For your clients—and your insurer—that little phrase "licensed and bonded" speaks volumes. It’s a shorthand for professionalism, a signal that you’re not just a business, but a business that operates with accountability.

A license gives you the legal green light to operate, while a bond is your financial promise to protect your customers from unethical conduct. In the high-stakes world of jewelry, this combination is the bedrock of trust, especially when securing comprehensive Jewelers Block insurance.

A Jeweler's Promise of Professionalism

Let's be honest: in the jewelry trade, trust is everything. When customers see you're licensed and bonded, it immediately tells them you've met official standards and are committed to doing things the right way. It's more than just industry jargon; it’s a public statement about your integrity.

Here’s a simple way to think about it:

- Your business license is like your driver's license. It’s the official permission slip from a government body—your city, county, or state—that says you’re legally allowed to operate your jewelry store. It proves you're a legitimate, recognized business.

- A surety bond, however, is like a financial backstop for your clients. It’s a three-way agreement between you (the jeweler), your customer, and a surety company. This bond guarantees that you'll live up to your professional promises.

Together, these two credentials create a powerful foundation for your business. They're the first step in showing everyone, from customers to your insurance underwriter, that you're a serious, responsible professional.

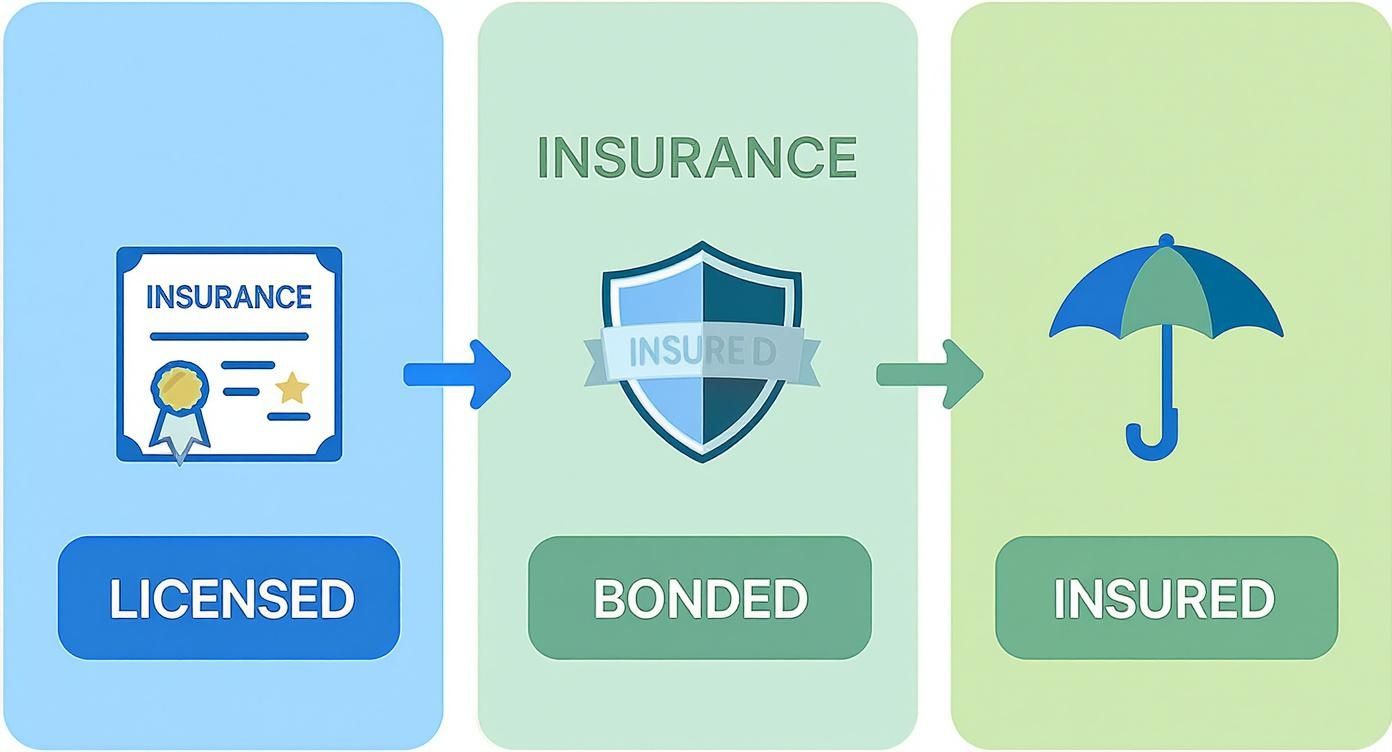

To make these concepts even clearer, let's break them down side-by-side with insurance. People often confuse these terms, but they each play a distinct role in protecting your business and your clients.

Licensed vs Bonded vs Insured At a Glance

| Credential | What It Is | Who It Protects | Primary Purpose |

|---|---|---|---|

| Licensed | Government-issued permission to legally operate your business. | The Public | Ensures compliance with local laws and regulations. |

| Bonded | A financial guarantee purchased from a surety company. | Your Clients | Protects customers from financial loss due to fraud or misconduct. |

| Insured | A policy purchased from an insurance company to cover specific risks. | Your Business | Protects the business itself from financial losses. |

As you can see, each credential serves a unique purpose. A license is about legal compliance, a bond is about client protection, and insurance for a jewelry store is about protecting your own assets.

Why This Status Matters to Insurers

When you apply for a specialized policy like Jewelers Block insurance, the underwriter's job is to size up your business's risk. Being licensed shows you're a known entity playing by the rules. Being bonded shows that you've already passed a financial background check with a surety company, which is essentially vouching for your stability.

A licensed and bonded status is a critical signal to insurers. It shows your jewelry business is professionally managed, legally compliant, and financially accountable. This dramatically lowers your perceived risk, which can pave the way for a much smoother underwriting process.

This dual credential demonstrates a proactive approach to managing risk. You've taken concrete steps to operate transparently and protect your customers. For an insurer, that’s a clear sign of a lower-risk partner, which can impact everything from your eligibility for a policy to your final premium. While different fields have different requirements, the core principle of building trust through official qualifications remains the same, a concept seen in everything from finance to fields requiring an immigration paralegal certification.

Ultimately, being licensed and bonded isn't just about checking a box. It’s a strategic move that bolsters your reputation, builds unshakable client trust, and makes your operation a far more attractive partner for essential allies—like the top-tier insurers who protect high-value assets like a stunning diamond ring on a display.

Securing Your Business License: A Mark of Legitimacy

Before you even start thinking about surety bonds or a comprehensive Jewelry store insurance policy, your first stop is always the same: getting licensed. This is a non-negotiable first step.

Think of your business license as the official stamp of approval from your city or state. It's the government's way of saying you have the legal right to open your doors and start trading. It’s more than just a piece of paper to hang on the wall—it’s a public declaration of your legitimacy.

For any jewelry business, a license is the absolute bedrock of trust. It tells your customers, your suppliers, and especially your future insurers that you're a serious professional who plays by the rules. Without one, you’re basically just a hobbyist in the eyes of the law.

The Different Licenses in a Jeweler's Toolkit

A lot of jewelers mistakenly assume that one single "business license" is all they need. The reality is, you'll likely need a small portfolio of permits, each one specific to what you actually do. The exact requirements can change dramatically from one city or state to another, so you’ll need to do your local homework.

Here are the most common licenses and permits a jeweler might need to get:

- General Business License: This is the big one. It's the basic permission slip you need to operate any commercial enterprise in your area.

- Secondhand Dealer License: If you plan on buying and selling estate jewelry, pre-owned watches, or any other secondhand precious goods, this license is almost always mandatory. It helps regulate the trade and prevent the sale of stolen property.

- Sales Tax Permit: You'll also see this called a seller's permit. This simply authorizes your business to collect sales tax from customers on behalf of the state.

- Precious Metal Dealer License: Some areas have very specific rules for businesses that deal in gold, silver, and platinum. This dedicated license ensures you're following fair trade practices.

Getting the right licenses isn't just about dodging fines. It's about showing you're committed to doing things the right way. While it's from a different industry, the principle behind adhering to industry-specific compliance standards like HIPAA is the same—demonstrating you meet legal standards is a powerful way to build trust.

Why Your License Matters to Insurers

When you approach an agency like First Class Insurance Jewelers Block Agency to get a quote for Jewelers Block, one of the first things underwriters look at is your license. Are you a legally recognized business? A valid license confirms that you are.

To an insurer, that simple check says a lot. It shows you're transparent. It proves you've met the minimum legal standards to operate. And it means you're far less likely to be shut down by regulators, which is a huge risk. An unlicensed business is an immediate red flag.

This single mark of legitimacy can directly impact whether you can even get insurance for a jewelry store, let alone get a good rate. Insurers want to partner with businesses built on a solid, lawful foundation. Being properly licensed is the first and most critical step in proving you're that kind of partner.

This isn't just about regulations; it's about commercial value. The global brand licensing industry hit $369.6 billion in retail sales, showing just how much consumers value official, licensed businesses. It’s clear proof that being officially licensed resonates with customers and adds tangible credibility.

Understanding Surety Bonds: The Jeweler's Public Promise

While your business license is your permission slip to operate, a surety bond is your public promise of integrity. When you tell a client you’re “bonded,” you’re making a powerful statement. You’re saying you have a financial guarantee in place—not for you, but for them.

Think of it as a three-way handshake between you (the Principal), your client (the Obligee), and a surety company (the Surety). Before they issue a bond, that surety company vets your business, digging into your financial stability and character. By issuing the bond, they’re essentially co-signing your promise to act ethically and fulfill your contracts.

So, if you fail to hold up your end of the deal—maybe by misrepresenting a diamond's quality or losing a consigned piece—your client can file a claim against the bond. The surety company then steps in to compensate the client for their financial loss, right up to the bond's full amount. This gives your customers a clear path to get their money back and makes your application for insurance for jewelry business look a whole lot better to underwriters.

How a Surety Bond Works in Practice

Let’s get real. Imagine a customer brings you a priceless family heirloom for a complex repair. If, through some mistake or misconduct, that piece is damaged or lost beyond what your regular insurance covers, the client could face a devastating financial and emotional blow.

A surety bond is the safety net here. It guarantees that if you drop the ball, there are funds ready to make your client whole again. That’s a level of assurance that goes far beyond a simple handshake agreement.

A surety bond is not business insurance. Insurance protects your business from losses. A bond protects your customers from you. This is a crucial distinction and the very reason being bonded is such a powerful symbol of consumer trust.

This commitment to protecting your clients is exactly why insurers love to see bonded jewelers. It tells them that a third-party financial institution has already kicked the tires on your business and deemed you a reliable risk. For them, that means fewer claims stemming from professional mistakes or bad faith.

Key Bond Types for a Jewelry Business

Not all bonds are the same. For jewelers, a few specific types are essential for building trust and keeping your operation secure. The right bond addresses the unique risks of our trade, from handling consigned goods to managing employees.

Here are the critical bond types that should be part of your jewelry store insurance portfolio:

- Consignment Bonds: Absolutely essential if you showcase pieces from other designers. This bond guarantees you'll either pay the artist for sold items or return the unsold inventory safely. It protects their valuable work while it’s in your hands.

- Fidelity Bonds: This is your defense against internal threats. A fidelity bond protects your business from losses caused by employee dishonesty, like theft of cash or inventory. While your Jewelers Block insurance covers outside criminals, this bond addresses the risk from within, showing insurers you've locked down your operation from all angles.

- Sales Tax Bonds: Some states require this, plain and simple. It's a guarantee that you will send all the sales tax you collect to the government, ensuring you meet your financial obligations to the state.

The surety market is a massive part of our financial infrastructure. Valued at $19.62 billion in North America, it grew by 6.8% last year alone, showing just how vital these guarantees are across all industries. You can learn more about the growth and leadership in the surety bonding industry to see its broader impact.

At the end of the day, being bonded is more than just a legal box to check—it’s a marketing tool. It tells the world you're a trustworthy partner, making it easier to attract discerning clients and secure the best possible insurance for a jewelry store.

Why Insurers Prioritize Licensed and Bonded Jewelers

When you sit down to apply for specialized insurance for a jewelry store, it’s more than just paperwork. You’re essentially making a case for your business to an underwriter, a professional whose entire job revolves around evaluating risk. In that high-stakes evaluation, being licensed and bonded is your ace in the hole. It instantly sets your application apart from the crowd.

Think of it from the underwriter's perspective. They're like a detective, piecing together a profile of your business's stability and professionalism. A valid license is the first clue—it proves you’re a legitimate operator recognized by the government. A surety bond is the second, more powerful piece of evidence. It shows that a financial institution has already kicked the tires on your business and is willing to put its own money behind your promises.

Together, these credentials don't just check a box; they tell a story. They say you’re a serious, compliant, and financially responsible jeweler who takes risk management seriously. That's a story every insurer wants to hear.

The Underwriter's Perspective on Risk

At its core, insurance is a game of managing risk. An underwriter’s main job is to figure out how likely you are to file a claim. Every detail you provide helps them build a risk profile for your jewelry business, and being licensed and bonded dramatically lowers that profile right from the start.

An underwriter sees a licensed and bonded jeweler not just as another policyholder, but as a partner in risk prevention. It proves you're committed to best practices that go far beyond just locking the doors at night. It shows your business is built on a foundation of integrity and accountability.

This perception isn't just a feel-good bonus; it translates directly to your bottom line. A lower-risk profile means real, tangible benefits.

- Better Premium Rates: This is the most immediate perk. Insurers save their best pricing for businesses they see as the safest bets. Being licensed and bonded puts you squarely in that preferred category.

- Wider Coverage Options: Low-risk jewelers often get access to better coverage terms and higher limits. When an insurer is confident in how you run your business, they're more willing to offer you their best protection.

- A Faster Underwriting Process: When an underwriter sees you’ve already been vetted by a state licensing board and a surety company, a big chunk of their homework is already done. This can seriously speed up the approval process, helping you get a quote for Jewelers Block and lock in your coverage faster.

Demonstrating Professionalism and Financial Stability

Let's be clear: getting licensed and bonded is a vetting process in itself. A surety company isn’t just going to hand you a bond. They dig into your business's financial health and even your personal credit history. They are putting their own capital on the line to guarantee your professional conduct, so they don’t take it lightly.

When you show that bond to an insurer, you’re not just asking for their trust—you’re handing them a third-party endorsement of your financial stability. You’re providing proof that another respected financial institution already backs you.

That’s a massive advantage. It tells an insurer that you have the discipline and integrity to meet your obligations, which is a huge green flag for anyone providing high-value Jewelry store insurance. It suggests you’re not the type to cut corners on security or engage in risky behavior that leads to claims. An insurer can see that you're already working with established partners, just as First Class Insurance Jewelers Block Agency works with trusted underwriters from the historic Lloyd's of London marketplace.

A Smoother Claims Experience

Hopefully, you’ll never have to file a major claim. But if you do, being licensed and bonded can make a world of difference. Your established record of compliance and good standing builds goodwill with your insurer from day one. It shows you operate in good faith, which often leads to a more collaborative and less adversarial claims process.

Insurers know that properly licensed and bonded businesses tend to keep better records and follow established procedures. This kind of documentation is gold during a claims investigation, helping to quickly verify your losses and get your payment processed. In the end, these credentials aren't just about meeting requirements. They’re about building a rock-solid reputation that pays off in every part of your business—especially when it comes to securing the absolute best protection.

Your Path to Getting Licensed and Bonded

Taking the steps to become a licensed and bonded jeweler does more than just check off a few legal boxes—it transforms your business from a simple operation into a trusted institution. This isn't about getting lost in a maze of red tape. Think of it as a clear roadmap to building a much stronger, more secure business.

Let's break down exactly what you need to do to earn both statuses.

This visual guide shows you how each step builds on the last, moving you from licensed and bonded to fully insured. That's the ultimate goal for total business protection.

As you can see, these aren't just separate hoops to jump through. They are layers of legitimacy and security, and both your clients and your future insurers will be looking for them.

The Action Plan for Securing Your License

Getting your business license is square one. It’s your official permission slip to operate, and it’s the very first thing any insurer, major partner, or savvy client will look for. The specifics will vary depending on where you are, but the process generally follows the same path.

- Identify the Right Agencies: Your journey starts at the local level. Head to the websites for your city hall, county clerk, and your state's Secretary of State or Department of Revenue. These are the gatekeepers for the licenses you’ll need.

- Determine Your Specific Permits: A general business license is a must, but don't stop there. Do you buy and sell estate pieces? You'll probably need a secondhand dealer license. Offer repair services? That might require a specific repair permit. Make a list of every single service you provide and hunt down the corresponding license for each.

- Gather Your Documentation: Get your paperwork in order before you start filling out forms. Have your business's legal name, federal tax ID number (EIN), business address, and a clear description of your operations ready to go. This simple prep work makes the application process a whole lot smoother.

And a license does more than just keep you compliant. As you can learn from the latest whitepaper on global licensors on Licensing International's website, official recognition is what builds lasting trust and turns a brand into a household name.

Navigating the Surety Bond Process

Once you're licensed, getting bonded is the next logical step. This is where you partner with a surety company that will financially back your professional conduct and guarantee you’ll do right by your clients.

The process is pretty straightforward and really just boils down to verifying your reliability. Just like with licensing, a little preparation goes a long way.

A surety bond application is basically a financial health check-up. The surety company needs to feel confident that you’re a responsible business owner who honors their commitments. When they see that, they view the bond as a low-risk guarantee for them to provide.

Ready to get started? Here’s how to find and secure the right bond for your jewelry business.

- Find a Reputable Surety Agency: Look for agencies that specialize in commercial bonds. Your insurance agent can often point you in the right direction, or you can find great recommendations through industry associations.

- Prepare for the Application: The surety underwriter is going to take a close look at your business and personal finances. Be prepared to provide financial statements, your business history, and your credit report. A solid financial track record and good credit are your best friends here—they're key to getting approved at a good rate.

- Select the Correct Bond Type and Amount: Work with the agency to pinpoint the right bonds for your specific operations, like a consignment bond or a sales tax bond. The required coverage amount is usually set by the state or tied to your sales volume.

Completing these steps isn't just about meeting legal requirements. It sends a powerful signal to everyone—from clients to the underwriters at First Class Insurance Jewelers Block Agency—that you are a professional of the highest caliber. It’s a proactive move that strengthens your business from the inside out.

And if you're looking to connect with a community of other trusted professionals, consider joining an organization like the Southern Jewelry Travelers Association.

Common Mistakes to Avoid on Your Journey

Getting licensed and bonded is a huge milestone for any jewelry business. It proves you're serious and trustworthy. But the road to getting there—and staying there—is filled with little traps that can trip up even seasoned professionals.

A simple oversight with your paperwork can lead to fines, a damaged reputation, and make it a whole lot harder to get that crucial Jewelers Block insurance policy. Knowing what these common pitfalls are ahead of time is the best defense. Let's walk through the mistakes others have made so you don't have to.

Letting Your Credentials Go Stale

This is, without a doubt, the most common and easily avoidable mistake: simply forgetting to renew a license or bond. Government agencies and surety companies don't mess around with deadlines. If your business license expires, you could be looking at steep fines, late fees, or even a temporary shutdown order until you’re back in good standing.

It's the same with your bond. A lapsed surety bond instantly voids your "bonded" status and leaves your clients completely exposed. This isn't just a paperwork problem; it's a breach of trust that can seriously harm the reputation you've worked so hard to build.

Here's the most critical thing to understand about surety bonds: They are not for you. A surety bond is a financial promise to your client. It is not a substitute for liability coverage or a Jewelers Block policy, which are designed to protect your business assets.

Confusing these two is a rookie error with major consequences. If a claim is made against your bond, the surety company pays your client, and then you have to pay the surety company back. Relying on it for your own protection leaves your inventory, tools, and finances wide open to risk.

Picking a Bond Amount That's Too Small

Another frequent misstep is trying to save a few bucks by choosing a bond with a low coverage amount. It might seem like a smart way to cut costs, but it’s a gamble that can backfire badly.

If a client has a legitimate claim that’s higher than your bond limit, they'll only get a partial payout. Not only does this create a very unhappy customer who might sue you for the rest, but it sends a red flag to everyone you work with. It suggests you're cutting corners on consumer protection. Always choose a bond amount that realistically covers the value of the customer property you handle. When an agency like First Class Insurance Jewelers Block Agency sees you have a properly valued bond, it shows them you're managing your risk the right way.

Got Questions? We’ve Got Answers.

Sorting through the requirements for licensing, bonding, and insurance can feel like a maze. Let’s clear up some of the most common questions jewelers ask, so you can focus on protecting your business and winning over customers.

Can I Get Jewelers Block Insurance Without a License or a Bond?

Technically, you might be able to, but it's not a great idea. Think of being licensed and bonded as showing up to a job interview in a suit. It tells the insurance underwriter that you’re a serious professional who plays by the rules.

Insurers see these credentials as proof that you're less of a risk. That commitment often translates into better eligibility for a solid jewelry store insurance policy, more attractive rates, and a much smoother application process.

How Much Is a Jeweler's Surety Bond Going to Cost Me?

The good news is you don't pay the full bond amount. The cost, which is called the premium, is just a small slice of the total coverage—usually somewhere between 1% and 5%.

The final price tag is set by the surety company after they take a look at your business's financial stability and your personal credit history. The stronger your financials and credit, the lower your premium will be.

It's crucial to remember: a surety bond is not insurance for you. It’s a safety net for your clients in case something goes wrong on your end. Your Jewelers Block insurance, on the other hand, is what protects your business from things like theft or damage.

If My Inventory Gets Stolen, Does My Bond Cover It?

No, a standard surety bond won't cover stolen inventory. That's exactly what a comprehensive insurance for jewelry business policy is built for.

There's a specific type of bond called a fidelity bond that might cover you if an employee steals from you, but it won’t help with outside jobs like a burglary or robbery. Your inventory is your biggest asset, and it’s your insurance—not your bond—that has its back.

A license and a bond are your foundation, but true protection comes from insurance that’s actually built for the jewelry world. First Class Insurance provides specialized Jewelers Block policies that safeguard everything from your inventory and tools to your hard-earned reputation. Get a Quote for Jewelers Block and get the peace of mind you and your clients deserve.