Let's get straight to it. You’ve probably heard the rule of thumb: ring insurance costs about 1-2% of the ring's appraised value each year.

So, for a $10,000 ring, you’re looking at an annual premium of roughly $100 to $200. Think of it as a small, predictable security detail for one of your most prized possessions.

The Real Cost Of Protecting Your Ring

While that 1-2% rule is a fantastic starting point, the full picture is a bit more nuanced. This guide will break down all the factors that go into that number for personal jewelry. We'll also dive into the world of commercial coverage—specifically Jewelers Block insurance, which is the non-negotiable safety net for any serious jewelry business.

Whether you're protecting a personal treasure or an entire store's inventory, the core principles of risk and value still apply. For business owners, securing the right insurance for a jewelry store isn't just a good idea; it's a foundational step for success. Here at First Class Insurance Jewelers Block Agency, we specialize in crafting the right coverage for every single need.

To give you a clearer picture, here’s a quick breakdown of what you can expect to pay based on your ring's value.

Estimated Annual Ring Insurance Premiums At a Glance

| Ring Appraised Value | Estimated Annual Premium (1% Rate) | Estimated Annual Premium (2% Rate) |

|---|---|---|

| $5,000 | $50 | $100 |

| $10,000 | $100 | $200 |

| $15,000 | $150 | $300 |

| $25,000 | $250 | $500 |

| $50,000 | $500 | $1,000 |

As you can see, the cost remains predictable and scales directly with the value of your piece.

Understanding Your Ring's Value

Before you can even think about a quote, you need to know exactly what you're insuring. The difference between Fine Jewelry vs Fashion Jewelry, for instance, can determine whether a policy is even necessary and what the premium might look like.

This initial classification is what leads to a professional appraisal—the cornerstone of any accurate insurance policy. For a closer look at the kind of stunning pieces that demand robust protection, you can see our gallery of high-value rings.

A Look At The Broader Market

This focus on insuring rings isn't just a personal priority; it's a global trend. Rings absolutely dominate the jewelry insurance market, capturing a massive 32.6% share of all policies worldwide. They are, by far, the single most insured jewelry item.

In the United States, which commands a 26% share of the global market, this translates into a pretty clear and established pricing structure.

For a high-value piece, that 1-2% rule holds firm. A $50,000 ring will typically cost between $500 and $1,000 per year to insure. Frankly, it's a small price to pay for true peace of mind against theft, loss, or damage.

For jewelers, this data only highlights the critical importance of having solid insurance for jewelry business. When you need to protect an entire inventory of rings and other pieces, it’s time to Get a Quote for Jewelers Block. It’s the only coverage truly designed to protect every asset, from the pieces in the vault to those sparkling in the display case.

Key Factors That Influence Your Insurance Premium

That old 1-2% rule is a decent starting point, but it's just that—a start. The actual premium you’ll pay is a much more nuanced calculation. Insurers look at a whole range of factors to build a risk profile for your specific ring, and understanding what they're looking for is the key to knowing what your final cost will be.

Think about it like car insurance. A sports car driven in a big city is going to cost more to insure than a sedan in a quiet suburb. It's the same principle. An underwriter doesn't just see a dollar figure; they see a complete story about where the ring lives, how it’s protected, and what kinds of risks it might face.

Let's break down the variables that really move the needle.

Geographic Location: Your Home Base Matters

Where you live is one of the single biggest factors in what you’ll pay. Insurers have mountains of data on theft rates, and they use it to assess the risk in your specific zip code. A $50,000 ring in a major city with higher crime stats will almost always have a higher premium than the exact same ring in a sleepy, low-crime town.

It’s just a matter of exposure. The environment itself plays a huge role in the level of risk.

Your Personal Claims History

Your own track record with insurance also comes into play. If you’ve filed multiple claims in the past—for anything, not just jewelry—you might be viewed as a higher risk.

An underwriter might see a history of claims as a red flag, signaling a higher likelihood of future losses. A clean record can definitely help you lock in a better rate, but a spotty one could lead to a surcharge of 10% or more on your premium.

Security Measures You Have in Place

This is where you can take back some control. Insurers love to see that you’re proactive about protecting your assets, and they’ll often reward you with discounts for it.

Taking these steps can make a real difference in your bottom line:

- Home Security Systems: A professionally monitored alarm system is a huge plus in an underwriter's eyes.

- Safes and Vaults: Simply storing your ring in a bolted-down home safe when it's not being worn drastically cuts the risk of theft.

- Bank Vaults: For truly high-value pieces or items you only wear on special occasions, a bank's safe deposit box offers top-tier security and can lead to some serious premium savings.

Considerations for Commercial Jewelry Businesses

For jewelers, all these factors get amplified, and the stakes are infinitely higher. Underwriting insurance for a jewelry business is a far more rigorous process. A standard business policy won't even scratch the surface; you need a specialized Jewelers Block policy built for the unique risks of the trade.

When calculating the premium for your jewelry store insurance, underwriters scrutinize everything. For a Jewelers Block policy, they’ll dig into:

- Physical Security: The UL rating of your safes and vaults, the quality of your camera system, and even the locks on your display cases.

- Inventory Management: Your processes for tracking, handling, and storing every single piece.

- Transit Risks: The protocols you have in place for shipping valuables or traveling with inventory to trade shows.

The complexity of insuring commercial jewelry assets is exactly why a standard policy just won't do. Protecting a business means understanding its specific vulnerabilities, from a single lost earring to a full-scale heist. The challenges of insuring antique jewelry, for example, introduce a whole other layer of complexity that only a specialist can properly handle.

In the end, whether it’s for a personal heirloom or an entire store's collection, the premium is a direct reflection of risk. By actively managing these key factors, you can get more control over what it costs to protect your most valuable assets. If you're ready to secure that level of protection for your business, it’s time to Get a Quote for Jewelers Block from an expert who truly understands your industry.

Comparing Personal and Commercial Policy Options

When you're trying to protect a valuable ring, one size definitely does not fit all. The insurance policy you need depends entirely on one crucial question: are you an individual protecting a personal keepsake, or a business owner safeguarding your entire livelihood? The risks, the stakes, and the solutions are worlds apart.

For a private owner, it’s often a choice between convenience and comprehensive coverage. But for a business, there’s only one real gold standard—a policy built from the ground up to handle the unique, high-stakes risks of the jewelry trade. Getting this right means your coverage is a perfect fit, whether for a single beloved ring or a million-dollar inventory.

Personal Ring Insurance Options

If you're insuring a personal piece like an engagement ring, you generally have two paths to take. Each has its own pros and cons.

Homeowners or Renters Policy Rider: This is often called a "rider," "floater," or "scheduled personal property endorsement." It’s essentially an add-on to your existing home insurance. People like it because it seems simple—one bill, one company. But that convenience can be deceptive. These riders often come with significant coverage gaps, lower limits, and might not cover situations like a "mysterious disappearance."

Standalone Jewelry Policy: This is a dedicated policy created just for your jewelry. Think of it as a specialized bodyguard for your ring. It offers much stronger protection, typically including worldwide coverage, safeguards against accidental damage, and even covers mysterious disappearance. It’s a separate policy, sure, but the peace of mind it delivers is almost always worth the tiny bit of extra effort.

The Gold Standard Insurance For a Jewelry Store

For a business, the insurance game is completely different. A standard business owner's policy is dangerously inadequate for the high-value, high-risk world of jewelry. This is where Jewelers Block insurance becomes the absolute lifeblood of your operation.

A Jewelers Block policy isn't just insurance; it's a comprehensive security strategy. It's an all-in-one package designed to shield a jewelry business from nearly every risk imaginable, covering your assets at every single stage of your operations.

This specialized insurance for a jewelry store is built to cover your entire inventory—the pieces locked in the vault, the items sparkling in your display cases, the jewelry being shipped to a client, and even the merchandise you’re showing at a trade show. It is the only type of policy that truly delivers the level of security a jeweler needs to operate with confidence.

Comparing Ring Insurance Policy Types

To make the right call, it helps to see the options laid out side-by-side. The table below breaks down the key differences to help you see which approach fits your situation, whether you're an individual or a business owner.

| Policy Type | Best For | Typical Coverage Scope | Key Advantage |

|---|---|---|---|

| Homeowners Rider | Individuals with lower-value pieces | Limited coverage, often restricted to theft and fire | Convenience of a single policy and bill |

| Standalone Jewelry Policy | Individuals with high-value rings | Comprehensive "all-risk" coverage, including loss & damage | Broader protection and specialized claims handling |

| Jewelers Block Insurance | Any insurance for jewelry business needs | Inventory, transit, customer property, tools, and more | Total, all-in-one protection built for the industry's specific risks |

This isn't a small market we're talking about. The global jewelry insurance market was projected to hit roughly $5.28 billion in 2025, with rings making up a massive 32.6% of all insured items. For independent jewelers and wholesalers, commercial policies like Jewelers Block are vital, especially when U.S. FBI statistics show around $500 million in annual jewelry thefts. As specialists, we can help you explore the

At the end of the day, navigating these choices is all about matching the policy to the risk. At First Class Insurance Jewelers Block Agency, we work with both individuals and businesses to find that perfect fit. For business owners, the next step is clear—Get a Quote for Jewelers Block and ensure your livelihood is protected with the industry's best defense.

How to Get an Accurate Insurance Quote

Getting a real, no-nonsense quote for ring insurance isn't about pulling a number out of thin air. It's about doing your homework. To figure out what protecting your ring will actually cost, you need to show the insurer exactly what they're being asked to cover. A little prep work here goes a long way in securing a fair price and the right protection.

Think of it this way: the entire process comes down to proving the ring's true value. Insurers use that information to calculate their risk, which directly translates into your premium. If you follow these steps, you’ll get a quote that’s built for your specific piece, not just a generic estimate.

Start With a Professional Appraisal

First things first: get a professional appraisal. This is the absolute foundation of any jewelry insurance policy and it's non-negotiable. An insurer won't even talk to you without one. This document is the official, certified valuation of your ring and establishes its "replacement value"—the amount the policy will pay out if you need to make a claim.

An appraisal is far more than just a sales receipt. It’s a detailed report from a certified gemologist that breaks down everything:

- The 4Cs: A complete evaluation of the diamond's Cut, Color, Clarity, and Carat weight.

- Metal Details: It specifies the type of metal (like platinum or 18k gold), its weight, and any unique markings.

- Setting Information: It describes the ring's setting and details any side stones.

- Current Replacement Value: This is the most important number, representing what it would realistically cost to replace the ring in today's market.

Gather Your Essential Documents

With the appraisal in hand, it's time to pull together the rest of your paperwork. You're essentially building a complete file on the ring. The more detailed your records are, the easier everything becomes, from getting the initial quote to filing a claim down the road.

Make sure you have these items ready:

- The Original Receipt: This shows what you initially paid and proves ownership.

- High-Quality Photographs: Snap clear pictures of the ring from a few different angles. Be sure to capture any unique features or engravings.

- Grading Reports: If your diamond has a certificate from a lab like the Gemological Institute of America (GIA), that's a key document to include.

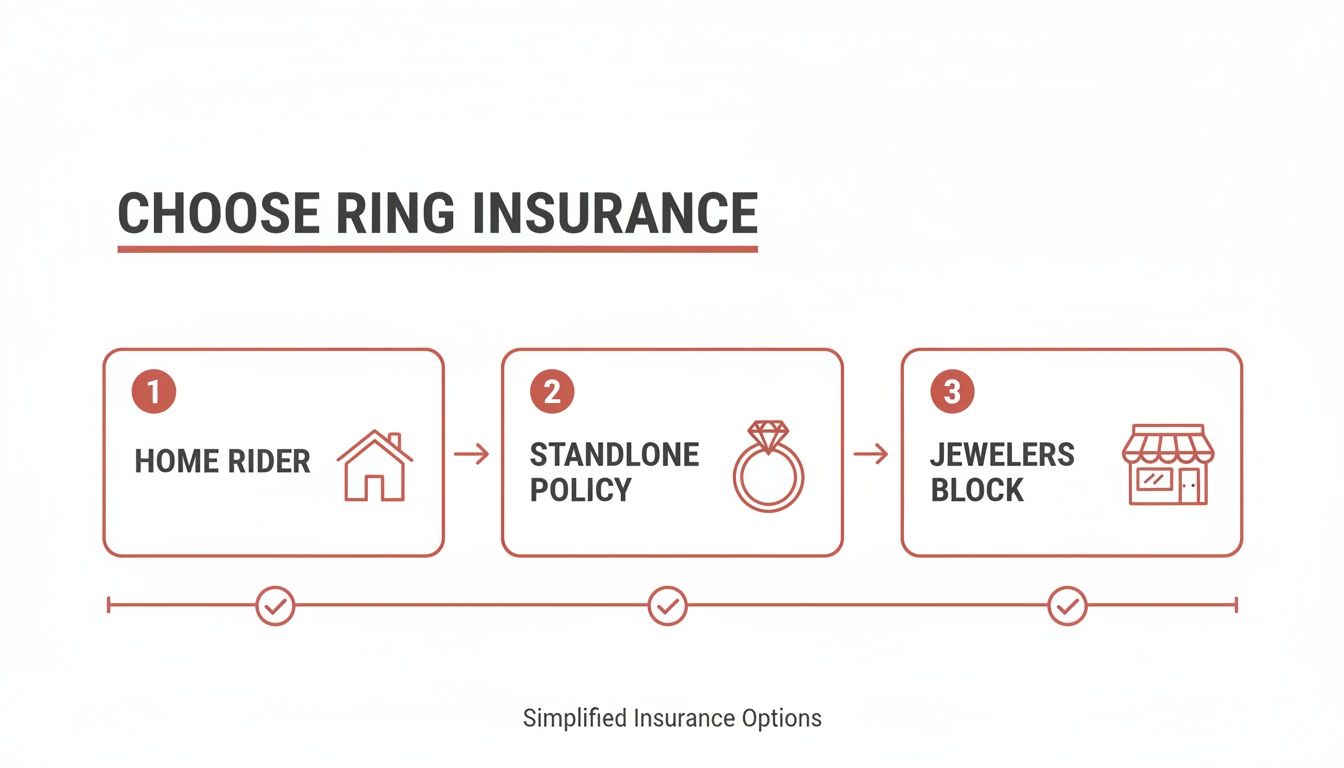

This process visualizes the different paths to insuring your jewelry, from a simple homeowner's policy add-on to specialized commercial coverage.

Each option—a home rider, a standalone policy, or Jewelers Block—offers a different level of protection suited for different needs, from personal keepsakes to entire business inventories.

Choose the Right Insurance Partner

Now you're ready to find an insurer. Instead of just going with a generic, big-box company, you'll get a massive advantage by working with a specialist. An expert agency gets the nuances of protecting jewelry and works directly with underwriters who know these kinds of high-value assets inside and out.

Working with a specialist like First Class Insurance Jewelers Block Agency connects you with experts who live and breathe jewelry protection. Our deep industry knowledge means we can deliver tailored, competitive options that generalist providers simply can't match.

For those of us in the trade who need insurance for a jewelry store, this kind of expertise is absolutely critical. If you're looking for a Jewelers Block quote, our focused approach means we ask the right questions to get a true picture of your risks, from the inventory in your vault to pieces out on the road. It's how we deliver a precise and competitive insurance for jewelry business quote, often in less than 24 hours.

Actionable Strategies to Lower Your Insurance Costs

Everyone wants solid protection for their valuables, but nobody wants to overpay for it. The good news is, the first quote you get for ring insurance isn't the final word. You can take real, practical steps to lower your premium, whether you're protecting a family heirloom or the entire inventory of a jewelry store.

It all comes down to showing your insurer that you're a low-risk client. A few smart adjustments can lead to serious savings over the life of your policy.

Choose a Higher Deductible

One of the quickest ways to bring down your premium is to choose a higher deductible. Think of the deductible as your share of the risk—it's what you agree to pay out-of-pocket before your insurance kicks in.

When you take on a bit more of that initial cost, you reduce the insurer’s potential payout. It signals that you won't be filing small claims, and in return, they reward you with a lower annual premium. It's a straightforward trade-off for immediate savings.

Invest in Top-Tier Security

Insurers love seeing proactive security measures because they directly cut down the risk of theft. Investing in security is one of the smartest ways to earn some major discounts on your policy.

For both personal and commercial policies, these security upgrades really move the needle:

- Home Safes or Bank Vaults: For individuals, even storing your ring in a securely bolted-down home safe when you're not wearing it can lower your premium. For extremely valuable pieces, a bank's safe deposit box offers maximum security and can lead to even bigger discounts.

- UL-Rated Safes and Vaults: For any jewelry store insurance, the quality of your safe is a huge deal. A high-security, UL-rated vault is absolutely essential for getting a favorable rate on a Jewelers Block policy.

- Monitored Alarm Systems: A professionally monitored security system that alerts the authorities to a break-in is a powerful deterrent and a key factor for reducing what you pay.

By showing you take security seriously, you're fundamentally changing your risk profile. An insurer sees a well-protected asset as a safer bet, which translates directly into lower costs for you. This is especially true for businesses seeking comprehensive insurance for a jewelry business.

Keep Your Appraisals Current

The value of precious metals and gemstones is always changing. An appraisal from five years ago might not reflect what your ring is actually worth today. If prices have dropped, an outdated, higher appraisal means you could be paying for more coverage than you really need.

We recommend getting your high-value pieces re-appraised every two to three years. This ensures you're insured for the correct replacement value—no more, no less. An accurate, up-to-date valuation is the foundation of fair and cost-effective insurance for a jewelry store or a personal collection.

When you're ready to lock in the right coverage at the best price, Get a Quote for Jewelers Block from a specialist who understands these details.

Navigating the Claims Process Like a Pro

An insurance policy is just a piece of paper with a promise on it. The claims process is where that promise becomes real. When something awful happens to your ring, knowing exactly what comes next can turn a moment of panic into a straightforward plan of action.

The whole point of insurance is to make you whole again, but what that looks like can differ. When you have a dedicated partner like First Class Insurance, you aren't just filling out a form and hoping for the best. You’re working with people who will walk you through every step to get a fair and fast resolution.

Understanding Your Settlement Options

When you file a claim for a lost or damaged ring, the insurance company will generally offer a few ways to settle it. Your specific policy will spell out the details, but it usually boils down to three main paths.

- Repair: If a prong breaks or a stone gets chipped, your policy will cover the cost to have a skilled jeweler restore it. The goal is to make it look exactly like it did before the damage occurred.

- Replace: If your ring is stolen or lost completely, the insurer will replace it with a new one of "like kind and quality." This is where that detailed appraisal you got becomes your best friend—it’s the blueprint for creating the replacement piece.

- Cash-Out: Some policies let you take a cash payment equal to the replacement cost. It’s flexible, for sure, but be aware that the cash offer is often less than what it would cost the insurer to replace the ring through their network of jewelers.

It's absolutely vital to know which of these options your policy is built around. A great policy gives you the flexibility to get a settlement that truly puts you back where you started, whether that’s a perfect repair or an identical replacement.

The Importance of Mysterious Disappearance Coverage

Here’s one of the most valuable features you’ll find in a specialized jewelry policy: mysterious disappearance coverage. This covers you when your ring is just… gone. You can’t prove it was stolen, you don’t remember losing it, but it has vanished.

This is a huge deal because standard homeowners policies almost always exclude this scenario, leaving a massive hole in your protection. A policy that includes this coverage offers genuine peace of mind, acknowledging that sometimes things just disappear without a dramatic story attached.

How Jewelers Block Claims Work for Businesses

For our commercial clients, things look a bit different. A claim on a Jewelers Block insurance policy is a whole other ballgame. This kind of insurance for a jewelry store is designed to cover everything from a single damaged item in a showcase to a catastrophic inventory loss after a heist.

A claim for one damaged piece might be a simple repair cost. But a claim for a vault full of stolen goods is incredibly complex, demanding police reports, security footage, and a deep-dive inventory audit. This is where an expert agency like First Class Insurance Jewelers Block Agency is non-negotiable. We have the experience to manage the chaos and get your insurance for jewelry business to respond so you can get back to work.

When a claim happens, solid documentation is everything; learn how to streamline insurance claims with QR codes to speed things up. When you’re ready for a partner who understands the stakes, Get a Quote for Jewelers Block and make sure your claims process is as professional as your business.

Ring Insurance FAQs: The Bottom Line

Let's cut through the noise. Here are the straight answers to the most common questions we get about insuring jewelry.

Is It Worth Insuring an Engagement Ring?

Without a doubt. Think about it—an engagement ring is a huge investment, both financially and emotionally. For an annual cost that’s usually just 1-2% of the ring's value, you buy complete peace of mind. Losing it, having it stolen, or damaging it would be devastating. Insurance is a tiny price to pay to make sure that a disaster doesn't turn into a total financial loss.

Doesn't My Homeowners Insurance Already Cover My Ring?

Not really, and relying on it is a massive gamble. A standard homeowners policy usually has a laughably low limit for jewelry, often capped at just $1,000 to $2,000. Even worse, it probably won’t cover you for common scenarios like simply losing the ring (what insurers call "mysterious disappearance").

A dedicated policy—whether for you personally or a Jewelers Block insurance policy for your business—gives you real protection without forcing you to file a claim against your main homeowners policy, which can cause its own set of problems.

What Exactly Is Jewelers Block Insurance?

Jewelers Block is the master key to insurance for anyone in the jewelry business. It's the one all-in-one policy specifically built to cover your inventory against pretty much every risk you can think of—theft, fire, accidental damage, you name it. It's your business's most critical safety net.

This kind of comprehensive insurance for a jewelry store has you covered no matter where your assets are:

- Sitting safely in your store's vault.

- In transit being shipped to a client.

- Traveling with you to a trade show on the other side of the country.

Honestly, it's the single most important policy any jewelry business owner can have.

How Often Should I Get My Ring Re-Appraised?

Get your high-value pieces re-appraised every two to three years. It’s not just a suggestion; it’s a necessity. The market for gold, platinum, and diamonds is always moving.

An updated appraisal ensures you're not paying for too much coverage or, far worse, that you're not under-insured. If you have to file a claim, the last thing you want is a gap between what your ring is worth today and what your policy will actually pay out. A current appraisal keeps everything aligned.

Ready to stop worrying and get your assets properly protected? Whether you need personal coverage or a comprehensive Jewelers Block insurance plan for your business, the experts at First Class Insurance have your back. Let's get you a quote and the peace of mind you deserve. Get a Quote for Jewelers Block