If you’re a distributor in the jewelry business, grabbing an off-the-shelf insurance policy is one of the biggest risks you can take. Standard business insurance just isn't built for the realities of your world. It leaves dangerous, often costly, gaps in your protection because it fails to account for one simple fact: your most valuable assets are constantly on the move.

For any wholesale or retail jewelry operation, specialized coverage like Jewelers Block insurance isn't just a good idea—it's essential. This is the ultimate insurance for a jewelry store and the foundation of any sound insurance for jewelry business plan.

Why Generic Insurance Fails the Jewelry Business

Many business owners think a standard commercial policy is a solid safety net. For a jewelry distributor, that’s like using the wrong type of oil in a high-performance engine. It might seem to work for a little while, but when the pressure is on, a catastrophic failure is almost guaranteed.

Generic policies are designed for static businesses—think of a local shop where the inventory stays put. Your business is the complete opposite. This fundamental mismatch means a standard policy for a jewelry store insurance plan simply can't keep up with the real-world risks you face every single day.

The Critical Gaps in Standard Policies

So, where do these generic policies fall short? It all comes down to their limitations and exclusions, which are often in direct conflict with how a jewelry distributor operates. They’re built around protecting a fixed location, leaving massive financial holes the moment your products leave the building.

A typical business owner's policy (BOP) might cover your inventory while it's safe in your warehouse, but what happens when it’s:

- In transit with a carrier like FedEx or UPS?

- With a traveling salesperson visiting clients on the road?

- On display at a major trade show across the country?

- On memo or consignment at a retail partner's store?

In nearly every one of these scenarios, a standard policy offers little to no coverage. This leaves your inventory—the lifeblood of your business—completely exposed to theft, accidental damage, or even just disappearing without a trace.

For a business built on movement, stationary insurance is a recipe for disaster. Your value isn't just in the inventory you store; it's in what you ship, show, and sell from coast to coast. Specialized insurance for distributors is designed to protect that value at every single point in your supply chain.

The Necessity of Specialized Coverage

This is exactly why dedicated insurance for your jewelry business is a necessity, not a luxury. Policies designed for distributors are built specifically to plug the gaps that generic plans leave wide open. For anyone in the high-value goods trade, Jewelers Block insurance is the undisputed gold standard.

Instead of only protecting your building, it protects your core asset—your inventory—no matter where it goes.

When you work with a specialist like First Class Insurance Jewelers Block Agency, you get coverage built around the way your business actually works. We understand that your risks don't just stop at the loading dock. We craft policies that secure every link in your chain, from your vault to your customer's hands. Don’t wait for a devastating loss to find out what your policy doesn’t cover.

Understanding Jewelers Block Insurance Coverage

If you’re a distributor in the jewelry business, you’ve heard the term Jewelers Block insurance. It’s the gold standard, but what does it actually do? Why is it so different from the policies other businesses use?

The short answer is this: Jewelers Block is built from the ground up for the one-of-a-kind risks of our industry. It offers a level of security that your standard business insurance just can't touch.

Picture a protective bubble that wraps around your entire inventory. Now, imagine that bubble isn't stuck to one building—it moves with your assets, wherever they go. That dynamic, follow-you-anywhere protection is the heart of a Jewelers Block policy and the foundation of proper insurance for a jewelry store or wholesale operation.

The Power of an All-Risk Design

Here’s where things get really different. Most commercial policies are "named peril," meaning they only cover losses from a specific list of events, like a fire or a robbery. It’s a very rigid, limited approach.

Jewelers Block insurance, on the other hand, is almost always an "all-risk" policy. This completely flips the script. Instead of listing what is covered, it covers everything unless it’s specifically named as an exclusion.

This means you’re protected against a huge range of potential disasters, even the ones you’d never think to plan for. It's a proactive way to manage risk, built on the assumption that the unexpected will happen. For a business built on high-value, highly portable assets, that difference is everything.

The real strength of an all-risk policy is its breadth. It provides a safety net for known dangers like theft while also protecting against less common but equally devastating events, such as mysterious disappearance or accidental damage during transit.

Why Standard Property Insurance Is Not Enough

So, why not just get a standard commercial property policy? Because that kind of policy is designed to protect stuff that stays in one place—like the inventory sitting inside your warehouse.

The second a salesperson walks out the door with a diamond bracelet, that piece is no longer protected by a standard policy. That's a massive, dangerous gap for any active jewelry distributor.

Think about the everyday scenarios where a standard policy leaves you completely exposed:

- Goods in Transit: When your pieces are with a shipping carrier, they are at their most vulnerable.

- Off-Premises Sales: Your inventory is at risk the moment it's with a salesperson visiting clients.

- Trade Shows and Exhibitions: Displaying valuable items at a busy event is a huge liability.

- Consignment (Memo): When your jewelry is in a retail partner's care, it's out of your direct control.

A Jewelers Block insurance policy is engineered to plug every single one of these gaps. It follows your inventory, making sure that protective bubble stays intact whether a piece is locked in your vault, on the road with a sales rep, or on display a thousand miles away.

Coverage That Moves with Your Business

The jewelry distribution business is constantly in motion, and your insurance needs to be just as fluid. A wholesaler might have millions of dollars in inventory scattered across the country at any given moment. Trying to stitch together protection with a patchwork of limited, location-based policies is a recipe for disaster.

This is exactly why Jewelers Block insurance is the absolute cornerstone of risk management for jewelry wholesalers. It brings all your protection under a single, powerful policy that understands and adapts to the mobile reality of your business. It lets you operate with confidence, knowing your most critical assets are secure at every single point in the supply chain.

Building Your Jewelry Business Insurance Portfolio

While Jewelers Block insurance is the absolute cornerstone for any jewelry business, a truly protected operation needs more than just one line of defense. Think of Jewelers Block as the high-tech, specialized vault guarding your most precious asset: your inventory. But what about the rest of your business? Your store, your delivery vans, the products themselves—they all have their own vulnerabilities.

Putting together the right insurance for a jewelry store is a bit like packing a toolkit. You wouldn't use a tiny jeweler's screwdriver to fix a truck engine, and you shouldn't rely on one policy to cover every single risk you face. A fire at your facility, an accident on the road, or a lawsuit from a faulty product are all completely different threats, and each one needs its own dedicated coverage. Without these extra layers, you’re leaving massive, potentially devastating gaps in your protection.

Beyond Inventory: The Product Liability Shield

One of the sneakiest risks for any jewelry business is the product itself. What if a piece of jewelry you sell ends up harming a customer? This is exactly where Product Liability Insurance steps in, and it's non-negotiable.

This policy protects you from claims that a product you sold or supplied caused bodily injury or property damage. For a jeweler, that could be anything from a claim that an alloy in a ring caused a severe allergic reaction to a complaint that a faulty clasp on a bracelet broke, causing the customer to lose it.

Product Liability coverage is your financial backstop in the supply chain. Even if you didn't make the item, as a distributor or retailer, you're on the hook legally for its safety. This policy is what stands between your company's assets and a potentially crippling lawsuit.

Without it, one single product issue could unleash a flood of legal bills and settlement costs that could easily sink your entire operation. It’s a foundational piece of any solid plan for insurance for distributors.

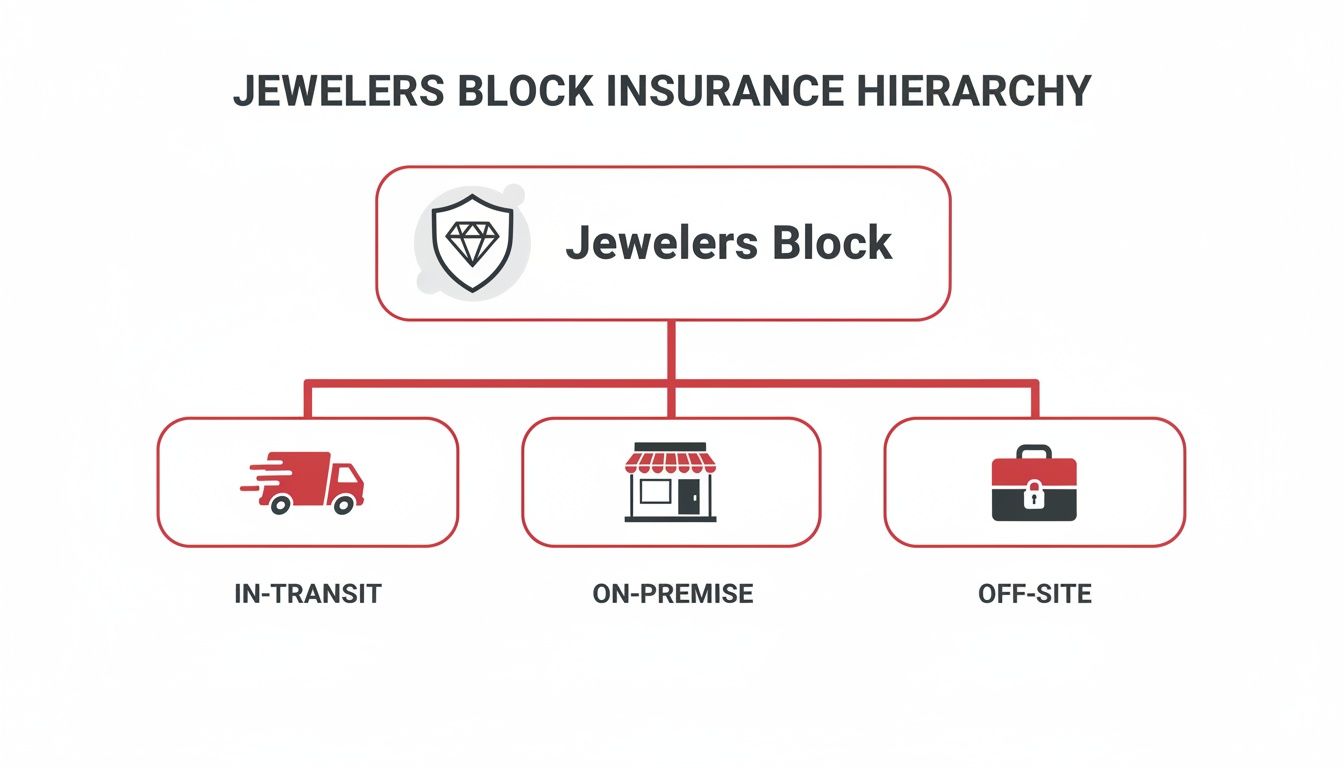

The diagram below really breaks down how Jewelers Block insurance gives you that layered protection for your inventory, no matter where it is.

It perfectly illustrates the policy's core strength: protecting your goods whether they're locked down in your facility, on the road, or out with a salesperson.

To help you visualize how these different coverages work together, here's a quick-reference table outlining the essentials.

Key Insurance Policies for Jewelry Businesses

| Insurance Policy | What It Primarily Protects | Example Scenario for a Jeweler |

|---|---|---|

| Jewelers Block | Your high-value inventory (jewelry, watches, precious stones) wherever it is—on-premise, in-transit, or off-site. | A salesperson's vehicle is broken into, and a case of diamond rings is stolen. |

| Product Liability | Your business from claims of bodily injury or property damage caused by the products you sell. | A customer sues, claiming a necklace you distributed caused a severe skin rash. |

| Commercial Property | Your physical building (store, office) and its contents (computers, equipment, furniture). | A fire breaks out in your store overnight, destroying the building and your office equipment. |

| Commercial Auto | Your company-owned vehicles used for business purposes, covering liability and physical damage. | One of your delivery drivers causes a multi-car accident while transporting an order. |

| Cargo (Inland Marine) | Goods and merchandise while being transported over land by your vehicle or a third-party carrier. | A truck carrying your shipment overturns on the highway, damaging the entire load. |

This table isn't exhaustive, but it highlights the distinct role each policy plays in building a comprehensive safety net.

Protecting Your Physical and Mobile Assets

Your business is much more than just the inventory you move. You have buildings, vehicles, and all sorts of goods crisscrossing the country. Each of these moving parts needs its own specific protection to keep you up and running if something goes wrong.

A complete insurance portfolio will always address these with a few key policies:

- Commercial Property Insurance: This is what protects your physical locations—your store, your office—and everything inside them that isn't inventory. Think computers, display cases, office furniture. If a burst pipe floods your main retail hub, this is the coverage that gets you back on your feet.

- Commercial Auto Insurance: If your business owns even a single vehicle for sales calls or deliveries, your personal auto policy won't cover it. Commercial Auto handles the liability and physical damage for your fleet, protecting you from the astronomical costs of an accident involving your employees and company vehicles.

- Cargo Insurance (Inland Marine): While Jewelers Block is the star for your high-value inventory, Cargo insurance protects other goods while they're in transit over land. It covers risks like theft from a shipping truck or damage from a collision. It's also the right place to look for insuring specific collections, like these stunning luxury watches, to make sure every single asset is properly accounted for.

Creating a Comprehensive Safety Net

By strategically layering the right policies, you create a comprehensive safety net that covers the full range of risks a modern jewelry business faces. This isn't about buying every policy under the sun; it's about carefully choosing the coverage that matches how you actually operate.

Think of it as a simple resilience checklist. Own a store? You need Commercial Property. Have a delivery van? Commercial Auto is a must-have. Don't want to be sued into oblivion over the products you sell? Product Liability is essential.

Working with a specialist like us at First Class Insurance Jewelers Block Agency lets you audit what you currently have and pinpoint any vulnerabilities. An expert can help you bundle these policies correctly, making sure there are no gaps between them and that your entire business is secure. That way, you can focus on growth with the confidence that you're protected on every front.

How Underwriters Look at Your Business Risk

Ever wonder what actually happens behind the curtain after you Get a Quote for Jewelers Block? The file lands on the desk of an underwriter, a specialist whose entire job is to size up your business and figure out the level of risk you represent. It’s not some mysterious art form; it’s a detailed, logical deep-dive into how well you protect your assets.

Understanding how they think gives you a huge advantage. Think of it as knowing the questions on a test before you walk into the exam room. When you know what underwriters are looking for, you can put your best foot forward, highlight your strengths, and proactively fix any weak spots. This is a game-changer when you're trying to secure the right insurance for a jewelry store or wholesale operation.

At the end of the day, an underwriter’s goal is simple: predict the odds of you filing a claim. They do this by building a complete risk profile of your business, digging into everything from your vault specifications to your financial health.

The Key Factors in Your Risk Profile

Underwriters don't just guess at a number. They use a methodical approach to analyze specific parts of your jewelry business, focusing on four main pillars of risk. Each one tells a piece of the story about your company's commitment to keeping its inventory safe.

Here's what they're looking at:

- Inventory Value and Composition: What are you actually protecting? The total value of your stock, the average value of each piece, and the type of inventory (like loose diamonds versus finished watches) directly shape the potential size of a loss.

- Physical Security Measures: How tough is your primary location to break into? Underwriters will want to know everything about your safes (their UL rating is key), your alarm systems (who monitors them?), and your camera setup.

- Transit and Off-Premise Protocols: How do you protect inventory when it’s on the move? They’ll examine your shipping methods, whether you use armored transport, your procedures for traveling salespeople, and how you handle security at trade shows.

- Business History and Management: What’s your track record? This covers your claims history, how long you've been in business, and the experience level of your leadership team.

Turning Your Strengths into Lower Premiums

The good news is that you have a ton of control over these factors. By actively managing them, you can lower how risky your business appears—and in turn, lower your insurance premiums. It's all about proving you take security seriously.

An underwriter's job is to price risk accurately. When you can prove you have taken concrete steps to reduce that risk—like installing a higher-rated vault or using GPS tracking on all shipments—you make their job easier and your premiums lower.

For example, showing that you’ve invested in a TRTL-30×6 rated safe can make a huge difference in your rates. The same goes for providing detailed logs of employee security training—it shows that risk management is baked into your company culture, not just an afterthought.

This proactive approach is especially powerful in the current market. In the third quarter of 2025, global commercial insurance rates fell by 4%, the fifth quarter in a row of decreases. This "softening" market means insurers are competing more for good business, giving well-prepared jewelers more leverage to negotiate better rates and terms. For more on this, check out the latest global insurance market index from Marsh.

Get Your Documentation Ready for Underwriting

Being prepared is half the battle. When you apply for coverage, having all your documents in order makes the underwriter’s job easier and shows you’re a professional. This almost always leads to a faster and better outcome.

Before you start asking for quotes, get this file together:

- A Detailed Inventory Report: A complete, itemized list of your current stock with up-to-date values.

- Security System Specifications: Provide the nitty-gritty details on your alarm system (including monitoring company certificates) and your safe (make, model, and UL rating).

- Financial Statements: Recent profit and loss statements and a balance sheet to show your business is stable.

- Claims History Report: A five-year "loss run" report from your previous insurance carriers.

- Business Operational Plan: A simple summary of your procedures for shipping, employee travel, and trade show security.

Having this information ready to go empowers you to walk into the quoting process with confidence. It sends a clear signal to underwriters, including those at prestigious markets like Lloyd's of London, that you're a well-run, low-risk partner they want to work with.

Mastering Claims and Proactive Risk Management

Think of your insurance policy as your financial safety net. But what good is a safety net if you don't know how to use it? Knowing precisely what to do when something goes wrong is just as crucial as having the right coverage in the first place. A calm, methodical response can be the difference between a smooth claims process and a drawn-out, frustrating nightmare.

Even better than a good claims experience is avoiding one altogether. Building a culture of security—proactive risk management—is the most powerful way to protect your business. It's about preventing losses before they ever happen through smart strategies and consistent team training. Get this right, and you don't just protect your inventory; you build a stronger relationship with your insurer, leading to better terms and lower costs down the road.

Your Immediate Steps After an Incident

When a loss happens—whether it's a theft, damage, or a mysterious disappearance—the first few hours are absolutely critical. The steps you take right away set the tone for the entire claims process. Panic is your enemy. A clear, step-by-step approach is your best friend.

Here’s your immediate action plan to protect your interests:

- Secure the Scene and Call the Police: If you suspect a crime, this is your first call. Don’t touch anything. Preserve any evidence and make sure your team and remaining assets are safe.

- Contact Your Insurance Broker Immediately: Your very next call should be to your agent, like the team at First Class Insurance Jewelers Block Agency. They are your guide and will walk you through your policy's specific requirements to get the claim started on the right foot.

- Document Everything: Pull out your phone and take photos and videos of any damage from every possible angle. Sit down and write out a detailed narrative of what happened while it’s still fresh in your mind.

- Gather Your Proof of Loss: Start collecting all the relevant paperwork: inventory records, purchase invoices, appraisals, and the police report. The more organized and thorough your documentation is, the stronger and faster your claim will be.

Building a Proactive Defense Against Loss

Let’s be honest: the best claim is the one you never have to file. A solid risk management program is the bedrock of any secure insurance for jewelry business plan. You're essentially creating multiple layers of defense to make your operation a much harder target for criminals and less susceptible to simple accidents.

This all starts with your people. Regular security training ensures every single employee understands their role in protecting the company’s assets. This isn't just about locking the doors; it’s about protocols for handling high-value items, spotting suspicious behavior, and knowing how to react in an emergency.

A well-trained team is your first and best line of defense. By embedding security awareness into your company culture, you turn every employee into an active participant in your risk management strategy, significantly reducing the likelihood of a preventable loss.

Proven Best Practices for Loss Prevention

Strengthening your defenses doesn't need to be overly complicated. Implementing a few key best practices can dramatically lower your risk profile, making you a much more attractive client to underwriters—and a far less attractive target for thieves.

Start by zeroing in on these key areas:

- Conduct Regular Inventory Audits: Frequent, unannounced audits are one of the best ways to catch internal theft or inventory discrepancies before they spiral out of control. For any serious jewelry business, a perpetual inventory system isn't a luxury; it's a non-negotiable standard.

- Thoroughly Vet Shipping Partners: Don't just go with the cheapest option. Dig into the security protocols of your shipping partners, confirm their insurance coverage, and always use discreet packaging that doesn’t scream "valuable contents inside!"

- Maintain and Test Security Systems: Your alarms, cameras, and safes are only good if they actually work. You need to schedule regular maintenance and testing to ensure every system is functioning perfectly and meets your insurer's strict standards.

For especially difficult or denied claims, it can be helpful to understand the benefits of using a public adjuster to manage commercial claims. By mastering both sides of the coin—the claims process and proactive prevention—you build a truly resilient operation that's ready for whatever comes its way.

Finding the Right Insurance Partner

Picking an insurance partner is one of the most important calls you'll make for your jewelry business. You could go with a general agent, sure, but they rarely have the deep-seated knowledge needed to properly protect a high-value, constantly moving inventory. This is where working with a specialist, like a First Class Insurance Jewelers Block Agency, becomes a real strategic move, not just another line item on your expense sheet.

Here’s a good way to think about it: you wouldn’t ask your family doctor to perform open-heart surgery. So why would you trust a generalist insurance agent with the very specific, high-stakes risks of the jewelry business? A specialist lives and breathes your world. They get the nuances of having inventory on memo, understand the precise security protocols for shipping, and know the exact policy language required to make sure a claim actually gets paid.

The Specialist Advantage

Unlike agents juggling policies for bakeries one minute and construction sites the next, specialists bring expertise that directly protects your bottom line. They’ve built solid relationships with the niche underwriters who focus solely on policies like Jewelers Block insurance. That access means they can negotiate better terms, find more competitive pricing, and build coverage that closes the dangerous gaps a standard policy would leave wide open.

Because their entire focus is on insurance for a jewelry store or wholesale operation, they’re already thinking about risks you haven’t even considered yet.

Your Simple Path to Secure Coverage

Getting the right protection shouldn’t feel like navigating a maze. We’ve designed our process to be straightforward and clear, getting you from our first conversation to being fully covered with total confidence. We’ll handle the heavy lifting so you can stay focused on what you do best.

Just follow these four simple steps to get covered:

- Get Your Docs in Order: Pull together your latest inventory records, information on your security systems (like safes and alarms), and a history of any recent claims.

- Schedule a Quick Chat: Hop on a call with our team. We'll talk through how your business really works, from how you ship products to your security rules for traveling salespeople.

- Review Your Custom Proposal: We’ll walk you through a clear, detailed insurance proposal built just for your business, explaining what every part of the coverage means for you.

- Lock In Your Policy: Once you give the green light, we finalize the policy. Just like that, your assets are officially protected.

Ready to protect your business with someone who truly gets it? Reach out to our team today to Get a Quote for Jewelers Block and feel the difference that specialized protection makes.

Jewelry Business Insurance FAQ

It's only natural to have questions when you're wading through insurance options. Here are some of the most common ones we hear from jewelry business owners, with straightforward answers to give you some clarity.

Does My General Liability Policy Cover the Products I Sell?

Not in the way you'd hope. Think of your General Liability policy as covering what happens at your location—like a customer slipping and falling in your store. It's about your premises and your operations.

But once a product is out the door and in the hands of a customer, General Liability offers little to no protection if that product causes harm. For that, you absolutely need a separate Product Liability policy. It’s the essential piece that protects you from claims related to the items you sell.

What’s the Real Difference Between Jewelers Block and Standard Property Insurance?

It all comes down to one word: movement. Your standard property insurance is static; it’s built to cover inventory and assets sitting in one specific, named location, like your store or office. It’s not designed for a business where valuable goods are constantly on the move.

Jewelers Block insurance, on the other hand, was created for the fluid nature of the jewelry business. It protects your high-value inventory no matter where it is—in the vault, with a sales rep on the road, being shipped by a carrier, or showcased at a trade show. It’s a far more comprehensive and realistic solution for a jeweler.

The real value of a Jewelers Block policy is that it understands your inventory isn't just sitting on a shelf. It wraps a shield around your assets at every point in their journey, from your safe to the final sale.

How Do I Prove My Inventory’s Value If I Have to File a Claim?

This is where your record-keeping becomes your best friend. In the insurance world, if you can't prove it, it doesn't exist. You absolutely must have a rock-solid, perpetual inventory system.

This means more than just a simple list. For every piece, you need detailed descriptions, original purchase invoices, appraisals, and good, clear photographs. When you file a claim, the insurer will demand this documentation to verify the value of your loss. Using a modern inventory management software makes this so much easier and ensures you’re always prepared.

Ready to get coverage that's actually built for the way you do business? The team at First Class Insurance has spent over 30 years creating policies that protect jewelers like you from real-world risks.