A single, devastating lawsuit can shatter a jewelry business faster than a dropped diamond. When a catastrophic claim blows past the limits of your standard policies, commercial umbrella insurance is the critical layer of protection that kicks in to safeguard your business from financial ruin.

Think of it as the ultimate safety net for your entire operation.

Protecting Your Jewelry Business from Catastrophic Lawsuits

Imagine your business is a fortress protected by several walls. Your primary insurance policies—like your Jewelers Block insurance, general liability, and commercial auto—are those outer walls. They handle the everyday risks and smaller incidents.

But what happens when a truly catastrophic event hits? One that completely breaches those primary defenses?

This is where commercial umbrella insurance is so essential. It acts as a master vault, a final, heavily fortified layer that protects the very core of your business when the outer walls are overwhelmed. In an era of soaring litigation costs and multi-million dollar "nuclear verdicts," relying solely on primary coverage is a high-stakes gamble.

For a business handling high-value assets and a discerning clientele, a single severe incident can generate a lawsuit that far exceeds a typical $1 million policy limit.

Why Standard Policies Are No Longer Enough

The hard reality is that the financial risks for any business are growing, and that's especially true for an insurance for a jewelry store. A serious car accident involving a company vehicle or a severe slip-and-fall in your showroom can easily result in a lawsuit demanding several million dollars in damages.

Once your primary policy's limit is exhausted, you're personally on the hook for the rest.

This extra layer of insurance provides true peace of mind and financial security. Here’s what it does:

- Adds Higher Liability Limits: It sits right on top of your existing policies, adding millions in extra coverage.

- Covers Catastrophic Claims: It's designed specifically for those high-cost, low-frequency events that can bankrupt a business.

- Safeguards Business Assets: It prevents you from having to liquidate business assets or personal wealth to pay off a massive judgment.

For this reason, insurance experts at First Class Insurance Jewelers Block Agency view a robust commercial umbrella policy not as an optional add-on, but as a foundational element of any comprehensive insurance strategy for a jewelry business. It’s the ultimate defense for your legacy.

To see how these policies fit together, take a look at this quick side-by-side comparison.

Primary Policy vs Umbrella Policy at a Glance

This table offers a clear, side-by-side comparison to quickly show how primary policies and commercial umbrella insurance work together to protect your jewelry business.

| Feature | Primary Policies (General Liability, Commercial Auto) | Commercial Umbrella Insurance |

|---|---|---|

| Primary Role | Acts as the first line of defense for specific, everyday risks like slips, falls, or minor auto accidents. | Serves as a secondary, high-limit layer that activates only after primary policy limits are exhausted. |

| Coverage Scope | Covers defined risks associated with the specific policy (e.g., bodily injury, property damage). | Extends liability protection across multiple underlying policies, offering a broad safety net. |

| Typical Limits | Commonly capped at $1 million to $2 million per occurrence, which is often insufficient for major lawsuits. | Provides additional limits, typically starting at $1 million and going up to $10 million or more. |

Understanding this structure is key—the primary policy handles the initial hit, and the umbrella policy is there to absorb the massive shockwave that follows a catastrophic claim, keeping your business intact.

How Commercial Umbrella Insurance Actually Works for Jewelers

So, how does this all play out in the real world? It's easier to think of commercial umbrella insurance less as a separate policy and more as a high-level security detail for your existing coverage. Its one job is to step in when a truly catastrophic claim blows past the limits of your primary policies.

When a major lawsuit hits, your insurance for a jewelry store doesn't just kick in all at once. It’s a layered response, and understanding that sequence is key.

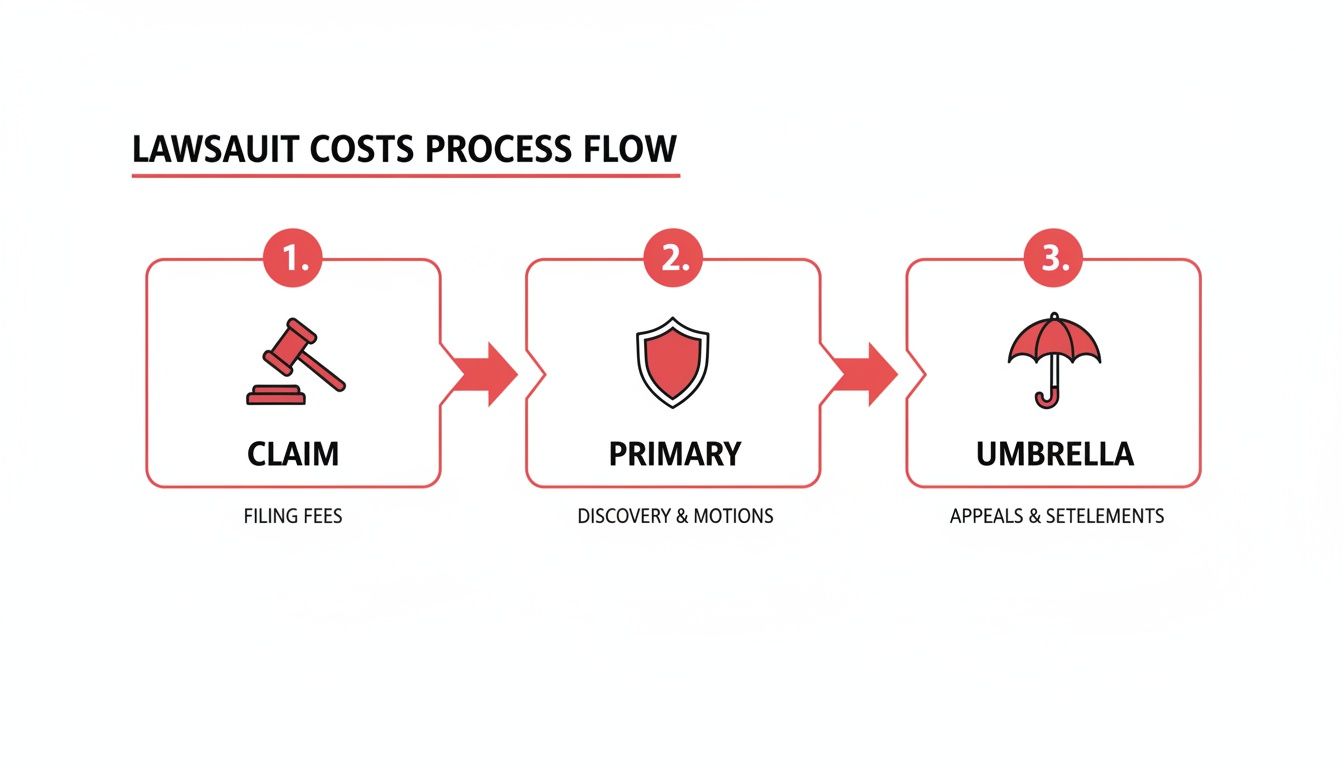

The Three-Step Payout Process

Think of it as a financial first-responder system. This layered structure is specifically designed to shield your business assets from the crippling financial weight of a massive claim—the kind that goes way beyond a simple slip-and-fall.

Here’s how it unfolds step-by-step:

- The Claim Happens: A covered event occurs, but it’s a big one. A customer suffers a life-altering injury in your showroom, or an employee causes a multi-car pileup while making a delivery. The lawsuit that follows is seeking damages that dwarf your standard policy limits.

- Your Primary Policy Jumps In: Your first line of defense—your general liability or commercial auto policy—goes to work. It covers the legal bills and damages, but only up to its limit, say, $1 million.

- The Umbrella Policy Takes Over: Once that $1 million is completely used up, your commercial umbrella policy activates. It seamlessly picks up the tab for the rest of the settlement or judgment, all the way up to its own much higher limit, stopping the financial bleeding before it reaches your business's bank account.

This visual breaks down how the costs of a major lawsuit get handled by your stacked insurance protection.

The takeaway is simple: your umbrella policy creates a continuous financial shield, kicking in right where your other coverage taps out.

Understanding Key Policy Concepts

While the process is straightforward, a couple of terms are critical for any jewelry business owner to get right. These concepts dictate exactly how and when your umbrella policy engages. The big one is Self-Insured Retention (SIR).

An SIR works a lot like a deductible, but it usually only comes into play if your umbrella policy has to cover something your primary policy won't. For instance, if your general liability excludes a particular type of claim but your umbrella covers it, you’d pay the SIR amount out-of-pocket before the umbrella policy starts paying.

The other major distinction is in the policy's architecture. Umbrella policies are built in one of two ways.

Understanding the difference between 'following form' and 'broader coverage' is vital. It dictates whether your umbrella policy simply adds more money to your existing protection or expands the scope of what’s covered.

- Following Form Policies: This is the most basic type. It literally "follows the form" of your primary policies, matching their terms, conditions, and exclusions exactly. It doesn't add any new types of coverage; it just adds a much bigger pile of money on top.

- Broader Coverage Policies: This is where an umbrella policy really proves its worth. It can "drop down" to cover claims that are explicitly excluded by your primary policies, subject to that Self-Insured Retention (SIR). A great example is a libel or slander claim that your standard general liability policy won't touch.

For a high-value insurance for jewelry business, a policy with broader coverage can be a complete game-changer. You're not just beefing up your limits; you're actively plugging potential gaps in your entire insurance program. When you get a quote for Jewelers Block and umbrella coverage from a specialist like First Class Insurance Jewelers Block Agency, hammering out these details is absolutely essential to building the right protection.

Umbrella vs. Excess Liability: What Jewelers Must Know

When you start looking for more liability protection, you’ll hear two terms thrown around a lot: commercial umbrella and excess liability. They sound interchangeable, and they both add coverage, but they are fundamentally different beasts.

For a jeweler, confusing the two can leave a catastrophic gap in your risk management strategy. You could be left exposed right when you think you're most secure.

The core difference comes down to depth versus breadth. One policy just piles more money on top of what you already have, while the other adds more money and can cover a wider range of potential disasters. It's a critical distinction that completely changes how you protect your jewelry store insurance program from the unexpected.

Getting this right is the first step toward having a real, strategic conversation with your broker at First Class Insurance Jewelers Block Agency about what your business actually needs to survive a major lawsuit.

Excess Liability Simply Adds More Money

Think of an excess liability policy like a spare gas tank you attach to your car. It’s a straightforward extension of a single, primary insurance policy.

If your general liability policy maxes out at $1 million, an excess policy might tack on another $2 million right on top of it. But—and this is the important part—it’s a "following form" policy. It follows the exact same rules, terms, and exclusions as the policy underneath it.

- No New Coverage: If your primary policy excludes a specific type of claim, so will the excess policy. No exceptions.

- Specific Application: It usually only applies to one underlying policy, like your general liability or your commercial auto, but not both.

- Identical Terms: It only kicks in for the exact same reasons the primary policy would; it just gives you a higher payout.

In short, excess liability gives you a vertical boost in dollars, but it offers zero horizontal expansion in your protection.

Commercial Umbrella Insurance Adds Broader Protection

This is where commercial umbrella insurance really shows its value, especially for a complex business like a jewelry store. An umbrella policy is designed to be a much broader shield. It doesn't just raise your liability limits; it can also step in and cover claims that your primary policies flat-out deny.

A true commercial umbrella policy can act as primary insurance for risks not covered by your other policies. This "drop-down" feature is one of the most powerful advantages it offers, turning potential coverage gaps into protected areas.

Let’s say a competitor sues your business for slander over a new advertising campaign. Your standard general liability policy might have a clear exclusion for this kind of "personal and advertising injury" claim. An excess liability policy, following form, would deny it too.

But a solid commercial umbrella policy could be your saving grace. After you pay a pre-agreed deductible, known as a Self-Insured Retention (SIR), the umbrella policy can "drop down" to cover the legal nightmare and potential settlement. This one feature can literally save a business.

It’s no surprise that market analysis shows small and medium-sized businesses make up over 60% of the commercial umbrella insurance market. To learn more, you can dig into these commercial umbrella insurance market trends and see why jewelers protect their general liability, commercial auto, and employer's liability policies first.

Real-World Scenarios Where Umbrella Coverage Is Crucial

It’s one thing to talk about insurance concepts, but seeing commercial umbrella insurance in action is where its power really hits home. That theoretical protection becomes a very real, business-saving asset when a nightmare scenario unfolds.

These examples show just how quickly a normal day can spiral into a financial catastrophe for a jewelry business—and how an umbrella policy is the one thing that can control the damage.

Scenario 1: The High-Stakes Delivery Accident

Picture this: an employee is driving across town to deliver a set of custom wedding bands. On the highway, they cause a severe multi-car pileup. Your company is found at fault, and the crash results in catastrophic injuries to multiple people, including a surgeon who can no longer operate.

The lawsuits start rolling in, demanding damages for medical bills, lost lifetime income, and pain and suffering.

- Primary Policy Payout: Your commercial auto policy has a $1 million liability limit. That money is gone in a flash, covering initial legal fees and just a fraction of the settlement for one injured party.

- The Massive Shortfall: The final judgment against your business totals $4.5 million. This leaves a staggering $3.5 million gap that you are now legally on the hook for.

- Umbrella to the Rescue: The moment your auto policy is maxed out, your commercial umbrella policy kicks in. It covers the remaining $3.5 million, saving your business from liquidating inventory, selling assets, or declaring bankruptcy just to pay the judgment.

Without that extra layer of coverage, a single traffic accident could have completely wiped out the business you worked so hard to build.

Scenario 2: The Showroom Slip-and-Fall

You’re hosting a private viewing event. A high-profile client slips on a freshly polished marble floor, falls awkwardly, and suffers a permanent back injury. The client, a prominent executive, sues your store for negligence, claiming the fall has severely impacted their future earning potential.

The settlement demand is astronomical—far more than you ever imagined for a simple fall.

A seemingly minor incident inside your store can escalate into a multi-million dollar lawsuit with shocking speed. When a claimant has significant personal assets and earning power, the damages sought can far exceed standard general liability limits.

Here’s how the finances break down:

- General Liability Limit: Your insurance for a jewelry store includes a general liability policy with a $2 million limit.

- Final Judgment: After a drawn-out legal battle, the court awards the injured client $3.75 million.

- Umbrella Policy Action: Your primary policy pays its full $2 million. Your commercial umbrella insurance then steps up to cover the remaining $1.75 million, protecting your business's capital and letting you stay open.

This is a classic example of why pairing general liability with a strong umbrella policy is non-negotiable.

Scenario 3: The Unexpected Product Liability Claim

Your workshop designs a beautiful, custom necklace with an intricate clasp. A few months later, the client claims the clasp failed, causing the heavy pendant to fall and leave a severe, disfiguring injury. They hit you with a product liability lawsuit, alleging a manufacturing defect.

The story gets picked up by the media, adding reputational damage to your mounting legal bills. The case goes to trial, and the jury sides with the plaintiff, awarding a massive sum for medical costs, punitive damages, and emotional distress. To get a better sense of how a single piece can create risk, our guide on protecting valuable diamond rings with the right insurance offers some great context.

The court’s final bill comes to $5 million. Your Jewelers Block insurance won't cover this liability, and your general liability policy is capped at $2 million. That $3 million shortfall would be a death sentence for your business. But with an umbrella policy in place, that entire amount is covered, preserving your company’s future.

Determining the Right Amount of Umbrella Coverage

Choosing the right limit for your commercial umbrella insurance isn't a guessing game. It's a calculated decision based on the very real risks your jewelry business faces every day. Standard advice often falls short for a high-value operation like yours, so you need a framework that digs into your unique vulnerabilities to figure out how much coverage is actually enough.

This means looking past basic numbers and getting real about what creates major liability exposure for your insurance for jewelry business. The goal is to build a financial shield strong enough to survive a worst-case scenario, protecting your assets and making sure your company is still standing after a catastrophic claim.

Key Factors in Your Risk Assessment

To land on the right number, you and your insurance specialist at a firm like First Class Insurance Jewelers Block Agency need to evaluate several key areas of your business. Each one represents a potential doorway for a massive lawsuit.

Your assessment should include:

- Business Net Worth: One of the main jobs of an umbrella policy is to protect your assets. At the absolute minimum, your coverage should be high enough to shield your business's total net worth from being wiped out in a lawsuit.

- Value of Your Inventory: While your Jewelers Block insurance covers the stock itself, a catastrophic liability claim could still force you to liquidate that inventory to pay off a judgment. A higher umbrella limit acts as a firewall for these core assets. You might also have options to protect specific high-value inventory, like the specialized insurance for luxury watches we cover in other guides.

- Client Interactions: Do you regularly work with high-net-worth individuals or public figures? These clients have a much higher potential to claim significant damages for things like lost income or reputational harm, which ramps up your risk profile.

- Geographic Location: Operating in a historically litigious state or a wealthy urban area can dramatically increase both the likelihood and the potential cost of a lawsuit.

The Growing Threat of Nuclear Verdicts

A huge reason for needing higher umbrella limits is the alarming trend of "social inflation" and "nuclear verdicts"—jury awards that blast past the $10 million mark. These massive judgments are becoming more frequent, driven by public sentiment against businesses and aggressive, well-funded plaintiff's attorneys.

You can see this trend in the market itself. The global commercial umbrella insurance market is forecast to surge from USD 19.6 billion in 2025 to over USD 39.7 billion by 2033. This explosion is fueled by the increasing frequency of nuclear verdicts, which saw a 27% jump from 2022 to 2023 in North America alone. It's a clear sign that robust umbrella policies are now essential. You can dig into more of these powerful commercial insurance trends on Global Growth Insights.

A standard $1 million or $2 million primary policy doesn't stand a chance against a nuclear verdict. Your commercial umbrella policy is the only tool designed to absorb that kind of financial shockwave.

Contractual Obligations and Your Limits

Finally, don't forget that your coverage needs might be set by someone else. Landlords, event organizers, and high-end suppliers often require you to carry specific liability limits as a non-negotiable part of their contracts.

These requirements can establish a baseline for your coverage, but your own risk assessment should always determine the final amount. By working with a specialist, you can make sure your policy is sized correctly to protect everything that makes your insurance for a jewelry store so unique.

Putting a Price on Peace of Mind: What Your Policy Will Cost

Let's talk numbers. Investing in commercial umbrella insurance is one of the smartest strategic moves a jeweler can make. While it does mean another premium, that cost is a tiny fraction of what a multi-million dollar lawsuit could do to your business.

The premium for an insurance for a jewelry store isn't pulled out of a hat. Underwriters look at your business from every angle to figure out a specific rate, making sure the price you pay is a true reflection of your unique risks.

What Shapes Your Premium?

When an underwriter calculates your cost, they’re digging into the details of your operation. Your claims history is a huge one—a clean track record is proof of good risk management and almost always earns you a better price.

But they also look at other key factors:

- Industry Risk: Let’s face it, the jewelry business is high-risk by nature. The sheer value of your inventory and the clients you serve automatically sets a certain baseline for rates.

- Your Existing Policy Limits: Before you can even get an umbrella policy, your underlying policies (like general liability) need to meet certain minimum limits. Sometimes, having higher limits on those base policies can actually bring your umbrella premium down.

- Employee Driving Records: If you have staff making deliveries or visiting clients, their driving records will be scrutinized. A few bad apples can definitely impact the cost.

- Business Operations: The scope and scale of what you do—whether you're a small retailer, a large wholesaler, or a manufacturer—plays a big part in the final calculation.

The logic here is simple: the bigger the perceived risk of a massive claim, the higher the premium will be. A specialist broker at First Class Insurance Jewelers Block Agency knows how to position your business in the best possible light for underwriters.

Navigating a Tough Insurance Market

It's also crucial to know that prices are affected by things happening in the wider insurance world. Right now, the commercial umbrella market is getting squeezed. Reports show that as of Q3 2025, businesses are seeing rate hikes anywhere from 8% to 20%. In fact, 58.4% of US clients already saw their premiums jump in the first quarter of the year.

This trend makes it more important than ever to work with an agency that lives and breathes this stuff. You can read more about these 2025 market dynamics and what they mean for your business.

Get the Right Quote for Your Jewelry Business

Getting the right protection for your insurance for jewelry business shouldn't be a complicated, frustrating process. This is where working with a specialist like First Class Insurance Jewelers Block Agency makes all the difference. We get the unique liabilities of the jewelry world and have built strong relationships with top-tier underwriters, including those at esteemed institutions like

That expertise means we can track down the most appropriate and cost-effective coverage for you. It all starts with a straightforward chat about how your business runs and what coverage you already have in place.

Ready to build a true fortress around your business? The next step is to Get a Quote for Jewelers Block and commercial umbrella insurance at the same time. Taking an integrated approach ensures there are no dangerous gaps between your asset protection and your catastrophic liability shield, giving you the freedom to focus on what you do best.

Frequently Asked Questions About Jewelers Umbrella Insurance

When you're dealing with high-value assets and a public-facing business, it’s only natural to have questions about commercial umbrella insurance. For a jeweler, getting the right answers isn't just good practice—it's a critical part of building a real financial fortress. Let's walk through some of the most common questions we hear.

Does Jewelers Block Insurance Cover Liability Lawsuits?

This is a fantastic question because it gets right to the heart of how different policies work together. Think of your Jewelers Block insurance as the specialized guardian of your most valuable physical assets—your inventory, stock, and the precious pieces customers entrust to you. It’s built to respond to things like theft, damage, or loss of the jewels themselves.

But it is not a liability policy. If a customer slips and falls in your showroom or an employee gets into a serious car accident while on a delivery, your Jewelers Block policy won't do a thing. That’s the specific job of policies like General Liability and Commercial Auto. Your umbrella policy then sits on top of those, creating a complete jewelry store insurance strategy. They’re two different, equally vital, pieces of the puzzle.

Can I Buy a Standalone Commercial Umbrella Policy?

In short, no. An umbrella policy isn't designed to be a standalone product; its entire purpose is to sit on top of your other liability policies and extend their limits. It can't stand on its own because there's nothing for it to build upon.

Before any insurance carrier will even consider writing a commercial umbrella insurance policy, they'll verify you have solid, primary coverage already in place. This almost always includes:

- General Liability Insurance: Your frontline defense against claims of bodily injury or property damage to others.

- Commercial Auto Liability: For any accidents involving your business vehicles.

- Employer's Liability: This is part of your workers' comp policy and responds if an employee sues you for a work-related injury.

You'll have to meet the insurer's minimum limits for these base policies—often $1 million or more—before you can even qualify to add the extra layer of umbrella protection.

What If a Claim Is Not Covered By My Primary Policy?

This is where a truly well-designed umbrella policy shows its value. Some basic umbrellas just add more money on top of your existing coverage. The better ones, however, offer something called "drop-down" coverage.

This powerful feature allows the umbrella to step in and cover certain claims that are specifically excluded by your primary policies. Imagine your general liability policy has a particular exclusion for an advertising injury claim, but your umbrella policy does cover it. In that case, the umbrella can "drop down" to act as the primary insurance for that specific incident.

When this happens, you’ll usually have to pay what's called a Self-Insured Retention (SIR). It works like a deductible you pay out-of-pocket before the umbrella policy kicks in for that otherwise uncovered claim.

How Much Does a Bad Claims History Affect My Premium?

It affects it massively. Your claims history is one of the very first things an underwriter looks at. A clean record shows you run a tight ship, making you a much lower risk and earning you better rates.

On the flip side, a history riddled with frequent or severe liability claims is a huge red flag. To an insurer, it signals a much higher chance of a future disaster, and your premium will shoot up accordingly. In some cases, a poor claims history can make it incredibly difficult to find a carrier willing to offer you a policy at any price.

Protecting your business requires a complete strategy, covering both your valuable assets and your exposure to catastrophic lawsuits. The experts at First Class Insurance Jewelers Block Agency can help you secure both Jewelers Block and commercial umbrella insurance with one seamless process. Get a Quote for Jewelers Block and build your complete fortress of protection today.