Picture this: a fire sweeps through your store, destroying your custom-built mahogany display cases. Replacement cost coverage isn't about what those cases were worth yesterday—it's about the cash you need to build and install brand-new ones today, without taking a hit for age or wear.

For anyone serious about protecting their jewelry business, this is the single most important insurance concept to get right.

What Is Replacement Cost? The Foundation of a Real Recovery

When you get a Jewelers Block insurance policy, every single asset—from the inventory in the safe to the specialized lighting overhead—gets a value assigned to it. The method used to calculate that value is what determines how much money you’ll actually see after a disaster strikes. Getting your head around replacement cost is the first step to making sure your policy can truly get you back on your feet.

Think of it this way: if your trusty five-year-old jeweler's bench is destroyed, a lesser policy might only pay you what a used, five-year-old bench is worth. That’s a recipe for a huge out-of-pocket expense.

Replacement Cost Value (RCV), on the other hand, gives you the funds to go out and buy a brand new, comparable bench at today's prices. It completely ignores depreciation. The only thing it cares about is the cost to restore your operations without you having to drain your bank account to bridge the gap.

Why This Is Non-Negotiable for a Jewelry Store

The stakes are sky-high for a jeweler. Your assets aren't just generic office equipment; they're specialized, expensive, and often custom.

- Protecting Your Core Assets: Your showcases, vault, security cameras, and gemological tools are the heart of your business. RCV ensures you can replace them with modern equivalents, not outdated hand-me-downs.

- Inventory Security: If a whole collection is stolen or destroyed, this coverage gives you the capital to replace it based on current market costs for metals and gemstones, not what you paid for them five years ago.

- Keeping the Doors Open: A full payout means you can rebuild and reopen faster, cutting down on lost revenue. It’s often the difference between a temporary setback and having to close for good.

Replacement Cost Value is designed to put you back in the exact same financial position you were in moments before the loss. It’s not about the "book value" of your stuff; it’s about the real-world cost to rebuild your livelihood from scratch.

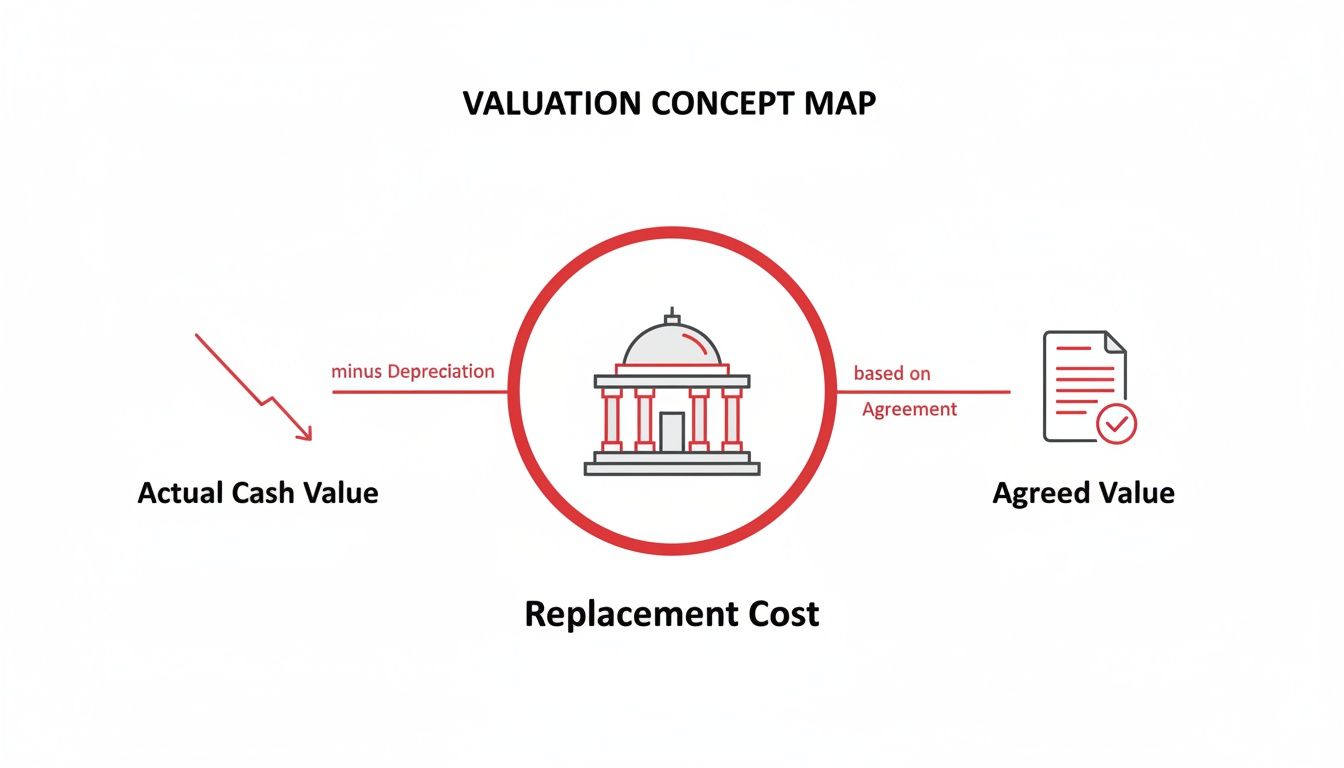

This map breaks down how replacement cost stacks up against the other valuation methods you'll run into.

As you can see, replacement cost is all about restoration with new, current-value items, which is a world away from depreciated or pre-agreed values.

Of course, safeguarding your assets with the right coverage goes hand-in-hand with making them look their best. For instance, knowing how to take better product photos boosts the perceived value of your inventory, making its protection even more critical. Getting the valuation right is the bedrock of a resilient jewelry store insurance plan.

Replacement Cost vs. Actual Cash Value Showdown

When insuring your jewelry business, the choice between Replacement Cost Value (RCV) and Actual Cash Value (ACV) is where a tiny detail in your policy becomes a massive financial reality during a claim. Getting this wrong isn't just an administrative error; it's a mistake that can threaten your business's survival after a disaster.

Let’s get practical. Imagine a vital piece of equipment—your five-year-old laser welder—gets stolen or destroyed in a fire. You originally paid $15,000 for it, but after five years of wear and tear, its depreciated value is only $6,000. This scenario is the perfect battleground for these two valuation methods.

The Actual Cash Value Trap

An ACV policy is built to pay you what the item was worth the moment before it was destroyed. In this case, your insurance check would be for $6,000. On paper, that might seem fair. In reality, it leaves you in a terrible spot.

A new, comparable laser welder still costs $15,000. Your ACV payout covers less than half of that. Suddenly, you have to find an extra $9,000 out of your own pocket just to get your operations back up and running. This gap is the fundamental weakness of ACV coverage.

Sure, ACV policies often come with lower premiums, which can be tempting. But that upfront "savings" evaporates the second you file a claim, exposing your business to crippling out-of-pocket costs. For a jeweler, where specialized tools, showcases, and safes are non-negotiable, this shortfall can be devastating.

Why Replacement Cost Is the Gold Standard

Now, let's hit rewind and run the same scenario with a Replacement Cost Value (RCV) policy. When your laser welder is gone, RCV doesn't care about its old, depreciated value. It asks a much more useful question: "What will it cost to replace that welder with a brand new one of similar kind and quality today?"

Your RCV policy would pay the full $15,000 needed to buy a modern equivalent. There’s no deduction for depreciation, and no massive financial hole for you to fill. You simply replace your equipment and get back to work without having to drain your cash reserves or take on new debt.

With RCV, you are made whole again. With ACV, you are left holding the bill for depreciation—a cost that can easily run into the tens or even hundreds of thousands of dollars when you add up everything from showcases to security systems.

This is exactly why RCV is the non-negotiable standard for any serious insurance for a jewelry business. It ensures you can completely rebuild and re-equip your store to its pre-loss condition, no questions asked.

Comparing RCV and ACV Side-by-Side

Let's break down the core differences in a way that matters for your jewelry store.

| Feature | Replacement Cost Value (RCV) | Actual Cash Value (ACV) |

|---|---|---|

| Payout Basis | Cost to buy a new, comparable item today. | Current value of the item, minus depreciation. |

| Depreciation | Ignored. You get the full replacement amount. | Deducted from your payout. You pay for it. |

| Out-of-Pocket Cost | Minimal to none (outside of your deductible). | Potentially huge, as you must cover the gap. |

| Business Recovery | Fast and complete. You can fully restore your assets. | Slow and compromised. Forces you to downgrade. |

| Best For | Essential business assets: tools, showcases, safes. | Non-essential items where a used replacement works fine. |

Ultimately, this choice defines your recovery. One path leads to a swift restoration that keeps your business moving forward. The other forces you to compromise, downgrade, or dip into critical capital reserves just to get back on your feet. For any professional jeweler, protecting your essential assets with RCV isn't an upgrade—it's a foundational business necessity.

How Inflation Silently Erodes Your Coverage

Think of inflation as a leak in your insurance policy—a slow, silent drain that can leave you with a massive financial shortfall when you need your coverage the most. For a jeweler, this threat is especially real. The cost of raw materials, skilled labor, and specialized equipment is always on the move, and a Jewelers Block policy that was perfect two years ago could be dangerously outdated today.

The replacement cost you locked in for your storefront, custom showcases, and equipment isn't a static number. It's a moving target. The gap between your coverage limit and the real-world cost to rebuild is where inflation does its damage, often without you even noticing.

The Real-World Impact of Rising Costs

Let's make this real. Imagine a burst pipe floods a section of your store, destroying your custom-built hardwood display cases and ruining specialized lighting fixtures. You file a claim, feeling secure in your coverage.

But then the quotes start rolling in. The price of high-quality wood, tempered glass, and the skilled millwork needed to restore your store's unique look has shot up. Suddenly, the $100,000 in coverage you thought was more than enough only covers 70% of the actual $143,000 bill. That $43,000 deficit comes straight out of your pocket, draining your capital and delaying your reopening.

This isn't just a bad-luck story; it’s a reality driven by economic forces that are often more aggressive than headline inflation. Between 2019 and 2022, U.S. property replacement costs jumped by an astounding 30.4%—a rate that doubled the general Consumer Price Index (CPI).

For jewelers, it gets even worse, with surges in the cost of metals, specialized glass, and security fixtures. It's no surprise that U.S. property and casualty insurers hiked commercial property premiums by 11.8% in the fourth quarter of 2023 alone, driven almost entirely by these inflated replacement costs. You can explore more data on how inflation impacts insurance replacement costs.

Protecting Your Policy from Inflation

Ignoring inflation is a choice to let your insurance policy lose value year after year. The good news is, you can fight back and ensure your coverage keeps up with reality.

The single most effective weapon in this fight is the inflation guard endorsement.

This is a simple, powerful addition to your policy that automatically increases your coverage limits by a set amount each year—usually between 2% and 8%. It’s designed to help offset the steady creep of construction and material costs, making sure your policy’s value doesn't get left behind.

An inflation guard endorsement acts as an automatic buffer, helping to close the gap between your insured value and the true replacement cost in a volatile market. It's a simple tool for maintaining the integrity of your coverage.

Your Action Plan Against Inflation

An inflation guard is a fantastic start, but a truly resilient strategy requires a more hands-on approach. Staying ahead of rising costs means treating your jewelry store insurance as a living document, not a file-and-forget contract.

Here’s your checklist:

- Conduct Annual Policy Reviews: Never just auto-renew. Schedule time with your insurance specialist every year to go over the coverage limits for your building, inventory, and business property line by line.

- Update Your Valuations: Get fresh appraisals on your high-value inventory and research what it would actually cost to replace your safes, benches, and computer systems today. An old valuation is an invitation to be underinsured.

- Discuss Replacement Cost Trends: Your agent should be a resource. Ask them about local construction and labor cost trends. These can vary dramatically by region, and your coverage needs to reflect your specific market.

- Confirm Your Endorsements: Double-check that an inflation guard endorsement is active on your policy. More importantly, make sure the percentage is high enough to keep pace with current economic conditions.

Making these steps a routine part of your business operations turns your insurance from a static expense into a dynamic shield. It ensures that when you need to answer the question of "what is replacement cost," your policy provides an answer that reflects today’s reality, not yesterday’s prices.

Calculating Replacement Cost for Your Business Assets

Defining replacement cost is one thing, but actually applying it to your own business is where the rubber meets the road. This isn't just a paperwork exercise; it's about taking a hard, honest look at your assets to make sure your insurance policy can actually cover the real-world cost of a total loss. Guesswork here is a gamble you can't afford to lose.

The whole process boils down to evaluating the three pillars of your operation: your jewelry inventory, your business property and equipment, and the building you work in. Each one needs its own approach to get the valuation right, and your involvement is absolutely critical.

Valuing Your Jewelry Inventory

Your inventory is the lifeblood of your business, and its value is always shifting with the market. Relying on old invoices or last year's pricing is the fastest way to find yourself dangerously underinsured after a claim.

The only way to do this right is with meticulous, up-to-date documentation.

- Professional Appraisals: For your high-value, one-of-a-kind, or custom pieces, a recent appraisal from a certified gemologist isn't just a good idea—it's essential. This document is your proof, establishing an item's value based on today's market for stones and precious metals.

- Detailed Inventory Lists: For the rest of your stock, you need a detailed, itemized list. It should include clear descriptions, what you paid for it, and quantities. This needs to be a living document, updated constantly as you sell and acquire new pieces.

Think about it: if the worst happens, your insurer will use this paperwork to figure out the payout needed to get you back in business. Without it, you're stuck trying to prove the value of things that no longer exist. That's a losing battle. For a closer look at properly documenting these kinds of items, see our guide to insuring unique jewelry and watches.

Assessing Business Property and Equipment

It’s easy to focus on the jewelry, but your business relies on a ton of other expensive gear. We're talking about everything from your high-security safes and laser welders to the custom showcases and point-of-sale system that runs the whole show. Each of these items has a replacement cost that needs to be accounted for.

The math here is pretty simple, but it demands attention to detail. The goal is to figure out what it would cost to buy a new, comparable item right now.

- Create an Asset List: Literally walk through your store, workshop, and back office. Write down every single significant piece of equipment, furniture, and fixtures.

- Research Current Prices: For every item on that list, find out what a new, similar model costs today. Check supplier websites, catalogs, or just call your vendors for quotes.

- Factor in Soft Costs: Don't forget the "hidden" costs. That includes delivery, professional installation, and setup. Replacing a 1,000-pound safe, for instance, involves a whole lot more than just the price of the safe itself.

Your total replacement cost for business property is the sum of every single item—from the vault to the velvet displays—purchased brand new at today's prices, plus all the costs to get it delivered and installed.

Determining the Building's Replacement Cost

If you own your building, this is the most complicated part of the equation. This has nothing to do with market value or what you could sell it for. It’s about the raw cost to rebuild the entire structure from a vacant lot after a fire or other disaster.

Insurers use specialized software for this, and it crunches a lot of data.

- Construction Costs: The software analyzes the current local cost per square foot for commercial builds, factoring in materials like steel, concrete, and roofing.

- Labor Rates: It accounts for the going wage for skilled tradespeople—plumbers, electricians, masons—in your specific zip code.

- Unique Features: This is where you come in. Things like reinforced vault rooms, high-end showroom finishes, or complex security and HVAC systems all add to the base cost.

Your job is to give your insurance agent all the details about your building's construction and any upgrades you've made. The more accurate information you provide—blueprints, renovation records, notes on specialized features—the more precise their calculation will be. This ensures your policy limit is high enough to actually fund a complete rebuild.

Getting these numbers right from the start is the key to a smooth claims process. To help you stay organized, here’s a quick checklist of the documentation you'll need.

Essential Documentation for Accurate Replacement Cost

| Asset Type | Required Documentation | Pro Valuation Tip |

|---|---|---|

| High-Value Jewelry | GIA/AGS reports, certified appraisals (updated every 2-3 years), high-resolution photos. | The appraisal should specifically state the "retail replacement value," not just market or liquidation value. |

| General Inventory | Detailed inventory management system records, supplier invoices, itemized lists with costs. | Regularly audit your physical inventory against your digital records. A 5% discrepancy can mean tens of thousands of dollars. |

| Equipment & Tools | Purchase receipts, model/serial numbers, vendor quotes for current models, photos of each item. | Don't forget "soft costs" like shipping and professional installation fees in your total valuation. |

| Building Structure | Original blueprints, records of all renovations/upgrades, recent contractor estimates for similar work. | Provide your agent with details on custom security features (vaults, reinforced walls) as these significantly impact rebuilding costs. |

Without this paper trail, you’re asking an insurance company to take your word for it after a loss. Having everything documented and ready makes the difference between a quick recovery and a long, painful financial struggle.

Insuring Unique and High-Value Jewelry Pieces

While replacement cost coverage is the gold standard for your store's equipment and everyday stock, what happens when an item is truly irreplaceable?

A standard policy promises to replace a lost piece with one of "like kind and quality." But that language completely falls apart when you’re dealing with a one-of-a-kind antique, a signed designer piece, or a custom creation. This is a critical—and potentially costly—gap for any high-end jewelry business.

Think about a vintage Cartier necklace from the 1920s. Its value isn't just in the platinum and diamonds. The real worth is tangled up in its history, its designer provenance, and its unique artistry—qualities you simply can't replicate with a modern piece. In a situation like this, standard replacement cost can quickly lead to disputes and deep dissatisfaction.

Introducing Agreed Value Coverage

For these special assets, you need a different kind of protection: agreed value coverage. This is the premier solution for insuring items where the very idea of "replacement" is meaningless.

With an agreed value policy, you and your insurer decide on the item's exact worth before the policy is even written, typically based on a professional appraisal. That pre-negotiated amount is then locked in. If a loss happens, the insurance payout is that exact figure. No arguments. No debates over depreciation or what a "comparable" item might cost. It completely removes the uncertainty from the claims process.

Of course, the foundation of this coverage is meticulous documentation. Accurate records and high-quality imagery are non-negotiable for proper valuation. Investing in professional jewelry photography isn't just for marketing; it’s a crucial step that can significantly strengthen your appraisal and simplify any future claims.

Why Agreed Value Is the Superior Choice for Your Best Pieces

For a jewelry store with a high-end collection, using agreed value for your most precious assets isn't a luxury—it's a strategic necessity. It provides a level of certainty that standard policies just can't touch, giving both you and your clients invaluable peace of mind. To see how these policies protect your most valuable items, take a look at our guide to insuring one-of-a-kind diamond pieces.

Agreed value is the ultimate protection for the irreplaceable. It transforms the insurance conversation from "How much is this worth now?" to "We agree this is its value, and you will be paid this amount if it's lost."

This approach is especially critical in a volatile market. The Insurance Information Institute found that U.S. home repair replacement costs shot up by 55% between 2020 and 2022. That trend directly mirrors the rising costs we see in commercial property insurance for a jewelry store. With nearly 63% of homeowners admitting their policies lack annual inflation adjustments, many are left dangerously underinsured—a risk that jewelers simply cannot afford.

Ultimately, a well-structured Jewelers Block insurance plan uses a blended approach. It applies replacement cost for your building, tools, and general inventory while strategically using agreed value endorsements for the unique, high-value pieces that define your brand. This smart combination ensures every single asset in your business is protected with the right valuation method.

Get a Quote for Your Jewelers Block Policy

Understanding what replacement cost really means is the first critical step. But it’s acting on that knowledge that truly protects your life’s work.

A generic business insurance policy just won’t cut it. The risks are too high, the assets are too specialized, and the potential for a devastating financial loss is all too real when it comes to insurance for a jewelry business.

Navigating the minefield of valuation methods, wild market swings, and one-of-a-kind inventory demands a partner who speaks your language. This is where a specialist Jewelers Block insurance agency becomes your most valuable asset. A dedicated expert does more than just sell you a policy—they build a strategic defense for your entire operation.

Why a Specialist Partner Is Essential

Choosing the right insurance for a jewelry store goes way beyond comparing premium quotes. It's about finding a true advocate who gets the massive difference between simple inventory value and what it actually costs to replace everything after a disaster.

A partner like the First Class Insurance Jewelers Block Agency brings decades of focused experience to the table. We don't just write policies; we build relationships and provide the kind of ongoing risk management that helps you sleep at night. Our team acts as your champion during a claim, making sure the valuation method works for you, not against you. We work with a trusted network of underwriters from esteemed markets like Lloyd's of London.

Don't leave your legacy vulnerable to a standard business policy. Your assets—from irreplaceable collections to the essential tools in your workshop—demand coverage built by professionals who live and breathe the jewelry trade.

Secure Your Business Today

The time to make sure your jewelry store insurance is built for a complete recovery is now, not after a catastrophe strikes.

Protecting your inventory, your property, and your peace of mind starts with a simple conversation. Let our experts at the First Class Insurance Jewelers Block Agency conduct a thorough review of your current coverage. We’ll identify potential gaps, explain your options clearly, and deliver a no-obligation quote designed for total protection.

Get a Quote for Jewelers Block today and secure the future of your business.

Got Questions About Replacement Cost? We've Got Answers.

When it comes to insuring your jewelry business, the nitty-gritty details of valuation can feel overwhelming. But understanding what replacement cost really means for your premiums, inventory, and peace of mind is one of the most important things you can do. Let's break down some of the most common questions we hear from jewelers.

Does Replacement Cost Mean a Higher Premium?

Yes, it almost always does. A policy built on replacement cost value (RCV) will have a higher premium than one based on actual cash value (ACV), and for a very simple reason: the potential payout is massively different.

RCV coverage is designed to give you the funds to replace what you lost with brand-new items of similar quality at today's prices. ACV, on the other hand, only pays you what your property was worth after factoring in depreciation. While an ACV policy looks cheaper upfront, it leaves you footing the bill for the difference between a used item's value and a new one's cost. That superior financial protection is what you're paying for with RCV.

How Often Do I Need to Update My Inventory Valuation?

At an absolute minimum, you need to be re-evaluating your entire inventory once a year. The prices of precious metals and gemstones are constantly in flux, and market trends can dramatically alter the cost of replacing your finished pieces. A valuation from just a couple of years ago is a surefire way to find yourself underinsured.

You should also do an immediate review any time you bring in a major collection or a few exceptionally high-value items. Consistent appraisals and an immaculate inventory list are the bedrock of a solid Jewelers Block insurance policy. They ensure your coverage limits actually match what it would cost to restock your store after a total loss.

An outdated inventory valuation is one of the fastest ways to get caught underinsured. Think of regular updates not as a chore, but as a critical part of your risk management—it's what makes sure your policy can actually do its job.

What if the Replacement Cost Is More Than My Policy Limit?

If the real cost to replace your stolen or damaged property ends up being higher than your policy's coverage limit, you’re on the hook for the difference. It’s a painful situation, and it’s precisely why setting your limits based on current replacement costs—not old invoices or wishful thinking—is so vital.

Being underinsured can turn a terrible event into a business-ending catastrophe. This is where having a specialist on your side to review your policy regularly becomes your best defense against a devastating financial shortfall.

What Is Functional Replacement Cost?

Functional replacement cost is a different beast altogether. It's an option where the insurer agrees to pay to replace damaged property with modern, less expensive materials that are functionally the same but not necessarily identical. For instance, it might cover replacing custom millwork with standard cabinetry.

While it can lower your premium, this is generally a bad fit for a high-end jewelry store where aesthetics, specific materials, and brand image are everything. It’s far better suited for an old warehouse where you just need the space back, not the original charm. For a jeweler, sticking with standard replacement cost is almost always the right call.

Protecting your business takes more than just buying a policy—it takes a partner who gets it. The team at First Class Insurance lives and breathes the unique risks of the jewelry world. We're ready to help you build a plan that lets you sleep at night. Get a Quote for Jewelers Block and make sure your coverage truly has your back.