When you're shipping a diamond ring, you're not just sending a package—you're transferring a small, high-value asset. Trusting that shipment to a carrier's standard protection is a roll of the dice that no savvy jeweler should ever take. Their default coverage is almost always a fraction of what your pieces are actually worth, creating a financial black hole if something goes wrong.

Why Standard Shipping Protection Fails for Jewelers

Relying on a shipping carrier's built-in liability coverage for a high-value piece is like putting a simple padlock on a bank vault. Sure, there's a lock on the door, but it's nowhere near strong enough to protect what's inside. That’s the problem in a nutshell: standard carrier protection was never built to handle the unique risks and sky-high values of the jewelry industry.

This basic coverage, known as carrier liability, isn’t real insurance at all. It's just a minimal financial responsibility the carrier agrees to take on for the goods they're moving. The payout is usually based on the package's weight or some other generic tariff, not its actual value. In their world, a one-pound box with a $15,000 diamond ring could be valued the same as a one-pound box of trinkets.

The Critical Coverage Gap

The gap between what a carrier offers and what a jeweler actually needs is massive. A proper insurance on freight policy, especially one designed for the jewelry trade, closes that dangerous gap. It covers your item for its true agreed-upon or cash value, making sure a loss in transit doesn't turn into a financial catastrophe for your business.

For a jeweler, this is about more than just getting a check. It’s about business survival. A specialized freight policy ensures you can replace a lost item, keep your customer happy, and protect your hard-earned reputation without having to absorb a devastating financial hit.

Take a look at just how different these two types of protection really are.

Carrier Liability vs Specialized Freight Insurance

The table below breaks down the fundamental differences and highlights why carrier liability just doesn't cut it for high-value jewelry shipments.

| Protection Feature | Standard Carrier Liability | Specialized Freight Insurance |

|---|---|---|

| Basis of Coverage | Limited, often based on weight (e.g., cents per pound) or a low declared value. | Based on the actual appraised or declared value of the jewelry. |

| Claim Payout | Typically covers manufacturing cost, not the retail price. | Pays out the agreed value, allowing for full replacement and preserving profit. |

| Burden of Proof | The shipper must prove the carrier was negligent to receive a payout. | The shipper only needs to prove that a loss or damage occurred during transit. |

| Claim Process | Often slow and adversarial; carriers aim to minimize their payout. | A streamlined process with an insurer acting as your advocate. |

As you can see, the protection you get from a dedicated policy is in a different league entirely.

Ultimately, investing in proper insurance for your shipments isn't optional—it's a non-negotiable cost of doing business safely. To appreciate the value and beauty of what you're protecting, take a look at this stunning diamond ring on a black background. A specialized solution provides the only real peace of mind.

The Reality of Carrier Liability Limitations

If you've ever trusted your high-value inventory to a shipping carrier's standard protection plan, you're setting yourself up for a harsh reality check the moment a package goes missing. So many jewelers make the mistake of thinking "declared value" is the same as insurance. It’s not. It’s simply the carrier’s maximum liability, and all that fine print is there to protect them, not your jewelry business.

Let’s walk through a real-world scenario. You ship a small parcel of loose gemstones worth $50,000. Somewhere along the way, it vanishes—a total loss. You file a claim, expecting a check that makes you whole again. Instead, the carrier just points to a clause in their tariff agreement.

Under laws like the Carmack Amendment, which governs interstate shipments, liability is often capped at a laughably low dollar amount per pound. If your one-pound parcel of gems has a liability limit of $1.00 per pound, you’d get a check for a single dollar. Even if you paid for a higher "declared value," their payout is often limited to the manufacturing cost, not the retail value. You’re left to eat the lost profit.

Why Carriers Deny Claims

The claims process itself feels like an uphill battle from the start. To get a single penny, you have to prove the carrier was negligent—a tough and time-consuming burden. Carriers, on the other hand, have a long list of excuses to deny claims, and they are masters at using them.

Common reasons for a denied claim include:

- Acts of God: Carriers aren't on the hook for losses from natural disasters like floods, hurricanes, or earthquakes.

- Improper Packaging: If they decide your box wasn't packed well enough, they can deny the claim and put all the blame squarely on you.

- Acts of a Public Enemy: This clause covers losses from military action or terrorism.

- Shipper Fault: Any mistake you make—a typo on a label, an error in documentation—can be used as grounds for denial.

This whole system is built to minimize the carrier's financial hit. Their job is to limit payouts, not to keep your business running. The process can drag on for months, leaving you out of pocket with missing inventory and no compensation.

The Superiority of True Insurance

This is where true insurance on freight is a completely different ballgame. Unlike carrier liability, a real insurance policy is a contract designed to protect your financial interests. When you have a dedicated policy, especially as part of a Jewelers Block insurance plan, the power dynamic shifts completely.

The core insight is that carrier liability is a defense mechanism for the shipping company. In contrast, a specialized policy like Jewelers Block is a protective shield for your business, ensuring that a transit disaster doesn't become a financial one.

With a proper policy in place, you no longer have to prove the carrier was negligent. You just have to show that a loss happened while the goods were in their hands. The claim is handled by your insurance provider, who acts as your advocate, working to get you paid quickly—often within 30 days. This lets you replace the lost inventory and keep your customers happy.

For any jewelry business, this level of protection isn't a luxury; it's an essential safeguard for your assets and your reputation. Get a Quote for Jewelers Block; it's the first step toward securing this vital protection.

Choosing the Right Freight Insurance for Your Business

Trying to figure out freight insurance can feel overwhelming, but for a jeweler, it really comes down to one thing: finding a shield as strong as the assets it protects. There are several types of policies out there, each designed for a specific leg of the supply chain. Knowing the difference is the first step toward making the right call for your business.

The journey of a diamond ring or a luxury watch can span thousands of miles by land, sea, and air. This reality led to specialized policies built to cover goods during these distinct phases of travel. The two big categories you'll hear about are Inland Transit and Marine Cargo insurance.

Differentiating General Transit Policies

These two policies are the foundation of logistics protection, but they serve very different purposes.

- Inland Transit Insurance: This covers your goods while they’re on the move over land—think trucks or trains—within a single country. For a jewelry business, this kicks in for domestic shipments between your store, your suppliers, or your customers.

- Marine Cargo Insurance: Don’t let the name fool you; this policy isn’t just for sea voyages. It’s built to protect goods during international transit, whether by ship or by plane. It's an absolute must for jewelers sourcing gems globally or shipping finished pieces to international clients.

You could technically try to protect your shipments by understanding the fine print of policies like Motor Truck Cargo Insurance. But can you imagine trying to piece together separate coverage for every single package you send out? It's a logistical nightmare that leaves dangerous, and potentially ruinous, gaps in your protection.

The Gold Standard: Jewelers Block Insurance

This is where a solution designed specifically for the jewelry industry becomes not just a better option, but the only one that truly makes sense. The most effective insurance for a jewelry store is a Jewelers Block insurance policy. This isn't just another freight policy; it's a comprehensive protective bubble for your entire operation.

Think of Inland Transit or Marine Cargo policies as individual tools in a toolbox. A Jewelers Block policy, on the other hand, is the entire professional-grade toolkit. It’s engineered from the ground up to cover the unique risks of the jewelry trade, and that includes robust, built-in protection for your goods in transit.

This integrated approach is simply better. Instead of scrambling to buy a separate policy every time you ship with FedEx, UPS, or an armored courier, your Jewelers Block coverage automatically extends to your inventory while it’s on the move, subject to your policy's terms. It provides seamless, door-to-door protection for your assets, whether they're sitting in your vault, sparkling in a display case, or being shipped across the country.

The real power of a Jewelers Block policy is its 'all-risk' nature. It’s designed to cover just about every peril your business faces—including theft, damage, and even mysterious disappearance—all under one clear, consolidated plan.

Why an Integrated Policy Is So Important

Opting for an all-in-one policy like Jewelers Block insurance simplifies your life and massively strengthens your financial security. You have one policy to manage, one set of rules to follow, and one number to call when things go wrong. Most importantly, you get the peace of mind that comes from knowing there are no dangerous gaps between different policies.

Insuring valuable cargo isn't a new concept. In fact, the global cargo transportation insurance market is projected to hit USD 69.38 billion by 2029, proving just how critical it is to modern commerce. The whole idea dates back to 17th-century London coffee houses, where merchants first pooled their risk on shipments of spices and silks.

Today, that same fundamental need applies to luxury goods, where a single lost shipment can be financially catastrophic for a business.

For any jeweler, this is the key takeaway: your conversation with an insurance agent shouldn't be about buying one-off shipment protection. It should be about securing a comprehensive Jewelers Block policy that wraps your entire inventory—in-store and in-transit—in a blanket of specialized protection. It's the only approach that lets you operate with real confidence, knowing your most valuable assets are properly secured.

Understanding Who Insures the Shipment with Incoterms

When you're sourcing gemstones from Asia or shipping a custom piece to a client in Europe, one simple question can make or break the entire transaction: who is responsible for the insurance?

The answer isn't always as simple as you'd think. It’s all defined by a set of globally recognized rules called Incoterms (International Commercial Terms). Think of these terms as a kind of shorthand in your sales contracts that spells out the exact moment when risk and responsibility for the goods transfer from the seller to you, the buyer.

Get this wrong, and you could create a dangerous gap where your high-value goods are in transit with absolutely zero protection. For any jeweler, understanding these terms is fundamental to securing your supply chain.

For jewelers, two of the most common Incoterms you'll run into are FOB and CIF. They might sound like dry industry jargon, but they have very real-world consequences for your bottom line.

FOB vs. CIF: A Jeweler's Scenario

Imagine you're a jeweler in New York buying a parcel of sapphires from a supplier in Thailand. The terms you agree to will decide who has to arrange and pay for the insurance on the freight.

-

FOB (Free On Board): If your contract says "FOB Bangkok," the seller is only on the hook for the gems until they are loaded onto the cargo ship or plane in Bangkok. The second they are "on board," the risk—and the insurance responsibility—is all yours. You must have your own policy ready to cover the entire journey from that point all the way to your store.

-

CIF (Cost, Insurance, and Freight): Under these terms, the seller's responsibility goes a lot further. They have to pay the costs to ship the gems and buy an insurance policy to cover them all the way to the Port of New York. But this convenience comes with a huge hidden risk. The insurance the seller buys is often the cheapest, most basic coverage they can find, which is almost always totally inadequate for high-value jewelry.

Relying on a seller's CIF policy is a massive gamble. You have zero control over the coverage limits, the exclusions, or the deductible. If a loss happens, you're stuck dealing with an unfamiliar—and often foreign—insurance company to try and file a claim.

Taking Control of Your Coverage

For any serious jewelry business, it's almost always better to buy goods under FOB terms and use your own comprehensive insurance, like a Jewelers Block insurance policy.

This move ensures your assets are protected by a policy you actually understand and trust, with coverage tailored to the true value of your inventory. It puts you in the driver's seat.

When you're navigating international trade, clarity is everything. Digging deeper into roles like the Importer of Record can shed more light on who carries the risk and insurance burden, especially when Incoterms are involved. You can explore a comprehensive guide on the Importer of Record to get a better handle on these complexities.

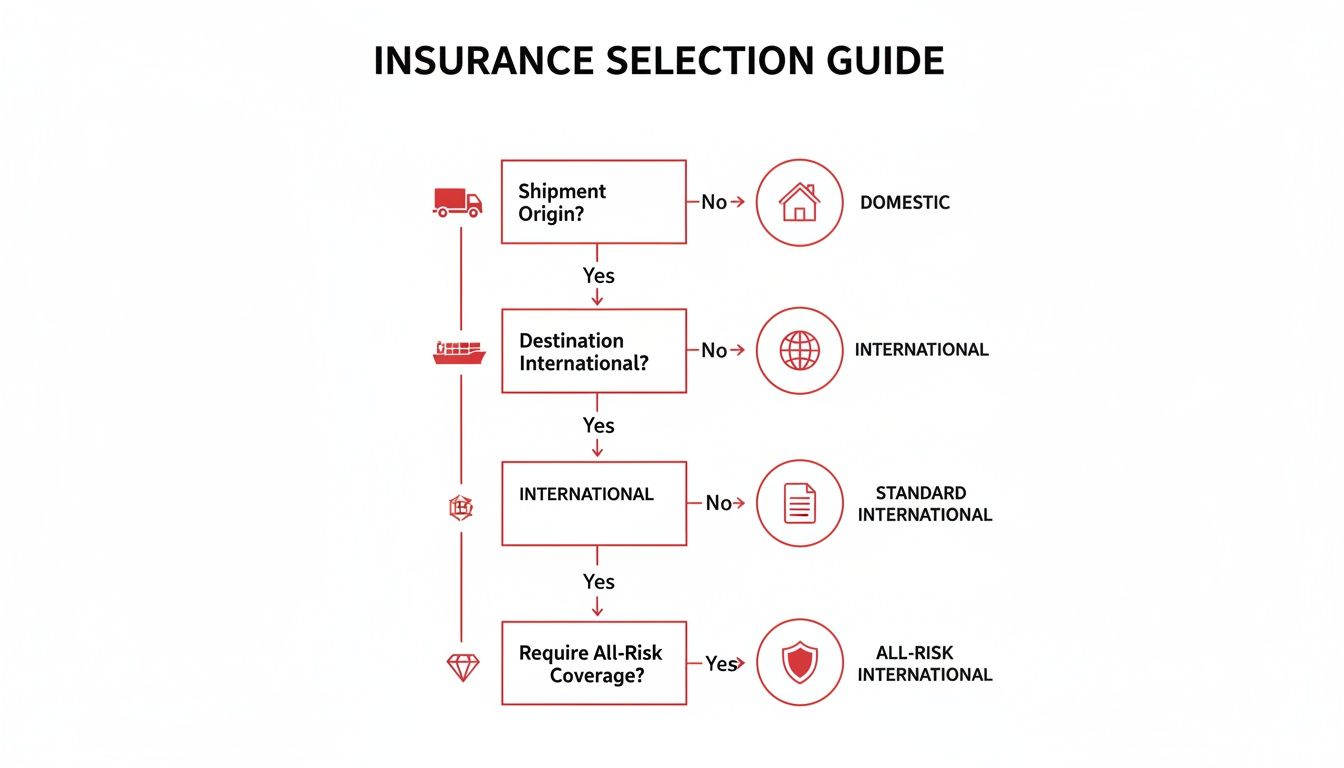

This decision tree gives you a simplified way to think about your insurance needs based on your specific shipment.

Ultimately, what this chart highlights is that whether your shipment is domestic or international, the best protection comes from an all-risk policy that you control. By mastering Incoterms and securing your own robust insurance, you eliminate dangerous blind spots and make sure every single high-value shipment is protected from door to door.

How Your Freight Insurance Premiums Are Calculated

Trying to figure out what you’ll pay for insurance on freight can feel a bit like reading tea leaves. But it’s not random. Insurers are essentially professional risk assessors, and they’re looking at a handful of very specific factors to decide how much of a gamble your shipments represent.

Once you understand what they’re looking for, you can start making smarter choices that put you back in control of your costs.

The single biggest factor? The total value of your shipments. It’s simple math: the more your goods are worth, the bigger the potential loss for the insurer. A jeweler shipping a $100,000 ring faces a much higher potential claim than one sending a $10,000 bracelet, and the premium will reflect that.

Key Factors in Premium Calculation

But it's not just about the price tag. Underwriters get granular, digging into the specifics of your shipments to build a complete risk profile.

- Type of Jewelry: Not all sparkle is the same in an insurer’s eyes. A box of loose diamonds is small, easy to pocket, and a massive theft risk. A crate of bulky designer watches? A little harder to make disappear. The smaller and more valuable the item, the higher the perceived risk.

- Shipping Routes and Destinations: Where your package is headed is a huge deal. Sending a piece to a location known for logistical chaos or high theft rates is a completely different risk than shipping it two states over via a secure, well-worn route.

- Modes of Transport: How it gets there matters, too. An armored truck is one thing; standard mail is another entirely. Your choice of carrier and their security game directly impacts your rate.

- Claims History: This is your report card. If you have a history of frequent losses, insurers will see you as a higher risk and charge you accordingly. A clean record, on the other hand, proves you’re serious about security and can earn you much better terms.

The Impact of Market Conditions

It’s also important to know that some factors are completely out of your hands. The entire transportation industry is feeling the squeeze right now, and those costs inevitably find their way into insurance premiums.

You don't have to look far to see the proof. Physical damage rates have shot up by 18% to 25%, while auto liability has climbed 7.5% to 20%. These aren't small jumps. They're driven by major economic forces like labor shortages, inflation driving up repair costs, and ongoing supply chain headaches. You can get more familiar with these transportation market trends to see the bigger picture.

The bottom line is this: your premium is a direct reflection of your risk. The more you do to minimize that risk, the more you can influence your final cost.

Taking Control with Proactive Risk Management

This is where you get to play offense. Insurers love jewelers who take security seriously. Proactive risk management is the single most powerful tool you have for getting your rates down for your insurance for a jewelry business.

When you show an underwriter that you’re committed to preventing losses, they see a partner, not just a liability. Here are a few moves that can make a real difference:

- Advanced Security: Use tamper-evident packaging. It’s a simple way to know immediately if a package has been compromised.

- GPS Tracking: For anything truly high-value, a GPS tracker gives you real-time visibility and peace of mind.

- Splitting Shipments: Don't put all your eggs in one basket. Break up large orders into several smaller shipments to minimize the impact of any single loss.

- Discreet Packaging: Never, ever advertise what’s inside. A boring brown box is your best friend.

Taking these steps isn't just about protecting your inventory—it's about proving to your insurer that you're a low-risk client. That proactive mindset is your best strategy for locking in insurance on freight that’s both solid and affordable.

Your Action Plan for Managing Claims and Preventing Loss

When a high-value shipment disappears or arrives damaged, your first moves are everything. Acting fast and methodically can be the difference between a paid claim and a massive financial hit. Having a clear action plan in place before a crisis hits means you can navigate the stress without missing a critical step.

This organized approach gives your insurer exactly what they need to process your claim and get you back on your feet.

The second you suspect something is wrong, the clock is ticking. Your very first call should be to your insurance agent. Prompt notification isn’t just good practice—it's usually a policy requirement. It lets your insurer jump into action immediately.

The Claims Process Checklist

After you’ve looped in your insurer, it's all about gathering evidence. A well-documented claim is a strong claim.

- Document Everything: Snap clear photos or videos of any damaged goods and packaging from every possible angle. Keep every scrap of paper related to the shipment—receipts, tracking numbers, bills of lading, you name it.

- Secure the Damaged Items: Don't throw anything away. Your insurance company will almost certainly send an adjuster to inspect the damaged merchandise and packaging as part of their investigation.

- File a Police Report: If you have any reason to suspect theft, get to the local police and file a report right away. That official report is crucial for validating a theft claim with your insurer.

A specialized insurance agency isn’t just selling you a policy; they’re your partner in a crisis. A good agent will walk you through these steps, fight for you, and make sure your claim is handled efficiently so you can get back to business.

Proactive Risk Management Strategies

Of course, the best way to deal with a claim is to avoid one in the first place. Smart, proactive security measures woven into your shipping protocol can dramatically lower your risk profile. This is the kind of attention to detail underwriters love to see when they calculate premiums for your insurance on freight.

Think about adding these best practices to your routine:

- Use Discreet Packaging: Never use branded boxes or labels that hint at the valuable contents inside. A boring, plain box is your best friend when it comes to avoiding targeted theft.

- Split High-Value Orders: Whenever it makes sense, break up a large order into several smaller shipments. It's a simple strategy that minimizes your potential loss if one package goes missing.

- Maintain Flawless Records: Your inventory records need to be meticulous and always up-to-date. If a loss occurs, you have to be able to prove exactly what was in that box and what it was worth.

Working with an expert agency like First Class Insurance Jewelers Block Agency gives you a direct line to these kinds of industry best practices. Staying active in organizations like the Southern Jewelry Travelers Association is another way smart jewelers stay ahead of the curve. These preventative steps aren't just chores; they're foundational to protecting your business.

Your Top Questions About Jewelry Shipment Insurance, Answered

When you're dealing with high-value inventory on the move, questions are bound to come up. Getting the right answers is the difference between true peace of mind and a costly oversight. Let's tackle some of the most common things jewelers ask about insuring their shipments.

Does My Jewelers Block Policy Cover All My Shipments?

This is probably the single most-asked question, and for good reason. You’d think a policy designed for jewelers would just automatically cover every single package you send, right? Well, not exactly.

While most Jewelers Block insurance policies do include transit coverage, the devil is always in the details. The limits per shipment, what carriers are approved, and even where you can ship to can vary wildly from one policy to the next. It’s absolutely critical to dig into your policy’s specific transit clause to know your numbers. If you're sending something that blows past your standard limit, you'll need a special endorsement. Never assume you're covered—always check with your agent first.

Is Mysterious Disappearance Covered When I Ship Jewelry?

Ah, "mysterious disappearance"—the jeweler’s nightmare. It’s when you receive a package that looks perfectly sealed and untampered with, but the box is empty. No signs of a break-in, no evidence of theft, just… gone. This is where a generic shipping plan fails you and a specialized policy proves its worth.

Standard insurance policies often exclude this specific risk, leaving you holding the bag for a massive, uncovered loss. A quality Jewelers Block policy, on the other hand, is built for exactly this kind of scenario and almost always includes this crucial protection. Honestly, this coverage is one of the biggest reasons to get dedicated insurance for your jewelry business.

The need for this kind of specific coverage is only growing. The global cargo insurance market, which handles insurance on freight for high-value goods like jewelry, is projected to hit USD 75,214.5 million by 2025. That number tells a story about increasingly complex supply chains and the need for policies that can handle sophisticated risks. You can see more on the growth of the cargo insurance market in this report.

Should I Buy Extra Insurance From FedEx Or UPS?

If you already have a proper Jewelers Block insurance policy, then buying extra insurance from carriers like FedEx or UPS is just throwing money away. Worse, it gives you a false sense of security.

Here's the thing: what they sell isn't true insurance. It's "declared value" coverage, and it’s riddled with loopholes, exclusions, and a claims process designed to work against you. Your own policy is your first and best line of defense. It gives you broader protection and a claims process handled by people who actually understand the jewelry industry—they're your advocates, not your adversaries.

Protecting your high-value shipments shouldn't feel like a roll of the dice. At First Class Insurance, we build Jewelry store insurance policies that give you the robust, door-to-door protection your business actually needs. Get a quote today and start shipping with real confidence. Learn more at https://firstclassins.com.