Yes, your homeowners insurance policy does cover jewelry, but here's the catch—it's probably not nearly enough. Think of it as a token gesture. For most standard policies, the coverage for valuables like jewelry is shockingly low, often capping out at just $1,500 for your entire collection.

That means if your engagement ring, a family heirloom, and a few other nice pieces are stolen, you'll get a check for $1,500, total. It's a painful financial lesson that many learn far too late.

Is Your Jewelry Actually Covered by Home Insurance?

Relying on your basic home insurance to protect valuable jewelry is a huge gamble. It's like using a tiny, decorative umbrella in a hurricane—sure, it’s technically providing cover, but it’s completely mismatched for the job.

The fundamental problem is that homeowners policies are built to protect the structure of your house and your general belongings, not small, high-value, and easily lost items. To keep their own risk in check, insurance companies place strict internal limits on these categories.

What's a sub-limit? It’s a cap on how much the insurer will pay for a specific category of items, regardless of your overall personal property coverage. You might have $200,000 in personal property coverage, but the sub-limit for jewelry could still be a measly $1,500.

Understanding the Coverage Gaps

Beyond the low dollar limits, standard policies are riddled with other crucial gaps. Most are written on a “named peril” basis. This means your jewelry is only covered for the specific list of disasters written in the policy, like a fire, a burst pipe, or a documented break-in.

So, what common scenarios are almost always left out?

- Mysterious Disappearance: This is the industry term for when an item just… vanishes. Your ring slips off at the beach, you leave your earrings at a hotel, or a necklace is simply gone from its box with no sign of forced entry. A standard policy won't cover this.

- Accidental Damage: Dropping a diamond and chipping it? Snagging a bracelet on a car door and breaking the clasp? These everyday accidents are not covered.

- Theft Away From Home: While some policies offer limited coverage for items stolen outside your home, it's often even more restrictive than the coverage you have inside.

It’s no surprise that people are waking up to this reality and seeking out better options. The global jewelry insurance market hit a staggering $4.5 billion in 2023 and continues to climb, with North America making up 38% of that. A big reason for this is a reported 15% spike in thefts targeting high-value items, which has pushed homeowners and jewelers to find real protection. You can explore more data on the jewelry insurance market.

This reality check often comes at the worst possible time—right after a loss. It's critical to understand these limitations before you ever have to file a claim. If you own high-value pieces like these, you're well past the point of needing more than basic homeowners coverage.

Standard Homeowners vs Specialized Jewelry Coverage at a Glance

To see the difference in black and white, let’s compare a typical homeowners policy against a specialized jewelry insurance option, like a scheduled endorsement or a standalone policy.

| Coverage Feature | Standard Home Insurance | Specialized Jewelry Insurance |

|---|---|---|

| Coverage Limit | Capped at $1,500 – $2,500 total | Covers the full appraised value of each item |

| Perils Covered | "Named Perils" only (fire, theft, etc.) | "All-Risk" or "Open Peril" |

| Deductible | Standard home deductible applies ($1,000+) | Often has a $0 deductible option |

| Mysterious Disappearance | Not covered | Covered |

| Accidental Damage | Not covered | Covered |

| Global Coverage | Limited or non-existent | Worldwide coverage is standard |

As you can see, the difference isn't just in the dollar amount. Specialized coverage is designed from the ground up to protect against the real-world risks that jewelry owners face every day. It closes the dangerous gaps left wide open by a standard policy.

Uncovering the Hidden Risks in Your Homeowners Policy

Most people assume their homeowners insurance has them covered. But when it comes to valuable items like jewelry, the devil is truly in the details. Digging into your policy’s fine print can feel tedious, but it’s where the most expensive surprises often hide. Beyond those surprisingly low payout limits, two critical terms determine whether you’ll get a check or a headache after a loss: deductibles and named perils.

Think of your deductible—let's say it's $1,000—as the amount you have to pay out-of-pocket before your insurance even starts to help. That $1,000 might seem reasonable when you're facing a $20,000 roof repair, but it can completely negate a claim for a single piece of jewelry.

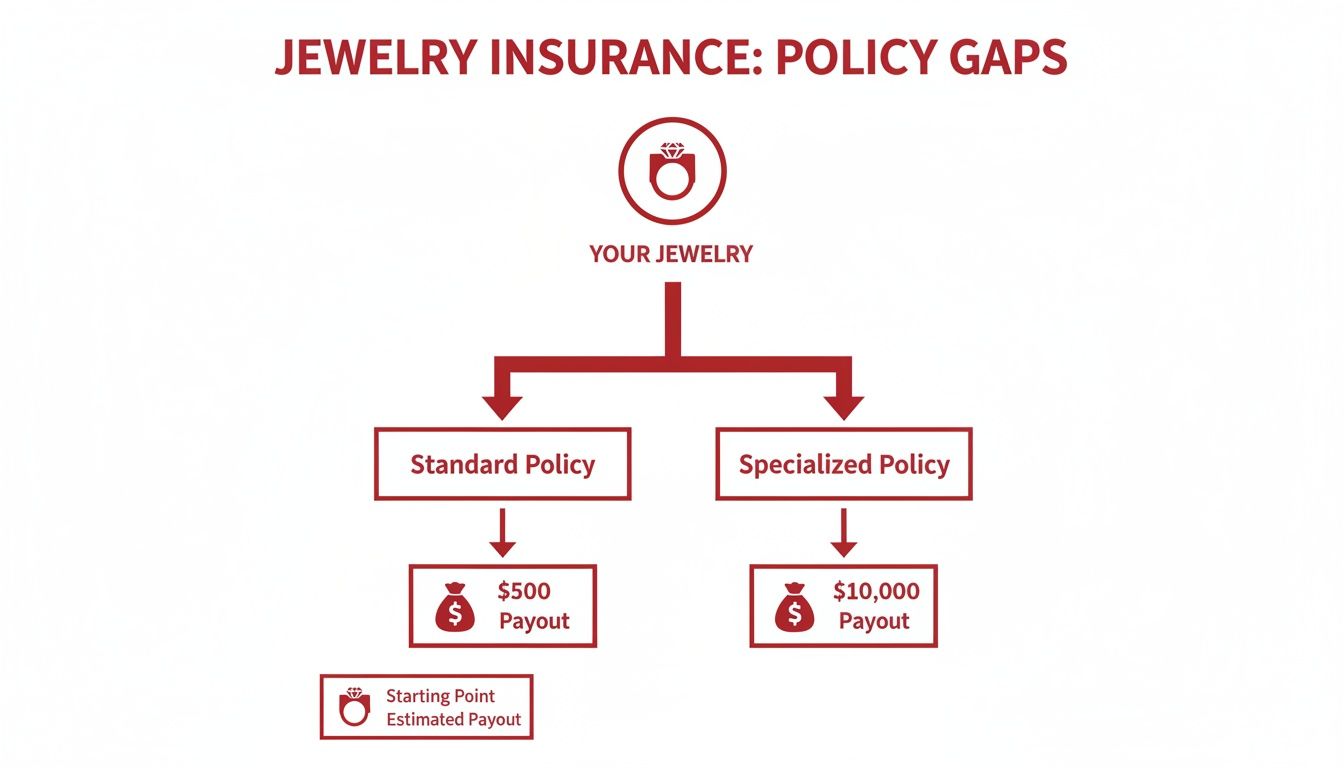

How a $10,000 Ring Becomes a $500 Payout

Let’s walk through a scenario that happens all too often. Imagine you have a beautiful $10,000 engagement ring. It's not just valuable; it's a family treasure. One afternoon, you come home to find you've been burglarized, and the ring is gone. You file a claim, thinking, "Thank goodness I have insurance."

But here’s how the numbers actually break down, and it's a shock for most homeowners:

- Your policy has a special, much lower limit (a sub-limit) for all jewelry, capped at just $1,500.

- Your standard policy deductible is $1,000.

The insurance company takes that $1,500 jewelry limit and immediately subtracts your $1,000 deductible. You’re left with a check for a mere $500. That's a $9,500 loss on an item you thought was protected. This is why it’s so critical to understand your general home insurance policy limits and how they apply—or don't apply—to your most precious items.

The "Mysterious Disappearance" Trap

Perhaps the biggest gap in a standard policy is what it doesn't cover. At the top of that list is "mysterious disappearance." This is, by far, the most common way jewelry gets lost. It's when your necklace simply isn't in its box anymore, or when a ring slips off your finger while you're out running errands. There’s no break-in, no police report, no clear evidence of theft. It just vanished.

Standard homeowners policies almost never cover mysterious disappearance. They are built to protect you from specific, provable events like fire or theft, not the simple, unexplainable losses that happen in everyday life. For many people, this one exclusion is the painful discovery that their basic coverage was never going to be enough.

As global wealth increases, so does this risk. The jewelry insurance market is expected to grow from $351.8 billion in 2023 to over $578.5 billion by 2033. This boom is fueled in part by a 12% yearly increase in personal policies since 2020, as more people realize their most sentimental and valuable pieces are left completely exposed during travel and daily wear. This trend makes it clearer than ever that you need protection that goes well beyond the basics.

How to Get the Right Coverage for Your Jewelry

So, you've realized your standard homeowners policy isn't going to cut it. That's a critical first step. Now, let's talk about how to actually close those coverage gaps and make sure your jewelry is properly protected.

Thankfully, you've got a couple of solid options that go far beyond the basic, often disappointing limits of a standard plan. Each one is a major upgrade, but they're designed for slightly different situations. The right choice for you will really boil down to the value of your collection and how much peace of mind you’re looking for.

This chart shows just how different the financial outcome can be when you compare a standard policy to specialized coverage after a major loss.

As you can see, the insurance path you take directly impacts your wallet. It can be the difference between a financial disaster and a completely manageable hiccup.

Option 1: Schedule Your Jewelry on Your Homeowners Policy

The most popular route is to "schedule" your jewelry as an endorsement, or what's often called a rider, on your existing homeowners policy. Think of it as creating a special, itemized list for your most precious pieces. Instead of being lumped in with all your other belongings under a low, generic limit, each valuable item gets its own line item and coverage amount.

This approach has some real advantages:

- Insured for Full Value: Every scheduled piece is covered for its specific, professionally appraised value. No guesswork.

- Broader Protection: Coverage is usually expanded to "all-risk," which means you're protected against things like mysterious disappearance and accidental damage—not just theft or fire.

- It's Convenient: It’s all handled through one policy and one bill, keeping things simple.

Just keep in mind, a claim on this rider is still a claim against your primary homeowners policy. That could potentially affect your rates down the road.

Option 2: Purchase a Standalone Jewelry Policy

If you have a more substantial collection or simply want to keep your jewelry insurance totally separate from your home policy, a standalone policy is the way to go. This is an insurance policy created for one thing and one thing only: protecting your jewelry.

A standalone policy creates a protective bubble around your jewelry that's completely independent of your home insurance. If you file a claim for a lost ring, it won't touch your home policy's rates or your claims history.

This is often the most comprehensive protection you can buy. It typically provides worldwide, all-risk coverage and often comes with a $0 deductible. That means if you ever have to make a claim, you pay nothing out of pocket. You can learn more about how this dedicated coverage works for specific pieces, like valuable antique jewelry, to see how tailored it can be.

Whichever option sounds best to you, the journey starts with one crucial, non-negotiable step: getting a professional appraisal. An up-to-date valuation from a certified gemologist is the bedrock of your coverage. It establishes the official replacement value your insurer will use, ensuring you’re not just guessing what your pieces are worth—which is the fastest way to find yourself underinsured.

When Your Business Needs Jewelers Block Insurance

When jewelry is your livelihood, the stakes are completely different. For anyone in the trade—designers, wholesalers, retailers—relying on a personal policy or even a standard business owner's policy is like trying to guard a fortress with a padlock. The unique, high-value nature of your inventory demands an entirely different class of protection: Jewelers Block insurance.

This isn't just a simple upgrade; it’s a purpose-built shield designed for the specific job of protecting a jewelry business. Think of it like this: you wouldn't use your family sedan's insurance to cover a commercial trucking fleet. One policy is for personal use, while the other is built to protect an entire operation—the cargo, the drivers, the rigs, and massive liability. It's the same principle here. Insurance for a jewelry business has to cover a world of risks that personal policies simply aren't designed to handle.

What Is Jewelers Block Insurance?

At its core, Jewelers Block is a specialized, all-in-one commercial policy that provides wall-to-wall coverage for the assets of a jewelry business. It bundles several critical protections into a single, comprehensive package, addressing the day-to-day realities that jewelers face.

Why is this so important? Because a standard business owner's policy (BOP) almost always has gaping holes where you need coverage most, often with explicit exclusions for high-value merchandise like jewelry. Insurance for a jewelry store has to account for a whole host of potential losses unique to the industry.

This growing awareness is reflected in the market. Between 2019 and 2024, the global jewelry insurance market expanded significantly. It's now projected to boom to $7,500 million by 2025, fueled by a strong 7.5% compound annual growth rate. This trend makes it clear: both consumers and businesses see the absolute necessity of solid protection for these assets. You can dig into more about this growing market demand on DataInsightsMarket.com.

Core Protections for Your Jewelry Business

So, what exactly does a Jewelers Block policy cover that others won't? It’s designed to safeguard your business from every angle, whether your inventory is locked in the vault, sitting in a display case, or in transit across the country.

A true Jewelers Block policy is your business's financial fortress. It protects your inventory, your customers' property, and your operations against the specialized perils of the jewelry trade, ensuring a single incident doesn't become a catastrophic failure.

Here are the key areas where it has your back:

- Inventory Protection: This is the cornerstone of the policy. It covers your entire stock—finished pieces, loose stones, and precious metals—against theft, damage, or mysterious disappearance.

- Customer Property (Bailee Coverage): Absolutely critical for your reputation. This protects the items customers leave with you for repair, appraisal, or consignment.

- Goods in Transit: Your inventory is covered while being shipped or transported, whether it’s going to a trade show, an exhibition, or another one of your locations.

- Showcase and Window Coverage: Specifically addresses the high risk of "smash-and-grab" thefts from your display windows and cases.

- Travel Protection: Provides coverage when you or your salespeople are on the road carrying merchandise to meet with clients.

To make the distinction crystal clear, let's compare how a personal jewelry policy stacks up against a commercial Jewelers Block policy.

Comparing Personal Jewelry Coverage and Jewelers Block

While both types of insurance protect valuable jewelry, they are built for fundamentally different needs and risks. One is for the individual owner, the other for the business professional.

| Feature | Scheduled Personal Jewelry Policy | Jewelers Block Insurance |

|---|---|---|

| Who's Covered | An individual jewelry owner or collector. | A business entity (retailer, wholesaler, designer, etc.). |

| What's Covered | A specific, itemized list of personal jewelry. | The entire business inventory, including raw materials, works in progress, and items owned by customers. |

| Scope of Coverage | Protects against loss, theft, damage, and mysterious disappearance of personal items. | Covers a broad range of commercial risks: theft (including employee dishonesty), goods in transit, bailee liability, and showcase damage. |

| Typical Location | Covers items anywhere in the world, on or off the owner's person. | Covers inventory at the business premises, in a vault, in transit, at trade shows, and while with salespeople. |

| Primary Goal | To replace a lost or damaged personal heirloom or valuable piece. | To protect the financial viability and assets of the entire business operation. |

Ultimately, the choice isn't just about value—it's about purpose. A personal policy is for protecting personal assets, while a Jewelers Block policy is the industry standard for safeguarding your entire livelihood. If you run any kind of jewelry business, from a small local shop to an international wholesaler, this specialized coverage isn't a luxury; it's a necessity.

Navigating the Claims Process Like a Pro

When a cherished piece of jewelry vanishes or gets damaged, the last thing you need is a nightmare claims process. The secret to a smooth experience isn't just having the right insurance; it's being prepared long before anything ever happens. Honestly, your best weapon in any claim is proactive documentation.

This means you need a dedicated file for your high-value pieces. It should be filled with up-to-date professional appraisals, clear photos from several angles, the original sales receipts, and any GIA certificates or other authenticity papers. If there's a theft, a police report isn't optional—it's one of the very first things the insurance company will ask for. Getting this organized ahead of time can turn a major headache into a simple, straightforward process.

Filing a Claim Step-by-Step

Whether your jewelry is covered by a rider on your homeowner's policy or you have a standalone policy, the first moves you make are pretty much the same. Acting fast and giving clear, organized information from the get-go is key.

Here’s how it usually plays out:

- Notify the Authorities Immediately: If your jewelry was stolen, your first call is to the police. File a report and make sure you get the report number; your insurer will need it.

- Contact Your Insurance Agent: Call your agent or the insurance company's claims line as soon as you can. They’ll get the ball rolling and assign an adjuster to your case.

- Provide All Your Documentation: This is where your prep work really shines. Send your adjuster the appraisal, photos, receipts, and the police report right away.

- Work with the Adjuster: The adjuster is there to review your documents, understand what happened, and figure out the settlement based on the fine print of your policy.

Getting a feel for the general landscape of home insurance claims can be a huge help here, as it gives you a better idea of how insurers typically handle property loss.

Expert Tips for a Smooth Process

Successfully getting through a claim is about more than just turning in paperwork. The way you communicate and handle the back-and-forth can dramatically impact your settlement and your stress levels.

The outcome of a jewelry claim is often decided before the piece is even lost. Detailed records—appraisals, receipts, photos—are what make a swift and fair settlement possible, turning a potential argument into a simple verification.

Keep all your communication with the adjuster clear and, whenever possible, in writing. It's a good habit to follow up any phone call with a quick email summarizing what you talked about. You should also be ready to discuss repair or replacement options. Some policies offer a cash settlement, while others require you to use a specific jeweler.

Having an insurance partner who knows the ropes, especially when dealing with high-value collections like fine watches and timepieces, is a game-changer. They can guide you through what can be a really stressful time, making sure you feel supported and confident from start to finish.

Time to Secure Your Valuables

Here’s the hard truth: your standard home insurance jewelry coverage probably isn't enough. It's a tough lesson to learn after something goes wrong. The default limits are surprisingly low and often won't cover common risks like accidental damage or just plain losing a piece.

For professionals in the jewelry business, the stakes are exponentially higher. You simply can't rely on anything less than specialized insurance to protect your livelihood.

Whether you're protecting a family heirloom or an entire store's inventory, the next step is clear. For personal collections, scheduling your items is a massive upgrade. For any jewelry business, a comprehensive Jewelers Block insurance policy isn't just a good idea—it's essential.

Don’t wait for a loss to discover you’re underinsured. Taking proactive steps today is the single most effective way to secure your valuables, your business, and your peace of mind.

Ready to find the right protection? An experienced First Class Insurance Jewelers Block Agency can walk you through a no-obligation quote, whether it's for your personal collection or your entire business. Get a Quote for Jewelers Block and see how affordable true peace of mind can be.

Common Questions About Insuring Your Jewelry

When it comes to protecting your jewelry, a lot of questions pop up. It makes sense—these are valuable, often sentimental pieces. Whether you've just received an engagement ring, inherited a family heirloom, or run a jewelry business, getting the right answers is crucial. Let's walk through some of the most common things people ask.

How Often Should I Get My Jewelry Appraised?

Think of it like a regular check-up. We recommend getting your valuable jewelry professionally appraised every two to three years. Why? Because the market for gold, diamonds, and other precious materials is always moving.

An appraisal from a few years ago might not reflect what it would actually cost to replace your piece today. If it's undervalued, you'd be underinsured, leaving you to pay the difference out of pocket after a loss. Keeping that appraisal current is the single best way to make sure your coverage can actually make you whole again.

What Happens If I Lose My Ring While on Vacation?

This is a classic "it depends" scenario, and it really highlights the limitations of basic coverage. Your standard homeowners policy is almost guaranteed not to cover something you simply lose, a scenario often called "mysterious disappearance." Those policies are designed to cover specific, named events like a fire or a burglary at your house.

This is exactly why people opt for more specialized coverage. An endorsement added to your home policy (often called a rider or "scheduling" an item) or a completely separate jewelry policy typically provides "all-risk" protection. This kind of policy is built to cover you against loss, theft, or damage, no matter where you are in the world. That global peace of mind is one of the biggest reasons to upgrade.

Do I Really Need Jewelers Block Insurance for My Small Online Shop?

Yes, without a doubt. If you run a jewelry business of any size—even a small online store—Jewelers Block insurance is non-negotiable. It's the industry-standard policy designed from the ground up to protect the unique risks of your trade.

A general business policy just won't cut it. In fact, most specifically exclude the kind of high-value inventory you handle. Insurance for a jewelry business needs to cover everything from your raw materials and finished pieces in the vault to items being shipped to customers and even a client's watch you might have for repair. Only a Jewelers Block policy wraps all that protection into one package. Proper jewelry store insurance is essential for survival.

If I File a Jewelry Claim, Will My Homeowners Insurance Rates Go Up?

That’s a definite risk. Filing any claim against your homeowners policy, even for an item scheduled on a rider, can be a red flag for insurers and lead to a higher premium when it's time to renew.

This is another huge point in favor of a standalone jewelry policy. Since it's a completely separate contract, filing a claim on it has zero impact on your homeowners insurance. Your home policy's rates and claims-free history stay clean.

Ready to make sure your valuables have the right protection? The experts at First Class Insurance can walk you through your options, whether it's for a personal collection or a comprehensive Jewelers Block policy for your business. Stop by our website at https://firstclassins.com to get a personalized quote.