When a customer hands you a cherished piece of jewelry, they're not just giving you an object—they're trusting you with a memory. A general liability waiver is a way to formalize that trust and set clear expectations from the start.

Think of it as a formal "Use at Your Own Risk" agreement for specific services, from delicate repairs to exclusive showroom viewings. It’s your first line of defense, but it’s not an impenetrable forcefield against every possible legal claim.

What Are General Liability Waivers in a Jewelry Business

You know that velvet rope at a high-end gallery? It’s not just for show. It sets a clear boundary, guiding visitors and protecting the priceless art on display. A general liability waiver does the same thing for your jewelry business—it establishes the boundaries of responsibility before you even touch a customer's piece.

This signed document is all about protecting your business by having clients acknowledge and accept specific, known risks. When they sign, they're essentially saying they understand things can happen—like accidental damage or injury—and agree not to hold you liable for what's called ordinary negligence. This simple step can stop a minor mishap from blowing up into a major legal headache.

Key Scenarios for Waivers in Jewelry Operations

While no two jewelers operate exactly the same, some situations practically demand a well-written waiver. Making them a standard part of your process is a sign of a professionally managed business.

Here’s where they really come in handy:

- Customer Repairs: A client brings in their great-grandmother’s ring for resizing. A waiver can cover the risk of discovering a pre-existing flaw in the setting or an accidental scratch during the work.

- Private Viewings and Events: Hosting an exclusive trunk show or appraisal event brings its own set of risks. A waiver can address everything from a guest tripping over a rug to potential damage to an item they’re handling.

- "While You Wait" Services: For quick jobs like ultrasonic cleaning or minor prong adjustments done on the spot, a waiver confirms the customer understands the process and accepts the small, inherent risks involved.

A waiver is more than just a piece of paper; it’s a communication tool. It transparently outlines risks, manages customer expectations, and demonstrates that your business takes liability seriously.

A Tool, Not a Cure-All

It’s crucial to remember that a waiver is not a replacement for solid insurance for a jewelry store. While it can shield you from claims of ordinary negligence, it will almost never hold up in court if you’re found guilty of gross negligence—like ignoring a frayed wire on your polishing machine that ends up injuring someone.

The smartest strategy is to see general liability waivers as one layer in a much bigger safety net. They are perfect for managing everyday, predictable risks and setting clear terms with your clients. But for the big, catastrophic events, your specialized insurance for jewelry business is the ultimate financial backstop. This partnership between waivers and insurance is what truly protects your business from all angles.

How Legally Enforceable Are Liability Waivers

Having a customer sign a piece of paper feels final, but when it comes to general liability waivers, that signature is just the start of the story. The one question every jeweler asks is: will this document actually hold up in court if something goes wrong?

The honest, if frustrating, answer is "it depends." The legal power of a waiver is never a sure thing.

Think of it as a lock on your front door. A simple latch might stop a casual thief, but a determined professional will get right through it. In the same way, a waiver can fend off frivolous claims, but it can easily crumble under a serious legal challenge—especially if your business is found to be seriously at fault.

The legal system draws a very sharp line between different kinds of fault, and that line is everything when it comes to your waiver.

Ordinary vs. Gross Negligence

The single most critical concept for any business owner to grasp is the difference between ordinary negligence and gross negligence. This is the bedrock on which a waiver’s enforceability is built.

Ordinary negligence is a simple mistake or a momentary lapse in judgment. For instance, an employee mops the showroom floor and forgets to put out a "wet floor" sign. If a customer slips, that’s likely ordinary negligence. This is exactly the kind of incident a well-written waiver is designed to protect you from.

Gross negligence is a whole other beast. It’s a conscious, voluntary disregard for safety—a reckless action that shows a blatant indifference to the well-being of others.

Here’s what that might look like in a jewelry store:

- Ignoring a known electrical problem with a display case that ends up shocking a customer.

- Continuing to use a polishing wheel after its safety guard has broken off.

- Failing to fix a loose floor tile that several employees have already tripped on, which eventually causes a customer to fall and get seriously hurt.

A court will almost never uphold a waiver that tries to protect a business from its own gross negligence. Public policy dictates that you can't just contract your way out of your fundamental duty to keep your customers reasonably safe.

State Laws and the Essential Ingredients for a Strong Waiver

The rules for liability waivers can change dramatically the second you cross a state line. Some states, like Virginia and Montana, are notoriously tough and rarely enforce them for personal injury. Others are more business-friendly but still demand that you check all the right boxes.

No matter where you're located, a waiver has a much better shot of holding up in court if it has a few key ingredients. These elements prove the customer made a clear, informed choice to accept the risks.

For a waiver to have a fighting chance, it must be:

- Clear and Unambiguous: The language has to be simple enough for the average person to understand. If it's loaded with confusing legal jargon or vague phrases like "release from any and all liability," a judge will likely toss it out.

- Conspicuous: The waiver can't be buried in the fine print. It needs to be a standalone form or a clearly marked section with a bold heading, making it impossible for the signer to miss what they’re agreeing to.

- Voluntary: The customer must sign of their own free will, without being pressured. They need to have enough time to actually read and understand it before signing on the dotted line.

At the end of the day, a waiver is a strategic risk management tool, not an ironclad shield. It creates a significant legal hurdle for someone thinking about suing you for ordinary negligence. But it’s not absolute protection, which is why it must work hand-in-hand with a robust insurance policy built for the unique world of a jewelry business.

Common Mistakes That Invalidate Liability Waivers

A poorly written waiver gives you a false sense of security. It’s a legal document that looks the part but crumbles the moment it’s challenged, leaving your jewelry business completely exposed right when you thought you were protected. You need to craft these documents carefully, avoiding the common pitfalls that can make them worthless in a courtroom.

One of the biggest mistakes is pulling a generic template off the internet. These one-size-fits-all documents just don't cut it. They miss the specific, nuanced risks of the jewelry world—from the delicate nature of repair work to the high value of the items you handle. A court could easily toss a generic waiver because it never actually informed the customer of the real risks they were accepting.

Think about it this way: a skydiving waiver has to talk about parachute failure. A jeweler’s waiver needs to be just as specific, mentioning things like the possibility of a stone chipping during a setting adjustment. The more your waiver reflects the reality of your operations, the more likely it is to hold up.

Burying the Waiver in Fine Print

Another sure-fire way to invalidate a waiver is to hide it. If your liability clause is tucked away in tiny font on the back of a receipt or lost in a long service agreement, a customer has a strong case that they never knowingly agreed to it.

For a waiver to have any legal teeth, it must be clear, conspicuous, and unambiguous. That means it should be its own document or, at the very least, a separate section with a bold heading like "Release of Liability and Assumption of Risk." The customer has to see it and understand what they’re signing.

A judge is going to ask one simple question: "Would a reasonable person have known they were giving up their right to sue?" If the waiver was hidden, the answer is no, and it’s getting thrown out.

Using Vague or Overly Broad Language

It might seem like a smart move to use sweeping language to cover every possible thing that could go wrong, but this tactic almost always backfires. Courts are skeptical of waivers that are overly broad because they can be deemed "unconscionable"—basically, completely unfair. A clause trying to absolve your business of "any and all liability, for any reason whatsoever" is a massive red flag.

Specificity is your friend here. Ditch the vague catch-all phrases and focus on the risks you can actually foresee.

- Vague and Weak: "Customer releases the store from liability for any damage that may occur."

- Specific and Strong: "Customer acknowledges the inherent risk of minor scratches or stress fractures to the setting during the ring resizing process and agrees to hold the store harmless for such occurrences."

That level of detail demonstrates the customer was informed of a specific, plausible risk and chose to accept it.

Relying on Confusing Legal Jargon

Finally, don't let your waiver get bogged down in complex legal terminology. Remember, this is an agreement with your customer, not another lawyer. If an average person can't understand what they’re signing, it fails the basic test of being a "knowing and voluntary" agreement.

Use plain, simple language. Your goal is clarity, not to sound like a law school textbook. A waiver that is easy to read and understand is far more likely to be upheld than one that requires a dictionary to make sense of. Steering clear of these mistakes is the first step to creating general liability waivers that actually do their job and protect your business.

Why Waivers and Insurance Are Better Together

Choosing between a general liability waiver and an insurance policy is a false choice—and a potentially crippling mistake for a jeweler. The smart move is to see them as two essential, complementary layers of protection. Each has a job to do, and when they work together, they build a far more resilient defense against financial disaster.

Think of it like securing your store. A heavy-duty lock on your front door is your first line of defense. That's your waiver. It's a solid deterrent that stops casual opportunists and discourages frivolous trouble. It handles the predictable, everyday risks.

But that lock won't do much against a determined professional. For that, you need a monitored alarm system wired directly to a security team. That's your insurance policy. When something truly bad happens, the alarm sounds, and a powerful, comprehensive response kicks in to protect your most valuable assets.

How Waivers and Insurance Work in Harmony

A well-drafted general liability waiver is a workhorse in your day-to-day risk management. It can shut down flimsy or opportunistic lawsuits before they ever get off the ground. When a customer signs a document that clearly spells out specific risks, they are far less likely to chase a minor claim.

This simple act directly protects your bottom line by filtering out the small stuff. Fewer claims often lead to a cleaner loss history, which can help keep your insurance premiums from creeping up. In this way, the waiver acts as a gatekeeper, handling low-level issues so your insurance is there for a real emergency.

But a waiver’s protection only goes so far. It will likely offer little to no defense against a major incident, like a serious customer injury on your property or a lawsuit alleging gross negligence. This is where your insurance policy steps in as your ultimate financial backstop.

A waiver is a proactive tool for managing predictable risks and setting clear customer expectations. Insurance is a reactive shield designed to absorb the financial shock of unpredictable, catastrophic events.

This is exactly where specialized Jewelers Block insurance becomes so critical. It’s designed from the ground up to cover the staggering legal fees, defense costs, and potential settlements that a simple waiver could never touch. This kind of policy understands the unique, high-stakes world you operate in. You can see how top-tier insurers, like those at Lloyd's of London, provide the horsepower for this kind of robust coverage.

To really understand how these two tools fit together, let's compare them side-by-side.

Risk Mitigation Role of Waivers vs. Insurance

| Feature | General Liability Waiver | General Liability Insurance |

|---|---|---|

| Primary Role | Proactive risk management and deterrent | Reactive financial protection |

| Scope of Protection | Narrow; covers ordinary negligence for specified risks | Broad; covers a wide range of liability claims |

| Best For | Minor incidents, frivolous claims, setting expectations | Major incidents, catastrophic events, serious injuries |

| Cost | Low (legal drafting fees) | Ongoing (premium payments) |

| Legal Strength | Varies by state; can be challenged in court | Legally binding contractual obligation |

| Limitation | Unenforceable against gross negligence or willful misconduct | Subject to policy limits, deductibles, and exclusions |

This table makes it clear: a waiver is your first line of defense, but insurance is your ultimate safety net. One manages everyday friction, while the other protects you from financial ruin.

The Statistical Reality Check

Jewelry stores and wholesalers everywhere use general liability waivers to protect against lawsuits from slips, falls, or on-site property damage. But these documents are far from airtight, especially when a court finds you were negligent.

In the U.S., where premises liability claims are incredibly common, businesses that go to court only win about 61% of the time, according to recent legal analyses. That means businesses end up paying out in nearly 40% of cases, even when they had a signed waiver.

This is where the partnership between waivers and insurance becomes so clear. Your waiver can help you win that 61% of cases involving ordinary, predictable risks. But it's your insurance policy that saves your business from the financial fallout of the other 40%. To really get the most from this combination, it's worth digging into the nuances of the insurance industry to see how policies are built to respond when a waiver just isn't enough.

Ultimately, by layering these two tools, you build a truly resilient business. The waiver handles expectations and deflects the minor headaches, while your insurance for a jewelry store stands ready to protect you from the major threats that could otherwise put you out of business for good. They aren't competing for a spot in your risk plan; they are essential partners.

How to Create an Effective Waiver for Your Store

Alright, let's move from theory to what actually works on the ground. Building a solid general liability waiver isn't about grabbing some template off the internet—it's about careful, thoughtful construction. The whole point is to create a document that's clear, fair, and specific enough for a customer to actually understand what they're signing.

A truly powerful waiver is one that lays out the risks without hiding behind a wall of confusing legalese. Forget the one-size-fits-all approach. The risks in your showroom are completely different from the risks at your repair bench, and your paperwork needs to reflect that.

Tailoring Clauses to Specific Jewelry Operations

This is where the rubber meets the road. Specificity is what makes a waiver stand up in court. You have to really think through the distinct risks tied to every single service you offer and spell them out. A judge is far more likely to respect a clause that addresses a real, foreseeable risk.

Here’s how you might break it down for different parts of your business:

-

For the Retail Showroom: The main game here is premises liability—someone slipping or tripping. Your waiver should focus on that. A simple clause could state that the customer acknowledges the display cases, rugs, and different floor surfaces and agrees to navigate the space carefully.

-

For Repair Intake: This is where you need the most detail. The waiver has to be crystal clear about the inherent risks of working on delicate, sometimes ancient, pieces. You should absolutely mention the chance of discovering hidden flaws, stress fractures, or even a stone chipping during a simple prong adjustment.

-

For "While-You-Wait" Services: For quick jobs like a cleaning or a prong check, the waiver can be much simpler. It just needs to focus on the customer confirming they’ve inspected the item after the service and are happy with it before they walk out the door.

Think of your waiver as a conversation on paper. It should clearly say, "Here are the specific, reasonable risks involved here. By signing, you're telling us you understand and accept them."

Best Practices for Implementation and Record-Keeping

How you hand over the waiver is just as important as what’s written on it. You could have the most perfectly worded document in the world, but if the process is sloppy, it’s useless.

1. Make It a Separate, Legible Document: Never, ever bury your waiver in the tiny print of a sales receipt. It needs to be its own document with a big, bold title like "Waiver and Release of Liability." Use a font that people can actually read.

2. Allow Time for Review: Shoving a clipboard in someone's face and telling them to "sign here" is a huge red flag for a court. Hand them the waiver and give them a moment. Let them read it without you breathing down their neck. This shows their signature was a knowing, voluntary act.

3. Maintain Secure Records: Whether you’re using paper or digital copies, you need a system for storing these signed waivers that’s both secure and organized. This is your proof. If you're looking to modernize the process, it’s worth learning about adding digital signatures to forms using tools like Google Forms.

The Ever-Present Challenge of "Social Inflation"

Even with a well-crafted waiver, you have to be aware of the legal environment we're all operating in. Waivers really took off after tort reforms back in the 1970s, but today they're up against something called "social inflation"—a nasty trend of rising litigation costs and bigger and bigger jury awards.

From 2014-2024, overall liability losses shot up from $231.6 billion to $281.2 billion, and regular inflation was only a tiny part of that jump. This just proves that even with a waiver, the financial risk of a lawsuit is higher than ever, which makes having great insurance absolutely non-negotiable.

Of course, this guidance is no substitute for professional legal advice. Always have your attorney review your final documents to make sure they're airtight for your state and local laws.

Protecting Your Business Against Major Risks

So, after digging into the good and the bad of general liability waivers, the last piece of the puzzle is figuring out when to trust the waiver and when to let your insurance take the lead. Think of a waiver as your go-to tool for managing the predictable, everyday stuff. It's perfect for setting clear expectations with customers for routine jobs like repairs or cleanings, and it's great at heading off silly claims over minor bumps and scrapes.

But a waiver has its limits. It's simply not built to save your business from the financial wreckage of a catastrophic event. Things like gross employee negligence, a devastating fire or theft, or a serious customer injury are way beyond what a waiver can handle. In those worst-case scenarios, the waiver takes a backseat, and your insurance policy steps up as your primary line of defense.

The Comprehensive Safety Net

Here’s the main takeaway: you never choose between a waiver and an insurance policy. You have to layer them strategically to build a complete risk management system. Your waiver is the proactive, frontline defense, while a specialized Jewelers Block insurance policy is the ultimate safety net that ensures your business survives to open its doors another day. In the high-stakes world of jewelry, you need both.

For independent jewelers running events or pop-ups, a waiver is non-negotiable. But even the best waiver only reduces risk—it doesn't eliminate it. For example, motor vehicle incidents made up almost half of all U.S. commercial liability payouts in 2023. A solid policy from an expert like the First Class Insurance Jewelers Block Agency covers these massive gaps, like the staggering $42.8 billion in excess motor tort values recorded from 2014-2023. With litigation driving loss ratios higher and the market projected for 90.6% growth, smart owners layer waivers with robust insurance for a jewelry store to get real peace of mind. You can learn more about these liability insurance market trends to see why this layered strategy is so vital.

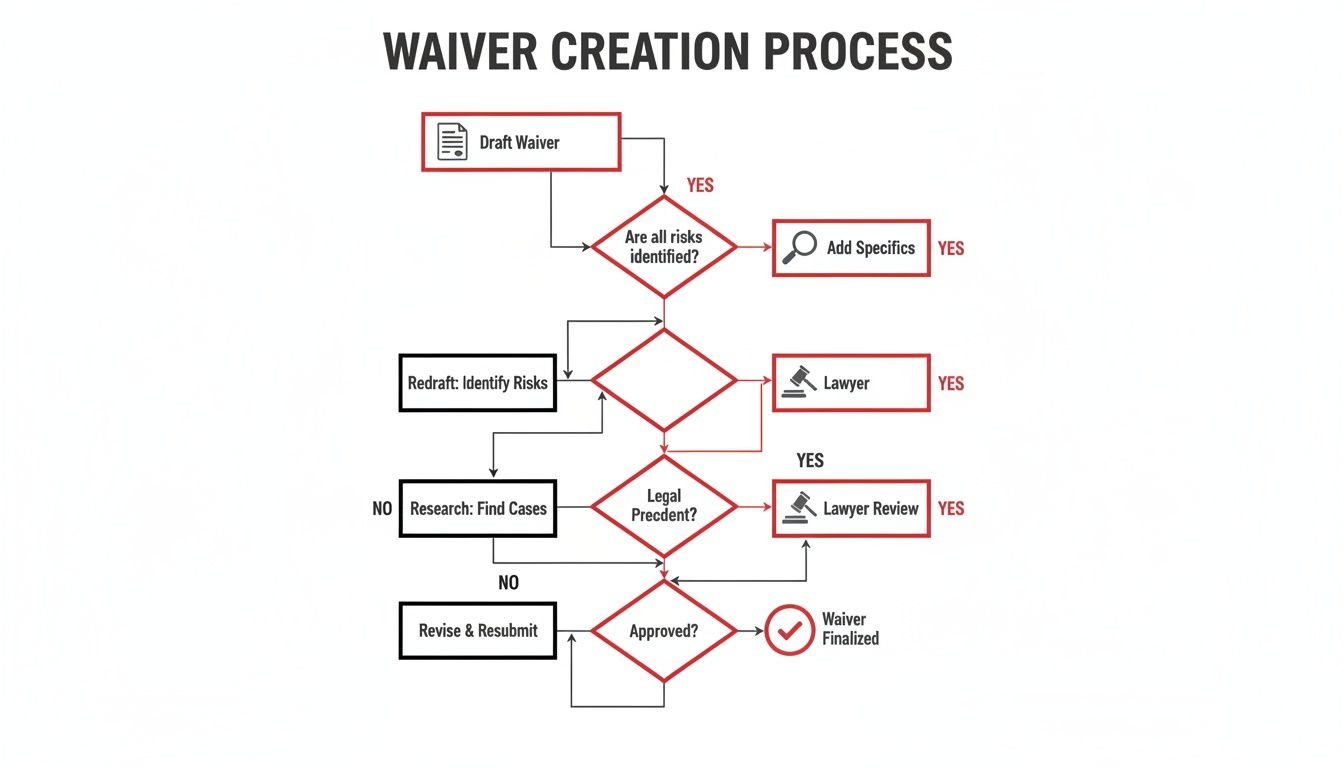

This simple flowchart shows the foundational steps to building a waiver that can actually hold up under pressure.

Every single step here—from the first draft to that final review by a lawyer—is critical for making the document as legally sound as possible.

Securing Your Legacy with Expert Guidance

At the end of the day, your goal is to protect your inventory, your reputation, and your financial future. A well-written waiver is a key part of that strategy, but only a specialized insurance for jewelry business policy provides the heavy-duty protection you need against a devastating loss.

The final, and most important, step is to consult an expert to make sure your coverage is perfectly matched to how you actually do business. When you need to protect high-value assets, seeing a properly insured diamond ring is a perfect reminder of the confidence that expert coverage brings. The specialists at an agency like First Class Insurance can make sure every single facet of your business is protected.

Your Top Questions About Liability Waivers, Answered

When it comes to general liability waivers, it's easy to get tangled up in the legal details. Let's clear up some of the most common questions jewelers ask, so you can feel confident you're protecting your business the right way.

Can a Customer Still Sue Me Even if They Signed a Waiver?

Yes, they absolutely can. Think of a signed waiver as your first line of defense, not an impenetrable fortress. It's a powerful tool that often discourages lawsuits, but it doesn't legally prevent someone from filing one.

Whether that waiver holds up in court is another story. It all comes down to the specifics of what happened, how clearly your waiver was written, and your state's laws. A judge is far more likely to toss out a waiver if the incident involved gross negligence, or if the language was so confusing and one-sided that it’s deemed unfair. This is exactly why your Jewelers Block insurance is non-negotiable—it’s there to pay for a legal battle, even if you did everything right and have a signed waiver ready to go.

Should I Use Different Waivers for Repairs and Showroom Visits?

Not only should you, but you must. Using a one-size-fits-all waiver is a huge mistake. The risks a customer faces while browsing your engagement ring selection are worlds apart from the risks involved in entrusting a family heirloom to your bench jeweler.

- Showroom Waiver: This one should be all about premises liability. It covers the basics: slips, trips, and falls that could happen because of a wet floor, a loose rug, or a display case.

- Repair Intake Waiver: This waiver needs to be incredibly specific. You have to spell out the delicate nature of repair work—the risk of discovering a hidden fracture in a stone, the possibility of scratching a piece during polishing, or the potential for damage when setting a fragile gem.

Using separate, specific waivers shows a court you took the time to inform the customer of the exact risks for that particular activity. It makes your defense much, much stronger.

Is a Digital Signature on a Waiver Legally Binding?

It sure is. Thanks to the federal E-SIGN Act, electronic signatures have the same legal standing as a pen-and-ink signature here in the U.S. A customer tapping "I Agree" on a tablet is just as valid as them signing a piece of paper.

The key, however, is to make sure your digital process is solid. You need a secure system that can prove who signed the document and when, creating a clean, unchangeable digital record. You have to store these digital waivers just as carefully as you'd lock away your paper files in a cabinet.

At the end of the day, paperwork alone isn't enough. A smart risk management plan uses waivers for everyday incidents but relies on specialized Jewelry store insurance to protect against the kind of loss that could shut you down for good. The team at First Class Insurance creates custom Jewelers Block policies that are built for the real-world risks you face. Get a Quote for Jewelers Block and protect the business you've worked so hard to build.