A free jewellery appraisal is almost always a quick, verbal opinion of your item's value—not a formal, written document. It’s a fantastic way to satisfy your curiosity about an inherited piece or get a ballpark figure if you're thinking of selling, but it’s not what you need to get something insured.

What a Free Jewellery Appraisal Really Means

Think of it this way: a free appraisal is like asking a car enthusiast their quick opinion on your vintage Mustang. They’ll know enough to give you a rough idea of its worth based on experience, but that’s entirely different from the detailed, multi-page inspection report a certified mechanic would give you before you buy it.

Jewelry retailers often offer these complimentary estimates to build relationships with customers. It's also a common first step before they make an offer to buy your piece or accept it as a trade-in. It gives you a starting point without any financial commitment.

Setting Realistic Expectations

It's absolutely crucial to understand the limits of a free verbal estimate, especially when you're dealing with valuable assets. This is not, and will never be, a substitute for the detailed, formal documentation that an insurance company requires.

An informal verbal estimate is for your information; a formal written appraisal is for your protection. The latter is a legal document that forms the basis of your insurance coverage, ensuring you can replace an item at its true current value.

For a jewelry business owner, this distinction is even more critical. Proper jewelry store insurance demands precise, documented valuations to adequately cover your inventory against theft, damage, or loss. A verbal opinion simply holds no weight when you need to file a claim.

Why You Need a Formal Appraisal for Insurance

When you’re securing coverage for a jewelry business, insurers need a comprehensive report that breaks down the specifics of every high-value item. This is the only way to ensure your policy limits are set correctly and that you're truly covered. A free appraisal just doesn't have the necessary detail or legal standing.

- Satisfying Curiosity: A free verbal appraisal is perfect for getting a quick, no-cost opinion on a piece you're curious about.

- Initial Sales Estimate: It can give you a ballpark figure if you're considering selling an item and want to know if it's worth pursuing.

- Insurance Ineligibility: It is not a valid document for obtaining personal jewelry coverage or a commercial Jewelers Block insurance policy.

At the end of the day, a free appraisal is a great tool for casual inquiries. But for the serious business of protecting your assets, a paid, professional, and written appraisal is the only way to go. Understanding that difference is the first step in making sure your valuable pieces are properly protected. You can see examples of pieces that would absolutely require formal documentation, like this stunning diamond ring on a black background, to understand what's at stake.

The Hidden Risks of a Free Appraisal

Everyone loves the sound of "free." But when it comes to a free jewellery appraisal, that word can hide some serious risks that might cost you dearly down the road. It seems like a quick, no-hassle way to get a ballpark figure, but what you gain in convenience, you often lose in accuracy and security.

The biggest issue right out of the gate is a potential conflict of interest. The person giving you that free verbal estimate often has a stake in the outcome. Think about it: they might also be interested in buying your piece or selling you something new.

This creates a tricky dynamic. A jeweler looking to buy your grandmother's brooch might give you a lowball figure to maximize their profit margin. On the flip side, if they're appraising a ring they just sold you, they might inflate its value to make you feel great about your purchase—giving you a dangerous and false sense of its true replacement cost.

Why a Verbal "Appraisal" Is Just an Opinion

Another major pitfall is the lack of any real documentation. A quick verbal estimate is exactly that—someone's opinion. It carries no legal weight and is completely useless when it comes to getting insurance coverage.

Imagine trying to file a claim for a stolen diamond necklace with only a "he said, she said" valuation. Your insurer will ask for a detailed, written appraisal report, and without it, you have zero proof of value. Your assets are effectively unprotected.

This is especially true when securing proper insurance for a jewelry store. Comprehensive policies like Jewelers Block insurance are built entirely on precise, documented valuations. These formal reports are what underwriters use to set your coverage limits and premiums. A casual verbal number simply isn't part of the professional equation.

A verbal 'free' opinion can become an expensive mistake when you need it most. The lack of a formal report makes it impossible to substantiate a loss, turning a potential insurance claim into a total financial loss for your business.

Inaccuracy and Missing the Details

Let’s be honest, a quick once-over at the counter is never going to be a thorough examination. A professional appraisal is an in-depth process involving specialized tools to analyze gemstone quality, clarity, metal purity, and craftsmanship. A fast, visual inspection can easily miss the subtle details that dramatically swing an item's value.

This superficial approach often leads to significant inaccuracies. For a business owner, basing your insurance for jewelry business on these numbers is a massive gamble. An inaccurate, lowball valuation means you could be dangerously underinsured, leaving you exposed to a catastrophic financial hit if a theft or disaster occurs.

Let's break down the key differences.

Free Estimate vs Certified Appraisal at a Glance

| Feature | Free Jewellery Appraisal | Professional Certified Appraisal |

|---|---|---|

| Cost | Typically free | Paid service, $75 – $350+ |

| Format | Verbal and informal | Written, detailed, multi-page report |

| Purpose | Quick estimate for curiosity or potential sale | Insurance, legal, estate, or resale purposes |

| Legal Standing | None; just an opinion | Legally binding document |

| Detail Level | Minimal; a quick visual inspection | Comprehensive analysis of the 4Cs, metals, etc. |

| Insurance Use | Unacceptable for insurers | Required to obtain proper coverage |

In the end, while a free estimate has its place for satisfying simple curiosity, it's a high-risk approach for valuing any serious asset. A professional, paid appraisal isn't just another business expense—it's a critical investment in protecting what's yours.

Why an Appraisal Is Not the Same as a Valuation

In the jewelry world, people throw around the words "appraisal" and "valuation" like they’re the same thing. They're not.

For a jewelry store owner, confusing the two is like mistaking a single sales receipt for your entire inventory report. They serve completely different functions, and getting it wrong can leave your business catastrophically underinsured.

Imagine you own a jewelry store. Your biggest concern is protecting that inventory, which is why you have a specialized Jewelers Block insurance policy. This is the coverage that kicks in for everything from a smash-and-grab robbery to a diamond that mysteriously disappears from its setting. To get the right coverage, you need the right kind of appraisal, because not all values are created equal.

The Three Core Types of Value

A number on a piece of paper means nothing without context. The "value" of an item shifts dramatically depending on why you need to know it—are you selling it, insuring it, or settling an estate? A free jewellery appraisal might just give you a number, but a true professional will always ask, "Value for what purpose?"

Here are the three main types of valuation you absolutely need to understand:

- Insurance Replacement Value (IRV): This is the big one. It’s the full retail cost to replace an item with a brand new, identical, or comparable piece from a retail jeweler, right now. This is the only value that matters for your insurance for a jewelry store.

- Fair Market Value (FMV): This is a lower number. It represents what a willing buyer would pay a willing seller for a pre-owned item as-is. Think estate sales or reselling a piece.

- Liquidation Value: This is almost always the lowest figure. It’s the "cash right now" price you'd get if you had to sell an item immediately, usually to a wholesaler or pawn shop.

Getting these values mixed up is a recipe for disaster. If your insurance for jewelry business is based on Fair Market Value, any claim payout will fall painfully short of what you actually need to replace your stolen inventory at its full retail cost.

A Real-World Insurance Scenario

Let's make this real. Say a thief smashes a case and grabs a custom diamond ring.

Your wholesale cost for the materials was $5,000. Its Fair Market Value, if you were to sell it as a pre-owned piece, might be around $8,000. But its Insurance Replacement Value—the cost for you to recreate and sell a new one to a customer—is $15,000.

If your insurance policy was written based on an incorrect "valuation" of $8,000, you’d get a check that doesn't even cover the cost of replacing that single ring, let alone your lost profit. This is exactly why a precise, documented appraisal for insurance replacement value is non-negotiable. It ensures your Jewelers Block insurance policy has the financial muscle to make your business whole again after a loss, protecting both your bottom line and your peace of mind.

How Appraisals Impact Your Jewelers Block Insurance

Let’s be clear: a formal, written appraisal from a certified professional isn't just another piece of paper. For a business built on high-value assets, it’s the absolute bedrock of your risk management strategy. That detailed report is the one document that allows you to get meaningful protection through a specialized Jewelers Block insurance policy.

Insurers who cover the jewelry business demand these reports for one simple reason: they establish an agreed-upon, legally defensible value for your entire inventory. Without it, setting coverage limits and premiums becomes a total guessing game—a gamble that can leave your business dangerously exposed. A quick verbal opinion or a free jewellery appraisal just won't cut it in this high-stakes arena.

The Dangers of Outdated Valuations

Relying on old appraisals is one of the most common—and most costly—mistakes a jewelry store owner can make. The market values for precious metals and gemstones are in constant motion. An appraisal from five years ago might as well be from a different economic era, almost guaranteeing your insurance for a jewelry store is nowhere near adequate.

If your appraisal is outdated, your insurance is outdated. A policy based on five-year-old gold prices won't come close to covering the actual cost to replace stolen inventory today, turning a recoverable loss into a potential business-ending event.

This is exactly why partnering with a specialty provider like First Class Insurance Jewelers Block Agency is so critical. We get it. We know that accurate, up-to-date valuations are essential for building a policy that truly protects your assets against major risks like theft, mysterious disappearance, and losses during transit.

Appraisals as the Foundation for Coverage

Think of your appraisal report as the architectural blueprint for your insurance policy. It hands the underwriter all the critical details—gemstone grades, metal weights, craftsmanship quality—needed to calculate your precise level of risk and set the right coverage limits.

- Establishes Replacement Cost: The appraisal locks in the official replacement value, ensuring your policy can cover the full cost to recreate or replace a lost piece.

- Determines Accurate Premiums: Insurers use this hard data to calculate a fair premium based on the true value of the assets they are protecting. No more, no less.

- Validates Claims: When a loss occurs, the appraisal serves as undeniable proof of value. This speeds up the entire claims process and ensures you get a fair and fast payout.

The industry is waking up to how crucial this is. The global jewelry appraisal market was valued at around USD 1.6 billion in 2023 and is projected to more than double to USD 3.4 billion by 2033. That surge shows a growing recognition among business owners that precise valuations are the key to securing proper insurance for jewelry business.

Ultimately, a professional appraisal isn’t an expense; it’s a non-negotiable investment in your business's financial security. It turns your abstract inventory value into a concrete, insurable asset. Before you even think about getting a quote for Jewelers Block insurance, making sure your appraisals are current and professionally done is the most important first step you can take. To see the kinds of underwriters we work with, you can learn more about our relationships with major insurers like Lloyd's of London.

Finding a Qualified Appraiser You Can Trust

So, you understand why a formal appraisal is non-negotiable. Let's talk about the "how." Finding a truly independent professional you can trust is the single most important step in protecting your assets.

Here’s the thing: not all appraisals are created equal. The expert behind the valuation makes all the difference, and you can’t afford to get it wrong.

Forget relying on just any retailer. You need to look for professionals who hold serious credentials from respected organizations. The gold standard is the GIA (Gemological Institute of America). An appraiser with a Graduate Gemologist (G.G.) diploma has gone through rigorous training to identify and grade gemstones with precision. It's a clear signal of real expertise. You can also learn more by checking out industry groups like the Southern Jewelers & Travelers Association that bring professionals together.

Preparing for Your Appointment

A little prep work on your end can make the whole appraisal process smoother and far more accurate. Think of it as giving the appraiser all the puzzle pieces they need to see the full picture.

- Gather Your Items: Make sure everything is clean. Dust and grime can obscure important details during the examination of gemstones and metalwork.

- Bring Documentation: Dig up any old sales receipts, diamond grading reports (especially from GIA), or previous appraisals. Every bit helps.

- Note Any History: If you know the story behind a piece—especially for antique or heirloom jewellery—share it. Provenance can sometimes add significant value.

This prep work really does streamline the appointment and helps ensure you walk away with the most precise valuation possible. And honestly, an appraiser's professionalism should extend beyond the loupe; their overall client experience, including their digital presence, builds trust. Having an effective conversion rate optimization strategy for luxury brands is often a sign they take their business seriously.

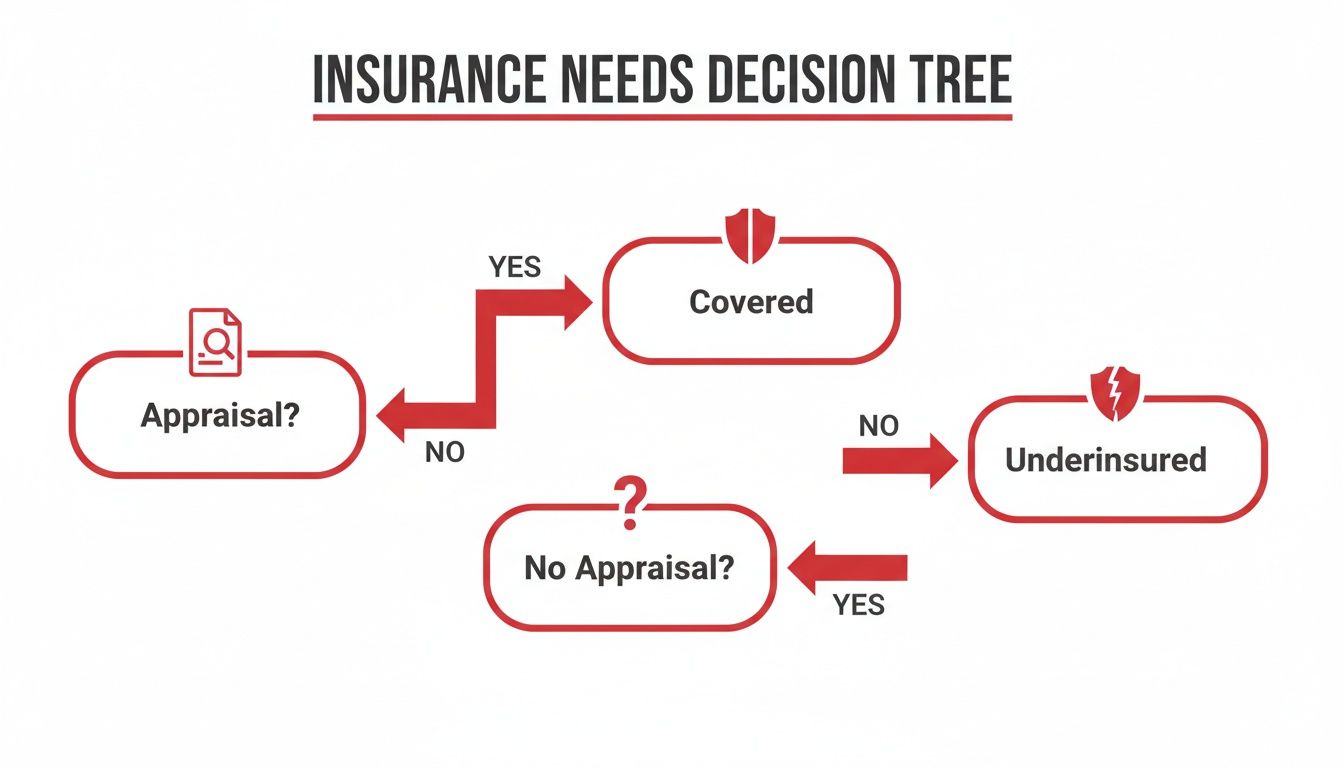

The image below shows you exactly how a proper appraisal connects directly to your insurance coverage.

As the decision tree makes clear, getting that formal appraisal is the first and most critical step to being properly insured. Skip it, and you're leaving yourself dangerously underinsured and at risk.

Key Questions to Ask Your Appraiser

Finally, don't be shy about interviewing a potential appraiser. You're hiring a professional for a crucial job.

Ask them about their methodology. What tools do they use? How do they arrive at their values? Critically, ask about their fee structure. A legitimate appraiser will charge a flat or hourly rate—never a percentage of the item's value. That’s a massive conflict of interest.

This proactive approach is how you secure a credible appraisal and build a solid foundation for protecting what's yours.

Protecting Your Assets with Specialized Insurance

So you've got a certified, professional appraisal in hand. That detailed document is the foundation for protecting your business—it's the key to getting an insurance for a jewelry store policy that actually covers what your inventory is worth.

This is where a specialist agency like First Class Insurance Jewelers Block Agency comes in. For over 30 years, we’ve focused exclusively on the jewelry industry. We know that a generic business policy just doesn’t cut it when you’re dealing with unique risks like theft, mysterious disappearance, or damage during shipping. Our entire focus is on building policies that give you real security.

How Your Appraisal Powers Your Policy

That appraisal isn't just a piece of paper for the file cabinet; it's the blueprint for your entire protection plan. We take the precise, documented values from your report and use them to build a Jewelers Block insurance policy specifically for your business.

This isn't off-the-shelf coverage. It's designed to protect every single part of your operation.

- Inventory Coverage: This protects your entire stock, whether it’s locked in the vault or sitting in the showroom.

- Goods in Transit: Your pieces are covered while being shipped to a customer or moved between your locations.

- Tools and Equipment: Safeguards the specialized tools and machinery you rely on every day.

Now that you know what your assets are worth, let us protect them. An accurate appraisal is the first step, but a tailored insurance policy is what ensures your business can recover and thrive after a loss.

The need for precise valuations is growing fast. Different market analyses show just how dynamic the jewelry appraisal sector is—one report values it at USD 3.3 billion in 2024 and projects it will hit USD 5 billion by 2030. Another predicts even faster growth, expecting a jump of USD 2.07 billion between 2024 and 2029.

These numbers all point to one thing: the increasing demand for accurate appraisals to back up solid insurance for jewelry business policies. Protecting your valuable assets starts with finding the right coverage, which often means speaking with experienced and qualified insurance agents who truly understand your specific needs.

For jewelry store owners, wholesalers, and designers, getting the right protection is straightforward. Contact First Class Insurance today to get a quote for Jewelers Block insurance—we can often have one ready for you within 24 hours.

A Few Final Questions

It’s natural to have questions when you’re navigating the world of appraisals and insurance. Here are some straightforward answers to the questions we hear most often.

How Often Should I Get Jewelry Re-Appraised for Insurance?

Think of an appraisal like a snapshot in time. Because the market values for precious metals and gemstones are always shifting, that snapshot gets old. For most high-value pieces, we recommend getting an updated appraisal every two to three years.

An outdated appraisal is one of the biggest risks a jeweler can take, as it could leave you seriously underinsured. Keeping your documents current ensures your Jewelers Block insurance policy accurately reflects the real-world replacement value of your assets.

Can I Use a Free Appraisal for a Jewelers Block Policy?

In a word, no. A free, verbal appraisal is a great starting point, but it won't hold up for securing a serious insurance for a jewelry store policy.

Insurers absolutely require a formal, detailed written appraisal from a qualified gemologist-appraiser. This document isn't just a piece of paper—it's the legal and factual foundation for your coverage and is non-negotiable for a smooth claims process.

A professional written appraisal is the foundational document for any solid insurance for jewelry business. Without it, an insurer cannot accurately calculate risk or provide the right level of coverage, leaving your assets vulnerable.

Does a Higher Appraisal Value Always Mean a Higher Premium?

Generally, yes. A higher appraised value means the insurer is taking on more risk, so your premium will likely be higher. But that’s not the whole story.

Your premium is also heavily influenced by other factors, like the quality of your security measures, your business's claims history, and even your physical location. A specialist agency like First Class Insurance Jewelers Block Agency knows how to look at the complete picture, helping you find that sweet spot between comprehensive coverage and a cost-effective premium.

Now that you see just how critical the right appraisal is for protecting your business, it's time to take the next step. Contact First Class Insurance to get a quote for Jewelers Block and make sure your most valuable assets are properly secured.