At its core, general liability insurance is the policy that protects your jewelry business from claims involving bodily injury, property damage, and personal injury to others. It’s absolutely essential for any business that has a physical location or interacts with the public, but let’s be crystal clear on one thing: it does not cover your precious inventory.

The Welcome Mat for Your Jewelry Business

Think of general liability insurance as the welcome mat at your front door. Its entire job is to handle mishaps that happen to visitors—like a customer, a vendor, or even a delivery driver—the moment they step onto your property. It's your first line of defense against the everyday risks that come with running a business where people come and go.

But it’s so important to understand the limits of that welcome mat. It protects the entrance, but it does absolutely nothing to guard the high-value assets inside your showroom. This policy isn’t designed to protect your diamonds, watches, or loose stones. For that, you need a specialized policy like Jewelers Block insurance.

Core Pillars of Protection

When you boil it down, general liability insurance for a jeweler stands on three main pillars. Getting a handle on these makes it obvious what this policy is for—and what it’s not.

- Bodily Injury: This is the classic slip-and-fall scenario. If a customer trips over a rug in your showroom and gets hurt, this covers their medical bills and your legal defense.

- Property Damage: This kicks in if you or an employee accidentally damage someone else’s property. Say, you’re helping a client try on a bracelet and scratch the crystal on their expensive watch—this is what would respond.

- Personal and Advertising Injury: This is less about physical damage and more about reputational harm. It protects you against claims of slander, libel, or copyright infringement if, for example, your new marketing campaign accidentally uses an image you didn't have the rights to.

This foundational shield is non-negotiable for any jewelry store. It addresses public-facing risks, from a simple trip-and-fall to a complex advertising lawsuit, ensuring a single incident doesn't jeopardize your entire business.

To make this even clearer, let's break down how general liability coverage applies (and doesn't apply) in a typical jewelry store setting.

General Liability At a Glance What It Covers for Jewelers

This table shows exactly where a standard general liability policy helps and where it falls short, highlighting why specialized coverage is so critical for jewelers.

| Coverage Type | What It Protects Against | Jewelry Store Example | Typically Not Covered |

|---|---|---|---|

| Bodily Injury | Medical costs and legal fees from third-party injuries on your premises. | A customer slips on a wet floor and breaks their wrist, leading to a lawsuit. | Employee injuries (this is covered by Workers' Comp). |

| Property Damage | Costs to repair or replace a third party's property that you damage. | An employee accidentally knocks over and shatters a customer's expensive smartphone. | Damage to your own property, inventory, or building. |

| Personal & Advertising Injury | Legal defense and damages from claims like libel, slander, or copyright infringement. | You run a print ad that mistakenly uses a competitor's slogan, and they sue. | Intentional acts of misrepresentation or fraud. |

| Products & Completed Operations | Liability claims arising after a customer has purchased your product. | A clasp on a necklace you sold is defective and causes a severe allergic reaction. | The cost to recall or replace your own faulty products. |

While this policy is great for managing your public-facing liabilities, true security for a jeweler demands a more layered approach. You can learn more about protecting your actual high-value assets in our guide on diamond and jewelry insurance. Later, we’ll put this policy head-to-head with a Jewelers Block policy to show you the difference.

The Three Pillars of General Liability Coverage Explained

So, what is general liability insurance, really? Think of it less like a complicated legal document and more like a three-part shield defending your business. Each part is designed to protect you from a different, very common, and potentially devastating risk.

Let's break down this policy language into real-world scenarios that any jeweler could easily face. At its core, this coverage is all about handling claims from outsiders—your customers, your landlord, or just a member of the public—so that one accident doesn't bring your entire operation to a halt.

Bodily Injury Liability

This is the one most people think of first. It’s straightforward: if someone gets physically hurt on your property or because of something your business did, this coverage is designed to handle the fallout. That means covering medical bills, legal defense costs, and any settlements that might arise.

Imagine a rainy Tuesday. A customer hurries into your store to get out of the downpour and doesn't see a small puddle by the door from another person's umbrella. They slip, fall, and fracture their wrist. This is exactly what bodily injury liability is for. It steps in to manage the medical bills and any legal action that follows, so you aren't paying for it all out of your own pocket.

Property Damage Liability

This second pillar kicks in when you or your business accidentally damage something that belongs to someone else. For a jeweler, this risk is everywhere—during repairs, appraisals, or even just a simple consultation. It’s all about protecting the value of what your customers entrust to you.

Here's a classic example: a client brings in a cherished family heirloom, an antique watch, for a quick battery change. While it's on your workbench, your hand slips, and a tool leaves a deep scratch across the crystal. Property damage liability is there to cover the cost of repairing or replacing that watch, saving both your reputation and your bank account.

These first two pillars are the absolute bedrock of protection for any business with a physical location. That includes defending against specific issues like those in product liability lawsuits, which can pop up if a product you designed or sold ends up causing harm.

Personal and Advertising Injury

The final pillar is less about physical damage and more about protecting your reputation and how you market your business. It’s your defense against claims like slander, libel, copyright infringement, or even accusations that you ripped off an advertising idea.

Let's say you launch a new ad campaign on social media for your latest collection. To your surprise, a competitor across town sues you, claiming your new slogan is almost identical to theirs and that you stole their concept. This is where personal and advertising injury coverage activates. It funds your legal defense and handles potential settlements for this kind of non-physical harm. Together, these three parts form the essential shield every jewelry business needs.

Why General Liability Alone Is Not Enough for Jewelers

Relying solely on general liability insurance to protect your jewelry business is a dangerous and expensive mistake. It leaves your most valuable assets—your inventory—completely exposed. A standard general liability policy is essential, but understanding what is general liability insurance also means understanding its strict limitations.

Think of it this way: general liability is like the security guard at your front door. Their job is to manage public interactions and prevent incidents involving visitors, like a slip-and-fall. But that guard has no key to the vault where your diamonds, gold, and client pieces are stored. For that, you need a different, specialized form of protection.

The Major Gaps in Coverage

General liability is exclusively for third-party claims. This means it only responds when your business is accused of causing harm to someone else or their property. It does nothing to protect your own business assets, which is where the real value lies for a jeweler.

Here are the high-stakes risks that a general liability policy will not cover:

- Theft: If a burglar breaks in overnight and clears out your display cases, general liability offers zero coverage for your stolen inventory.

- Mysterious Disappearance: If a diamond ring vanishes from your safe without any sign of forced entry, that loss is not covered.

- Damage in Transit: If you ship a high-value piece to a client and it gets damaged or lost by the courier, general liability will not pay to replace it.

- Customer's Property in Your Care: You’re repairing a client's watch and it’s stolen from your workshop. Your general liability policy will not cover their loss.

- Employee Dishonesty: A trusted employee is caught stealing pieces over several months. This is considered an internal matter, not a third-party liability claim.

These scenarios represent millions in potential losses for a jewelry business, and they all fall outside the scope of general liability. This policy is fundamental for public-facing risks but completely inadequate for protecting the core of your operation.

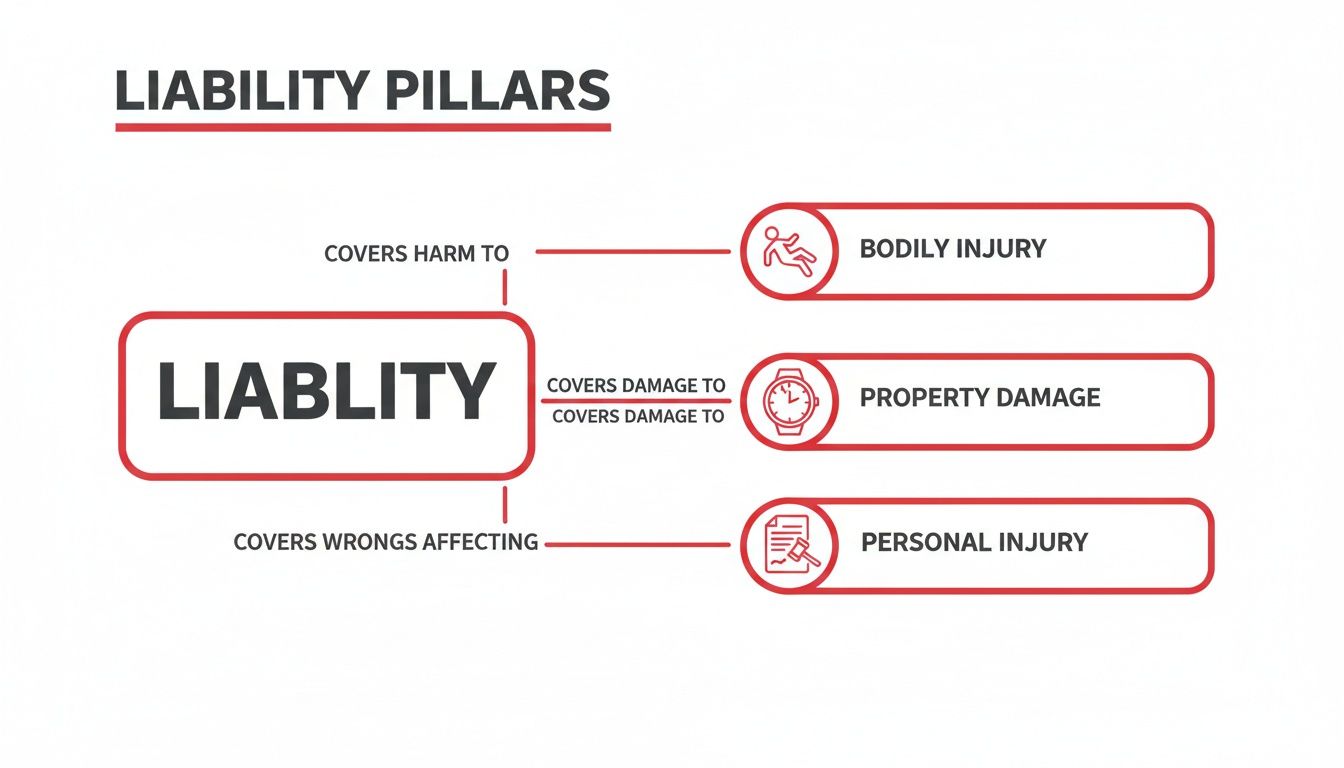

The three pillars of general liability—bodily injury, property damage, and personal injury—focus entirely on your interactions with the public.

This visual shows that the policy's entire function is to manage external claims, leaving your own assets completely unprotected.

General Liability vs Jewelers Block: A Head-to-Head Comparison

It's easy to get confused, so let's break it down. The table below shows exactly how these two policies respond to real-world scenarios in a jewelry business. You'll see one is for public-facing accidents, and the other is for your precious inventory.

| Risk Scenario | Covered by General Liability? | Covered by Jewelers Block? | Key Takeaway |

|---|---|---|---|

| A customer slips and falls in your showroom, breaks an arm, and sues you for medical bills. | Yes | No | This is a classic third-party bodily injury claim, the core purpose of General Liability. |

| A thief smashes your display case overnight and steals $250,000 in diamond rings. | No | Yes | This is a first-party loss of your business inventory; it requires specialized coverage. |

| Your employee accidentally scratches a customer’s expensive watch during a repair. | Yes (as property damage) | Yes (as care, custody, and control) | This can be a gray area, but Jewelers Block is specifically designed for this risk. |

| An engagement ring disappears from your safe with no sign of forced entry. | No | Yes | This "mysterious disappearance" is a unique peril covered only by a Jewelers Block policy. |

| You ship a $50,000 necklace to a client, but the package is lost or stolen in transit. | No | Yes | Coverage for goods in transit is a cornerstone of Jewelers Block, not General Liability. |

| A disgruntled ex-employee posts false, damaging reviews online, leading to a lawsuit for slander. | Yes (as personal & advertising injury) | No | This is a reputational harm claim, which falls under the personal injury pillar of General Liability. |

As you can see, these policies are not interchangeable—they’re two essential, non-overlapping layers of security. One without the other leaves you dangerously exposed.

The Reinforced Vault: Jewelers Block Insurance

This is where a Jewelers Block insurance policy becomes essential. It’s the reinforced vault that protects your inventory from the unique risks your business faces. It's specifically designed to cover your stock of jewelry, precious stones, and metals, whether they are in your store, in a safe, in transit, or out on memo.

A layered strategy is the only way to secure a jewelry business. Combining general liability with a Jewelers Block policy ensures you're protected from both a customer lawsuit and a catastrophic inventory loss.

A specialist agency like First Class Insurance provides comprehensive solutions that merge both policies into a single, cohesive protection plan. While General Liability insurance provides crucial protection for third-party claims, it often doesn't cover damages to your own business property. For complete protection, it’s vital to also understand what Commercial Property Insurance Covers for your physical assets. This combination, along with a Jewelers Block policy for your valuable antique jewelry inventory, creates the security you need.

Understanding the Cost of General Liability Insurance

When it comes to general liability insurance, there’s no such thing as a one-size-fits-all price tag. Your premium is a direct reflection of your business’s unique risk profile, calculated by insurers to match the potential for a claim.

Think of it like getting a custom suit tailored. Every single measurement—from your daily operations to your past performance—matters in crafting a premium that fits just right. The goal is to get you adequate protection without paying a penny more than you need to.

Key Drivers of Your Insurance Premium

The math behind your premium starts with a careful look at the core of your jewelry business. To an underwriter, each of these factors tells a story about how likely you are to face a claim.

- Business Location: A retail store in a bustling urban mall has a completely different risk profile than a private, by-appointment-only studio. More foot traffic almost always means a higher potential for slip-and-fall claims, which can nudge your premium upward.

- Annual Sales and Revenue: Your total sales volume gives insurers a sense of your overall business activity. Higher revenues usually mean more customer interactions and, therefore, greater exposure to potential liability issues.

- Number of Employees: A larger team can mean more opportunities for things to go wrong—an employee accidentally damaging a customer's property, for instance. Each person on your payroll is a small but measurable factor in your risk calculation.

- Claims History: This is a big one. A clean track record shows you're serious about risk management and can earn you much better rates. On the flip side, a history of frequent claims signals higher risk and will almost certainly lead to a higher premium.

Getting a handle on these factors is the first step to seeing your business through an insurer's eyes.

Proactive Steps and Market Dynamics

Beyond those core metrics, the steps you take to run a tight ship can make a real difference. If you can show an insurer that you've implemented and documented robust safety protocols—like regular floor inspections or clear employee training—you’re proving you're a lower-risk client.

The broader insurance market plays a role, too. After a few years of painful premium spikes, the market has started to stabilize, with most businesses seeing more modest 4% to 5% increases. Looking ahead, experts are forecasting 1% to 9% premium hikes. The good news is that there’s still healthy capacity, which means competitive terms are available for well-managed businesses like many jewelry stores. As detailed in recent general liability insurance market forecasts, managing your risk profile has never been more important for securing good coverage.

The single most effective way to manage your insurance costs is to partner with an expert who knows the jewelry industry inside and out. A specialized broker can navigate the market for you and fight on your behalf to secure the most competitive rates.

Working with a specialist like First Class Insurance is a strategic move. We understand the specific nuances of getting insurance for a jewelry business and know how to frame your risk profile in the best possible light. Getting a tailored Quote for Jewelers Block and general liability is the first step toward securing your assets without overpaying.

Navigating Claims and Finding the Right Insurance Partner

Knowing what your policy covers is one thing. Knowing what to do when things go wrong is something else entirely. A general liability claim can be a chaotic experience, but having a clear game plan—and the right partner in your corner—can turn a crisis into a manageable bump in the road.

The key is to move fast, document everything, and keep the lines of communication wide open.

When an accident happens, the first priority is always safety. Make sure everyone is okay and prevent any more harm. Once the dust settles, the claims process begins. You’ll report the incident to your insurance partner, and they'll walk you through the investigation and resolution. Remember, good documentation is your most powerful tool here.

The Steps of a Typical General Liability Claim

While every situation has its own quirks, most claims follow a pretty standard path. Knowing these steps ahead of time makes the whole ordeal feel a lot less overwhelming.

- Incident Report: The moment it's safe, write down exactly what happened. Get the date, time, location, and everyone involved. If you can, take photos or videos of the scene, any damage, or injuries. You can't have too much evidence.

- Immediate Notification: Call your insurance broker or agent right away. Don’t wait. Most policies require prompt reporting, and it gets an expert on your side from the very beginning.

- Formal Claim Filing: Your insurer will send you the official forms. Fill them out with as much detail and honesty as you can, using your initial notes as a guide.

- The Investigation: An adjuster will be assigned to your case. Their job is to review all the documentation, talk to witnesses, and assess the damage to figure out if the claim is valid and what your policy covers.

- Resolution: This can go a few ways. The insurer might pay a settlement to the third party, the claim might be denied if it falls outside your coverage, or it could head to court if no one can agree on a resolution.

Choosing an insurance provider is about more than just a policy. It’s about finding a partner who will have your back when things get tough. This is non-negotiable in the jewelry business, where your risks are unlike anyone else's.

Why a Specialist Insurance Partner Matters

When it comes to insurance for a jewelry business, a generic, one-size-fits-all provider just won't cut it. You need an agency that gets it—someone who understands the difference between a slip-and-fall claim and a six-figure inventory loss. This is where a specialist like First Class Insurance makes all the difference, with programs built specifically for jewelers, from general liability to Jewelers Block insurance.

The global liability insurance market is massive, hitting USD 291.86 billion and projected to climb to USD 524.66 billion by 2034. In the U.S. alone, that number is expected to reach USD 196.39 billion. These liability insurance market trends show just how critical it is for businesses to have an expert guide. With over 30 years in the game, we help jewelers navigate this complex world.

Before you Get a Quote for Jewelers Block or anything else, grill any potential partner with these questions:

- Do you actually specialize in insurance for a jewelry store?

- How many jewelers do you work with right now?

- Which underwriters do you use for this kind of coverage?

- Walk me through your claims process for a situation specific to my business.

Their answers will tell you everything you need to know. You'll quickly see if they're a true expert or just a generalist trying to make a sale. A partner who lives and breathes your industry, like our team at the First Class Insurance Jewelers Block Agency, doesn't just sell you a policy. They deliver peace of mind. We're proud to work with top-tier underwriters, which is why you’ll see the respected Lloyd's of London logo associated with our partners.

Common Questions About Jewelry Store Insurance

When you're trying to protect a jewelry business, the world of insurance can feel like a maze of fine print. Getting the right answers is non-negotiable. Let's clear up some of the most common—and critical—questions jewelers have when building their insurance strategy.

Does General Liability Cover Stolen Jewelry?

No. And if there's one thing you take away from this, let it be this distinction.

The short answer to what is general liability insurance is that it protects you from things like a customer slipping and falling in your store. It’s about third-party claims. It has absolutely nothing to do with your own inventory and offers zero protection if your pieces are stolen.

To safeguard your diamonds, precious metals, and finished jewelry from theft, damage, or loss, you need a highly specialized policy called Jewelers Block insurance. It’s the only coverage built from the ground up to protect your most valuable assets.

Is General Liability Needed for a Private Studio?

Yes, absolutely. Even if you don't have a public showroom, liability risks are everywhere. A delivery person could get hurt on your property, a private client could trip during an appointment, or even a marketing campaign on social media could trigger a lawsuit.

Beyond that, most trade shows, industry events, and commercial landlords will demand to see a certificate of insurance before they’ll even talk to you. This makes general liability a foundational piece of any professional insurance for jewelry business plan, regardless of your setup.

Even without a retail storefront, every interaction with clients, vendors, and partners creates a potential liability. General liability insurance isn't just a good idea; it's the professional standard that shields your business from accidents and legal headaches.

What Is the Difference Between General Liability and a BOP?

A Business Owner's Policy (BOP) is essentially a package deal, bundling general liability with commercial property insurance. It sounds convenient, but for a jeweler, it's a terrible fit.

Why? Because the property coverage in a standard BOP is riddled with low limits and major exclusions for high-value items like jewelry. A jewelry business is far better served with two distinct policies: a standalone general liability policy and a dedicated Jewelers Block insurance policy. This layered approach ensures your public-facing risks are handled while your unique, high-value inventory is protected by a policy that actually understands it.

How Can I Get an Accurate Insurance Quote?

The only way to get a truly accurate quote for your jewelry store insurance is to work with a specialist who lives and breathes this industry. A generalist agent simply won't grasp the nuances of your business, from memo risks and travel exposures to the threat of mysterious disappearance.

At First Class Insurance, we make it straightforward. When you reach out to Get a Quote for Jewelers Block and general liability, we’ll start a real conversation about how you operate. From there, we build a proposal that combines the right coverages for your specific needs. As a leading First Class Insurance Jewelers Block Agency, we partner with the best underwriters in the business to deliver protection that’s both rock-solid and cost-effective.

Ready to secure your business with coverage that’s actually designed for jewelers? The experts at First Class Insurance are here to build a policy that protects your inventory, your reputation, and your peace of mind. Get your personalized quote today by visiting https://firstclassins.com.