Think of product recall insurance as a different kind of safety net. It’s not there to catch your physical inventory if it's stolen or damaged—that's the job of your Jewelers Block insurance. Instead, it’s there to rescue your brand’s reputation and finances when a product you’ve already sold goes terribly wrong.

It’s a specialized shield for a very specific kind of crisis, stepping in to manage the fallout after a defective piece leaves your control. This is about protecting your bottom line and, just as importantly, your name in the market. It's a critical component of comprehensive insurance for a jewelry store.

The Critical Difference Between Recall and Jewelers Block Insurance

Most jewelers are already familiar with Jewelers Block insurance. It’s the cornerstone of our industry’s protection, covering physical assets against theft, fire, or damage while they’re in your possession. If your store gets hit or a showcase is smashed, your Jewelers Block policy is the first call you make.

Product recall insurance, however, operates in a completely different world. It kicks in when a product you’ve sold is found to be faulty, unsafe, or defective.

Don't think of it as insurance for the jewelry itself. Instead, think of it as insurance for the messy, expensive, and complicated process of getting that jewelry back.

What It Really Covers (And What It Doesn’t)

Here’s where a lot of people get confused. Product recall insurance does not pay to remake the defective jewelry. That’s generally seen as a cost of doing business—your responsibility to fix the flawed product.

What it does cover are the enormous expenses tied to pulling those faulty items out of the market and away from your customers.

This specialized coverage isn't for replacing the faulty pieces themselves, but for managing the expensive, reputation-critical process of retrieving them. It protects your brand's financial stability during a product crisis.

The policy is designed for scenarios unique to the jewelry world. For example, imagine you launch a new line of earrings, but the posts are made from an alloy that causes widespread skin reactions.

Or maybe a batch of necklace clasps has a manufacturing flaw, causing them to fail and putting customers' priceless pendants at risk of being lost forever. These are the moments product recall insurance was built for.

Protecting Your Brand and Bottom Line

In a recall situation, the costs can spiral out of control almost immediately. This is where the policy really shines, helping you cover expenses like:

- Customer Notifications: Paying for the ad campaigns, emails, and letters needed to inform the public and your clients about the recall.

- Shipping and Logistics: Covering the costs for return shipping labels and managing the complex process of collecting hundreds or even thousands of pieces.

- Public Relations: Hiring a crisis management firm to protect your brand’s reputation from the inevitable negative press.

- Temporary Staff: Bringing on extra help to field the flood of customer calls, emails, and returns.

By handling these logistical and financial burdens, the insurance frees you up to focus on fixing the core problem and rebuilding trust with your customers. In a business where perfection is everything, this coverage provides a crucial safety net for those rare times it’s compromised.

Common Recall Triggers and What Your Policy Covers

When you hear "product recall," you might picture a massive, headline-making event. But for a jeweler, the trigger is often a subtle flaw that quietly blossoms into a huge financial and reputational nightmare. Understanding these very specific scenarios is the key to seeing why product recall insurance isn't a luxury—it's a critical safety net for any jewelry business.

The problems usually start small. Imagine a new line of necklaces made with faulty clasps. If one fails and a customer loses an heirloom pendant, you're suddenly on the hook for property damage. That's a classic policy trigger.

Or what if a supplier accidentally sends a metal alloy containing undeclared nickel? A whole batch of earrings could cause widespread skin reactions, forcing you to pull the product to protect both your customers and your brand. These are precisely the situations this specialized insurance is built for.

Unpacking the Most Common Jewelry Recall Scenarios

A broken clasp or an allergic reaction are the obvious examples, but the list of potential triggers is longer than you’d think. You have to look beyond simple manufacturing defects and consider every possible risk hiding in your inventory.

Here are a few real-world situations that could easily set a recall in motion:

- Sharp Edges or Prongs: A beautiful new ring design might have settings with microscopic burrs. If they’re sharp enough to snag clothing or cause even minor scratches, the entire line could be deemed a safety hazard.

- Banned or Hazardous Materials: Regulators don’t mess around. If a new plating solution is found to contain unsafe levels of lead or cadmium, a government agency could mandate a full recall.

- Component Failure: Think beyond clasps. Earring backs that don't secure properly, charm bracelet links that snap, or brooch pins that detach can all lead to loss or injury, kicking your policy into action.

At its core, the principle is simple: if your product creates a potential risk of bodily injury or property damage to a customer, the costs of getting it off the market are very likely covered.

This protection is more vital than ever. The industry trend isn't about more frequent recalls; it's about the sheer size of them. In a recent quarter, the number of U.S. recall events actually dropped by 9.2%, but the number of units pulled from the market exploded to 258.98 million—a staggering 201.6% jump. This shows how one bad component can infect a massive volume of products, and it’s why having a solid recall plan is non-negotiable. You can explore more about these emerging risk trends to get a better handle on the landscape.

First-Party vs. Third-Party Costs: A Clear Distinction

Once a recall is underway, the bills start rolling in fast. Your product recall policy neatly organizes these expenses into two main buckets, making sure you’re covered from every angle.

First-Party Costs: Your Direct Expenses

These are the immediate, out-of-pocket costs your business has to pay to manage the recall. It’s the direct financial aid to get you through the crisis.

- Notification Costs: Paying for email blasts, social media announcements, or even ads to get the word out to customers.

- Logistics & Shipping: The cost of sending out return labels, setting up collection points, and transporting the faulty items back.

- Extra Personnel: Needing to hire temporary staff to manage the flood of customer calls and process returns.

- Public Relations Support: The cost to bring in a crisis management firm to protect your hard-earned reputation.

- Product Disposal: Safely destroying the recalled jewelry so it can never find its way back onto the market.

Third-Party Costs: Losses Your Partners Incur

This is where the coverage really shines—it extends beyond your own four walls. If you sell wholesale, your retail partners are also taking a financial hit because of your product.

- Retailer Reimbursement: Paying back a department store for their costs to pull your product from shelves and notify their own customer base.

- Lost Profits for Partners: Some policies go a step further and can even cover the profits a retail partner lost because they couldn't sell your defective jewelry.

This dual-layer protection is what makes product recall insurance so powerful. It doesn’t just help your business survive the storm; it helps you protect the crucial relationships with your distributors and retail partners, ensuring everyone can recover and move forward together.

What Your Product Recall Policy Will Not Cover

Knowing what your product recall insurance covers is only half the battle. To really protect your jewelry business, you need to be just as clear on what it doesn’t cover. Trust me, finding out your policy has limits after a crisis hits is a painful way to learn, often leading to massive, unexpected bills.

The single biggest exclusion you need to wrap your head around is this: the policy will not pay for the cost of remaking or replacing the faulty jewelry itself. Insurance carriers see this as a basic cost of doing business.

If a batch of rings goes out with a bad alloy, your policy will pay to get those rings back from customers. But the cost to melt them down and manufacture a new, correct batch? That’s on you.

Think of it this way: if a restaurant serves a burnt steak, their insurance isn't going to buy them a new filet mignon. The recall policy is there to manage the chaos—contacting customers, handling the PR fallout, and making sure nobody else gets a bad meal. It’s about managing the crisis, not replacing the product.

Key Exclusions to Remember

Besides the cost to remanufacture, a standard product recall policy has a few other hard lines drawn in the sand. These are put in place to keep the coverage squarely focused on the direct costs of pulling a dangerous product off the market.

It's vital to know these before you ever have to file a claim.

- Government Fines and Penalties: If a body like the Consumer Product Safety Commission (CPSC) hits you with fines over a safety issue, your policy won’t cover them.

- Lost Profits from Reputational Damage: The policy will cover hiring a PR firm to manage your brand’s reputation, but it won't cut you a check for future sales you lose because customer trust has eroded.

- Aesthetic or Quality Issues: Coverage only kicks in when there's a risk of bodily injury or property damage. A recall for a purely cosmetic flaw—like cloudy gemstones or plating that's a shade off—is not going to be covered.

The Safety vs. Aesthetics Distinction

That last point is absolutely critical for jewelers. The line between a safety hazard and a simple quality control slip-up is what determines whether your policy responds.

Here’s how that plays out in the real world:

- Scenario A (Not Covered): You ship a line of engagement rings, but the center stones are cloudy and don't meet your brand’s standards. Customers are rightfully upset and sending them back. Because the rings pose no physical danger, the cost to get them back and replace them is just a business expense, not an insurable recall.

- Scenario B (Likely Covered): You produce a similar line of rings, but the prongs are poorly finished, leaving sharp edges that could scratch someone or snag and ruin clothing. This defect creates a clear risk of both bodily injury and property damage, which would trigger your product recall coverage to manage the whole retrieval process.

A product recall policy is built to handle public safety emergencies, not internal quality control problems. The key that unlocks your coverage is the real, tangible risk of harm.

Understanding these boundaries helps you prepare for every eventuality. Many jewelers also find that working with industry groups provides extra resources and standards to help prevent these problems from happening in the first place. For instance, you can learn more about membership opportunities with the Southern Jewelry Travelers Association (SJTA) and see how they champion industry best practices.

Pairing that kind of proactive work with the right insurance policy is the strongest defense you can build for your brand.

How Insurers Determine Your Policy's Cost

When you get a quote for product recall insurance, the number you see isn't pulled out of thin air. Insurers go through a detailed risk assessment, much like a gemologist inspects a diamond from every angle to determine its true value.

At the end of the day, they're trying to answer one fundamental question: what’s the real-world probability your business will have a recall, and how much would it cost if you did?

Why does one jeweler pay more for the same coverage than another? It all comes down to a specific set of factors that paint a picture of your unique risk profile. A major brand with millions in sales and a global footprint will naturally face higher potential recall costs than a small artisan designer, and the premiums will reflect that reality.

Key Factors That Influence Your Premium

Insurers dig deep into the nuts and bolts of your jewelry business to understand what could go wrong. Your annual sales volume is an obvious starting point—higher revenue usually means more products out in the world, which scales up the potential size and cost of any recall.

But they go way beyond just sales figures. Underwriters will want to understand the specifics of your operation. Here are the main things they'll be looking at:

- Supply Chain Complexity: Do you get your materials from a dozen different countries, or do you work with just a handful of trusted local suppliers? A complex, multi-layered global supply chain introduces far more variables and potential points of failure, which can drive up your premium.

- Product Types: What you sell matters. A lot. A business that specializes in children's jewelry, for instance, is under a much bigger microscope when it comes to safety regulations and liability. That higher risk translates directly into a more expensive policy.

- Quality Control Processes: An insurer is going to want to see solid, documented quality control. If you can show them you have rigorous testing for your metals, component strength, and the safety of your final products, they'll see you as a much lower risk.

This is exactly why working with a specialized broker, like the First Class Insurance Jewelers Block Agency, is so crucial. They know what underwriters from places like

are looking for and can help you frame your business in the best possible way.

Adjusting Your Coverage and Cost

The final price tag isn't set in stone. You have a few levers you can pull to make it fit your budget. The two most powerful ones are your deductible and your coverage limits.

Think of the deductible as the portion you agree to pay yourself before the insurance money starts flowing. If you choose a higher deductible, you’re telling the insurer you're willing to take on more of the initial financial hit. That almost always brings your premium down.

On the flip side, the coverage limit is the absolute maximum the insurer will pay out for a single recall. A policy with a $1 million limit will, of course, cost less than one with a $5 million limit. The trick is to strike the right balance—enough coverage for a true worst-case scenario, but not so much that the premium breaks your budget.

The market for product recall insurance is booming, reaching about USD 11.14 billion globally. It’s expected to nearly double to USD 21.12 billion in the next seven years, with a compound annual growth rate of 9.7%. This growth is fueled by increasingly complex supply chains and a greater focus on consumer safety. You can learn more about these product recall market trends and what they signal for the industry.

Understanding these moving parts puts you in the driver's seat. You can have a smarter conversation with your insurance provider, negotiate the right deductible, and pick a coverage limit that makes sense for your business, ensuring your policy is both effective and affordable.

Your Step-by-Step Guide to Filing a Recall Claim

That sinking feeling you get when you discover a defect in one of your jewelry pieces? It’s a moment every jeweler dreads—a nightmare scenario where panic and confusion take over. But with the right product recall insurance and a clear head, you can shift from chaos to a structured, manageable response.

The claims process isn't just about getting a check in the mail. It's an active partnership with your insurer to get you through the crisis. The second you confirm a potential recall, the clock is ticking. Acting fast and methodically is everything when it comes to protecting your customers, your brand, and your business.

Step 1: Notify Your Insurer Immediately

This is your first, most critical move. Don’t wait. Don’t try to fix it yourself first. Many product recall policies give you immediate access to a crisis response team—PR experts, legal advisors, and recall consultants who live and breathe this stuff. Calling your insurer right away unlocks these resources when you need them most.

Think of it like pulling a fire alarm. The sooner you do it, the faster the experts arrive to help contain the fire. Delaying that call not only makes the situation worse but could even put your coverage at risk. Your broker, especially a specialist like the First Class Insurance Jewelers Block Agency, can be your first call to help you navigate this.

A Walkthrough: The 'Luna Gems' Scenario

To bring this to life, let’s imagine a fictional jewelry brand, 'Luna Gems.' They discover that a batch of their new silver earrings contains a faulty alloy that’s causing severe skin reactions. A customer complaint, backed by a dermatologist's report, confirms the problem isn't a one-off—it’s widespread in that specific product line.

The moment the defect is confirmed, Luna Gems' owner calls their insurance broker. Within hours, the insurer assigns a dedicated claims manager who activates a crisis response team. This team includes a PR pro to help draft customer communications and a legal expert to make sure they’re following all safety regulations.

Step 2: Document Absolutely Everything

From the very first hint of a problem, documentation is your best friend. Your insurer will need a detailed, meticulous record to process your claim and give you the right advice. Start a dedicated file and log every single detail, no matter how small it seems.

This means keeping track of:

- Customer Complaints: Save every email, social media message, and note from phone calls.

- Supplier Communications: Document every conversation you have with the supplier who provided the bad component or material.

- Internal Records: Pull batch numbers, production dates, and any quality control reports tied to the defective product.

- Initial Expenses: Track any money you spend right away, like for initial product testing or customer refunds.

Luna Gems gets on this immediately. They create a folder with the first customer complaint, photos of the skin reactions, their emails with the silver alloy supplier, and the production logs for the earring batch. This thorough paperwork gives the claims team a crystal-clear picture of the situation's scope.

Step 3: Work With the Experts to Execute the Recall

Your insurer’s team isn’t there to take over; they're there to work with you. You're the expert on your product and your customers. They’re the experts on managing recalls. Together, you’ll build and launch a recall strategy. The plan will map out how to notify the public, get the defective jewelry back, and handle all the logistics.

The pressure from product recalls isn't going away. The United States saw over 3,200 product recall events in a recent year, the second-highest total in six years. This just underscores how critical it is for businesses to have a rapid response plan ready. You can find more insights on these persistent recall trends on ProgramBusiness.com.

Working with their crisis team, Luna Gems puts together a multi-channel notification plan. It includes a dedicated page on their website, a direct email to every customer who bought the earrings, and carefully crafted social media posts. The insurer’s logistics expert even helps them set up a simple return system with pre-paid shipping labels, making it as painless as possible for their customers.

Step 4: Submit Your Expenses for Reimbursement

While you're putting the recall plan into action, keep a running list of every single expense. This is the final piece of the puzzle: submitting your documented costs to the insurer to get reimbursed, up to your policy limit.

Luna Gems tracks everything—the cost of the email campaign, the PR consultant's time, the return shipping fees, and the overtime they paid their customer service team. They send these invoices to their claims manager, who processes them for reimbursement. Just like that, their product recall policy turns a potentially business-ending financial crisis into a manageable event.

Choosing the Right Product Recall Insurance Policy

Let’s be clear: picking a product recall insurance policy isn’t about chasing the lowest price. It's about finding a true partner to have in your corner when things go sideways. The best policies are far more than just a financial safety net; they’re a complete support system built to help you navigate the chaos of a recall.

When you start comparing plans, look past the coverage limits on the first page. The real value is often in the details, like built-in crisis management services. Having immediate access to PR pros and legal experts who can help you manage communications and meet regulatory rules is a game-changer when your brand’s reputation is hanging in the balance.

Key Features to Look For in a Policy

Not all recall insurance is the same, especially for a niche industry like jewelry. A generic, one-size-fits-all policy can leave you exposed because it doesn't account for the unique risks you face—from a single bad batch of clasps from an overseas supplier to the high value of customer trust.

A solid policy for a jeweler should absolutely include:

- Reputational Harm Repair: This covers the cost of a PR campaign to rebuild customer confidence after a recall. It's about restoring your good name.

- Third-Party Financial Loss: This is critical. It reimburses your retail partners for their costs and lost profits, which helps protect those essential business relationships.

- Government-Mandated Recall Coverage: You need to be sure the policy covers recalls ordered by a regulatory body, not just the voluntary ones you decide to launch.

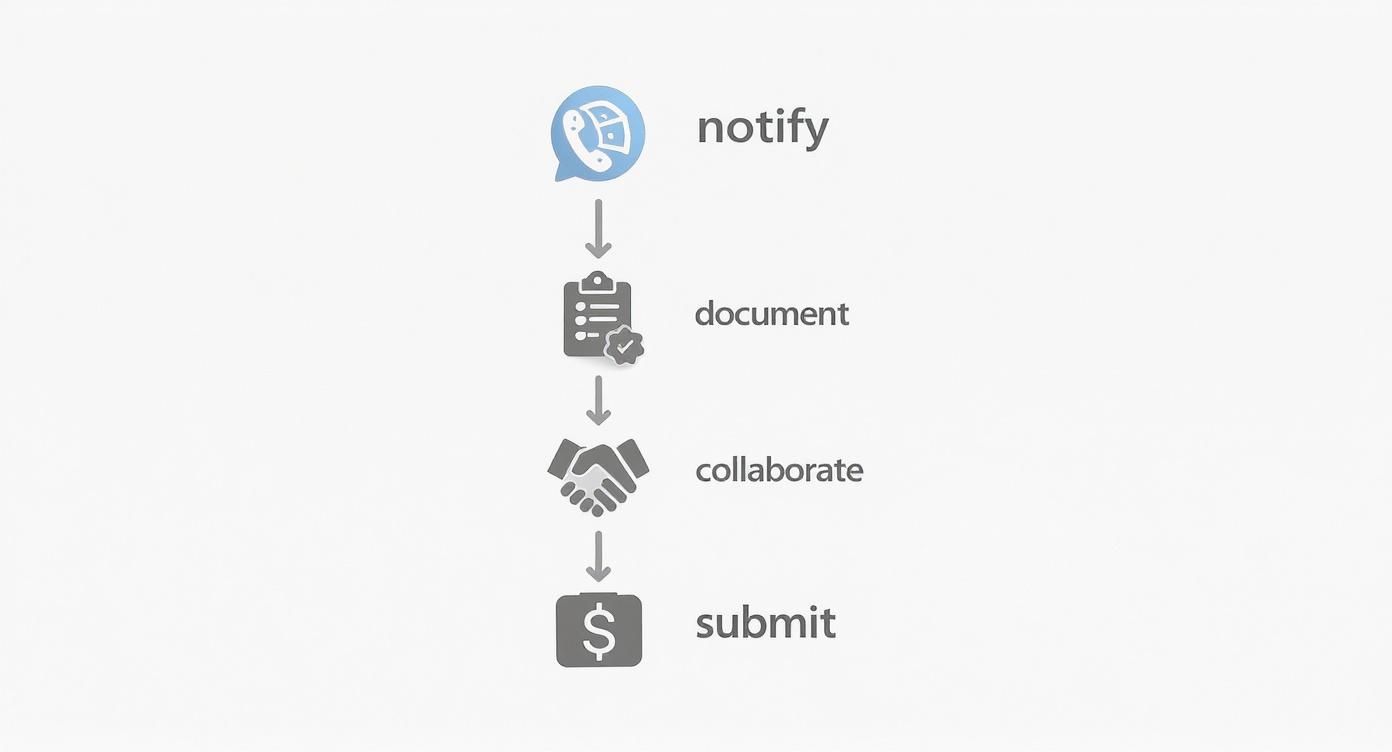

The workflow below shows how a good insurance partner helps turn a chaotic event into a structured, manageable process.

It’s all about having a clear plan—from the first notification to the final reimbursement—so you’re never navigating the crisis alone.

Asking the Right Questions Before You Buy

To really understand what you're buying, you have to dig deep with some pointed questions. Don't be shy about pressing for specifics. Your goal is to get rid of any gray areas before you sign anything.

This is where working with a specialist, like the First Class Insurance Jewelers Block Agency, gives you a huge advantage. They speak both languages—insurance and jewelry—so they can make sure you get a policy that fits your actual risks without paying for coverage you don’t need.

When you're vetting an insurer, have this list of questions ready:

- What specific situations or discoveries actually trigger the coverage?

- Does the policy cover both voluntary recalls and those mandated by a government agency?

- Are crisis management and PR services included in the base premium, or are they an expensive add-on?

- How do you define "third-party damages"? Does it include the lost profits of my retail partners?

- What are the notification rules? How fast do I have to report a potential issue to make sure my coverage is valid?

Getting straight answers to these questions lets you compare quotes based on their true value, not just the price tag. It's the diligence you do now that ensures you get comprehensive insurance for a jewelry business that will actually be there to protect your brand’s future when you need it most.

Frequently Asked Questions

When it comes to something as specific as product recall insurance, a lot of questions pop up, especially for jewelers. Let's tackle some of the most common ones to give you a clearer picture of how this coverage really works.

Is This Coverage Only for Government-Ordered Recalls?

No, and this is a really important point to understand. While your policy will absolutely kick in if a government body like the CPSC forces a recall, that’s not the only trigger.

Most policies are written to cover voluntary recalls as well. That’s when you discover a problem yourself and decide to pull the product. Acting fast to get a dangerous item off the market is often the best move for your customers and your reputation. A good policy backs you up, giving you the financial muscle to do the right thing without having to wait for a government order.

My Jewelry Business Is Small. Do I Really Need This?

It’s easy to think of product recalls as a problem for massive corporations, but the opposite is true. Small businesses are often the most vulnerable. A huge company might have the cash on hand to handle the massive costs of a recall, but for a small or medium-sized jeweler, that kind of expense can be a death blow.

Think about it: the cost of customer notifications, return shipping, and managing the PR nightmare could easily bankrupt a smaller business. In that sense, product recall insurance is a financial safety net, making sure one bad batch doesn't sink the entire ship you’ve worked so hard to build.

How Is This Different from General Liability Insurance?

This is probably the most crucial question we get. General Liability and product recall insurance are designed to handle two completely different kinds of risk.

General Liability covers third-party claims of bodily injury or property damage that your product has already caused. A product recall policy, on the other hand, covers the first-party costs of getting a potentially dangerous product off the market to stop those injuries or damages from ever happening.

Here’s an example: A faulty clasp on a necklace breaks, and a customer loses a priceless family heirloom attached to it. Your General Liability might step in to cover the "property damage" claim for the lost heirloom. But your product recall insurance would pay for the much larger cost of notifying every other customer who bought that necklace and getting the entire batch with the bad clasps back.

Beyond the direct costs of a recall, jewelers also have to think about strong online brand protection strategies to fight counterfeits that can damage your reputation. Ultimately, these two policies work together like a one-two punch to protect your business—one helps you manage the fallout, and the other helps you prevent the crisis in the first place.

Figuring out the complexities of jewelry store insurance isn't something you should do alone. You need a specialist. The team at the First Class Insurance Jewelers Block Agency has spent decades crafting custom protection for jewelers, from Jewelers Block insurance to specific product recall coverage. Protect your inventory, your reputation, and your peace of mind. Get a quote today. Get a Quote for Jewelers Block.