For any jeweler, the annual premium for a comprehensive Jewelers Block insurance policy is one of the biggest checks you’ll write all year. It’s absolutely essential coverage that protects your high-value inventory from theft, damage, and a whole host of other risks. But it often comes with a hefty, upfront price tag that can put a serious strain on your cash flow, tying up funds that could be put to much better use.

Free Up Capital With Insurance Premium Financing

Think about it this way: you wouldn’t think twice about financing a rare, high-value diamond to add to your collection. It’s a smart, strategic move to grow your inventory without draining all your cash reserves. Insurance premium financing applies that same powerful logic to your insurance policy.

Instead of seeing your premium as just another unavoidable bill, you can start treating it like a significant business asset—one that can be managed intelligently.

Turn a Burden Into an Opportunity

By financing your premium, you turn a massive one-time expense into predictable, fixed monthly payments. This isn't just a simple payment plan; it's a strategic financial move that directly liberates your working capital. Insurance premium financing is a powerful way to manage your expenses and dramatically improve business cash flow, keeping a huge upfront payment from tying your hands.

This unlocked capital can be immediately put back to work in ways that actually generate revenue and strengthen your business. The possibilities are huge:

- Acquire New Inventory: Jump on opportunities to buy sought-after gems, watches, or even entire collections, especially right before the peak selling season.

- Invest in Marketing: Launch that new digital ad campaign you’ve been planning, overhaul your website, or host an exclusive event to draw in new clients.

- Upgrade Operations: Invest in better security systems, sleek new showroom displays, or technology that elevates the customer experience.

- Expand Your Business: Open a second location, bring on a master goldsmith, or finally build out your e-commerce platform to reach a global market.

By smoothing out your single largest operational expense, you create serious financial agility. That stability allows you to navigate market ups and downs and invest in growth with confidence, all because you know your cash flow is steady and reliable.

At the end of the day, premium financing is a tool for boosting your business's financial health and giving you a competitive edge. It lets you secure the robust insurance for a jewelry store you need without sacrificing the capital required to grow and thrive. You can protect your most valuable assets, like a stunning

, while simultaneously funding your next big move.

How Premium Financing Works for a Jewelry Store

At first glance, insurance premium financing might sound a little complicated, but the actual process is refreshingly straightforward, especially when you have a specialty agency in your corner. Think of it as a simple, coordinated effort between four key players, all working to get your coverage in place without putting a major dent in your cash flow.

Let's quickly meet the team involved in the transaction:

- Your Jewelry Store (The Insured): That’s you—the business that needs robust protection like a Jewelers Block policy.

- Your Insurance Agency: A specialized guide, like First Class Insurance, who finds the right policy and lines up the financing for you.

- The Underwriter: This is the actual insurance carrier (often a syndicate at a major institution like Lloyd's of London) that assesses your risk and officially issues your policy.

- The Premium Finance Company: This is the third-party lender that pays your insurance premium upfront on your behalf.

A Step-by-Step Walkthrough

To see how this all comes together, let’s walk through a real-world scenario. Imagine your jewelry store just received its annual Jewelers Block insurance quote for $50,000. That’s a big check to write, especially if it’s right before the holiday rush when every dollar of capital counts.

This is exactly where your agent would step in and suggest premium financing.

The whole thing kicks off when you sign a Premium Finance Agreement (PFA). It's just a simple contract with the finance company that lays out the loan terms: the amount being financed, the interest rate (APR), and your monthly payment schedule. At this stage, you'll also make a down payment, which is usually around 20-25% of the total premium.

So, for that $50,000 policy, a 25% down payment comes out to $12,500. That’s your only significant upfront cost.

Once the PFA is signed and your down payment is in, the finance company immediately wires the full $50,000 premium directly to your insurance underwriter. Just like that, your policy is paid in full for the year, and your coverage is locked in. You’ve secured complete protection without draining your operating account.

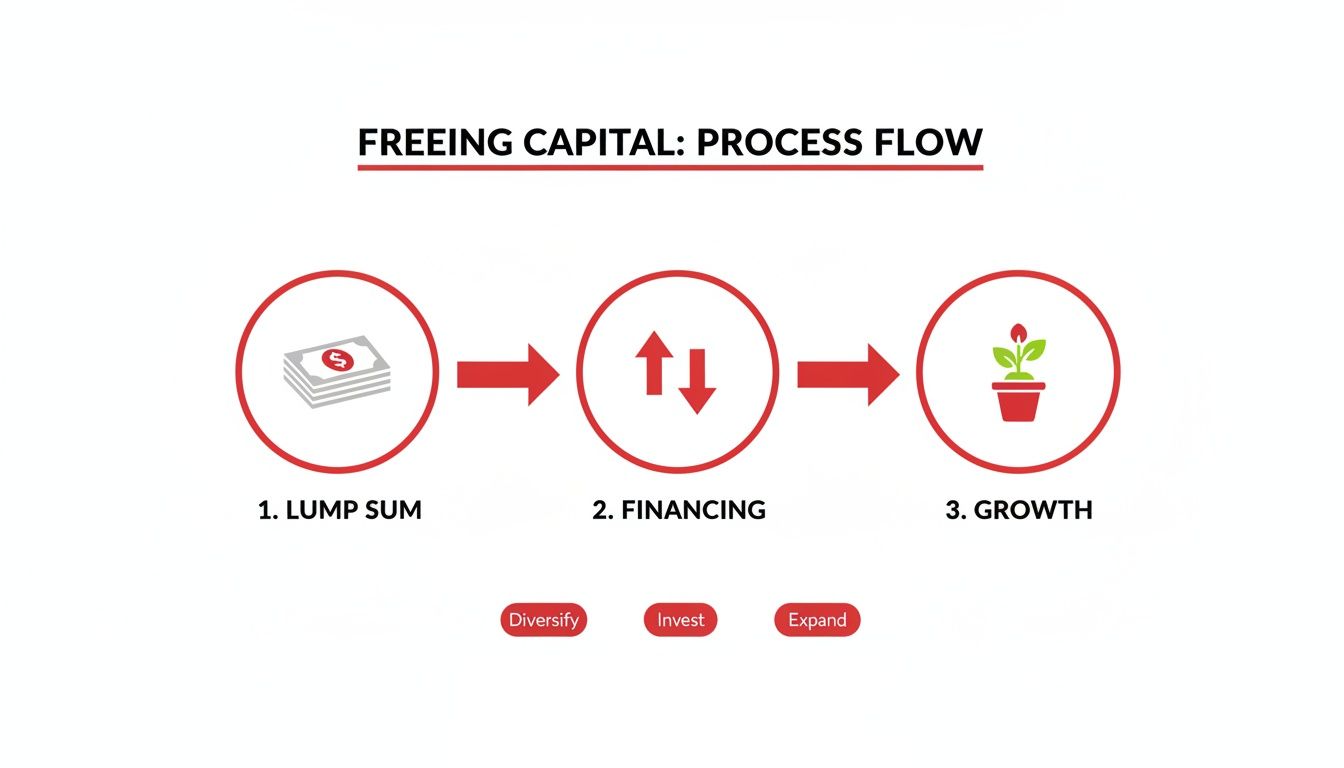

This diagram perfectly illustrates how financing turns a huge one-time expense into freed-up capital you can put to work in other areas of your business.

The real beauty here is that you’ve instantly unlocked cash that would have otherwise been tied up for an entire year in a single insurance payment.

To really see the difference, let’s compare paying in full versus financing that $50,000 policy.

Comparing Premium Payment Options for a $50,000 Jewelers Block Policy

| Payment Method | Initial Cash Outlay | Monthly Cash Flow Impact | Capital Available for Inventory/Operations |

|---|---|---|---|

| Pay in Full | $50,000 | $0 (after initial payment) | $0 (from premium funds) |

| Premium Financing | $12,500 (25% down payment) | ~$4,167 + interest (for 9 months) | $37,500 |

This table makes it crystal clear: financing keeps $37,500 in your hands—money you can use to buy new inventory, run a marketing campaign, or invest in store upgrades.

Managing Your Payments and Coverage

Now that the underwriter has been paid, your only remaining obligation is to the finance company. You’ll make regular monthly payments to them for the rest of the loan term, which is typically 9 or 10 months. These payments cover the principal you borrowed ($37,500 in our example) plus a small amount of interest.

The entire process is designed to be seamless. A good specialty agency will often show you a financing quote right alongside your insurance quote, so you can see the cash flow advantages from the very beginning. It just makes protecting your business that much more manageable.

This strategic approach is becoming more critical than ever. As premiums rise, jewelers are looking for smarter ways to manage costs. The global premium finance market is expected to grow from $51.37 billion to $57.13 billion, largely because businesses in high-value sectors need these kinds of tools.

Working with an experienced First Class Insurance Jewelers Block Agency ensures every step is handled correctly. From negotiating with underwriters, including those represented by the iconic

, to finding the best financing terms, the right partner turns a potentially complicated financial move into a powerful strategy for your business.

The Strategic Benefits for Your Jewelry Business

Deciding to finance your insurance premium isn't just a different way to pay a bill. It's a savvy financial move that can give your jewelry business a real, tangible edge. The biggest and most immediate advantage? A dramatic improvement in your cash flow—the lifeblood that fuels your ability to grow and jump on market opportunities.

When you turn a massive, single expense into smaller, predictable monthly payments, insurance premium financing keeps your working capital free and ready. This is a game-changer in the jewelry world, where the chance to buy a one-of-a-kind estate piece or an entire collection can pop up without warning.

Supercharge Your Capital and Seize Growth Opportunities

Freeing up that much cash opens a door to strategic possibilities that would otherwise be locked. Instead of seeing tens of thousands of dollars tied up in an insurance policy for a year, that money can be put to work for your business right now.

This flexibility means you can make critical investments exactly when they'll have the most impact. Just think about the moves you could make with that extra capital:

- Boost Holiday Inventory: Snap up those in-demand pieces just before the fourth-quarter rush, making sure you have the inventory to meet peak season demand.

- Launch a New Marketing Campaign: Invest in a targeted digital ad blitz or an exclusive trunk show to draw in high-net-worth clients and get people through the door.

- Enhance Your Showroom: Upgrade your lighting, displays, or security to create a more luxurious and secure experience that encourages bigger sales.

At its core, financing your insurance for a jewelry business lets you operate from a position of strength. You get to be proactive and opportunistic instead of reactive and held back by the cash you have on hand.

Simplify Your Budgeting with Predictable Payments

Beyond freeing up capital, another huge plus of premium financing is the stability it brings to your financial planning. Running a jewelry store means juggling fluctuating costs all the time, from buying inventory to hiring seasonal staff.

Premium financing takes one of the largest and most unpredictable annual expenses off that roller coaster. By locking in fixed, consistent monthly payments, you can budget with far more precision.

This predictability is invaluable. It smooths out your financial obligations, gets rid of the stress of a massive lump-sum payment, and makes forecasting your monthly and quarterly expenses so much easier.

That kind of stability lets you plan better for the long term, helping you put your resources where they’ll do the most good throughout the year.

Secure Superior Coverage Without Draining Your Accounts

Maybe the most important benefit of all is being able to afford the absolute best protection for your business. A comprehensive Jewelers Block insurance policy is non-negotiable, but let's be honest—the best coverage comes with the biggest price tag.

Too many business owners face a tough choice: pay for top-tier coverage and suffocate their operating budget, or settle for a weaker policy to keep cash free. Insurance premium financing completely removes that compromise.

It empowers you to get the robust coverage your high-value inventory demands without emptying your operational bank account. You can afford the policy that truly protects you from the big risks—theft, shipping losses, or mysterious disappearance. It ensures that one catastrophic event won’t put the future of your business in jeopardy. When you're ready to see what's possible, it’s always smart to Get a Quote for Jewelers Block from a specialist who lives and breathes this stuff.

Understanding Your Premium Finance Agreement

Signing an insurance premium financing agreement is the final step to unlocking serious cash flow benefits for your jewelry store insurance. But before you put pen to paper, you need to understand exactly what you’re signing.

Think of it like inspecting a GIA certificate before buying a diamond—the fine print matters. This agreement is a formal, legally binding contract between your business and the finance company. It lays out all the terms for the loan they're providing to pay your Jewelers Block insurance premium in full. While the document might look dense, it really just boils down to a few key pieces of information.

Key Financial Terms in Your Agreement

When that agreement hits your desk, your eyes should immediately jump to the numbers. These are the terms that define your total cost and financial commitment, so you can budget accurately without any surprises down the road.

Here’s what to look for:

- Down Payment: This is the portion you pay upfront to get the ball rolling, usually somewhere between 20% and 25% of your total premium. The finance company then steps in to cover the rest.

- Annual Percentage Rate (APR): This is your interest rate, plain and simple. It’s the total cost of borrowing expressed as a yearly percentage. Your APR will depend on things like your business's financial health, the premium amount, and what interest rates are doing in the broader market.

- Finance Charge: This is the bottom-line dollar amount you'll pay in interest over the life of the loan. It’s a straightforward calculation based on the amount you financed and your APR.

- Monthly Payment Amount: This is the fixed, predictable amount you’ll pay each month. Loan terms are typically for 9 or 10 months.

Getting a handle on these numbers gives you the full financial picture. You can clearly see the cost of the finance charge and weigh it against the huge advantage of keeping that working capital free and available in your business.

The Critical Power of Attorney Clause

Tucked away in the legal boilerplate of nearly every premium finance agreement is a clause that you absolutely have to understand: the Power of Attorney. This is standard industry practice and a necessary part of the deal, but you need to know what it means.

When you sign, you’re giving the finance company a very specific, limited right to act on your behalf, but only if you default on your payments. This clause gives them the authority to contact your insurance carrier directly and request a cancellation of your policy.

The insurer would then refund the unused portion of your premium—not to you, but directly to the finance company to settle your outstanding loan. This is the collateral that secures the loan and makes the whole premium financing model work.

It sounds serious, and it is, but this clause only kicks in if you stop making payments. It’s the lender's protection, and it underscores just how important it is to stay on top of your monthly payments to ensure your insurance for a jewelry business stays in force without a hitch.

In the U.S., premium financing has become a lifeline as insurance costs for high-value risks continue to climb. For jewelers, wholesalers, and artisans navigating the North American property and casualty market, it's a game-changer. Financing at a good rate turns a massive lump-sum payment into manageable monthly expenses, freeing up cash—a trend that’s only grown as specialized brokers make the process smoother. You can dig deeper into these market dynamics in the Allianz Global Insurance Report.

Your Step-by-Step Guide to Securing Financing

Getting started with insurance premium financing is far simpler than you might think, especially with a clear roadmap. The entire process is designed to be smooth and efficient, getting you from a quote to a fully funded policy without interrupting your business.

This guide breaks it all down into a few manageable steps, so you can lock in the right financing for your jewelry store insurance with total confidence.

Step 1: Request Your Jewelers Block Quote

It all starts with getting a quote for your Jewelers Block insurance. This isn't a job for a generalist—you need to connect with a specialty agency like First Class Insurance. An expert who lives and breathes the jewelry industry will understand your specific risks, from inventory value and transit needs to your security setup.

Make sure you tell your agent right away that you’re interested in financing. That way, they can get financing quotes at the same time, giving you a complete financial picture from day one.

Step 2: Review and Select Your Financing Proposal

Once your insurance quote is ready, your agent will also present you with one or more financing proposals. These documents spell out the key terms in plain English: the down payment, the Annual Percentage Rate (APR), the total finance charge, and what your monthly payment will be.

Now’s your chance to compare the offers and see which one fits your cash flow best. A good agent will walk you through the numbers, making sure you understand every detail before you move forward.

At this stage, transparency is everything. The goal is to find a financing solution that provides financial flexibility without introducing any surprises. You should have a clear understanding of the total cost of borrowing versus the immediate benefit of preserving your working capital.

After you’ve picked your financing option, the last step is making it official and getting your coverage turned on.

Step 3: Sign the Agreement and Activate Your Policy

With your chosen plan in hand, you'll sign the Premium Finance Agreement (PFA). This is the official contract that locks in the loan terms. Thanks to modern tech, this is usually just a quick e-signature process.

Once you sign, you'll make your initial down payment. As soon as the finance company gets the signed agreement and your payment, they pay your entire annual premium directly to the insurance carrier. Just like that, your Jewelers Block insurance is paid in full for the year, and your coverage is active.

This whole process is about protecting beautiful and unique assets—just take a look at our gallery of stunning antique jewelry to see what's at stake.

Essential Questions to Ask Your Agent and Lender

Before you sign on the dotted line, you need to be in the driver's seat. Asking the right questions now can prevent major headaches later.

Here’s a quick checklist to run through with your agent:

- Cancellation Policy: What happens if I need to cancel my policy mid-term? How is the refund calculated and applied to my loan?

- Grace Periods: Is there a grace period for late payments? How long is it, and what are the late fees?

- Early Payoffs: Can I pay off the loan early if I have a great sales month?

- Prepayment Penalties: Are there any fees for paying off the loan ahead of schedule?

Asking these questions ensures the financing plan you choose truly works for your insurance for a jewelry business, not against it.

Comparing Your Payment and Financing Options

While insurance premium financing offers serious flexibility, it’s just one tool in your financial toolkit. To really appreciate why it’s often the smartest move for managing the hefty cost of Jewelers Block insurance, you have to see what you're comparing it to.

The most common alternative is an installment plan offered directly by your insurance carrier. On the surface, it looks a lot like financing, but the devil is in the details.

Insurer-led installment plans often bake higher administrative fees into each payment. They're also usually rigid, demanding larger down payments or shorter repayment windows than a dedicated finance company would ever ask for.

Insurer Installments Versus Premium Financing

Think of a carrier's plan as the convenient, off-the-shelf option. Premium financing, on the other hand, is a more sophisticated financial strategy. A dedicated finance company is built from the ground up to create manageable payment structures—that focus almost always means better terms and more adaptable schedules for your insurance for a jewelry store.

Choosing between them is like deciding between a standard setting and a custom-designed piece. The standard option works, but the custom solution is crafted specifically to fit your unique needs—in this case, your business’s cash flow.

When you're ready to explore these custom solutions, the best place to start is to Get a Quote for Jewelers Block from a specialist. A First Class Insurance Jewelers Block Agency can lay out both carrier plans and financing options side-by-side, giving you a clear, apples-to-apples comparison of the costs and benefits.

Advanced and High-Risk Alternatives

For the massive, multi-store operations, other complex solutions exist, but they are rarely practical for the typical independent jeweler. One of these is a captive insurance program, where a huge company or a group of them creates its own insurance company to cover its risks. It's an incredibly complex and capital-heavy strategy reserved for major corporations.

Another option, at least in theory, is self-insurance. This means you just set aside a pile of cash to cover potential losses instead of buying a policy. For the kind of high-stakes risks covered by Jewelers Block insurance, this is an exceptionally dangerous and flat-out unworkable strategy. A single major theft could wipe out your cash reserves and bankrupt the business overnight.

Ultimately, you need a payment solution that protects your business without strangling its ability to grow. This is why specialized insurance premium financing so often comes out on top for a modern jewelry business—it’s the perfect balance of comprehensive protection and crucial financial agility.

Common Questions About Insurance Premium Financing

Even after seeing how premium financing can work, it's normal to have a few more questions pop up. We're talking about a major financial decision for your jewelry business, and you need to have total clarity before moving forward.

Let's walk through some of the most common things jewelers ask so you have all the information you need.

Will Using Insurance Premium Financing Ding My Business Credit Score?

This is easily one of the top concerns we hear, and the short answer is: probably not. Unlike a standard business loan you'd get from a bank, a premium finance agreement isn't typically reported to business credit bureaus.

Why? Because the loan isn't secured by your general business assets or creditworthiness. It's secured by something much more specific: the unearned portion of your insurance premium itself.

But there's a big "if" here. You absolutely must make your payments on time. If you default, the finance company can cancel your Jewelers Block insurance. That leaves you with a dangerous coverage gap and can make it much harder to get insurance or other financing down the road.

What Happens if I Cancel My Jewelers Block Policy Mid-Term?

Business plans change. Maybe you're selling the store or changing your business model, and you need to cancel your policy before the full term is up. When that happens, the process is pretty straightforward. Your insurance carrier will figure out the pro-rated, unused premium and issue a refund for that amount.

The key thing to remember is that the refund check goes directly to the premium finance company, not to you. They apply those funds to your outstanding loan. If there's money left over after your loan is paid off, they'll send the surplus to you. If the refund doesn't cover the full balance, you're still on the hook for the rest.

Can I Finance Other Business Insurance Policies, Too?

Yes, absolutely. This guide is zeroed in on insurance for a jewelry business because Jewelers Block policies carry such a hefty price tag, but premium financing is available for almost every kind of commercial insurance. In fact, many jewelers find it's much more efficient to bundle several policies into one financing agreement.

This lets you roll everything into a single payment plan, including coverage for:

- General Liability

- Commercial Property

- Workers' Compensation

- Commercial Auto

Bundling turns a tangled mess of different renewal dates and big, lumpy payments into one predictable monthly expense. It's a simple move that can dramatically simplify your budgeting and free up cash flow across your entire operation.

Figuring out the fine print of Jewelers Block insurance is no small task—it takes a specialist. The team at First Class Insurance brings over 30 years of experience to the table, building policies that protect your inventory, your reputation, and your peace of mind.

To get the right coverage with a payment plan that fits your business, connect with us today. Get a Quote for Jewelers Block and see how we protect your most valuable assets. Learn more at https://firstclassins.com.