So, what is liability insurance for business? At its heart, it’s a financial shield. It's built to protect your company when you're accused of causing harm to someone else or damaging their property.

Think of it as your first line of defense against lawsuits that can spring from accidents, injuries, or claims of negligence tied to your business operations.

Your Business's Financial Shield Against Accidents

Let’s get real for a moment. Picture a customer trying on engagement rings in your showroom. The floor was just mopped, and they slip, breaking their wrist. Suddenly, you're facing medical bills and a potential lawsuit that could easily run into thousands—or even millions—of dollars. Business liability insurance is designed for exactly these kinds of moments.

But it's just as important to know what this shield doesn't cover. This kind of policy is all about "third-party" claims. That means claims from customers, vendors, or anyone else who isn't you or an employee. It has absolutely nothing to do with your own property, like your inventory of diamonds, watches, or precious metals.

This is probably the most critical distinction to get right: liability insurance for a jewelry business protects you from lawsuits. A completely separate policy, like Jewelers Block insurance, protects your valuable inventory.

Understanding Liability Coverage in Practice

The whole point of liability coverage is to handle the financial mess that comes from claims of negligence. This covers incidents that happen right there in your store or even off-site during your business activities.

For example, if one of your employees is making a delivery and accidentally damages a client's antique table, your liability coverage is what would step in to handle it. It's the absolute foundation of any solid risk management plan for a jeweler.

This core protection is really an umbrella term for several specific types of coverage, each acting as another layer of your financial shield. To get a quick overview of the most common types, take a look at the table below. Each one is designed to tackle a unique risk your business faces every single day.

Quick Guide to Core Business Liability Protections

| Type of Liability Insurance | What It Primarily Protects Your Business Against |

|---|---|

| General Liability | Bodily injury or property damage to third parties on your business premises. |

| Product Liability | Harm caused by a product you manufacture or sell, like a faulty clasp. |

| Professional Liability | Financial loss due to your professional errors, such as a mistaken appraisal. |

| Employer's Liability | Claims from employees who suffer a work-related injury or illness. |

Getting the right mix of these protections is how you build a real safety net for your jewelry business. Now, let's break down what each of these really means in the real world.

The Four Pillars of Liability Protection for Your Jewelry Store

Knowing you need a liability shield is just the first step. A truly solid defense isn't a single wall; it's built on several distinct pillars of protection, each designed to hold up a different part of your business.

For a jeweler, liability isn't one big, scary monster. It’s a collection of unique risks that demand specific kinds of coverage. To really get a grip on what liability insurance for business is, you have to look past the generic definition and break it down into the four core types every jeweler should have on their radar.

General Liability: The Foundation for Your Physical Store

This is the bedrock of your entire protection plan. Think of it as your "slip-and-fall" insurance. General Liability is all about claims of bodily injury or property damage that happen on your premises or because of your day-to-day operations.

Picture this: your team just polished the showroom floor, and it's gleaming. A customer, completely captivated by a tray of engagement rings, misses the "wet floor" sign, slips, and fractures an arm.

That’s where your general liability policy kicks in. It’s designed to handle the fallout, which could include:

- Medical Payments: Covering the client's hospital bills and physical therapy.

- Legal Defense: Paying for your attorneys and court fees if they decide to sue.

- Settlements or Judgments: Covering the final amount awarded if you're found responsible.

A single accident could force you to pay these costs out-of-pocket, putting your entire business on the line. And while insurance handles the financial risk, proactive prevention is always the best policy. For a deep dive into that, check out this guide on choosing security systems for businesses to stop incidents before they even start.

Product Liability: Protection Against Faulty Goods

Your responsibility doesn't end when a piece of jewelry walks out the door. Product Liability insurance is built to protect you if something you sell, manufacture, or distribute ends up causing harm to a person or their property.

Let's say you sell a custom-made necklace. A few weeks later, the customer calls, distraught. The clasp was faulty, it broke open, and a priceless family heirloom pendant that was attached is now gone forever.

The client could sue your business for the full value of that lost pendant, arguing that your defective product was the direct cause. Product liability is what stands between you and that kind of claim, covering your defense and any resulting damages.

This coverage is absolutely critical in our industry, where the products we sell are often connected to items of immense sentimental—and monetary—value.

Professional Liability: Coverage for Your Expertise

As a jeweler, you’re selling more than just beautiful objects; you’re selling your expertise. Professional Liability insurance, often called Errors & Omissions (E&O), protects you from claims of financial loss caused by mistakes in the professional services you provide.

Imagine a longtime client brings in a vintage watch for an appraisal before they take it to auction. You appraise it at $5,000, and they sell it for that exact price. But later, an expert discovers it was a much rarer model actually worth $50,000. Your client could sue you for the $45,000 difference, claiming your professional error caused them a massive financial loss.

This is exactly what professional liability is for. It has nothing to do with physical injury or a broken product—it's all about the financial damage caused by your expert advice or services. If you offer appraisals, repairs, or custom design consultations, this coverage is non-negotiable.

Employer's Liability: Protecting Your Team

You have a duty of care to the people on your payroll. While Workers' Compensation (which is mandated in most states) covers medical bills and lost wages for employees hurt on the job, Employer's Liability adds another crucial layer of protection.

It shields your business if an employee sues you over a workplace injury, claiming your negligence was a contributing factor. For instance, an employee gets seriously hurt by a faulty polishing machine that you knew needed repairs but hadn't gotten around to fixing. They could sue you for damages beyond what workers' comp covers, like pain and suffering. Employer's Liability is what would pay for your legal defense and any settlement.

These four pillars are the foundation of a rock-solid liability defense. It's a massive sector for a reason—the global liability insurance market was estimated at US$290–330 billion in 2024–2025 and is only expected to grow. Understanding these key coverages is the first step to making sure your business is built to last.

What Liability Insurance Covers and What It Leaves Exposed

Knowing the boundaries of your liability insurance is just as important as having the policy in the first place. Think of it as knowing the exact perimeter of your financial fortress. A standard liability policy is a powerful tool, but it has very specific jobs.

Understanding what those jobs are—and what they aren't—is the key to avoiding a devastating surprise when a crisis hits.

A typical general liability policy acts as your financial backup for claims involving harm to a third party. It’s designed to handle the unpredictable accidents of daily business. If a lawsuit pops up from one of these incidents, your coverage generally steps in to pay for the essential costs.

What Is Typically Included in Liability Coverage

When you're facing a covered claim, your liability insurance is there to handle several major financial burdens that could otherwise be crippling. These protections are the core reason this coverage is so fundamental.

Here's a breakdown of what you can generally expect your policy to cover:

- Legal Defense Costs: This is a big one. It includes attorney fees, court costs, and other legal expenses needed to defend your business against a lawsuit—even if the claim is completely bogus.

- Settlements and Judgments: If your business is found liable, the policy will cover the court-ordered damages or a negotiated settlement, right up to your policy limit.

- Medical Payments: This covers medical bills for someone injured on your property, often without arguing over who was at fault. It's a great way to keep a minor slip-and-fall from snowballing into a major lawsuit.

These components work together to ensure a single accident doesn't derail your entire business. But the protection has very clear and important limits.

The Critical Gaps Liability Insurance Does Not Fill

This is where a lot of business owners get into trouble—assuming their liability policy is a catch-all solution. For a jewelry store, the exclusions are just as important as the coverages. These are the risks your policy is specifically designed not to handle.

The most significant exclusion for any jewelry business is the loss of your own property and inventory. If your showroom is robbed overnight, your general liability policy will offer zero help in replacing your stolen diamonds, gold, and other pieces.

Beyond this massive gap, other common exclusions create vulnerabilities that demand different types of insurance for a jewelry store. You can see the kind of high-value items that need specialized protection in our gallery of stunning timepieces and precious metals.

Here are some other major risks that fall outside the scope of a standard liability policy:

- Intentional Acts: Your policy won't cover damages or injuries that you or your employees cause on purpose.

- Criminal Activities: Any liability that comes from illegal acts committed by your business is explicitly excluded. No surprises there.

- Professional Mistakes: As we've discussed, a general liability policy won't cover financial losses from a bad appraisal. That's a job for professional liability coverage.

- Employee Injuries: If one of your own staff gets hurt, that’s what workers' compensation and employer's liability policies are for.

This clear line between what is and isn't covered reveals a dangerous gap for any jewelry business. Your most valuable assets—the very core of your company—are left completely exposed by liability insurance alone. This is precisely why specialized coverage isn't a luxury; it's a necessity.

Bridging the Gap with Jewelers Block Insurance

We’ve already established one critical fact: general liability insurance protects your jewelry business from lawsuits. But it leaves your most valuable assets—your inventory—completely exposed. This creates a massive, dangerous gap in your financial security.

So, while liability coverage handles the "what if a customer gets hurt" scenarios, what protects the very heart of your business?

The answer is a specialized policy designed from the ground up for the unique world of gems, precious metals, and fine jewelry. It’s called Jewelers Block insurance, and it’s the specific shield built to protect your inventory. This is the only real solution to bridge the gap that liability insurance creates.

Unlike a standard business property policy that might cover your office furniture, Jewelers Block is the only way to truly secure your collection of loose stones, finished pieces, precious metals, and customer items left in your care.

A Tailored Shield for High-Value Assets

Think of standard property insurance as a one-size-fits-all raincoat. It offers basic protection but won't hold up in a hurricane. For a jeweler, risks like a sophisticated overnight heist, a snatch-and-grab theft, or a mysterious disappearance are the hurricane.

You need insurance for a jewelry business that anticipates these specific threats. That's where a specialist like First Class Insurance Jewelers Block Agency comes in.

A Jewelers Block policy provides coverage that follows your inventory wherever it goes, offering protection that extends far beyond the four walls of your store. This specialized coverage typically protects your assets in a variety of situations:

- Inside Your Store: Covering items in your vault, safes, and showcases.

- In Transit: Protecting jewelry while it's being shipped to customers or other locations.

- At Trade Shows: Securing your inventory while you're exhibiting at industry events.

- On Memo: Covering pieces that are out with clients, sales staff, or other jewelers.

This dynamic protection is essential for the way a modern jewelry business operates. It recognizes that your most valuable assets are rarely stationary, and it protects them accordingly. You can see examples of the kinds of high-value pieces this coverage is designed to protect by exploring expertly photographed diamond jewelry on our site.

Liability vs. Jewelers Block: A Visual Guide

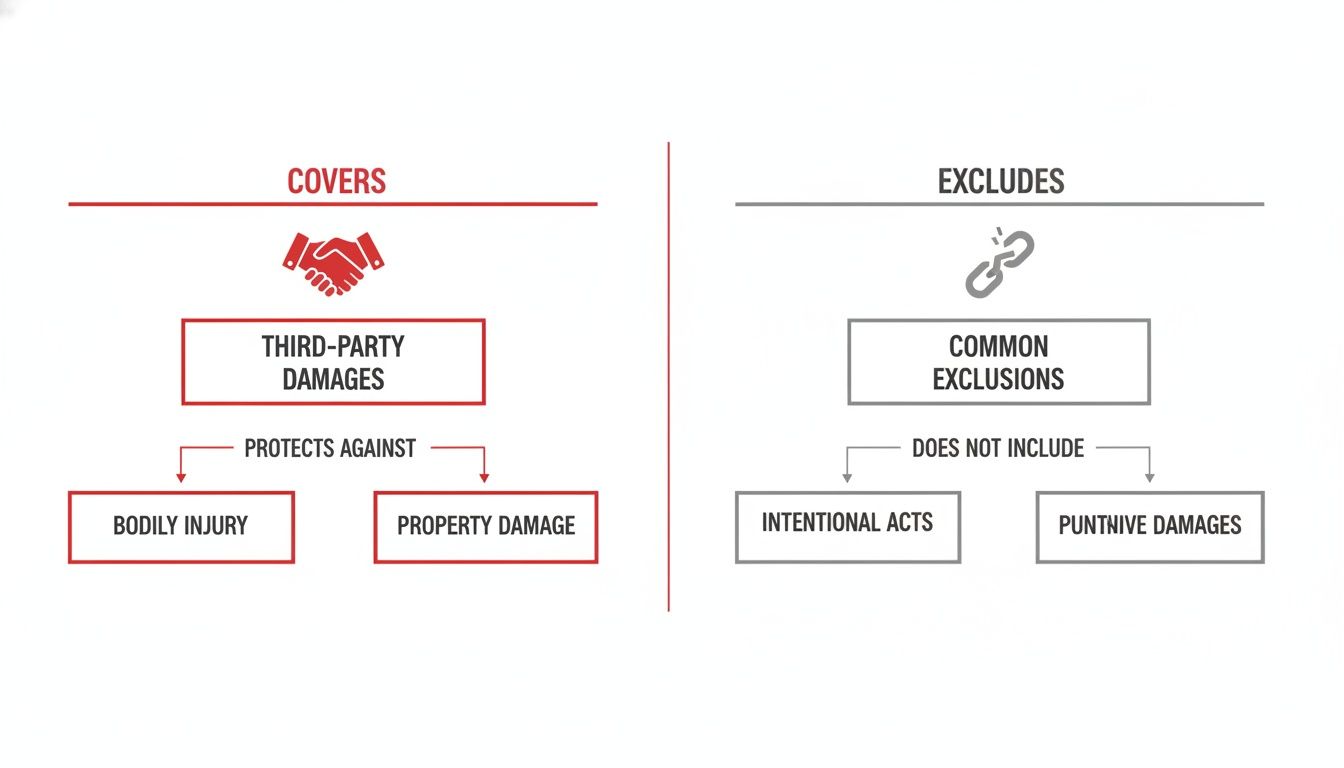

To truly understand how these two policies work together to form a complete protection plan, it helps to see their roles side-by-side. Liability insurance and Jewelers Block insurance are not interchangeable; they are two halves of a whole.

This infographic clearly illustrates the core function of liability coverage—showing what it is designed to cover versus the critical elements it excludes, such as your own valuable property.

The visualization reinforces a key idea: liability insurance is outward-facing, dealing with claims from other people, while Jewelers Block insurance is inward-facing, protecting the assets you actually own.

How Liability and Jewelers Block Work Together

Let’s make this crystal clear by looking at a few real-world scenarios every jeweler fears. The following table breaks down which policy would respond to each crisis, reinforcing how they provide two different but equally vital types of protection for your business.

General Liability vs. Jewelers Block Insurance Key Differences

| Risk Scenario | Covered by General Liability? | Covered by Jewelers Block? |

|---|---|---|

| A customer slips on a wet floor in your showroom and sues for medical costs. | Yes. This is a classic third-party bodily injury claim. | No. This does not involve your inventory or property. |

| Your store is burglarized overnight, and $200,000 worth of jewelry is stolen. | No. General liability explicitly excludes theft of your own business property. | Yes. This is the primary purpose of Jewelers Block coverage. |

| An employee accidentally knocks over and shatters a customer's antique vase while showing a necklace. | Yes. This policy covers damage to a third party's property. | No. The damaged item was not part of your jewelry inventory. |

| A tray of diamond rings "mysteriously disappears" from a display case during business hours. | No. This is an inventory loss, which is not a liability issue. | Yes. "Mysterious disappearance" is a unique risk often covered by this policy. |

| A package of loose gems is lost or stolen while being shipped to a manufacturer. | No. This is a loss of your business property, not a liability claim. | Yes. This policy is designed to cover inventory in transit. |

This comparison highlights the absolute necessity of having both policies. Relying on one without the other leaves you dangerously exposed.

General liability protects your business from being sued into bankruptcy, while Jewelers Block protects the tangible assets that generate your revenue in the first place. For any serious jeweler, the next logical step is to see how this essential coverage fits into your operational budget.

How Your Jewelry Business Insurance Costs Are Calculated

Ever gotten an insurance quote and wondered where that final number actually comes from? The price tag on your jewelry store insurance isn't pulled out of thin air. It’s a carefully calculated assessment of your business's unique risk profile.

Insurance underwriters, like the specialists at an agency like First Class Insurance Jewelers Block Agency, analyze a very specific set of factors to land on your premium. When you understand what they're looking at, the whole process makes a lot more sense—and you're in a much better position to manage those costs.

Before we get into the nitty-gritty, let’s quickly cover two terms that directly shape your premium: policy limits and deductibles. Your policy limit is the absolute maximum an insurer will pay out for a covered claim. A higher limit gives you a bigger safety net, but it also comes with a higher premium. Your deductible, on the other hand, is what you pay out of your own pocket before the insurance money kicks in. Choosing a higher deductible can lower your premium, but it means you’ll shoulder more of the upfront cost if you ever have to file a claim.

Key Factors That Shape Your Premium

Think of an underwriter looking at your business through a jeweler's loupe. They're examining every tiny detail that could possibly lead to a loss. For a jeweler, this goes way beyond just the square footage of your store or how many people you employ.

Here are the biggest factors they're zooming in on:

- Total Inventory Value: This is the single most important driver for Jewelers Block insurance. It’s simple, really. The higher the value of your diamonds, gold, and finished pieces, the bigger the potential loss, which naturally means a higher premium.

- Physical Security Measures: How strong are your defenses? Underwriters will want to know everything about your safes and vaults (the UL rating is a huge deal), your alarm systems, surveillance cameras, and how you control access to your store. The stronger your security, the lower your risk—and that can lead to lower premiums.

- Business Operations: The way you run your business day-to-day matters. Do you ship high-value items often? Travel to trade shows? Do your salespeople carry inventory with them on the road? Each of these activities introduces new layers of risk that directly influence what you pay for insurance.

Your History and Location Matter More Than You Think

Beyond your inventory and security, insurers also take a hard look at your business’s track record and where you're located. These pieces of the puzzle give them a much clearer picture of how likely you are to file a claim down the road.

A clean claims history is one of your most valuable assets. If your business has few or no past claims, you’re seen as a lower risk and will almost always get better pricing. On the flip side, a history of frequent or major losses signals a higher risk to underwriters, and your premiums will reflect that.

Your location is another powerful factor. Insurance rates are heavily influenced by regional litigation trends and crime statistics. A store in an area with a high rate of smash-and-grab robberies or a litigious local environment will face higher premiums than one in a lower-risk zone.

This isn't just a hunch; it's a well-documented trend. The frequency and severity of claims have created huge differences in liability pricing from one region to another. In 2025, even as global commercial insurance rates saw a dip, casualty insurance in the U.S. kept climbing, which shows just how much local legal environments can affect what a business pays. You can dig into a full market overview of these global insurance trends on aon.com.

At the end of a day, the cost of your insurance is a direct reflection of this detailed risk assessment. By investing in better security, keeping a clean claims record, and working with a specialist, you can present your business as a much more attractive risk and have a real impact on your premiums.

Securing Complete Protection for Your Jewelry Business

After walking through the different shields you need to guard your operations, the main takeaway should be crystal clear. When it comes to insurance for a jewelry business, true security isn’t about picking one type of coverage over another. It's about weaving them together into an airtight safety net. Relying on just liability or just inventory protection leaves a gaping hole in your defenses—a risk no smart operator can afford.

Your standard business policy just wasn't designed for the high-stakes world of fine jewelry. Most are riddled with hidden exclusions and tiny sub-limits on precious metals and gems that can render an otherwise decent policy useless right when you need it most. This is exactly why partnering with a specialist isn't just a good idea; it's the only way to get genuine peace of mind.

Your Next Step Toward Real Security

The path to protecting your life's work doesn’t just end with knowing the risks. It ends when you take decisive action. The obvious next step is to team up with an expert who speaks your language—someone who understands that your inventory isn't just "business property."

The world of liability insurance is massive and getting bigger. In fact, premiums are expected to hit around US$330 billion in 2025 as commercial risks and lawsuits continue to climb. That growth highlights just how critical it is to get precise, expert-guided coverage, which you can read more about in this global insurance market survey.

You need a guide to navigate this complex landscape. While some larger operations might explore the benefits of a captive insurance company for highly customized risk management, the most direct solution for most jewelers is a policy built specifically for the trade. The mark of a trusted underwriter often comes from their established partnerships, like those with the historic

.

It's time to make sure your protection is as meticulously crafted as the pieces you create and sell. Connect with the specialists at First Class Insurance Jewelers Block Agency to Get a Quote for Jewelers Block. Their expertise is the best tool you have for building an insurance strategy that truly has your back.

Your Top Jewelry Insurance Questions, Answered

Once you get the basics down, the real questions start to pop up. It's one thing to understand a policy in theory, but it's another to know how it works when a real-life scenario hits your store. Let's tackle some of the most common questions we hear from jewelers every day.

Getting these details right is the difference between having a policy and having the right policy. Let's clear up the confusion.

I Damaged a Customer's Ring During a Repair. Is That Covered by My General Liability Policy?

That's a hard no, and it’s a situation where many jewelers get tripped up. General liability is there to protect you if, say, a customer slips and falls in your store. It handles bodily injury and property damage that’s completely separate from the professional work you do.

When you take in a customer's ring for repair, it's under your "care, custody, and control." Any damage that happens while you're working on it is a professional risk, not a general one. This is exactly what bailee's coverage is for, and you'll typically find it as a key part of a proper Jewelers Block insurance policy. It’s a perfect example of why specialized jewelry store insurance from an expert like First Class Insurance Jewelers Block Agency is non-negotiable.

What’s the Real Difference Between Product and Professional Liability?

It’s easy to mix these two up, but they cover very different kinds of risk. Here’s a simple way to think about it:

-

Product Liability is about the thing you sell. If you sell a pair of earrings and the customer has a severe allergic reaction, claiming an undisclosed metal caused it, that’s a product liability claim. The physical product caused the harm.

-

Professional Liability is about your expertise or the service you provide. If you appraise a diamond at a much higher value than it's worth and your client loses money because they relied on your expert opinion, that’s a professional liability (or "Errors & Omissions") claim. Your advice caused the financial loss.

Can’t I Just Get a Standard Business Owner's Policy (BOP) for My Store?

You could, but it would be a dangerously bad idea. A standard BOP is a package deal that bundles general liability with property insurance, but it's built for a typical main street business, like a flower shop or a bookstore—not a jewelry store. The property coverage inside a BOP has shockingly low limits for theft of high-value items like jewelry, gems, and precious metals.

A generic BOP is not designed to cover the unique and severe risks your inventory faces. A Jewelers Block policy is the only coverage truly built from the ground up to protect your high-value stock from theft, mysterious disappearance, and losses during transit.

Ready to make sure your business is shielded with coverage that actually understands the jewelry industry? Contact First Class Insurance today to Get a Quote for Jewelers Block and build a policy that protects every single facet of your hard work.