In the high-stakes world of the jewelry business, loss prevention isn't just another line item on your budget—it's a core investment in your store's survival. These services are a mix of strategic security measures, smart inventory controls, and airtight employee protocols. They're all designed to stop theft, fraud, and other losses dead in their tracks, before they can touch your most valuable assets. This comprehensive approach is fundamental to securing the right insurance for a jewelry business.

Why Modern Loss Prevention Is Non-Negotiable

For any jeweler, your inventory is concentrated wealth. A single tray of diamond rings walking out the door can wipe out months of hard-earned profit. That simple fact makes a tough security strategy absolutely essential, not just a nice-to-have.

Running a modern jewelry store without a comprehensive loss prevention plan is like trying to guard a bank vault with a cheap padlock. You’re just asking for trouble. It's about shifting your mindset from reacting to a break-in to proactively preventing one from ever happening.

Effective loss prevention is so much more than a few cameras and a loud alarm. It’s a layered approach that creates a secure bubble around your business from every conceivable angle.

- Physical Defenses: We're talking high-security safes, shatter-resistant showcases, and controlled access points. These are the physical barriers that stand between a criminal and your inventory during a smash-and-grab or after-hours burglary.

- Digital Shields: In a world where everything is connected, protecting your point-of-sale system, customer data, and online inventory from cyber threats is just as vital as locking your front door.

- Procedural Safeguards: This is the human element. Strict inventory handling procedures, dual-control systems for high-value pieces, and thorough employee training are what minimize the risks from the inside.

Understanding the Growing Need

You don't have to take my word for it—the market growth tells the whole story. The global Loss Prevention Services market is on track to hit a staggering $7.6 billion in 2025, with a projected compound annual growth rate (CAGR) of 20.30% from 2025 to 2033. For jewelers, these numbers point to a critical reality: the threats are growing, and the industry is investing heavily to fight back.

Ultimately, the goal is to clamp down on "shrinkage"—the industry’s term for inventory loss from theft, fraud, or simple error. Getting a handle on effective strategies for business shrinkage prevention is fundamental to protecting your bottom line.

By bringing these services into your operation, you’re not just guarding your inventory. You're securing your reputation, your future, and your peace of mind.

Building Your Fortress of Layered Security

A solid loss prevention plan isn't about buying a single high-tech alarm or a bigger safe. It's about building a fortress—a series of interlocking defenses where each layer supports the others. For jewelers, whose assets are small, priceless, and incredibly portable, this layered approach is the only way to build a business that can withstand real-world threats.

Think of it like an old-school castle. The builders didn't just rely on a tall outer wall. They added a moat, a drawbridge, reinforced gates, and guards on patrol. In your store, those layers translate into a smart mix of physical barriers, airtight procedures, and a well-trained team.

The whole point is to make your business a frustratingly difficult target. If a criminal manages to bypass one layer, another one is right there waiting to stop them. It’s about encouraging them to give up and go somewhere else.

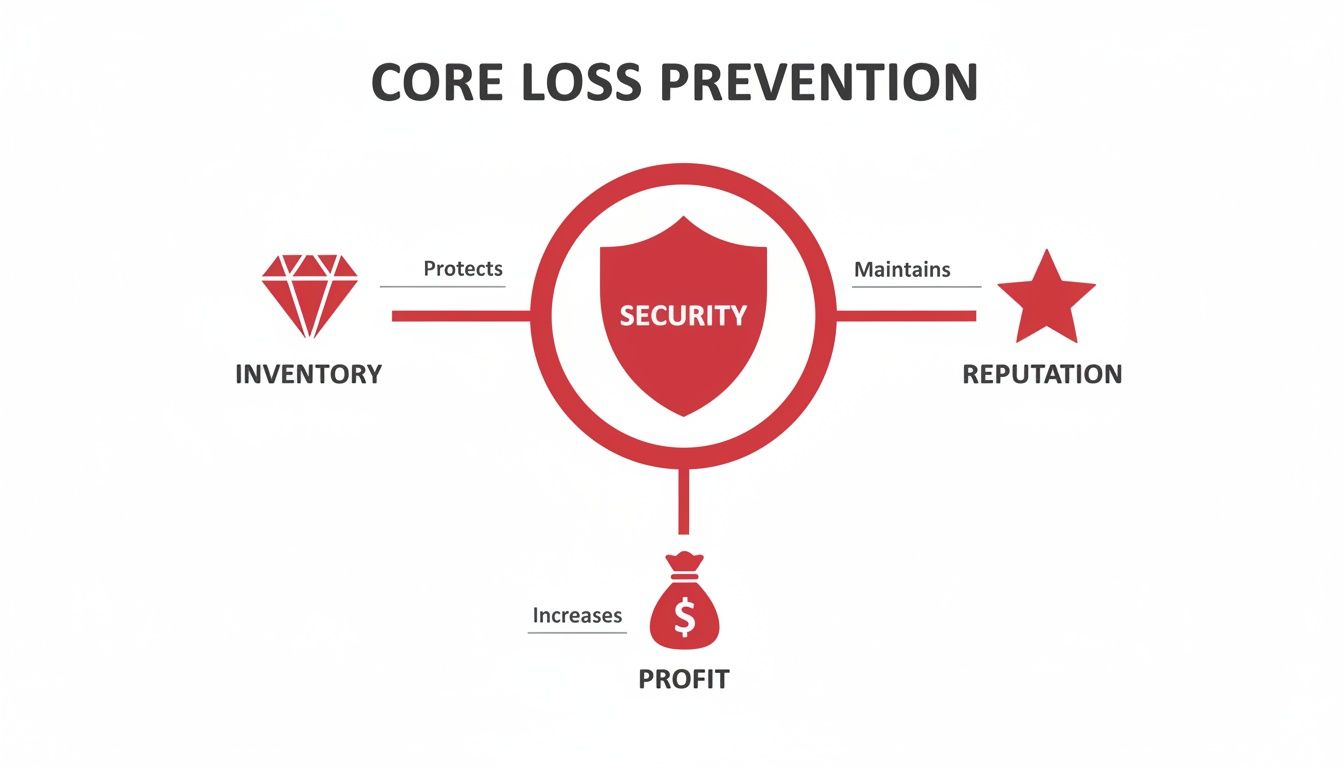

This diagram shows how a central focus on security does more than just stop theft—it protects your inventory, your reputation, and ultimately, your bottom line.

As you can see, strong security isn't just a defensive move. It's a core business function that enables growth and stability.

Let's break down the essential services that form these layers. Each service targets specific threats, offering a primary benefit that strengthens your entire operation.

Key Loss Prevention Services for Jewelers

| Service Type | Threat Addressed | Primary Benefit |

|---|---|---|

| Physical Security | Smash-and-grab, burglary | Deters and delays physical attacks |

| Inventory Control | Internal theft, paperwork errors | Creates accountability, identifies loss quickly |

| Armed & Unarmed Guards | Robbery, organized retail crime | Provides a visible deterrent and immediate response |

| Background Screening | Internal theft, fraud | Prevents hiring high-risk individuals |

| Employee Training | Procedural errors, social engineering | Empowers staff to be the first line of defense |

| Digital & POS Security | Data breaches, fraudulent transactions | Protects customer data and financial assets |

| CCTV & Monitoring | All forms of theft, false claims | Provides evidence, deters criminal activity |

These services are the building blocks of a resilient security strategy, working together to close gaps and protect your business from every angle.

Layer 1: The Physical Foundation

This is the most obvious part of your fortress—the walls, gates, and locks. It’s your first defense against brute-force attacks like smash-and-grab robberies and overnight burglaries. It all starts with the physical structure of your store.

- High-Security Safes and Vaults: Your most valuable pieces must live in UL-rated safes or vaults when you're closed. This isn't just a good idea; it's a non-negotiable standard for getting proper insurance for a jewelry store.

- Reinforced Showcases: Using laminated, shatter-resistant glass in your showcases won't stop a determined thief forever, but it will slow them down. Those few extra seconds are critical for your staff and security systems to react.

- Access Control Systems: You have to control who goes where. Keycard or biometric systems for your vault, back office, and inventory rooms are essential. They create a digital paper trail, logging exactly who entered a secure area and when.

These physical deterrents are designed to make a quick, easy score impossible. They force a criminal to spend time and make noise—two things they can't afford.

Layer 2: Meticulous Inventory Control

Let's be blunt: if you can't track it, you can't protect it. Airtight inventory control is the absolute backbone of any effective loss prevention services program, protecting you from threats both outside and inside your business. It's about knowing exactly what you have, where it is, and whose hands it has passed through.

A well-documented inventory system is your most powerful tool for identifying mysterious disappearance and internal theft, which are often silent but significant drains on profitability.

Regular, systematic audits are a must. These checks—whether you do them daily, weekly, or monthly—reconcile your physical stock against your digital records. They immediately flag discrepancies that signal a problem, long before a small issue becomes a major loss. This level of detail is also a huge factor underwriters look at when you get a quote for Jewelers Block insurance.

Layer 3: The Human Element

Your team is your greatest asset. But without the right training and procedures, they can also become your biggest vulnerability. Strong employee protocols act as a human firewall, protecting your business from the inside. This layer is all about careful hiring, constant training, and clear, non-negotiable rules.

Here are a few essential protocols:

- Thorough Background Screening: Verifying the history and checking the references of every potential hire is the first and most fundamental step in preventing internal theft.

- Strict Opening and Closing Procedures: Always require at least two employees to be present during opening and closing. This simple rule drastically reduces the risk of an ambush or robbery.

- Secure Handling of High-Value Items: Implement a "show one at a time" policy and never, ever leave a valuable piece unattended on the counter. Every item goes back into a secure location immediately after being shown.

- Ongoing Training: Regularly train your staff on how to spot suspicious behavior, how to react calmly during a robbery, and why following every single security protocol is so important.

When you integrate these layers—the physical, the procedural, and the human—you create a formidable defense. Each element reinforces the others, building a security system that is far stronger than the sum of its parts and absolutely essential for any jewelry store insurance plan.

Strengthening Your Jewelers Block Insurance

Think of loss prevention services and your Jewelers Block insurance as two sides of the same coin. Loss prevention is the proactive part—all the measures you take day-in and day-out to stop a theft before it happens. Insurance is the reactive safety net, there to catch you financially if something goes wrong anyway.

You can't have one without the other. A truly secure jewelry business needs both working in lockstep.

When you apply for insurance, underwriters don’t just pick a number out of a hat. They perform a deep dive into your business, scrutinizing every single security measure you have in place. They’re essentially placing a bet on how likely you are to file a claim.

This is where your investment in loss prevention pays for itself. A rock-solid security program tells an insurer you're a lower-risk partner, which can have a direct, positive impact on your policy's terms and, most importantly, its cost. It’s a tangible return on your security spending that goes straight to your bottom line.

How Underwriters See Your Business

Insurance underwriters are, by trade, professional risk analysts. They view your business through a lens of potential weak spots, evaluating everything from the locks on your doors to the firewalls on your computers. A sloppy or outdated security setup sends up immediate red flags, often leading to painfully high premiums or, in some cases, an outright denial of coverage.

On the other hand, a comprehensive security plan shows that you’re a responsible partner in managing risk. It proves you’re actively working to prevent the very incidents that lead to costly claims. That kind of proactive approach is exactly what carriers want to see.

An underwriter's job is to price risk accurately. When you implement certified and documented loss prevention measures, you are actively lowering your risk profile. This makes your business a much more attractive—and less expensive—client to insure.

This direct link between security and insurance costs is a powerful motivator. The money you spend upgrading your safe or training your team isn't just an expense; it's an investment that can reduce your annual insurance premiums for years to come.

Key Security Measures That Lower Premiums

While every policy is different, some security upgrades are universally recognized by underwriters as major risk reducers. When you can prove these measures are in place and properly maintained, you give yourself serious negotiating power for your jewelry store insurance.

-

UL-Rated Safes and Vaults: This is the big one. Underwriters will specifically ask for the UL rating of your safes (e.g., TRTL-30×6). A higher rating signifies greater resistance to attack, which directly lowers their perceived risk.

-

Certified Alarm Systems: The industry standard is a central station-monitored alarm with layers of protection—motion sensors, glass-break detectors, and door contacts. Proof of professional installation and monitoring is a must.

-

Strict Inventory Controls: Having a bulletproof system for tracking every single piece shows underwriters you can identify a loss instantly and are less vulnerable to internal theft. That kind of discipline is highly valued.

-

CCTV and Surveillance: High-definition cameras covering all critical areas act as a powerful deterrent and provide priceless evidence if an incident occurs. Underwriters will want to know about your camera placement, recording duration, and remote access capabilities.

Making these upgrades demonstrates a real commitment to security. It’s something that underwriters, including those from respected markets like the one represented by the Lloyd's of London logo, see as the hallmark of a well-managed business.

Ultimately, beefing up your security is about more than just stopping thieves; it’s about building a resilient business from the foundation up. When you align your loss prevention strategy with the requirements of your Jewelers Block insurance, you create a powerful synergy that protects your assets, lowers your costs, and buys you invaluable peace of mind.

Choosing the Right Security Partners

Pinpointing the loss prevention services you need is one thing. Picking the right partners to bring them to life is where your strategy will either sink or swim. In the high-stakes world of jewelry, a generic security provider just won't do. You need partners who speak your language—people who understand the unique magnetic pull and the immense vulnerability of small, high-value inventory.

Think of choosing a vendor like hiring the person who holds the keys to your vault. You wouldn’t hand those over without a serious background check and a look at their track record. The same exact thinking applies here. Not every security firm is built to handle the very specific threats a jeweler faces every day.

Vetting Your Vendors for Industry Experience

The single most important factor is deep, proven experience in the jewelry business. A company that spends its days installing basic home alarm systems simply doesn't grasp the nuances of protecting a million-dollar inventory from a sophisticated, planned-out attack. Their expertise is your first and most critical line of defense.

To really vet a potential partner, you have to dig deeper with targeted questions that cut through the sales pitch. You're listening for concrete answers backed by real-world experience, not generic promises.

Here are the questions you absolutely have to ask:

- Jewelers Block Insurance: "How do your systems and services help us meet—or even exceed—the requirements of our Jewelers Block insurance policy?" A partner who knows their stuff can actually help you get better terms from your insurer.

- High-Value Inventory: "Tell me about your experience protecting businesses with inventory like ours. Can you share a few case studies?"

- Industry Certifications: "Are your central monitoring stations UL-certified? What other industry-specific certifications do your technicians and systems hold?"

- Emergency Response: "Walk me through your exact protocol when an alarm is triggered at a jewelry store. What’s your average response time?"

These questions shift the conversation from technical specs to what truly matters: their ability to protect your specific business when it counts.

A security partner who gets the jewelry industry isn't just selling you equipment. They're a consultant, helping you square your security measures with your insurance obligations and day-to-day operations. They make your entire business stronger.

Looking Beyond Traditional Security

Your web of trusted partners should extend well beyond alarm companies and armored transport. Protecting your assets often means securing your entire supply chain, especially when you're dealing with international shipments. This is where highly specialized expertise becomes priceless.

Importing gemstones or finished pieces, for instance, comes with a whole different set of risks—from customs delays to an outright seizure if your paperwork isn't perfect. It's crucial to understand what a customs broker is and why they are essential for stopping losses before that inventory even has a chance to hit your showroom floor.

It works the same way when you build relationships at industry events. A trade show isn't just for sourcing new pieces; it’s a prime opportunity to meet and vet potential partners face-to-face. Choosing the right partners means building a fortress around every single aspect of your operation, making sure every link in the chain is as secure as the last.

Securing Your Digital Assets and Data

In the jewelry business, your most valuable assets aren't always locked away in a safe. Think about your digital inventory: customer lists, purchase histories, supplier details, and all your financial records. For a modern criminal, that data is a high-value target.

A data breach isn't just some IT headache; it's a direct threat to your physical security, which is why digital protection has become a core piece of modern loss prevention services.

Think it through for a second. A stolen client database is basically a shopping list for thieves. It tells them exactly who bought that five-carat diamond ring, where they live, and maybe even when they're planning their next vacation. This kind of information is a goldmine for planning a targeted home invasion or robbery, bridging the gap between a cyber attack and a real-world physical crime.

For that reason alone, protecting your data is just as critical as protecting your diamonds. The hit to your reputation after a data breach can be catastrophic, destroying the customer trust you've spent years building and leaving you on the hook for major financial penalties. That’s a risk no amount of insurance for a jewelry business can fully undo after the fact.

Understanding Data Loss Prevention (DLP)

Data Loss Prevention, or DLP, is a combination of strategies and tools built to make sure sensitive information doesn't just walk out the door. It’s like having a digital security guard watching every piece of data trying to leave your network, whether it’s through an email, a file transfer, or someone plugging in a USB drive.

The global DLP market was valued at $3.1 billion in 2025 and is expected to explode to $13.8 billion by 2034, with North America holding a massive 29.8% share. That explosive growth points to one hard truth for businesses like ours: customer databases are gold. Pairing a solid Jewelers Block insurance policy with DLP is how you prevent the one-two punch of a digital breach followed by a physical theft. You can learn more about the expanding data loss prevention market and what it means for our industry.

A data breach not only puts your customers at risk but also shatters the trust that is the bedrock of any successful jewelry business. Protecting their information is protecting your reputation and your future.

Key Areas for Digital Security

To build a tough digital defense, you have to focus on the spots where your data is most exposed. A real strategy covers your entire digital footprint, from the front counter to the back office.

- Securing Your Point-of-Sale (POS) System: Your POS is the heart of your operation, and it's a huge target. It needs to be on its own secure network, kept up-to-date with every security patch, and fully compliant with payment card industry (PCI) standards to keep credit card data locked down.

- Protecting Customer Databases: This is non-negotiable. All customer information must be encrypted, both when it's just sitting on your server and when it’s being sent somewhere. Access should be on a need-to-know basis, period.

- Ensuring Secure Communications: Employee emails can be a huge weak spot. Putting email encryption in place makes sure that sensitive conversations with suppliers or clients are unreadable, even if they're intercepted.

These digital safeguards aren't optional anymore. They are an essential layer of your security fortress, working right alongside your physical measures to give you complete protection. Integrating strong digital security doesn't just protect your assets—it shows underwriters that you're serious about managing all forms of risk when you get a quote for Jewelers Block insurance.

Putting Your Loss Prevention Plan into Action

Knowing you need stronger security and actually building it are two very different things. A full-blown strategy can feel like a massive undertaking, but the secret is breaking it down. Think of it less as one giant project and more as a series of manageable steps that turn a complex goal into a clear action plan.

The journey doesn't start with buying new gear. It starts with becoming a detective in your own store. You have to scrutinize every part of your operation through the eyes of a thief, from the moment inventory arrives to the second it leaves with a customer. Where are the weak spots? That’s what you need to find first.

Prioritizing Your Security Investments

Once you’ve mapped out your vulnerabilities, it’s time to prioritize. Not every risk carries the same weight. A ground-floor window with standard glass is probably a more urgent fix than an older, but still working, CCTV camera. You have to focus your budget where it will make the biggest dent in your specific risks.

This is also the perfect moment to loop in your Jewelers Block insurance provider. Show them your assessment and what you plan to upgrade. They can give you priceless feedback on which improvements might lead to better policy terms or lower premiums, helping you get the most bang for your buck. Their input ensures your plan is aligned with insurance requirements right from the start.

A Sample 90-Day Implementation Timeline

To make this feel less overwhelming, breaking the process into phases is key. A structured timeline gives you a clear road map and lets you track your progress without getting bogged down.

Here’s a sample plan showing how you could methodically shore up your defenses over the next three months.

Sample 90-Day Loss Prevention Implementation Plan

| Phase | Timeline | Key Actions | Success Metric |

|---|---|---|---|

| Foundation | Month 1 | Upgrade physical security (safes, locks, showcase glass) and implement stricter access controls. | All high-value inventory is secured in UL-rated safes; access to sensitive areas is logged. |

| Procedures | Month 2 | Roll out new inventory protocols (audits, secure handling) and conduct mandatory staff training. | Staff can articulate and demonstrate all key security procedures without hesitation. |

| Integration | Month 3 | Deploy digital security measures (POS hardening, data encryption) and review your Jewelers Block policy. | All security upgrades are documented and submitted to your insurer for policy review. |

This timeline follows a logical flow. You start with the hard physical barriers that give you immediate protection, then move on to the procedures and digital layers that back them up.

Remember, security isn't a "one and done" project. It’s an ongoing process. Your loss prevention plan needs to be a living document that you review and adapt as new threats emerge or your business changes.

By following a structured plan, you systematically build a fortress around your business. Each step adds another layer of protection, strengthening your defenses and giving you the peace of mind that comes from a proactive security strategy. The goal is to weave security into the very fabric of your culture, not just treat it as a reaction to a threat.

Frequently Asked Questions

Stepping into the world of loss prevention can feel complex, and as a jeweler, you need straight answers to make smart decisions that protect your business. Here are some of the most common questions we hear from jewelers just like you.

How Much Do Loss Prevention Services Cost?

The price tag on loss prevention varies wildly because it’s not a one-size-fits-all solution. A simple upgrade to a UL-rated safe is a one-time purchase, while things like central station monitoring or hiring guards are ongoing expenses. The trick is to stop thinking of it as a cost and start seeing it as an investment—one that not only protects your assets but can actually bring down your Jewelers Block insurance premiums.

Everything starts with a solid risk assessment. This pinpoints your biggest vulnerabilities, so you can put your money where it will have the most impact on your security.

The goal isn't just to buy a bunch of security gadgets. It’s about making strategic investments that directly lower your risk profile. That's the kind of proactive approach insurance underwriters love to see when you get a quote for Jewelers Block.

Will These Services Lower My Insurance Premiums?

Yes, in many cases, they absolutely will. Insurance for a jewelry store is priced based on one thing: risk. When you put real loss prevention measures in place, you’re sending a clear message to underwriters that you're a lower-risk client.

Having documented proof of these kinds of upgrades can make a huge difference:

- UL-Rated Safes and Vaults: The higher the rating, the more seriously insurers take it.

- Certified Central Station Monitoring: Professional, 24/7 monitoring is a non-negotiable for most carriers.

- Comprehensive CCTV Coverage: High-definition cameras covering every critical angle.

- Strict Inventory Protocols: Detailed records prove you can spot a loss the moment it happens.

When you present these improvements to your insurer, you can often negotiate for better terms and a lower annual premium. Over time, that security investment can easily pay for itself.

What's More Important: Physical or Digital Security?

That's a bit of a trick question, because for any modern jeweler, they are both equally critical. It's not an either/or situation. A complete protection strategy needs both.

Physical security is about protecting your tangible inventory from old-school threats like burglary and robbery. Digital security, on the other hand, is what guards your data—your customer lists, financial records, and operational secrets.

A data breach can be just as devastating as a physical heist. Imagine a thief stealing your customer database to plan targeted robberies—that’s a direct line from a cyber-attack to a real-world crime. A truly strong security strategy defends both fronts, making sure your fortress has no weak points, whether they're digital or physical.

Ready to build a stronger defense and lock in better insurance terms? The experts at the First Class Insurance Jewelers Block Agency can help you match your security upgrades with the right policy. Get a Quote for Jewelers Block and see for yourself how a smarter security strategy protects your assets and your bottom line.