So, what's the bottom-line cost? Let's cut straight to the chase.

As a solid rule of thumb, you can expect the cost to insure a ring to be 1% to 3% of its total appraised value each year.

So, if you have a $10,000 engagement ring, you’re looking at an annual premium of somewhere between $100 and $300. It’s a pretty straightforward calculation and gives you an excellent place to start budgeting for that peace of mind.

Understanding the Baseline Cost of Ring Insurance

Think of that 1-3% figure as the base rate. It’s the starting point before an underwriter begins layering in other factors, like where you live, the specifics of the ring's design, or how you plan to store it.

This percentage model is the industry standard for a reason: it ties the cost of protection directly to the ring's replacement value. If it costs more to replace, it costs a bit more to insure. Simple as that.

This same logic scales up, whether you’re an individual protecting a cherished heirloom or a jeweler protecting your entire business. For a retail store, the same principle underpins a comprehensive Jewelers Block insurance policy, which is designed to cover every single piece in the inventory.

Estimated Annual Ring Insurance Premiums

To give you a clearer picture of how this plays out in the real world, the table below shows how the annual premium scales up as the ring's value increases.

Estimated Annual Ring Insurance Premiums

This table shows sample annual insurance premium calculations based on the 1-3% industry standard, illustrating how cost scales with a ring's appraised value.

| Appraised Ring Value | Estimated Annual Premium (1%) | Estimated Annual Premium (2%) | Estimated Annual Premium (3%) |

|---|---|---|---|

| $5,000 | $50 | $100 | $150 |

| $10,000 | $100 | $200 | $300 |

| $25,000 | $250 | $500 | $750 |

| $50,000 | $500 | $1,000 | $1,500 |

As you can see, the cost remains predictable and proportional.

This growing need for clear, reliable protection is a big deal. In fact, the global jewelry insurance market is currently sitting at around $7.5 billion and is expected to climb steadily. This isn't just a niche product; it's a reflection of a wider understanding that high-value assets demand dedicated risk management. If you're interested in the market trends, you can find more jewelry insurance market insights on Data Insights Market.

Getting a handle on these baseline costs is the first, most crucial step. From here, you can start digging into the details that will shape your final policy.

Key Factors That Influence Your Premium

That 1% to 3% rule of thumb is a great starting point for estimating how much to insure a ring for, but the final number on your quote is a much more personal calculation. Insurance is all about risk, and underwriters look at a handful of specific details about you and your ring to land on that final premium.

Think of it like car insurance. Two people can own the exact same make and model, but they won't pay the same premium. Their driving record, where they live, and how they store the car all play a part. It's the same story with your ring. The ring’s appraised value is the biggest piece of the puzzle—and having a professional guide for valuing antique jewellery can be a huge help here. Naturally, the higher the value, the higher the premium.

Your Location and Claims History

Where you live plays a bigger role than most people think. Insurers use crime and theft statistics tied to your zip code to get a sense of the environmental risk. A ring that lives in an area with a high rate of property crime is simply a bigger risk to insure than one in a safer, low-risk neighborhood.

Your personal history with insurance claims is another major factor. If you've filed claims in the past, especially for lost or stolen jewelry, the insurance company will see you as a higher risk. This can trigger a "loading" or surcharge on your premium, sometimes bumping it up by 10% or more. On the flip side, a clean record shows you're a responsible owner, which helps keep your rates down.

The real takeaway here is that your premium isn't just about the ring itself. It’s a reflection of the world that ring lives in—and your history within it.

The Role of Your Deductible

Finally, the deductible you select will have an immediate and direct impact on your annual premium. A deductible is simply the amount you agree to pay out-of-pocket on a claim before the insurance company steps in and pays the rest.

It’s a straightforward trade-off:

- Higher Deductible: If you choose a higher deductible, say $1,000, you're telling the insurer you're willing to take on more of the initial financial hit yourself. Because this lowers their potential payout, they'll reward you with a lower annual premium.

- Lower Deductible: If you go with a low or even $0 deductible, the insurer is on the hook from the very first dollar. This convenience costs more, so you’ll see a higher yearly premium.

Picking the right deductible is a strategic move. You have to balance the appeal of a lower monthly payment against what you could comfortably afford to pay out on a moment's notice if you actually had to file a claim.

How a Ring's Design Impacts Its Insurance Cost

When an insurer looks at a ring, they see more than just its appraised value. They see a story about risk, and the ring’s physical design is a huge part of that story. Just like a high-performance sports car costs more to insure than a family sedan, a ring’s intricate features can directly bump up its premium.

Think about two rings, both appraised at $15,000. One is a classic solitaire—a single, large diamond held securely by six beefy platinum prongs. The other is a delicate vintage-style piece, covered in a halo and dozens of tiny pavé-set diamonds.

Even with the same value, that pavé ring is a much higher risk to an underwriter. Why? Because every single one of those tiny stones is a potential claim waiting to happen. It's incredibly easy to knock one loose during daily wear. The solitaire, on the other hand, is built like a tank. Its simple, sturdy design has far fewer weak points, making it less of a liability. That difference in risk almost always means a lower premium for the simpler ring.

Gemstone and Metal Choices Matter

The type of stone at the heart of the ring is another massive factor. Diamonds are famous for their toughness, scoring a perfect 10 on the Mohs scale of hardness. That durability makes them a relatively low-risk choice when it comes to chips or scratches.

But if the ring features a softer stone, the risk profile changes completely. Take a look at some popular alternatives:

- Emeralds: Gorgeous, yes, but they often have natural internal fractures (inclusions) that make them much more vulnerable to chipping.

- Opals: Known for their incredible fire, but they’re very soft (5.5-6.5 on the Mohs scale) and can easily crack if they experience a sudden temperature change.

- Pearls: As organic gems, they are extremely soft and can be easily damaged by everyday chemicals and simple abrasion.

To an insurer, a ring with a softer, more fragile gemstone has a much higher chance of a damage claim. That increased risk translates directly into a higher premium compared to a diamond ring of the same value.

The metal used for the setting also plays a part. Platinum is incredibly dense and durable, giving gemstones top-tier protection. While 14k or 18k gold is certainly strong, it's softer than platinum and more prone to bending or prong wear over time. These subtle differences are all plugged into the underwriter's risk calculation, impacting how much to insure a ring for. This image of a securely set diamond ring on a black background is a perfect example of a design that insurers would consider lower-risk.

Choosing the Right Insurance Policy for Your Needs

Picking the right insurance for a ring isn't a one-size-fits-all deal. The best policy really depends on who you are—an individual owner or a jewelry business.

For a personal piece, you're usually looking at two options: adding a 'rider' to your existing homeowner's policy or getting a standalone 'personal articles floater.' A rider is convenient, sure, but a floater usually gives you much stronger, specialized protection. It often covers "mysterious disappearance"—that frustrating moment when the ring is just gone, with no clear signs of theft.

But if you’re in the jewelry business, you're playing a completely different game. Your standard policies won't touch the high-stakes risks you face every single day. That's where Jewelers Block insurance comes in.

For Jewelers: The Power of Jewelers Block Insurance

Insurance for a jewelry store is worlds away from insuring a single sentimental item. A Jewelers Block policy is built for this reality. Think of it as a comprehensive shield that protects your entire inventory, from the diamonds locked in the vault and the watches in your display case to a piece being shipped across the country to a client.

This specialized jewelry store insurance is designed to cover the unique threats of the trade, including:

- Armed robbery or burglary

- Damage during handling or repairs

- Losses that happen while you're at a trade show

- Theft by employees or even customers

It's the foundational safety net for anyone running a jewelry business. The process typically starts when you Get a Quote for Jewelers Block from an expert, like a First Class Insurance Jewelers Block Agency. This step is crucial because these specialists get the industry's nuances. They partner with top-tier underwriters, including those at the famous Lloyd's of London marketplace, to build a policy that actually fits your business.

We see this same risk-based thinking on the consumer side, too. Research shows that while 67% of engagement ring purchases are insured, only 34% of other fine jewelry gets the same level of protection. It’s clear that people are focused on protecting the items with the most significant financial and emotional weight.

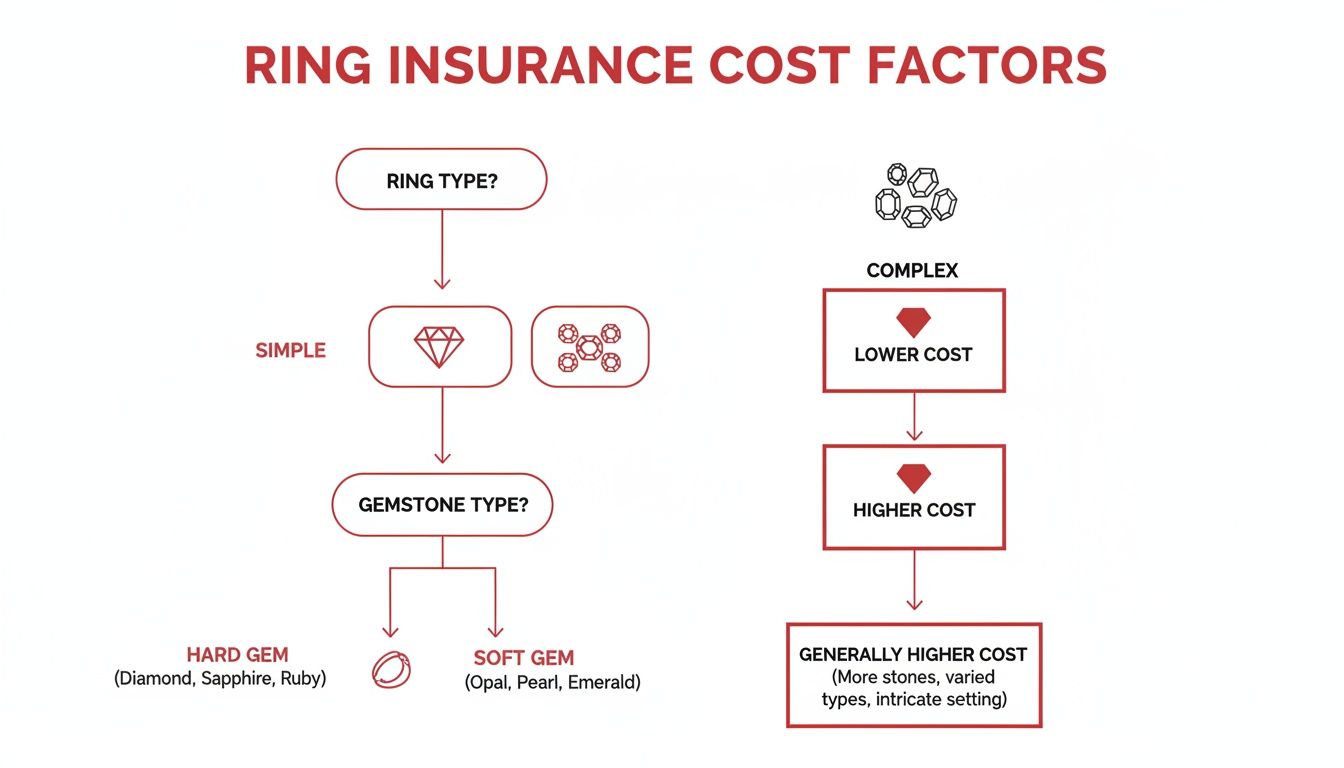

This chart breaks down how an insurer might look at different risk factors.

It’s a simple visual, but it makes an important point: rings with softer gems or delicate, complex settings naturally present a higher risk of damage or loss, which usually translates to higher premiums.

To make sense of the options, let's compare the most common policies head-to-head.

Comparing Ring Insurance Policy Types

| Policy Type | Primary User | Coverage Scope | Best For |

|---|---|---|---|

| Homeowners Endorsement (Rider) | Individual Owner | Limited; adds specific jewelry coverage to an existing policy. Often has lower limits and more exclusions. | Basic, convenient coverage for lower-value pieces. |

| Personal Articles Floater | Individual Owner | Standalone policy with broader, all-risk coverage, including mysterious disappearance. | Comprehensive protection for high-value personal jewelry. |

| Jewelers Block Insurance | Jewelry Business | All-encompassing; covers entire inventory, goods in transit, and business-specific risks. | Any business dealing with jewelry, from retailers to wholesalers. |

| Ultimately, choosing the right policy means matching your coverage to the role the asset plays. Whether it’s a single precious ring on your finger or a showroom filled with inventory, the goal is the same: eliminate financial risk without overpaying for protection you don’t need. |

And remember, insurance is just one piece of the puzzle. It’s just as important to think about physical security. Knowing some effective burglar proofing tips for your store or home is a vital part of any complete protection strategy.

Why a Professional Appraisal Is Non-Negotiable

Trying to get a ring insured without a professional appraisal is like asking a bank for a loan with no proof of income. It just doesn't work. You might have a good idea of what your ring is worth, but an insurer needs cold, hard, documented proof.

An appraisal isn't just a receipt or a price tag. It's a highly detailed report from a certified gemologist that becomes your ring’s official biography. It lays out every single detail an underwriter needs to see, creating the bedrock for your entire insurance policy.

What a Proper Appraisal Includes

A legitimate appraisal goes way beyond just a dollar figure. It's a technical breakdown that captures your ring's unique DNA. For a diamond, that means a deep dive into the Four Cs—Cut, Color, Clarity, and Carat weight—but it doesn’t stop there.

A thorough appraisal must also include:

- Detailed Measurements: The exact dimensions of the gemstones and setting.

- Metal Identification: The type and purity of the precious metal, like platinum or 18k gold.

- High-Quality Photographs: Clear, professional images from multiple angles that document the ring's design and condition.

- Distinguishing Marks: Notes on any unique features, like hallmarks, serial numbers, or custom engravings.

This level of detail is critical for both individuals and professionals in the jewelry business. For jewelers, a single appraisal can impact an entire Jewelers Block insurance policy. It establishes an undisputed baseline for an item's value, like this stunning piece of antique jewelry with detailed craftsmanship.

Replacement Value Versus Market Value

Here’s where a lot of people get tripped up. The most important number on an insurance appraisal is the replacement value. This figure is what truly matters to your insurer, and it’s almost always different from what you could sell the ring for.

Replacement value is the real-world cost to buy or create a new ring that is virtually identical to the one being insured. It accounts for today's market prices for gemstones, precious metals, and the skilled labor needed to craft a similar piece.

This is exactly why an insurer insists on this specific valuation. Their job isn't to cut you a check for what the ring might fetch in a pawn shop. Their promise is to make you whole by replacing the lost or damaged item with one of like, kind, and quality.

To make sure your coverage keeps up, it’s a good idea to get your ring reappraised every two to three years. Gemstone and metal markets are always shifting, and an old appraisal could leave you seriously underinsured, turning a claim into a financial nightmare.

How to Get Your Ring Insured Step by Step

Alright, you understand the difference between appraisals and policy types. Now it's time to actually get your ring covered. Breaking the process down into a few simple steps makes it far less intimidating, whether you're insuring a single engagement ring or an entire store's inventory.

First things first, get your paperwork in order. This is your foundation. You’ll need that professional appraisal we talked about, the original sales receipt if you can find it, and a few clear, high-quality photos of the ring. Having this folder ready to go makes everything else run smoothly.

Finding the Right Insurer

Next, you need to find the right partner. For an individual, this could mean calling your current homeowners insurance agent or getting a quote from a company that specializes in personal jewelry coverage.

But if you’re a jeweler, you absolutely need a specialist. A standard business policy just won't cut it—it’s full of gaps that leave you exposed. Your best bet is to connect with an expert agency like First Class Insurance Jewelers Block Agency and Get a Quote for Jewelers Block. They live and breathe insurance for a jewelry store and know how to build a policy that truly protects your assets.

Think of a specialized agency as your advocate. They connect you with underwriters who actually understand the unique risks of the jewelry trade, ensuring you get the right coverage without paying for things you don't need.

Asking the Crucial Questions

Once you're talking to an insurer, don't just take the first quote you get. This is your chance to dig in and understand exactly what you’re buying. A policy you don't understand is a risk you can't afford.

Here are the non-negotiable questions you need to ask your agent:

- Does the policy cover both damage and theft?

- What about "mysterious disappearance"? Is that included?

- Are there any specific situations or locations where the ring is not covered? (Think international travel or while on loan).

- How often do I need a new appraisal to keep my coverage valid?

- Walk me through the exact process for filing a claim. What paperwork will I need?

By taking these deliberate steps, you turn a potentially overwhelming task into a manageable process. You’ll end up with a jewelry store insurance plan—or a personal policy—that’s built on clarity and real-world protection.

Ring Insurance FAQs

Sorting through the ins and outs of ring insurance can feel a bit overwhelming. You've got questions, whether you're a jeweler protecting your inventory or an individual making sure a precious piece is safe.

Here are some straightforward answers to the questions we hear most often.

Does My Homeowners Policy Cover My Ring?

Not in any meaningful way, no. It’s a common and often costly assumption that your standard homeowners policy has you covered. The hard truth is, these policies typically cap jewelry theft payouts at a very low limit—often just $1,000 to $2,000 for your entire collection.

If your ring is worth more than that, you have a massive coverage gap. To truly protect its value, you need to add a specific rider to your policy or, even better, get a dedicated jewelry insurance plan.

What Is Jewelers Block Insurance?

Think of Jewelers Block insurance as the comprehensive, all-in-one shield specifically built for a jewelry business. It’s a commercial policy that protects a store's inventory from just about every angle: theft, damage, fire, and even loss during transit.

This specialized insurance for a jewelry store covers everything from the pieces in your vault to the items in your display case. For a professional jeweler, it's not just another policy—it's the absolute foundation of a solid risk management plan.

"Mysterious disappearance" is a policy feature you need to know about. It covers you when a ring vanishes without a clear explanation—you just know it’s gone. This isn't automatically included in every policy, so make it a point to ask your agent if you have this crucial protection.

Do I Really Need to Get My Ring Reappraised?

Yes, and it’s not just a suggestion. The value of precious metals and gemstones fluctuates constantly with the market. If your last appraisal was years ago, your coverage is almost certainly out of date.

We recommend getting a fresh appraisal every two to three years. This simple step ensures the insured value matches the ring's current replacement cost, saving you from being underinsured when you need the coverage most.

Protecting high-value assets demands real expertise. Whether you're looking for personal coverage or a comprehensive plan for your jewelry business, the team at First Class Insurance Jewelers Block Agency is here to help. We work with leading underwriters to build the right protection for your unique needs. Get a Quote for Jewelers Block and get the peace of mind you deserve.