So, how much should a ring appraisal really cost? Let's get straight to it.

On average, you can expect to pay between $75 and $200 for a professional ring appraisal. For a simple solitaire engagement ring, you'll likely land on the lower end of that range. But for more complex pieces—think multi-stone designs, intricate antique rings, or custom work—the price will naturally climb higher to reflect the detailed work involved.

Understanding the Baseline Cost of a Ring Appraisal

Knowing the cost of an appraisal is fundamental for any jewelry business. Whether you're valuing new inventory or helping a customer protect their recent purchase, this document is your starting point.

It’s the key to securing the right amount of coverage with a Jewelers Block insurance policy, which is the specialized shield that protects your assets against theft, loss, and damage. A precise appraisal ensures your insurance for a jewelry store is actually based on what your pieces are worth in today's market.

That fee isn't just a random number. It reflects the appraiser's time, skill, and the complexity of the ring itself. Think of it like a mechanic: you wouldn't expect to pay the same for an oil change as you would for a full engine rebuild. The same logic applies here—an intricate heirloom requires far more work than a simple wedding band.

Key Pricing Tiers for Appraisals

To help you budget, here’s a rough breakdown of what you can expect to pay:

- Simple Rings ($75 – $125): This is the sweet spot for straightforward pieces. We're talking solitaire diamond rings or classic wedding bands with minimal design. The process is quick because it focuses on a single primary stone and a standard setting.

- Standard Engagement Rings ($100 – $200): Most modern engagement rings and wedding sets fall right into this category. This price point accounts for rings with a center stone plus side stones or a more detailed setting that takes a bit more time to properly document.

- Complex or Antique Rings ($200+): When you get into pieces with dozens of tiny gems, incredibly detailed metalwork, or a significant history, the price goes up. These appraisals demand extensive research and a meticulous, time-consuming examination to get right.

An appraisal is far more than just a price tag. It's a detailed, official report that acts as your proof of ownership and value. For any insurance for jewelry business, this document is a non-negotiable tool for managing risk and a must-have for getting comprehensive coverage.

Across the United States, appraisal costs are fairly consistent, though you’ll see some variation based on location and the appraiser's credentials. In most major cities, a basic diamond ring appraisal will run you $75 to $125. For the broader market of standard rings, fees typically sit between $100 and $200.

It’s no surprise that rates are often a bit higher in urban centers where the cost of doing business is greater. Understanding these nuances is the first step toward smart inventory management and making sure your store has the robust protection it needs.

What Really Drives the Price of an Appraisal

Ever wondered why one ring appraisal is $75 and another, for what looks like a similar piece, comes in at $300? It’s not just a random number. The price directly reflects the time, skill, and deep-dive analysis that goes into accurately valuing the specific ring on the appraiser's desk.

Think of it like this: appraising a simple, modern solitaire ring is a bit like a standard tune-up for your car—fairly straightforward and predictable. But asking an appraiser to evaluate a complex Art Deco ring with dozens of tiny, hand-set stones? That’s more like a full engine rebuild. It’s a forensic process that demands a whole different level of time and expertise.

The Complexity of the Ring Itself

The single biggest factor that moves the needle on cost is the ring's intricacy. A clean, simple piece with one center stone and a plain band is a quick job. A halo setting with a pavé band, however, is another story entirely. Every single element adds to the appraiser's workload.

Here’s a quick look at what they’re sizing up:

- Number of Gemstones: Each stone has to be identified, measured, graded for color and clarity, and checked for treatments. A ring with 30 small diamonds takes way more time than a ring with just one.

- Intricacy of Metalwork: That delicate filigree, milgrain edging, or hand-engraved pattern? All of it needs to be carefully examined, described, and valued. This kind of craftsmanship is valuable, and documenting it properly takes time.

- Antique or Period Pieces: Evaluating a vintage ring isn't just about the materials. It often involves hitting the books to research its history, verify the era, and confirm its manufacturing techniques, adding another layer of work to the process.

This painstaking detail is absolutely essential for securing proper insurance for a jewelry store. An underwriter needs a precise, detailed blueprint of every valuable piece before they can write an accurate policy.

The Appraiser’s Credentials and Expertise

You wouldn't pay a general practitioner and a brain surgeon the same fee for a consultation, right? It's the same principle with appraisers. A report from a highly certified professional simply carries more weight and authority, especially when you hand it over to an insurance carrier.

An appraisal from a GIA Graduate Gemologist (GG) or an Accredited Senior Appraiser (ASA) isn't just a piece of paper. It's a rock-solid validation of value, backed by years of intensive training and strict ethical standards. This is exactly the kind of credibility underwriters demand for Jewelers Block insurance.

These pros have invested a ton of time and money mastering gemology, valuation science, and market analysis. Their higher fees reflect that deep well of knowledge, giving you confidence that the appraisal is accurate, defensible, and meets the tough standards required for robust insurance for jewelry business coverage. You're paying for the peace of mind that their valuation will hold up if you ever need to make a claim.

Pricing Models Flat Fee vs Hourly Rate

Appraisers generally stick to one of two pricing structures. Knowing the difference helps you get the best value, whether you're appraising a single knockout piece or your entire inventory for your jewelry store insurance.

Flat Fee:

This is the most common way to go for a single ring. You’ll pay a set price, usually somewhere in the $95 to $125 range per item. It’s clean, predictable, and perfect for your standard inventory items or for handling a client's piece.

Hourly Rate:

If you're dealing with a large collection or an incredibly complex piece that requires a lot of research, an hourly rate—typically $150 to $195 per hour—can actually be more economical. With this model, you only pay for the exact time the appraiser puts in.

Now, here’s a huge red flag: never, ever work with an appraiser who charges a percentage of the ring's final value. This is a massive ethical conflict of interest, plain and simple. It gives them a direct financial incentive to inflate the valuation. A true professional charges for their time and expertise, not a commission on the number they write down. Remember, you'll need an appraisal from a reputable source when you're ready to Get a Quote for Jewelers Block.

Choosing the Right Type of Appraisal for Your Needs

Not all appraisals are the same. Picking the wrong one is like using a map of New York to navigate Los Angeles—it’s just not going to get you where you need to go. You have to know what you’re asking for, especially when the end goal is a solid Jewelers Block insurance policy. The type of report you get directly defines how much protection your business actually has.

For any jewelry business, the only document that truly matters is an Insurance Replacement Value appraisal. This isn't a suggestion; it’s the gold standard that insurance carriers demand. It answers one simple but critical question: "What would it cost to recreate this exact ring from scratch, right now, in today's market?" This value factors in current metal prices, the cost of comparable gemstones, labor, and even the retailer's markup.

This is the only way to ensure that if a piece is lost, stolen, or destroyed, your insurance payout will be enough to replace it with an item of like kind and quality. It’s the only appraisal that truly protects your assets and makes sure your insurance for a jewelry store is built on a realistic, solid foundation.

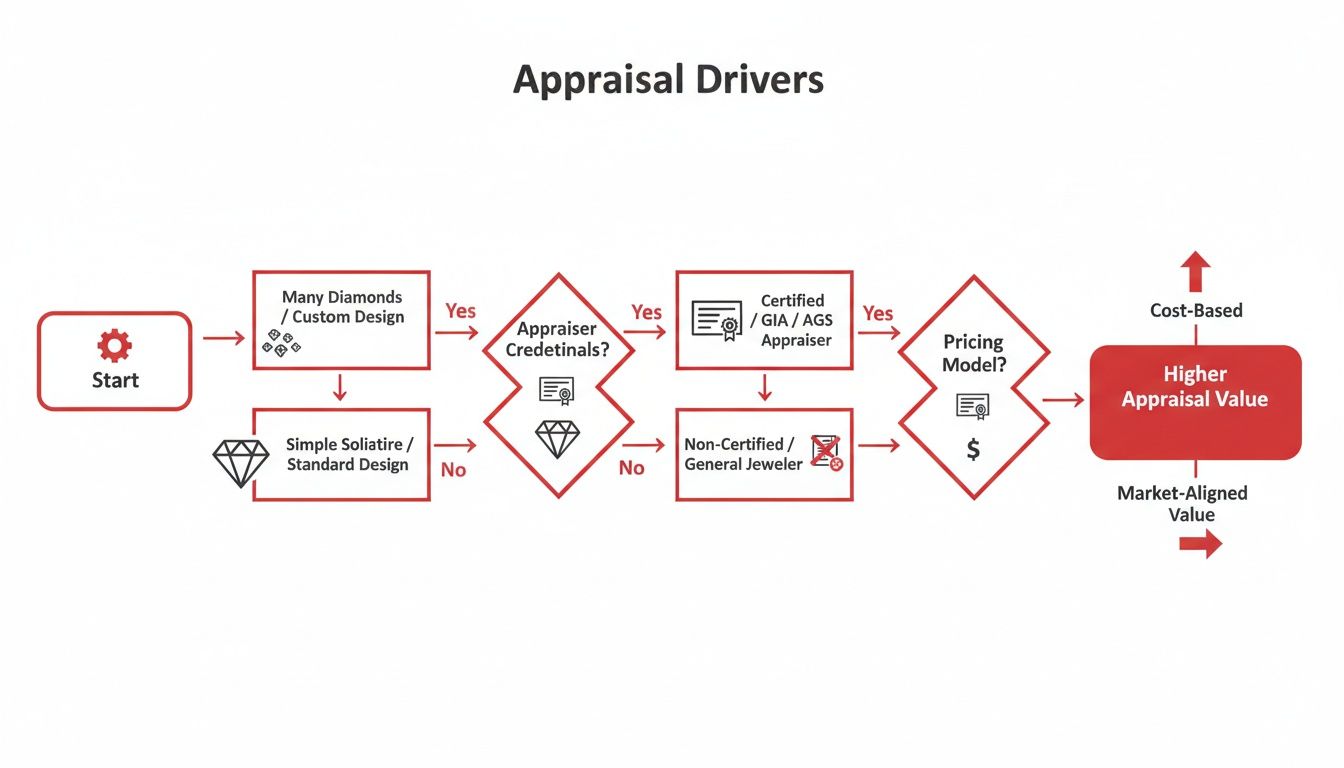

The cost drivers—like the ring's complexity, the appraiser's credentials, and their pricing model—all feed into this final valuation. This flowchart breaks down how those key drivers come together.

As you can see, each step informs the next, guiding the appraiser from an initial inspection to a final, defensible value that an underwriter can count on.

Contrasting Replacement Value With Other Valuations

While insurance replacement value is your go-to, it helps to understand how it stacks up against other common appraisals. Knowing the difference prevents mix-ups and ensures you're always using the right tool for the job. The main alternative you'll run into is the Fair Market Value (FMV) appraisal.

An FMV appraisal figures out what a willing buyer would pay a willing seller for the ring in its current state, where neither person is under any pressure. This number is almost always lower than the insurance replacement value because it doesn't have to account for the cost of new materials, skilled labor, or retail overhead.

So, where does an FMV appraisal come in handy? It's typically used for legal and financial situations that have nothing to do with replacement, like:

- Estate Settlements: To figure out the value of assets for taxes or for distributing them to heirs.

- Divorce Proceedings: To help divide marital assets fairly.

- Charitable Donations: To set the tax-deductible value of a donated item.

- Resale or Liquidation: To establish a realistic asking price for a pre-owned ring.

Why the Distinction Matters for Your Business

Handing over the wrong appraisal can be a costly mistake. If you submit an FMV appraisal for your insurance for jewelry business policy, you will be severely underinsured. If you have to file a claim, the payout would only reflect that lower resale value, leaving you with a huge financial gap between what you get and what it actually costs to replace your inventory.

This is especially critical when you're dealing with one-of-a-kind or antique pieces, where replacement costs can be sky-high. For a closer look at the unique challenges these pieces present, you can learn more about protecting antique jewelry collections in our guide.

At the end of the day, you have to be precise. When you need to Get a Quote for Jewelers Block from a trusted provider like First Class Insurance Jewelers Block Agency, the underwriter will expect a detailed report based on full replacement value. By confidently requesting the right appraisal from the start, you give your business the accurate documentation it needs to truly protect its assets.

Why Outdated Appraisals Are a Business Risk

An appraisal from five years ago might as well be from another century. For a jewelry business, hanging onto outdated valuations isn't just lazy bookkeeping—it's a massive financial gamble. It's like insuring your newly renovated store based on what it was worth before you put in a new vault and showcases. You'd never do that with your building, so why would you do it with your inventory?

The jewelry market doesn't sit still. The prices for gold, platinum, and diamonds are in constant motion, driven by everything from global supply chains to economic forecasts. An old appraisal completely misses this appreciation, leaving your business dangerously underinsured and one incident away from a devastating loss. This isn't just about paperwork; it's a core part of your risk management and the foundation of solid jewelry store insurance.

The Growing Gap Between Old Value and Current Cost

Let’s put this in real numbers. Say five years ago, you had a platinum engagement ring appraised for $8,000. Fast forward to today. Thanks to market shifts, the actual cost to recreate that exact ring—finding a comparable diamond and casting the same setting—is now $10,500.

If that ring gets stolen and your Jewelers Block insurance is still based on the old $8,000 valuation, guess what? That’s all your insurance company will pay out. You’re now stuck covering a $2,500 shortfall out of your own pocket. Now imagine that gap across a dozen high-value pieces. The potential for a catastrophic loss adds up terrifyingly fast.

This isn't just a hypothetical. Jewelry values have been steadily climbing for decades. According to the U.S. Bureau of Labor Statistics, a piece of jewelry that cost $100 back in 1986 would be valued around $204.57 today—a 104.57% increase. That doubling of prices powerfully shows why old valuations are a huge liability for proper insurance for a jewelry store. You can dig into more data on historical jewelry price inflation to see these long-term trends for yourself.

The Real-World Consequences of Underinsurance

When you file a claim, that appraisal document is everything. It’s the blueprint the insurer uses to understand what they’re replacing and how much to pay. An outdated report throws a wrench in the whole process and can seriously hurt your business.

Here’s exactly what’s at stake with an old appraisal:

- Serious Financial Loss: Just like in the example above, you'll be left with a gap between your payout and the true replacement cost. That difference comes straight from your bottom line.

- A Painful Claims Process: An appraisal from years ago gives your insurer a reason to push back. They might question the value, kicking off a long, frustrating negotiation that holds up your money when you need it most.

- Inadequate Coverage Limits: Your overall Jewelers Block insurance policy limits are based on the total value of your inventory. If that total is based on old numbers, your entire policy might not be enough to cover a major event like a store-wide theft.

Think of your appraisal portfolio as a living document. It has to breathe and change with the market. Keeping it current isn't an expense; it's a direct investment in your business's financial health and ability to bounce back from anything. It turns your insurance for jewelry business from a line item into a real safety net.

Proactive Management A Pillar of Your Insurance Strategy

Updating your appraisals isn't just a "nice-to-have." It's a fundamental part of maintaining effective insurance coverage. Most insurers and industry experts will tell you to get your high-value items reappraised every three to five years. This simple habit ensures your valuations reflect reality and your policy reflects the true worth of your assets.

Regular updates do more than just protect you in a claim, too. They give you an accurate, ongoing picture of your inventory's value, which is vital for financial planning and business valuation. When you're ready to Get a Quote for Jewelers Block, a portfolio of current, detailed appraisals tells underwriters that you're a serious, low-risk client. Reputable agencies like First Class Insurance Jewelers Block Agency see this as the mark of a well-run business, which can often lead to better terms and a much smoother partnership.

Finding a Qualified Appraiser Insurers Trust

Let’s be honest: an appraisal is only as good as the person who signs it. When you’re protecting your business with Jewelers Block insurance, that report needs to be absolutely rock-solid. This is your game plan for finding a professional whose work will stand up to scrutiny from any insurance carrier, ensuring your coverage is built on a foundation of trust and precision.

Think of it like this: you wouldn't let an uncertified accountant manage your business's finances, would you? The same logic applies here. An appraiser’s credentials aren't just letters after their name; they're proof of their training, ethical standards, and ability to produce a defensible valuation that underwriters for jewelry store insurance will accept without a second thought.

Key Credentials to Look For

When you're vetting an appraiser, there are a few certifications that are simply non-negotiable. These designations tell you the individual has gone through rigorous training and lives by a strict code of professional ethics. They are the language of trust in the jewelry world.

- GIA Graduate Gemologist (GG): This is one of the industry's most respected credentials, showing that the appraiser has deep training from the Gemological Institute of America in grading diamonds and colored stones.

- Accredited Senior Appraiser (ASA): Awarded by the American Society of Appraisers, this title means the person has a high level of expertise in valuation science for personal property, which includes fine jewelry.

- Certified Gemologist Appraiser (CGA): This certification from the American Gem Society signals a dual mastery of advanced gemology and ethical appraisal practices.

Finding an appraiser with these credentials ensures their report will be detailed, accurate, and authoritative—exactly what you need for a smooth claims process down the road. It also makes a huge difference when you Get a Quote for Jewelers Block, because underwriters at firms like First Class Insurance Jewelers Block Agency put a lot of weight on thorough, professional documentation.

The Importance of Independence

The most reliable appraisals always come from independent professionals—people who don't buy or sell jewelry themselves. Their only job is to give you an objective, unbiased valuation. This complete independence strips away any potential conflict of interest, guaranteeing the appraisal reflects the ring’s true replacement cost, not a hidden sales pitch.

An independent appraisal provides a layer of objectivity that is invaluable. Since the appraiser has no financial stake in the ring's value beyond their fee, insurers view their reports as a more credible and impartial assessment, which is critical for any insurance for a jewelry store.

This unbiased approach is absolutely essential for locking in accurate insurance for jewelry business policies. It gives both you and your insurer the confidence that your coverage limits are firmly based in reality. The role of a qualified insurance appraiser goes beyond just the initial valuation; they can be a critical ally if a claim is ever denied or undervalued by an insurer.

Red Flags You Cannot Ignore

While looking for credentials is key, it’s just as important to know what warning signs to run from. The biggest red flag of all? An appraiser who wants to charge a fee based on a percentage of the ring's final value. This is a massive ethical breach because it creates a direct financial incentive to inflate the valuation, which will only lead to you paying unnecessarily high insurance premiums.

A true professional will always charge a flat fee or an hourly rate for their time and expertise. Before you agree to anything, ask how they structure their fees. Protecting your assets starts by choosing an expert whose integrity is as solid as the gems they evaluate. For a better sense of how top-tier underwriters view these practices, look at the standards set by entities like Lloyd's of London, a major player in the specialty insurance market.

How Appraisals Impact Your Jewelers Block Policy

Think of an appraisal as more than just a piece of paper with a dollar figure on it. For a jewelry business, it's the language you use to speak to your insurer, translating the real-world value of your inventory into the black-and-white terms of financial protection. This document is the bedrock of your entire Jewelers Block insurance policy.

Insurance companies rely on these detailed reports to understand exactly what they’re being asked to cover. The value listed on the appraisal directly sets the coverage limits for your overall inventory, as well as for those high-ticket items that need to be scheduled individually. Without that clear valuation, getting the right insurance for a jewelry store becomes a guessing game—one you can't afford to lose.

This process is so central to the industry that it's fueling major growth. The global jewelry appraisal market hit around $1,160.36 million in 2021 and is expected to balloon by another $2.07 billion between 2024 and 2029. It’s a clear sign that jewelers are recognizing just how crucial proper valuations are for protecting their assets. You can dig into these market trends to see the bigger picture.

The Appraisal in a Claims Scenario

The true power of an appraisal shines brightest when you actually have to make a claim. Let’s say your store is burglarized and several valuable rings are stolen. The chaos and stress are overwhelming, but what happens next depends almost entirely on the quality of your paperwork.

Here’s how that moment plays out with and without the right documentation:

-

With a Current Appraisal: You hand the detailed report over to your claims adjuster. It’s all there: crisp photos, specific gemological details, and a clear replacement value. The adjuster has an indisputable blueprint of what was lost, making the claims process clean, quick, and fair.

-

Without a Current Appraisal: The whole process grinds to a halt. Suddenly, you and the insurer are stuck in a negotiation, trying to agree on a value after the item is already gone. This is a recipe for disputes, agonizing delays, and a payout that might not come close to what you really need to replace the stolen inventory.

Setting Correct Premiums and Coverage Limits

Your appraisals don't just bail you out during a claim; they also make sure you’re paying the right price for your policy from day one. Insurers base your premiums on the total value of the assets they’re covering. Accurate, professional reports allow them to calculate fair premiums for your Jewelers Block insurance.

Proactive appraisal management isn't just a tedious administrative task—it's the foundation of a reliable insurance partnership. It shows underwriters that you are a diligent, low-risk client who takes asset protection seriously.

This kind of diligence makes all the difference when you need to get a quote for Jewelers Block. Top-tier providers like First Class Insurance Jewelers Block Agency see a well-maintained portfolio of current appraisals as the mark of a well-run business. It proves you know what your inventory is worth and are serious about protecting it—the absolute cornerstone of any effective insurance for jewelry business strategy.

Common Questions About Ring Appraisals

Even if you’ve been in the jewelry business for years, the appraisal process can still bring up some tough questions. Whether you're helping a customer or getting your own inventory documented for insurance, you need clear, straightforward answers. Here are a few of the most common ones we run into.

How Long Does a Ring Appraisal Take to Complete?

It all comes down to the ring’s complexity. A simple solitaire engagement ring? An experienced appraiser can often knock that out in about an hour, sometimes while you wait. The process is pretty clean—one main stone, one setting.

But for more complex pieces, the clock starts ticking. An antique ring with intricate filigree work or a modern design loaded with tiny pavé diamonds demands a much deeper dive. The appraiser might need a few days to do their homework, grade every single stone, and put together the kind of detailed report required for your Jewelers Block insurance.

Does a Higher Appraisal Mean the Ring Is Better?

This is one of the biggest myths out there. A higher appraisal value doesn't mean a "better" ring. Not at all. An insurance appraisal is based on the full retail replacement cost—what it would cost to make a brand-new, identical ring from scratch in today's market.

That number bakes in current metal and gem prices, labor, and the jeweler's markup. It’s a figure purely for insurance coverage, not a grade of quality or a reflection of what you could sell it for. For example, a ring's Fair Market Value, which is used for things like estate sales, is almost always way lower than its insurance replacement value. A good appraisal gives you an honest replacement cost, not an inflated ego boost.

Should I Use an Appraiser from the Store Where I Bought the Ring?

It might be convenient, but the gold standard is always an independent, third-party appraiser. These are professionals who only appraise jewelry—they don’t buy or sell it. That complete separation removes any hint of a conflict of interest.

Their only job is to give you an accurate, unbiased valuation. This independence is exactly what insurance carriers look for when writing insurance for a jewelry store. A clean report from a certified, independent appraiser shows them the value isn't just tied to a recent sale, which gives your documentation a whole lot more credibility.

What Should Be Included in the Final Appraisal Report?

A real appraisal is a detailed, technical document, not just a slip of paper with a number on it. To be taken seriously for insurance for jewelry business purposes, the final report needs to have several key pieces of information.

A proper report will always include:

- A Detailed Description: It should list the metal type, the ring's weight, and any stamps or engravings.

- Complete Gem Analysis: You need a full breakdown of every gem, including the 4Cs (carat, cut, color, clarity) and any known treatments.

- A Clear Photograph: A crisp, high-quality image of the ring is a must for proper identification.

- The Final Value: The report has to clearly state the appraised value and explain its purpose (e.g., "for insurance replacement purposes").

- Appraiser’s Signature: The document must be signed and dated by the certified appraiser who did the work.

Without this level of detail, you're just guessing at your coverage.

Protecting your inventory starts with understanding its true value. At First Class Insurance, we specialize in building robust policies that reflect the real worth of your assets. Get a Quote for Jewelers Block and ensure your business is secured with the expertise it deserves.