So, let's get right to it: how much does jewelry insurance cost?

The quick answer is you can generally expect to pay 1-2% of your jewelry's appraised value each year. That means for a $10,000 engagement ring, you’re looking at a premium between $100 and $200 annually for solid, reliable protection.

Breaking Down The Real Cost of Jewelry Insurance

The idea of insuring jewelry isn't just for museum-quality heirlooms. It's a surprisingly affordable and smart move for anyone who owns pieces that matter to them. Whether you're looking to protect a brand-new engagement ring or a whole collection, figuring out the cost is the first step toward real peace of mind.

That 1-2% rule of thumb is a great place to start because it gives you a clear financial snapshot right away. Think about it this way: insuring a $5,000 watch would probably cost between $50 and $100 a year. That’s about what you’d spend on a nice dinner out for twelve full months of coverage.

This simple math helps turn the high value of an asset into a predictable, manageable expense, making true protection feel much more accessible. You can see how this plays out across different values below.

The table below provides a quick look at the estimated annual premium for insuring personal jewelry items at different values, based on the standard 1-2% rule.

| Appraised Value Of Jewelry | Estimated Annual Insurance Cost At 1% | Estimated Annual Insurance Cost At 2% |

|---|---|---|

| $5,000 | $50 | $100 |

| $10,000 | $100 | $200 |

| $25,000 | $250 | $500 |

| $50,000 | $500 | $1,000 |

| Please note: These are estimates. Your actual premium will depend on several factors, including your location, deductible, and the specifics of your policy. |

As you can see, the cost is often far less than people imagine, making it a practical choice for safeguarding valuable pieces.

Personal vs. Business Coverage: It’s Not The Same Thing

It’s absolutely critical to understand the difference between insuring your personal jewelry and getting coverage for a jewelry business. They are two completely different worlds. A personal policy is designed to protect your individual items from loss, theft, or damage.

But for a jewelry business? Standard insurance just won't cut it. You need a highly specialized policy known as Jewelers Block insurance. This isn't just a simple rider; it's a comprehensive policy built from the ground up to cover the unique and high-stakes risks of the jewelry industry, including:

- Your Full Inventory: Covering everything from loose diamonds and raw metals to finished pieces on display.

- Goods In Transit: Protecting your assets while they're being shipped to customers, suppliers, or trade shows.

- Customer Property: Covering items that clients leave in your care for repair, appraisal, or consignment.

First Class Insurance: Your Jewelers Block Specialist

Because Jewelers Block is so complex, you really need an expert partner who lives and breathes the industry. A specialist agency like First Class Insurance understands the subtle details that others miss. We dive deep with you, assessing critical risks like your store’s security systems, your travel schedule, and the total value of your inventory to build a policy that actually fits the way you do business.

While personal insurance often follows that simple 1-2% rule, a business policy premium is calculated after a much more detailed risk assessment. Ready to protect your livelihood? Get a Quote for Jewelers Block and see just how affordable real, comprehensive coverage can be.

Decoding The Factors That Influence Your Premium

While that 1-2% rule is a fantastic starting point, it’s just that—a start. The actual cost of your jewelry insurance isn't a one-size-fits-all number. Think of it like a recipe: the final price is a unique blend of ingredients, and each one has a say in your premium. Insurers carefully weigh all these factors to calculate risk, which is really the heart of how they determine what you’ll pay.

Getting a handle on these variables is the key to seeing the full picture. Whether you’re protecting a single family heirloom or securing an entire jewelry business, these are the elements that turn a ballpark estimate into a precise quote.

Location: Your Geographic Risk Profile

One of the biggest factors in your premium is simply where you live or where your business is located. Insurers use location-based data to get a clear picture of the theft risk in your area.

A diamond ring in a quiet, low-crime suburb will almost always cost less to insure than the exact same ring in a bustling city center with higher crime stats. For a jewelry store insurance policy, this factor is even more critical. A storefront in a high-traffic urban area just has a completely different risk profile than one tucked away in a secure, monitored shopping mall.

This isn’t about judging your neighborhood; it's a purely statistical calculation based on historical claims data for your specific zip code.

Key Takeaway: Your premium is directly tied to the statistical risk of your location. Higher local theft rates often translate to a higher insurance cost, as the probability of a claim is considered greater by the insurer.

The Nature of The Jewelry Itself

Not all jewelry is created equal in the eyes of an insurer. The type, value, and even the design of your pieces play a huge role in what you'll end up paying.

-

Item Value: This one is pretty straightforward. A $50,000 diamond necklace will naturally cost more to insure than a $5,000 bracelet because the potential financial loss for the insurer is ten times greater.

-

Type of Piece: Let’s be realistic—some items are just riskier than others. An engagement ring worn every single day is exposed to way more potential for damage or loss than a pair of earrings you only break out for special occasions.

-

Brand and Designer: High-demand designer pieces, like those from Cartier or Tiffany & Co., can sometimes carry higher premiums simply because they are more attractive targets for theft.

Your Personal Claims History

Your past insurance claims can also move the needle on your premium. If you’ve filed multiple claims for lost or stolen items in the past, an insurer might see you as a higher-risk client.

This can result in a "loading" on your premium, which is just an additional percentage tacked onto the base rate. For example, a previous claim might add a 10% loading to your annual cost. A clean record, on the other hand, is one of your best tools for keeping rates as low as possible.

Commercial Factors for Your Jewelry Business

When it comes to insurance for a jewelry business, the risk assessment gets much more detailed. A Jewelers Block insurance policy is built on a deep understanding of how you operate. Insurers will analyze several key commercial factors to determine the premium for your insurance for a jewelry store.

Key Business Risk Factors

- Total Inventory Value: The total worth of your on-hand stock is a primary driver of cost. Higher inventory values mean higher potential losses and, as you'd expect, a higher premium.

- Security Systems: This is where you have the most control. A store with UL-rated safes, central station-monitored alarms, and high-definition surveillance is seen as a much lower risk. Investing in top-tier security is one of the most effective ways to bring down your insurance costs.

- Travel and Transit: Do you travel for trade shows or ship high-value items frequently? The amount of time your inventory spends outside the security of your store directly impacts your risk and, in turn, your premium.

To explore this further, you can see how these principles apply to other high-value items by understanding insurance coverage and costs for valuable goods during transit.

Ultimately, every detail matters. From your zip code to your safe's rating, each factor helps the insurer build a clear picture of risk. At First Class Insurance, we specialize in navigating these complexities. We can help you understand your unique risk profile and find the most effective coverage, whether for a single precious ring or an entire store.

Personal Jewelry Insurance Costs In The Real World

That 1% to 2% rule of thumb is a great starting point, but what does it actually mean for your wallet? It's one thing to talk percentages; it's another to see real dollars and cents.

Let’s walk through a few common scenarios to put some real numbers on the board. This is where the theory gets practical, showing you exactly how the value and type of your jewelry can swing your annual premium.

Scenario 1: The Brand New Engagement Ring

You just bought a stunning engagement ring appraised at $8,000. It’s on a finger every single day, which automatically puts it at a higher risk for everything from accidental damage to outright loss or theft.

For a piece like this, you can expect the insurance to run between $80 and $160 per year. That breaks down to just $7 to $14 a month—a pretty small price to pay for peace of mind on such a meaningful investment.

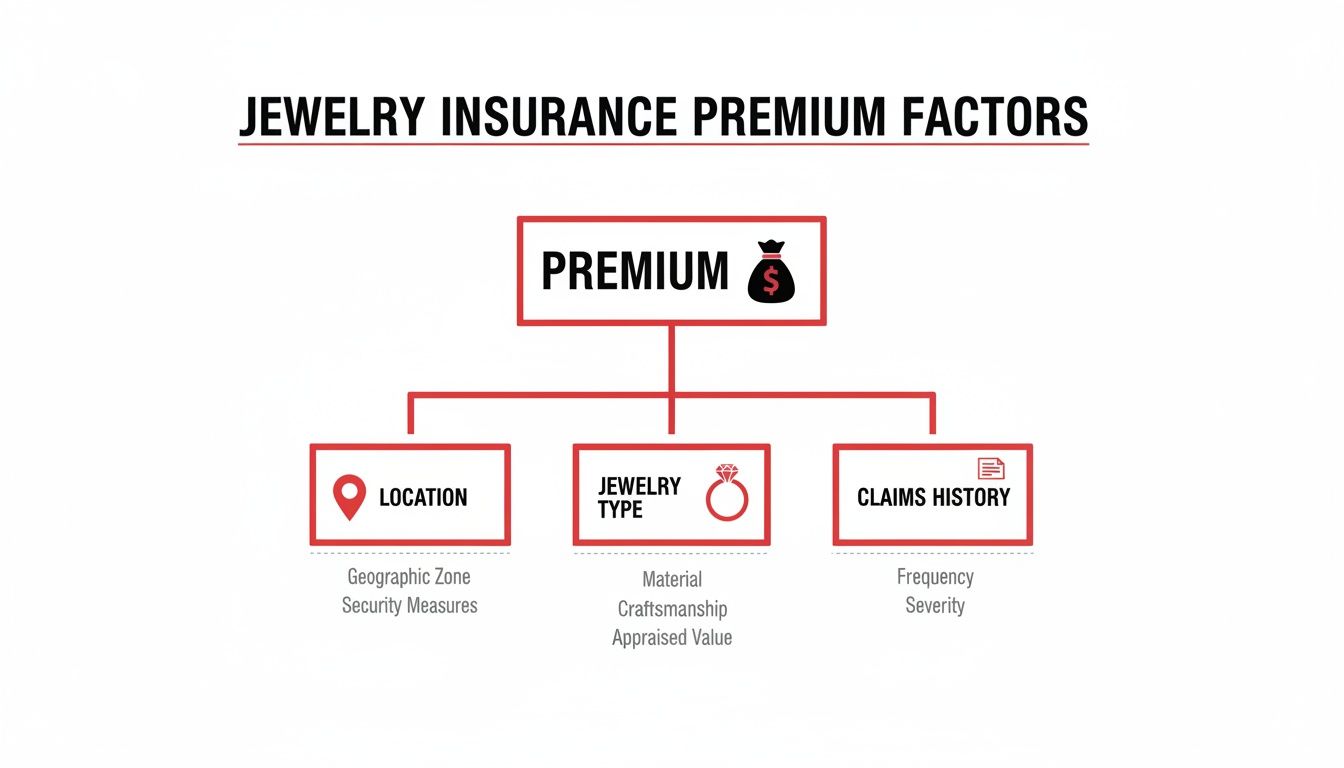

This flowchart breaks down the core elements that insurers look at when calculating your premium.

As you can see, it’s a mix of where you live, what you’re insuring, and your own history. Insurers blend all these factors together to figure out the risk.

Scenario 2: The Cherished Heirloom Watch

Now, let's say you have a vintage family heirloom watch, valued at a cool $15,000. You don't wear it daily—it’s saved for special occasions and lives in a home safe the rest of the time.

This is a much lower-risk situation, so your premium will likely hug the 1% end of the range. You'd be looking at an annual cost of around $150. Taking precautions like secure storage signals to insurers that you're a responsible owner, and they often reward that with better rates. A quick look at images of high-value pieces is a good reminder of why protecting these assets is so important.

Scenario 3: The Modest Jewelry Collection

What if you don't have one big-ticket item, but a collection of pieces? Imagine you have a necklace, a few pairs of earrings, and a bracelet that together appraise for $12,000.

Bundling them all under one policy would likely cost between $120 and $240 a year. This is almost always a smarter and more cost-effective move than trying to insure each item on its own. It gives you broad protection for everything you love under one simple policy.

Standalone Policy Or Homeowners Rider?

This is a big one. Should you just add your jewelry to your existing homeowners policy (this is called a "rider" or "floater"), or get a separate, dedicated policy? While tacking it onto your home insurance sounds easy, it's often a trap.

Here’s why a standalone policy is almost always the better choice:

- Weak Coverage: Most homeowners policies cap jewelry coverage at a shockingly low amount, often just $1,500. Worse, they typically only cover specific events like a fire or a break-in at your home.

- Major Gaps: What about "mysterious disappearance"? If your ring simply slips off your finger while you're out, your homeowners policy will almost certainly say, "Sorry, not covered." A specialized policy is built for exactly that kind of real-world accident.

- Painful Deductibles: You’ll likely have to pay your full homeowners deductible—often $1,000 or more—before you see a dime. Many dedicated jewelry policies come with a $0 deductible option.

- Rate Hikes: Filing a jewelry claim through your homeowners insurance can jack up your entire premium for years. A claim on a separate policy won’t touch your home insurance rates.

For all these reasons, a standalone policy from a specialist like First Class Insurance just delivers better, more reliable protection. It’s designed from the ground up to cover the unique risks that come with owning valuable jewelry, making sure you’re actually covered when you need it most.

Understanding Jewelers Block Insurance For Your Business

If you’re in the business of selling beautiful things, your insurance needs are nothing like a typical retailer's. Standard business policies just don’t get the unique, high-stakes world of a jeweler. That’s where Jewelers Block insurance comes in—it’s not just another policy, but a specialized shield built for the jewelry trade from the ground up.

Think of it this way: personal jewelry insurance is like a security guard for a single home. Jewelers Block is the complete security detail for an entire fortress. It’s an all-in-one policy that protects the full scope of your business operations.

This isn't just about what's in the showcase. It covers your entire on-hand inventory, from loose stones locked away in the safe to the finished pieces your customers are admiring. Critically, it also protects customer property left in your care for repairs or appraisals. It even covers your assets while they're in transit, whether you're shipping to a client or carrying pieces to a trade show.

What Drives The Cost Of Jewelers Block Insurance

Unlike the simple 1-2% rule of thumb for personal items, figuring out the cost of insurance for a jewelry business is a much deeper dive. Insurers look at your entire operation to get a clear picture of your risk, and your premium is a direct reflection of that assessment.

Of course, the biggest factor is your total inventory value. A business holding $5 million in inventory is a much bigger potential loss than one with $500,000, and the premium will scale with it. But the value of what you have is just the start of the conversation.

Your physical security is probably the most critical factor you can control. Underwriters will meticulously examine every layer of your defenses.

- Safes and Vaults: Are your safes rated TL-30 or, even better, TRTL-30×6 by Underwriters Laboratories (UL)? A high-grade, burglar-resistant safe sends a strong signal that you take security seriously.

- Alarm Systems: The industry standard is a central station-monitored alarm that protects every single point of entry. A basic, unmonitored system just doesn't cut it.

- Surveillance: High-definition cameras covering every critical area—inside and out—are non-negotiable. They act as a powerful deterrent and are essential for investigating any incident that occurs.

An investment in top-tier security isn't just an expense; it's the single most powerful tool you have to actively manage and reduce your insurance premiums. It shows underwriters you’re a partner in mitigating risk, and they reward that.

Operational Risks And How They Impact Your Premium

Beyond your storefront's physical hardware, the way you run your business day-to-day plays a massive role in what you'll pay. Your operational protocols are put under a microscope to see how well you manage risk when your inventory is at its most vulnerable.

For example, how much travel is involved in your business? A jeweler who frequently attends trade shows or meets clients off-site is a higher risk than one operating from a single, secure location. The more time your inventory spends out in the world, the higher the potential for something to go wrong.

Your employee protocols are also a huge deal. Underwriters will want to know about your procedures for opening and closing, how you handle high-value pieces, and your inventory management process. A business with strict, documented security procedures is always seen in a better light. A long-tenured, trusted staff can also have a positive impact on your rates. The history of this kind of specialized underwriting goes way back, with established entities like the Lloyd's of London marketplace having centuries of experience in specialty risk.

Comparing Scenarios For Jewelry Store Insurance

Let’s look at how this plays out in the real world. The table below gives you a clear comparison of how different business profiles can result in wildly different insurance premiums.

Key Factors Influencing Jewelers Block Insurance Premiums

| Cost Factor | Lower Premium Scenario | Higher Premium Scenario |

|---|---|---|

| Security System | UL-rated safe, central station alarm, full camera coverage | Basic safe, local alarm system, limited camera views |

| Inventory Control | Daily inventory counts, strict access protocols, secure displays | Infrequent inventory checks, lax handling procedures |

| Business Travel | Primarily operates from a single retail location | Frequent travel to trade shows and client meetings |

| Location | Store in a secure, monitored shopping center with low crime rates | Street-front location in a high-theft urban area |

As you can see, two businesses with the exact same inventory value could end up paying very different premiums based entirely on how they manage their risk.

Ultimately, getting the right coverage at the right price is a partnership. At First Class Insurance, we see ourselves as your risk management advisor. We help you spot potential vulnerabilities and guide you toward the security upgrades and procedural tweaks that will not only make your business safer but also bring down your premiums. When you’re ready to protect your life’s work, we invite you to Get a Quote for Jewelers Block and see what true peace of mind looks like.

Actionable Strategies To Lower Your Insurance Costs

Knowing what insurance costs is one thing, but actively bringing that number down? That’s where you take back control. Whether you’re protecting a personal heirloom or securing your entire jewelry business, there are real, practical steps you can take to make your premium more manageable without gutting your coverage.

Think of it as a playbook for getting the best possible protection at a price that makes sense.

The underlying principle here is pretty simple: the lower your risk, the lower your premium. When you can show an insurer that you're a responsible and proactive owner, you directly influence how much you pay for that peace of mind.

Smart Moves For Personal Jewelry Insurance

For your personal pieces, lowering your premium often boils down to a few key decisions and habits. These small changes show insurers you’re serious about protecting your valuables and can lead to some real savings over time.

-

Choose a Higher Deductible: This is the most direct lever you can pull. Your deductible is what you pay out-of-pocket before your insurance kicks in. Simply moving from a $0 deductible to a $500 one can make a noticeable dent in your annual premium.

-

Install a Home Safe: It sounds basic, but storing your jewelry in a securely bolted-down home safe when you’re not wearing it drastically cuts the risk of theft. Insurers love to see this, and many will offer a discount for this simple security measure.

-

Get Regular Appraisals: The value of gold, diamonds, and gemstones is always shifting. An appraisal from five years ago might mean you're overpaying for insurance based on a value that’s no longer accurate. Keeping your appraisals current—think every 2-3 years—ensures you’re only paying for the coverage you actually need. You can see how different high-value pieces are protected and why an accurate valuation is so critical.

Advanced Strategies For Your Jewelry Business

When it comes to a jewelry store insurance policy, the stakes are much higher—but so are the opportunities for serious savings. Your investments in security and your daily procedures are the most powerful tools you have for managing your Jewelers Block insurance costs.

Investing in robust security infrastructure isn’t just an operational expense; it’s a direct negotiation tool for lowering your insurance premiums. A well-protected business is a lower-risk business, and insurers price their policies accordingly.

Here are some of the most effective strategies for bringing down your insurance for jewelry business premium:

-

Upgrade Your Security Infrastructure: Your physical security is non-negotiable. Investing in things like UL-rated safes (a TL-30, for example), a central station-monitored alarm system, and high-definition surveillance cameras can lead to substantial discounts on your policy.

-

Implement Rigorous Inventory Control: Strong inventory management systems, complete with daily counts and secure handling protocols, prove that the risk of internal theft or mysterious loss is low. That kind of operational discipline is exactly what underwriters want to see.

-

Foster a Culture of Security: Train your staff relentlessly on security procedures. This includes everything from opening and closing routines to how high-value items are shown to customers. A well-trained team is your best first line of defense and a massive factor in reducing your overall risk.

By getting ahead of these areas, you can significantly lower what your jewelry insurance costs. At First Class Insurance, we can help you pinpoint the strategies that will make the biggest impact for your specific situation. Get a Quote for Jewelers Block today and let us show you how a smarter approach to risk leads to better coverage at a better price.

How To Get An Accurate Jewelry Insurance Quote

So, you're ready to stop guessing and find out exactly what it will cost to protect your jewelry. Getting an accurate quote is actually pretty simple, but it all comes down to having the right information on hand before you start. A little prep work now ensures the quote you get is a perfect match for what you own.

What You'll Need For A Precise Quote

For your personal pieces, the process is straightforward. You’ll want to pull together a recent appraisal (anything from the last two years is ideal), a few clear photos of each item, and any original receipts you still have. Properly valuing antique jewelry is especially important, as that appraisal value is the bedrock of your entire premium.

If you’re looking for insurance for a jewelry business, the checklist gets a bit more detailed. You'll need a complete inventory list, specifications on your security systems (think safe ratings and alarm monitoring), and a quick rundown of your business operations, including how often you travel with inventory.

It's no surprise that getting the right protection is more critical than ever. The global jewelry insurance market is expected to climb as high as $7.5 billion by 2025, a direct result of more people owning high-value luxury goods around the world.

This is where working with a specialist like First Class Insurance Jewelers Block Agency makes all the difference. We can walk you through gathering the right documents, whether it’s for your personal collection or for your jewelry store insurance.

Ready to take that final step toward real peace of mind? Get a Quote for Jewelers Block or personal coverage today, and let us build the right protection for you.

Your Jewelry Insurance Questions, Answered

When you're looking into jewelry insurance, it's natural to have questions, whether you're protecting a family heirloom or your entire business inventory. Let's clear up some of the most common ones we hear every day.

Is It Worth Insuring Jewelry Under $1,000?

This really comes down to a gut check on your personal risk tolerance and how much sentimental value the piece holds.

While the 1-2% rule of thumb makes insuring a pricey item a no-brainer, think about your homeowners policy for a second. Most have a deductible of $500 to $1,000, which could mean a claim for a less expensive piece is completely wiped out. A specialized jewelry policy with a $0 deductible can be a game-changer, especially for items you truly love. It's always worth seeing a quote—you might be surprised how little peace of mind costs.

Isn't My Jewelry Already Covered By My Homeowners Policy?

Yes, but barely. Most standard homeowners policies toss in a tiny bit of jewelry coverage, but it’s incredibly limited. We often see caps as low as $1,500 for all your pieces combined, and they typically only cover very specific events, like a theft from your home.

What they almost never cover are the real-world problems: dropping a ring down the drain, losing a stone from its setting, or the dreaded "mysterious disappearance." A dedicated policy is built to handle all of that, filling the massive gaps your homeowners insurance leaves wide open.

Why Do I Need a Recent Appraisal for a Quote?

An up-to-date appraisal, ideally from the last 2-3 years, is non-negotiable for a couple of key reasons. First and foremost, it locks in the current replacement value. The price of gold, platinum, and diamonds fluctuates, and an old appraisal could leave you seriously underinsured.

Second, that appraisal gives the insurer a detailed, professional breakdown of exactly what they're covering. This is crucial for calculating an accurate premium and, more importantly, ensuring that if you ever need to file a claim, you'll get a replacement of the exact same kind and quality.

How Can My Business Lower Its Jewelers Block Premium?

When it comes to jewelry store insurance, nothing moves the needle on your premium more than upgrading your physical security and tightening your inventory controls. The cost of a Jewelers Block insurance policy is a direct reflection of how much risk an underwriter sees in your operation.

Investing in best-in-class security sends a clear message that you're a low-risk partner. Think UL-rated safes, a central station-monitored alarm, and high-def surveillance cameras. These aren't just expenses; they're investments that pay for themselves in significant, long-term savings on your insurance for jewelry business.

Ready to get the right protection in place? The team at First Class Insurance is here to build a policy that actually fits your needs, whether it's for a single ring or an entire storefront. We make it simple. Get a straightforward, no-obligation quote by visiting us at https://firstclassins.com today.