At its core, commercial insurance coverage is a financial backstop. It’s built to protect your business from the kinds of everyday risks that can shut a company down for good—accidents, theft, fire, and property damage. Think of it as a shield against a catastrophic loss, making sure one bad day doesn’t erase years of hard work.

But for a business built on high-value, portable assets like jewelry, this protection isn't just a good idea. It's the only way to operate safely.

Your Business Is Not a Standard Business

Let’s be clear: the risks facing a jeweler are worlds apart from those facing a typical retail store. You wouldn't hire a general contractor to repair a Patek Philippe, would you? The same logic applies to your insurance. A standard business owner's policy (BOP) is a blunt instrument, designed for common risks, not the highly specific threats you face every day.

Your dangers aren't just a customer slipping on a wet floor. They involve sophisticated criminals targeting high-value, easily concealed inventory. A generic policy might cover your display cases if they’re damaged in a fire, but it’s likely to fall short when a thief walks out with a tray of engagement rings. This is why you need a policy built by people who understand the unique perils of the jewelry business.

Specialized Protection Is the Only Option

Business owners are increasingly recognizing that one-size-fits-all coverage just doesn't cut it. From 2018 through 2023, premiums in the commercial insurance sector grew by an average of 8 percent annually, a trend confirmed by McKinsey's global report on the industry. This proves that smart businesses are seeking out targeted risk management.

For jewelers, this isn’t a trend; it’s a necessity.

The greatest risk for a jeweler is not a lack of insurance, but the wrong kind of insurance. A policy that doesn’t understand the nuances of your inventory—from loose stones to pieces on consignment—is a liability in itself.

This is precisely why Jewelers Block insurance was created. It's not a standard policy with a few add-ons; it’s a purpose-built package that bundles all the critical coverages a jeweler needs into one seamless plan. It’s designed to handle everything from a smash-and-grab robbery to mysterious disappearance and damage during transit.

To really see the difference, let’s compare a standard policy to specialized coverage.

General Business Insurance vs. Specialized Jeweler Coverage

Relying on a generic commercial policy for a jewelry business is like using a standard safe to protect millions in diamonds—it creates dangerous, high-stakes gaps. This table breaks down exactly where those gaps lie.

| Coverage Area | Standard Commercial Policy | Specialized Jewelers Insurance (e.g., Jewelers Block) |

|---|---|---|

| Inventory Protection | Often limited to on-premises theft with low value caps. | Covers inventory on-premises, in transit, at trade shows, and out with sales staff. |

| Mysterious Disappearance | Typically excluded, meaning unexplained losses are not covered. | Includes coverage for inventory that vanishes without evidence of theft. |

| Customer Property | Limited or no coverage for items left for repair or appraisal. | Explicitly covers customers' jewelry while in your care, custody, and control. |

| Transit & Shipping | Requires a separate, often expensive, inland marine policy. | Integrated coverage for shipping and transport is a core feature of the policy. |

As you can see, a standard policy leaves you exposed right where you’re most vulnerable. True security only comes from a policy designed by experts who live and breathe your industry.

Working with a specialist like First Class Insurance Jewelers Block Agency is the crucial next step. You can get a quote for Jewelers Block to see how coverage built for your world can properly safeguard your business and your assets.

The Core Policies That Protect Your Jewelry Business

To really get a handle on commercial insurance, you have to look at the specific policies that act as shields for your jewelry business. These aren't just abstract ideas; they're the practical tools that defend your assets against very real threats. For jewelers, the conversation always starts with the industry's single most important protection.

The heart of any smart insurance strategy for a jewelry store is Jewelers Block insurance. Think of it less as a single policy and more as a master key designed for your business—one that unlocks a whole suite of coverages bundled together. It’s an "all-risk" policy, which means it covers pretty much everything except for a few specific exclusions. That creates a broad, powerful safety net for your most valuable assets.

This all-in-one approach is so much better than trying to piece together separate policies, which almost always leaves dangerous gaps in your coverage. Jewelers Block is the cornerstone because it was built from the ground up by people who understand how a jewelry business actually works.

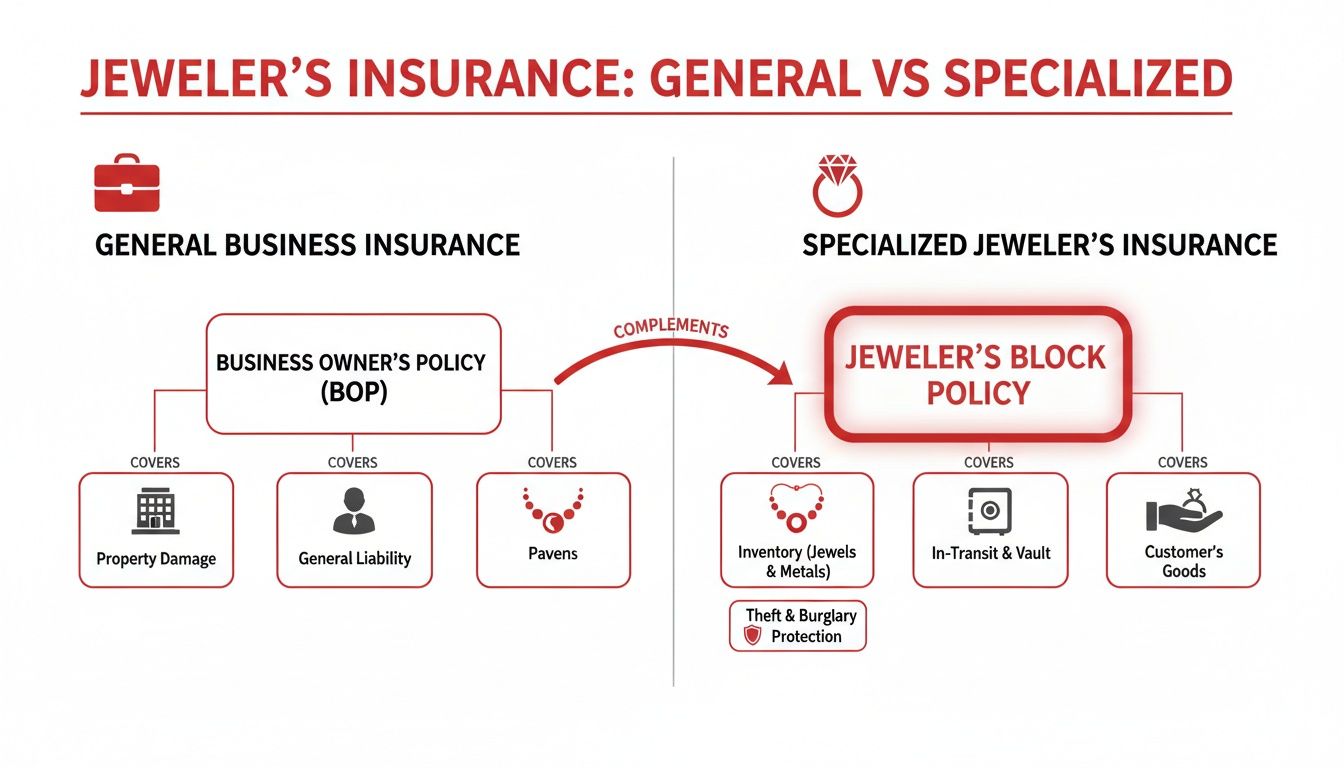

This flowchart breaks down the key differences between a standard business policy and the specialized protection a jeweler truly needs.

As you can see, a general policy is fine for common business risks, but a specialized policy like Jewelers Block zeroes in on the high-stakes threats that are unique to our trade.

Commercial General Liability

While your inventory is obviously the main event, your business faces other risks every single day. That's where Commercial General Liability (CGL) comes in. It protects you from claims of bodily injury or property damage that happen on your premises.

Picture this: a customer is admiring a ring in your showroom, slips on a freshly mopped floor, and fractures their wrist. Without CGL, the medical bills and a potential lawsuit would land squarely on you. This policy handles the legal defense costs and any settlement, protecting your financial stability.

Commercial Property Insurance

What about the physical structure of your store and everything in it that isn't for sale? Commercial Property insurance is the policy that protects your brick-and-mortar location. It covers damage to the building you own or lease, along with your business property inside, from disasters like fire, storms, or vandalism.

This isn't just the walls and roof. It covers the essential equipment you need to operate, such as:

- Display cases and custom cabinetry

- Computers and POS systems

- Jeweler's tools and benches

- Office furniture and lighting fixtures

A fire could destroy not just your store but the very tools you need to do business. This policy gives you the funds to rebuild and replace those vital assets.

Your business is an entire ecosystem. While Jewelers Block protects your precious inventory, Commercial Property insurance protects the habitat where your business lives and breathes.

Inland Marine for Assets in Motion

Your jewelry is rarely sitting still. It moves between your vault, display cases, repair shops, appraisers, and even to clients. The moment your inventory leaves your shop, it enters a high-risk zone where standard property policies no longer apply.

This is where Inland Marine coverage is absolutely critical. Often baked right into a Jewelers Block policy, it protects your property once it’s out the door. Whether you're shipping a custom diamond ring across the country or a salesperson is traveling with a collection to a trade show, this coverage ensures your assets are protected every step of the way. You can see examples of the kinds of high-value pieces that need this vital protection in our gallery of beautifully crafted rings.

Crime and Mysterious Disappearance

Finally, we have to talk about two of the biggest threats to any jewelry business: crime and unexplained loss. Any comprehensive insurance plan has to tackle these head-on.

Crime insurance is built specifically to cover losses from criminal acts like robbery, burglary, and employee theft. For instance, if you discover an employee has been pocketing small items from inventory over several months, this policy would help you recover those financial losses.

Mysterious Disappearance is a unique but essential coverage for jewelers. It kicks in when an item vanishes without any clear evidence of what happened. If a ring is in the case during your morning count but is gone by closing with no sign of theft or a clear explanation, this coverage can be the difference between eating a major loss and being made whole.

How Your Jewelers Block Policy Actually Works

Having an insurance policy is one thing. Truly understanding how it will protect you when you need it most is something else entirely. While the policy document itself can feel dense, the core mechanics are actually quite straightforward once you cut through the jargon.

Think of your Jewelers Block policy less as a legal document and more as the financial blueprint for your business's security. Let’s break down the essential pieces that decide how, when, and how much your policy pays if you ever have a loss.

Understanding Your Policy Limits

The easiest concept to get your head around is the policy limit. Picture your high-security vault—it has a maximum capacity. It can only hold and protect a specific value of inventory. Your policy limit works the exact same way for your entire business.

It’s the absolute maximum dollar amount your insurer will pay for a covered loss. If your limit is $2 million, that’s the total value your insurance can protect. It’s absolutely critical that this limit reflects the full, current value of your inventory and other assets, or you risk being dangerously underinsured.

The Role of Your Deductible

Next up is the deductible. This is simply the amount you agree to pay out-of-pocket before your insurance kicks in. Think of it as your initial stake in the claim. If you have a $5,000 deductible and suffer a $50,000 covered theft, you pay the first $5,000, and your insurer handles the remaining $45,000.

A higher deductible usually means a lower premium, since you're taking on more of the initial risk yourself. The key is to pick a deductible your business can comfortably afford to pay at a moment's notice.

You can also customize your policy with add-ons, known as endorsements, to plug specific gaps. For instance, you might add an endorsement for extra coverage at trade shows or for high-value items you frequently ship. These are like custom upgrades that fortify your standard protection against the unique risks your business faces.

Valuation: The Financial Heart of Your Policy

This is it—the single most critical part of your policy. The valuation clause dictates how your insurer will calculate the value of your lost or damaged property. The method used can make a massive difference in how much money you receive in a claim.

-

Actual Cash Value (ACV): This pays for the replacement cost of an item minus depreciation. Since fine jewelry and materials often appreciate in value, ACV is almost always a bad fit for a jewelry business. It can leave you seriously short-changed.

-

Replacement Cost Value (RCV): This covers what it would cost to replace a lost or damaged item with a similar new one at today's market prices, with no deduction for depreciation. This is a much stronger level of protection for a business whose inventory costs can fluctuate.

-

Agreed Value: For unique, high-value pieces, this is often the gold standard. You and the insurer agree on the value of specific items before the policy is written. If a covered loss happens, the insurer pays that pre-agreed amount—no arguments, no last-minute appraisals. This is absolutely essential for things like one-of-a-kind watches and bespoke jewelry.

The financial difference between these valuation methods isn't just a few dollars. It can be huge.

How Valuation Method Affects Your Payout

Let's say a high-end watch is stolen from your inventory. You originally paid $18,000 for it, but its current market value is $20,000. The table below shows just how different your insurance payout would be based on your policy's valuation clause.

| Valuation Method | How It's Calculated | Example Payout for Stolen Watch (Valued at $20,000) |

|---|---|---|

| Actual Cash Value (ACV) | Replacement cost minus depreciation. | $16,500 (Assumes depreciation, paying less than its worth) |

| Replacement Cost (RCV) | The full cost to buy an identical new watch today. | $20,000 (Covers the full current market cost to replace it) |

| Agreed Value | The value you and the insurer agreed upon beforehand. | $20,000 (Pays the pre-determined value with no negotiation) |

As you can see, the right valuation clause is what ensures you actually have the funds to make your business whole again. It's what protects your bottom line. Working with an expert who understands this, like the specialists at an agency like First Class Insurance Jewelers Block Agency, makes sure your policy is built to truly protect what you've worked so hard to build.

Choosing the Right Insurance for Your Jewelry Store

Finding the right insurance for your jewelry business isn’t just about ticking a box on a to-do list—it's about forging a partnership with a provider who genuinely gets your world. The process has to start with a clear-eyed look at your unique vulnerabilities. Securing the best jewelry store insurance means getting way more specific than a generic checklist and building a risk profile that’s as detailed as a GIA certificate.

A thorough risk assessment is the bedrock of any solid policy. You need to catalog every potential threat, from the total value of your inventory during the holiday rush down to the specific security measures protecting your storefront. How often do you transport high-value pieces? What are the risks involved with every single shipment or private client viewing outside your store?

This detailed evaluation is the essential first step toward getting the right insurance for a jewelry store. Without it, you're flying blind, hoping your coverage matches what you actually need.

Honesty Is the Best Policy

When you apply for coverage, complete transparency isn't just a suggestion—it’s non-negotiable. It can be tempting to downplay certain risks to chase a lower premium, but that strategy almost always backfires. Insurers write their policies based on the information you give them; any inaccuracies or omissions can give them grounds to deny a claim right when you need that protection the most.

Think of your application as a pact of good faith. Being upfront about your security systems, inventory controls, and day-to-day procedures builds a strong foundation with your insurer. This honesty makes sure your policy is built to respond to your real-world risks, preventing the kind of devastating coverage gaps that can sink a business.

The most expensive insurance policy is one that fails to pay out a claim. Full transparency during the application process is your best defense against claim denial and ensures the protection you pay for is the protection you actually get.

Why a Specialist Broker Is a Jeweler's Best Asset

You wouldn't ask a general family doctor to perform a delicate heart surgery, and the same logic applies to your insurance broker. A generalist agent might understand basic business insurance, but they lack the deep, nuanced knowledge required for the jewelry trade. They just don't speak your language.

This is where partnering with a dedicated agency like First Class Insurance Jewelers Block Agency becomes one of your most important business decisions. A specialized broker lives and breathes the intricacies of Jewelers Block insurance. They have direct access to underwriters who focus specifically on the jewelry industry, like the iconic Lloyd's of London.

Right now, the global commercial insurance market is a buyer-friendly environment, and strong competition is leading to broader coverage options. However, this market makes a sharp distinction between well-managed, lower-risk jewelers and those with higher risk profiles. For preferred businesses, this means better terms and pricing are on the table, a trend highlighted in a recent global insurance market overview by Aon. A specialist broker knows exactly how to position your business as a "preferred risk" to lock in these advantages.

They translate your unique operational details into a compelling story for underwriters, ensuring you get the best possible terms. When you are ready to Get a Quote for Jewelers Block, a specialist makes the whole process smoother, more efficient, and ultimately, far more effective—giving you the peace of mind that your life's work is properly protected.

How Proactive Risk Management Can Lower Your Premiums

The best insurance claim is the one you never have to file. While your commercial insurance coverage is the ultimate safety net, proactive risk management is your best offense. It’s all about shifting your mindset from just reacting to losses to actively preventing them from ever happening.

This is a strategy that underwriters absolutely notice, and they reward it with better terms and lower premiums on your Jewelers Block insurance. Taking these steps shows an insurer that you're a serious, low-risk partner, not a liability waiting to happen.

Strengthening Your Physical Security

Your first line of defense is always your physical location. When an underwriter evaluates your application for insurance for a jewelry store, the quality of your physical security is one of the first things they look at. It's a direct indicator of your risk level—weak security means higher premiums, but robust, layered measures can lead to significant savings.

Insurers want to see that you've made your business a hard target for criminals. Key elements they look for include:

- UL-Rated Safes: This is completely non-negotiable. Insurers will often mandate a specific UL rating based on your inventory value, like a TRTL-30×6, which signifies serious protection against both torch and tool attacks.

- Advanced Alarm Systems: Your system needs to be comprehensive, with motion detectors, glass-break sensors, and a cellular backup. Crucially, it must be monitored 24/7 by a UL-certified central station.

- High-Security Locks: Medeco or similar high-security locks on every single entry point are a must to prevent easy picking or bumping.

- HD Surveillance Cameras: High-definition cameras covering all entrances, exits, and showroom areas act as both a powerful deterrent and an essential investigative tool if something does go wrong.

These physical upgrades are true investments. They pay for themselves not just by preventing devastating losses, but also through direct reductions in your premiums. For any jewelry store, implementing the top loss prevention strategies for retail businesses is a fundamental part of a risk management plan that insurers want to see.

Implementing Airtight Operational Protocols

Beyond the hardware, what you and your team do every single day is just as critical. Insurers scrutinize your operational protocols to see how you manage risk from the inside. Inconsistent or sloppy procedures are massive red flags that can send the cost of your insurance for jewelry business soaring.

The most secure safe in the world is useless if an employee forgets to lock it. Your operational protocols are the human element of your security system, and they must be flawless.

Essential protocols that underwriters look for include:

- Strict Inventory Management: You need a rigorous, documented system for tracking every single piece from the moment it enters your possession to the moment it's sold. Daily and weekly counts are crucial for spotting discrepancies right away.

- Secure Opening and Closing Procedures: Always require at least two employees to be present during opening and closing. These procedures need to be written down and followed to the letter, every single day, without exception.

- Thorough Employee Screening: Run comprehensive background checks on all potential hires. This should include criminal and credit history to protect your business from the significant risk of internal theft.

These proactive measures demonstrate to underwriters that you run a tight ship, making you a much more attractive risk. This is especially important right now. While global commercial insurance rates recently fell by 4% after seven straight years of increases, insurers are getting more selective. They're saving the best pricing for clients who can prove they have superior risk management in place.

By fortifying both your physical and operational security, you take control of your risk profile. This proactive stance doesn't just safeguard your assets—it puts you in a much stronger position when it's time to Get a Quote for Jewelers Block from a specialist like First Class Insurance Jewelers Block Agency.

It's Time to Secure Your Business with the Right Coverage

You've poured years of passion, expertise, and a whole lot of capital into building your jewelry business. The last thing you want is to see it all vanish because of a risk you didn't account for. Understanding the fine print of your insurance policy isn't just a box to check—it's the critical first step in protecting your legacy.

This means moving beyond generic, one-size-fits-all policies. The standard business insurance just doesn't cut it. You need specialized protection built for the unique world you operate in, one where your assets are small, valuable, and highly portable.

The only real path forward is with Jewelers Block insurance. This isn't just another policy; it's a solution crafted specifically for the high-stakes risks you navigate every single day. To get the right insurance for a jewelry store, you need a partner who speaks your language and gets the day-to-day realities of your business. That relationship between you and your agent is what makes sure your needs are actually met and there are no surprises down the line.

Take the Next Step with Confidence

Getting the right protection doesn't have to be complicated. We recommend connecting with the specialists at First Class Insurance Jewelers Block Agency for a personalized risk assessment. They'll help you cut through the complexities of insurance for jewelry business and make sure your coverage is truly airtight.

Don't leave your life's work exposed for another minute. Taking a proactive step to protect what you've built gives you the peace of mind that comes from knowing you're covered, no matter what happens. Get a Quote for Jewelers Block and see how the right partnership can make all the difference. Think of it less as buying a policy and more as investing in the long-term stability of your business.

Answering Your Top Questions About Jewelers Insurance

Figuring out the right insurance for a jewelry business brings up a lot of questions. It's a high-stakes industry, after all. Let's walk through some of the most common ones we hear from jewelers just like you.

What Is the Most Important Coverage for a Jewelry Business?

Without question, it's Jewelers Block insurance. This isn't your standard, off-the-shelf business policy. It’s built from the ground up for the specific dangers jewelers face every day.

A Jewelers Block policy bundles all your critical protections into one package: inventory in your store, pieces you're shipping, items at a trade show, and even jewelry with your traveling salespeople. Most importantly, it covers unique risks like mysterious disappearance that generic policies simply won’t touch.

How Is My Inventory Valued in a Claim?

This is a critical detail that dictates how much you get paid after a loss. Most policies use one of two methods: Replacement Cost (what it would cost to buy a similar new item today) or Agreed Value (a fixed price you and the insurer agree on when you buy the policy).

Make sure you know which one you have. Getting this wrong can mean being seriously underfunded when you need the money most.

Does Jewelers Block Cover Items Left for Repair?

Yes, a solid Jewelers Block policy will absolutely cover customers' property that is in your care, custody, and control. This isn't just a financial safeguard; it's a reputation-saver.

If a customer's family heirloom is stolen from your shop while you're repairing it, this coverage is what makes things right. It helps you restore their property and, just as importantly, their trust in your business.

Having the right insurance for a jewelry business means protecting more than just your own stock; it means safeguarding the trust and property of your clients. This is a core component that distinguishes specialized jeweler policies from general ones.

Will My Premium Go Down if I Improve My Security?

Absolutely. Insurers are all about risk, and every security upgrade you make proves you're serious about protecting your inventory. That makes you a lower risk, which directly translates to lower premiums.

Here are some of the key upgrades that can lead to real savings:

- Installing a higher-rated, UL-certified safe (like a TRTL-30×6).

- Upgrading to a multi-layered alarm system with central station monitoring.

- Implementing strict, documented opening and closing procedures that require multiple employees.

- Keeping a meticulous, real-time inventory management system.

For more general questions that apply across different types of policies, this list of general insurance FAQs is a helpful resource.

Can I Get Coverage for My Jewelry at a Trade Show?

Yes, but you need to be proactive about it. Most Jewelers Block policies extend coverage for inventory when you're traveling or exhibiting at shows, but there are often specific limits and security protocols you have to follow.

Always let your agent know your travel and show schedule well in advance. This ensures your coverage is active and high enough for the value of the goods you're carrying. Assuming you're covered without confirming it first is a recipe for a denied claim.

Protecting your life's work requires a partnership with experts who understand your industry inside and out. The specialists at First Class Insurance Jewelers Block Agency can help you secure the right coverage for your unique needs. Get a Quote for Jewelers Block and gain the peace of mind that comes with proper protection.