quickly to adjuster requests and review settlement drafts.

Step By Step Claims Workflow

Once you discover a loss, email your broker immediately—ideally the same day. Cargo claims hinge on airway bills, courier labels and a full tracking history to pinpoint the last known location.

Liability claims, by contrast, rely on medical invoices, witness statements and repair estimates. Nail these deadlines and you can shrink a months-long process down to 30 days.

| Document | Purpose | Deadline |

|---|---|---|

| Shipment Proofs | Verify item details and condition | 7 days |

| Police or Carrier Report | Confirm theft or damage | 14 days |

| Valuation Certificate | Support accurate reimbursement | 30 days |

| Medical or Repair Bills | Justify liability settlement amounts | 30 days |

Use your broker’s digital portal to upload everything in one shot. Cloud-based folders, organized by date and type, keep critical docs at your fingertips.

Tip: Keep a master claim packet template—forms, dates and contact info—so you never miss a required item.

“Fast, accurate documentation can cut your claim cycle in half,” says Maria Lopez at First Class Insurance.

Maintain an open line with underwriters. Weekly status updates and clear questions nip hold-ups in the bud and strengthen your broker relationship.

Preventive Risk Management Strategies

Think of your risk-management plan as a multi-layered security system for your inventory. Each layer adds protection, from departure to delivery.

-

Secure-Package Design

- Reinforced corrugated boxes with custom foam inserts

- Tamper-indicator seals that reveal unauthorized access

-

Carrier Vetting

- Compare historical loss ratios and on-time performance

- Verify insurance limits match declared values

-

GPS Tracking

- Real-time location pings every hour in transit

- Geo-fencing alerts if packages stray off course

-

Staff Training Drills

- Monthly simulations for incident reporting

- Role-play scenarios for customer injury responses

Implementing these steps is like installing a high-tech alarm system around your precious inventory.

Audit Checklist For Jewelers

An annual audit shines a light on gaps in your shipping and showroom procedures. Use this checklist to inspect processes, documentation and preventive controls.

| Audit Item | Frequency | Action |

|---|---|---|

| Packaging Inspection | Quarterly | Test seals, box integrity and labels |

| Carrier Performance | Biannual | Compare delivery reliability and claims |

| Training Drill | Monthly | Practice incident response protocols |

| Documentation Review | Quarterly | Check claim readiness and form accuracy |

Regular audits pinpoint weak links—loose packaging, missing signatures or outdated forms. Partnering with a specialty broker like First Class Insurance ensures your program evolves alongside emerging risks. Over time, you’ll see fewer claims and lower insurance costs.

Practical Scenarios And Coverage Checklist

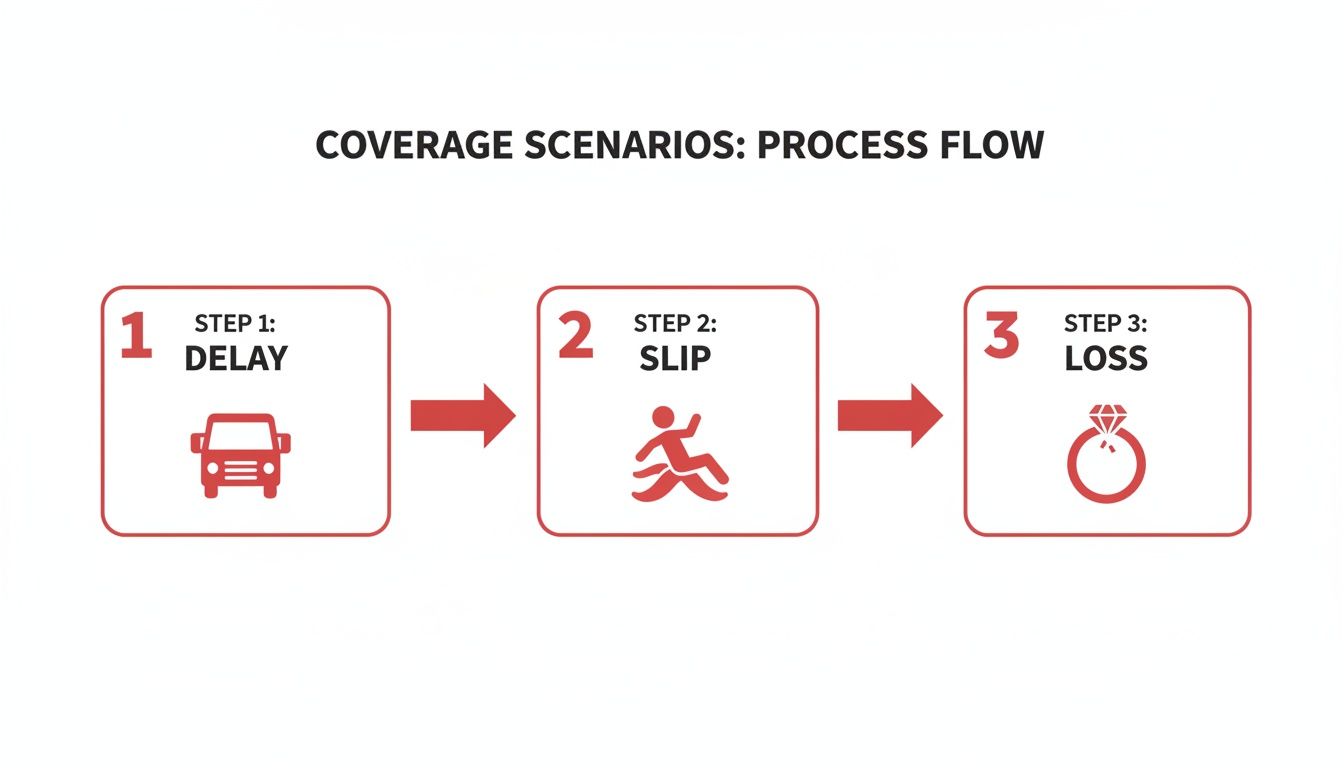

Insurance jargon can feel abstract until it’s tested in real life. These three snapshots pull back the curtain on how cargo and liability insurance actually kick in. You’ll see where hidden gaps lurk—and how to plug them fast.

Cross-Border Shipment Delay

Imagine a $150,000 diamond parcel heading from Miami to Toronto with a 48-hour delivery promise. Customs decides to inspect it, tacking on an extra 72-hour hold—well past the policy’s trigger window.

Here's what saved the jeweler:

- Notify the underwriter within 24 hours of the delay.

- Collect and submit the invoice, tracking logs and the customs hold notice.

- Obtain adjuster sign-off and receive a payout based on the agreed value.

This example underlines one truth: always double-check your transit windows and coverage triggers before you ship.

In-Store Slip And Fall Scenario

A customer catches their foot on a showroom rug and takes a tumble. Suddenly, that decorative carpet turns into a liability.

Key takeaways:

- The liability insurance policy kicks in with per-occurrence limits.

- Medical bills and a settlement hit $10,000—well under the $100,000 cap.

- Notify your insurer, gather incident reports, medical records and witness statements.

- Watch out for defense costs—they can erode your aggregate limit faster than you think.

Mysterious Disappearance During Transit

A ring vanishes without a trace between the warehouse handoff and the courier pickup. No broken glass, no forced entry—just one less diamond.

Thanks to the mysterious disappearance endorsement and an agreed-value clause, the jeweler received a clean $50,000 payout. No carrier disputes required.

“These walkthroughs help jewelers pinpoint exactly when and how policies respond,” says risk manager Elena Ruiz.

Coverage Checklist

Use this list to lock in the right limits, endorsements and broker expertise:

- Calculate your limit based on maximum consignment value and shipping frequency.

- Confirm your broker holds Jewelers Block certification and transit experience.

- Verify endorsements: in-transit, mysterious disappearance, and automatic reinstatement.

- Schedule policy reviews at least 60 days before renewal.

How To Use This Checklist

Go through each item line by line with your broker to be sure every risk is covered. Then:

- Consult the technical guide page for detailed packaging standards.

- Align renewal dates with your peak sales seasons.

- Run regular drills and mock claims to keep your team sharp.

By mapping these scenarios against the checklist, you build a proactive framework that safeguards both profits and reputation.

Read also: Learn about secure watch shipments in transit in our detailed watch shipment guide.

Implementing this checklist closes coverage gaps and accelerates claims resolution.

- Conduct annual broker interviews to tweak endorsements.

- Match declared values to seasonal inventory peaks.

Partnering with an experienced agency like First Class Insurance brings those specialized insights—and faster quotes—to the table. Keep communication clear and timely to ensure smooth renewals and coverage adjustments.

Stay proactive: review your policies every year.

Secure your assets today with expert support.

Contact First Class Insurance for a personalized quote.