When it comes to insurance for a jewelry business, there’s one number that stands above all others in determining your financial survival: Total Insured Value, or TIV.

Simply put, your TIV is the absolute maximum amount your insurance company will pay out if your business suffers a catastrophic event, like a devastating fire or a major heist. Getting this number right isn’t just paperwork—it’s the entire foundation of a solid Jewelers Block insurance policy.

What TIV Really Means for Your Jewelry Business

Think of your Total Insured Value as a custom-built safety net. Its job is to catch every single valuable asset your store owns or is responsible for. If the net is too small, precious items fall right through, forcing you to cover the loss out of your own pocket. If it’s too big, you’re just paying for coverage you don’t actually need. The entire goal of a strong jewelry store insurance policy is to size this net perfectly.

But it’s a mistake to think TIV is just the sum of the price tags in your display case. A truly accurate TIV in insurance is a far more comprehensive calculation, reflecting the full, complex scope of your entire operation.

Key Components of a Jeweler’s TIV

To get a complete picture of your store’s value, you have to account for every category of asset under your roof—and even those that aren’t. A miscalculation or omission here can leave a dangerous, and expensive, gap in your coverage.

Your main components include:

- On-Premises Inventory: This is the obvious one—all the stock inside your store, whether it’s in showcases, the vault, or back rooms.

- Goods in Transit: This covers jewelry being shipped to customers, pieces coming in from suppliers, or items being moved between your locations.

- Customer Property: Any item a client leaves with you for repair, appraisal, or consignment is your responsibility. Its value must be included.

- Memo Goods: That tray of diamonds you’re holding for another dealer? It’s in your care, custody, and control, making its value a critical part of your TIV.

An imprecise TIV is one of the most common—and most avoidable—risks in the jewelry business. It’s not just a number on a form; it’s the financial blueprint for your recovery after a disaster.

The Foundation of Your Protection

Ultimately, your TIV is the cornerstone of your Jewelers Block insurance policy. It directly dictates your premiums, your coverage limits, and the terms an underwriter is willing to offer. An inaccurate valuation can lead to painful coinsurance penalties or even denied claims right when you need that support the most.

This is precisely why partnering with a specialist like First Class Insurance Jewelers Block Agency from the very beginning is so critical. Trying to navigate the complexities of valuing one-of-a-kind pieces, fluctuating metal prices, and a constantly changing inventory requires true expertise.

A specialist ensures your safety net is woven correctly from the start, giving you the peace of mind that your business can fully recover from whatever comes its way. The first step is to Get a Quote for Jewelers Block based on a TIV that’s been calculated with meticulous care.

How TIV Shapes Your Jewelers Block Policy

Your Total Insured Value is, without a doubt, the cornerstone of your Jewelers Block insurance policy. It’s the single most important number underwriters look at to grasp the full scope of your risk, nail down your premium, and ultimately, define the absolute maximum you could be paid after a major loss.

Think of your TIV as the foundation of a house. If that foundation is weak or miscalculated, the entire structure of your financial protection is at risk of collapsing when you need it most. Getting this number right isn’t just about ticking a box; it’s a strategic move that puts your insurance partner in the best position to protect you.

The Direct Link Between TIV and Your Premium

The math insurers use is refreshingly simple: your premium is your TIV multiplied by a specific rate. So yes, a higher TIV generally means a higher premium because the insurer is shouldering more potential risk. A jewelry store with a $2 million TIV will naturally pay more than a store with a $500,000 TIV, all other things being equal.

But the real story is in that “rate.” Underwriters analyze dozens of factors to set it—your security systems, where you’re located, your claims history, and exactly what kind of assets you have. An accurate TIV in insurance gives them the confidence they need to apply the best possible rate for your business.

A precisely calculated TIV is your best negotiating tool. It screams professionalism and transparency, allowing a specialist broker to argue for better terms and higher coverage limits on your behalf.

How TIV Influences Coverage Limits and Capacity

Your TIV doesn’t just affect the price tag; it dictates the entire architecture of your insurance for a jewelry store. Every underwriter has a ceiling on how much risk they can take on for one client. If your TIV is particularly high, they might need to bring in backup through reinsurance—which is basically insurance for insurance companies.

This is why a meticulously documented TIV is so critical. Insurers underwrite a jeweler based on total exposure, which includes everything from the stock in your showcases and safes to items being shipped. As noted in U.S. Treasury reports on insurance markets, this total valuation is a key factor in determining how much underwriting capacity is even available for high-value retailers. For the clients we serve at First Class Insurance Jewelers Block Agency, a precise TIV directly impacts premiums, available limits, and the ability to get coverage for major exposures. You can dig deeper into how valuations impact underwriting in the annual Federal Insurance Office report.

The Foundation for Specialty Coverage

Finally, your TIV helps build out the special coverages that are absolutely essential for an insurance for jewelry business policy. These are the add-ons that protect you in the real world, including:

- Transit Limits: Coverage for pieces you ship out of the store.

- Mysterious Disappearance: Protection for when inventory vanishes with no clear sign of theft.

- Off-Premises Coverage: For when you take jewelry to trade shows, private viewings, or an appraiser.

An underwriter’s willingness to offer you strong limits for these specialty risks is directly tied to their confidence in your overall TIV. A clear, defensible valuation proves you have a firm grasp on your operations, making you a much more attractive risk. When you Get a Quote for Jewelers Block, coming to the table with a detailed TIV from the get-go paves the way for a policy that truly protects every facet of your business.

Calculating Your Total Insured Value Accurately

Knowing your TIV is the bedrock of your Jewelers Block insurance is one thing. Actually calculating it with precision? That’s another story entirely.

It’s tempting to just add up the value of the pieces in your display case and call it a day. But that’s a classic mistake, and one that almost guarantees you’ll be underinsured. This kind of shortcut leaves your jewelry store insurance policy full of dangerous, expensive gaps.

A truly accurate TIV in insurance demands a methodical, piece-by-piece inventory. Think of it like building a complete financial snapshot of your business, making sure every single asset you own—or are responsible for—is accounted for. Let’s break down the essential building blocks for a TIV calculation that will actually stand up when you need it most.

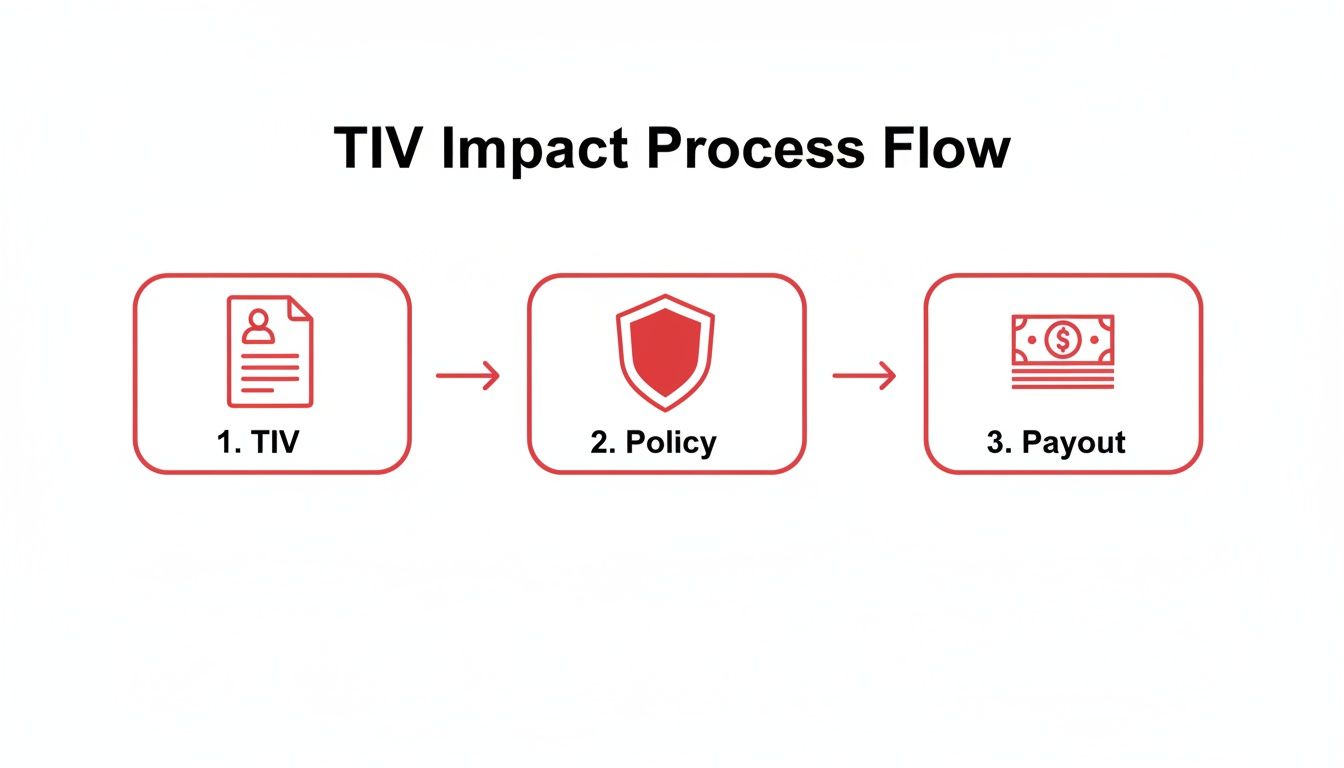

This simple process flow shows how your TIV calculation directly impacts your policy and any potential claim payout.

As you can see, getting the TIV right from the start is what determines the strength of your policy’s shield and, ultimately, the size of the payout you receive after a loss.

Step 1: On-Site Inventory Valuation

The biggest piece of your TIV puzzle is, without a doubt, the value of all the property you keep at your business premises. And I mean all of it—not just the finished pieces sparkling in the showcase.

To get this right, you have to include:

- Finished Jewelry: Every ring, necklace, bracelet, and watch ready for sale.

- Loose Stones and Metals: All of your raw materials, from loose diamonds and gemstones to gold and platinum.

- Workshop Materials: Don’t forget the small stuff used for creation and repair, like findings and solder.

- Safe and Vault Contents: Every high-value item you store securely overnight.

- Window Display Items: Remember to account for the total value of pieces left in the window after hours.

Here’s a critical detail: value these items based on their replacement cost, not your wholesale cost or the ticket price. Ask yourself, if a diamond ring was stolen today, what would it cost in the current market to buy a similar stone and manufacture a new setting? That’s the number you need.

Step 2: Accounting for Off-Premises Assets

A huge portion of a jeweler’s risk happens when assets are outside the four walls of the store. Forgetting to include these items is one of the most common—and costly—errors jewelers make when calculating their TIV.

Your off-premises valuation has to cover:

- Goods in Transit: Any inventory being shipped to or from clients, suppliers, or other stores. This includes packages sent with carriers like FedEx or USPS and items moved by armored car.

- Trade Show Stock: The complete value of the inventory you bring to industry events and exhibitions.

- Items with Setters or Appraisers: Any pieces that are temporarily in the hands of third-party contractors for work.

Each of these categories needs its own specific limit on your insurance for jewelry business policy. Declaring their maximum value within your TIV is the only way to make sure you have adequate coverage for these high-risk scenarios.

Step 3: Valuing Property of Others

Your responsibility doesn’t stop with your own inventory. A comprehensive TIV must also include the full value of any items you have in your care, custody, or control that belong to someone else.

Including property of others in your TIV is non-negotiable. If a customer’s heirloom diamond is stolen from your repair bench, your Jewelers Block policy is what covers that loss—but only if you’ve accounted for its value.

This category breaks down into two main types of property:

- Customer Property: These are the items left with you for repair, resizing, appraisal, or even just a simple cleaning. You are legally responsible for protecting these pieces, and their value has to be part of your TIV.

- Memo Goods: This includes any jewelry or stones you’re holding on consignment from other dealers or wholesalers. Until those items are sold or sent back, you are liable for their full value.

For a clearer picture of the kinds of assets needing protection, take a look at this high-value diamond ring on a black background, a perfect example of an item that would require precise valuation in a TIV calculation.

TIV Calculation Worksheet for Jewelers

To help pull all of this together, we’ve created a sample worksheet. Use this table as a guide to break down the components of your Total Insured Value with examples tailored for a typical jewelry store.

| Asset Category | Valuation Method | Example Calculation | Estimated Value |

|---|---|---|---|

| On-Premises Finished Goods | Replacement Cost | 500 rings @ avg. $2,000 + 200 necklaces @ avg. $1,500 | $1,300,000 |

| Loose Stones & Metals | Market Value | 50 carats loose diamonds @ $4,000/ct + bulk gold | $250,000 |

| Goods in Transit (Max) | Declared Value | Max value shipped in one package via armored car | $500,000 |

| Trade Show Inventory (Max) | Replacement Cost | Total value of pieces taken to a major show like JCK | $2,000,000 |

| Customer Property (Max) | Declared Value | Highest estimated value of customer items on-hand | $150,000 |

| Memo Goods (Max) | Supplier’s Cost | Max value of consignment pieces held at one time | $300,000 |

| Total Insured Value (TIV) | Sum of All Categories | Sum of all above values | $4,500,000 |

This worksheet is just a starting point, but it illustrates how each component contributes to a comprehensive and defensible TIV.

By meticulously adding up these three core components—on-site inventory, off-premises assets, and property of others—you build a complete and accurate TIV. This number gives your insurance partner, like First Class Insurance Jewelers Block Agency, the clear information needed to structure a policy that truly protects every facet of your operation. When you are ready to move forward, the next step is to Get a Quote for Jewelers Block with confidence in your numbers.

The Hidden Dangers of Underinsuring Your Assets

It’s one of the most tempting—and most costly—mistakes a jeweler can make: intentionally underreporting your Total Insured Value (TIV) to get a lower premium. The immediate savings might look good on paper, but this high-risk gamble can lead to devastating financial surprises right when you need your policy the most.

Think of it like knowingly buying a safety net that’s too small for your high-wire act.

Underinsuring your assets leaves your business dangerously exposed. It’s not just about a gap in coverage. It’s about triggering specific policy clauses that can slash your claim payout, forcing you to cover a huge chunk of a major loss out of your own pocket. This is where a small shortcut on your premium can lead to a catastrophic financial shortfall.

The Coinsurance Penalty Explained

The most painful consequence of underreporting your TIV in insurance is the coinsurance penalty. Most Jewelers Block insurance policies have a clause that requires you to insure your property for a specific percentage of its full value—usually somewhere between 80% and 100%.

If you fail to meet that threshold when a loss happens, the insurance company will only pay a fraction of your claim.

The formula is straightforward and absolutely unforgiving:

(Amount of Insurance Carried / Amount of Insurance Required) x Amount of Loss = Your Payout

This means if your inventory is only insured for 80% of what it should be, you’ll only get 80% of your claim payout, minus your deductible. It’s a harsh penalty, but it’s designed to ensure fairness across the board.

Underinsuring is a bet against yourself that you can’t afford to lose. The insurer will apply the coinsurance penalty no matter the size of the loss, turning what could have been a manageable incident into a business-threatening event.

A specialist broker is your best defense against this hidden danger. They work with you to make sure your valuation is precise, so you never have to face a coinsurance penalty.

A Real-World Scenario

Let’s walk through a realistic example of how this plays out for an insurance for a jewelry store policy.

- Actual Inventory Value (TIV Required): $2,000,000

- Insured Value (TIV Reported): $1,600,000 (You underinsured by 20% to save a little on the premium)

- Coinsurance Requirement: 100%

- Amount of Loss: A theft results in a $500,000 loss.

Because you only insured for 80% of the required value ($1.6M / $2.0M), the insurer will only cover 80% of your claim.

Calculation: ($1,600,000 / $2,000,000) x $500,000 = **$400,000**

In this case, your decision to underinsure by 20% leaves you with a $100,000 shortfall. That’s money you have to come up with out-of-pocket, and that’s before you even factor in your deductible. It’s a staggering price to pay for a minor premium discount.

How Simple Oversights Create Big Risks

Underinsurance isn’t always a deliberate choice. For a jewelry business, values can fluctuate dramatically and quickly, creating accidental gaps in your coverage that can be just as damaging.

Common mistakes include:

- Forgetting Seasonal Spikes: Failing to adjust your TIV for a massive holiday shipment can leave you severely underinsured during your busiest—and riskiest—season.

- Ignoring Metal Price Swings: A sudden surge in gold or platinum prices can drive up your inventory’s replacement cost overnight, pushing you below your coinsurance threshold without you even realizing it.

- Overlooking Memo Goods: Forgetting to include a large consignment of diamonds from a supplier in your TIV calculation is an easy mistake with expensive consequences.

Industry analysis confirms that undervaluing TIV is a frequent cause of disputed claims and can slash recoveries by 10-30% or more. Maintaining accurate, up-to-date TIV records with an expert partner is the only way to prevent these painful reductions when you file a claim.

Avoiding this high-stakes gamble starts with an honest and meticulous valuation. A specialist broker is invaluable here, making sure there are no devastating surprises when you need your policy to come through.

Advanced TIV Strategies for Larger Operations

Calculating the Total Insured Value (TIV) for a single jewelry store is one thing. It’s detailed, sure, but manageable. But once your operation grows to include multiple stores, a wholesale division, or a large-scale distribution network, TIV stops being a simple calculation and becomes a complex strategic challenge.

The core ideas are the same, but the scale changes everything.

Think about it from an insurer’s perspective. A $50 million TIV packed into one major city is a completely different beast than the same $50 million spread across several states. One is a massive, concentrated risk. The other is diversified. This distinction is the key to everything and will directly impact what you pay for your Jewelers Block insurance.

Understanding TIV Aggregation and Concentration

TIV aggregation is just a technical term for adding up the value of everything you own—all your locations, goods in transit, and items in off-site storage—into one grand total. To an underwriter, this number is their total potential exposure to your entire jewelry business.

What really keeps them up at night, though, is geographic concentration. If your whole $50 million TIV sits in a city prone to hurricanes, or maybe in a district with a history of civil unrest, a single catastrophic event could wipe you out. That’s an enormous, terrifying risk for your insurance carrier.

For a large-scale operation, managing your TIV isn’t just an accounting chore anymore. It’s an exercise in strategic risk management. The way you frame and present your total exposure can dramatically shift your policy terms and premiums for the better.

A smart partner, like First Class Insurance Jewelers Block Agency, can help you model this exposure in a way that underwriters feel good about, often unlocking better terms for your insurance for jewelry business.

The Role of Reinsurance and Diversification

When your total TIV gets big enough, your primary insurer can’t shoulder all that risk on their own. It’s just too much. So, they turn to reinsurance—basically, insurance for insurance companies—to spread out the potential cost of a massive claim. And this is exactly where your risk concentration starts hitting your wallet.

Insurers and their reinsurance partners are constantly watching aggregate TIV in insurance by region and by peril. As groups like the International Association of Insurance Supervisors have pointed out, when declared values climb in concentrated areas, it raises the capital needed to back those risks. For brokers trying to place coverage for high-value clients, being able to show diversified risk—like using different transit routes or secure off-site vaults—can genuinely lower these reinsurance costs. You can learn more about how global markets see these risks in the IAIS Global Insurance Market Report.

This means you can be proactive and make your business a much more attractive risk. Here’s how:

- Geographic Diversification: Spread your inventory across stores in different states or regions. Simple, but effective.

- Secure Off-Site Storage: Use a high-security, third-party vault in a separate location to hold excess inventory.

- Varied Shipping Routes: Don’t send all your high-value shipments through the same carrier hub or along the same route.

Taking these steps proves to underwriters that you’re on top of your game and actively managing your exposure. The reward? Better rates and higher available coverage limits. As you think about modernizing your approach, it’s also worth seeing how new technology is transforming insurance claims with Agentic AI, which offers a glimpse into the future of risk management.

When you’re ready to see what’s possible, it’s time to Get a Quote for Jewelers Block from a specialist who lives and breathes these advanced dynamics.

Mastering Your TIV Reporting and Documentation

Your Total Insured Value isn’t a number you can just set and forget. Think of it as a living document that has to evolve right alongside your business. Getting proactive with your TIV in insurance is the final, crucial piece of the puzzle, ensuring your Jewelers Block insurance policy remains an airtight shield against loss.

This means you have to move beyond a simple annual review. It’s about adopting a continuous process of reporting and documentation.

This constant vigilance is what turns your policy from a static piece of paper into a dynamic asset that protects your business in real-time. Without it, even a perfectly calculated initial TIV can become dangerously outdated and insufficient in just a few months.

Best Practices for Airtight TIV Management

Keeping your TIV accurate for your insurance for a jewelry store demands discipline and a sharp eye for detail. Flawless records aren’t just for your accountant; they are your most powerful tool if you ever have to make a claim. They prove the value of what was lost and dramatically speed up the recovery process.

Here are a few key habits to build:

- Perform Regular Audits: Don’t wait for renewal. Conduct physical inventory counts at least twice a year and square them up against your sales and acquisition records to make sure nothing slips through the cracks.

- Use Professional Appraisers: For one-of-a-kind, high-value, or antique pieces, professional appraisals are non-negotiable. Their documented valuations provide the solid, third-party validation that underwriters and claims adjusters trust.

- Maintain Flawless Records: Every single shipment, memo transaction, and customer repair has to be documented. This creates an undeniable paper trail that validates your TIV declarations. When you’re dealing with high-end timepieces like these luxury watches, you can see just how critical that level of detail becomes.

When to Immediately Notify Your Broker

While checking in annually is standard, certain events demand an immediate call to your broker at First Class Insurance Jewelers Block Agency. Waiting until renewal to report a major jump in value is a gamble you just can’t afford to take.

Your insurance broker is your strategic partner, not just a vendor. Keeping them in the loop about major value changes is the single best way to prevent dangerous coverage gaps from emerging between renewal cycles.

Get on the phone with your broker immediately if you:

- Acquire a large estate collection or a significant parcel of stones.

- Receive a high-value consignment that blows past your typical memo limits.

- Plan for a massive influx of inventory for the holiday season.

- Substantially change your shipping methods or frequency.

To really level up your TIV reporting, you can even explore advanced tools like those used for data analytics in the insurance industry. These can help turn static reports into real-time insights, making your documentation that much stronger.

Your insurance for jewelry business is only as solid as the information it’s built on. By mastering your documentation and keeping the lines of communication open, you ensure your coverage truly reflects your business’s value.

Common TIV Questions We Hear from Jewelers

Even after getting the hang of it, Total Insured Value can still feel a bit tricky. We get it. Let’s walk through some of the most common questions jewelers ask, with straight-to-the-point answers that clear up any confusion about managing your TIV in insurance.

How Often Should I Update My TIV?

Think of your TIV as a living number. You need to sit down with your insurance broker for a formal review at least once a year, usually before your policy renews. But the real key? You have to speak up the moment something big changes.

Proactive communication is everything. This means picking up the phone when you:

- Land a major estate collection.

- Dramatically increase your stock for the holiday rush.

- Plan a high-value shipment that blows past your usual transit limits.

Reporting these shifts immediately keeps your coverage where it needs to be. It’s the single best way to protect yourself from a nasty underinsurance penalty if a claim hits you during one of those peak value moments.

What’s the Difference Between Replacement Cost and Actual Cash Value?

These are two very different ways of looking at value, and the one on your policy will make or break your recovery after a loss. Getting this right is fundamental to your insurance for a jewelry store.

Actual Cash Value (ACV) is what your property is worth today, after factoring in wear, tear, and age—in other words, depreciation. This is almost never the right fit for a jeweler. ACV simply won’t give you enough money to go out and buy a new piece to replace what was stolen.

Replacement Cost Value (RCV) is the money it would take to replace a lost or damaged item with a brand-new, similar one, with zero deduction for depreciation. For a jewelry business, your policy absolutely has to be based on replacement cost or an “agreed value” for unique items. Anything less, and you won’t be made whole.

Your TIV calculation has to be based on the same valuation method listed in your Jewelers Block policy. If those two don’t match, you’re setting yourself up for a serious headache when you file a claim.

Does My TIV Need to Include Jewelry on Memo?

Yes, one hundred percent. Your Jewelers Block insurance is specifically built to cover property in your “care, custody, or control.” That phrase is industry-speak for everything you’re responsible for, and it absolutely includes goods you’re holding on memo from other dealers.

If you don’t include the full value of memo goods in your TIV, you are underinsured. Period. If those pieces are stolen or damaged on your watch, you could be facing a massive coinsurance penalty and a financial hole you can’t climb out of.

Can I Save Money by Declaring a Lower TIV?

Trying to lower your premium by intentionally under-reporting your TIV is one of the riskiest gambles you can take in this business. Yes, your premium will be lower—but you’re exposing yourself to catastrophic risk.

If you have a loss, your insurer will discover the discrepancy and hit you with a coinsurance penalty. They’ll reduce your payout by the same percentage you were underinsured. If you only insured 80% of your true value, you might only get 80% of your claim paid out. A few dollars saved on a premium simply isn’t worth a potential six-figure loss that could put you out of business.

Getting TIV right is a cornerstone of a solid Jewelers Block policy, and it takes a specialist’s eye to navigate the details. The experts at First Class Insurance Jewelers Block Agency live and breathe this stuff. We’re here to help you build a policy that gives you complete, accurate protection. Get a Quote for Jewelers Block and get the peace of mind you deserve.