Let's get right to it: figuring out the ring insurance cost for your jewelry business isn't as simple as looking up a price online. It’s a nuanced calculation. Typically, you can expect premiums for Jewelers Block insurance to fall somewhere between 0.5% and 2.5% of your total inventory value each year.

So, if your store is holding $500,000 in stock, your annual premium would likely be in the ballpark of $2,500 to $7,500. But what pushes you to the lower or higher end of that range? Let's break down exactly what insurers are looking at when they assess your insurance for jewelry business.

How Much Does Insurance for a Jewelry Store Really Cost?

Calculating the real cost of insurance for a jewelry store is a deep dive into your specific risks, not a one-size-fits-all fee. Think of it less like buying something off the shelf and more like having a custom security system designed for your exact layout and vulnerabilities.

Your final premium is a direct reflection of how well you protect your assets. This is where specialized coverage, known as Jewelers Block insurance, comes in. It’s built from the ground up to cover the unique perils of our industry and is the only real financial backstop for a serious jewelry business.

Core Factors Driving Your Premium

When an underwriter looks at your application, they are meticulously piecing together a complete picture of your operational risk. Your final ring insurance cost comes down to a blend of tangible security measures and day-to-day protocols. Each piece of the puzzle helps them determine the price you'll pay for proper protection.

Here’s a look at the heavy hitters:

- Total Inventory Value: This is the big one. The higher the value of your stock—from loose diamonds to finished watches—the greater the potential loss, and the higher your premium will be. It's a simple matter of exposure.

- Physical Security Measures: How tough is your store to crack? Insurers look closely at the quality of your safes (especially their UL rating), your alarm systems, surveillance cameras, and how you control access. Stronger security is always rewarded with better rates.

- Business Location: Geography matters. Underwriters analyze crime statistics in your area, and a shop in a quiet suburban strip mall will be priced very differently than a high-profile location in a dense urban center.

Here's a quick summary of what underwriters focus on when they build your quote for jewelry store insurance.

Key Factors Influencing Your Jewelry Insurance Premiums

| Factor | Description | Impact on Cost |

|---|---|---|

| Inventory Value | The total wholesale or replacement cost of your stock. | The single biggest driver. Higher value equals higher premiums. |

| Physical Security | Quality of safes, vaults, alarms, and surveillance. | Strong, UL-rated security significantly lowers your costs. |

| Location | Geographic area and local crime rates. | High-risk areas lead to higher premiums. |

| Operational Protocols | How you handle inventory, opening/closing, and travel. | Strict, documented procedures can earn you discounts. |

| Claims History | Your past five years of loss history. | A clean record results in more favorable pricing. |

| Business Experience | How long you've been established in the industry. | A proven track record can demonstrate stability and reduce risk. |

Understanding these drivers is the first step toward getting a fair and accurate premium.

Protecting your business isn’t just about locking the doors at night. It’s about building a multi-layered defense that insurers recognize and reward. This proactive approach transforms insurance from a simple expense into a strategic asset.

Why a Standard Policy Is Not Enough

Trying to protect a jewelry business with a generic commercial policy is a recipe for financial disaster. Those plans are full of holes. They almost always include exclusions for high-value items, "mysterious disappearance," or goods that are off-premises—all of which are everyday risks for a jeweler.

Specialized insurance for a jewelry store is designed to plug those gaps and give you the specific protection you actually need. To see what we mean by high-value items, our gallery has a great example of a beautiful diamond ring on a black background.

Ultimately, a knowledgeable agent can walk you through this process, helping you highlight your strengths to secure a Jewelers Block quote that truly reflects your operation.

Understanding Jewelers Block Insurance Coverage

Think of a standard business policy as a chain-link fence. It might deter a casual trespasser, but it won’t stop someone who really wants to get in. Jewelers Block insurance, on the other hand, is a purpose-built fortress—a multi-layered security system designed specifically to protect a high-value, high-risk target like your jewelry business.

This isn’t just basic insurance for a jewelry store. It’s a specialized, all-in-one policy crafted for the unique dangers of our industry. Generic business policies are almost always riddled with exclusions for high-value inventory and the specific types of loss we face daily. Jewelers Block is built from the ground up to plug those dangerous gaps, giving you a single, seamless policy that guards your business from every critical angle.

Beyond the Display Case: On-Premises Protection

When you think of jewelry store insurance, the first thing that comes to mind is protecting the inventory inside your four walls. But Jewelers Block is much smarter than that, offering layered protection that understands the flow of your daily operations.

It’s designed to cover your entire inventory, no matter where it is on the premises:

- In the showcase: Your main display inventory is covered against threats like a smash-and-grab.

- In the safe or vault: When the doors are locked for the night, your most valuable pieces are protected while secured in a UL-rated safe.

- At the bench: That one-of-a-kind piece being repaired or designed is covered while your jewelers are working on it.

- Customer property: The policy also extends to items customers leave in your care for repair, resizing, or appraisal. This is crucial for protecting your liability and your reputation.

Protecting Your Assets in Motion

Your inventory rarely sits still, and neither do your risks. Some of the greatest vulnerabilities a jeweler faces happen when inventory leaves the relative safety of the store. This is another area where a standard policy offers little to no help, but where Jewelers Block truly shines.

This vital part of your insurance for jewelry business covers your valuable goods while they are:

- In transit: Whether you’re shipping an engagement ring to a client via an armored carrier or receiving a new collection from a designer.

- At trade shows: Your booth and inventory are covered while you’re exhibiting at industry events—a notoriously high-risk environment.

- With salespeople: When your reps are on the road visiting clients, their sample lines and travel stock are fully protected.

This "outside the premises" coverage is non-negotiable, ensuring your assets are secure no matter where your business takes you.

One of the most critical features that sets Jewelers Block apart is its coverage for "mysterious disappearance." This protects you if an item vanishes from your inventory with no physical evidence of a break-in or theft. It’s a unique risk in our industry and one that is almost always excluded from standard policies.

The All-Risks Approach

Most insurance policies are "named peril," meaning they only cover a specific list of events, like fire or a burst pipe. Jewelers Block insurance flips that on its head. It’s typically written on an "all-risks" basis, which means it covers every type of loss unless it is specifically excluded in the policy document.

This approach provides incredibly broad protection against the most common threats jewelers face, from armed robbery and burglary to shoplifting and employee dishonesty. It becomes the bedrock of a solid risk management plan, safeguarding your financial stability when the worst happens.

Ultimately, understanding these core pillars makes it obvious why this specialized policy is essential. If you're ready to build a fortress around your business, you can Get a Quote for Jewelers Block from an expert who lives and breathes these details. At First Class Insurance Jewelers Block Agency, we specialize in crafting this protection for businesses just like yours.

How Insurers Calculate Your Premium

Ever wonder why your insurance quote looks the way it does? It’s not a number pulled out of a hat. When an underwriter calculates your premium for Jewelers Block insurance, they're essentially acting like a detective, piecing together a complete picture of your business's risk.

This deep dive explains why two jewelers with seemingly identical inventory values might get wildly different quotes for insurance for a jewelry store. They look at everything from your physical security and daily procedures to your neighborhood's crime stats and your past claims. Understanding how they see your business is the first step to getting a better handle on your ring insurance cost.

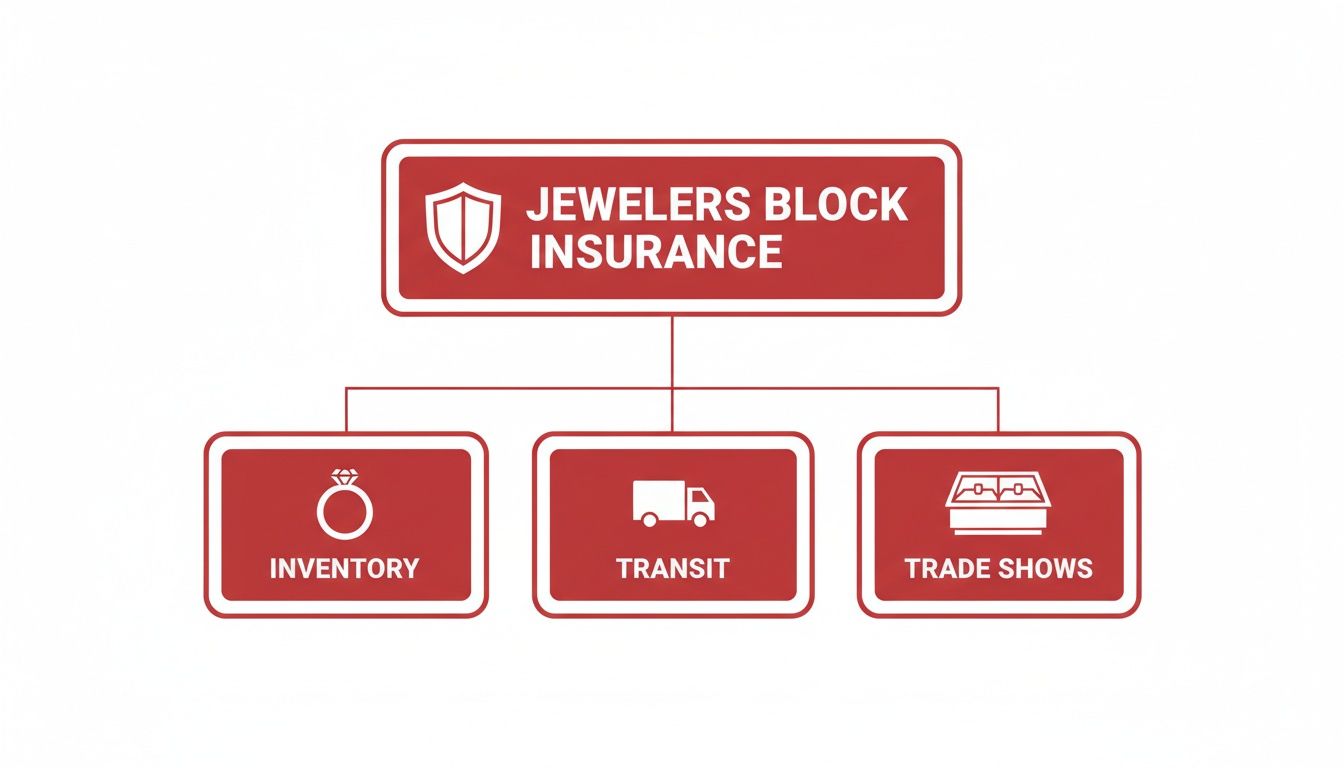

This diagram breaks down the core areas a solid Jewelers Block policy is designed to protect.

As you can see, it’s a comprehensive shield—covering your pieces whether they’re sitting in your vault, being shipped to a client, or displayed at a trade show.

Inventory Value And Composition

The total value of your inventory is the obvious starting point. More value means more exposure for the insurance company, which naturally sets a higher baseline for your premium.

But it’s not just about the total dollar amount. The kind of inventory you carry matters, too. An underwriter will see a collection of loose diamonds and high-end watches as a much juicier target for thieves than, say, larger, custom silver pieces. The easier it is to grab and sell, the higher the perceived risk.

Physical Location And Security Infrastructure

Where your store is located plays a huge role. Insurers have access to incredibly detailed crime data for your specific zip code, looking closely at burglary and robbery trends. A shop in a busy downtown area with a history of theft is going to face higher premiums than one in a quiet suburb with a low crime rate. It’s just a fact of the business.

Your security setup is your best defense—and your most powerful negotiating tool. Insurers will pore over the details of your defenses, including:

- Safes and Vaults: The UL rating on your safe is one of the first things they'll ask about. A high-rated safe, like a TL-30 or TRTL-30×6, proves it can withstand a serious professional attack and can directly lower your premium.

- Alarm Systems: A professionally installed, centrally monitored alarm system is non-negotiable. They expect to see comprehensive protection covering every window, door, wall, and even the ceiling.

- Surveillance: Clear, high-definition video cameras that store footage off-site are a must. They not only deter criminals but also provide critical evidence if you ever need to file a claim. You can explore some of the history behind the insurance market by looking into institutions like Lloyd's of London.

Operational Protocols And Claims History

How you run your business day-to-day tells an underwriter a lot about your level of risk. They want to see that you have strict, documented procedures for everything—from opening and closing routines to how you show high-value items to customers. A disciplined operation is seen as a much safer bet.

Your claims history from the last three to five years is also put under the microscope. A clean record is proof that your security and procedures are working, and you’ll be rewarded for it. On the flip side, a pattern of losses will raise red flags, leading to higher costs or even making it tough to find coverage at all. The market for insurance for jewelry business is competitive, but a poor history makes you a less attractive client.

The U.S. is a major player, accounting for 26% of the global market in 2023, driven by a strong economy and a culture of insuring valuable assets. This is especially true for retailers and designers who need protection from theft, mysterious disappearance, and shipping losses—all risks that a Jewelers Block policy is built to cover. For a more personal perspective on coverage, this guide to engagement ring insurance cost is a great resource.

By looking at your business through an underwriter’s eyes, you can spot areas to improve and strengthen your risk profile. The next step is connecting with an expert who knows how to present those strengths to get you the best possible rate.

Balancing Deductibles and Coverage Limits

Figuring out the deductibles and coverage limits for your Jewelers Block insurance is a balancing act. It's a lot like setting the price on a one-of-a-kind piece—get it right, and you’ve found the sweet spot between affordable protection and real security. Get it wrong, and you could find yourself dangerously exposed right when you need coverage the most.

Think of your deductible as your shop's co-pay on a claim. It’s the amount you agree to handle out-of-pocket before the insurance company steps in. Choosing a higher deductible is a popular way to bring down your yearly premium, which helps manage the upfront ring insurance cost.

But it’s a classic trade-off. A smaller premium looks great on the books, but you have to be absolutely certain your business can absorb that higher deductible if something goes wrong.

Understanding Your Deductible Options

For a jewelry business, deductibles aren’t a one-size-fits-all situation. They are usually structured to apply to different kinds of losses, which gives you more control over where you’re comfortable taking on a little more risk.

Common deductible setups in insurance for a jewelry store include:

- Per-Claim Deductible: This is a fixed amount you pay for any single incident, whether it’s a fire, a shipping loss, or a break-in.

- Theft or Burglary Deductible: You'll often see a specific—and usually higher—deductible just for theft. This reflects the greater risk associated with this kind of loss.

- Mysterious Disappearance Deductible: Some policies will have a separate deductible for those baffling inventory shortages that turn up during an audit.

Choosing a higher deductible, say $10,000 instead of $2,500, can make a real dent in your annual premium. The critical question, though, is whether your business can comfortably write a check for $10,000 after a major incident without throwing your cash flow into chaos. It's a decision that directly shapes the total cost of your jewelry store insurance.

A smart deductible lines up perfectly with your shop's financial resilience. It needs to be high enough to get you a better premium but low enough that it won't stop you from recovering after a loss.

The Critical Importance of Coverage Limits

While your deductible helps you manage the smaller hits, your coverage limit is the absolute ceiling on what your policy will pay out after a catastrophe. This is hands-down the most important number in your policy, and setting it too low can be devastating for your insurance for jewelry business.

It's a cautionary tale we've seen before: a wholesaler with $1.5 million in inventory buys a policy with a $1 million limit to save a little on the premium. A professional crew hits their vault overnight, clearing it out completely. The insurance pays out its maximum of $1 million, leaving the business to swallow a $500,000 loss. That’s a hit most businesses can’t come back from.

Underinsurance is one of the most dangerous gambles in our industry. Your coverage limit must reflect the full replacement value of your maximum inventory at any given time—especially during peak seasons like the holidays when your cases are full.

The need for adequate coverage is more important than ever. While 67% of engagement ring buyers get insurance, a staggering number don't cover other fine jewelry. Globally, only 34% of these pieces are insured, leaving billions in assets exposed in a market projected to hit $348 billion by 2025. This trend puts U.S. jewelers, who account for 25% of global consumption, at immense uninsured risk. You can explore more about these jewelry industry trends to get a better feel for the market.

Ultimately, balancing these two levers—deductibles and limits—is the key to smart risk management. Working with an expert at First Class Insurance Jewelers Block Agency means you're making these calls with confidence, getting solid protection without overpaying. Let us help you Get a Quote for Jewelers Block that gives you true peace of mind.

Actionable Strategies to Lower Your Insurance Costs

While your Jewelers Block insurance premium is a necessary cost of doing business, it's definitely not set in stone. Think of it as a number you can directly influence. Proactive jewelers can take very specific steps to lower their risk profile in the eyes of an underwriter, effectively investing in security measures that pay dividends through a lower ring insurance cost every single year.

These strategies aren't just about saving a few bucks; they're about making your business a much harder target for criminals. When you show insurers you're a responsible, low-risk partner, they reward you. A multi-layered defense is the key to getting the best possible premium on your insurance for a jewelry store.

Fortify Your Physical Defenses

An underwriter's first look is always at your physical security. It's the most tangible factor they evaluate, and it’s where smart investments deliver the biggest returns on your policy. Strength and resilience get noticed—and rewarded.

- Upgrade Your Safes: The UL rating on your safe is a deal-breaker. If you're using an older, lower-rated safe, upgrading to a TL-30 or a TRTL-30×6 is one of the most powerful moves you can make. It's a clear signal to insurers that you can withstand a professional attack.

- Enhance Surveillance: Basic cameras just don't cut it anymore. High-definition (HD) systems covering every corner of your showroom, back office, and entry points are the new standard. Your system absolutely must store footage off-site or in the cloud so it can't be tampered with during a break-in.

- Install Layered Alarms: A single alarm system is simply not enough. Underwriters want to see a centrally monitored system with multiple layers of protection, like motion detectors, glass-break sensors, and pressure pads inside your vaults.

Sharpen Your Operational Protocols

How you run your business every single day tells an underwriter a lot about your real-world risk. Documented, enforced procedures show that your commitment to security goes far beyond just locks and cameras.

Enforcing strict protocols is a huge part of your overall insurance for jewelry business strategy. For example, understanding the specific security needs for different types of valuable pieces, like those in this gallery of exquisite antique jewelry, helps you build smarter procedures.

- Strict Inventory Management: Your best defense against a mysterious disappearance claim is a meticulous paper trail. Regular, documented audits and a modern inventory tracking system prove you have total control over your assets.

- Documented Staff Training: Don't just train your staff—document every bit of it. Regular sessions on security protocols, spotting suspicious behavior, and strict opening/closing procedures build a culture of security that underwriters love to see.

- Travel and Show Protocols: If you or your team travel with inventory, you need ironclad, written rules for how it's transported and secured. Never, ever leave items in a personal vehicle, and always follow best practices at trade shows.

A clean claims history is your most valuable asset when negotiating your premium. Every year you operate without a loss, you become a more attractive client to insurers, giving you more leverage for better rates.

Partner with Security Experts

At the end of the day, managing your jewelry store insurance cost is all about making the strongest possible case to the underwriter. To really move the needle on your premiums, you need to implement robust jewellery shop security measures. Working with security professionals and specialized insurance agents ensures all your hard work gets the recognition—and the discounts—it deserves.

By taking these tangible steps, you stop being a passive insurance buyer and start actively managing your risk. This proactive approach doesn't just protect your inventory; it directly boosts your bottom line. When you're ready to see how your security investments can translate into real savings, it's time to Get a Quote for Jewelers Block from the experts at First Class Insurance Jewelers Block Agency.

Partner with an Expert for a Tailored Quote

Trying to secure the right insurance for your jewelry business with a generic, one-size-fits-all policy is a recipe for disaster. The complexities of inventory value, transit risks, and specific security protocols demand a specialist's touch—someone who lives and breathes this industry.

For over 30 years, First Class Insurance Jewelers Block Agency has been that trusted partner for jewelers across the country. We get the unique challenges you face because it’s the only thing we do. Our job is to build coverage that truly protects your business, not just check a box.

Why a Specialist Matters

Working with a dedicated agency means you aren't just another number. You get the focused attention you deserve, combined with the market access of a much larger firm. We leverage our deep relationships to find the most competitive and complete coverage out there.

Because we focus exclusively on jewelry store insurance, we know exactly what underwriters are looking for. We know how to frame your business to get you the best possible terms.

Our entire process is built to be fast and painless, typically getting you a comprehensive quote within 24 hours. Let us handle the heavy lifting of protecting your inventory, your reputation, and your peace of mind.

Choosing an insurance partner is one of the biggest business decisions a jeweler will make. An expert who speaks your language can be the difference between a policy that saves your business and one that leaves you dangerously exposed after a loss.

Navigating a Growing Market

The need for real expertise has never been more obvious. In 2023, the United States accounted for a massive 26% of the global jewelry insurance market, a clear sign of the sheer value jewelers are tasked with protecting every single day.

This is why sophisticated policies like Jewelers Block insurance exist. They’re designed for a market that’s projected to explode from $351.8 billion in 2023 to $578.5 billion by 2033. You can dig deeper into these numbers with these jewelry insurance market growth insights.

This explosive growth means the risks are getting bigger, too. Having a dedicated expert in your corner ensures your coverage keeps pace with your business and the industry itself.

Ready to see the difference a specialist makes? Connect with us today to Get a Quote for Jewelers Block insurance that's actually built for your business.

Answering Your Top Questions About Jewelers Block Insurance

When it comes to the details of insurance for a jewelry store, it’s only natural to have a few questions. Let's break down some of the most common ones we hear, clearing up the key concepts so you can make confident decisions to protect your business.

Getting these details right is the first step in managing your overall ring insurance cost and securing the right protection.

What Is the Average Cost of Insurance for a Jewelry Store?

This is the million-dollar question, but there's no single "average" price because every policy is built around a specific jeweler's risks. As a general rule of thumb, you can expect premiums for Jewelers Block insurance to fall somewhere between 0.5% and 2.5% of your total inventory value per year. But that's just a ballpark.

For example, a shop with $500,000 in inventory and top-notch security might land in the $2,500 to $5,000 annual range. On the other hand, a larger operation with $2 million in stock located in a high-crime area could be looking at premiums from $20,000 to $50,000. It really all comes down to the specifics—your safe's UL rating, your alarm systems, where you're located, and your claims history are the big drivers. The only way to know for sure is to get a quote that reflects your unique operation.

Does Jewelers Block Insurance Cover Mysterious Disappearance?

Yes, and this is one of the most important reasons why Jewelers Block insurance is so essential for anyone in the jewelry industry.

Mysterious disappearance is when an item from your inventory is discovered missing, but there’s no clear evidence of how it happened—no broken lock, no shattered showcase, no sign of forced entry. It’s a unique and devastating risk that standard business policies simply won't touch.

This coverage is your safety net for those head-scratching moments when inventory counts just don't add up. It protects you from those unexplainable losses that are otherwise impossible to prove, making it a cornerstone of any solid insurance for jewelry business policy.

How Can I Get the Best Possible Rate on My Policy?

Getting the best rate is all about proving to the underwriters that your business is a tough target and a well-run ship. The lower your risk profile, the better your premium will be.

It really comes down to taking a few proactive steps:

- Fortify Your Security: Don't cut corners here. Invest in high-quality, UL-rated safes, a centrally monitored alarm system, and crystal-clear HD video surveillance.

- Keep Flawless Records: Meticulous and up-to-date inventory records are non-negotiable. They help you spot discrepancies instantly and prove you have strong internal controls.

- Maintain a Clean Claims History: Nothing speaks louder than a loss-free track record. It’s the ultimate proof that your security measures are working.

Finally, don’t go it alone. Working with a broker who lives and breathes this stuff is a game-changer. A specialist at First Class Insurance Jewelers Block Agency knows the market, has relationships with multiple underwriters, and can fight for you to get the most competitive terms available.

Ready to protect your inventory, reputation, and peace of mind? The experts at First Class Insurance can build a policy that fits your business perfectly. Get a Quote for Jewelers Block and secure your assets today.