When it comes to your jewelry business, "inventory tracking" is a massive understatement. It's not just about counting what you have. It’s the core of your security, the driver of your profits, and the proof you need to be properly insured. Think of it as the central nervous system protecting your most valuable, often irreplaceable, assets from simply vanishing.

Why Standard Inventory Tracking Fails For Jewelers

If you've ever tried using a generic inventory system built for a clothing boutique or a coffee shop, you already know the frustration. It just doesn't work. How could it? A system designed to track T-shirts can't possibly handle the complexities of precious metals, unique gemstones, and one-of-a-kind custom pieces. The standard retail playbook is useless when a single item in your case is worth more than an entire wall of products in another store.

The stakes are entirely different. Your inventory isn't just stock; it's a collection of high-value assets that are constant targets for sophisticated theft. A basic spreadsheet or a simple POS system can’t follow the complicated life of a single piece of jewelry—from the vault, to the display case, out on memo with a client, or over to the bench for a repair.

It's these gaps in tracking that create opportunities for "mysterious disappearance," leaving you to absorb a huge, and often uninsurable, loss.

The Unique Risks in Jewelry Retail

For jewelers, inventory control isn't a boring back-office chore; it's a critical part of your daily risk management strategy. The threats you face are specific and require a specialized approach that generic systems completely miss:

- One-of-a-Kind Pieces: You can't just use a SKU for an antique diamond brooch. Each piece demands its own detailed file with photos, certifications, and a full history.

- High Value Density: A small pouch of loose diamonds or a single tray of rings can represent an incredible amount of capital. This concentration of value makes your inventory a prime target for both internal and external theft.

- Complex Item Journeys: Your pieces are always on the move. They might be in the safe, on the sales floor, with a trusted salesperson, or even off-site for an appraisal. Meticulously tracking every step of that journey is absolutely essential.

This is exactly why a rock-solid, detailed inventory system is non-negotiable if you want to secure comprehensive Jewelers Block insurance that will actually pay out when you need it.

For a jewelry business, inventory management is not a back-office task—it is a front-line security measure. Your ability to meticulously track every single piece is directly linked to your ability to protect your life's work and secure a proper Jewelers Block insurance policy.

Bridging the Gap Between Inventory and Insurance

When you have to file an insurance claim, your well-documented inventory system instantly becomes your most powerful tool. Insurers require definitive proof of ownership at the time of a loss. Without it, you’re walking into a painful, uphill battle that often ends in a denied or disputed claim.

Your daily tracking records create the undeniable audit trail you need to substantiate a claim for theft or mysterious disappearance. This is especially true when securing specialized insurance for jewelry business owners, where proof of loss is paramount.

This is a lesson many businesses are learning the hard way. A 2023 logistics report found that while 77% of businesses have basic reporting, they lack the real-time visibility needed to prevent major discrepancies. For a jeweler, that lack of granular tracking isn't just an inaccuracy—it's a massive financial vulnerability.

Choosing Your Jewelry Inventory Management System

If you're still relying on spreadsheets, it’s time for a serious upgrade. Moving to a proper inventory management system (IMS) is one of the most important security decisions you can make for your jewelry business. But let’s be clear: this isn't about finding software with a million features. It’s about picking a tool that speaks the unique language of high-value assets.

A generic retail platform just won't cut it. It simply can't provide the kind of granular control you need when dealing with gems and precious metals.

The right system becomes your silent partner in protecting every single piece. It creates a solid digital record for everything from a loose diamond to a finished engagement ring, which is absolutely vital for your day-to-day operations and your insurance for a jewelry store compliance.

Core Features That Actually Matter for Jewelers

Forget the generic sales pitches. When you're looking at different systems, you need to zero in on the functions built for the real-world complexities of jewelry. These are the non-negotiables.

- Unique Serialization: This is the bedrock of real inventory control. Your system must let you assign a unique serial number or stock-keeping unit (SKU) to every item. A specific 1.5-carat diamond ring can never be confused with another of the same style.

- High-Resolution Photo Integration: In an insurance claim, a picture is your best evidence. You need the ability to attach multiple high-quality photos showing hallmarks, certifications, and unique marks. This provides indisputable proof of an item's existence and its condition.

- Component and Raw Material Tracking: A great system tracks more than just finished pieces. It follows the loose stones, the metal findings, and the settings that make up your creations. This gives you a true, comprehensive picture of your total asset value.

- Memo and Repair Management: Your inventory is always moving. A good IMS has dedicated modules to track items out on memo to a client or with your bench jeweler for a repair, creating a clear and unbroken chain of custody.

Barcodes vs. RFID: A Practical Comparison

Tagging your items is ground zero for a modern inventory system. For jewelers, the choice usually boils down to old-school barcodes or newer Radio-Frequency Identification (RFID) tags. They both beat manual entry, but they serve very different purposes.

Barcodes are cheap and reliable for basic tasks, like ringing up a sale. They need a direct line of sight to be scanned, which works for individual transactions but makes counting your entire inventory a massive headache.

RFID, on the other hand, can be a total game-changer for efficiency and security. An RFID tag can be read from a distance, without needing a direct line of sight. This means you can scan an entire tray of rings—or even the entire contents of your safe—in seconds. You'll know instantly if a specific piece is missing.

For a business built on high-value items, the investment in RFID often pays for itself by slashing audit times and giving you near-real-time security alerts.

For a jeweler, the ability to confirm the presence of hundreds of items in a vault in under a minute isn't a luxury; it's a powerful security protocol. RFID technology transforms a time-consuming manual audit into a swift, accurate, and repeatable process.

Your System Implementation Roadmap

Just buying the software isn't enough. You need a clear plan to weave it into the fabric of your daily operations.

First, standardize your SKU system. Before you enter a single piece, create a consistent, logical format. A good structure might include codes for item type, metal, and a unique ID (e.g., ER-18YG-00121 for an 18k yellow gold engagement ring).

Next, integrate it with your tech stack. Make sure the IMS talks to your Point-of-Sale (POS) system and your accounting software. This connection gets rid of duplicate data entry, cuts down on human error, and gives you one unified view of your sales, stock, and financials.

Finally, plan your data migration. This is the heavy lift. You need to set aside dedicated time to photograph and enter every single piece you own into the new system. It’s an intensive process, but it's absolutely critical for creating a clean, accurate baseline. Don't cut corners here.

When you're making your final choice, look for a system that offers specific inventory analytics for jewelry, giving you real insight into your unique business. The goal is to get a system that does more than just count—it should actively help you protect your assets, satisfy your insurer, and make smarter decisions.

Developing Airtight Tagging and Record-Keeping Protocols

An expensive inventory system is a fantastic tool, but it's only as sharp as the daily habits you build around it. Think of your software as the vault and your record-keeping as the guard on duty—one is pretty useless without the other. This is where you forge the unbreakable audit trail that protects every single piece in your collection.

Airtight inventory tracking for any business, especially a jeweler, starts the second a new piece comes through your door. It’s all about creating a complete digital identity for every item long before it ever sees a display case. This digital profile becomes your first and most important line of defense.

This detailed record is the bedrock of your entire security and insurance strategy. It’s not just about knowing what you have; it’s about being able to prove it, without a shadow of a doubt, when something goes wrong.

Creating the Digital Dossier for Each Piece

For every single item, your digital record needs to be exhaustive. This isn’t just another line on a spreadsheet; it's a complete biography that leaves zero room for error or ambiguity.

- Supplier and Cost Information: Log the vendor, the date you acquired it, and the exact cost. This data is non-negotiable for accurate valuation, profit analysis, and, most importantly, insurance claims.

- Detailed Descriptions: Go way beyond "gold ring." Document the metal type (e.g., 18k yellow gold), weight, stone types, carat weights, color, and clarity. For unique pieces like this diamond ring, you need to capture every last detail.

- High-Resolution Photographs: Take multiple, crystal-clear photos from every angle. Get close-ups of hallmarks, engravings, or any unique identifying marks. These images act as undeniable proof of possession and condition.

- Certificates and Appraisals: Scan and attach all relevant documents, like GIA certificates or third-party appraisals, directly to the item’s digital file.

This level of detail is exactly what separates a paid claim from a denied one. If you want to understand why insurance brokers need digital proof, look no further. Your digital dossier is precisely the kind of concrete evidence they demand.

The Importance of Consistent Tagging Procedures

Once an item has a digital profile, it needs a physical one. Consistent tagging connects the physical piece to its digital record, making your tracking seamless and dead-on accurate. Whether you opt for barcodes or RFID tags, the protocol must be followed religiously by every single person on your team.

The tag itself should contain the unique SKU or serial number that links directly to the master record in your system. That connection is what allows for quick scans during sales, transfers, or cycle counts, ensuring your data stays clean through every transaction.

The cardinal rule of inventory management is this: nothing moves without a scan. From receiving a shipment to processing a repair, every single touchpoint must be logged in real-time. That discipline is what separates a secure inventory from a vulnerable one.

This disciplined approach is what kills the guesswork and human error that plague manual systems. Analysis shows that small businesses integrating barcode scanning can hit 99% inventory accuracy. That’s a world away from the 60-70% error rates we often see in jewelers still clinging to spreadsheets.

Upholding Data Integrity in Daily Operations

Your airtight protocols are only as strong as the team putting them into practice. Training isn't a one-and-done event; it's an ongoing commitment to precision. Every employee must understand their role in protecting the integrity of your inventory data.

This means having clear standard operating procedures (SOPs) for every possible scenario:

- Receiving New Stock: What is the step-by-step process for unboxing, inspecting, photographing, and tagging a new delivery before it’s placed in the vault?

- Making a Sale: How is an item scanned and its status updated in the system at the point of sale to reflect it has been sold?

- Handling Consignments: What documentation and system entries are required when accepting or sending an item on memo?

- Processing Repairs: How is a customer’s piece logged and tracked separately from your own stock while it's in your care?

By embedding these strict protocols into your daily workflow, you turn inventory tracking from a reactive chore into a proactive security measure. This meticulous record-keeping not only shields you from loss but also shows your insurance provider that you run a tight, professional ship.

Mastering Cycle Counts and Physical Audits

The very thought of a full, wall-to-wall annual inventory count is enough to give any business owner a headache. It means shutting down, pulling your best people off the sales floor, and burning days counting every last item. For a jeweler, where every single piece is unique and high-value, that process is a minefield of stress and potential mistakes.

But there’s a much smarter way to operate.

Effective inventory tracking for a small business isn’t about one massive, dreaded event. It’s about building a continuous, proactive process that keeps your records razor-sharp and your assets locked down all year long. This is where cycle counting comes in.

Instead of that once-a-year scramble, cycle counting is simply auditing small, manageable segments of your inventory on a rotating basis. This flips the script, turning auditing from a painful chore into one of your most powerful, ongoing security measures.

The Power of Proactive Cycle Counting

Cycle counting breaks a mammoth task into simple, repeatable actions. One week, you might count all your diamond engagement rings. The next, your gold chains. The week after that, loose gemstones. This approach has massive advantages over the old-school annual audit.

- Minimal Business Disruption: You can get these counts done quickly, either before you open or during a slow period. You never have to close your doors.

- Immediate Discrepancy Detection: Finding a missing item a week after it was last handled is a problem you can solve. Discovering that same gap six months later during an annual audit? The trail has gone cold.

- Improved Accuracy: Let's be honest, fatigue leads to errors. Frequent, smaller counts keep your team focused and sharp, drastically reducing the mistakes that plague those marathon multi-day audits.

- Demonstrates Due Diligence: A documented cycle counting program is gold in the eyes of your insurance provider. It's hard evidence that you have strong internal controls and take protecting your assets seriously.

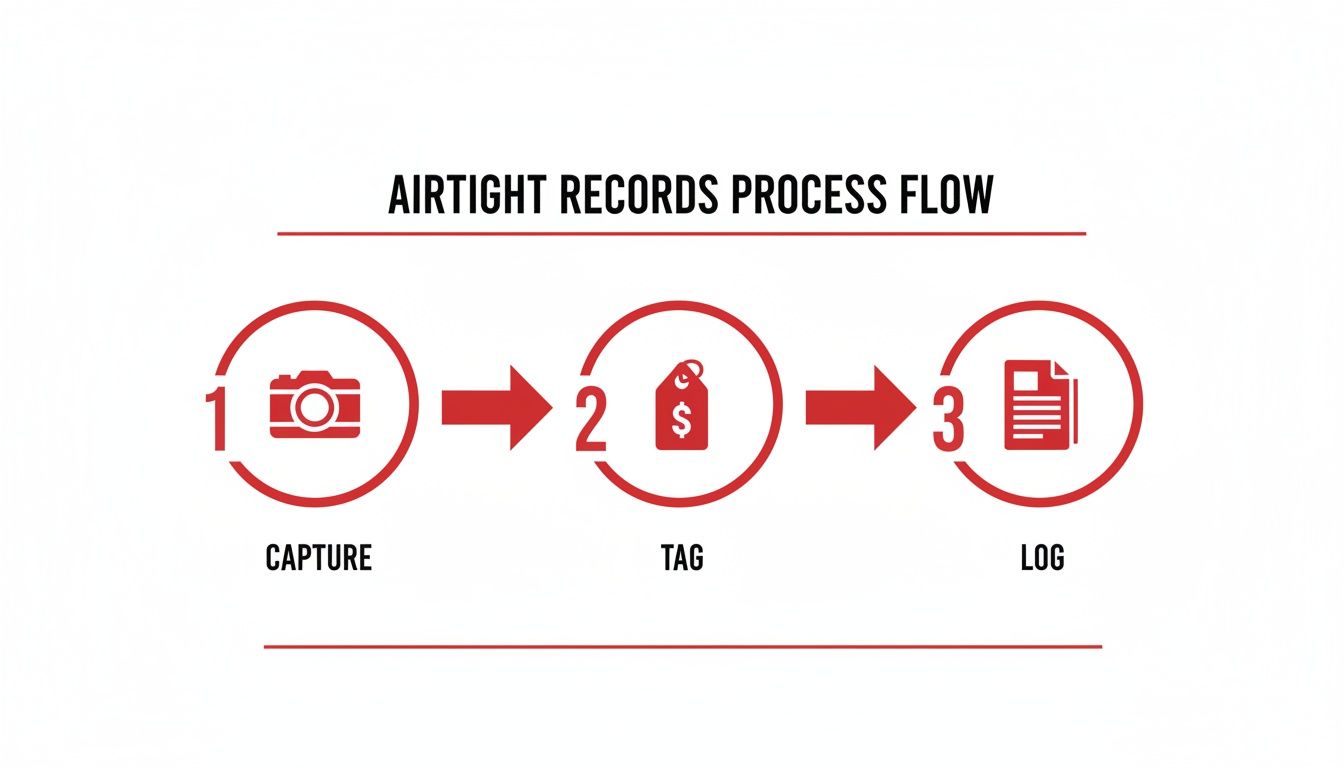

The whole process of keeping airtight records really boils down to a simple, continuous flow.

This "Capture, Tag, Log" workflow is the foundation. It ensures every piece has a solid identity, both physically and in your system, which is what makes accurate cycle counts possible in the first place.

Responding to Inventory Discrepancies

No matter how buttoned-up your system is, discrepancies are going to happen. The real test is how you respond. When a cycle count shows a piece isn't where it should be, panic is your enemy. A calm, methodical investigation is your best friend.

First, verify the count immediately. Have a different team member recount that same section. You need to rule out simple human error before you do anything else. Then, double-check your system. Was the item just sold? Transferred to another location? Sent out for repair without being logged?

Next, follow the data trail. Dive into the item’s history in your inventory software. Pinpoint its last recorded location, review any recent transactions, and see who handled it. Pull up your security camera footage for the time frame around its last known movement.

A discrepancy isn't just a number on a spreadsheet; it's a lead. Whether it points to a simple clerical error or a potential theft, investigating it thoroughly is a critical security exercise that strengthens your entire operation.

If these initial steps don't solve the mystery, it’s time to escalate. Your goal is to figure out if you're looking at a process breakdown—like a missed scan at the point of sale—or something far more serious. A simple data entry mistake is a training opportunity. A pattern of missing items is a massive red flag.

This is the kind of diligence that a solid insurance for a jewelry business requires. Precise records and a clear response plan are essential for protecting your business from major financial loss and giving you the peace of mind you deserve.

Aligning Inventory Controls with Security and Insurance

All the hard work you’ve poured into tagging, tracking, and auditing your inventory really comes to a head right here. This is where your day-to-day operational habits stop being just "best practices" and become your most powerful risk management tool.

When it comes to your Jewelers Block insurance, a well-documented inventory system is the strongest proof you have. It’s the critical link between your physical assets and your financial security. Without it, you're just crossing your fingers. With it, you have undeniable evidence that can make or break a claim.

Think of your insurance policy as an active partnership. Insurers need to see you’re taking every possible step to protect the high-value assets they’re covering. A rock-solid inventory protocol is the most convincing evidence you can give them.

Making Your Inventory Your Best Witness

In the awful event of a theft or a mysterious disappearance, your ability to file a successful insurance claim boils down to one thing: proof. You have to prove not just that a specific item existed, but that you actually owned it when the loss happened. Vague descriptions or spotty records can lead to long, drawn-out disputes—or worse, a flat-out denied claim.

This is where your detailed inventory records become your star witness. Those digital files you've built for each piece—complete with high-res photos, supplier invoices, and gemological certificates—provide the concrete evidence needed to back up your loss.

Imagine a smash-and-grab empties one of your display cases. Instead of scrambling to remember what was taken or digging through incomplete paperwork, you can instantly pull a report from your system. This report will list every single stolen piece, its full description, its cost, and its unique ID number.

That level of precision just shuts down any ambiguity. It helps the claims process move forward quickly and efficiently, so you get the settlement you deserve and can start putting your business back together.

Aligning Procedures with Insurer Expectations

Insurance underwriters at firms like Lloyd's of London have seen it all. They know exactly where the weak spots are in a jewelry business. That’s why a top-tier Jewelers Block insurance policy is written with the assumption that you have strong internal controls in place. Your inventory tracking has to meet those expectations.

Your inventory system is a direct reflection of your business's overall health and security. To an insurer, a business with a disorganized, inaccurate inventory is a high-risk client. A business with a real-time, auditable system is a responsible partner.

Here’s what insurers are looking for as proof of strong controls:

- Tracking in Showcases: How do you watch over items on the sales floor? Things like daily showcase counts and immediately logging sales are non-negotiable.

- Vault Security: Your system needs to provide a crystal-clear, real-time list of every single item locked in the vault at the end of each day.

- Memo and Transit Logs: Any piece that leaves your store—whether it's on memo with a client or out for repair—must be tracked with a signed agreement and a clear digital log. This documentation is vital for your off-premises coverage.

This isn't just about being organized for your own sake. It’s a requirement for keeping your insurance partnership solid.

An Investment in Business Resilience

When you start seeing your inventory protocols as an investment instead of a chore, everything changes. Every scan, every count, and every detailed record you create is a direct deposit into your business's resilience. It hardens your defenses against loss and reinforces your financial safety net.

Many retailers hit a wall as they grow. Square's 2026 Retail Guide notes that while most small businesses start out tracking inventory, their manual systems fall apart as product lines and sales channels multiply. For jewelers in the US managing millions in assets, this creates a dangerous blind spot that can lead to losses from theft or shipping risks—exactly the kinds of incidents a First Class Insurance Jewelers Block Agency is built to cover.

Ultimately, the goal is peace of mind. Knowing you have an unbreakable audit trail for every single piece in your collection lets you operate with confidence. It means that if the worst should happen, you are fully prepared. This proactive approach doesn't just lead to smoother claims and better insurance terms; it strengthens the very foundation of a secure, profitable, and lasting jewelry business.

Common Questions About Jewelry Inventory Management

Even when you have the best systems humming along, the reality of running a jewelry business means questions will always pop up. Staying on top of your inventory tracking for small business owners in this industry isn't just about software—it's about handling the day-to-day challenges that come your way.

Let's dive into some of the most common questions I hear from jewelers. This isn't just theory. This is about what to do when you're standing in front of the vault, prepping for an audit, or trusting a client with a five-figure piece. Nailing these details is what separates a good inventory system from a great one.

Ultimately, you'll see a running theme here: precision, consistency, and the unbreakable link between how you run your store and how well your insurance protects you.

How Often Should My Jewelry Store Do a Full Physical Inventory?

While daily or weekly cycle counts are your best friend for managing high-value items, a complete, wall-to-wall physical inventory is non-negotiable at least once a year. Think of it as the ultimate reset button for your records, making sure every single piece is accounted for.

For Jewelers Block insurance, this isn't just a suggestion. Most providers require a full, documented physical count that was performed within the last 12 months as a condition of the policy.

If you can swing it, doing one semi-annually gives you even tighter control and helps spot systemic problems before they snowball. The key is to keep meticulous, consistent records from every count that you can hand over to your insurance partner to prove you’re doing your due diligence.

What Is the Safest Way to Track Jewelry on Memo or Out for Repair?

An item should never, ever leave your premises without a rock-solid digital and physical paper trail. The second a piece is out of your hands, its risk profile completely changes, and your records need to reflect that immediately.

Inside your inventory system, assign it a specific status like "On Memo" or "Out for Repair." This isn't just a label; it's a critical log that must include:

- Who has it: The client's or artisan's full name and contact info.

- When it left: The exact date the clock started ticking.

- What it's worth: The full, agreed-upon value for insurance purposes.

- When it's due back: A clear deadline for you to follow up.

And just as important, always use a signed memo agreement that spells out the terms of responsibility. This piece of paper is vital for your Jewelers Block policy. It proves you still own the item and ensures it’s covered under your policy’s transit and off-premises clauses.

An unsigned memo is an invitation for a costly dispute. A detailed, signed agreement, backed by a clean digital log, is your proof of professional control. It shields you from liability and keeps your insurance coverage firmly in place.

Can I Just Use a Standard Retail POS for My Jewelry Inventory?

I know it’s tempting, but using a generic retail point-of-sale (POS) system for a jewelry business is a massive security risk. A standard POS can ring up a sale, sure, but it's completely blind to the nuances that jewelers need to protect their assets.

A generic system can't track an item's journey from loose stones and findings to a finished piece. That's a huge problem when you need to prove accurate costing and valuation for your insurance for a jewelry business after a loss.

Jewelry-specific systems are built from the ground up to handle things like:

- Unique serial numbers for one-of-a-kind pieces.

- Component tracking for loose diamonds, mountings, and metals.

- Repair and custom job management that keeps client property separate from your stock.

- Detailed attributes like metal type, carat weight, and certifications.

Investing in a specialized system isn't just an operational choice; it's a foundational part of your security and risk management strategy.

How Does Accurate Inventory Control Affect My Insurance Premiums?

Insurers see a business with a real-time, highly detailed inventory system as a fundamentally lower risk. It's a clear signal that you have strong internal controls and you're proactive about preventing loss—which is exactly what underwriters love to see.

When you can produce a clean, auditable inventory list at a moment's notice, it builds tremendous confidence and makes the entire application and renewal process smoother. And if you ever have to file a claim, those meticulous records can dramatically speed up the settlement, getting you the cash you need to get back on your feet.

While a lot of factors go into your final premium, demonstrating this level of professional diligence helps position your jewelry store insurance application in the best possible light. It proves you're a responsible partner in managing risk, which can help you lock in the best possible terms for your Jewelers Block policy.

Protecting your life's work takes more than a strong vault. It demands smart, proactive controls and the right insurance partner who gets it. The team at First Class Insurance has over 30 years of experience helping jewelers secure the coverage they need because we have a deep understanding of this industry's unique risks. Get a quote for Jewelers Block and see how our specialized approach can protect your inventory, your reputation, and your peace of mind.