If you're shipping high-value jewelry overseas, it's easy to assume your standard business policy—or even your Jewelers Block policy—has you fully covered. But that's a dangerous assumption.

Think of ocean marine insurance coverage as a specialized shield built for the unique chaos of sea transit. We're talking about risks like piracy, violent weather, and mishandled containers—perils most general policies were never designed to handle. This coverage is absolutely essential for protecting your assets once they leave solid ground.

Why Your Jewelry Needs Specialized Marine Coverage

Moving high-value jewelry across the ocean isn't like shipping t-shirts. A single container can be packed with millions of dollars in inventory, turning every leg of the journey into a high-stakes operation. Your standard insurance for a jewelry store simply can't keep up; it's riddled with gaps when it comes to international voyages.

Here's a better way to look at it: your Jewelers Block insurance is an expert at protecting your assets on land. It guards your store, your safe, and your domestic shipments. But the open ocean is a different world, governed by maritime law and exposed to a completely different set of dangers. A dedicated ocean marine policy acts as a vital extension, closing the critical vulnerabilities that could otherwise lead to a catastrophic financial hit.

Bridging Critical Coverage Gaps

Many jewelers are shocked to learn just how limited their primary insurance for jewelry business becomes once their cargo is loaded onto a ship. This is precisely why a dedicated marine policy isn't just a nice-to-have; it's non-negotiable for any jewelry business in the global trade.

Here are the key reasons this specialized coverage is so vital:

- Protection Against Sea Perils: It specifically covers losses from events like a ship sinking, running aground, getting battered by heavy weather, or being targeted by pirates—all of which are typically excluded from standard property policies.

- General Average Coverage: This is a big one. If cargo has to be jettisoned to save the ship, maritime law requires all cargo owners to share the financial loss. Your marine policy covers this mandatory contribution, preventing your assets from being held hostage until you pay up.

- Warehouse-to-Warehouse Protection: The best policies protect your jewelry from the moment it leaves your supplier's facility until it arrives safely at its final destination, not just for the time it's on the water.

The reality is that the high seas present a unique set of risks that most standard insurance simply wasn't designed for. Ocean marine coverage is less of an add-on and more of a specialized shield for your assets.

Once you understand the specific risks, the value of this coverage becomes crystal clear. Think about the complex journey of a single diamond ring—it passes through multiple hands and environments, each with its own potential for loss.

As a leading First Class Insurance Jewelers Block Agency, we always stress that the right ocean marine policy is a cornerstone of a sound risk management strategy. To get a better sense of what's at stake, check out our visual guide on high-value diamond ring security. It really highlights why this type of jewelry store insurance is so critical.

Decoding Ocean Marine Insurance for Jewelers

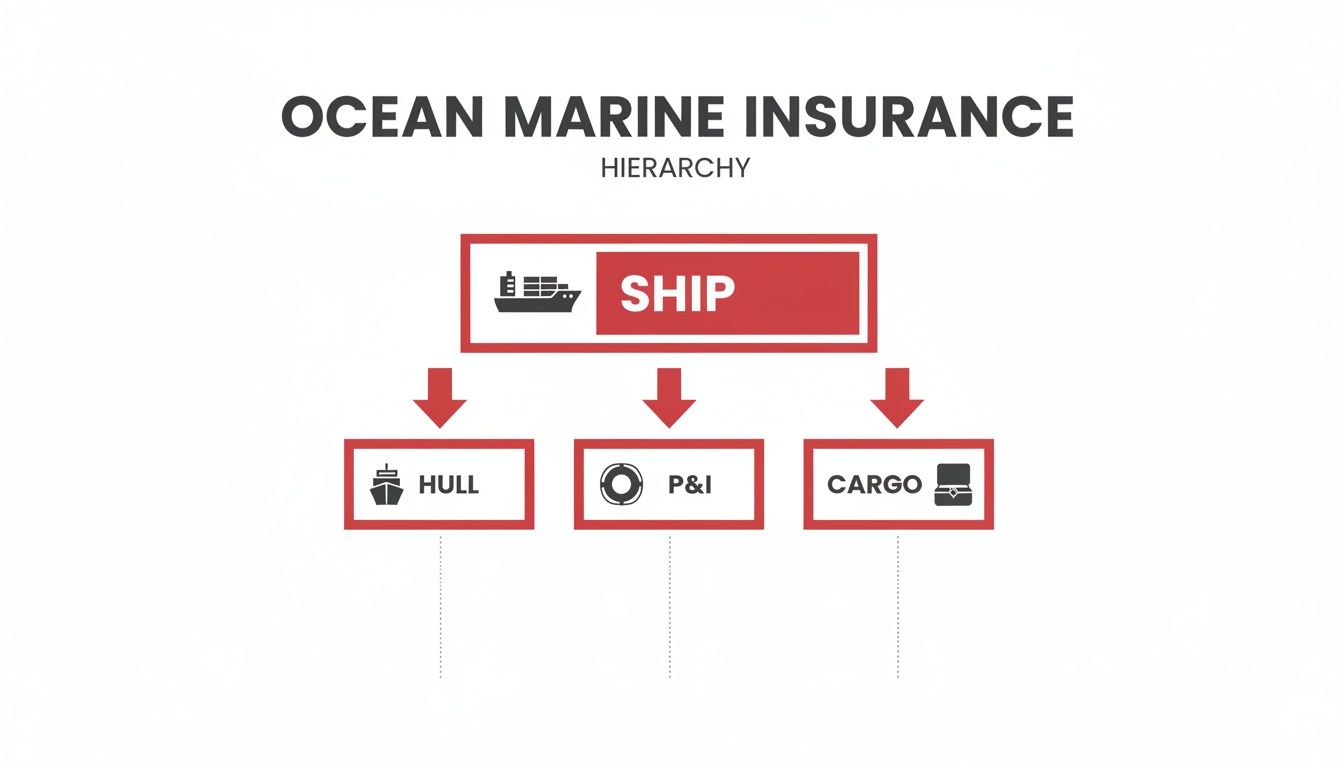

When you hear "ocean marine insurance," you might picture the colossal container ships themselves. But for your insurance for jewelry business, you can set all that aside. A comprehensive policy for a vessel covers the ship itself (Hull Insurance) and its legal liabilities (Protection & Indemnity), but your focus is much narrower and far more critical: Cargo Insurance.

Think of it this way: a cargo ship is like a massive, floating armored truck on a long-haul journey. The insurance on the truck's engine, frame, and tires is the "Hull" part. The policy covering accidents the truck might cause is "P&I." But Cargo Insurance is the specialized, high-security policy that protects only the precious contents inside your specific package. This is the piece of the puzzle that shields your inventory from disaster.

The Foundation of Your Coverage

Your deep dive into cargo insurance starts with two core concepts that draw the line between what’s covered and what isn’t. At the heart of it all are the "perils of the sea"—those unexpected, often violent events unique to a sea voyage, like a rogue wave, a sudden storm, or a collision. How well you’re protected from these perils depends entirely on the type of policy you choose.

There are two main flavors here:

- All-Risk Policies: This is the gold standard and, frankly, the only real option for high-value goods like jewelry. It covers any and all losses or damages from any external cause, unless a peril is specifically excluded in the policy’s fine print. The ball is in the insurer’s court to prove a listed exclusion applies.

- Named Perils Policies: This is a much tighter, more restrictive policy. It only covers losses from perils that are specifically listed—things like fire, sinking, or collision. If your cargo gets damaged by something that isn't on that list, you're out of luck. The burden of proof is on you to show a listed peril caused the loss.

For any jeweler, an all-risk policy isn't a luxury; it's a non-negotiable part of doing business. The financial stakes are simply too high to gamble on an unlisted event wrecking your shipment.

Distinguishing Between Policy Types

Let's make this real. Imagine you're shipping a case of diamond engagement rings. Under an "all-risk" policy, if that container shows up with water damage because of a leaky roof—and "leaky container roof" wasn't on the small list of exclusions—you’re covered. Simple as that.

Now, picture the same scenario with a "named perils" policy. If "leaky container roof" wasn't explicitly listed as a covered event, you’d be absorbing that entire financial loss yourself. It’s a subtle distinction on paper but a massive one in practice, and it’s why combing through policy details is so crucial.

While marine coverage has its own unique quirks, the core principles of protecting assets in transit are universal. Brushing up on essential insurance tips for a stress-free move can offer broader insights that reinforce the need for comprehensive protection.

This kind of specialized insurance is a historic marketplace, with giants like

setting the standards for centuries. Understanding these foundational concepts is the first, most important step toward giving your international shipments the bulletproof protection they demand.

Essential Clauses in Your Marine Insurance Policy

The fine print in an ocean marine policy can feel like a maze of legalese. But for a jeweler, a handful of key clauses aren't just details—they're the very foundation of your protection. Getting these right is the difference between a minor hiccup and a business-ending financial loss.

Let's be clear: not all policies are built the same. The specific clauses included are what give your ocean marine insurance coverage its real strength.

This diagram breaks down the main moving parts of ocean marine insurance. As you can see, while other parts protect the vessel itself, your entire focus is on that last piece: Cargo.

While Hull and P&I insurance take care of the ship and its liabilities, the safety of your inventory rests entirely on a solid Cargo policy.

Understanding the Institute Cargo Clauses

At the core of almost every cargo policy are the Institute Cargo Clauses (ICC). Think of them as pre-set packages of coverage—A, B, and C—each offering a different level of protection. For a jewelry business, the choice is glaringly simple.

-

ICC (A): This is the gold standard. It’s "all-risk" coverage, which means it protects your goods against all risks of loss or damage, except for a short list of specific exclusions. It’s the only realistic option for high-value items like diamonds, gems, and finished jewelry.

-

ICC (B): This is a massive step down. It’s a "named perils" policy, meaning it only covers losses from a specific list of events like fire, sinking, or collision. Crucially, it leaves you wide open to common risks like theft or damage from rough handling.

-

ICC (C): This is the bare minimum, covering only a handful of catastrophic events. It’s completely unsuitable for protecting high-value assets and should never be considered for a jewelry business.

The takeaway here is non-negotiable: for any jeweler, ICC (A) is the only option. The financial stakes of shipping your inventory are far too high to gamble on a limited policy that will almost certainly fail you when you need it most.

To make this clearer, here’s a quick breakdown of how these clauses stack up.

Institute Cargo Clauses (ICC) A, B, and C at a Glance

| Coverage Level | Type of Coverage | Key Perils Covered | Typical Exclusions | Recommended For |

|---|---|---|---|---|

| ICC (A) | All-Risk | All risks of physical loss or damage, unless specifically excluded. Includes theft, damage from handling, water damage, etc. | Willful misconduct of the insured, ordinary leakage/wear and tear, inherent vice, war, strikes (unless added). | High-value goods like jewelry, electronics, and pharmaceuticals. This is the standard for jewelers. |

| ICC (B) | Named Perils (Limited) | Major events: Fire, explosion, vessel sinking/stranding, collision, earthquake, lightning, general average sacrifice. | Theft, damage from rough seas/handling, water damage from rain, and all exclusions from Clause A. | Bulk goods and commodities where the primary risk is total loss of the vessel (e.g., coal, grain). |

| ICC (C) | Named Perils (Most Limited) | Only the most catastrophic events: Fire, explosion, vessel sinking/stranding, collision, general average sacrifice. | Everything excluded in Clause B, plus events like earthquake, volcanic eruption, or washing overboard. | Low-value bulk goods where only a major catastrophe is a concern. Completely unsuitable for jewelers. |

As you can see, the difference in protection is dramatic. Opting for anything less than Clause (A) exposes your business to an unacceptable level of risk.

Extending Protection Beyond the Port

One of the most dangerous mistakes a shipper can make is assuming their insurance only kicks in at the port. What happens if your package is stolen from a warehouse before it's even loaded? Or from the back of a delivery truck after it arrives? This is exactly where the Warehouse to Warehouse Clause becomes critical.

This clause extends your ocean marine insurance coverage so it protects your goods from the moment they leave your supplier’s door until they safely arrive at yours. It closes the dangerous gaps in coverage that exist on land—before and after the ocean voyage.

Without the Warehouse to Warehouse clause, your policy is incomplete. It essentially leaves your high-value assets uninsured during some of the most vulnerable parts of their journey.

Adding Layers for Modern Risks

Global supply chains are fragile. They’re vulnerable to all sorts of human-made disruptions that a standard policy might not cover. That’s why you need endorsements to protect against today’s unpredictable world.

A crucial add-on is the Strikes, Riots, and Civil Commotions (SR&CC) Clause. This endorsement specifically covers loss or damage caused by:

- Strikes and labor disputes

- Riots or civil unrest

- Terrorist acts or politically motivated violence

Imagine your shipment is sitting at a port when a labor strike shuts everything down. If your goods are damaged or looted in the ensuing chaos, a standard policy without this clause would likely leave you with nothing. This is a small price to pay for real-world peace of mind.

As a leading First Class Insurance Jewelers Block Agency, we build these vital clauses into policies from the ground up. A strong Jewelers Block insurance program has to integrate this level of detailed marine protection. When you Get a Quote for Jewelers Block, make sure these specific marine clauses are part of the conversation—your business depends on it.

How to Properly Value Your Jewelry Shipments

Getting the valuation wrong on an international shipment is one of the easiest—and most painful—mistakes a jeweler can make. Underinsuring your cargo is a massive financial gamble. If something goes wrong, you're left with a gap that could have easily been closed, turning a simple claim into a business-threatening loss.

Proper valuation isn’t just about the price on the invoice. It's about making your business whole again after a disaster. That means covering the cost of the goods, all the money you spent getting them from point A to point B, and even the profit you were counting on. A solid ocean marine insurance policy is built on this number.

Agreed Value vs. Actual Cash Value

When you're dealing with something as unique as jewelry, the fine print on valuation methods is everything. Most standard insurance policies operate on Actual Cash Value (ACV), which is a fancy way of saying "replacement cost minus depreciation." For a jeweler, that's a non-starter. ACV completely ignores the timeless value of precious metals, the increasing worth of rare gemstones, and the artistry of the piece itself.

For anyone in the jewelry trade, the only way to go is Agreed Value. This is simple: you and the insurance company agree on what your items are worth before the policy is even issued. If a total loss occurs, that's the amount you get paid. No arguments, no deductions for depreciation. This is absolutely critical for one-of-a-kind pieces, custom work, and antique jewelry where "replacement cost" is a meaningless concept.

With Agreed Value, you lock in the worth of your assets from day one. There's no guesswork or debate when a claim happens, ensuring your policy responds exactly as you expect it to.

This approach respects the true nature of your inventory. Protecting unique pieces requires this level of detail, which you can see in how we approach safeguarding antique jewelry collections.

The Standard Formula for Insured Value

So, how do you get to the right number? Thankfully, there's a simple, industry-standard formula that ensures you’re covering your entire financial exposure, not just the wholesale cost.

Here's the calculation:

Invoice Cost + Freight Charges + 10% (or more) = Total Insured Value

Let's quickly break that down:

- Invoice Cost: This is your starting point—the price you paid the supplier.

- Freight Charges: This covers all the costs to move the goods, from shipping fees to handling charges. If the shipment disappears, that money is gone, too.

- The "Uplift" (Plus 10%): This extra buffer, often called the "Plus 10," is crucial. It's there to cover all the other expenses you'd face to replace the order—things like currency exchange fees, your team's administrative time, and the profit you just lost. For particularly rare or high-value items, you can often negotiate this uplift higher, sometimes to 20%.

Putting It All Together: A Practical Example

Let's say you're importing a collection of diamond necklaces. The invoice from your supplier is for $100,000. The total cost for shipping and handling comes to $2,500.

Here’s how you’d use the formula to find your total insured value:

- Invoice Cost: $100,000

- Freight: $2,500

- Subtotal: $102,500

- Plus 10% Uplift: $10,250 ($102,500 x 0.10)

- Total Insured Value: $112,750

By insuring the shipment for $112,750, you've protected yourself completely. If the worst happens, you’ll get back your initial investment, the shipping costs, and a cushion to cover your lost profit and extra expenses. To really nail down your numbers, it's smart to consult an expert guide to accurately calculate gold value to ensure every component of your inventory is priced correctly. Getting this right is the foundation of a policy that truly works for you.

Best Practices for Shipping and Documentation

While your ocean marine insurance coverage acts as a crucial financial safety net, the best claim is always the one you never have to file. Proactive risk management isn't just about checking boxes; it's about building a tough, resilient supply chain that protects your assets from door to door. Honestly, what you do before a shipment even leaves your hands can make all the difference if something goes wrong.

Following these practices shows your insurer you're serious about due diligence, which strengthens your position and makes you a much better risk. Think of it as building your case before there’s even a problem to solve.

Securing Your Shipment Before It Moves

The way you physically prepare your cargo is your first and most important line of defense. Good packaging does more than just stop things from breaking—it actively deters theft. For high-value jewelry, using generic, unbranded outer boxes isn't just a suggestion; it's non-negotiable. You don’t want to advertise what’s inside.

But it’s about more than just the box. You need to consider these steps:

- Tamper-Evident Measures: Use uniquely numbered security seals or special tamper-evident tape. Snap a quick photo of the sealed package before it’s handed off. This gives you a clear timestamped record of its condition when it left your control.

- Neutral Packaging: The outer container should give zero clues about its valuable contents. No logos, no text—nothing that screams "jewelry" or "luxury goods."

- Internal Protection: Inside, make sure you use secure, form-fitting padding to stop items from rattling around. Any movement can cause scratches or damage, especially during a rough journey.

Meticulous preparation isn't just good practice; it's a clear signal to your insurance carrier that you are a responsible partner in managing risk. Every step you take to secure your cargo reinforces the strength of your coverage.

Documentation: The Bedrock of a Successful Claim

When it comes to insurance, the old saying is true: if you didn’t document it, it didn’t happen. Your paperwork is the most powerful tool you have. Inaccurate or incomplete documents are one of the fastest ways to get a claim complicated, delayed, or even denied.

Your mission is to create an airtight paper trail that tells the full story of your shipment, from your shop to its final destination. This leaves no room for doubt and gives your insurer the proof they need to get your claim processed without a fuss.

Your Essential Documentation Checklist

Treat this checklist as mandatory for every single international shipment. Having these documents organized and ready to go will be a lifesaver if you ever need to file a claim.

- Detailed Packing List: This needs to itemize every single piece in the shipment. Include detailed descriptions, weights, metal types, stone details, and the value of each item. A photo of the contents laid out before you seal the box is powerful visual proof.

- Commercial Invoice: The invoice has to be perfectly accurate and match the packing list and the insured value to the penny. Any discrepancy, no matter how small, will raise red flags and cause major delays.

- Clean Bill of Lading (B/L): This is your official receipt from the carrier. You need to make sure it's a "clean" bill, which means the carrier agrees they received the goods in good condition. If it’s marked as "claused" or "dirty," that means there was pre-existing damage, and that will torpedo your claim.

By adopting these shipping and documentation habits, you shift from simply having insurance for a jewelry store to actively managing your own risk. For jewelers looking to weave these strategies into a solid Jewelers Block insurance policy, it pays to talk to an expert. As a leading First Class Insurance Jewelers Block Agency, we can help you build a program that actually rewards you for this level of diligence.

Navigating the Claims Process After a Loss

That sinking feeling when you realize a high-value shipment is lost or damaged is one every jeweler dreads. But this isn't the time for panic. It's the time for a calm, methodical response, built on the back of the careful documentation you've already prepared. Knowing exactly what to do in those first few moments can make or break your claim.

As soon as you even suspect a loss, the clock is running. You need to make two calls, and they need to happen almost at the same time.

First, immediately notify your insurance broker at First Class Insurance. They are your advocate, your guide, and the one who will get the formal claims process rolling with the underwriters. Second, you must put the shipping carrier or any other responsible party on written notice, officially holding them liable. If you drag your feet on either of these, you could put your entire claim in jeopardy.

Key Players and Critical First Steps

Once the alarm is raised, a few key people will step in to figure out what happened. The most important is the surveyor, an independent expert hired by the insurance company to investigate the cause and extent of the loss. Their job is to be impartial, and their findings become a formal surveyor's report—a document that will become the cornerstone of your claim.

To keep things moving in the right direction, here’s what you need to do right away:

- Preserve the Evidence: Don't throw anything away. Damaged goods, torn packaging, broken seals—the surveyor needs to see it all, exactly as you found it.

- Mitigate Further Loss: Take reasonable steps to keep a bad situation from getting worse. If a crate is sitting in a puddle, get it somewhere dry and secure.

- Document Everything: Pull out your phone and start taking photos and videos. Get shots of the damaged cargo, the shipping container, and any signs of tampering. Visual evidence is incredibly hard to dispute.

Think of the claims process as building a case. The more organized, timely, and thorough your initial response is, the stronger your position will be, leaving no room for disputes or delays.

Assembling Your Claims Documentation

While the surveyor is doing their work, your job is to pull together the paperwork that proves your loss. Your broker will give you a specific list, but it will almost certainly be the core documents you prepared before the shipment ever went out. This is where all that diligent record-keeping pays off.

Here is the essential documentation you’ll need to have ready:

- The Original Insurance Certificate: This is the primary proof of your ocean marine insurance coverage.

- The Commercial Invoice: This proves the value of the goods that were lost.

- The Bill of Lading: This is your contract with the carrier and shows they took possession of your shipment.

- A Detailed Packing List: This itemizes every single piece, confirming what was inside.

- Your Written Claim Against the Carrier: This is a copy of that formal notice you sent holding them responsible.

- The Surveyor’s Report: The final report from the expert detailing the findings of their investigation.

Staying organized and being responsive is everything. When you promptly give your broker at First Class Insurance Jewelers Block Agency all the information they ask for, you give them the power to fight for you effectively. It turns a chaotic situation into a clear path toward getting you paid.

Frequently Asked Questions About Marine Insurance

When you're dealing with high-value assets crossing oceans, a lot of questions come up. Let's tackle some of the most common ones we hear from jewelers trying to get their ocean marine insurance coverage right.

Is Ocean Marine Coverage Part of My Jewelers Block Policy?

Sometimes, but you can't assume it is. A solid Jewelers Block insurance policy might have some transit coverage built in, but you have to dig into the details. Many standard policies have shockingly low sub-limits for goods in transit or exclude international ocean voyages entirely.

That's where Ocean Marine Cargo insurance comes in. It's a distinct, highly specialized policy built specifically for the chaos of sea transport. The only way to be sure is to review your policy line-by-line with your broker to confirm your shipments are protected from the moment they leave one warehouse until they arrive at the next.

What Is General Average and How Does It Affect Me?

General Average is one of those ancient maritime laws that can come as a nasty surprise. In simple terms, it means that if a voluntary sacrifice is made to save a ship—like throwing cargo overboard to prevent it from sinking in a storm—everyone with a stake in that voyage shares the loss proportionally.

Here's the critical part: if another company's cargo gets tossed to save the ship, you are legally on the hook for your share of that loss. Your own jewelry won't be released from the port until you pay up. A proper insurance for a jewelry business that includes a marine cargo policy will cover this contribution, preventing your shipment from being held hostage by someone else's misfortune.

How Is the Cost of Marine Insurance Calculated?

There's no flat rate here; the premium for ocean marine insurance coverage is a direct reflection of risk. Insurers are going to look at the total value of your jewelry, the specific route it's taking, the age and condition of the vessel, and what level of coverage you've chosen. A comprehensive "all-risk" policy like ICC 'A' will naturally cost more than a bare-bones one.

Premiums are typically calculated as a percentage of the total insured value. For example, a rate of $0.50 per $100 of value on a $200,000 shipment would mean a $1,000 premium.

This is where working with an experienced broker makes a huge difference. A specialist who knows the jewelry trade can find insurers who are comfortable with high-value goods and can negotiate much better terms on your behalf.

Protecting your inventory as it crosses the globe requires more than just a standard policy—it demands real expertise. As a leading First Class Insurance Jewelers Block Agency, we build coverage that closes the dangerous gaps that other policies leave wide open. We make sure your jewelry store insurance is airtight, from your showroom floor to any destination worldwide. Ready for a policy that truly understands your risks? Get a Quote for Jewelers Block.