You’ve probably heard the rule of thumb: wedding ring insurance cost is typically between 1% and 2% of the ring's total value per year. So, for a $10,000 ring, you're looking at an annual premium of about $100 to $200.

It’s a simple formula, but let's talk about what that really means for your peace of mind.

The True Cost of Protecting Your Wedding Ring

Think about the moment you first saw that ring—it's more than just a piece of jewelry; it's a symbol of a promise. Now imagine the sinking feeling of it slipping off your finger on vacation, or a diamond coming loose without you noticing. That’s the kind of worry that insurance is designed to eliminate.

The 1% to 2% annual premium is one of the most affordable ways to protect such a meaningful, high-value asset. A stunning $10,000 ring, for example, would only cost between $100 and $200 a year to insure. It’s a small investment that provides a massive safety net.

A Quick Glance at Potential Costs

To put those numbers in perspective, let's break down the annual and monthly costs for a few common ring values. You’ll see that the premium is often less than a couple of fancy coffees or a streaming subscription each month.

Estimated Annual Wedding Ring Insurance Cost

This table gives you a quick snapshot of what you might pay based on the standard 1-2% rule.

| Appraised Ring Value | Estimated Annual Premium (1%-2%) | Estimated Monthly Cost |

|---|---|---|

| $5,000 | $50 – $100 | $4 – $8 |

| $10,000 | $100 – $200 | $8 – $17 |

| $15,000 | $150 – $300 | $12 – $25 |

| $25,000 | $250 – $500 | $21 – $42 |

As you can see, the protection is surprisingly affordable. That small yearly payment ensures that a moment of bad luck doesn't turn into a huge financial blow.

Why Specialized Insurance Matters

It might seem easier to just add your ring to your existing homeowners or renters insurance, but that approach often leaves you dangerously under-insured. Most standard policies cap jewelry coverage at a very low limit—sometimes as little as $1,500.

Worse yet, they often won't cover common scenarios like accidentally losing the ring or having a stone fall out of its setting. That’s a massive risk gap.

A dedicated jewelry insurance policy is built specifically for the risks that come with valuable, wearable items. It offers broader protection that follows you anywhere, ensuring your ring is safe whether you’re at home or traveling the world.

A specialized policy from an agency like First Class Insurance Jewelers Block Agency provides a level of security that standard policies just can't touch. For high-value pieces, the difference between a homeowners policy limit and your ring's actual worth can be thousands of dollars. We’ll dive deeper into the policy types later, but the key takeaway is this: for an irreplaceable asset, you need protection that’s built for the job. You can learn more about protecting high-value jewelry from our other expert guides.

Key Factors That Influence Your Insurance Premium

That 1% to 2% rule of thumb is a fantastic starting point, but the final price on your policy is never just a simple calculation. It’s a lot like getting a car insurance quote—the final number depends on the car you drive, where you park it at night, and your driving record. Insurers look at a similar mix of variables for your wedding ring.

Getting a handle on these factors does more than just explain your quote. It puts you in the driver's seat, showing you exactly where you have some control to lower your premium without ever sacrificing the quality of your protection.

The Foundation of Your Premium: The Ring Itself

No surprise here: the single biggest factor is the appraised value of your ring. A $25,000 ring simply represents more financial risk for the insurer than a $5,000 ring, so the premium will naturally be higher. This is why a recent, detailed appraisal from a certified gemologist isn't just a suggestion—it's a requirement.

But it’s not just about the total price tag. The little details matter, too. Certain gemstones, intricate designs, or specific metals can be more fragile or costly to repair, and that can nudge the premium up.

- Center Stone: A large, high-quality diamond is usually the main driver of the ring's value.

- Setting Complexity: A simple solitaire setting is far easier (and cheaper) to repair than a complex pavé or halo setting packed with tiny stones.

- Metal Type: The cost to repair or replace platinum is different from gold, and that gets factored into the equation.

Where You Live Matters

Your zip code has a direct and significant impact on your rate. Insurance companies rely heavily on location-based data to figure out the risk of theft. A ring that lives in a neighborhood with a high rate of property crime is almost always going to cost more to insure than the exact same ring in an area with very low crime rates.

This isn't personal; it's purely statistical. Insurers are just calculating the probability of a claim based on historical data for your specific area. While moving just to get a cheaper rate isn't practical, this factor helps explain why quotes can be so different from one city—or even one neighborhood—to the next.

Your Personal Risk Profile

Just like a driver with a history of accidents pays more for car insurance, your personal claims history can influence your jewelry insurance premium.

A clean claims history shows you're a responsible owner, which can unlock more favorable rates. On the other hand, if you've filed several claims for lost or damaged personal items in the past, an insurer might see you as a higher risk and adjust your premium upward.

This is why it pays to be careful and only file claims for truly significant losses. Your past behavior is often seen as the best predictor of future risk. A prior claim won’t necessarily stop you from getting coverage, but it might lead to a "loading"—a small percentage-based increase on your base premium.

How You Protect and Store Your Ring

This is where you can take real, tangible steps to lower your wedding ring insurance cost. Insurers love to see proactive, responsible ownership, and they often reward it with discounts.

Common ways to earn a lower rate include:

- Secure Storage: This is a big one. Storing the ring in a bank deposit box or a home safe when you're not wearing it can earn you a serious discount. It dramatically cuts down the risk of theft or loss.

- Home Security: Having a professionally monitored alarm system installed in your home directly reduces the risk of burglary.

- Your Deductible: Choosing a higher deductible—the amount you agree to pay out-of-pocket on a claim—will always lower your annual premium. It's a trade-off, though, as you'll take on more of the initial cost if something happens.

Comparing Your Options: Homeowners vs. Standalone Policies

When it comes to insuring that irreplaceable ring, you’ve got two main choices: tack it onto your existing homeowners policy, or get a dedicated, standalone jewelry policy. At first glance, the homeowners option seems easy. But honestly, comparing the two is like putting a simple screen protector up against a military-grade, waterproof case for your phone. The level of protection isn't even in the same ballpark.

Lots of people make the costly assumption that their homeowners policy already has them covered. This is a huge mistake. Standard policies are built to protect your house and the everyday stuff inside it—not high-value, portable items like jewelry. They almost always come with laughably low coverage limits, often capping jewelry protection at just $1,500.

If your ring is worth more than that—and let's face it, most are—you're underinsured from day one. A claim would only get you a tiny fraction of its real value, leaving you to foot the rest of the bill.

The Hidden Limits of Homeowners Insurance

Beyond those low caps, a standard homeowners policy is a minefield of gaps that leave your ring exposed. It’s typically designed to cover only specific "named perils," like a fire or a break-in at your house. That sounds good, but it means you have zero protection for the most common ways a ring actually gets lost.

- No "Mysterious Disappearance" Coverage: Did your ring slip off at the gym? Vanish while you were on vacation? A homeowners policy will almost certainly deny that claim. "Mysterious disappearance" is a standard exclusion.

- Sky-High Deductibles: Most homeowners policies carry a hefty deductible, often $1,000 or more. If you file a claim for a $1,500 loss, you could end up paying most of it yourself anyway, making the insurance nearly worthless for this exact purpose.

- Limited Scope: The coverage is usually tied to your home. If your ring is lost or stolen while you're traveling across the country—or the world—you're probably out of luck.

Trying to rely on a homeowners policy is a massive gamble. The small convenience just isn't worth the huge potential for financial loss and heartbreak.

The Superior Protection of a Standalone Policy

A standalone jewelry insurance policy is built from the ground up for one mission: protecting your valuable jewelry. It provides what's known as "all-risk" coverage, which is just what it sounds like. Your ring is protected against nearly any scenario you can think of—theft, damage, accidental loss, and yes, that dreaded mysterious disappearance.

A specialized policy offers agreed-value replacement. This means you and the insurer agree on the ring's value upfront (based on an appraisal). If you have to file a claim, you get the full, agreed-upon amount. No arguments, no depreciation.

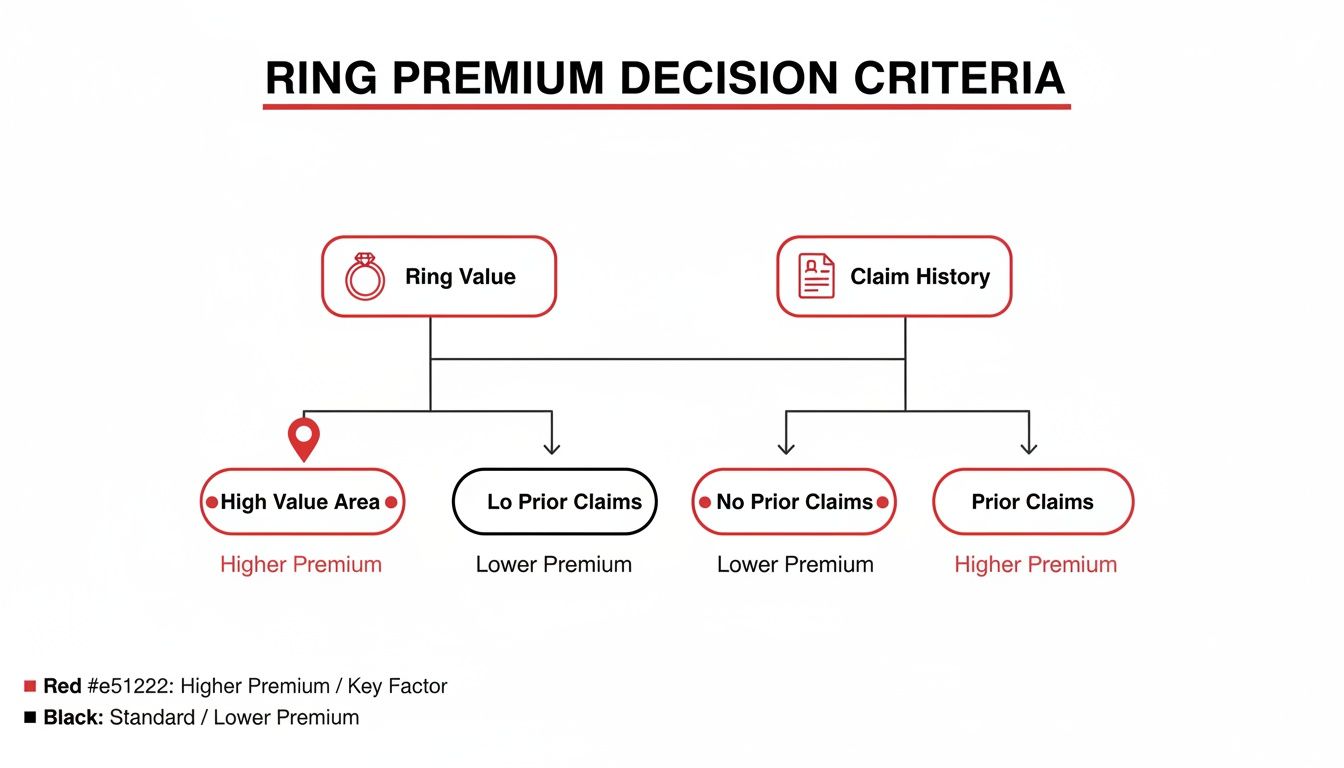

This flowchart breaks down the key decision points that influence your premium, giving you a clear picture of what insurers look at when calculating your cost.

As you can see, your ring’s value, where you live, and your past claims history are the biggest drivers of your final quote.

To help you see the differences more clearly, let's break it down side-by-side.

Policy Comparison: Homeowners vs. Standalone Jewelry Insurance

| Feature | Standard Homeowners/Renters Policy | Standalone Jewelry Insurance Policy |

|---|---|---|

| Coverage Scope | Limited to specific perils (fire, theft at home) | "All-risk" (theft, damage, loss, disappearance) |

| Coverage Limits | Very low, often $1,500 max for jewelry | Covers the full appraised value of the ring |

| Deductible | Typically high ($1,000+) | Often $0 or very low options available |

| Mysterious Disappearance | Almost never covered | Standard, comprehensive coverage |

| Claim Impact | Can raise your entire homeowners premium | Claim is separate, won't affect home insurance |

| Geographic Limits | Usually restricted to your residence | Worldwide coverage is standard |

| Replacement Type | Actual cash value (depreciated) | Agreed-value (full appraised amount) |

The table makes it crystal clear: a specialized policy is simply in a different league.

Standalone policies also win big when it comes to deductibles. This one detail can make or break the value of your insurance. Some studies have found that 64% of people with jewelry on their home policies had deductibles over $2,000, with a shocking 40% facing $5,000 or more. This is precisely why specialized insurers are the way to go; the best firms offer no-deductible options, covering the full replacement cost, anywhere in the world.

For jewelry business owners, this same level of detailed, specific protection is available for your entire inventory. Just like a standalone policy for one ring, Jewelers Block insurance is purpose-built for the unique risks of the trade. If you're a professional, you can see how First Class Insurance Jewelers Block Agency protects businesses.

Ultimately, whether you're protecting a single cherished ring or an entire store, the choice is clear: specialized coverage is the only way to get true peace of mind.

Jewelers Block Insurance: The Only Real Protection for Your Entire Business

While a newly engaged couple worries about protecting a single ring, a jewelry professional faces a world of risk that multiplies with every piece in their inventory. For jewelry store owners, designers, and wholesalers, a standard business policy is just as useless as a basic homeowner's policy is for a $20,000 engagement ring. It simply wasn't built for the high-stakes, specialized world of the jewelry trade.

That’s where Jewelers Block insurance comes in. It’s not just another line item on your expenses; it's a purpose-built fortress designed to protect every single facet of a jewelry business. This is the only kind of insurance for a jewelry business that truly understands and covers your assets and operations, safeguarding your inventory, your reputation, and your livelihood.

What Makes Insurance for a Jewelry Business So Different?

Sure, a standard business owner's policy might cover a slip-and-fall in your showroom or fire damage to your building. But it leaves gaping holes big enough to drive an armored truck through when it comes to the real risks you face every day.

Think about these all-too-common scenarios that would get a flat-out "denied" from a typical insurer:

- A smash-and-grab where thieves are in and out in seconds.

- A shipment of diamonds that vanishes while in transit to a client.

- Mysterious disappearance when a high-value piece is simply gone during inventory, with no signs of a break-in.

- A customer’s heirloom getting damaged or stolen while in your care for a simple repair.

These aren’t outlier events; they are the everyday realities and biggest fears for anyone running an insurance for jewelry business operation. Jewelers Block insurance is structured specifically to cover these exact situations, providing a safety net where other policies are full of holes.

The Core Protections of a Jewelers Block Policy

The real power of Jewelers Block insurance is that it’s all-encompassing. It wraps multiple, essential coverages into one seamless policy that follows your inventory from the moment you acquire it to the moment it’s sold.

This specialized coverage is designed to protect your stock whether it's locked in a vault, sitting in a showcase, traveling with a salesperson, or being worked on at the bench. It even covers "care, custody, and control," protecting you if a customer's jewelry is lost or damaged while you're responsible for it.

This is the kind of protection that builds client trust and keeps your business financially stable. As you work to improve your jewellery business, a solid Jewelers Block policy is the foundation of your entire security strategy.

Finding the Right Protection for Your Operation

Just like an individual needs a policy tailored to their ring's value, a jewelry business needs coverage built around its unique operational risks. A wholesale diamond dealer who ships globally has completely different needs than a retail storefront or a custom designer working from a private studio.

This is exactly why you need to work with a specialist. An expert like First Class Insurance Jewelers Block Agency lives and breathes this industry. They know the difference between a retailer’s needs and a manufacturer’s risks, and they can build a policy that reflects your specific business model—from your vault specifications to your shipping protocols. When you need to get a quote for Jewelers Block, an experienced agent will ask the right questions to build the most effective and efficient coverage plan.

Getting an Accurate Quote and Saving on Your Premiums

Getting a fair and accurate insurance quote isn't about jumping through hoops; it's about giving the insurer a crystal-clear picture of what they're protecting. When you provide solid documentation and show you’re serious about security, you empower them to give you their best rate.

It all starts with one essential document: a professional appraisal.

The Appraisal: Your Policy's Foundation

Think of an appraisal as the blueprint for your insurance policy. It's the official document that tells an insurer exactly what your ring is worth, and without it, they're just guessing. A guess is not something you want to build your financial protection on.

A legitimate appraisal has to be done by a certified gemologist. It needs to be incredibly detailed, spelling out the "4 Cs" (cut, color, clarity, carat) of the main stone, the type and weight of the metal, and any special features or side stones. High-quality photos are also a huge help in documenting the piece, and using professional tools like product jewelry macro presets can ensure every detail is captured perfectly.

Crucial Tip: Get your ring reappraised every couple of years. The market for gems and precious metals is always shifting. An old appraisal could leave you dangerously underinsured if you ever need to make a claim.

Real-World Strategies to Lower Your Insurance Bill

Once that appraisal is in hand, you can start looking for ways to bring down your annual premium. At its core, insurance is a game of risk. The more you do to minimize that risk, the more an insurer will reward you with a lower price.

These aren't complicated tricks—just common-sense steps that can lead to real savings.

1. Raise Your Deductible

This is the fastest way to see a drop in your premium. Your deductible is what you agree to pay out-of-pocket before the insurance money kicks in. Moving from a $0 deductible to $500 or even $1,000 will immediately lower your yearly cost.

Just remember, you're making a trade-off: a lower annual payment in exchange for a higher one-time cost if you ever need to file a claim. Make sure it's a number you're comfortable with.

2. Show Off Your Security

Insurers breathe a sigh of relief when they see you've taken extra steps to protect your ring. Proving your ring is secure when it's not on your finger can unlock some nice discounts.

- A Home Safe: A good-quality, fire-rated safe that’s bolted to the floor is a major plus in an insurer's eyes.

- A Bank Vault: For maximum security (and the biggest potential discount), storing your ring in a bank's safe deposit box is the gold standard.

- A Home Alarm: If you have a monitored alarm system that automatically calls the police during a break-in, that directly cuts the risk of theft and your premium.

3. Bundle Your Policies

Don't be afraid to ask about multi-policy discounts. If you're looking at a standalone jewelry policy, see if that same company can handle your homeowners or auto insurance. Insurers love keeping business under one roof and will often give you a discount across all your policies for it.

4. Keep a Clean Claims History

This one is simple: your track record matters. An insurance history with no claims tells a provider that you're a responsible owner who takes good care of your valuables. That "good behavior" translates directly into a lower risk profile, which is often rewarded with better rates.

Why Investing in Jewelry Protection Matters More Than Ever

Deciding to insure a wedding ring—or the entire inventory of a jewelry business—isn't just about managing risk. It’s about acknowledging an asset’s true worth. After digging into the details of premiums and policy types, one thing becomes crystal clear: protection isn't an afterthought. It's a fundamental strategy for guarding both your financial investment and your sentimental treasures.

This isn't some niche concern, either. It’s a fast-moving global trend. The wedding ring insurance market is blowing up, with the global engagement ring insurance sector projected to jump from $1.6 billion to $3.2 billion by 2032. That’s a staggering 9.05% CAGR. This boom tells us one thing: people everywhere are waking up to the fact that their standard homeowners policy, which often caps jewelry coverage at a measly $1,500, just doesn't cut it. You can learn more about this major market shift and what it means for you.

What This Means for You and Your Business

This growth is fantastic news for anyone looking for coverage. As more people seek out specialized policies, the increased competition forces insurers to innovate. The result? Better policy options, sharper pricing, and more polished service for everyone, from individual ring owners to large-scale jewelry businesses.

The core ideas we’ve covered apply whether you have one ring or a thousand.

- For Individuals: Protecting a family heirloom or a brand-new engagement ring with a standalone policy means you’re covered for its full value against real-world risks like theft, accidental loss, or damage—exactly the kinds of things your basic insurance will leave you high and dry on.

- For Businesses: For a jewelry store, there's no substitute. Jewelers Block insurance is the only real way to protect your assets from the unique threats of the trade, like mysterious disappearance or a loss during shipping. This kind of specialized jewelry store insurance keeps your entire operation secure.

Whether you're safeguarding one priceless ring or an inventory worth millions, the lesson is the same: specialized risks demand specialized protection. Relying on generic coverage leaves dangerous gaps that can lead to devastating financial and emotional loss.

Ultimately, choosing the right insurance is a commitment to your own peace of mind. It’s knowing that no matter what happens, the value of what’s most precious to you is protected. Don't leave your security up to chance. To truly safeguard your investments, talk to experts who live and breathe the unique risks of the jewelry world. You can get a quote for Jewelers Block today and make sure your business is truly covered.

Answering Your Top Questions About Wedding Ring Insurance

When you're looking into protecting a precious ring—or an entire store's worth of them—you're bound to have some questions. Let's clear up some of the most common ones so you can feel confident about your coverage.

Does Insurance Cover a Lost Stone From My Ring?

Yes, a good standalone jewelry policy absolutely should. A stone falling out of its setting is one of the most common (and heartbreaking) ways a ring gets damaged. This is exactly the kind of real-world accident that a dedicated jewelry policy is designed for, whereas a standard homeowners policy will often leave you out in the cold.

How Often Should I Get My Ring Reappraised?

Think of getting your ring reappraised every two to three years. The market for diamonds, gold, and platinum is always shifting. If your appraisal is five years old, you could be seriously underinsured, and a claim might not cover what it actually costs to replace your ring today.

Keeping your appraisal up-to-date is probably the single most important thing you can do to ensure your wedding ring insurance cost is accurate and your protection is solid.

Your current appraisal is the foundation of your entire policy. It’s the proof that ensures you get compensated for your ring's true replacement value, not what it was worth back when you bought it.

What Is the Process for Filing a Claim?

Filing a claim is usually pretty straightforward. The first step is always to contact your insurance provider to report what happened, whether it was lost, stolen, or damaged. If it was stolen, you'll need to provide a police report number.

From there, you’ll submit your proof of ownership—that’s your original receipt and detailed appraisal. Your insurer will then walk you through the next steps, which typically involve going to a jeweler of your choice to get the piece repaired or replaced, up to the value stated in your policy.

Is Jewelers Block Insurance Really Necessary for My Business?

For a jewelry store? It's not just necessary; it's the only thing that makes sense. Trying to protect a jewelry business with a standard business owner's policy is like trying to guard a vault with a bicycle lock. It simply won't cover the unique, high-stakes risks you face every single day.

What about a mysterious disappearance from your inventory? Theft while a piece is in transit? Or damage to a customer's heirloom that was in your care? A standard policy won't touch those.

Jewelers Block insurance is the only coverage actually built to shield a jewelry business from these threats. The right insurance for a jewelry store is non-negotiable for protecting your assets and your reputation. A specialist broker like First Class Insurance Jewelers Block Agency can build a policy that fits your operation perfectly, whether you're a retailer, wholesaler, or private designer.

Having insurance isn't enough; you need the right insurance. For protection that understands the unique risks of the jewelry world, you need an expert. Contact First Class Insurance today to get a quote for Jewelers Block and get true peace of mind for your business.